Professional Documents

Culture Documents

Using DXY For Confluence - September 17 2021

Using DXY For Confluence - September 17 2021

Uploaded by

Robert PhamCopyright:

Available Formats

You might also like

- Turtle Soup 1Document32 pagesTurtle Soup 1julian barreroNo ratings yet

- CSMeter EADocument4 pagesCSMeter EABiantoroKunartoNo ratings yet

- The Araujo Report: Institutional Position Analysis and ForecastDocument7 pagesThe Araujo Report: Institutional Position Analysis and ForecastHoratiuBogdanNo ratings yet

- 60 BIWS Bank Projections Reference PDFDocument5 pages60 BIWS Bank Projections Reference PDFAnish ShahNo ratings yet

- Supply and Demand TradingDocument39 pagesSupply and Demand Tradingamirhosein tohidli100% (3)

- Hedge Fund AlertDocument12 pagesHedge Fund AlertHFGXNo ratings yet

- Forex Trading Using Intermarket Analysis Forex Strategies 84 138Document55 pagesForex Trading Using Intermarket Analysis Forex Strategies 84 138f.work200070No ratings yet

- CORE TRAINING ANALYSIS Trading With FOMC Key LevelDocument10 pagesCORE TRAINING ANALYSIS Trading With FOMC Key LevelsalemivoryconsultingNo ratings yet

- LMD Multicurrency: Strategy DescriptionDocument8 pagesLMD Multicurrency: Strategy DescriptionCardoso PenhaNo ratings yet

- Fundamental Factors That Affect Currency ValuesDocument3 pagesFundamental Factors That Affect Currency ValuesVishvesh SinghNo ratings yet

- Caravan TradersDocument5 pagesCaravan TradersFelipe SilvaNo ratings yet

- FX Weekly Forecast-17/05/2020: Presented by - Trading - HubDocument6 pagesFX Weekly Forecast-17/05/2020: Presented by - Trading - HubLaurentiu GramaNo ratings yet

- USD/JPY - Long Trade Called at 27/09/2011. HIGH RISK TRADE! James FournierDocument5 pagesUSD/JPY - Long Trade Called at 27/09/2011. HIGH RISK TRADE! James Fournierapi-100874888No ratings yet

- Thread - On - Power - of - Thread - by - Dangstrat - Apr 6, 23 - From - RattibhaDocument15 pagesThread - On - Power - of - Thread - by - Dangstrat - Apr 6, 23 - From - Rattibhasami lyNo ratings yet

- Forex Killer Oneminute StrategyDocument7 pagesForex Killer Oneminute StrategyCửu Lộc NguyễnNo ratings yet

- Can You Understand My Thread by fx4 LivingDocument5 pagesCan You Understand My Thread by fx4 LivingFrom Shark To WhaleNo ratings yet

- International Monetary SystemsDocument19 pagesInternational Monetary SystemsIdrees BharatNo ratings yet

- SFP PDFDocument12 pagesSFP PDFمحمد مصطفى100% (1)

- Firststrike 1 PDFDocument8 pagesFirststrike 1 PDFgrigoreceliluminatNo ratings yet

- 8 Basic Forex Market ConceptsDocument5 pages8 Basic Forex Market ConceptsSachinNo ratings yet

- Fundamental AnalysisDocument82 pagesFundamental AnalysisChecker Nicolas100% (1)

- Correlating Currency PairsDocument2 pagesCorrelating Currency Pairsquentin oliver100% (3)

- The Braveheart Report #Issue002Document21 pagesThe Braveheart Report #Issue002dogajunk100% (1)

- NFP Day Trading Report-2Document6 pagesNFP Day Trading Report-2Etelka IvanicsNo ratings yet

- ZulTheTrader HTF To Intraday Notes (Not For Sale)Document25 pagesZulTheTrader HTF To Intraday Notes (Not For Sale)Spine StraightenerNo ratings yet

- The First Battle Edition 3Document33 pagesThe First Battle Edition 3Athimoolam SubramaniyamNo ratings yet

- Trading and SettlementDocument12 pagesTrading and SettlementLakhan KodiyatarNo ratings yet

- Forex 4 UDocument25 pagesForex 4 US N Gautam100% (2)

