Professional Documents

Culture Documents

PERMALINO - Learning Activity 20. Capital Budgeting Techniques

PERMALINO - Learning Activity 20. Capital Budgeting Techniques

Uploaded by

Ara Joyce PermalinoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PERMALINO - Learning Activity 20. Capital Budgeting Techniques

PERMALINO - Learning Activity 20. Capital Budgeting Techniques

Uploaded by

Ara Joyce PermalinoCopyright:

Available Formats

MANAGEMENT ACCOUNTING & CONTROLLERSHIP

CAPITAL BUDGETING

Learning Activity 20. Capital Budgeting Techniques

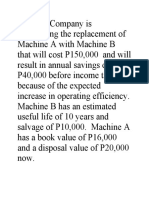

Problem 1. Permalino, Inc. is planning to acquire a new machine at a total cost of Php

360,000. The estimated life of the machine is six years with no salvage value. The straight-line

method of depreciation will be used. Permalino estimates that the annual cash flow from

operations, before income taxes, from using the machine amounts to Php 90,000. Assume that

Permalino’s cost of capital is 8% and the income tax rate is 40%. The present vale of P1 at 8%

for 6 years is 0.630. The present value of an annuity of P1 in arrears at 8% for 6 years is 4.623.

a. What would be the payback period for the machine?

b. What would be the net present value?

Problem 2. Tenorio Company is planning to invest Php 40,000 in a 3-year project.

Tenorio’s expected rate of return is 10%. The present value of P1 at 10% for 1 year is .909, for 2

years is .826 and for 3 years is .751. The cash flow net of income taxes will be Php 15,000 for

the 1st year (PV of Php 13,635) and Php 18,000 for the 2nd year (PV of Php 14,868).

Assuming the rate is exactly 10%, what would the cash flow, net of income taxes be for

the 3rd year?

Problem 3. Paunil Books is considering the purchase of a new binding equipment that will

reduce operating costs. The cost of the equipment will be Php 70,000, which will be depreciated

straight line over 5 years to a zero-salvage value. Sales are expected to increase Php 65,000 per

year, with an expected cash flow earnings before depreciation and taxes/sales ratio of 60%.

What is the expected after-tax cash flows from the project if the tax rate is 40%?

Solutions for problems:

Problem 1:

A. Annual cash flow before taxes 90,000 90,000

Less Depreciation: (360,000/6) 60,000

Taxable Income 30,000

Income Tax x 40% 12,000

Annual Cash flow after taxes 78,000

Payback Period: (360,000/78,000) 4.6 years

B. Present value of cash flow after taxes (78,000 x 4.623) 360,590

Cost of Machine 360,000

Net Present Value 590

Problem 2:

PV Factor Present

Cashflow

Year @ 10% (B) Value

(A)

(A) X (B)

1 15,000.00 0.91 13,635.00

2 18,000.00 0.83 14,868.00

Total 28,503.00

If the rate of return is exactly 10% Present value of cash inflow and present value of cash

outflow will be equal.

Present value of Outflow 40,000.00

Less: Present value of Inflow for two years 28,503.00

Present Value cash inflow for 3rd year 11,497.00

Cash flow net of taxes for 3rd year = Present value of cash inflow/Pv factor for 3rd year

= 11,497/0.751

Cash flow net of taxes for 3rd year = 15,308.95

Problem 3:

Depreciation per annum = 70,000 / 5

= 14,000

Increase in sales ₱65,000.00

Cash Flow before depreciation and tax (65,000 x 60%) 39,000.00

Less: Depreciation 14,000.00

Earning before tax 25,000.00

Less: Tax (40%) 10,000.00

Earning after Tax 15,000.00

Add: Depreciation 14,000.00

Cash Flow after tax per annum ₱ 29,000.00

Cash flow after tax for 6 Year = 29,000 x 6

Cash flow after tax for 6 Year = 174,000

You might also like

- Pittman Company Is A Small But Growing Manufacturer of Telecommunications Equipment.Document12 pagesPittman Company Is A Small But Growing Manufacturer of Telecommunications Equipment.Kailash KumarNo ratings yet

