Professional Documents

Culture Documents

Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengaluru

Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengaluru

Uploaded by

Harjot SinghCopyright:

Available Formats

You might also like

- Ielts TRFDocument1 pageIelts TRFHarjot SinghNo ratings yet

- Ca ReportDocument8 pagesCa ReportHarjot SinghNo ratings yet

- Bedfordshire OfferDocument5 pagesBedfordshire OfferHarjot SinghNo ratings yet

- Surjit KaurDocument5 pagesSurjit KaurHarjot SinghNo ratings yet

- S170318 Financial Planning For Salaried Employee and Strategies For Tax Savings PDFDocument4 pagesS170318 Financial Planning For Salaried Employee and Strategies For Tax Savings PDFSURAJNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAdarsh KeshariNo ratings yet

- ACK712972670260723Document1 pageACK712972670260723Firoz AliNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearRavi KumarNo ratings yet

- Purchase OrderDocument2 pagesPurchase Ordershakeel ahmedNo ratings yet

- Digitally Signed by Kundan Kumar Date: 2021.07.25 23:34:27 ISTDocument8 pagesDigitally Signed by Kundan Kumar Date: 2021.07.25 23:34:27 ISThimanshu pandaNo ratings yet

- Computation 3Document2 pagesComputation 3Sai DyNo ratings yet

- HEPL Financials v1.9 FinalDocument15 pagesHEPL Financials v1.9 FinalA YoungNo ratings yet

- Pie Network ItrDocument1 pagePie Network ItrsanchitNo ratings yet

- Computation Sheet of Taxable Income & Income TaxDocument2 pagesComputation Sheet of Taxable Income & Income TaxPandu DoradlaNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Subhransu SarangiNo ratings yet

- PDF 979868730130323Document1 pagePDF 979868730130323Abhilash Bhavan SasiNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruBINAYAK CHAKRABORTYNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument15 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceEathenNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument4 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceSaran ManiNo ratings yet

- Rajesh Bora Itr PLBS 2022Document5 pagesRajesh Bora Itr PLBS 2022ABDUL KHALIKNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearShivi ChaurasiaNo ratings yet

- 16746568618RI_PreOpen_AddDocument4 pages16746568618RI_PreOpen_Addyadavravindranath57No ratings yet

- My Udyam Registration CertificateDocument2 pagesMy Udyam Registration CertificateISO CertificationNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruSagar Kumar GuptaNo ratings yet

- 2A. HDFC May2019 EstatementDocument7 pages2A. HDFC May2019 EstatementNanu PatelNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument9 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancevadivel ramalingamNo ratings yet

- ITR 2024-25Document1 pageITR 2024-25indiandksinghNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument24 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceAnup YadavNo ratings yet

- Zerodha Securities Private Limited: Transaction With Holding StatementDocument1 pageZerodha Securities Private Limited: Transaction With Holding StatementArun KumarNo ratings yet

- Udhyam RegistrationDocument1 pageUdhyam RegistrationDeepanshu Singh PanwarNo ratings yet

- Print - Udyam Registration CertificateDocument1 pagePrint - Udyam Registration CertificateSandeep KumarNo ratings yet

- PDF 816776770290723Document1 pagePDF 816776770290723Sunita SinghNo ratings yet

- ITR-2 Indian Income Tax Return: Part A-GENDocument13 pagesITR-2 Indian Income Tax Return: Part A-GENHarish100% (1)

- 1Document4 pages1Abhishek SinghviNo ratings yet

- Vamsi Krishna Velaga - ITDocument1 pageVamsi Krishna Velaga - ITvamsiNo ratings yet

- Form 16: Wipro LimitedDocument8 pagesForm 16: Wipro LimitedpadduNo ratings yet

- FAA Letter To BoeingDocument2 pagesFAA Letter To BoeingDavid SlotnickNo ratings yet

- Vipin Manohar Agarwal Computetion Ay-2022-23Document2 pagesVipin Manohar Agarwal Computetion Ay-2022-23giyanendersingh1No ratings yet

- Chartered Accountant Full Set of Tourist VisaDocument4 pagesChartered Accountant Full Set of Tourist VisaManikandanNo ratings yet

- The Ine That We NeedDocument8 pagesThe Ine That We NeedTyrion LannisterNo ratings yet

