Professional Documents

Culture Documents

HKMU BAFS 2022 P2A Question Eng

HKMU BAFS 2022 P2A Question Eng

Uploaded by

JaeeeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HKMU BAFS 2022 P2A Question Eng

HKMU BAFS 2022 P2A Question Eng

Uploaded by

JaeeeCopyright:

Available Formats

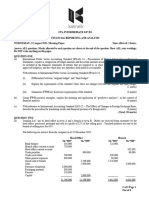

2022-DSE MOCK

BAFS

PAPER 2A HONG KONG METROPOLITAN UNIVERSITY

HONG KONG DIPLOMA OF SECONDARY EDUCATION MOCK EXAMINATION 2022

BUSINESS, ACCOUNTING AND FINANCIAL STUDIES PAPER 2A

Accounting Module

2 hours 15 minutes

This paper must be answered in English

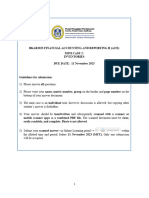

INSTRUCTIONS

(1) There are three sections in this paper.

(2) All questions in Section A are compulsory. You are required to answer two of the three

questions in Section B and one of the two questions in Section C.

(3) Write your answers in the answer book. Start EACH question (not part of a question)

on a NEW page.

Not to be taken away

SECTION A (24 marks)

Answer ALL questions in this section.

1. Star Trading Limited manufactures and sells two products: Gphone and Gwatch. Information of

the two products in 2020 is stated below:

Gphone Gwatch

Unit selling price $6 000 $3 500

Unit variable cost $4 200 $1 850

Sales mix ratio 5 4

The total fixed costs shared by all two products are $10 389 600.

REQUIRED:

(a) Determine the breakeven point in sales quantity and in dollars for each individual product

in 2020. (4 marks)

(b) Calculate sales level in dollars that needed to earn a target net profit of $7 800 000 if the

sales mix ratio is maintained. (Tax implications are ignored.) (2 marks)

(c) State two assumptions of Cost-Volume-Profit Analysis. (2 marks)

(Total: 8 marks)

2022-DSE Mock-BAFS 2A (Eng) 1

2. Mango Limited is in the process of preparing the year-end adjustments for 2021. It has its

financial year end date on 31 December 2021. The chief financial officer found that the

following issues have not yet been considered and were not included in the trial balance for the

year ended 31 December 2021.

Issue 1:

Mango Limited paid $1 200 000 for 3 years’ rent for the office for the years 2021 to 2023 on

1 January 2021. Mango Limited debited the prepaid expense account when it prepaid its

expenses.

Issue 2:

Mango Limited incurred utilities expense amounted to $12 300 for the month of December 2021.

This amount has not yet been paid as at 31 December 2021.

Issue 3:

Mango Limited purchased a car for $360 000 on 1 July 2021. The car should be depreciated

using straight-line method based on an estimated useful life of 5 years and residual value of

$5 000. The depreciation expense is only calculated at the end of the year.

REQUIRED:

(a) Prepare journal entries to record the necessary adjustments for the above three issues.

(Narrations are not required.) (3 marks)

(b) Prepare an extract of income statement for the year ended 31 December 2021 and an extract

of statement of financial position as at 31 December 2021 in relation to the above issues.

(5 marks)

(Total: 8 marks)

2022-DSE Mock-BAFS 2A (Eng) 2

3. Moon Company has credit sales of $3 800 000 for the year 2021. The company provides the

allowance for doubtful accounts based on the age of the accounts receivable. The aging analysis

of accounts receivable as at 31 December 2021 and the percentage of allowance required are as

follows:

Amount of Age of Percentage of Allowance for

Accounts Receivables Accounts Receivable Doubtful Accounts

$650 000 Less than 30 days 2%

$380 000 31 days – 90 days 10%

$180 000 91 days – 180 days 20%

$65 000 More than 180 days 40%

The balance of the allowance for doubtful accounts as at 31 December 2020 was $23 000

(credit). Write-off of bad debts during the year of 2021 totaled $7 100.

REQUIRED:

(a) Determine the balance of the allowance for doubtful accounts and the net accounts

receivable to be presented in the statement of financial position as at 31 December 2021.

(4 marks)

(b) Prepare the journal entries to adjust for the allowance for doubtful accounts for the year

2021. (Narrations are not required.) (2 marks)

(c) Briefly explain the accounting concept or principle in relation to the above adjustment.

