Professional Documents

Culture Documents

$RVUKR3K

$RVUKR3K

Uploaded by

naveen0 ratings0% found this document useful (0 votes)

7 views2 pagesThe document compares the income statements and balance sheets of Coca-Cola and Pepsi from 2014-2017. It finds that both companies saw decreasing revenues and expenses over this period. However, their net incomes in 2017 decreased significantly due to large increases in interest and tax expenses. Pepsi showed more stable financials overall compared to Coca-Cola. The document also analyzes trends in the companies' assets, liabilities, and equity over time.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document compares the income statements and balance sheets of Coca-Cola and Pepsi from 2014-2017. It finds that both companies saw decreasing revenues and expenses over this period. However, their net incomes in 2017 decreased significantly due to large increases in interest and tax expenses. Pepsi showed more stable financials overall compared to Coca-Cola. The document also analyzes trends in the companies' assets, liabilities, and equity over time.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

7 views2 pages$RVUKR3K

$RVUKR3K

Uploaded by

naveenThe document compares the income statements and balance sheets of Coca-Cola and Pepsi from 2014-2017. It finds that both companies saw decreasing revenues and expenses over this period. However, their net incomes in 2017 decreased significantly due to large increases in interest and tax expenses. Pepsi showed more stable financials overall compared to Coca-Cola. The document also analyzes trends in the companies' assets, liabilities, and equity over time.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

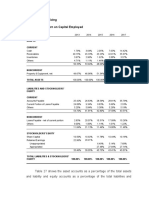

Comparative Balance sheet of Two

Companies and its analysis

THE COCA-COLA COMPANY (% change)

INCOME STATEMENT 2017 2016 2015 2014

Net Revenue 77.0% 91.0% 96.3% 100.0%

(Cost of goods sold) 74.1% 92.0% 97.7% 100.0%

Gross profit 78.8% 90.4% 95.4% 100.0%

(operating expenses) 80.7% 90.9% 89.8% 100.0%

EBIT 75.0% 89.3% 106.9% 100.0%

(Interests and taxes) 267.4% 80.3% 118.0% 100.0%

Net income 17.6% 92.0% 103.6% 100.0%

BALANCE SHEET 2017 2016 2015 2014

Total assets 95.52% 94.83% 97.90% 100.00%

Non-current assets 86.98% 90.21% 96.04% 100.00%

Current assets 110.79% 103.10% 101.24% 100.00%

Equity + Liabilities 95.52% 94.83% 97.90% 100.00%

Equity 62.10% 75.98% 84.30% 100.00%

Non-current liabilities 143.44% 128.98% 128.57% 100.00%

Current liabilities 84.00% 81.95% 83.18% 100.00%

Table 5- Coca-Cola balance sheet horizontal analysis

PEPSICO (% change)

INCOME STATEMENT 2017 2016 2015 2014

Net Revenue 95.26% 94.18% 94.56% 100.00%

(Cost of goods sold) 93.20% 91.34% 93.03% 100.00%

Gross profit 97.04% 96.62% 95.88% 100.00%

(operating expenses) 92.42% 94.61% 99.06% 100.00%

EBIT 109.69% 102.13% 87.18% 100.00%

(Interests and taxes) 184.22% 112.65% 94.56% 100.00%

Net income 74.57% 97.17% 83.71% 100.00%

BALANCE SHEET 2017 2016 2015 2014

Total assets 113.18% 104.23% 98.81% 100.00%

Non-current assets 97.86% 94.37% 93.56% 100.00%

Current assets 150.16% 128.01% 111.46% 100.00%

Equity + Liabilities 113.18% 104.23% 98.81% 100.00%

Equity 62.58% 63.82% 68.55% 100.00%

Non-current liabilities 138.58% 118.03% 114.88% 100.00%

Current liabilities 113.32% 116.82% 97.16% 100.00%

ANALYSIS & INTERPRETATION

Pepsi’s income statement shows more stability than Coca-Cola’s, as

revenues slowly decrease, expenses do the same. Again, everything

is completely normal until the net income of the year 2017 which,

again, shows a big decrease.

This decrease is not as big as in Coca-Cola’s case, but it can be

clearly seen that the cause is the same as interest and taxes almost

double in 2017.

Other than this, the only other important change is the increase in

EBIT from 2015 to 2016, while the revenues stay the same, which

later leads to a higher net income in 2016. This is due to a cost

reduction in 2016, as operating expenses and cost of goods sold

(COGS) are both lower that year.