- Print - Udyam Registration CertificateDocument1 pagePrint - Udyam Registration Certificatevaibhavk6035No ratings yet

- Statement For HDFC Bank Credit Card HDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6Document4 pagesStatement For HDFC Bank Credit Card HDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6Rushika BavaniaNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearDev puniaNo ratings yet

- Employee Details Payment & Leave Details: Arrears Current AmountDocument2 pagesEmployee Details Payment & Leave Details: Arrears Current AmountNagaraj NaikNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearAbhinaba SahaNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Immanuel Suman ShijuNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDattatraya JoshiNo ratings yet

- Nalco Tender - 1 PDFDocument3 pagesNalco Tender - 1 PDFRajiv PoddarNo ratings yet

- Ack 367661020050723Document1 pageAck 367661020050723Sivaram PopuriNo ratings yet

- Form 16 FY 19-20Document6 pagesForm 16 FY 19-20Anurag SharmaNo ratings yet

- Itr 20-21Document1 pageItr 20-21Rohit kandpalNo ratings yet

- PDF 438429930210822Document1 pagePDF 438429930210822peetamber agarwalNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruRoshanjit ThakurNo ratings yet

- Deposit Confirmation/Renewal AdviceDocument1 pageDeposit Confirmation/Renewal Adviceekta rajoriaNo ratings yet

- Welcome To Aditya Birla Insurance Brokers Limited, A Subsidiary of Aditya Birla Capital Limited!Document4 pagesWelcome To Aditya Birla Insurance Brokers Limited, A Subsidiary of Aditya Birla Capital Limited!Prathamesh KannaNo ratings yet

- Commodities Account Opening Form: Document Significance PAGE(s)Document47 pagesCommodities Account Opening Form: Document Significance PAGE(s)surprise MFNo ratings yet

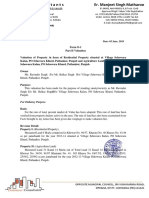

- Manjeet Singh MatharuDocument3 pagesManjeet Singh Matharusunny singhNo ratings yet

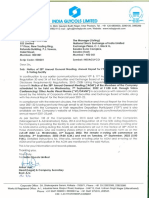

- India Glycols Limited: 2-B, +911206860000, 3090200 3090111, E-MailDocument179 pagesIndia Glycols Limited: 2-B, +911206860000, 3090200 3090111, E-MailPriyam RoyNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Deeksha SinghNo ratings yet

- Ea XHZV CPT B9 Q QNZ 6Document14 pagesEa XHZV CPT B9 Q QNZ 6Rakesh SNo ratings yet

- Akshay - Dev@vedanta - Co.in F16Document10 pagesAkshay - Dev@vedanta - Co.in F16Akshay DevNo ratings yet

- 1A. HDFC Apr2019 EstatementDocument9 pages1A. HDFC Apr2019 EstatementNanu PatelNo ratings yet

- Itr-V Amzpy8600m 2020-21 347932700070620Document1 pageItr-V Amzpy8600m 2020-21 347932700070620Piyu VaiNo ratings yet

- Ramavath A.Y 2020-21 Tax - AcknowledgementDocument1 pageRamavath A.Y 2020-21 Tax - AcknowledgementBhashya RamavathNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengalurukingNo ratings yet

- Online Tax Payment PortalDocument1 pageOnline Tax Payment PortalHarjot SinghNo ratings yet

- CamScanner 03-12-2022 14.34Document1 pageCamScanner 03-12-2022 14.34Harjot SinghNo ratings yet

- Online Tax Payment PortalDocument1 pageOnline Tax Payment PortalHarjot SinghNo ratings yet

- Financials OnlineDocument11 pagesFinancials OnlineHarjot SinghNo ratings yet

- Https WWW - Punjabhsrp.in Customer Reprint - PHP Reg No PB10BA8211&Invoice No PB8222331421Document1 pageHttps WWW - Punjabhsrp.in Customer Reprint - PHP Reg No PB10BA8211&Invoice No PB8222331421Harjot SinghNo ratings yet

- ApplicationDocument2 pagesApplicationHarjot SinghNo ratings yet

- Exercise FlyerDocument1 pageExercise FlyerHarjot SinghNo ratings yet

- Online Tax Payment PortalDocument1 pageOnline Tax Payment PortalHarjot SinghNo ratings yet