- Volume Profile AnalysisDocument67 pagesVolume Profile AnalysisAnaedum EbukaNo ratings yet

- 02 0 When To Trade Counter Trend Using The Sequence and WoW TradesDocument3 pages02 0 When To Trade Counter Trend Using The Sequence and WoW Tradesmikestar_tarNo ratings yet

- Exercise 1 RevDocument7 pagesExercise 1 Revmalik kondoNo ratings yet

- 2011 08 05 Migbank Daily Technical Analysis Report+Document15 pages2011 08 05 Migbank Daily Technical Analysis Report+migbankNo ratings yet

- The Markets Ways To TradeDocument8 pagesThe Markets Ways To TradeNassim Alami Messaoudi100% (1)

- The Realignment. Using Multiple Timeframes To Locate A TradeDocument6 pagesThe Realignment. Using Multiple Timeframes To Locate A TradeMikeNo ratings yet

- Creating A Hedge Position To Enable ScaleDocument5 pagesCreating A Hedge Position To Enable Scalehusserl01No ratings yet

- International Monetary SystemDocument7 pagesInternational Monetary SystemAmethyst NocelladoNo ratings yet

- Forex For Beginners: "Rapid Quick Start Manual" by Brian CampbellDocument10 pagesForex For Beginners: "Rapid Quick Start Manual" by Brian CampbellBudi MulyonoNo ratings yet

- Lesson-4 World Trading HoursDocument14 pagesLesson-4 World Trading HoursKARTHIK P JAYSWAL 2123321No ratings yet

- Ict - Tip? - Keys - To - Daily - Thread - by - Sirpickle - Feb 18, 23 - From - RattibhaDocument5 pagesIct - Tip? - Keys - To - Daily - Thread - by - Sirpickle - Feb 18, 23 - From - Rattibhasami lyNo ratings yet

- Open How To Read The Simplified Cot Reports PDF Email Size Djhu2lDocument32 pagesOpen How To Read The Simplified Cot Reports PDF Email Size Djhu2lessamt300No ratings yet

- Lesson 1 - Supply and Demand With The TrendDocument1 pageLesson 1 - Supply and Demand With The TrendAlexis Edax100% (1)

- My Trading StrategyDocument10 pagesMy Trading StrategyYiunam LeungNo ratings yet

- Moda Trendus ManualDocument9 pagesModa Trendus ManualCapitanu IulianNo ratings yet

- Commodity Channel IndexDocument2 pagesCommodity Channel IndexMeet Darji100% (1)

- OrangeRoshan SRDC MethodDocument4 pagesOrangeRoshan SRDC Methodaziz sahadaniNo ratings yet

- CorrelacionesDocument1 pageCorrelacionesJorge Luis CangasNo ratings yet

- Chart PatternsDocument6 pagesChart Patternssam2976No ratings yet

- Thread - On - SMT - Divergence - Thread - by - Dangstrat - Apr 21, 23 - From - RattibhaDocument17 pagesThread - On - SMT - Divergence - Thread - by - Dangstrat - Apr 21, 23 - From - RattibhaJeton AliuNo ratings yet

- 3 EuroLondonScalpDocument20 pages3 EuroLondonScalpUnix 01100% (1)

- VanessaFX Advanced SystemsDocument25 pagesVanessaFX Advanced SystemspetefaderNo ratings yet

- Online Couse Max B ForexDocument76 pagesOnline Couse Max B ForexUmair KhalidNo ratings yet

- 1 Hour Tunnel Method Forex StrategyDocument7 pages1 Hour Tunnel Method Forex StrategyDaut Lopes JuniorNo ratings yet

- A9Ry0p5e4 Eppe6w 830Document10 pagesA9Ry0p5e4 Eppe6w 830elisaNo ratings yet

- Trend Trading StrategyDocument3 pagesTrend Trading Strategysimon toloNo ratings yet

- Yen Breakout Forex Trading StrategyDocument8 pagesYen Breakout Forex Trading StrategyVictor Garcia100% (1)

- London Forex RushDocument56 pagesLondon Forex RushM Syahrizal100% (1)

- The Beast User GuideDocument25 pagesThe Beast User GuideJack Janneton100% (1)

