Professional Documents

Culture Documents

ATS - DAILY TRADING PLAN 15sept2022

ATS - DAILY TRADING PLAN 15sept2022

Uploaded by

Martin WibowoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ATS - DAILY TRADING PLAN 15sept2022

ATS - DAILY TRADING PLAN 15sept2022

Uploaded by

Martin WibowoCopyright:

Available Formats

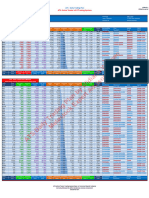

EZstartinvest ATS - Daily Trading Plan Website :

Channel : ATSTradingStrategies.com EZstartinvest.id

ATS Active Trader v2.8 Trading System

Date : Thursday, September 15, 2022 Periodicity : Daily Chart

Source : Metastock Professional Type of Analysis : Daily Stocks Exploration

System : ATS Active Trader v2.8 Expert Advisor Developed by : Widiarto Wibowo

ATS - Daily Trading Plan (Bullish)

Tabel saham dengan kecenderungan harga naik

Stocks Close Stop Loss Stop Loss Price Tgt 1 Price Tgt 2 Support Resistance Stochastic Oversold Overbought Price Volatility Stocks Accumulation Price Market MACD

Code Price (IDR) (%) (IDR) (IDR) (IDR) (IDR) (%) (IDR) (IDR) (IDR) % Code Distribution Movement Cycle Signal

JPFA 1,495 1,482 0.87% 1,525 1,540 1,482 1,525 25 1,484 1,565 30 2.0% JPFA Accumulate Upward Sideway Death Cross

ESSA 1,140 1,131 0.79% 1,203 1,235 1,131 1,167 34 1,123 1,231 63 5.5% ESSA Accumulate Limited upside Sideway Death Cross

MTEL 775 772 0.39% 789 796 772 785 38 768 796 14 1.8% MTEL Distribute Upward Sideway Death Cross

PTBA 4,360 4,335 0.57% 4,464 4,516 4,335 4,433 50 4,258 4,466 104 2.4% PTBA Accumulate Limited upside Sideway Death Cross

RALS 605 588 2.81% 623 632 588 645 53 584 607 18 3.0% RALS Accumulate Upward Trend Death Cross

HMSP 900 897 0.33% 911 917 897 910 55 894 908 11 1.2% HMSP Accumulate Upward Sideway Golden Cross

ICBP 8,525 8,504 0.25% 8,693 8,777 8,504 8,658 55 8,319 8,668 168 2.0% ICBP Distribute Upward Sideway Golden Cross

MPMX 1,030 1,026 0.39% 1,054 1,066 1,026 1,047 58 1,011 1,048 24 2.3% MPMX Accumulate Upward Trend Death Cross

AUTO 1,255 1,244 0.88% 1,278 1,290 1,244 1,282 65 1,225 1,274 23 1.8% AUTO Accumulate Upward Trend Death Cross

MEDC 975 927 4.92% 1,032 1,061 927 1,022 65 874 985 57 5.8% MEDC Accumulate Upward Sideway Golden Cross

AALI 9,200 9,122 0.85% 9,354 9,431 9,122 9,433 67 9,030 9,294 154 1.7% AALI Accumulate Upward Trend Golden Cross

WIKA 1,070 1,049 1.96% 1,106 1,124 1,049 1,107 68 1,036 1,075 36 3.4% WIKA Accumulate Upward Trend Death Cross

INDY 3,100 3,075 0.81% 3,196 3,244 3,075 3,133 69 2,916 3,148 96 3.1% INDY Accumulate Limited upside Sideway Golden Cross

SSIA 372 363 2.42% 383 389 363 381 69 354 371 11 3.0% SSIA Accumulate Upward Trend Golden Cross

DOID 422 419 0.71% 439 448 419 430 71 386 430 17 4.0% DOID Distribute Limited upside Sideway Golden Cross

BBRI 4,580 4,553 0.59% 4,668 4,712 4,553 4,667 73 4,353 4,611 88 1.9% BBRI Distribute Limited upside Trend Golden Cross

ELSA 352 343 2.56% 367 375 343 365 73 320 355 15 4.3% ELSA Accumulate Limited upside Trend Golden Cross

ISSP 314 302 3.82% 325 331 302 331 75 293 311 11 3.5% ISSP Accumulate Upward Trend Golden Cross