- 234-Anmoldeep Kaur-Decision LetterDocument1 page234-Anmoldeep Kaur-Decision LetterHarjot SinghNo ratings yet

- Bangkok Standard Itinerary ShamiliDocument4 pagesBangkok Standard Itinerary ShamiliHarjot SinghNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruHarjot SinghNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearHarjot SinghNo ratings yet

- FINANCIALDocument22 pagesFINANCIALHarjot SinghNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruHarjot SinghNo ratings yet

- Ca LetterDocument1 pageCa LetterHarjot SinghNo ratings yet

- Bank StatementDocument4 pagesBank StatementHarjot SinghNo ratings yet

- Legal Services Payment Plan AgreementDocument3 pagesLegal Services Payment Plan AgreementHarjot SinghNo ratings yet

- 1 CompressedDocument2 pages1 CompressedHarjot SinghNo ratings yet

- ਸੁਪਨ ਸਵਰ, ਖ਼ਲੀਲ ਜਿਬਰਾਨDocument94 pagesਸੁਪਨ ਸਵਰ, ਖ਼ਲੀਲ ਜਿਬਰਾਨHarjot SinghNo ratings yet

- आपके अवचेतन मन की शक्ति से आगे BEYONDDocument239 pagesआपके अवचेतन मन की शक्ति से आगे BEYONDHarjot SinghNo ratings yet

- ਮਿਲਖੀ ਦਾ ਸੱਸੀ ਪੁਨੂੰDocument68 pagesਮਿਲਖੀ ਦਾ ਸੱਸੀ ਪੁਨੂੰHarjot SinghNo ratings yet

- Payroll Accounting 2018 28Th Edition Bieg Test Bank Full Chapter PDFDocument36 pagesPayroll Accounting 2018 28Th Edition Bieg Test Bank Full Chapter PDFentrickaretologyswr100% (9)

- Allianz Life Fund Performance Report 2013 PDFDocument346 pagesAllianz Life Fund Performance Report 2013 PDFChong Vun KinNo ratings yet

- Lesson 002 Branches of AccountingDocument4 pagesLesson 002 Branches of AccountingYnnoJhom harthartNo ratings yet

- Economic Survey 2017Document329 pagesEconomic Survey 2017plg rdpcbNo ratings yet

- Big Basket Invoice 30-5Document1 pageBig Basket Invoice 30-5rajendra singhNo ratings yet

- Republic v. CaguioaDocument3 pagesRepublic v. Caguioavictoria100% (1)

- Crypto PDFDocument7 pagesCrypto PDFNikhil MohiteNo ratings yet

- Annual Report 2022 BunnyslimitedDocument61 pagesAnnual Report 2022 BunnyslimitedMuhammad Shafay MalikNo ratings yet

- FORM 20-F: United States Securities and Exchange CommissionDocument219 pagesFORM 20-F: United States Securities and Exchange Commissionaggmeghantarwal9No ratings yet

- BLTST119ExOr NY PDFDocument1 pageBLTST119ExOr NY PDFmoresubscriptionsNo ratings yet

- On November I 2013 Campbell Corporation Management Decided To Discontinue PDFDocument1 pageOn November I 2013 Campbell Corporation Management Decided To Discontinue PDFFreelance WorkerNo ratings yet

- Updated-PdpDocument540 pagesUpdated-Pdpapi-648810768No ratings yet

- G.R No. 227049, September 16, 2020Document1 pageG.R No. 227049, September 16, 2020cyrusgalicia3No ratings yet

- BAC 3634 - Corporate Accounting IDocument20 pagesBAC 3634 - Corporate Accounting IBongDanielNo ratings yet

- Syllabus BS 4years Economics PDFDocument114 pagesSyllabus BS 4years Economics PDFJaveria WahabNo ratings yet

- Overtown GatewayDocument162 pagesOvertown GatewayNone None None100% (2)

- Demand - Engineering EconomicsDocument15 pagesDemand - Engineering EconomicsPankaj Gill0% (1)

- New LIC Jeevan Akshay VI Annuity PlanDocument37 pagesNew LIC Jeevan Akshay VI Annuity PlanJAYAMIN PATELNo ratings yet

- Lecture 17 - Factors Affecting Investment and Production CostDocument17 pagesLecture 17 - Factors Affecting Investment and Production CostGoa TripNo ratings yet