In the balance sheet, it can be seen that, like in Coca-Cola’s case,

Current assets and non-current liabilities increase, but in this case,

non-current assets and current liabilities stay stable over time. This

means that this increase is through a decrease in equity and an

overall growth in assets and liabilities. These new assets are mostly

financed with non-current liabilities, which increase by almost 40%

since 2015.

You might also like

- Carlyle Model Interview Test - InstructionsDocument2 pagesCarlyle Model Interview Test - Instructionsjorgeetcheverria100% (1)

- Clothing Retailers Financial Statements AnalysisDocument15 pagesClothing Retailers Financial Statements Analysisapi-277769092No ratings yet

- Horizontal Analysis AltmanDocument8 pagesHorizontal Analysis AltmanClaudine Anne AguiatanNo ratings yet

- Financial Statements For BYCO Income StatementDocument3 pagesFinancial Statements For BYCO Income Statementmohammad bilalNo ratings yet

- Tugas AlkDocument7 pagesTugas AlkMuthia FadillaNo ratings yet

- Annual Report of Pakistan Oilfield Limited (POL)Document22 pagesAnnual Report of Pakistan Oilfield Limited (POL)Kehkashan AnsariNo ratings yet

- 2020 PBB Form Completion AssistanceDocument6 pages2020 PBB Form Completion AssistanceAvlean Rica TorralbaNo ratings yet

- Business FinanceDocument43 pagesBusiness FinanceKimNo ratings yet

- 01.2018 Question Answer HorizontalDocument2 pages01.2018 Question Answer HorizontalumeshNo ratings yet

- TASMARIDocument2 pagesTASMARIMoci MociNo ratings yet

- Trend Analysis 2Document1 pageTrend Analysis 2Isha NatuNo ratings yet

- Company Analysis - KRBL - Ayush SrivastavaDocument29 pagesCompany Analysis - KRBL - Ayush SrivastavaAyush SrivastavaNo ratings yet

- Vertical Horizontal Analysis Balance TemplateDocument4 pagesVertical Horizontal Analysis Balance TemplateGAZA MARY ANGELINENo ratings yet

- Keterangan 2015 2016 2017: Year To Year Anylisis Analisis Common SizeDocument9 pagesKeterangan 2015 2016 2017: Year To Year Anylisis Analisis Common SizeSahirah Hafizhah TaqiyyahNo ratings yet

- Afs 26 JunDocument8 pagesAfs 26 JunSyed Fakhar AbbasNo ratings yet

- LuxotticaDocument24 pagesLuxotticaValentina GaviriaNo ratings yet

- Financial Statement Analysis of Yes BankDocument12 pagesFinancial Statement Analysis of Yes BankAjay Suthar100% (1)

- ColoradoCaseAges County Small ClaimsDocument1 pageColoradoCaseAges County Small ClaimsCircuit MediaNo ratings yet

- FS Analysis 1Document37 pagesFS Analysis 1Roselyn AcbangNo ratings yet

- (Swaraj Kishan Bhuyan)Document3 pages(Swaraj Kishan Bhuyan)ASUTOSH MUDULINo ratings yet

- Activity-1 Unit 2 Financial Analysis 3BSA-1Document2 pagesActivity-1 Unit 2 Financial Analysis 3BSA-1JonellNo ratings yet

- Laurenz R. Patawe - Activity 1PART2 PDFDocument2 pagesLaurenz R. Patawe - Activity 1PART2 PDFJonellNo ratings yet

- H - Trend AnalysisDocument2 pagesH - Trend AnalysisJames Yvess ReyesNo ratings yet

- Fiscal Year Is Jan - Dec. 2015 2014 2013 2015 2014 2013Document12 pagesFiscal Year Is Jan - Dec. 2015 2014 2013 2015 2014 2013Amir ShahzadNo ratings yet

- riesgo y retorno del portafolio27.1.2024 (1) (1)Document28 pagesriesgo y retorno del portafolio27.1.2024 (1) (1)marquitoaqpNo ratings yet

- Exide Industries LTDDocument10 pagesExide Industries LTDAlok ChowdhuryNo ratings yet

- Nishat Chunian Group Consists of Three Companies - Nishat Chunian LimitedDocument4 pagesNishat Chunian Group Consists of Three Companies - Nishat Chunian LimitedAleena AshfaqueNo ratings yet

- Performance in DicatorsDocument1 pagePerformance in DicatorsBENJAMIN DEBISMENo ratings yet

- Infosys Common Size StatementsDocument1 pageInfosys Common Size Statementssagar SamantaraNo ratings yet

- Din Textile ReportDocument10 pagesDin Textile ReportcontactNo ratings yet

- Common Sizing EditedDocument3 pagesCommon Sizing EditedClaudine Anne AguiatanNo ratings yet