ADRO 4,010 3,964 1.15% 4,134 4,196 3,964 4,097 76 3,633 4,036 124 3.1% ADRO Accumulate Limited upside Trend Golden Cross

AMRT 2,250 2,173 3.42% 2,341 2,387 2,173 2,323 76 2,077 2,247 91 4.0% AMRT Accumulate Limited upside Trend Golden Cross

MAPI 1,050 1,018 3.05% 1,093 1,115 1,018 1,080 76 974 1,040 43 4.1% MAPI Accumulate Limited upside Trend Death Cross

WTON 252 246 2.38% 262 267 246 265 76 234 255 10 4.0% WTON Distribute Upward Trend Golden Cross

CTRA 1,020 1,004 1.57% 1,054 1,071 1,004 1,063 78 958 1,036 34 3.3% CTRA Accumulate Upward Trend Golden Cross

INKP 9,500 9,467 0.35% 9,802 9,953 9,467 9,800 79 8,523 9,577 302 3.2% INKP Distribute Limited upside Trend Golden Cross

TKIM 7,575 7,513 0.82% 7,784 7,889 7,513 7,758 79 6,929 7,595 209 2.8% TKIM Distribute Limited upside Trend Golden Cross

BBCA 8,500 8,414 1.01% 8,657 8,736 8,414 8,783 80 8,187 8,512 157 1.8% BBCA Distribute Upward Trend Golden Cross

LSIP 1,180 1,159 1.78% 1,210 1,225 1,159 1,200 80 1,141 1,180 30 2.5% LSIP Accumulate Upward Sideway Death Cross

MIKA 2,660 2,640 0.75% 2,744 2,786 2,640 2,740 80 2,558 2,682 84 3.2% MIKA Accumulate Limited upside Trend Golden Cross

ITMG 43,550 43,249 0.69% 44,773 45,385 43,249 44,450 81 40,013 43,524 1,223 2.8% ITMG Distribute Limited upside Sideway Golden Cross

MDKA 4,340 4,232 2.49% 4,512 4,598 4,232 4,527 81 4,020 4,349 172 4.0% MDKA Accumulate Upward Trend Golden Cross

JSMR 3,570 3,431 3.89% 3,644 3,681 3,431 3,697 82 3,353 3,496 74 2.1% JSMR Accumulate Upward Trend Golden Cross

KLBF 1,795 1,754 2.28% 1,841 1,864 1,754 1,868 83 1,657 1,789 46 2.6% KLBF Accumulate Upward Trend Golden Cross

PTPP 1,035 1,021 1.35% 1,068 1,085 1,021 1,075 83 994 1,040 33 3.2% PTPP Accumulate Upward Trend Golden Cross

PWON 494 488 1.21% 505 511 488 502 83 475 494 11 2.2% PWON Accumulate Upward Trend Death Cross

SMGR 6,650 6,610 0.60% 6,800 6,875 6,610 6,700 83 6,446 6,678 150 2.3% SMGR Accumulate Upward Trend Golden Cross

SMRA 650 644 0.92% 672 683 644 673 84 605 654 22 3.4% SMRA Accumulate Limited upside Sideway Golden Cross

BSDE 970 955 1.55% 990 1,000 955 987 85 923 966 20 2.1% BSDE Accumulate Limited upside Trend Golden Cross

ASII 7,150 7,012 1.93% 7,333 7,425 7,012 7,417 86 6,746 7,141 183 2.6% ASII Accumulate Upward Trend Golden Cross

BMRI 9,300 9,216 0.90% 9,522 9,633 9,216 9,500 86 8,740 9,321 222 2.4% BMRI Accumulate Upward Trend Golden Cross

ADHI 855 832 2.69% 883 897 832 888 89 805 849 28 3.3% ADHI Accumulate Upward Trend Golden Cross

ADMR 1,960 1,774 9.49% 2,060 2,110 1,774 2,150 90 1,670 1,842 100 5.1% ADMR Accumulate Upward Trend Golden Cross

BBNI 8,900 8,828 0.81% 9,085 9,178 8,828 9,050 90 8,493 8,881 185 2.1% BBNI Accumulate Limited upside Trend Golden Cross

UNVR 4,630 4,591 0.84% 4,717 4,761 4,591 4,663 90 4,491 4,628 87 1.9% UNVR Accumulate Upward Sideway Golden Cross

