Professional Documents

Culture Documents

Post Assessment Long Quiz 2 Attempt Review

Post Assessment Long Quiz 2 Attempt Review

Uploaded by

anonymousOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Post Assessment Long Quiz 2 Attempt Review

Post Assessment Long Quiz 2 Attempt Review

Uploaded by

anonymousCopyright:

Available Formats

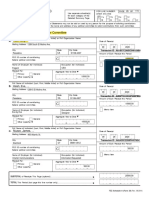

Started on Wednesday, 10 August 2022, 1:46 PM

State Finished

Completed on Wednesday, 10 August 2022, 4:46 PM

Time taken 3 hours

Grade 53.00 out of 70.00 (76%)

Feedback

Question 1

Incorrect Mark 0 out of 1

Initial direct cost paid by the lessor related to the acquisition of the leased asset is recognized in the books of

the lessor as

Select one:

An outright expense by the lessor

Part of the cost of the leased asset and depreciated over its useful life

Deferred Initial Direct Cost and amortized over the useful life of the leased asset

Deferred Initial Direct Cost and amortized over the lease term

Your answer is incorrect.

The correct answer is:

Part of the cost of the leased asset and depreciated over its useful life

Question 2

Correct Mark 1 out of 1

Instruction:

Write your answer without a peso sign and without commas.

Please follow the sample answer: 1000000

Answer: 604492

The correct answer is: 604492

Question 3

Incorrect Mark 0 out of 1

Instruction:

Write your answer without a peso sign and without commas.

Please follow the sample answer: 1000000

Answer: 10125000

The correct answer is: 1732500

Question 4

Correct Mark 1 out of 1

Net investment in a direct financing lease is equal to

Select one:

Cost of the asset plus guaranteed residual value

Cost of the asset plus initial direct cost paid by the lessor

Cost of the asset minus guaranteed residual value

Cost of the asset

Your answer is correct.

The correct answer is:

Cost of the asset plus initial direct cost paid by the lessor

Question 5

Correct Mark 1 out of 1

Instruction:

Write your answer without a peso sign and without commas.

Please follow the sample answer: 1000000

Answer: 900000

The correct answer is: 900000

Question 6

Correct Mark 1 out of 1

Which of the following statements is true about low value lease?

Select one:

The value of an underlying asset is based on the value of the asset when new regardless of the age of the asset.

All of these statements are true about low value lease.

The term of a low value lease may not be more than twelve months.

An underlying asset may qualify as low value lease even if the nature of the asset is such that the asset is typically not of low value when new.

Your answer is correct.

The correct answer is:

The value of an underlying asset is based on the value of the asset when new regardless of the age of the asset.

Question 7

Incorrect Mark 0 out of 1

Gross investment in the lease is equal to

Select one:

Sum of the lease payments receivable by a lessor under a finance lease and any unguaranteed residual value accruing to the lessor

The lease payments under a finance lease of the lessor

Present value of lease payments under a finance lease of the lessor and any unguaranteed residual value

Present value of lease payments under a finance lease of the lessor

Your answer is incorrect.

The correct answer is:

Sum of the lease payments receivable by a lessor under a finance lease and any unguaranteed residual value accruing to the lessor

Question 8

Correct Mark 1 out of 1

Instruction:

Write your answer without a peso sign and without commas.

Please follow the sample answer: 1000000

At the beginning of current year, Rapp Company leased a new machine to Lake Company for 5 years. The

annual rental is P900,000.Additionally, Lake Company paid P500,000 to Rapp Company as a lease bonus and

P250,000 as a security deposit to be refunded upon expiration of the lease. What amount should be reported as

rent revenue for the current year?

Answer: 1000000

The correct answer is: 1000000

Question 9

Correct Mark 1 out of 1

Instruction:

Write your answer without a peso sign and without commas.

Please follow the sample answer: 1000000

Answer: 391800

The correct answer is: 391800

Question 10

Correct Mark 1 out of 1

Instruction:

Write your answer without a peso sign and without commas.

Please follow the sample answer: 1000000

Answer: 130000

The correct answer is: 130000

Question 11

Correct Mark 1 out of 1

Lease payments under an operating lease shall be recognized as an income by the lessor on

Select one:

Sum of units basis

Diminishing balance basis

Cash basis

Straight line basis over the lease term

Your answer is correct.

The correct answer is:

Straight line basis over the lease term

Question 12

Incorrect Mark 0 out of 1

Instruction:

Write your answer without a peso sign and without commas.

Please follow the sample answer: 1000000

Answer: 9025000

The correct answer is: 6000000

Question 13

Correct Mark 1 out of 1

Instruction:

Write your answer without a peso sign and without commas.

Please follow the sample answer: 1000000

Answer: 800000

The correct answer is: 800000

Question 14

Correct Mark 1 out of 1

Instruction:

Write your answer without a peso sign and without commas.

