Professional Documents

Culture Documents

Itr Ay 2022-23

Itr Ay 2022-23

Uploaded by

Soumya Swain0 ratings0% found this document useful (0 votes)

168 views1 pageDuli Chand Jain filed their Indian Income Tax Return for the 2022-23 assessment year on June 20, 2022. Their total income was Rs. 4,96,870 and net tax payable was Rs. 0. They had already paid Rs. 1,802 in taxes. They are eligible for a tax refund of Rs. 1,800. The return was electronically filed and verified by Duli Chand Jain using an Electronic Verification Code generated through Aadhaar OTP mode.

Original Description:

Original Title

ITR AY 2022-23

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentDuli Chand Jain filed their Indian Income Tax Return for the 2022-23 assessment year on June 20, 2022. Their total income was Rs. 4,96,870 and net tax payable was Rs. 0. They had already paid Rs. 1,802 in taxes. They are eligible for a tax refund of Rs. 1,800. The return was electronically filed and verified by Duli Chand Jain using an Electronic Verification Code generated through Aadhaar OTP mode.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

168 views1 pageItr Ay 2022-23

Itr Ay 2022-23

Uploaded by

Soumya SwainDuli Chand Jain filed their Indian Income Tax Return for the 2022-23 assessment year on June 20, 2022. Their total income was Rs. 4,96,870 and net tax payable was Rs. 0. They had already paid Rs. 1,802 in taxes. They are eligible for a tax refund of Rs. 1,800. The return was electronically filed and verified by Duli Chand Jain using an Electronic Verification Code generated through Aadhaar OTP mode.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

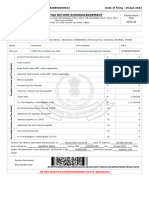

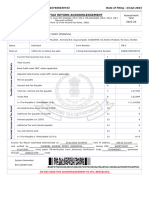

Acknowledgement Number:683381450200622 Date of filing:20-06-2022

INDIAN INCOME TAX RETURN ACKNOWLEDGEMENT

[Where the data of the Return of Income in Form ITR-1 (SAHAJ), ITR-2, ITR-3, ITR-4(SUGAM), ITR-5, ITR-6, ITR-7

Assessment Year

filed and verified] 2022-23

(Please see Rule 12 of the Income-tax Rules, 1962)

PAN AQBPJ3531E

Name DULI CHAND JAIN

Address THIKADAR PADA , TITILAGARH , TITILAGARH,BALANGIR , 24-Orissa , 91-India , 767033

Status Individual Form Number ITR-4

Filed u/s 139(1) Return filed on or before due date e-Filing Acknowledgement Number 683381450200622

Current Year business loss, if any 1 0

Total Income 4,96,870

Book Profit under MAT, where applicable 2 0

Adjusted Total Income under AMT, where applicable 3 0

Net tax payable 4 0

Interest and Fee Payable 5 0

Total tax, interest and Fee payable 6 0

Taxes Paid 7 1,802

(+) Tax Payable /(-) Refundable (6-7) 8 (-) 1,800

Accreted Income as per section 115TD 9 0

Additional Tax payable u/s 115TD 10 0

Interest payable u/s 115TE 11 0

Additional Tax and interest payable 12 0

Tax and interest paid 13 0

(+) Tax Payable /(-) Refundable (12-13) 14 0

Income Tax Return submitted electronically on 20-06-2022 10:46:16 from IP address 45.121.3.68 and verified by DULI CHAND JAIN having

PAN AQBPJ3531E on 20-06-2022 10:46:15 using paper ITR-Verification Form /Electronic Verification Code XW67MK5MII generated

through Aadhaar OTP mode

System Generated

Barcode/QR Code

AQBPJ3531E046833814502006223BA0A1CDC229492E00541490F9A5B13EE384D71C

DO NOT SEND THIS ACKNOWLEDGEMENT TO CPC, BENGALURU

You might also like

- Business Plan On Edible Cookie CupDocument28 pagesBusiness Plan On Edible Cookie Cupharvey barrientos100% (6)