INTP 9,675 9,569 1.10% 9,848 9,935 9,569 9,775 91 9,345 9,616 173 1.8% INTP Accumulate Limited upside Trend Golden Cross

ANTM 2,120 2,030 4.25% 2,200 2,240 2,030 2,207 93 1,915 2,064 80 3.8% ANTM Accumulate Limited upside Trend Golden Cross

HRUM 2,000 1,885 5.75% 2,086 2,129 1,885 2,090 95 1,723 1,916 86 4.3% HRUM Accumulate Upward Trend Golden Cross

INCO 6,750 6,541 3.10% 6,997 7,121 6,541 6,900 96 5,944 6,580 247 3.7% INCO Accumulate Upward Sideway Golden Cross

AKRA 1,375 1,250 9.09% 1,432 1,461 1,250 1,495 97 1,174 1,285 57 4.1% AKRA Accumulate Upward Trend Golden Cross

Stocks Close Stop Loss Stop Loss Price Tgt 1 Price Tgt 2 Support Resistance Stochastic Oversold Overbought Price Volatility Stocks Accumulation Price Market MACD

Code Price (IDR) (%) (IDR) (IDR) (IDR) (IDR) (%) (IDR) (IDR) (IDR) % Code Distribution Movement Cycle Signal

ATS - Daily Trading Plan (Bearish)

Tabel saham dengan kecenderungan harga turun

Stocks Close Buy back Buy back Price Tgt 1 Price Tgt 2 Support Resistance Stochastic Oversold Overbought Price Volatility Stocks Accumulation Price Market MACD

Code Price (IDR) (%) (IDR) (IDR) (IDR) (IDR) (%) (IDR) (IDR) (IDR) % Code Distribution Movement Cycle Signal

CPIN 5,600 5,752 2.71% 5,870 5,929 5,500 5,800 4 5,707 5,893 118 2.1% CPIN Distribute Downward Trend Death Cross

BRIS 1,465 1,480 1.02% 1,508 1,522 1,445 1,485 7 1,475 1,519 28 1.9% BRIS Distribute Downward Trend Death Cross

EMTK 1,805 1,825 1.11% 1,879 1,906 1,765 1,825 15 1,814 1,895 54 3.0% EMTK Accumulate Downward Trend Death Cross

TOWR 1,195 1,213 1.51% 1,245 1,261 1,165 1,225 16 1,197 1,272 32 2.7% TOWR Distribute Downward Trend Death Cross

INDF 6,225 6,251 0.42% 6,369 6,428 6,108 6,308 17 6,217 6,395 118 1.9% INDF Accumulate Downward Trend Death Cross

EXCL 2,590 2,644 2.08% 2,721 2,760 2,557 2,657 19 2,619 2,700 77 3.0% EXCL Distribute Downward Sideway Death Cross

ARTO 7,675 7,926 3.27% 8,282 8,460 7,458 8,058 22 7,825 8,399 356 4.6% ARTO Distribute Limited downside Sideway Death Cross

ACES 670 680 1.49% 701 712 657 687 25 670 719 21 3.1% ACES Accumulate Downward Trend Death Cross

BBHI 3,100 3,107 0.23% 3,211 3,263 3,007 3,147 25 3,076 3,324 104 3.4% BBHI Accumulate Limited downside Trend Death Cross

TBIG 2,850 2,878 0.98% 2,947 2,982 2,770 2,910 28 2,836 2,923 69 2.4% TBIG Distribute Downward Trend Death Cross

TLKM 4,480 4,533 1.18% 4,635 4,686 4,420 4,560 28 4,479 4,610 102 2.3% TLKM Distribute Downward Sideway Death Cross

TINS 1,485 1,504 1.28% 1,544 1,564 1,445 1,525 32 1,484 1,546 40 2.7% TINS Distribute Downward Sideway Death Cross

BBTN 1,535 1,547 0.78% 1,579 1,595 1,505 1,555 34 1,524 1,578 32 2.1% BBTN Accumulate Downward Sideway Death Cross

PGAS 1,840 1,868 1.52% 1,935 1,969 1,800 1,880 34 1,827 1,940 67 3.6% PGAS Distribute Downward Sideway Death Cross