- FX Advantages S&C February 2019Document11 pagesFX Advantages S&C February 2019Peter FrankNo ratings yet

- PureDMA Manual IgmDocument12 pagesPureDMA Manual IgmMichelle RobertsNo ratings yet

- The Guide To Fundamental AnalysisDocument9 pagesThe Guide To Fundamental AnalysisTrevormax NyambsNo ratings yet

- How To Develop A Profitable Trading System PDFDocument3 pagesHow To Develop A Profitable Trading System PDFJoe DNo ratings yet

- Swap Zones-1 PDFDocument5 pagesSwap Zones-1 PDFNakata YTNo ratings yet

- P4AFM SQB As - d09 PDFDocument108 pagesP4AFM SQB As - d09 PDFTaariq Abdul-MajeedNo ratings yet

- Shri Chinai College of Commerce and Economics Andheri (E) ,: Submitted By: Group 9Document21 pagesShri Chinai College of Commerce and Economics Andheri (E) ,: Submitted By: Group 9Mohit ZaveriNo ratings yet

- Capital Structure Issues: V. VI. V.1 Mergers and Acquisitions Definition and DifferencesDocument26 pagesCapital Structure Issues: V. VI. V.1 Mergers and Acquisitions Definition and Differenceskelvin pogiNo ratings yet

- StandardDocument5 pagesStandardRifqiNo ratings yet

- Demeter PresentationDocument29 pagesDemeter PresentationspeedenquiryNo ratings yet

- Financial MarketDocument10 pagesFinancial MarketLinganagouda PatilNo ratings yet

- Guide Engaging Marketing and Branding TeamsDocument23 pagesGuide Engaging Marketing and Branding TeamsJobin JoshuaNo ratings yet

- Basel - I, II, IIIDocument23 pagesBasel - I, II, IIISangram PandaNo ratings yet

- Different Types of Investments: What Is An 'Investment'Document8 pagesDifferent Types of Investments: What Is An 'Investment'Anonymous oLTidvNo ratings yet

- Notes - Money MarketDocument7 pagesNotes - Money MarketShivshankar KhemnarNo ratings yet

- Acct 602-Discussion 4Document2 pagesAcct 602-Discussion 4Michael LipphardtNo ratings yet

- ArbitrageDocument17 pagesArbitrageKamalakannan AnnamalaiNo ratings yet

- المصطلحات المستخدمة في عقود الشركاتDocument6 pagesالمصطلحات المستخدمة في عقود الشركاتMuhammad AtallahNo ratings yet

- Ebit Eps AnalysisDocument22 pagesEbit Eps AnalysisPiyuksha PargalNo ratings yet

- Battah, Angela - BigFishDocument3 pagesBattah, Angela - BigFishGeraldJadeLazaroNo ratings yet

- Pershing Square Q3 2008 Investor LetterDocument16 pagesPershing Square Q3 2008 Investor LetterDealBook100% (38)

- Hull OFOD10e MultipleChoice Questions Only Ch10Document4 pagesHull OFOD10e MultipleChoice Questions Only Ch10Kevin Molly KamrathNo ratings yet

- A Summer Internship Project On Investment Pattern On The Basis of Risk Profile of InvestorsDocument78 pagesA Summer Internship Project On Investment Pattern On The Basis of Risk Profile of Investorsgoreankush1No ratings yet

- DuPont Profitability ModelDocument1 pageDuPont Profitability ModelcwkkarachchiNo ratings yet

- Role of Rbi in Controlling Money Supply in IndiaDocument18 pagesRole of Rbi in Controlling Money Supply in Indiaarpita banerjeeNo ratings yet

- Bank of Tanzania: TZS '000 TZS '000Document1 pageBank of Tanzania: TZS '000 TZS '000MKUTA PTBLDNo ratings yet

- Currency Options: Free Powerpoint TemplatesDocument21 pagesCurrency Options: Free Powerpoint TemplatesRavikumardNo ratings yet

- CFA Before The ExamDocument2 pagesCFA Before The Exampingu_513501No ratings yet

- Diploma in Capital Markets: Key FeaturesDocument2 pagesDiploma in Capital Markets: Key FeaturesRich AremogNo ratings yet