- PDF 192659360280722Document1 pagePDF 192659360280722MILTON MOHANTYNo ratings yet

- AFFIDAVIT of Right To Lawful Currency of Exchange Template 1 1Document1 pageAFFIDAVIT of Right To Lawful Currency of Exchange Template 1 1Jason Manner100% (1)

- Sun Financial ServicesDocument7 pagesSun Financial ServicesfafafaggggNo ratings yet

- Microeconomics Notes (Advanced)Document98 pagesMicroeconomics Notes (Advanced)rafay010100% (1)

- PDF 382787590310722Document1 pagePDF 382787590310722Techwiser services and engineeringNo ratings yet

- PundlinkDocument1 pagePundlinkSHAIKH IBRAHIMNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearSagar GargNo ratings yet

- PDF 628846520240522Document1 pagePDF 628846520240522Narayana Rao GanapathyNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearRavi KumarNo ratings yet

- MeharwanDocument1 pageMeharwanSteve BurnsNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearRavi KumarNo ratings yet

- Ack 657377180240723Document1 pageAck 657377180240723SRIYA GADAGOJUNo ratings yet

- Paramjeet Kaur 2023-2024Document1 pageParamjeet Kaur 2023-2024thinkpadt480tNo ratings yet

- Nishar ItrDocument1 pageNishar ItrE-Ticket 40 RTNo ratings yet

- PDF 990850220061221Document1 pagePDF 990850220061221Olympia FitnessNo ratings yet

- Ack 504547400170723Document1 pageAck 504547400170723varsha sardesaiNo ratings yet

- Sunil MewadaDocument1 pageSunil MewadaSteve BurnsNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearAEN TRACKNo ratings yet

- Ack. AY 2022-23 RambirDocument1 pageAck. AY 2022-23 Rambirkdsss pNo ratings yet

- Ack - AY 2022-23 MeenaDocument1 pageAck - AY 2022-23 Meenakdsss pNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearSUDHEESH KUMARNo ratings yet

- Itr 22 23Document1 pageItr 22 23biswa chakrabortyNo ratings yet

- Itr 21-22Document1 pageItr 21-22MoghAKaranNo ratings yet

- Umesh ITR A.Y. 2023-2024Document1 pageUmesh ITR A.Y. 2023-2024swatigrv2004No ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruNANDAN SALESNo ratings yet

- Ashok S R 2021-22 AckDocument1 pageAshok S R 2021-22 AckSHIFAZ SULAIMANNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurumahesh bhorNo ratings yet

- 2122 ItrDocument1 page2122 ItrAjay PratapNo ratings yet

- ACK138389790080523Document1 pageACK138389790080523Vishal GoyalNo ratings yet

- PDF 808478730140722Document1 pagePDF 808478730140722Vishakha BhureNo ratings yet

- PDF 169223670270722Document1 pagePDF 169223670270722adhya100% (1)

- PDF 237557810150623Document1 pagePDF 237557810150623sgkv vasaNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearVINAY verma100% (1)

- ACK302828890260623Document1 pageACK302828890260623Jaswanth KumarNo ratings yet

- Itr Acknowledgement 2020Document1 pageItr Acknowledgement 2020AJAY KUMAR JAISWALNo ratings yet

- PDF 293196870250623Document1 pagePDF 293196870250623nagesh valunjNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment Yearvikas guptaNo ratings yet

- Acknowledgement AY 22-23Document1 pageAcknowledgement AY 22-23Nirav RavalNo ratings yet

- Ack Aalcs4258c 2022-23 448872891271023Document1 pageAck Aalcs4258c 2022-23 448872891271023deepakNo ratings yet

- PDF 596320240210723Document1 pagePDF 596320240210723Deepika SNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearSiyad KvNo ratings yet

- PDF 438429930210822Document1 pagePDF 438429930210822peetamber agarwalNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearP N rajuNo ratings yet

