Professional Documents

Culture Documents

Advance Payment of Tax

Advance Payment of Tax

Uploaded by

Rasel AshrafulCopyright:

Available Formats

You might also like

- Feasibility Report Amusement Park NRDADocument28 pagesFeasibility Report Amusement Park NRDANityaMurthy89% (9)

- Tax Planning and ManagementDocument23 pagesTax Planning and ManagementMinisha Gupta100% (19)

- Tax Deduction at SourceDocument62 pagesTax Deduction at SourcePallavisweet100% (1)

- Wilmington Trust Irrevocable Trust AgreementDocument14 pagesWilmington Trust Irrevocable Trust Agreementdiversified1100% (3)

- Advanced Payment of TaxDocument2 pagesAdvanced Payment of TaxEngr. Md. Ishtiak HossainNo ratings yet

- Tax Planning and Managerial DecisionDocument188 pagesTax Planning and Managerial Decisionkomal_nath2375% (4)

- Unit 1 - Advance Payment of TaxDocument4 pagesUnit 1 - Advance Payment of TaxAwesome AngelNo ratings yet

- Advance Tax PaymentDocument4 pagesAdvance Tax PaymentJaneesNo ratings yet

- Advance TaxDocument9 pagesAdvance TaxManvi JainNo ratings yet

- Module 07 - Overview of Regular Income TaxationDocument32 pagesModule 07 - Overview of Regular Income TaxationTrixie OnglaoNo ratings yet

- TaxationDocument12 pagesTaxationjanahh.omNo ratings yet

- Advance Tax, TDS, TCS - YVDocument34 pagesAdvance Tax, TDS, TCS - YVmuthuram2497No ratings yet

- Tax Deducted at SourceDocument5 pagesTax Deducted at SourceRajinder KaurNo ratings yet

- Advanced Tax (Math)Document1 pageAdvanced Tax (Math)Engr. Md. Ishtiak HossainNo ratings yet

- Unit 4 Return FillingDocument71 pagesUnit 4 Return FillingAnshu kumarNo ratings yet

- IFBPDocument11 pagesIFBPmohanraokp2279No ratings yet

- Module 07 Introduction To Regular Income TaxDocument21 pagesModule 07 Introduction To Regular Income TaxJeon KookieNo ratings yet

- Pay As You Earn PAYE Refunds 1Document2 pagesPay As You Earn PAYE Refunds 1bwalilubemba7No ratings yet

- Week 3 Income Tax AccountingDocument18 pagesWeek 3 Income Tax AccountingRavinesh Prasad100% (1)

- Advance Payment of TaxDocument2 pagesAdvance Payment of TaxMd.HasanNo ratings yet

- Note On Budget Proposals-2020Document7 pagesNote On Budget Proposals-2020Mayur VartakNo ratings yet

- Income Tax Law & Practice Unit 4Document8 pagesIncome Tax Law & Practice Unit 4MuskanNo ratings yet

- Income Tax 2024 - 25 5.14.24 PMDocument20 pagesIncome Tax 2024 - 25 5.14.24 PMAmal Living MiracleNo ratings yet

- Chapter-5 Advanced Payment of TaxesDocument25 pagesChapter-5 Advanced Payment of TaxesSumon iqbalNo ratings yet

- Advance TaxDocument2 pagesAdvance Tax1986anuNo ratings yet

- Chapter 10 - Carry Forward and AdjustmentsDocument14 pagesChapter 10 - Carry Forward and Adjustmentsanamul haqueNo ratings yet

- Module 07 Introduction To Regular Income Tax 3 2Document21 pagesModule 07 Introduction To Regular Income Tax 3 2Joshua BazarNo ratings yet

- Indian Income Tax Calculator: Double Click The IT Calculator - IT Will Automatically Calculate The Taxable AmountDocument23 pagesIndian Income Tax Calculator: Double Click The IT Calculator - IT Will Automatically Calculate The Taxable AmountshankarinsideNo ratings yet