- Cat 992K Wheel Loader: Fuel BurnDocument2 pagesCat 992K Wheel Loader: Fuel BurnDion Boediono100% (1)

- Toaz - Info Elec 1 Capital Budgeting Exercise Dec 6 2020 Bsa2 Answer Key PRDocument9 pagesToaz - Info Elec 1 Capital Budgeting Exercise Dec 6 2020 Bsa2 Answer Key PRJasper Gerald Q. OngNo ratings yet

- Financial Analysis-Sizing Up Firm Performance: Income Statement 2016 % of Sales Example CalculationsDocument30 pagesFinancial Analysis-Sizing Up Firm Performance: Income Statement 2016 % of Sales Example CalculationsanisaNo ratings yet

- Thoma Pharmaceutical Company-Capital Budgeting and Estimating Cash Flows-Part V-Chapter 12Document3 pagesThoma Pharmaceutical Company-Capital Budgeting and Estimating Cash Flows-Part V-Chapter 12Rajib Dahal78% (9)

- Practice Problems Ch12 PDFDocument57 pagesPractice Problems Ch12 PDFzoeyNo ratings yet

- 57984c89bf389 (BPI CAP) Account Opening Form and Client Agreement 04-06-2016Document15 pages57984c89bf389 (BPI CAP) Account Opening Form and Client Agreement 04-06-2016Nancy Hernandez- TurlaNo ratings yet

- Project Initiation Document ExDocument9 pagesProject Initiation Document ExMarxjhony JerezNo ratings yet

- Capital Budgeting Sample ProblemsDocument10 pagesCapital Budgeting Sample ProblemsMark Gelo WinchesterNo ratings yet

- Questions 520894998.xls Page 1 of 2Document2 pagesQuestions 520894998.xls Page 1 of 2loyd smithNo ratings yet

- PaybackDocument14 pagesPaybackHema LathaNo ratings yet

- Solution: Year Cash Inflows Present Value Factor Present Value $ @10% $Document10 pagesSolution: Year Cash Inflows Present Value Factor Present Value $ @10% $Waylee CheroNo ratings yet

- Prof 6 Activity 29 To 33 Answer KeyDocument9 pagesProf 6 Activity 29 To 33 Answer KeySolana SilvestreNo ratings yet

- Afm AssignmentDocument17 pagesAfm AssignmentHabtamuNo ratings yet

- EOQ QuestionsDocument2 pagesEOQ QuestionsHalsey Shih TzuNo ratings yet

- Addtl Exercises 10 12Document5 pagesAddtl Exercises 10 12John Lester C AlagNo ratings yet

- Tugas 2 MK IIDocument6 pagesTugas 2 MK IIKirana Maharani - SagasitasNo ratings yet

- Answer - Capital BudgetingDocument19 pagesAnswer - Capital Budgetingchowchow123No ratings yet

- Capital Budgeting IiiDocument25 pagesCapital Budgeting IiiRanu AgrawalNo ratings yet

- Cap Buget ProblemsDocument8 pagesCap Buget ProblemsramakrishnanNo ratings yet

- Case Study On LeveragesDocument5 pagesCase Study On LeveragesSantosh Kumar Roul100% (3)

- Problem 3 & 4 - Acctg 7Document6 pagesProblem 3 & 4 - Acctg 7Nyster Ann RebenitoNo ratings yet

- Fundamentals of Corporate Finance Canadian 6th Edition Brealey Solutions Manual 1Document36 pagesFundamentals of Corporate Finance Canadian 6th Edition Brealey Solutions Manual 1jillhernandezqortfpmndz100% (34)

- Unit 5, 6 & 7 Capital Budgeting 1Document14 pagesUnit 5, 6 & 7 Capital Budgeting 1ankit mehtaNo ratings yet

- 8 Capital Budgeting - Problems - With AnswersDocument15 pages8 Capital Budgeting - Problems - With AnswersIamnti domnateNo ratings yet