(2 marks)

(Total: 8 marks)

2022-DSE Mock-BAFS 2A (Eng) 3

SECTION B (24 marks)

Answer ANY TWO questions in this section.

4. Anson Limited produced 78 000 units of AL wristband during the year ended 31 December

2020. Of these units, 75 000 were sold for $140 each. There was no inventory on hand as at

31 December 2019.

Cost information for AL wristband is as follows:

Direct materials $14 per unit

Direct labour $24 per unit

Manufacturing overheads:

- Variable $10 per unit

- Fixed $507 000 per quarter

Marketing costs:

- Variable 8% of sales

- Fixed $160 000 per annum

REQUIRED:

(a) Prepare an income statement for the year ended 31 December 2020 for Anson Limited using

absorption costing. (6 marks)

(b) Explain the difference in net profit between the absorption costing and marginal costing

approaches. You are not required to compute the amount in the explanation. (2 marks)

Anson Limited sold its inventory on hand and all of January’s production by the end of January

2021. On 31 January 2021, a retailer approached Anson Limited with two order options:

(1) An order of 1 400 units of AL wristband at a price of $135 each, or

(2) An order of 2 000 units of AL wristband at a price of $132 each.

The order has to be completed within a month. Anson Limited has idle production capacity of

1 500 units during February 2021, and is able to increase its monthly production capacity by

500 units by hiring additional machinery at a cost of $45 000 per month. Variable costs per unit

in 2021 remain the same as those in 2020.

REQUIRED:

(c) Advise Anson Limited on which order option it should accept. Support your answer with

calculations. (4 marks)

(Total: 12 marks)

2022-DSE Mock-BAFS 2A (Eng) 4

5. The draft accounts of Coastal Company for the year ended 31 December 2021 failed to balance.

The total debit was $400 900 and total credit was $397 700, and the difference was recorded in

a suspense account.

During subsequent investigation, the following errors were discovered:

(i) $16 900 unearned rent revenue as at 31 December 2020 had not been brought down as an

opening balance.

(ii) In 2021, a batch of inventory costing $36 000 was sent to a sales agent on a sale or return

basis. Coastal Company was informed on 31 December 2021 that one-third of the goods

would be kept and the remaining goods would be returned in January 2022. The gross

profit margin of this batch of goods was 20%. No records had been made for sales

transaction and the goods were not included in the inventory.

(iii) Coastal Company declared and paid cash dividend of $100 000 on 30 June 2021. The

payment had been recorded as interest expense.

(iv) On 1 November 2021, Coastal Company rented out a property for $23 500 per month.

The tenant paid half year’s rent and a deposit of two months’ rent when signing the

agreement. The whole amount had been recorded as rent revenue.

(v) $7 000 interest on bank deposit had been omitted during bank reconciliation.

(vi) A payment of $13 700 was made for an advertising expense. The cheque payment was

recorded twice in the book’s bank account, but the related nominal account was recorded

correctly. The error was not caught during the bank reconciliation.

(vii) The year-end adjustment on the allowance for doubtful accounts had been omitted. The

aging schedule of accounts receivables indicated that an allowance of $9 500 (credit) was

required at the end of 2021. The account balance of allowance for doubtful accounts

before any adjustments on the trial balance was $3 700 (credit).

REQUIRED:

(a) Prepare journal entries to correct the above errors. (Narrations are not required.) (10 marks)

(b) Prepare the suspense account to account for the difference as per trial balance. (2 marks)

(Total: 12 marks)

2022-DSE Mock-BAFS 2A (Eng) 5

6. Byron Company sells a single product. It uses the periodic inventory system and weighted

average cost method for inventory costing. An excerpt of the company’s ledger account in

December 2021 can be found below:

Inventory (Debit side only)

1 Dec Balance b/f 130 units $ 65 000

5 Dec Purchase 104 units 61 360

16 Dec Purchase 140 units 89 438

Sales Revenue (Credit side only)

9 Dec 110 units $ 93 500

12 Dec 64 units 57 600

25 Dec 165 units 144 000

On 30 December, an accident damaged the remaining goods in the warehouse. Byron Company

estimated that the damaged goods can only be sold for $15 000 after having them repaired for

$2 350.

REQUIRED:

(a) Calculate the following figures of Byron Company for the month of December 2021:

(i) Cost of goods sold (4 marks)

(ii) Gross profit (2 marks)

(iii) Closing inventory (4 marks)

(b) Briefly explain the accounting concept or principle in relation to the adjustment of the

closing inventory. (2 marks)

(Total: 12 marks)

2022-DSE Mock-BAFS 2A (Eng) 6

SECTION C (20 marks)

Answer ONE question in this section.