- With Holding Tax-CompressedDocument8 pagesWith Holding Tax-CompressedNGANJANI WALTERNo ratings yet

- Income Tax TheoryDocument28 pagesIncome Tax Theorynextgensolution44No ratings yet

- TDS On SalaryDocument5 pagesTDS On SalaryAato AatoNo ratings yet

- P N 0 TH H T - T o H T: Module 36 Taxes: Co O ATEDocument3 pagesP N 0 TH H T - T o H T: Module 36 Taxes: Co O ATEZeyad El-sayedNo ratings yet

- 1035 Withholding TaxDocument8 pages1035 Withholding TaxViren GandhiNo ratings yet

- Merits of GST:: Compensation To Loss Making States For Five Years: It Has Been Proposed That TheDocument10 pagesMerits of GST:: Compensation To Loss Making States For Five Years: It Has Been Proposed That TheJyoti SinghNo ratings yet

- POWIBA NOTICE CORPORATE TAX AssessmentDocument2 pagesPOWIBA NOTICE CORPORATE TAX AssessmentHassan OmaryNo ratings yet

- Income Tax Calculations On Salaries and Other Income For The Assessment Year 2024Document20 pagesIncome Tax Calculations On Salaries and Other Income For The Assessment Year 2024ManoharanR Rajamanikam0% (1)

- Advance TaxDocument3 pagesAdvance TaxRia SarkarNo ratings yet

- Presentation ON TDS Advanced Tax Self Assesment TaxDocument15 pagesPresentation ON TDS Advanced Tax Self Assesment TaxVaishali ChouhanNo ratings yet

- Income Tax in IndiaDocument19 pagesIncome Tax in IndiaConcepts TreeNo ratings yet

- Income Tax - TRAINDocument27 pagesIncome Tax - TRAINSteveNo ratings yet

- M6 - Deductions P2 Students'Document53 pagesM6 - Deductions P2 Students'micaella pasionNo ratings yet

- 1 Accounting For Taxation: Section OverviewDocument36 pages1 Accounting For Taxation: Section Overviewsimran jeswaniNo ratings yet

- Tax Liab. of Ind.Document13 pagesTax Liab. of Ind.Arun SwamiNo ratings yet

- Itlp Question Bank 2019Document22 pagesItlp Question Bank 2019HimanshuNo ratings yet

- A. The Constitution and The Income Tax: Federal Income Tax Professor Morrison Fall 2003 CHAPTER 1: IntroductionDocument67 pagesA. The Constitution and The Income Tax: Federal Income Tax Professor Morrison Fall 2003 CHAPTER 1: IntroductioncjleopNo ratings yet

- Income Tax Basics - July 2023Document6 pagesIncome Tax Basics - July 2023maharajabby81No ratings yet

- Withholding TaxDocument8 pagesWithholding TaxNabbaale hanifahNo ratings yet

- Basic Concepts - SummaryDocument10 pagesBasic Concepts - SummarybadalNo ratings yet

- Advance Payment of TaxDocument3 pagesAdvance Payment of TaxSalman AnsariNo ratings yet

- Advance Tax Tds Tcs DtaaDocument43 pagesAdvance Tax Tds Tcs DtaaarafatNo ratings yet

- Pro Pyme GeneralDocument11 pagesPro Pyme GeneralSofia OgaldeNo ratings yet

- UntitledDocument30 pagesUntitledRavi BanothNo ratings yet

- Module 07 - Introduction To Regular Income TaxDocument25 pagesModule 07 - Introduction To Regular Income TaxJANELLE NUEZNo ratings yet

- NIRC V. TRAInDocument11 pagesNIRC V. TRAInJin De GuzmanNo ratings yet

- Law and Procedure (TDS, TCS APT) Unit-4Document26 pagesLaw and Procedure (TDS, TCS APT) Unit-4Varsh SharmaNo ratings yet

- PAS 12 Accounting For Income TaxDocument17 pagesPAS 12 Accounting For Income TaxReynaldNo ratings yet