- Advanced Accounting Baker Test Bank - Chap009Document57 pagesAdvanced Accounting Baker Test Bank - Chap009donkazotey100% (3)

- 25 High ROE Stocks - CanadaDocument1 page25 High ROE Stocks - CanadaPattyPattersonNo ratings yet

- BM60112 - CFFA - FP 2021 - v1.0Document2 pagesBM60112 - CFFA - FP 2021 - v1.0MousumiNo ratings yet

Using DXY For Confluence - September 17 2021

Using DXY For Confluence - September 17 2021

Uploaded by

Robert PhamOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Using DXY For Confluence - September 17 2021

Using DXY For Confluence - September 17 2021

Uploaded by

Robert PhamCopyright:

Available Formats

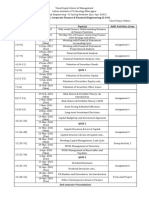

Using DXY for Confluence -

September 17 2021

Tags Correlation

What is the DXY? The dxy is the dollar index. The dollar index shows us the strength or

weakness of the US dollar. Since the USD is the worlds reserve currency and most the

world trades dollars, it is crucial to watch the DXY if you are trading any USD pairs.

Here is an example from Sept 17 2021 - of how you can use DXY to add confluence to

a trade idea on EURUSD.

With first glance, we can see that price is bearish. We are creating lower lows and lower

highs. Price is currently in a corrective phase and we should be looking to get into a

trade to ride the next impulsive leg.

We can see that heading into NY open, price has reached a premium level. We would

want to look for sells but on the 1 hour timeframe there is no clear supply zone for us to

Using DXY for Confluence - September 17 2021 1

start looking for shorts. We don't want to sell based solely on being in a premium, we

want to find areas of supply to increase our probability and increase our RR.

So we want to look for sells but nothing is clear on the 1H. For added confluence, we

look at the DXY to see that if our bias lines up or there is something else it is telling us.

On DXY we can see that price has tapped into a clear 1 hour demand zone. Our setup

is forming and we should be looking for a continuation on the DXY. EURUSD and DXY

are inversely correlated so when one is going up, the other is going down. This gives us

added confluence that we should continue to look for shorts on EURUSD.

Using DXY for Confluence - September 17 2021 2

If we zoon in to the 15 minute on EU, we can see that we are pushing into a nice supply

zone. This matches up with our DXY bias and we can start looking for a shift in market

structure before starting to take any shorts. We want confirmation that this level is going

to hold and we will see it on a LTF.

Using DXY for Confluence - September 17 2021 3

We can even refine our POI to a 5 min supply zone. Now we go down to the 1 minute

and look for a momentum shift.

Price rejects off the 5 min supply zone with aggression and we now want to see price

break the previous low before we can start looking for any shorting opportunities. IF

price breaks the low, then we have confirmation that there is a structural shift on the 1

min which follows HTF intention.

Using DXY for Confluence - September 17 2021 4

Price breaks the low, giving us confirmation that orderflow has shifted and it is time to

start to look for sells. Before breaking, price created a new supply zone. Once again, we

would look for range, initiation, mitigation, and continuation.

Because we have 2 supply zones close to each other, we could be safe and put our

stop loss above the higher zone. This way if price decides it wants to tap into that zone

Using DXY for Confluence - September 17 2021 5

instead, we are safe.

As we are expecting price to create a continuation on the higher timeframe as well (

because the dxy is lining up on 1H), we can set our target to the previous low at

minimum.

Using DXY for Confluence - September 17 2021 6

Trade triggered

From here, price doesn't look back.

1H after, price continues to melt even further for a beautiful 50+ pip move in the span of

a few hours. This is a 1:10 trade without even using a super tight stop loss!

Using DXY for Confluence - September 17 2021 7

Looking at the DXY, we can see it plays out beautifully as well

For pairs that are XXXUSD crosses, sells would have been favorable with this DXY

setup. for USDXXX pairs, buys would have been favorable.