GGRM 23,675 23,911 1.00% 24,287 24,475 23,425 24,075 36 23,663 24,198 376 1.6% GGRM Accumulate Downward Sideway Golden Cross

UNTR 34,000 34,354 1.04% 35,138 35,530 33,550 34,400 40 33,545 35,366 784 2.3% UNTR Distribute Downward Sideway Death Cross

WOOD 515 517 0.39% 535 544 492 532 42 503 527 18 3.5% WOOD Accumulate Downward Sideway Death Cross

ERAA 466 471 1.07% 483 489 455 475 44 454 484 12 2.6% ERAA Accumulate Downward Trend Death Cross

BUKA 284 290 2.11% 303 310 271 295 48 279 295 13 4.6% BUKA Accumulate Downward Trend Death Cross

SCMA 220 223 1.36% 231 235 215 223 52 215 225 8 3.6% SCMA Accumulate Downward Sideway Death Cross

AGII 2,170 2,194 1.11% 2,291 2,340 2,103 2,223 60 2,088 2,212 97 4.5% AGII Distribute Downward Sideway Golden Cross

ISAT 7,125 7,242 1.64% 7,481 7,601 6,858 7,408 62 6,995 7,305 239 3.4% ISAT Distribute Downward Sideway Death Cross

Stocks Close Buy back Buy back Price Tgt 1 Price Tgt 2 Support Resistance Stochastic Oversold Overbought Price Volatility Stocks Accumulation Price Market MACD

Code Price (IDR) (%) (IDR) (IDR) (IDR) (IDR) (%) (IDR) (IDR) (IDR) % Code Distribution Movement Cycle Signal

Stocks

ATS Active Trader Trading System Base on Technical Market Indicator

and only intended to define tendencies of price movement.

Disclaimer On.

You might also like

- Case 01 Buffett 2015 F1769TNDocument18 pagesCase 01 Buffett 2015 F1769TNVaney IoriNo ratings yet

- SUMMER INTERNSHIP REPORT - DoxDocument47 pagesSUMMER INTERNSHIP REPORT - DoxShubham Srivastava60% (5)

- ATS - DAILY TRADING PLAN 27juli2022Document1 pageATS - DAILY TRADING PLAN 27juli2022Martin WibowoNo ratings yet

- Ats - Daily Trading Plan 16okt2023Document1 pageAts - Daily Trading Plan 16okt2023Diense ZhangNo ratings yet

- ATS - DAILY TRADING PLAN 16sept2022Document1 pageATS - DAILY TRADING PLAN 16sept2022Martin WibowoNo ratings yet

- ATS - DAILY TRADING PLAN 14sept2022Document1 pageATS - DAILY TRADING PLAN 14sept2022Martin WibowoNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- Ats - Daily Trading Plan 16juni2023Document1 pageAts - Daily Trading Plan 16juni2023AxelNo ratings yet

- ATS Active Trader v2.7 Trading System: ATS - Daily Stocks ExplorationDocument1 pageATS Active Trader v2.7 Trading System: ATS - Daily Stocks ExplorationKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS Active Trader v2.8 Trading SystemDocument1 pageATS Active Trader v2.8 Trading SystemChi ChikyuuNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS - Daily Trading Plan 4april2019Document1 pageATS - Daily Trading Plan 4april2019KPH BaliNo ratings yet

- ATS - Daily Trading Plan 6februari2019Document1 pageATS - Daily Trading Plan 6februari2019KPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM Channel: WebsiteDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM Channel: WebsitewahidNo ratings yet

- ATS - DAILY TRADING PLAN 1juli2022Document1 pageATS - DAILY TRADING PLAN 1juli2022Martin WibowoNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS - Daily Trading PlanDocument1 pageATS - Daily Trading PlanRonAlNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelSeroja NTT 2021No ratings yet

- ATS Active Trader v2.7 Trading System: Happy New Year 2019Document1 pageATS Active Trader v2.7 Trading System: Happy New Year 2019KPH BaliNo ratings yet

- Ats - Daily Trading Plan 8mei2024Document1 pageAts - Daily Trading Plan 8mei2024sehat.tantiNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS - Daily Trading Plan 14januari2019Document1 pageATS - Daily Trading Plan 14januari2019KPH BaliNo ratings yet

- ATS - Daily Trading Plan 20agustus2018Document1 pageATS - Daily Trading Plan 20agustus2018wahidNo ratings yet