Please follow the sample answer: 1000000

Answer: 630000

The correct answer is: 630000

Question 15

Correct Mark 1 out of 1

Under a direct financing lease, the excess of aggregate rentals over the cost of the underlying asset should be

recognized as interest income of the lessor

Select one:

After the cost of the underlying asset has been fully recovered through rentals

In increasing amounts during the term of the lease

In constant amounts during the term of the lease

In decreasing amounts during the term of the lease

Your answer is correct.

The correct answer is:

In decreasing amounts during the term of the lease

Question 16

Incorrect Mark 0 out of 1

The profit on a finance lease transaction for lessors who are manufacturers or dealers should

Select one:

Be recognized on a straight-line basis over the lease term

Only be recognized at the end of the lease term

Not be recognized separately from finance income

Be recognized in the normal way on the transaction

Your answer is incorrect.

The correct answer is:

Be recognized in the normal way on the transaction

Question 17

Incorrect Mark 0 out of 1

Instruction:

Write your answer without a peso sign and without commas.

Please follow the sample answer: 1000000

Chocho leases and operates a retail store. The following information relates to the lease for the current year:

(1) the store lease an operating lease, calls for a base monthly rent of 15,000 on the first day of each month .

(2) Additional rent is computed at 6% of net sales over 3,000,000-6,000,000 and 5% of net sales over 6,000,000

per year.

(3) Net sales for the year amounted to 9,000,000.

(4) The entity paid executory costs to the lessor for property taxes of 12,000 and insurance of 5,000.

What total amount of expenses should be reported for the year?

Answer: 17000

The correct answer is: 527000

Question 18

Correct Mark 1 out of 1

Instruction:

Write your answer without a peso sign and without commas.

Please follow the sample answer: 1000000

Answer: 5250000

The correct answer is: 5250000

Question 19

Correct Mark 1 out of 1

Instruction:

Write your answer without a peso sign and without commas.

Please follow the sample answer: 1000000

Answer: 480000

The correct answer is: 480000

Question 20

Correct Mark 1 out of 1

Applying operating lease in the point of view of the lessee the lease payments are recognized as

Select one:

Prepaid Rent

RIght of Use Asset

Rent Expense

Property and equipment

Your answer is correct.

The correct answer is:

Rent Expense

Question 21

Correct Mark 1 out of 1

Instruction:

Write your answer without a peso sign and without commas.

Please follow the sample answer: 1000000

On May 1, 2020, Hug Company leased equipment to Rave Company which expires May 1, 2021. Rave Company

could have bought the equipment from Hug for P3,200,000 instead of leasing it. Hug’s accounting records

showed a carrying amount for the equipment on May 1, 2020 of P2,800,000. Hug’s depreciation on the

equipment in 2020 was P360,000.During 2020, Rave Company paid P720,000 in rentals to Hug Company for the

8-month period. Hug incurred maintenance and other related costs under the terms of the lease of P64,000 in

2020.After the lease with Rave Company expires, Hug Company will lease the equipment to another entity for

two years. What is the pretax income derived by Hug for 2020?

Answer: 296000

The correct answer is: 296000

Question 22

Incorrect Mark 0 out of 1

In a direct financing lease, unearned interest income

Select one:

Does not arise

Should be amortized over the lease term using the interest method

Should be recognized at the lease expiration

Should be amortized over the lease term using the straight line method

Your answer is incorrect.

The correct answer is:

Should be amortized over the lease term using the interest method

Question 23

Incorrect Mark 0 out of 1

The lease receivable in a direct financing lease is

Select one:

The gross amount of lease payments

The present value of lease payments

The difference between the gross rentals and the fair value of the leased asset

The cost of the asset less any accumulated depreciation

Your answer is incorrect.

The correct answer is:

The present value of lease payments

Question 24

Correct Mark 1 out of 1

All of the following would be included in the lease receivable, except

Select one:

A purchase option that is reasonably certain

Unguaranteed residual value

All would be included

Guaranteed residual value

Your answer is correct.

The correct answer is:

All would be included

Question 25

Incorrect Mark 0 out of 1

Instruction:

Write your answer without a peso sign and without commas.

Please follow the sample answer: 1000000

As an inducement to enter a lease, Iwabe, a lessor, granted Inojin, a lessee, nine months of free rent under a five

year operating lease. The lease was effective July 1, 2019 and provided for monthly rental of 10,000 to begin

April 1, 2020. In the income statement for the year ended June 20, 2020, What amount should be reported as

rent expense?

Answer: 127500

The correct answer is: 102000

Question 26

Correct Mark 1 out of 1

Instruction:

Write your answer without a peso sign and without commas.

Please follow the sample answer: 1000000

Answer: 2800000

The correct answer is: 2800000

Question 27

Correct Mark 1 out of 1

Instruction:

Write your answer without a peso sign and without commas.