7. Jason Lo Company is engaged in the sale of organic food. On 30 December 2020, the accountant

found that part of the accounting records were lost due to computer system errors. Jason Lo

provided the following information for the year ended 31 December 2020:

(i) The bank payment and bank receipts were as follows:

Bank payments: Bank receipts:

Office equipment – $1 548 000 Trade receivables – $2 008 000

Trade payables – $1 197 200 Consultancy income – $10 500

Utilities expenses – $37 500 Bank loan – $3 840 000

Insurance – $15 000

Rent – $306 000

Motor vehicles – $780 000

Wages and salaries – $240 000

Bank loan interest – $9 000

Staff training expenses – $13 500

All the sales and purchases of Jason Lo Company were on credit.

(ii) The $306 000 of rent paid represented the 24 months’ rent of office starting from

1 January 2020 to 31 December 2021.

(iii) On 1 October 2020, the company borrowed a 5-year bank loan of $3 840 000 at an

interest rate of 15% per annum.

(iv) The company adopts the following depreciation policies for non-current assets.

Office equipment 20% per annum on cost

Motor vehicles 40% per annum on a reducing-balance basis

A full year’s depreciation is to be charged in the year of acquisition.

The equipment has no residual value. There is no office equipment and motor vehicle

prior to the purchase in the year 2020 and all purchases of office equipment and motor

vehicles in 2020 were paid by bank.

(v) The company could only find the amounts for the following assets and liabilities as at

31 December 2019 and 31 December 2020:

2020 ($) 2019 ($)

Inventory 315 000 247 470

Trade receivables 690 000 680 000

Prepaid utilities expenses 5 130 0

Prepaid insurance 0 3 600

Bank 1 751 800 39 500

Trade payables 369 000 56 100

Accrued salaries 0 34 200

Capital, Jason Lo ? 880 270

2022-DSE Mock-BAFS 2A (Eng) 7

REQUIRED:

(a) Prepare an income statement for the year ended 31 December 2020 for Jason Lo Company.

(13 marks)

(b) Prepare a statement of financial position as at 31 December 2020. (7 marks)

(Total: 20 marks)

2022-DSE Mock-BAFS 2A (Eng) 8

8. Dragon Limited is a company incorporated in Hong Kong. It is engaged in selling electronic

products. The financial year of Dragon Limited ends on 31 December. Below are Dragon

Limited’s ledger account balances as at 31 December 2021 after closing all the nominal accounts

and preparing the draft income statement for the year ended 31 December 2021.

Debit ($) Credit ($)

Property, plant and equipment at cost 6 240 000

Accumulated depreciation

– Property, plant and equipment at 31 December 2021 2 355 000

Inventories at 31 December 2021 800 000

Trade receivables 438 000

Bank 74 000

Trade payables 500 000

5% Loan (Repayable in 2025) 600 000

Ordinary share capital 1 800 000

Retained profits at 31 December 2021 2 297 000

7 552 000 7 552 000

The following items have not been included into the above ledger account balances:

(i) On 1 September 2021, the company offered 20 000 ordinary shares to the public at $5

each, payable in full on application. $200 000 were received by the end of the application

period on 15 September 2021. The shares were allotted on 20 September 2021 and the

excess application monies were refunded 10 days later.

(ii) To finance the expansion of the business, a five-year 12% debenture of $900 000 in total

had been issued at par on 1 November 2021. Debenture interest is payable on 31 March

and 30 September each year. Applications were received for exactly $900 000 debentures

on 1 November 2021 and the allotment was also made on 1 November 2021.

(iii) In order to obtain the cash discount of 5% from a supplier, one-fifth of the monies

collected from issuance of debentures was used to pay the supplier during the discount

period as the full settlement of its account.

(iv) The board of directors of Dragon Limited resolved to transfer $250 000 to the general

reserve on 31 December 2021.

(v) The board of directors of Dragon Limited declared the final dividend of $120 000 to

shareholders on 31 December 2021. The dividend will be paid to shareholders on

1 March 2022.

2022-DSE Mock-BAFS 2A (Eng) 9

REQUIRED:

(a) Prepare journal entries for the events in (i) to (v) above for Dragon Limited. (Narrations are

not required.) (10 marks)

(b) Prepare a statement of financial position as at 31 December 2021 for Dragon Limited after

taking into account the above adjustments. (8 marks)

(c) Discuss the differences in accrual basis of accounting and cash basis of accounting.