- CH 2 FS AnalysisDocument1 pageCH 2 FS AnalysisREVELNo ratings yet

- Book 1Document3 pagesBook 1Reymark BaldoNo ratings yet

- 02 Pricing Bonds Solution Problem Set 2Document16 pages02 Pricing Bonds Solution Problem Set 2No NoNo ratings yet

- Macy's, Inc. Financial HealthDocument2 pagesMacy's, Inc. Financial Healthjoia.dej1234No ratings yet

- Delay Rate: Direktorat Operasi Perum LPPNPI Tangerang, 31 Maret 2017Document18 pagesDelay Rate: Direktorat Operasi Perum LPPNPI Tangerang, 31 Maret 2017cv nusa aradimasNo ratings yet

- Finance Detective - Ratio AnalysisDocument2 pagesFinance Detective - Ratio AnalysisAndhitiawarman NugrahaNo ratings yet

- Common Size P&L - VEDANTA LTDDocument20 pagesCommon Size P&L - VEDANTA LTDVANSHAJ SHAHNo ratings yet

- Fundamentals Ratios For YPF SA: Growth Rates 2020 2019 2018 2017 2016Document3 pagesFundamentals Ratios For YPF SA: Growth Rates 2020 2019 2018 2017 2016Isra MachicadoNo ratings yet

- ColoradoCaseAges County Expedited Permanency PlansDocument1 pageColoradoCaseAges County Expedited Permanency PlansCircuit MediaNo ratings yet

- Infl Ation: Year Inflation Moving Average All Commodities WPIDocument8 pagesInfl Ation: Year Inflation Moving Average All Commodities WPIDevanshNo ratings yet

- 02.2018 Question Answer HorizontalDocument4 pages02.2018 Question Answer HorizontalumeshNo ratings yet

- How To Pricing LoansDocument2 pagesHow To Pricing LoansMatNo ratings yet

- Tata Motors ForetradersDocument18 pagesTata Motors Foretradersguptaasoham24No ratings yet

- Fix It Right Kpi 2017Document1 pageFix It Right Kpi 2017Xavier MoraNo ratings yet

- Casting CompareDocument2 pagesCasting Compareprith.m217425No ratings yet

- Ramirez Lopez Francisco JohanDocument3 pagesRamirez Lopez Francisco Johan196P1379No ratings yet

- Confi Abilidad de Los Componentes: Controlador Fuente Energia VentiladorDocument6 pagesConfi Abilidad de Los Componentes: Controlador Fuente Energia VentiladorAkemi SalcedoNo ratings yet

- ACOFINDocument1 pageACOFINNonami AbicoNo ratings yet

- Banks RatiosDocument4 pagesBanks RatiosYAKUBU ISSAHAKU SAIDNo ratings yet

- Excel Crash Course - Book1 - Blank: Strictly ConfidentialDocument7 pagesExcel Crash Course - Book1 - Blank: Strictly ConfidentialআসিফহাসানখানNo ratings yet

- 03.2018 Question Answer Horizontal-2Document17 pages03.2018 Question Answer Horizontal-2umeshNo ratings yet

- 04.2018 Question Answer HorizontalDocument28 pages04.2018 Question Answer HorizontalumeshNo ratings yet

- Ratios Liquidity Ratios:: Days Sales OutstandingDocument3 pagesRatios Liquidity Ratios:: Days Sales OutstandingPraise BuenaflorNo ratings yet

- Final Cfa UltjDocument190 pagesFinal Cfa UltjYunita PutriNo ratings yet

- Excel Crash Course - Book1 - Complete: Strictly ConfidentialDocument5 pagesExcel Crash Course - Book1 - Complete: Strictly ConfidentialGaurav KumarNo ratings yet

- Hotel de L - Etoile Income StatementDocument2 pagesHotel de L - Etoile Income StatementasadNo ratings yet

- Excel Stock and Bond PortfolioDocument7 pagesExcel Stock and Bond Portfolioapi-27174321No ratings yet

- ABNB ValuationDocument4 pagesABNB ValuationKasturi MazumdarNo ratings yet

- Financial AnalysisDocument9 pagesFinancial AnalysisSam SumoNo ratings yet

- Cobb DouglasDocument6 pagesCobb DouglasnaveenNo ratings yet

- Law of VariableDocument9 pagesLaw of VariablenaveenNo ratings yet

- Data CollectionDocument5 pagesData CollectionnaveenNo ratings yet

- Data ScientistDocument39 pagesData ScientistnaveenNo ratings yet

- Author's Accepted Manuscript: Tribiology InternationalDocument30 pagesAuthor's Accepted Manuscript: Tribiology InternationalnaveenNo ratings yet