Please follow the sample answer: 1000000

A lessor, leased an equipment under an operating lease. The lease term is 5 years and the lease payments are

made in advance on January 1 of each year. P1,000,000 for 2020 and 2021; P1,400,000 for 2022; P1,700,000 for

2023 and P1,900,000 for 2024. On December 31, 2021, what amount should be reported as rent receivable

Answer: 800000

The correct answer is: 800000

Question 28

Correct Mark 1 out of 1

Instruction:

Write your answer without a peso sign and without commas.

Please follow the sample answer: 1000000

Answer: 146000

The correct answer is: 146000

Question 29

Correct Mark 1 out of 1

Instruction:

Write your answer without a peso sign and without commas.

Please follow the sample answer: 1000000

Answer: 1666000

The correct answer is: 1666000

Question 30

Correct Mark 1 out of 1

Instruction:

Write your answer without a peso sign and without commas.

Please follow the sample answer: 1000000

At the beginning of the current year, Wren Company leased a building to Brill Company under an operating

lease for ten years at P500,000 to a real estate broker as initial direct cost. The building is depreciated P120,000

per year. Wren Company incurred insurance and property tax expense totaling P90,000 for the current year.

What is the net rent income for the current year?

Answer: 275000

The correct answer is: 275000

Question 31

Incorrect Mark 0 out of 1

Instruction:

Write your answer without a peso sign and without commas.

Please follow the sample answer: 1000000

On January 1, 2019, Sarada signed a 5 -year operating lease for office space at 96,000 per year. The lease

included a provision for additional rent of 5% of annual company sales in excess of 5,000,000. The sales for the

year ended December 31, 2019 totaled 6,000,000. Upon execution of the lease, the entity paid 24,000 as bonus

for the lease. What is the rent expense for the year ended December 31, 2019?

Answer: 170000

The correct answer is: 150800

Question 32

Correct Mark 1 out of 1

Instruction:

Write your answer without a peso sign and without commas.

Please follow the sample answer: 1000000

Answer: 516000

The correct answer is: 516000

Question 33

Correct Mark 1 out of 1

Instruction:

Write your answer without a peso sign and without commas.

Please follow the sample answer: 1000000

Answer: 720000

The correct answer is: 720000

Question 34

Correct Mark 1 out of 1

Instruction:

Write your answer without a peso sign and without commas.

Please follow the sample answer: 1000000

Barnel Company owns and manages apartments. On signing a lease, each tenant must pay the first month

and last month rent and a P50,000 refundable security deposit. The security deposit is rarely refundable in total

because cleaning costs of P15,000 per apartment are almost always deducted. About 30% of the time, the

tenants are also charged for damages to the apartment which typically cost P10,000.If a one-year lease is

signed on a P90,000 per month apartment, what amount should be reported as refundable security deposit?

Answer: 50000

The correct answer is: 50000

Question 35

Incorrect Mark 0 out of 1

Instruction:

Write your answer without a peso sign and without commas.

Please follow the sample answer: 1000000

On July 1, 2019, Mitsuki leased office space for five years at P15,000 a month. On that date, the entity paid the

lessor the security deposit of 35,000; first month rent of 15,000; last month rent of 15,000 and nonrefundable

reimbursements to lessor for modifications to the leased premises of 90,000. The entity made timely rental

payments from August 1 to December 1. What portion of payments to the lessor should be deferred on

December 31, 2019?

Answer: 100000

The correct answer is: 131000

Question 36

Correct Mark 1 out of 1

Which statement is true regarding initial direct costs incurred by the lessor?

Select one:

In an operating lease, initial direct costs incurred by the lessor are deferred and allocated over the lease term

In a direct financing lease, initial direct costs are added to the net investment in the lease

All of these statements are correct

In a sales type lease, initial direct costs are expensed as component of cost of goods sold

Your answer is correct.

The correct answer is:

All of these statements are correct

Question 37

Correct Mark 1 out of 1

Instruction:

Write your answer without a peso sign and without commas.

Please follow the sample answer: 1000000

On July 1, 2020, Hutch Company leased equipment to Elder Company for a one-year period expiring June 30,

2021 for P60,000 a month. On July 1, 2021, Hutch Company leased this piece of equipment to Toil Company for a

three-year period expiring June 30, 2024 for P75,000 a month. The original cost of the equipment was

P4,800,000. The equipment, which has been continually on lease since July 1, 2017, is being depreciated on a

straight-line basis over an eight-year period with no residual value. What is the amount of net rental income

that would be reported by Hutch Company for the year ended December 31, 2021?

Answer: 210000

The correct answer is: 210000

Question 38

Correct Mark 1 out of 1

D. Sum of absolute amount of lease payments and guaranteed residual value

Select one:

Present value of lease payments

Sum of absolute amount of lease payments and guaranteed residual value

Absolute amount of lease payments

Present value of lease payments plus present value of unguaranteed residual value

Your answer is correct.

Under a sales type lease, what is the meaning of gross investment in the lease?

The correct answer is:

Sum of absolute amount of lease payments and guaranteed residual value

Question 39

Correct Mark 1 out of 1

Instruction:

Write your answer without a peso sign and without commas.