Using DXY for Confluence - September 17 2021 8

https://fearlessfx.com/training-mini-series/

Using DXY for Confluence - September 17 2021 9

You might also like

- Turtle Soup 1Document32 pagesTurtle Soup 1julian barreroNo ratings yet

- CSMeter EADocument4 pagesCSMeter EABiantoroKunartoNo ratings yet

- The Araujo Report: Institutional Position Analysis and ForecastDocument7 pagesThe Araujo Report: Institutional Position Analysis and ForecastHoratiuBogdanNo ratings yet

- 60 BIWS Bank Projections Reference PDFDocument5 pages60 BIWS Bank Projections Reference PDFAnish ShahNo ratings yet

- Supply and Demand TradingDocument39 pagesSupply and Demand Tradingamirhosein tohidli100% (3)

- Hedge Fund AlertDocument12 pagesHedge Fund AlertHFGXNo ratings yet

- Forex Trading Using Intermarket Analysis Forex Strategies 84 138Document55 pagesForex Trading Using Intermarket Analysis Forex Strategies 84 138f.work200070No ratings yet

- CORE TRAINING ANALYSIS Trading With FOMC Key LevelDocument10 pagesCORE TRAINING ANALYSIS Trading With FOMC Key LevelsalemivoryconsultingNo ratings yet

- LMD Multicurrency: Strategy DescriptionDocument8 pagesLMD Multicurrency: Strategy DescriptionCardoso PenhaNo ratings yet

- Fundamental Factors That Affect Currency ValuesDocument3 pagesFundamental Factors That Affect Currency ValuesVishvesh SinghNo ratings yet

- Caravan TradersDocument5 pagesCaravan TradersFelipe SilvaNo ratings yet

- FX Weekly Forecast-17/05/2020: Presented by - Trading - HubDocument6 pagesFX Weekly Forecast-17/05/2020: Presented by - Trading - HubLaurentiu GramaNo ratings yet

- USD/JPY - Long Trade Called at 27/09/2011. HIGH RISK TRADE! James FournierDocument5 pagesUSD/JPY - Long Trade Called at 27/09/2011. HIGH RISK TRADE! James Fournierapi-100874888No ratings yet

- Thread - On - Power - of - Thread - by - Dangstrat - Apr 6, 23 - From - RattibhaDocument15 pagesThread - On - Power - of - Thread - by - Dangstrat - Apr 6, 23 - From - Rattibhasami lyNo ratings yet

- Forex Killer Oneminute StrategyDocument7 pagesForex Killer Oneminute StrategyCửu Lộc NguyễnNo ratings yet

- Can You Understand My Thread by fx4 LivingDocument5 pagesCan You Understand My Thread by fx4 LivingFrom Shark To WhaleNo ratings yet

- International Monetary SystemsDocument19 pagesInternational Monetary SystemsIdrees BharatNo ratings yet

- SFP PDFDocument12 pagesSFP PDFمحمد مصطفى100% (1)

- Firststrike 1 PDFDocument8 pagesFirststrike 1 PDFgrigoreceliluminatNo ratings yet

- 8 Basic Forex Market ConceptsDocument5 pages8 Basic Forex Market ConceptsSachinNo ratings yet

- Fundamental AnalysisDocument82 pagesFundamental AnalysisChecker Nicolas100% (1)

- Correlating Currency PairsDocument2 pagesCorrelating Currency Pairsquentin oliver100% (3)

- The Braveheart Report #Issue002Document21 pagesThe Braveheart Report #Issue002dogajunk100% (1)

- NFP Day Trading Report-2Document6 pagesNFP Day Trading Report-2Etelka IvanicsNo ratings yet

- ZulTheTrader HTF To Intraday Notes (Not For Sale)Document25 pagesZulTheTrader HTF To Intraday Notes (Not For Sale)Spine StraightenerNo ratings yet

- The First Battle Edition 3Document33 pagesThe First Battle Edition 3Athimoolam SubramaniyamNo ratings yet

- Trading and SettlementDocument12 pagesTrading and SettlementLakhan KodiyatarNo ratings yet

- Forex 4 UDocument25 pagesForex 4 US N Gautam100% (2)

- Volume Profile AnalysisDocument67 pagesVolume Profile AnalysisAnaedum EbukaNo ratings yet

- 02 0 When To Trade Counter Trend Using The Sequence and WoW TradesDocument3 pages02 0 When To Trade Counter Trend Using The Sequence and WoW Tradesmikestar_tarNo ratings yet