- ACK544968000190723Document1 pageACK544968000190723hp agencyNo ratings yet

- Itr 23-24Document1 pageItr 23-24addy01.0001No ratings yet

- PDF - 878651410190722. SubhashDocument1 pagePDF - 878651410190722. SubhashYUVRAJ BhardwajNo ratings yet

- ACK431792790120723Document1 pageACK431792790120723ThiruNo ratings yet

- PDF 812625500111121 PDFDocument1 pagePDF 812625500111121 PDFPranav NegiNo ratings yet

- Vamsi Krishna Velaga - ITDocument1 pageVamsi Krishna Velaga - ITvamsiNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearAmiya Ranjan PaniNo ratings yet

- PDF 139527500310723Document1 pagePDF 139527500310723NithinNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearDirector GGINo ratings yet

- Ashok ITR 2022-23Document1 pageAshok ITR 2022-23SHIFAZ SULAIMANNo ratings yet

- Ack 638167400230723Document1 pageAck 638167400230723gamers SatisfactionNo ratings yet

- PDF 236811830140623Document1 pagePDF 236811830140623Akeybo 340No ratings yet

- Itr-V FKTPM7864L 2023-24 756976760270723Document1 pageItr-V FKTPM7864L 2023-24 756976760270723Samrat AseshNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearAditya Adi SinghNo ratings yet

- ACK131773880020523Document1 pageACK131773880020523Ritu RajNo ratings yet

- Itr 2023 2024Document1 pageItr 2023 2024Deepak ThangamaniNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearRajagopal ArunachalamNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruPradeep NegiNo ratings yet

- DILBAGH SINGH ITR 2023-2024 - UnlockedDocument1 pageDILBAGH SINGH ITR 2023-2024 - UnlockedmohitNo ratings yet

- Itr Ay 2022-23Document1 pageItr Ay 2022-23Soumya SwainNo ratings yet

- Om Prakash Comp Ay 2020-21Document4 pagesOm Prakash Comp Ay 2020-21Soumya SwainNo ratings yet

- Shree Khatu - Comp - Ay - 2021-22Document4 pagesShree Khatu - Comp - Ay - 2021-22Soumya SwainNo ratings yet

- New Doc 09-12-2022 21.07Document2 pagesNew Doc 09-12-2022 21.07Soumya SwainNo ratings yet

- ICICI Pru Mid Cap Fund - Lucky Draw For All FLs Except PD - Update As On 16.09.2022Document630 pagesICICI Pru Mid Cap Fund - Lucky Draw For All FLs Except PD - Update As On 16.09.2022Soumya SwainNo ratings yet

- Perform & Win July'22 For Frontline Managers Final ResultDocument196 pagesPerform & Win July'22 For Frontline Managers Final ResultSoumya SwainNo ratings yet

- Aadhaar Seeding Process ManualDocument2 pagesAadhaar Seeding Process ManualSoumya SwainNo ratings yet

- Resume Gopinath DeyDocument3 pagesResume Gopinath DeySoumya SwainNo ratings yet

- Itr Ay 2022-23Document1 pageItr Ay 2022-23Soumya SwainNo ratings yet

- Celebrating India - 75, August 2022 Exclusively For Frontline Managers - Updated As On 17 August, 202Document126 pagesCelebrating India - 75, August 2022 Exclusively For Frontline Managers - Updated As On 17 August, 202Soumya SwainNo ratings yet

- Red Carpet - Goa Calling 2022 - All Frontline Managers Update As On August 16, 2022Document99 pagesRed Carpet - Goa Calling 2022 - All Frontline Managers Update As On August 16, 2022Soumya SwainNo ratings yet

- Registration ReportDocument1 pageRegistration ReportSoumya SwainNo ratings yet

- Resume SOUMYADocument3 pagesResume SOUMYASoumya SwainNo ratings yet

- Os19611729 EbiDocument4 pagesOs19611729 EbiSoumya SwainNo ratings yet

- Test Bank Ch6 ACCTDocument89 pagesTest Bank Ch6 ACCTMajed100% (1)