- 2019-01 Nieuwsbrief Uzk ENUDocument2 pages2019-01 Nieuwsbrief Uzk ENUAdrian OanceaNo ratings yet

- 5de7ae39724bbpages From Tax Planning and ManagementDocument17 pages5de7ae39724bbpages From Tax Planning and ManagementVinay RajputNo ratings yet

- ACW 420 - TOPIC 3 Public SectorDocument74 pagesACW 420 - TOPIC 3 Public SectorNor Ihsan Abd LatifNo ratings yet

- National Power Corporation vs. The Provincial Treasurer of Benguet, Et Al.Document13 pagesNational Power Corporation vs. The Provincial Treasurer of Benguet, Et Al.red gynNo ratings yet

- UP V City Treasurer of Quezon CityDocument6 pagesUP V City Treasurer of Quezon CityTimothy JamesNo ratings yet

- TDS Section ListDocument3 pagesTDS Section Listprince vadgamaNo ratings yet

- 8 RR No. 16-2021 (Allowing Submission of Scanned Copies of 2307)Document3 pages8 RR No. 16-2021 (Allowing Submission of Scanned Copies of 2307)Mark DomingoNo ratings yet

- 5.2.tax Avoidance - Does Tax-Specific Industry Expertise Make A DifferenceDocument30 pages5.2.tax Avoidance - Does Tax-Specific Industry Expertise Make A Differenceemriz pratamaNo ratings yet

- Samudera Indonesia TBK - 31 Mar 2023Document116 pagesSamudera Indonesia TBK - 31 Mar 2023damycenelNo ratings yet

- ACCT217 - Sample Exam 2: Identify The Choice That Best Completes The Statement or Answers The QuestionDocument26 pagesACCT217 - Sample Exam 2: Identify The Choice That Best Completes The Statement or Answers The Questionphilker21No ratings yet

Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengaluru

Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengaluru

Uploaded by

Harjot SinghOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengaluru

Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengaluru

Uploaded by

Harjot SinghCopyright:

Available Formats

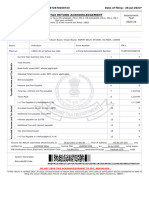

INDIAN INCOME TAX RETURN ACKNOWLEDGEMENT Assessment Year

[Where the data of the Return of Income in Form ITR-1 (SAHAJ), ITR-2, ITR-3,

ITR-4(SUGAM), ITR-5, ITR-6, ITR-7 filed and verified]

2021-22

(Please see Rule 12 of the Income-tax Rules, 1962)

PAN

DWNPS3846G

Name

DARSHAN SINGH

S/0; SUCHA SINGH, VILLAGE KHALWAN PO BHATHAL BHAI KE TARN TARAN PUNJAB 143409

Address

Status Form Number

Individual ITR-3

Filed u/s e-Filing Acknowledgement Number

139(1)-On or beforedue date 905706430261320

Current Year business loss, if any 1 0

Taxable Income and Tax details

Total Income 310940

Book Profit under MAT, where applicable 2 0

Adjusted Total Income under AMT, where applicable 3 310940

Net tax payable 4 0

Interest and Fee Payable 5 0

Total tax, interest and Fee payable 6 0

Taxes Paid 7 0

(+)Tax Payable /(-)Refundable (6-7) 8 0

Dividend Tax Payable 9 0

Distribution Tax

Interest Payable 10 0

Dividend

details

Total Dividend tax and interest payable 11 0

Taxes Paid 12 0

(+)Tax Payable /(-)Refundable (11-12) 13 0

Accreted Income & Tax

Accreted Income as per section 115TD 14 0

Additional Tax payable u/s 115TD 15 0

16 0

Detail

Interest payable u/s 115TE

Additional Tax and interest payable 17 0

Tax and interest paid 18 0

(+)Tax Payable /(-)Refundable (17-18) 19 0

Income Tax Return submitted electronically on 2-09-2022 10:47:19 from IP address 203.134.202.214 and verified by

DARSHAN SINGH

having PAN DWNPS3846G using duly signed ITR-V form received at “Centralized Processing Centre, Income Tax Department,