- Unit 5 TaxDocument15 pagesUnit 5 TaxVijay GiriNo ratings yet

- Law of Taxation ShivaniDocument29 pagesLaw of Taxation ShivaniShivani Singh ChandelNo ratings yet

- DTC - FinalDocument18 pagesDTC - FinalvjranavjNo ratings yet

- Ease of Paying TaxDocument3 pagesEase of Paying TaxjhnplmcsNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- 2017 MJDocument4 pages2017 MJRasel AshrafulNo ratings yet

- QIO Note On Mastefeed Agrotec LTDDocument2 pagesQIO Note On Mastefeed Agrotec LTDRasel AshrafulNo ratings yet

- ACME Pesticide Ltd. 28.09.2021Document239 pagesACME Pesticide Ltd. 28.09.2021Rasel AshrafulNo ratings yet

- Transfer Pricing Handout With Text - Lesson 2Document32 pagesTransfer Pricing Handout With Text - Lesson 2Rasel AshrafulNo ratings yet

- Answer - Investment AppraisalDocument3 pagesAnswer - Investment AppraisalRasel AshrafulNo ratings yet

- Amendment On Public Issues (Rules 2015) - Notification - 31.08.21Document4 pagesAmendment On Public Issues (Rules 2015) - Notification - 31.08.21Rasel AshrafulNo ratings yet

- IFRS 15 in Practice 2020 2021 - BDODocument127 pagesIFRS 15 in Practice 2020 2021 - BDORasel AshrafulNo ratings yet

- Attachment C Ifrs16 Illustrative Examples Ie 01 16Document61 pagesAttachment C Ifrs16 Illustrative Examples Ie 01 16Rasel AshrafulNo ratings yet

- Annul Report - 2019-2020 - AppexDocument48 pagesAnnul Report - 2019-2020 - AppexRasel AshrafulNo ratings yet

- 2019 Compliance Report With The Corporate Governance CodeDocument17 pages2019 Compliance Report With The Corporate Governance CodeRasel AshrafulNo ratings yet

- Nialco Fs Year End 2018 2019Document27 pagesNialco Fs Year End 2018 2019Rasel AshrafulNo ratings yet

- Online SalesDocument2 pagesOnline SalesRasel AshrafulNo ratings yet

- Notice 1Document1 pageNotice 1Rasel AshrafulNo ratings yet

- Nialco Fs Year End 2019 2020Document34 pagesNialco Fs Year End 2019 2020Rasel AshrafulNo ratings yet

- Finance Act 2011Document105 pagesFinance Act 2011Rasel AshrafulNo ratings yet

- Deffered TaxDocument20 pagesDeffered TaxRasel AshrafulNo ratings yet

- Finance Act 2012Document143 pagesFinance Act 2012Rasel AshrafulNo ratings yet

- Annual Report 2020 2021 Bengal BuiscuitsDocument33 pagesAnnual Report 2020 2021 Bengal BuiscuitsRasel AshrafulNo ratings yet

- Rebate On Transport Bills Nothi 367 Dated 28 Oct 2019Document1 pageRebate On Transport Bills Nothi 367 Dated 28 Oct 2019Rasel AshrafulNo ratings yet

- GO-17 - Mandatory Registration.Document6 pagesGO-17 - Mandatory Registration.Rasel AshrafulNo ratings yet

- Finance Act 2010Document100 pagesFinance Act 2010Rasel AshrafulNo ratings yet

- Transfer Pricing Handout With Text - Lesson 1Document20 pagesTransfer Pricing Handout With Text - Lesson 1Rasel AshrafulNo ratings yet

- Chapter 3 - Imposition of VAT - SBDocument50 pagesChapter 3 - Imposition of VAT - SBRasel AshrafulNo ratings yet

- VAT Laws Summary Covering Finance Act 2020Document58 pagesVAT Laws Summary Covering Finance Act 2020Rasel AshrafulNo ratings yet