- Exercise 1 RevDocument7 pagesExercise 1 Revmalik kondoNo ratings yet

- 2011 08 05 Migbank Daily Technical Analysis Report+Document15 pages2011 08 05 Migbank Daily Technical Analysis Report+migbankNo ratings yet

- The Markets Ways To TradeDocument8 pagesThe Markets Ways To TradeNassim Alami Messaoudi100% (1)

- The Realignment. Using Multiple Timeframes To Locate A TradeDocument6 pagesThe Realignment. Using Multiple Timeframes To Locate A TradeMikeNo ratings yet

- Creating A Hedge Position To Enable ScaleDocument5 pagesCreating A Hedge Position To Enable Scalehusserl01No ratings yet

- International Monetary SystemDocument7 pagesInternational Monetary SystemAmethyst NocelladoNo ratings yet

- Forex For Beginners: "Rapid Quick Start Manual" by Brian CampbellDocument10 pagesForex For Beginners: "Rapid Quick Start Manual" by Brian CampbellBudi MulyonoNo ratings yet

- Lesson-4 World Trading HoursDocument14 pagesLesson-4 World Trading HoursKARTHIK P JAYSWAL 2123321No ratings yet

- Ict - Tip? - Keys - To - Daily - Thread - by - Sirpickle - Feb 18, 23 - From - RattibhaDocument5 pagesIct - Tip? - Keys - To - Daily - Thread - by - Sirpickle - Feb 18, 23 - From - Rattibhasami lyNo ratings yet

- Open How To Read The Simplified Cot Reports PDF Email Size Djhu2lDocument32 pagesOpen How To Read The Simplified Cot Reports PDF Email Size Djhu2lessamt300No ratings yet

- Lesson 1 - Supply and Demand With The TrendDocument1 pageLesson 1 - Supply and Demand With The TrendAlexis Edax100% (1)

- My Trading StrategyDocument10 pagesMy Trading StrategyYiunam LeungNo ratings yet

- Moda Trendus ManualDocument9 pagesModa Trendus ManualCapitanu IulianNo ratings yet

- Commodity Channel IndexDocument2 pagesCommodity Channel IndexMeet Darji100% (1)

- OrangeRoshan SRDC MethodDocument4 pagesOrangeRoshan SRDC Methodaziz sahadaniNo ratings yet

- CorrelacionesDocument1 pageCorrelacionesJorge Luis CangasNo ratings yet

- Chart PatternsDocument6 pagesChart Patternssam2976No ratings yet

- Thread - On - SMT - Divergence - Thread - by - Dangstrat - Apr 21, 23 - From - RattibhaDocument17 pagesThread - On - SMT - Divergence - Thread - by - Dangstrat - Apr 21, 23 - From - RattibhaJeton AliuNo ratings yet

- 3 EuroLondonScalpDocument20 pages3 EuroLondonScalpUnix 01100% (1)

- VanessaFX Advanced SystemsDocument25 pagesVanessaFX Advanced SystemspetefaderNo ratings yet

- Online Couse Max B ForexDocument76 pagesOnline Couse Max B ForexUmair KhalidNo ratings yet

- 1 Hour Tunnel Method Forex StrategyDocument7 pages1 Hour Tunnel Method Forex StrategyDaut Lopes JuniorNo ratings yet

- A9Ry0p5e4 Eppe6w 830Document10 pagesA9Ry0p5e4 Eppe6w 830elisaNo ratings yet

- Trend Trading StrategyDocument3 pagesTrend Trading Strategysimon toloNo ratings yet

- Yen Breakout Forex Trading StrategyDocument8 pagesYen Breakout Forex Trading StrategyVictor Garcia100% (1)

- London Forex RushDocument56 pagesLondon Forex RushM Syahrizal100% (1)

- The Beast User GuideDocument25 pagesThe Beast User GuideJack Janneton100% (1)

- FX Advantages S&C February 2019Document11 pagesFX Advantages S&C February 2019Peter FrankNo ratings yet

- PureDMA Manual IgmDocument12 pagesPureDMA Manual IgmMichelle RobertsNo ratings yet

- The Guide To Fundamental AnalysisDocument9 pagesThe Guide To Fundamental AnalysisTrevormax NyambsNo ratings yet