Bengaluru - 560500” on 2-09-2022

DO NOT SEND THIS ACKNOWLEDGEMENT TO CPC, BENGALURU

Name of Assesse DARSHAN SINGH

Father's Name S. SUCHA SINGH

Address VILLAGE KHALWAN PO BHATHAL BHAI KE TARN TARAN PUNJAB 143409

Status Individual Assessment Year 2021-2022

Ward Year Ended 31.03-2020

PAN DWNPS3846G Date of Birth 10.03.1976

Residental Status Resident Sex Male

Nature of Business SHARE OF INCOME FROM FIRM ONLY

Filing Status Original

Last Year Return Filed On 09/07/2019 Serial No.: 547852136598741

Aadhaar No.: 869587379728 Passport No.:

Bank Name YES BANK, A/C 5010025390700, Type: Saving, IFSC: YESB0000071

Tele: Mob: 9056299359

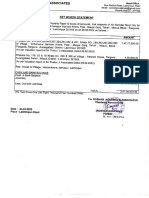

Computation of Total Income

Income from Business or Profession (Chapter IV D) 304440

From Firm GO AND GLOW COSMETICS

(50.00% Share)

Remuneration 54000

Interest 57600

(Profit Exempt u/s 10 2(A)-690/-)

111600

Income u/s 44AD 192840

Profit as per Profit and Loss a/c 0

Income from Other Sources (Chapter IV F) 13797

Interest From Saving Bank A/C 7299

Interest on F.D.r 6498

13797

Gross Total Income 318237

Less: Deductions (Chapter VI_A)

u/s 80TTA (Interest From Saving Bank Account.) 7299

7299

Total Income 310938

Round off u/s 288 A 310940

Agriculture Income 384000

Income Exempt u/s 10 -690

Adjusted total income (ATI) is not more than Rs. 20 lakh hence AMT not applicable.

NAME OF ASSESSEE : KULDIP SINGH A.Y. 2020-2021 PAN : EDHPS5832J Code: MFILE: 1334

Rebate Agriculture Income 39300

Tax Due 12188

Rebate u/s 87A 12188

0

Tax Payable 0

Details of Exempt Income

S.NO. Particulars Amount

1 Profit from Firm GO AND GLOW COSMETICS -690

Total -690

Due Date for filing Return July 31, 2021

Due date extended to 31/12/2021 88/2020/F. No. 370142/35/2020-TPL DT. 29.10.2021

Income Declared u/s 44 AD TURNOVER

Gross Reeceipts/ Turnover 1256620.00

Book Profit 192840.00 15.35%

Deemed Profit 100529.60 8.00%

Net Profit Declared 192840.00 15.35%

BANK ACCOUNT DETAIL

S.NO Bank Address Account No. MICR IFSC Code Type

1 HDFC BANK 5010025390700 HDFC0001332 Saving

Signature

(KULDIP SINGH)

Date- 23.12.2021

CompuTax: MFILE-1334 (KULDIP SINGH)

Generated at the time of Return File

You might also like

- Ielts TRFDocument1 pageIelts TRFHarjot SinghNo ratings yet

- Ca ReportDocument8 pagesCa ReportHarjot SinghNo ratings yet

- Bedfordshire OfferDocument5 pagesBedfordshire OfferHarjot SinghNo ratings yet

- Surjit KaurDocument5 pagesSurjit KaurHarjot SinghNo ratings yet

- S170318 Financial Planning For Salaried Employee and Strategies For Tax Savings PDFDocument4 pagesS170318 Financial Planning For Salaried Employee and Strategies For Tax Savings PDFSURAJNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAdarsh KeshariNo ratings yet

- ACK712972670260723Document1 pageACK712972670260723Firoz AliNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearRavi KumarNo ratings yet

- Purchase OrderDocument2 pagesPurchase Ordershakeel ahmedNo ratings yet

- Digitally Signed by Kundan Kumar Date: 2021.07.25 23:34:27 ISTDocument8 pagesDigitally Signed by Kundan Kumar Date: 2021.07.25 23:34:27 ISThimanshu pandaNo ratings yet

- Computation 3Document2 pagesComputation 3Sai DyNo ratings yet

- HEPL Financials v1.9 FinalDocument15 pagesHEPL Financials v1.9 FinalA YoungNo ratings yet

- Pie Network ItrDocument1 pagePie Network ItrsanchitNo ratings yet

- Computation Sheet of Taxable Income & Income TaxDocument2 pagesComputation Sheet of Taxable Income & Income TaxPandu DoradlaNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Subhransu SarangiNo ratings yet