Please follow the sample answer: 1000000

On January 1, 2020, Glen Company leased a building to Dix Company for a ten-year term at an annual rental of

P500,000.At inception of the lease, Glen Company received P2,000,000 covering the first two years’ rent of

P1,000,000 and a security deposit of P1,000,000.This deposit will not be returned to Dix Company upon expiration

of the lease but will be applied to payment of rent for the last two years of the lease. What amount should be

reported as current liability in the December 31, 2020 statement of financial position?

Answer: 500000

The correct answer is: 500000

Question 40

Correct Mark 1 out of 1

Refundable security deposit on the books of the lessor is recognized as

Select one:

Receivable

Rent income

Unearned income

Payable

Your answer is correct.

The correct answer is:

Payable

Question 41

Correct Mark 1 out of 1

In an operating lease that is recorded by the lessee, the equal monthly rental payments should be

Select one:

Recorded as a rental expense

Allocated between reduction in lease liability and interest expense

Recorded as rental income

Recorded as reduction of right of use asset

Your answer is correct.

The correct answer is:

Recorded as a rental expense

Question 42

Correct Mark 1 out of 1

The classification of a lease as either operating or finance lease is based on

Select one:

The lease payments being at least 50% of fair value

The length of the lease

The transfer of the risks and rewards of ownership

The economic life of the underlying asset

Your answer is correct.

The correct answer is:

The transfer of the risks and rewards of ownership

Question 43

Correct Mark 1 out of 1

Instruction:

Write your answer without a peso sign and without commas.

Please follow the sample answer: 1000000

Answer: 648000

The correct answer is: 648000

Question 44

Correct Mark 1 out of 1

Instruction:

Write your answer without a peso sign and without commas.

Please follow the sample answer: 1000000

Conn Company owns an office building and normally charges tenants P3,000 per square meter per year for

office space. Because the occupancy rate is low, Conn Company agreed to lease 1,000 square meters to

Hanson Company at P1,200 per square meter for the first year of a three-year operating lease. Rent for the

remaining years will be at the P3,000 rate. Hanson Company moved into the building on January 1, 2020, and

paid the first year’s rent in advance. What amount of rental revenue should be reported in the income

statement for the year ended September 30, 2020?

Answer: 1800000

The correct answer is: 1800000

Question 45

Correct Mark 1 out of 1

Instruction:

Write your answer without a peso sign and without commas.

Please follow the sample answer: 1000000

Answer: 500000

The correct answer is: 500000

Question 46

Incorrect Mark 0 out of 1

Instruction:

Write your answer without a peso sign and without commas.

Please follow the sample answer: 1000000

Answer: 2550000

The correct answer is: 2028000

Question 47

Correct Mark 1 out of 1

Which is the correct accounting treatment for a finance lease in the accounts of a lessor

Select one:

Treat as a noncurrent asset equal to net investment in lease and recognize all finance payments in income statement

Treat as a receivable equal to gross amount receivable on lease and recognized finance payments in cash by reducing debt

Treat as a receivable equal to net investment in the lease and recognize finance payments by reducing debt and taking interest

to income statement

Treat as a receivable equal to net investment in the lease and recognize finance payments in cash by reduction of debt

Your answer is correct.

The correct answer is:

Treat as a receivable equal to net investment in the lease and recognize finance payments by reducing debt and taking interest to income statement

Question 48

Correct Mark 1 out of 1

Instruction:

Write your answer without a peso sign and without commas.

Please follow the sample answer: 1000000

Answer: 6600000

The correct answer is: 6600000

Question 49

Correct Mark 1 out of 1

Instruction:

Write your answer without a peso sign and without commas.

Please follow the sample answer: 1000000

On January 1, 2020, Glen Company leased a building to Dix Company for a ten-year term at an annual rental of

P500,000.At inception of the lease, Glen Company received P2,000,000 covering the first two years’ rent of

P1,000,000 and a security deposit of P1,000,000.This deposit will not be returned to Dix Company upon expiration

of the lease but will be applied to payment of rent for the last two years of the lease. What amount should be

reported as noncurrent liability in the December 31, 2020 statement of financial position?

Answer: 1000000

The correct answer is: 1000000

Question 50

Correct Mark 1 out of 1

Instruction:

Write your answer without a peso sign and without commas.

Please follow the sample answer: 1000000

Answer: 780000

The correct answer is: 780000

Question 51

Correct Mark 1 out of 1

Instruction:

Write your answer without a peso sign and without commas.

Please follow the sample answer: 1000000

Answer: 500000

The correct answer is: 500000

Question 52

Incorrect Mark 0 out of 1

Which statement is correct regarding the lease capitalization criteria?

Select one:

The lease transfers ownership to the lessor

The present value of lease payments are at least 90% of fair value of asset

The lease contains a purchase option

The lease term is equal to at least 75% of the economic life of the underlying asset.

Your answer is incorrect.