(2 marks)

(Total: 20 marks)

END OF PAPER

2022-DSE Mock-BAFS 2A (Eng) 10

You might also like

- Ultimate Business Plan TemplateDocument36 pagesUltimate Business Plan TemplateDawne Vaughan Brown100% (16)

- Exercises in Adjusting EntriesDocument5 pagesExercises in Adjusting EntriesJhon Robert BelandoNo ratings yet

- Assignment #1 (With Answers)Document9 pagesAssignment #1 (With Answers)南玖No ratings yet

- CA Zambia Qa March 2022Document406 pagesCA Zambia Qa March 2022Johaness Boneventure100% (1)

- 2019 Dse Bafs 2a (E)Document10 pages2019 Dse Bafs 2a (E)lehcarNo ratings yet

- Cuac208 Tests and AssignmentsDocument8 pagesCuac208 Tests and AssignmentsInnocent GwangwaraNo ratings yet

- Far160 Pyq Feb2023Document8 pagesFar160 Pyq Feb2023nazzyusoffNo ratings yet

- December 2021 CA Zambia QaDocument403 pagesDecember 2021 CA Zambia QaChisanga Chiluba100% (1)

- CAF 1 FAR1 Autumn 2023Document6 pagesCAF 1 FAR1 Autumn 2023z8qcsqfj8dNo ratings yet

- Ca Zambia June 2021 QaDocument415 pagesCa Zambia June 2021 QaESGNo ratings yet

- Accounts and Statistics 2Document41 pagesAccounts and Statistics 2BrightonNo ratings yet

- IFRS For SMEs Exam June 2022 - English VersionDocument8 pagesIFRS For SMEs Exam June 2022 - English Versionramylearning98No ratings yet

- Midterm Test - Code 37 - FA - Sem 2 - 21.22Document5 pagesMidterm Test - Code 37 - FA - Sem 2 - 21.22Đoàn Tài ĐứcNo ratings yet

- Wa0003.Document6 pagesWa0003.joanNo ratings yet

- Assignment - FIB2413 (Sept 2022)Document6 pagesAssignment - FIB2413 (Sept 2022)VerrelyNo ratings yet

- Cuac208 Tutorial QuestionsDocument25 pagesCuac208 Tutorial QuestionsSamuel BureNo ratings yet

- BHMH2113 - Question Paper - Take - Home ExamDocument7 pagesBHMH2113 - Question Paper - Take - Home Examwd edenNo ratings yet

- 7001 Assignment #1Document6 pages7001 Assignment #1南玖No ratings yet

- Preparation and Analysis of Financial Statements (Assessment)Document6 pagesPreparation and Analysis of Financial Statements (Assessment)Talisha JosephNo ratings yet

- ACCT 312 - Exam 2 (Part 1) - Spring 2022 FinalDocument8 pagesACCT 312 - Exam 2 (Part 1) - Spring 2022 FinalMercy Jerop KimutaiNo ratings yet

- Caf-01 Far-01 Skans Mock QPDocument8 pagesCaf-01 Far-01 Skans Mock QPTaha MalikNo ratings yet

- BACC 2021 - 22 Sem 2 - MST Questions 2Document5 pagesBACC 2021 - 22 Sem 2 - MST Questions 2xa. vieNo ratings yet

- Indicate Which of These Items Would Typically Be Reported As Inventory in The Financial StatementsDocument5 pagesIndicate Which of These Items Would Typically Be Reported As Inventory in The Financial StatementsBONNo ratings yet

- Practice Midterm Questions JAN 2022 Second With SOLUTIONS v7Document17 pagesPractice Midterm Questions JAN 2022 Second With SOLUTIONS v7Aryan JainNo ratings yet

- Main Project - Accounting and Finance - Jan2023Document5 pagesMain Project - Accounting and Finance - Jan2023Farai BlessedWithout Measure MukamuraNo ratings yet

- Revision AccountsDocument3 pagesRevision AccountsZaara AshfaqNo ratings yet

- FINANCIAL ACCOUNTING & REPORTING - MA-2022 - QuestionDocument5 pagesFINANCIAL ACCOUNTING & REPORTING - MA-2022 - QuestionRakib KhanNo ratings yet