- PDF 979868730130323Document1 pagePDF 979868730130323Abhilash Bhavan SasiNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruBINAYAK CHAKRABORTYNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument15 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceEathenNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument4 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceSaran ManiNo ratings yet

- Rajesh Bora Itr PLBS 2022Document5 pagesRajesh Bora Itr PLBS 2022ABDUL KHALIKNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearShivi ChaurasiaNo ratings yet

- 16746568618RI_PreOpen_AddDocument4 pages16746568618RI_PreOpen_Addyadavravindranath57No ratings yet

- My Udyam Registration CertificateDocument2 pagesMy Udyam Registration CertificateISO CertificationNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruSagar Kumar GuptaNo ratings yet

- 2A. HDFC May2019 EstatementDocument7 pages2A. HDFC May2019 EstatementNanu PatelNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument9 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancevadivel ramalingamNo ratings yet

- ITR 2024-25Document1 pageITR 2024-25indiandksinghNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument24 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceAnup YadavNo ratings yet

- Zerodha Securities Private Limited: Transaction With Holding StatementDocument1 pageZerodha Securities Private Limited: Transaction With Holding StatementArun KumarNo ratings yet

- Udhyam RegistrationDocument1 pageUdhyam RegistrationDeepanshu Singh PanwarNo ratings yet

- Print - Udyam Registration CertificateDocument1 pagePrint - Udyam Registration CertificateSandeep KumarNo ratings yet

- PDF 816776770290723Document1 pagePDF 816776770290723Sunita SinghNo ratings yet

- ITR-2 Indian Income Tax Return: Part A-GENDocument13 pagesITR-2 Indian Income Tax Return: Part A-GENHarish100% (1)

- 1Document4 pages1Abhishek SinghviNo ratings yet

- Vamsi Krishna Velaga - ITDocument1 pageVamsi Krishna Velaga - ITvamsiNo ratings yet

- Form 16: Wipro LimitedDocument8 pagesForm 16: Wipro LimitedpadduNo ratings yet

- FAA Letter To BoeingDocument2 pagesFAA Letter To BoeingDavid SlotnickNo ratings yet

- Vipin Manohar Agarwal Computetion Ay-2022-23Document2 pagesVipin Manohar Agarwal Computetion Ay-2022-23giyanendersingh1No ratings yet

- Chartered Accountant Full Set of Tourist VisaDocument4 pagesChartered Accountant Full Set of Tourist VisaManikandanNo ratings yet

- The Ine That We NeedDocument8 pagesThe Ine That We NeedTyrion LannisterNo ratings yet

- Print - Udyam Registration CertificateDocument1 pagePrint - Udyam Registration Certificatevaibhavk6035No ratings yet

- Statement For HDFC Bank Credit Card HDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6Document4 pagesStatement For HDFC Bank Credit Card HDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6Rushika BavaniaNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearDev puniaNo ratings yet

- Employee Details Payment & Leave Details: Arrears Current AmountDocument2 pagesEmployee Details Payment & Leave Details: Arrears Current AmountNagaraj NaikNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearAbhinaba SahaNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Immanuel Suman ShijuNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDattatraya JoshiNo ratings yet

- Nalco Tender - 1 PDFDocument3 pagesNalco Tender - 1 PDFRajiv PoddarNo ratings yet

- Ack 367661020050723Document1 pageAck 367661020050723Sivaram PopuriNo ratings yet

- Form 16 FY 19-20Document6 pagesForm 16 FY 19-20Anurag SharmaNo ratings yet

- Itr 20-21Document1 pageItr 20-21Rohit kandpalNo ratings yet

- PDF 438429930210822Document1 pagePDF 438429930210822peetamber agarwalNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruRoshanjit ThakurNo ratings yet

- Deposit Confirmation/Renewal AdviceDocument1 pageDeposit Confirmation/Renewal Adviceekta rajoriaNo ratings yet

- Welcome To Aditya Birla Insurance Brokers Limited, A Subsidiary of Aditya Birla Capital Limited!Document4 pagesWelcome To Aditya Birla Insurance Brokers Limited, A Subsidiary of Aditya Birla Capital Limited!Prathamesh KannaNo ratings yet