- Supplier Pre Qualification QuestionnaireDocument6 pagesSupplier Pre Qualification Questionnaireمحمد MedaNo ratings yet

- Fin 301sdDocument23 pagesFin 301sdImran KhanNo ratings yet

- National - Income (1) - Circular FlowDocument6 pagesNational - Income (1) - Circular Flowaparnah_83No ratings yet

- Estimating IRR With Fake Payback Period-L10Document9 pagesEstimating IRR With Fake Payback Period-L10akshit_vij0% (1)

- Term Paper, Yohannes TesfayeDocument18 pagesTerm Paper, Yohannes TesfayeYohannes TesfayeNo ratings yet

- Prayas Enron ControversyDocument67 pagesPrayas Enron ControversyMadhav SharmaNo ratings yet

- Customer Acquisition 1Document14 pagesCustomer Acquisition 1Rahul KateNo ratings yet

- LMR PART B Case LawsDocument210 pagesLMR PART B Case LawsAnurag KhatriNo ratings yet

- Damodaran Chapter 1 Introduction To Valuation Winter 2020Document28 pagesDamodaran Chapter 1 Introduction To Valuation Winter 2020Jeff SNo ratings yet

- Data Mining in The Insurance Industry - Solving Business Problems Using SAS Enterprise Miner SoftwareDocument20 pagesData Mining in The Insurance Industry - Solving Business Problems Using SAS Enterprise Miner SoftwareShehan1No ratings yet

- Google Market Equilibrium ExamplesDocument11 pagesGoogle Market Equilibrium ExamplesAllicamet SumayaNo ratings yet

- Indirect-Tax - Sem VI PDFDocument73 pagesIndirect-Tax - Sem VI PDFMaheswar SethiNo ratings yet

- Tax2 TRAIN 8.5x13Document64 pagesTax2 TRAIN 8.5x13Kim EstalNo ratings yet

- Accounts Receivable: Chartered Institute of Internal AuditorsDocument7 pagesAccounts Receivable: Chartered Institute of Internal AuditorsClarice GuintibanoNo ratings yet

- Pay Slip 17623 March, 2022Document1 pagePay Slip 17623 March, 2022Abrham TadesseNo ratings yet

- Sales Tracker TemplateDocument9 pagesSales Tracker TemplateAL-Mawali87No ratings yet

- MinhNguyen Q9 22mar23 07Document109 pagesMinhNguyen Q9 22mar23 07Minh NguyễnNo ratings yet

- Market Attractiveness ModelDocument431 pagesMarket Attractiveness ModelAnish ChowdharyNo ratings yet

- Private Hospital Australia - Porter 5 ForcesDocument12 pagesPrivate Hospital Australia - Porter 5 ForcescherikokNo ratings yet

- BTCL IPO Prospectus (Latest) 06 01 16Document252 pagesBTCL IPO Prospectus (Latest) 06 01 16Nako Yaga NkukuNo ratings yet

- Jonathon Clements Long NSMDocument7 pagesJonathon Clements Long NSMValueWalkNo ratings yet

- Markets For Factor Inputs, Labour Market Economic Rent: Chapter 10 & 11Document24 pagesMarkets For Factor Inputs, Labour Market Economic Rent: Chapter 10 & 11Sapna RohitNo ratings yet

- Costing NotesDocument227 pagesCosting Noteschitkarashelly100% (1)

- Chapter 6 - Consolidated Financial Statements (Part 3)Document41 pagesChapter 6 - Consolidated Financial Statements (Part 3)Rena Jocelle NalzaroNo ratings yet

- Micawbernomics: A Christmas Gift of Wise Advice To Politicians and EconomistsDocument5 pagesMicawbernomics: A Christmas Gift of Wise Advice To Politicians and EconomistsIan ThorpeNo ratings yet