- Ilovepdf MergedDocument15 pagesIlovepdf MergedRakib KhanNo ratings yet

- Quiz 1 - ACPRE3 - 03.01.22Document4 pagesQuiz 1 - ACPRE3 - 03.01.22Cristal CristobalNo ratings yet

- 2022 FIA132 Term Test 1 FinalDocument9 pages2022 FIA132 Term Test 1 FinalkaityNo ratings yet

- CT Far160 Dec2022 QDocument4 pagesCT Far160 Dec2022 QSiti Nurul AtiqahNo ratings yet

- Final FAR-2 Mock Q. PaperDocument6 pagesFinal FAR-2 Mock Q. PaperAli OptimisticNo ratings yet

- Assignment #2 Problem Set-1Document5 pagesAssignment #2 Problem Set-1yunsu638No ratings yet

- FA - II - Project Work 2020Document3 pagesFA - II - Project Work 2020Yohanes DebeleNo ratings yet

- Homework 5 - Current Liabilities - RevisedDocument3 pagesHomework 5 - Current Liabilities - RevisedalvarezxpatriciaNo ratings yet

- Receivables ProblemsDocument4 pagesReceivables ProblemsLarpii MonameNo ratings yet

- Financial Accounting Paper 1.1 July 2023Document20 pagesFinancial Accounting Paper 1.1 July 2023johny SahaNo ratings yet

- 2022mar S4 Exam Paper 2 EngDocument13 pages2022mar S4 Exam Paper 2 EngsunnylamyathangNo ratings yet

- Diploma in Accountancy September 2023 Examinations Q ADocument225 pagesDiploma in Accountancy September 2023 Examinations Q AKipson Drizo MuksNo ratings yet

- Cma January-2022 Examination Operational Level Subject: F1. Financial OperationsDocument9 pagesCma January-2022 Examination Operational Level Subject: F1. Financial Operationsnatsu broNo ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/32Document12 pagesCambridge International AS & A Level: ACCOUNTING 9706/32muhammadxiaullahgNo ratings yet

- UOL ExamDocument11 pagesUOL ExamThant Hayman ThwayNo ratings yet

- Winter2021 Final ACCY112 QuestionDocument6 pagesWinter2021 Final ACCY112 QuestionaryanNo ratings yet

- Quiz #4 - Intangibles and Investment PropertyDocument2 pagesQuiz #4 - Intangibles and Investment PropertyfbaabgfgbfdNo ratings yet

- Boslon Audit3 Quiz 2Document6 pagesBoslon Audit3 Quiz 2Ra Dela RamaNo ratings yet

- 2022-23 UT2 Econ S5 Sect B QsDocument8 pages2022-23 UT2 Econ S5 Sect B Qs6s89ng2yymNo ratings yet

- Ap02 Error Corrections and Accounting ChangesDocument2 pagesAp02 Error Corrections and Accounting ChangesJean Fajardo BadilloNo ratings yet

- Mau de Thi CK-CMBCTCQT1Document3 pagesMau de Thi CK-CMBCTCQT1nguyenlantramy0No ratings yet

- Practice Exam QuestionsDocument14 pagesPractice Exam QuestionsdgfNo ratings yet

- Prelim ExamDocument6 pagesPrelim ExamJessie jorgeNo ratings yet

- httpswww.icagh.orgwp-contentuploads202401FINANCIAL-ACCOUNTING-PAPER-1.1Nov-2023.pdfDocument23 pageshttpswww.icagh.orgwp-contentuploads202401FINANCIAL-ACCOUNTING-PAPER-1.1Nov-2023.pdfProsperity Thēë BwøyNo ratings yet

- A231 MC 2 Inventories - QuestionsDocument4 pagesA231 MC 2 Inventories - QuestionsAmirul HaiqalNo ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/22Document20 pagesCambridge International AS & A Level: ACCOUNTING 9706/22Bora BoraNo ratings yet

- Accounts and Statistics 4Document41 pagesAccounts and Statistics 4BrightonNo ratings yet

- CA Examination September 2020 Q ADocument416 pagesCA Examination September 2020 Q AChisanga ChilubaNo ratings yet

- 6811 Notes Receivable and Loan ImpairmentDocument2 pages6811 Notes Receivable and Loan ImpairmentEsse ValdezNo ratings yet

- Practice Problems - Notes and Loans Receivable: General InstructionsDocument2 pagesPractice Problems - Notes and Loans Receivable: General Instructionseia aieNo ratings yet