- Commodities Account Opening Form: Document Significance PAGE(s)Document47 pagesCommodities Account Opening Form: Document Significance PAGE(s)surprise MFNo ratings yet

- Manjeet Singh MatharuDocument3 pagesManjeet Singh Matharusunny singhNo ratings yet

- India Glycols Limited: 2-B, +911206860000, 3090200 3090111, E-MailDocument179 pagesIndia Glycols Limited: 2-B, +911206860000, 3090200 3090111, E-MailPriyam RoyNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Deeksha SinghNo ratings yet

- Ea XHZV CPT B9 Q QNZ 6Document14 pagesEa XHZV CPT B9 Q QNZ 6Rakesh SNo ratings yet

- Akshay - Dev@vedanta - Co.in F16Document10 pagesAkshay - Dev@vedanta - Co.in F16Akshay DevNo ratings yet

- 1A. HDFC Apr2019 EstatementDocument9 pages1A. HDFC Apr2019 EstatementNanu PatelNo ratings yet

- Itr-V Amzpy8600m 2020-21 347932700070620Document1 pageItr-V Amzpy8600m 2020-21 347932700070620Piyu VaiNo ratings yet

- Ramavath A.Y 2020-21 Tax - AcknowledgementDocument1 pageRamavath A.Y 2020-21 Tax - AcknowledgementBhashya RamavathNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengalurukingNo ratings yet

- Online Tax Payment PortalDocument1 pageOnline Tax Payment PortalHarjot SinghNo ratings yet

- CamScanner 03-12-2022 14.34Document1 pageCamScanner 03-12-2022 14.34Harjot SinghNo ratings yet

- Online Tax Payment PortalDocument1 pageOnline Tax Payment PortalHarjot SinghNo ratings yet

- Financials OnlineDocument11 pagesFinancials OnlineHarjot SinghNo ratings yet

- Https WWW - Punjabhsrp.in Customer Reprint - PHP Reg No PB10BA8211&Invoice No PB8222331421Document1 pageHttps WWW - Punjabhsrp.in Customer Reprint - PHP Reg No PB10BA8211&Invoice No PB8222331421Harjot SinghNo ratings yet

- ApplicationDocument2 pagesApplicationHarjot SinghNo ratings yet

- Exercise FlyerDocument1 pageExercise FlyerHarjot SinghNo ratings yet

- Online Tax Payment PortalDocument1 pageOnline Tax Payment PortalHarjot SinghNo ratings yet

- 234-Anmoldeep Kaur-Decision LetterDocument1 page234-Anmoldeep Kaur-Decision LetterHarjot SinghNo ratings yet

- Bangkok Standard Itinerary ShamiliDocument4 pagesBangkok Standard Itinerary ShamiliHarjot SinghNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruHarjot SinghNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearHarjot SinghNo ratings yet

- FINANCIALDocument22 pagesFINANCIALHarjot SinghNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruHarjot SinghNo ratings yet

- Ca LetterDocument1 pageCa LetterHarjot SinghNo ratings yet

- Bank StatementDocument4 pagesBank StatementHarjot SinghNo ratings yet

- Legal Services Payment Plan AgreementDocument3 pagesLegal Services Payment Plan AgreementHarjot SinghNo ratings yet

- 1 CompressedDocument2 pages1 CompressedHarjot SinghNo ratings yet

- ਸੁਪਨ ਸਵਰ, ਖ਼ਲੀਲ ਜਿਬਰਾਨDocument94 pagesਸੁਪਨ ਸਵਰ, ਖ਼ਲੀਲ ਜਿਬਰਾਨHarjot SinghNo ratings yet

- आपके अवचेतन मन की शक्ति से आगे BEYONDDocument239 pagesआपके अवचेतन मन की शक्ति से आगे BEYONDHarjot SinghNo ratings yet

- ਮਿਲਖੀ ਦਾ ਸੱਸੀ ਪੁਨੂੰDocument68 pagesਮਿਲਖੀ ਦਾ ਸੱਸੀ ਪੁਨੂੰHarjot SinghNo ratings yet

- Payroll Accounting 2018 28Th Edition Bieg Test Bank Full Chapter PDFDocument36 pagesPayroll Accounting 2018 28Th Edition Bieg Test Bank Full Chapter PDFentrickaretologyswr100% (9)