- How To Develop A Profitable Trading System PDFDocument3 pagesHow To Develop A Profitable Trading System PDFJoe DNo ratings yet

- Swap Zones-1 PDFDocument5 pagesSwap Zones-1 PDFNakata YTNo ratings yet

- P4AFM SQB As - d09 PDFDocument108 pagesP4AFM SQB As - d09 PDFTaariq Abdul-MajeedNo ratings yet

- Shri Chinai College of Commerce and Economics Andheri (E) ,: Submitted By: Group 9Document21 pagesShri Chinai College of Commerce and Economics Andheri (E) ,: Submitted By: Group 9Mohit ZaveriNo ratings yet

- Capital Structure Issues: V. VI. V.1 Mergers and Acquisitions Definition and DifferencesDocument26 pagesCapital Structure Issues: V. VI. V.1 Mergers and Acquisitions Definition and Differenceskelvin pogiNo ratings yet

- StandardDocument5 pagesStandardRifqiNo ratings yet

- Demeter PresentationDocument29 pagesDemeter PresentationspeedenquiryNo ratings yet

- Financial MarketDocument10 pagesFinancial MarketLinganagouda PatilNo ratings yet

- Guide Engaging Marketing and Branding TeamsDocument23 pagesGuide Engaging Marketing and Branding TeamsJobin JoshuaNo ratings yet

- Basel - I, II, IIIDocument23 pagesBasel - I, II, IIISangram PandaNo ratings yet

- Different Types of Investments: What Is An 'Investment'Document8 pagesDifferent Types of Investments: What Is An 'Investment'Anonymous oLTidvNo ratings yet

- Notes - Money MarketDocument7 pagesNotes - Money MarketShivshankar KhemnarNo ratings yet

- Acct 602-Discussion 4Document2 pagesAcct 602-Discussion 4Michael LipphardtNo ratings yet

- ArbitrageDocument17 pagesArbitrageKamalakannan AnnamalaiNo ratings yet

- المصطلحات المستخدمة في عقود الشركاتDocument6 pagesالمصطلحات المستخدمة في عقود الشركاتMuhammad AtallahNo ratings yet

- Ebit Eps AnalysisDocument22 pagesEbit Eps AnalysisPiyuksha PargalNo ratings yet

- Battah, Angela - BigFishDocument3 pagesBattah, Angela - BigFishGeraldJadeLazaroNo ratings yet

- Pershing Square Q3 2008 Investor LetterDocument16 pagesPershing Square Q3 2008 Investor LetterDealBook100% (38)

- Hull OFOD10e MultipleChoice Questions Only Ch10Document4 pagesHull OFOD10e MultipleChoice Questions Only Ch10Kevin Molly KamrathNo ratings yet

- A Summer Internship Project On Investment Pattern On The Basis of Risk Profile of InvestorsDocument78 pagesA Summer Internship Project On Investment Pattern On The Basis of Risk Profile of Investorsgoreankush1No ratings yet

- DuPont Profitability ModelDocument1 pageDuPont Profitability ModelcwkkarachchiNo ratings yet

- Role of Rbi in Controlling Money Supply in IndiaDocument18 pagesRole of Rbi in Controlling Money Supply in Indiaarpita banerjeeNo ratings yet

- Bank of Tanzania: TZS '000 TZS '000Document1 pageBank of Tanzania: TZS '000 TZS '000MKUTA PTBLDNo ratings yet

- Currency Options: Free Powerpoint TemplatesDocument21 pagesCurrency Options: Free Powerpoint TemplatesRavikumardNo ratings yet

- CFA Before The ExamDocument2 pagesCFA Before The Exampingu_513501No ratings yet

- Diploma in Capital Markets: Key FeaturesDocument2 pagesDiploma in Capital Markets: Key FeaturesRich AremogNo ratings yet

- Advanced Accounting Baker Test Bank - Chap009Document57 pagesAdvanced Accounting Baker Test Bank - Chap009donkazotey100% (3)

- 25 High ROE Stocks - CanadaDocument1 page25 High ROE Stocks - CanadaPattyPattersonNo ratings yet

- BM60112 - CFFA - FP 2021 - v1.0Document2 pagesBM60112 - CFFA - FP 2021 - v1.0MousumiNo ratings yet