- ATS Active Trader v2.7 Trading System: Happy New Year 2019Document1 pageATS Active Trader v2.7 Trading System: Happy New Year 2019KPH BaliNo ratings yet

- Ats - 70 Sharia Stocks - Trading Plan 6okt2023Document1 pageAts - 70 Sharia Stocks - Trading Plan 6okt2023Diense ZhangNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: Happy New Year 2019Document1 pageATS Active Trader v2.7 Trading System: Happy New Year 2019KPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS - Daily Trading Plan 15maret2019Document1 pageATS - Daily Trading Plan 15maret2019KPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM Channel: WebsiteDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM Channel: WebsitewahidNo ratings yet

- ATS - Daily Trading Plan 27agustus2018Document1 pageATS - Daily Trading Plan 27agustus2018wahidNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS - Daily Trading Plan 8januari2019Document1 pageATS - Daily Trading Plan 8januari2019KPH BaliNo ratings yet

- ATS - Daily Trading Plan 14agustus2018Document1 pageATS - Daily Trading Plan 14agustus2018wahidNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- Weekly 12082017Document5 pagesWeekly 12082017Thiyaga RajanNo ratings yet

- Daily Market Sheet 1-5-10Document2 pagesDaily Market Sheet 1-5-10chainbridgeinvestingNo ratings yet

- IAMv3 Individual Sample Reports PDFDocument23 pagesIAMv3 Individual Sample Reports PDFAnonymous xv5fUs4AvNo ratings yet

- 05 03 2019anDocument120 pages05 03 2019anNarnolia'sNo ratings yet

- Submission v2Document32 pagesSubmission v2MUKESH KUMARNo ratings yet

- OMSEC Morning Note 13 09 2022Document6 pagesOMSEC Morning Note 13 09 2022Ropafadzo KwarambaNo ratings yet

- Enablers ReportDocument32 pagesEnablers ReportAhmerNo ratings yet

- Augmont Daily ReportDocument2 pagesAugmont Daily ReportSarthak KhandelwalNo ratings yet

- Ev-Ebitda Oil CompaniesDocument2 pagesEv-Ebitda Oil CompaniesArie Yetti NuramiNo ratings yet

- M Ceo Campaign As On 25.02.2024Document1 pageM Ceo Campaign As On 25.02.2024sivajaduNo ratings yet

- Mutual Fund: SEPTEMBER, 2020Document58 pagesMutual Fund: SEPTEMBER, 2020farron_vNo ratings yet

- LAPSEL.PAMO.22.05.2024Document164 pagesLAPSEL.PAMO.22.05.2024Shelly IINo ratings yet

- IAPM AssignmentsDocument29 pagesIAPM AssignmentsMUKESH KUMARNo ratings yet

- Daily Market Sheet 12-7-09Document2 pagesDaily Market Sheet 12-7-09chainbridgeinvestingNo ratings yet

- MarginDocument5 pagesMarginChirag BorkarNo ratings yet

- Daily Technicals (31-May-2023) - 230531 - 090018Document19 pagesDaily Technicals (31-May-2023) - 230531 - 090018ajayNo ratings yet

- Monitoring PSM Week 1 (1-2 AGUSTUS 2023)Document288 pagesMonitoring PSM Week 1 (1-2 AGUSTUS 2023)Rizky Tegar Agus PrasetyoNo ratings yet

- Daily FNO Overview: Retail ResearchDocument5 pagesDaily FNO Overview: Retail ResearchjaimaaganNo ratings yet

- Daily FNO Overview: Retail ResearchDocument5 pagesDaily FNO Overview: Retail ResearchjaimaaganNo ratings yet

- Beta Bloomberg OtomotifDocument52 pagesBeta Bloomberg OtomotifayuvwxyzNo ratings yet

- Persentase Keuntungan CryptoDocument5 pagesPersentase Keuntungan CryptoSaera AnindyaNo ratings yet

- Daihatsu Addm MaretDocument2 pagesDaihatsu Addm MaretAntonNo ratings yet

- Growth, Profitability, and Financial Ratios For Starbucks Corp (SBUX) From MorningstarDocument2 pagesGrowth, Profitability, and Financial Ratios For Starbucks Corp (SBUX) From Morningstaraboubakr soultanNo ratings yet