- Chapter Three: Opportunity Cost of Capital and Capital BudgetingDocument20 pagesChapter Three: Opportunity Cost of Capital and Capital Budgetingmuudey sheikhNo ratings yet

- FAR - PPE (Depreciation and Derecognition) - StudentDocument3 pagesFAR - PPE (Depreciation and Derecognition) - StudentPamelaNo ratings yet

- Investment Analysis FormulasDocument2 pagesInvestment Analysis FormulasNESIBE ERBASNo ratings yet

- MDLY 4Q19 Investor Presentation v3Document21 pagesMDLY 4Q19 Investor Presentation v3Dan NadNo ratings yet

- Fm-May-June 2015Document18 pagesFm-May-June 2015banglauserNo ratings yet

- Treasury MGT Assignment 2022Document3 pagesTreasury MGT Assignment 2022Abdulkarim Hamisi KufakunogaNo ratings yet

- Van Horne McqsDocument10 pagesVan Horne McqsMudassar Hassan100% (2)

- Namma Kalvi 12th Accountancy Unit 5 Sura English Medium Guide PDFDocument15 pagesNamma Kalvi 12th Accountancy Unit 5 Sura English Medium Guide PDFAakaash C.K.No ratings yet

- LeverageDocument3 pagesLeverageSatish Kumar SonwaniNo ratings yet

- Dey's Solution Book Accountancy XII Part-A 2021-22 EditionDocument56 pagesDey's Solution Book Accountancy XII Part-A 2021-22 Editionmanoj jainNo ratings yet

- Partneship Handout Without Answer KeyDocument10 pagesPartneship Handout Without Answer KeyAirah Manalastas0% (1)

- Annexure E Financial Follow-Up Report (FFR Ii) : Half-Yearly Operating StatementDocument9 pagesAnnexure E Financial Follow-Up Report (FFR Ii) : Half-Yearly Operating StatementNarendra Ku MalikNo ratings yet

- Quiz 4Document17 pagesQuiz 4Dawna Lee BerryNo ratings yet

- Riffat 12 16204 3 Slide ACC101 Chapter 3 Adjusting The AccountsDocument43 pagesRiffat 12 16204 3 Slide ACC101 Chapter 3 Adjusting The Accountsaimen aminNo ratings yet

- Managerial Accounting 13Th Edition Warren Solutions Manual Full Chapter PDFDocument36 pagesManagerial Accounting 13Th Edition Warren Solutions Manual Full Chapter PDFherbert.howard901100% (11)

- Problems: Problem 12 - 2Document9 pagesProblems: Problem 12 - 2Jein PNo ratings yet

- CSEC Principles of Accounts Syllabus 2019Document77 pagesCSEC Principles of Accounts Syllabus 2019natbw998No ratings yet

- Solutions To Chapter 7 Long-Term Debt-Paying AbilityDocument32 pagesSolutions To Chapter 7 Long-Term Debt-Paying AbilityGing freexNo ratings yet

- 4 5866240566815099684Document10 pages4 5866240566815099684Habteweld EdluNo ratings yet

- Basic Finance OverviewDocument23 pagesBasic Finance OverviewLorenz Rem FranciscoNo ratings yet

- Exam2 Solutions 40610 2008Document8 pagesExam2 Solutions 40610 2008blackghostNo ratings yet

- 2019491243256731WHTRateCardupdated09 03 19FinSupSecAmendAct2019Document5 pages2019491243256731WHTRateCardupdated09 03 19FinSupSecAmendAct2019Shoaib AhmedNo ratings yet

- Consolidated Financial StatementsDocument43 pagesConsolidated Financial StatementsSuresh Kadam100% (2)

- Assignment 1-6 WorksheetDocument5 pagesAssignment 1-6 WorksheetMonali PatelNo ratings yet

- Testbanks PrelimsDocument32 pagesTestbanks PrelimsSharmaine LiasosNo ratings yet

- Practice-Exam - Principles of AccountingDocument7 pagesPractice-Exam - Principles of AccountingNg. Minh ThảoNo ratings yet

- Accelerated Depreciation MethodsDocument4 pagesAccelerated Depreciation MethodsIvan PachecoNo ratings yet

- Shruti SaMPLEDocument65 pagesShruti SaMPLEUrvashi RajputNo ratings yet

- Capital Budgeting Sample QuestionsDocument2 pagesCapital Budgeting Sample QuestionsNCTNo ratings yet