The correct answer is:

The present value of lease payments are at least 90% of fair value of asset

Question 53

Correct Mark 1 out of 1

Instruction:

Write your answer without a peso sign and without commas.

Please follow the sample answer: 1000000

Answer: 1279200

The correct answer is: 1279200

Question 54

Correct Mark 1 out of 1

Instruction:

Write your answer without a peso sign and without commas.

Please follow the sample answer: 1000000

Answer: 400000

The correct answer is: 400000

Question 55

Correct Mark 1 out of 1

Instruction:

Write your answer without a peso sign and without commas.

Please follow the sample answer: 1000000

Answer: 600000

The correct answer is: 600000

Question 56

Correct Mark 1 out of 1

Net investment a sales type lease is equal to

Select one:

Gross investment in the lease less unearned finance income

Cost of the underlying asset

The lease payments

The lease payments less unguaranteed residual value

Your answer is correct.

The correct answer is:

Gross investment in the lease less unearned finance income

Question 57

Incorrect Mark 0 out of 1

Instruction:

Write your answer without a peso sign and without commas.

Please follow the sample answer: 1000000

On Oct. 1, 2019, Denki leased an equipment for 2 years, with a monthly rental of 3,000. As an inducement to the

lessee, the lessor permitted him to use the equipment for free in first three months. What amount should be

reported as rent expense at the December 31, 2020.

Answer: 3000

The correct answer is: 31500

Question 58

Correct Mark 1 out of 1

Instruction:

Write your answer without a peso sign and without commas.

Please follow the sample answer: 1000000

Answer: 10125000

The correct answer is: 10125000

Question 59

Correct Mark 1 out of 1

Which statement characterizes a sales type lease?

Select one:

The lessor recognizes only interest revenue over the lease term

The lessor recognizes only interest revenue over the useful life of the asset

The lessor recognizes a dealer profit at lease inception and interest revenue over the lease term

The lessor recognizes a dealer profit at lease inception and interest revenue over the useful life of the asset

Your answer is correct.

The correct answer is:

The lessor recognizes a dealer profit at lease inception and interest revenue over the lease term

Question 60

Incorrect Mark 0 out of 1

The primary difference between a direct financing lease and sales type lease is the

Select one:

Depreciation recorded each year by the lessor

Allocation of initial direct costs incurred by the lessor over the lease term

Manner in which rental collections are recorded as rental income

Recognition of the manufacturer or dealer profit at the inception of the lease

Your answer is incorrect.

The correct answer is:

Recognition of the manufacturer or dealer profit at the inception of the lease

Question 61

Correct Mark 1 out of 1

Which statement characterizes an operating lease?

Select one:

The lessor records depreciation and lease revenue

The lessee records a lease obligation

The lessee records depreciation and interest.

The lessor transfers title of the underlying asset to the lessee for the duration of the lease term

Your answer is correct.

The correct answer is:

The lessor records depreciation and lease revenue

Question 62

Incorrect Mark 0 out of 1

Lessors shall recognize asset held under a finance lease a receivable at an amount equal to the

Select one:

Gross rentals

Residual value, whether guaranteed or unguaranteed

Net investment in the lease

Gross investment in the lease

Your answer is incorrect.

The correct answer is:

Net investment in the lease

Question 63

Correct Mark 1 out of 1

Instruction:

Write your answer without a peso sign and without commas.

Please follow the sample answer: 1000000

Wall Company leased an office to Fox Company for a five-year term beginning January 1, 2020.Under the terms

of the operating lease, rent for the first year is P800,000 and rent for years 2 through 5 is P1,250,000 per annum.

However, as an inducement to enter the lease, Wall Company granted Fox Company the first six months of the

lease rent-free. What amount should be reported as rental income for 2020?

Answer: 1080000

The correct answer is: 1080000

Question 64

Correct Mark 1 out of 1

When should a lessor recognize income on a nonrefundable lease bonus paid by a lessee?

Select one:

At the inception of the lease

When received

Over the lease term

At the lease expiration

Your answer is correct.

The correct answer is:

Over the lease term

Question 65

Correct Mark 1 out of 1

Instruction:

Write your answer without a peso sign and without commas.

Please follow the sample answer: 1000000

Answer: 1850400

The correct answer is: 1850400

Question 66

Correct Mark 1 out of 1

Instruction:

Write your answer without a peso sign and without commas.

Please follow the sample answer: 1000000

Answer: 204492

The correct answer is: 204492

Question 67

Correct Mark 1 out of 1

Instruction:

Write your answer without a peso sign and without commas.

Please follow the sample answer: 1000000

Answer: 154000

The correct answer is: 154000

Question 68

Incorrect Mark 0 out of 1

One of the four determinative criteria for a finance lease specifies that the lease term be equal to or greater

than (US GAAP)

Select one:

75% of the economic life of the asset

The economic life of the underlying asset

50% of the economic life of the asset

90% of the economic life of the asset

Your answer is incorrect.