- ATS - DAILY TRADING PLAN 14sept2022Document1 pageATS - DAILY TRADING PLAN 14sept2022Martin WibowoNo ratings yet

- ATS - DAILY TRADING PLAN 16sept2022Document1 pageATS - DAILY TRADING PLAN 16sept2022Martin WibowoNo ratings yet

- ATS - DAILY TRADING PLAN 1juli2022Document1 pageATS - DAILY TRADING PLAN 1juli2022Martin WibowoNo ratings yet

- ATS - DAILY TRADING PLAN 27juli2022Document1 pageATS - DAILY TRADING PLAN 27juli2022Martin WibowoNo ratings yet

- Writing 1-10Document11 pagesWriting 1-10Martin WibowoNo ratings yet

- Assignment QuestionDocument13 pagesAssignment QuestionShalini DeviNo ratings yet

- Chapter 13Document61 pagesChapter 13ginish12No ratings yet

- Practice Session - PLDocument9 pagesPractice Session - PLDivyansh PandeyNo ratings yet

- Choosing The Right Valuation ModelDocument7 pagesChoosing The Right Valuation Modelbma0215No ratings yet

- Marginal Costing FinalDocument29 pagesMarginal Costing FinalAzim Samnani50% (2)

- Acc 211Document5 pagesAcc 211LIGHTHOUSE BUSINESS AND TECHNOLOGY INTEGRATION LTDNo ratings yet

- Activity With Youtube Video Shareholders Equity Part 1Document2 pagesActivity With Youtube Video Shareholders Equity Part 1Krestyl Ann GabaldaNo ratings yet

- Acctg 102Document3 pagesAcctg 102daughrie-ty.talledo.23No ratings yet

- Quiz On Corp Formation and Subsequent Trans SolutionDocument5 pagesQuiz On Corp Formation and Subsequent Trans SolutionreikreusNo ratings yet

- Cfas - Quiz QuestionsDocument3 pagesCfas - Quiz QuestionsNavdeep KaurNo ratings yet

- Branches of AccountingDocument14 pagesBranches of AccountingSharif ShaikNo ratings yet

- Accounting Objective QuestionsDocument63 pagesAccounting Objective QuestionsManjunathreddy Seshadri90% (10)

- Fnbslw444 - Case StudyDocument5 pagesFnbslw444 - Case Studyinfobrains05No ratings yet

- Lesson 1Document12 pagesLesson 1riyaz878100% (2)

- Lesson 2 Basic Cost ConceptsDocument32 pagesLesson 2 Basic Cost ConceptsMELODY MAE TIONGSONNo ratings yet

- Robin Nepal EnglishDocument1 pageRobin Nepal EnglishgpdharanNo ratings yet

- Financial Planning and Forecasting PDFDocument29 pagesFinancial Planning and Forecasting PDFzyra liam styles100% (2)

- Chap-6 Financial AnalysisDocument15 pagesChap-6 Financial Analysis✬ SHANZA MALIK ✬No ratings yet

- Case 12 Heinz FIN 635Document39 pagesCase 12 Heinz FIN 635jack stauberNo ratings yet

- Accounting, 21st EditionDocument56 pagesAccounting, 21st EditionwarsimaNo ratings yet

- Model - Student Version: MODULE 13 CORAL BAY HOSPITAL: Traditional Project AnalysisDocument23 pagesModel - Student Version: MODULE 13 CORAL BAY HOSPITAL: Traditional Project AnalysisHassanNo ratings yet

- Lecture 1444 DepreciationDocument22 pagesLecture 1444 DepreciationTesfa negaNo ratings yet

- Illustrative Problem Worksheet ADocument6 pagesIllustrative Problem Worksheet AJoy SantosNo ratings yet

- ACTBFAR Exercise Set #1Document7 pagesACTBFAR Exercise Set #1Nikko Bowie PascualNo ratings yet

- Set A Review Quiz QuestionsDocument7 pagesSet A Review Quiz QuestionsJan Allyson BiagNo ratings yet

- Cash Flow Literature ReviewDocument6 pagesCash Flow Literature Reviewelfgxwwgf100% (1)

- Gen 009 P1 ReviewerDocument2 pagesGen 009 P1 ReviewerShane QuintoNo ratings yet

- Monthly Report With Dummy DataDocument1 pageMonthly Report With Dummy Datasenthil velNo ratings yet