- Allianz Life Fund Performance Report 2013 PDFDocument346 pagesAllianz Life Fund Performance Report 2013 PDFChong Vun KinNo ratings yet

- Lesson 002 Branches of AccountingDocument4 pagesLesson 002 Branches of AccountingYnnoJhom harthartNo ratings yet

- Economic Survey 2017Document329 pagesEconomic Survey 2017plg rdpcbNo ratings yet

- Big Basket Invoice 30-5Document1 pageBig Basket Invoice 30-5rajendra singhNo ratings yet

- Republic v. CaguioaDocument3 pagesRepublic v. Caguioavictoria100% (1)

- Crypto PDFDocument7 pagesCrypto PDFNikhil MohiteNo ratings yet

- Annual Report 2022 BunnyslimitedDocument61 pagesAnnual Report 2022 BunnyslimitedMuhammad Shafay MalikNo ratings yet

- FORM 20-F: United States Securities and Exchange CommissionDocument219 pagesFORM 20-F: United States Securities and Exchange Commissionaggmeghantarwal9No ratings yet

- BLTST119ExOr NY PDFDocument1 pageBLTST119ExOr NY PDFmoresubscriptionsNo ratings yet

- On November I 2013 Campbell Corporation Management Decided To Discontinue PDFDocument1 pageOn November I 2013 Campbell Corporation Management Decided To Discontinue PDFFreelance WorkerNo ratings yet

- Updated-PdpDocument540 pagesUpdated-Pdpapi-648810768No ratings yet

- G.R No. 227049, September 16, 2020Document1 pageG.R No. 227049, September 16, 2020cyrusgalicia3No ratings yet

- BAC 3634 - Corporate Accounting IDocument20 pagesBAC 3634 - Corporate Accounting IBongDanielNo ratings yet

- Syllabus BS 4years Economics PDFDocument114 pagesSyllabus BS 4years Economics PDFJaveria WahabNo ratings yet

- Overtown GatewayDocument162 pagesOvertown GatewayNone None None100% (2)

- Demand - Engineering EconomicsDocument15 pagesDemand - Engineering EconomicsPankaj Gill0% (1)

- New LIC Jeevan Akshay VI Annuity PlanDocument37 pagesNew LIC Jeevan Akshay VI Annuity PlanJAYAMIN PATELNo ratings yet

- Lecture 17 - Factors Affecting Investment and Production CostDocument17 pagesLecture 17 - Factors Affecting Investment and Production CostGoa TripNo ratings yet

- 2019-01 Nieuwsbrief Uzk ENUDocument2 pages2019-01 Nieuwsbrief Uzk ENUAdrian OanceaNo ratings yet

- 5de7ae39724bbpages From Tax Planning and ManagementDocument17 pages5de7ae39724bbpages From Tax Planning and ManagementVinay RajputNo ratings yet

- ACW 420 - TOPIC 3 Public SectorDocument74 pagesACW 420 - TOPIC 3 Public SectorNor Ihsan Abd LatifNo ratings yet

- National Power Corporation vs. The Provincial Treasurer of Benguet, Et Al.Document13 pagesNational Power Corporation vs. The Provincial Treasurer of Benguet, Et Al.red gynNo ratings yet

- UP V City Treasurer of Quezon CityDocument6 pagesUP V City Treasurer of Quezon CityTimothy JamesNo ratings yet

- TDS Section ListDocument3 pagesTDS Section Listprince vadgamaNo ratings yet

- 8 RR No. 16-2021 (Allowing Submission of Scanned Copies of 2307)Document3 pages8 RR No. 16-2021 (Allowing Submission of Scanned Copies of 2307)Mark DomingoNo ratings yet

- 5.2.tax Avoidance - Does Tax-Specific Industry Expertise Make A DifferenceDocument30 pages5.2.tax Avoidance - Does Tax-Specific Industry Expertise Make A Differenceemriz pratamaNo ratings yet

- Samudera Indonesia TBK - 31 Mar 2023Document116 pagesSamudera Indonesia TBK - 31 Mar 2023damycenelNo ratings yet

- ACCT217 - Sample Exam 2: Identify The Choice That Best Completes The Statement or Answers The QuestionDocument26 pagesACCT217 - Sample Exam 2: Identify The Choice That Best Completes The Statement or Answers The Questionphilker21No ratings yet