The correct answer is:

75% of the economic life of the asset

Question 69

Correct Mark 1 out of 1

Instruction:

Write your answer without a peso sign and without commas.

Please follow the sample answer: 1000000

Answer: 453400

The correct answer is: 453400

Question 70

Correct Mark 1 out of 1

Instruction:

Write your answer without a peso sign and without commas.

Please follow the sample answer: 1000000

Answer: 5875000

The correct answer is: 5875000

Finish review

You might also like

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Gantt Chart: Plant Pals Operations and Training Plan Muntasim Manzoor LoneDocument5 pagesGantt Chart: Plant Pals Operations and Training Plan Muntasim Manzoor Lonegrowddon75% (4)

- CMPC 131 Short Term Finals Quiz 1Document4 pagesCMPC 131 Short Term Finals Quiz 1Nhel AlvaroNo ratings yet

- Financial Accounting and Reporting (Far) Sample QuestionsDocument18 pagesFinancial Accounting and Reporting (Far) Sample QuestionsblaireNo ratings yet

- Cpa Review QuestionsDocument54 pagesCpa Review QuestionsCodeSeeker0% (1)

- Quiz 7Document8 pagesQuiz 7shivnilNo ratings yet

- Finals Exam Intermediate Accounting 2Document21 pagesFinals Exam Intermediate Accounting 2Juan Dela cruzNo ratings yet

- Concept Test PDFDocument3 pagesConcept Test PDFKarabo CollenNo ratings yet

- Quiz 7 - CH 13 & 14 ACC563Document14 pagesQuiz 7 - CH 13 & 14 ACC563scokni1973_130667106No ratings yet

- KIRTI1Document19 pagesKIRTI1Pallavi KokateNo ratings yet

- 22 Finance Lease LessorDocument3 pages22 Finance Lease LessorAllegria AlamoNo ratings yet

- Review Part1IA2.Docx 1Document73 pagesReview Part1IA2.Docx 1HAZELMAE JEMINEZNo ratings yet

- Real Estate Consulting Final Q2Document3 pagesReal Estate Consulting Final Q2Michelle EsperalNo ratings yet

- Orca Share Media1575043628730Document4 pagesOrca Share Media1575043628730Jayr BV100% (1)

- ACCT557 Week 5 Quiz-SolutionsDocument4 pagesACCT557 Week 5 Quiz-SolutionsDominickdad100% (3)

- ACCT 202 Pre-Quiz Number Two (Ch. 15)Document7 pagesACCT 202 Pre-Quiz Number Two (Ch. 15)Gabrielle Gamble0% (1)

- Mock Phinma Exam: Intermediate Accounting 3 Name: Date: Section: Rating: General DirectionsDocument16 pagesMock Phinma Exam: Intermediate Accounting 3 Name: Date: Section: Rating: General DirectionsKATHRYN CLAUDETTE RESENTENo ratings yet

- Learning Resource 9 Lesson 3Document7 pagesLearning Resource 9 Lesson 3Vianca Marella SamonteNo ratings yet

- UGRD-TAX6148-2323T Income Taxation Midterm ExamDocument28 pagesUGRD-TAX6148-2323T Income Taxation Midterm ExamcybilmercadoNo ratings yet

- 15 Chapter Leases TrueDocument17 pages15 Chapter Leases TrueHuguette AssamoiNo ratings yet

- Ifrs 15 Construction ContractsDocument67 pagesIfrs 15 Construction ContractsAJNo ratings yet

- Seatwork - Day 20 - Leases AnswersDocument9 pagesSeatwork - Day 20 - Leases AnswersRj ArenasNo ratings yet

- Post-Assessment (Long Quiz 3) - Attempt ReviewDocument22 pagesPost-Assessment (Long Quiz 3) - Attempt ReviewanonymousNo ratings yet

- Multiple-Choice MlearningDocument29 pagesMultiple-Choice MlearningBích TiênNo ratings yet

- Only US$2.99/monthDocument3 pagesOnly US$2.99/monthKath LeynesNo ratings yet

- Acct557 Wk4 QuizDocument4 pagesAcct557 Wk4 QuizNatasha Declan100% (1)

- For RetakeDocument62 pagesFor RetakeIsaiah John Domenic M. CantaneroNo ratings yet

- 7th Exam (Page 1 of 9)Document10 pages7th Exam (Page 1 of 9)kaeya alberichNo ratings yet

- AcctgDocument35 pagesAcctgKariz CodogNo ratings yet

- RFBT Compilation Week 1 6Document155 pagesRFBT Compilation Week 1 6Mitch MinglanaNo ratings yet

- CH 18 IFM10 CH 19 Test BankDocument12 pagesCH 18 IFM10 CH 19 Test Bankajones1219100% (1)

- Learning Resource 8 Lesson 1Document7 pagesLearning Resource 8 Lesson 1Vianca Marella SamonteNo ratings yet