- 92 08 DeductionsDocument18 pages92 08 DeductionsNikkoNo ratings yet

- Afm New Topic CompiledDocument59 pagesAfm New Topic Compiledganesh bhaiNo ratings yet

- Week 8 - TDocument6 pagesWeek 8 - TataseskiNo ratings yet

- MODULE 8 Capital BudgetingDocument16 pagesMODULE 8 Capital BudgetingKatrina Peralta FabianNo ratings yet

- 10 Capital Budgetting Techniques of Evolution PDFDocument57 pages10 Capital Budgetting Techniques of Evolution PDFVishesh GuptaNo ratings yet

- Capital Budgeting TybmsDocument38 pagesCapital Budgeting TybmsKushNo ratings yet

- Chapter 13 Capital Budgeting Estimating Cash Flow and Analyzing Risk Answers To End of Chapter Questions 13 3 Since The Cost of Capital Includes A Premium For Expected Inflation Failure 1Document8 pagesChapter 13 Capital Budgeting Estimating Cash Flow and Analyzing Risk Answers To End of Chapter Questions 13 3 Since The Cost of Capital Includes A Premium For Expected Inflation Failure 1ghzNo ratings yet

- Capital BudgetingDocument2 pagesCapital BudgetingAlexis KingNo ratings yet

- Brealey 5CE Ch09 SolutionsDocument27 pagesBrealey 5CE Ch09 SolutionsToby Tobes TobezNo ratings yet

- Dewa Satria Rachman Lubis - 11 - 4-17Document15 pagesDewa Satria Rachman Lubis - 11 - 4-17DewaSatriaNo ratings yet

- Finc 3310 - Actual Test 3Document5 pagesFinc 3310 - Actual Test 3jlr0911No ratings yet

- Problem Set4 Ch09 and Ch10-SolutionsDocument6 pagesProblem Set4 Ch09 and Ch10-SolutionszainebkhanNo ratings yet

- 01.PGDTM 303 (B) - Tax Practices (Direct and Indirect Taxation) - Class No. 01Document3 pages01.PGDTM 303 (B) - Tax Practices (Direct and Indirect Taxation) - Class No. 01Md. Abu NaserNo ratings yet

- Afm All AmendmentsDocument140 pagesAfm All Amendmentsru007744No ratings yet

- BTDocument6 pagesBTthanhlong2692000No ratings yet

- Activity-Partnerships-METRILLO, JOHN KENNETH R.Document4 pagesActivity-Partnerships-METRILLO, JOHN KENNETH R.LordCelene C MagyayaNo ratings yet

- Corporate Finance Canadian 7th Edition Jaffe Solutions ManualDocument16 pagesCorporate Finance Canadian 7th Edition Jaffe Solutions Manualtaylorhughesrfnaebgxyk100% (31)

- Capital BudgetingDocument22 pagesCapital BudgetingSirshajit SanfuiNo ratings yet

- Fundamentals of Corporate Finance Canadian 6th Edition Brealey Solutions ManualDocument26 pagesFundamentals of Corporate Finance Canadian 6th Edition Brealey Solutions Manualmisentrynotal6ip1lp100% (19)

- Week 5 TutorialDocument8 pagesWeek 5 TutorialRenee WongNo ratings yet

- Final Mock1 - AnswerDocument7 pagesFinal Mock1 - AnswerK58 Hà Phương LinhNo ratings yet

- MBA Advance Financial Management - ASYNCHRONUS ACTIVITYDocument9 pagesMBA Advance Financial Management - ASYNCHRONUS ACTIVITYDaniella LampteyNo ratings yet

- Rules On Capital Assets Transactions Corporation IndividualDocument2 pagesRules On Capital Assets Transactions Corporation Individualzeref dragneelNo ratings yet

- Chapter 11Document10 pagesChapter 11Syed Sheraz AliNo ratings yet

- FINA 3330 - Notes CH 9Document2 pagesFINA 3330 - Notes CH 9fische100% (1)

- Elements ARR PaybackDocument3 pagesElements ARR PaybackAngela Miles DizonNo ratings yet