- Far-I Autumn 2021 TsaDocument3 pagesFar-I Autumn 2021 TsaUsman AhmedNo ratings yet

- 2A Paper A Exam 2022Document11 pages2A Paper A Exam 2022nkatekohlungwane000No ratings yet

- Audit of Liabilities - Set ADocument5 pagesAudit of Liabilities - Set AZyrah Mae SaezNo ratings yet

- Cpa Review School of The Philippines ManilaDocument2 pagesCpa Review School of The Philippines ManilaEsse ValdezNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Accounting Worksheet 2 Answer SheetDocument31 pagesAccounting Worksheet 2 Answer Sheetzeldazitha87No ratings yet

- PC2 AnswerSheetDocument3 pagesPC2 AnswerSheetLuWiz DiazNo ratings yet

- A. Fair Value of The Asset Given Up Plus The Amount of Any Cash or Cash Equivalent TransferredDocument3 pagesA. Fair Value of The Asset Given Up Plus The Amount of Any Cash or Cash Equivalent TransferredAlrac GarciaNo ratings yet

- Cost Sheet FormatDocument5 pagesCost Sheet Formatvicky3230No ratings yet

- Tax ProjectDocument19 pagesTax Projectsanskarbarekar789No ratings yet

- Bab 4 & 5Document30 pagesBab 4 & 5Harke PoliiNo ratings yet

- IB124 Introduction To Financial Accounting Autumn Term 2020 Seminar QuestionsDocument7 pagesIB124 Introduction To Financial Accounting Autumn Term 2020 Seminar QuestionsS3F1No ratings yet

- SoDChecker Version0 4Document45 pagesSoDChecker Version0 4ravin.jugdav678No ratings yet

- Corporate Income TaxDocument14 pagesCorporate Income Tax36. Lê Minh Phương 12A3No ratings yet

- RTP - CAP - III - Gr-I - Dec - 2022 (2) - 3-29Document27 pagesRTP - CAP - III - Gr-I - Dec - 2022 (2) - 3-29Mahesh PokharelNo ratings yet

- Business Valuation IIDocument30 pagesBusiness Valuation IIsuneshdeviNo ratings yet

- Chapter One: Capital Budgeting Decisions: 1.2. Classification of Projects Independent Verses Mutually Exclusive ProjectsDocument25 pagesChapter One: Capital Budgeting Decisions: 1.2. Classification of Projects Independent Verses Mutually Exclusive ProjectsezanaNo ratings yet

- Module 3 Quiz On Investment PropertiesDocument5 pagesModule 3 Quiz On Investment PropertiesLoven Boado100% (1)

- Naztech - 27.01.2021 - IrrDocument81 pagesNaztech - 27.01.2021 - IrrRashan Jida ReshanNo ratings yet

- E3 To E4 Management Question BankDocument20 pagesE3 To E4 Management Question BankGopikrishnan Radhakrishnan50% (2)

- LPG Cost CalculationDocument7 pagesLPG Cost CalculationBudiarso BudiarsoNo ratings yet

- Ias 40Document20 pagesIas 40Reever RiverNo ratings yet

- Sum of The YearsDocument9 pagesSum of The YearsMary Joy DelgadoNo ratings yet

- Chapter 4 End of The Period Adjustments Final ModuleDocument75 pagesChapter 4 End of The Period Adjustments Final ModuleRian Hanz AlbercaNo ratings yet

- Change in Method of DepreciationDocument8 pagesChange in Method of DepreciationSparsh GuptaNo ratings yet

- Chapter 5 - Replacement AnalysisDocument29 pagesChapter 5 - Replacement AnalysisUpendra ReddyNo ratings yet

- Business Plan ENT300Document52 pagesBusiness Plan ENT300AlohaaSwezzNo ratings yet

- MCQ With Answer Key 290323Document23 pagesMCQ With Answer Key 290323Aditya ChavanNo ratings yet

- Also Distinction Between Capital and Revenue ReceiptsDocument15 pagesAlso Distinction Between Capital and Revenue ReceiptsSun MoonNo ratings yet

- UCH801Document1 pageUCH801AdityaNo ratings yet

- Fa UserDocument101 pagesFa UserSrinibas MohantyNo ratings yet

- Audited FS MIL 2011 PDFDocument60 pagesAudited FS MIL 2011 PDFrachna357100% (1)

- Valuation Methodology: The Market ApproachDocument6 pagesValuation Methodology: The Market ApproachNguyen Anh Vu100% (1)