- Quiz 1 Leases PDFDocument4 pagesQuiz 1 Leases PDFken aysonNo ratings yet

- AC 506 Midterm ExamDocument10 pagesAC 506 Midterm ExamJaniña NatividadNo ratings yet

- Solved Examples On Lease AccountingDocument1 pageSolved Examples On Lease AccountingSoumen Sen100% (4)

- Chapter 16 - All Solutions From TextDocument17 pagesChapter 16 - All Solutions From TexthatemNo ratings yet

- Local Media6736412975002846091Document3 pagesLocal Media6736412975002846091reo30360No ratings yet

- Intermediate Financial Accounting II LeaseDocument6 pagesIntermediate Financial Accounting II LeaseDanoNo ratings yet

- Fed Income PretestDocument10 pagesFed Income PretestAndrea Mcnair-WestNo ratings yet

- Lease Accounting 2021Document5 pagesLease Accounting 2021Just JhexNo ratings yet

- Quiz 5 Bond MarketsDocument22 pagesQuiz 5 Bond Marketshimanshu mauryaNo ratings yet

- Islamic Finance Case StudyDocument4 pagesIslamic Finance Case StudyKhuzaima HussainNo ratings yet

- Quiz 4 Money MarketsDocument13 pagesQuiz 4 Money Marketshimanshu mauryaNo ratings yet

- Leases Part IIDocument21 pagesLeases Part IICarl Adrian ValdezNo ratings yet

- Discussion Problems - Lessor AccountingDocument4 pagesDiscussion Problems - Lessor AccountingangelapearlrNo ratings yet

- Business Laws and Reg 2ND Term PreDocument10 pagesBusiness Laws and Reg 2ND Term PreCasey Collera MedianaNo ratings yet

- IA2 Finals Retake Reviewer For PracticeDocument5 pagesIA2 Finals Retake Reviewer For PracticeLoro AdrianNo ratings yet

- Quizzes Midterm To Finals OnlyDocument40 pagesQuizzes Midterm To Finals OnlyMikasa MikasaNo ratings yet

- Financial Accounting and Reporting Far Sample QuestionsDocument17 pagesFinancial Accounting and Reporting Far Sample QuestionsAiziel OrenseNo ratings yet

- Part 1Document16 pagesPart 1exoloneloveNo ratings yet

- ODR Semester Test 1 2023 W MemoDocument15 pagesODR Semester Test 1 2023 W MemojustjasminesinghNo ratings yet

- ACC 108 P3 Quiz 1 Ans KeyDocument6 pagesACC 108 P3 Quiz 1 Ans Keyrago.cachero.auNo ratings yet

- BSAD 295 Solution 2Document52 pagesBSAD 295 Solution 2Erin Liu100% (1)

- Test 1 QuizzDocument7 pagesTest 1 QuizzEleni AnastasovaNo ratings yet

- Question Text: The Correct Answer Is: The Nominal Rate Exceeds The Yield RateDocument14 pagesQuestion Text: The Correct Answer Is: The Nominal Rate Exceeds The Yield RateKent TumulakNo ratings yet

- Mock Phinma Exam: Intermediate Accounting 3 Name: Date: Section: RatingDocument14 pagesMock Phinma Exam: Intermediate Accounting 3 Name: Date: Section: RatingMichelle Ann Langbis VinoyaNo ratings yet

- FPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)From EverandFPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)No ratings yet

- Property Investment Secrets - The Ultimate Rent To Rent 2-in-1 Book Compilation - Book 1: A Complete Rental Property Investing Guide - Book 2: You've Got Questions, I've Got Answers!: Using HMO's and Sub-Letting to Build a Passive Income - Financial Freedom UKFrom EverandProperty Investment Secrets - The Ultimate Rent To Rent 2-in-1 Book Compilation - Book 1: A Complete Rental Property Investing Guide - Book 2: You've Got Questions, I've Got Answers!: Using HMO's and Sub-Letting to Build a Passive Income - Financial Freedom UKNo ratings yet

- Real Estate Investing: Master Commercial, Residential and Industrial Properties by Understanding Market Signs, Rental Property Analysis and Negotiation StrategiesFrom EverandReal Estate Investing: Master Commercial, Residential and Industrial Properties by Understanding Market Signs, Rental Property Analysis and Negotiation StrategiesNo ratings yet

- Rental Property Investing: Complete Beginner’s Guide on How to Create Wealth, Passive Income and Financial Freedom with Apartments and Multifamily Real Estate Investing Even with No Money DownFrom EverandRental Property Investing: Complete Beginner’s Guide on How to Create Wealth, Passive Income and Financial Freedom with Apartments and Multifamily Real Estate Investing Even with No Money DownRating: 4 out of 5 stars4/5 (1)

- Partnership Revised Corporation Domingo p1 CompressDocument465 pagesPartnership Revised Corporation Domingo p1 CompressanonymousNo ratings yet

- StratCost PAAsDocument25 pagesStratCost PAAsanonymousNo ratings yet

- Group4 Case Study1 Hot Shot Plastic CompanyDocument14 pagesGroup4 Case Study1 Hot Shot Plastic CompanyanonymousNo ratings yet