- CH 12 SM AssigDocument6 pagesCH 12 SM AssigJefferson SarmientoNo ratings yet

- Lecture Slides After-Tax AnalysisDocument13 pagesLecture Slides After-Tax AnalysisfathimashariffdeenNo ratings yet

- Taxation Material 4Document36 pagesTaxation Material 4Shaira BugayongNo ratings yet

- Finals Exam SolutionsDocument6 pagesFinals Exam SolutionsZhengzhou CalNo ratings yet

- Esno Finial Fabricating-Self-correction Problems-Capital Budgeting and Estimating Cash FlowsDocument1 pageEsno Finial Fabricating-Self-correction Problems-Capital Budgeting and Estimating Cash FlowsRajib DahalNo ratings yet

- Capital BudgetingDocument12 pagesCapital BudgetingNike ColeNo ratings yet

- Model Solution: Solution To The Question No. 1Document9 pagesModel Solution: Solution To The Question No. 1HossainNo ratings yet

- Dewa Satria Rachman LubisDocument13 pagesDewa Satria Rachman LubisDewaSatriaNo ratings yet

- Financial Planning 2Document7 pagesFinancial Planning 2atentoangiaNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet

- 6 Matulungin 23-24 HptaDocument1 page6 Matulungin 23-24 HptaAra Joyce PermalinoNo ratings yet

- PERMALINO - Learning Activity 12 - Short Term BudgetingDocument2 pagesPERMALINO - Learning Activity 12 - Short Term BudgetingAra Joyce PermalinoNo ratings yet

- Enhancement Plan Mam ArahDocument3 pagesEnhancement Plan Mam ArahAra Joyce PermalinoNo ratings yet

- PERMALINO - Learning Activity 9 - Composite BEP AnalysisDocument2 pagesPERMALINO - Learning Activity 9 - Composite BEP AnalysisAra Joyce PermalinoNo ratings yet

- PERMALINO - Learning Activity 8 - BEP Sales With ProfitDocument2 pagesPERMALINO - Learning Activity 8 - BEP Sales With ProfitAra Joyce PermalinoNo ratings yet

- PERMALINO - Learning Activity 11 - Budget ProcessDocument4 pagesPERMALINO - Learning Activity 11 - Budget ProcessAra Joyce PermalinoNo ratings yet

- PERMALINO - Learning Activity 17 - Make or Buy DecisionDocument3 pagesPERMALINO - Learning Activity 17 - Make or Buy DecisionAra Joyce PermalinoNo ratings yet

- PERMALINO - Learning Activity 10 - Sensitivity AnalysisDocument4 pagesPERMALINO - Learning Activity 10 - Sensitivity AnalysisAra Joyce PermalinoNo ratings yet

- Learning Activity 7 - Variable & Fixed CostsDocument2 pagesLearning Activity 7 - Variable & Fixed CostsAra Joyce PermalinoNo ratings yet

- Learning Activity 6 - Variable Vs Absorption CostingDocument2 pagesLearning Activity 6 - Variable Vs Absorption CostingAra Joyce PermalinoNo ratings yet

- PERMALINO - Learning Activity 19. Working Capital ManagementDocument3 pagesPERMALINO - Learning Activity 19. Working Capital ManagementAra Joyce PermalinoNo ratings yet

- Learning Activity 5 - Classification of CostsDocument1 pageLearning Activity 5 - Classification of CostsAra Joyce PermalinoNo ratings yet

- Learning Activity 1 - Analysis of Financial StatementsDocument3 pagesLearning Activity 1 - Analysis of Financial StatementsAra Joyce PermalinoNo ratings yet

- PERMALINO - Learning Activity 18 - Eliminate or Continue A Product LineDocument2 pagesPERMALINO - Learning Activity 18 - Eliminate or Continue A Product LineAra Joyce PermalinoNo ratings yet

- Final Requirement - Permalino & ColladaDocument24 pagesFinal Requirement - Permalino & ColladaAra Joyce PermalinoNo ratings yet

- Kuliah Materi Budaya OrganisasiDocument19 pagesKuliah Materi Budaya OrganisasiTito YustiawanNo ratings yet

- Analysis and Identification of Nonconforming Products by 5W2H MethodDocument10 pagesAnalysis and Identification of Nonconforming Products by 5W2H MethodkkkkoaNo ratings yet

- Integra Nec Sv8100 ConfigurationDocument9 pagesIntegra Nec Sv8100 ConfigurationKetSaiNo ratings yet

- How Large Should Be Mysql Innodb Buffer Pool Size?Document4 pagesHow Large Should Be Mysql Innodb Buffer Pool Size?Gokhan OsmanNo ratings yet

- CapersJones - Scoring and Evaluating Software Methods, Practices, and ResultsDocument17 pagesCapersJones - Scoring and Evaluating Software Methods, Practices, and ResultsSharing Caring100% (1)

- Basic College Mathematics 9th Edition Lial Test Bank 1Document39 pagesBasic College Mathematics 9th Edition Lial Test Bank 1james100% (38)

- SalesForce Class 8 PDFDocument9 pagesSalesForce Class 8 PDFAmit Sharma100% (1)

- The Leela New NormalDocument24 pagesThe Leela New NormalDigvijay SinghNo ratings yet

- Current LogDocument10 pagesCurrent LogHernan BritoNo ratings yet

- Military Courtesy and DisciplineDocument33 pagesMilitary Courtesy and DisciplineCherry EyreNo ratings yet

- FILMUSIC - International Composing CompetitionDocument3 pagesFILMUSIC - International Composing CompetitionFrancesco NettiNo ratings yet

- Computer Notes 1 Year Chapter # 1 Short Questions (According To Alp)Document4 pagesComputer Notes 1 Year Chapter # 1 Short Questions (According To Alp)Nb KashifNo ratings yet

- Confocal LSM880 Airyscan ManualDocument15 pagesConfocal LSM880 Airyscan ManualdrduyoncoNo ratings yet

- Food Waste Reduction in School Canteens: Evidence From An Italian CaseDocument20 pagesFood Waste Reduction in School Canteens: Evidence From An Italian CaseAishwarya RamakrishnanNo ratings yet

- WalltzDocument10 pagesWalltzPreeti Kumari SharmaNo ratings yet

- It Assignment 2014Document143 pagesIt Assignment 2014Preeti GahlotNo ratings yet

- SOP Mission LiFE - Action Plan UploadDocument5 pagesSOP Mission LiFE - Action Plan Uploadঅভিষেক দাস রাকেশNo ratings yet

- Lenovo Legion Y740 Series User Guide: Downloaded From Manuals Search EngineDocument68 pagesLenovo Legion Y740 Series User Guide: Downloaded From Manuals Search Enginealexa fernandezNo ratings yet

- The Effect of Implant Abutment Junction Position On Crestal Bone Loss A Systematic Review and Meta AnalysisDocument17 pagesThe Effect of Implant Abutment Junction Position On Crestal Bone Loss A Systematic Review and Meta AnalysisBagis Emre GulNo ratings yet

- 757 TowbarDocument20 pages757 TowbarNad RockNo ratings yet

- TT Lubricating Oils Greases Shelf Life RecommendationsDocument2 pagesTT Lubricating Oils Greases Shelf Life RecommendationsSanogo YayaNo ratings yet

- Block Armour Recommended by Ministry of Information Technology, Govt. of India and DSCIDocument12 pagesBlock Armour Recommended by Ministry of Information Technology, Govt. of India and DSCIBlock ArmourNo ratings yet

- 45R-08 Scheduling Claims Protection MethodsDocument10 pages45R-08 Scheduling Claims Protection MethodsHatem HejaziNo ratings yet

- ArchibusDocument12 pagesArchibusapi-256135737No ratings yet

- Quantum-Enhanced Nonlinear MicrosDocument3 pagesQuantum-Enhanced Nonlinear MicrosMarkAllenPascualNo ratings yet

- Mihalis KAVARATZISDocument18 pagesMihalis KAVARATZISPaulo FerreiraNo ratings yet