- Chapter 1 Team QuizDocument14 pagesChapter 1 Team QuizanonymousNo ratings yet

- Post-Assessment (Long Quiz 3) - Attempt ReviewDocument22 pagesPost-Assessment (Long Quiz 3) - Attempt ReviewanonymousNo ratings yet

- Chapter 1 Practice Test - Problems (Answers)Document12 pagesChapter 1 Practice Test - Problems (Answers)anonymousNo ratings yet

- Chapter 1 Illustrative Case 1 - AuditDocument7 pagesChapter 1 Illustrative Case 1 - AuditanonymousNo ratings yet

- 67 5 3 AccountancyDocument27 pages67 5 3 AccountancyDhanshitha RaviNo ratings yet

- Strategic ManagementDocument14 pagesStrategic ManagementDrishti AggarwalNo ratings yet

- Case 9: Amazon in Emerging MarketsDocument7 pagesCase 9: Amazon in Emerging MarketsAaditya ByadwalNo ratings yet

- Viva On Project and CfsDocument7 pagesViva On Project and CfsCrazy GamerNo ratings yet

- Rangga Fakhrurriza - Kelompok 6 Konflik Dan NegosiasiDocument6 pagesRangga Fakhrurriza - Kelompok 6 Konflik Dan NegosiasiRangga FakhrurrizaKls AAkt 2021No ratings yet

- Poultry Meat Supply Chains in CameroonDocument17 pagesPoultry Meat Supply Chains in CameroonAyoniseh CarolNo ratings yet

- 09 Philguarantee2021 Part1 FsDocument5 pages09 Philguarantee2021 Part1 FsYenNo ratings yet

- Grade 7 EMS Mid Year Examination 2021Document7 pagesGrade 7 EMS Mid Year Examination 2021nkatekodawn72No ratings yet

- Top 250Document15 pagesTop 250Steve ToppeNo ratings yet

- 5 AgencyDocument30 pages5 AgencyJohn Rey LabasanNo ratings yet

- Survey FormDocument2 pagesSurvey FormChristy Marie Faunillan GabutanNo ratings yet

- IFA s1 QDocument8 pagesIFA s1 QКсения НиколоваNo ratings yet

- 2020 T3 GSBS6410 Lecture Note For Week 7 Pricing StrategyDocument26 pages2020 T3 GSBS6410 Lecture Note For Week 7 Pricing StrategyRenu JhaNo ratings yet

- Hsieh Mcconnell DonationsDocument9 pagesHsieh Mcconnell DonationsResourcesNo ratings yet

- Tle EntrepreneurshipDocument2 pagesTle EntrepreneurshipMark Anthony LibecoNo ratings yet

- Ap Socio - Economic Survey - Imp Points by Sriram Chandra, Achievers AcademyDocument12 pagesAp Socio - Economic Survey - Imp Points by Sriram Chandra, Achievers AcademyrupaNo ratings yet

- Resume Dhumal JayeshDocument3 pagesResume Dhumal JayeshNeesonNo ratings yet

- Prelimiinary Analysis of UT Kesoram Deal ClassDocument14 pagesPrelimiinary Analysis of UT Kesoram Deal ClassMohit SinghNo ratings yet

- SCM Coordination and ContractsDocument64 pagesSCM Coordination and ContractsdurgaNo ratings yet

- Making Canada A Global Leader in InnovationDocument4 pagesMaking Canada A Global Leader in InnovationPeggyNashNo ratings yet

- Central Asia Pipelines Are The New Silk RoadDocument3 pagesCentral Asia Pipelines Are The New Silk Roadstravinsky YuravinochNo ratings yet

- Reading Comprehension Passage-3 Read The Passage Carefully and Answer The FollowingDocument2 pagesReading Comprehension Passage-3 Read The Passage Carefully and Answer The FollowingadiG48 AtdiG48No ratings yet

- Price List OGOship Logistics 2022 DE-SOL ENDocument17 pagesPrice List OGOship Logistics 2022 DE-SOL ENDraganaNo ratings yet

- Downsizing and Its AlternativesDocument13 pagesDownsizing and Its AlternativesHarsh AgrawalNo ratings yet

- Presentation On Government BudgetingDocument2 pagesPresentation On Government BudgetingSherry Gonzales ÜNo ratings yet

- Project Report OBHRMDocument25 pagesProject Report OBHRMSiddharth BhujwalaNo ratings yet

- 01 Section 1 - Attachment 5 - Project Summary of Subcontract - Rev.1Document1 page01 Section 1 - Attachment 5 - Project Summary of Subcontract - Rev.1Andrei Ionut CiobanuNo ratings yet

- P39 JimenezDocument19 pagesP39 JimenezLan EvaNo ratings yet

- Business AsseessmentDocument28 pagesBusiness AsseessmentArisha NicholsNo ratings yet