- SRO 79 - Central VAT RegistrationDocument5 pagesSRO 79 - Central VAT RegistrationRasel AshrafulNo ratings yet

- Go 03 2020Document4 pagesGo 03 2020Rasel AshrafulNo ratings yet

- Tax Return - Mr. X - AY 2022-23Document12 pagesTax Return - Mr. X - AY 2022-23Rasel AshrafulNo ratings yet

- Transfer Pricing Sheet PrintDocument11 pagesTransfer Pricing Sheet PrintRasel AshrafulNo ratings yet

- Penalty and ProsecutionDocument6 pagesPenalty and ProsecutionRasel AshrafulNo ratings yet

- Alternative Dispute Resolution (ADR)Document2 pagesAlternative Dispute Resolution (ADR)Rasel AshrafulNo ratings yet

- SK Forms - Budget PrepDocument45 pagesSK Forms - Budget Prepsteven orillaneda50% (2)

- CAT Previous Paper 20021 PDFDocument22 pagesCAT Previous Paper 20021 PDFAshokrajaNo ratings yet

- BIR Forms (Official)Document10 pagesBIR Forms (Official)annNo ratings yet

- InternationalMarketing Rohinmalhotra PGP08245Document6 pagesInternationalMarketing Rohinmalhotra PGP08245angel enterprisesNo ratings yet

- Week 01 Orientation Accounting BasicsDocument34 pagesWeek 01 Orientation Accounting BasicsJM Balano0% (1)

- Compendium-June, 2017: International Appointments-National/InternationalDocument52 pagesCompendium-June, 2017: International Appointments-National/InternationalChirag BatraNo ratings yet

- Company BackgroundDocument2 pagesCompany BackgroundMary Grace Dela CruzNo ratings yet

- Aptitude TestSeries DI 3Q&ADocument7 pagesAptitude TestSeries DI 3Q&APrateek JainNo ratings yet

- Ia Midterm ExamDocument2 pagesIa Midterm ExamResty VillaroelNo ratings yet

- Activity 4 - Job Order CostingDocument2 pagesActivity 4 - Job Order CostingBea GarciaNo ratings yet

- Journal On FACTORS AFFECTING VOLUNTARY COMPLIANCE PDFDocument16 pagesJournal On FACTORS AFFECTING VOLUNTARY COMPLIANCE PDFFasika AbedomNo ratings yet

- Icai CocDocument50 pagesIcai CocHarsha OjhaNo ratings yet

- YPF Investor Day 2018 PDFDocument43 pagesYPF Investor Day 2018 PDFAndres GoldbaumNo ratings yet

- 04 - IP - UK - Development - of - Centre - For - Wellness - and - AYUSH - Treatment - (AYUSH Gram)Document25 pages04 - IP - UK - Development - of - Centre - For - Wellness - and - AYUSH - Treatment - (AYUSH Gram)Rupally Sharma0% (1)

- Liquidity RatioDocument3 pagesLiquidity RatioMusfequr Rahman (191051015)No ratings yet

- RTP Group-1 For May-2020 (CA Final New Course)Document144 pagesRTP Group-1 For May-2020 (CA Final New Course)Jayendrakumar KatariyaNo ratings yet

- Đ C An - BTVN Bu I 1 Task 1Document5 pagesĐ C An - BTVN Bu I 1 Task 1Phuong NguyenNo ratings yet

- Reen LawnsDocument8 pagesReen LawnsAshish BhallaNo ratings yet

- Lecture15 - Error CorrectionDocument2 pagesLecture15 - Error Correctionjsus22No ratings yet

- Arpita BajajDocument92 pagesArpita BajajPradyumn DixitNo ratings yet

- Colgate Cash FlowsDocument2 pagesColgate Cash FlowsChetan DhuriNo ratings yet

- Ashutosh Sohil Salary 2020-03 PDFDocument1 pageAshutosh Sohil Salary 2020-03 PDFMohit Sharma100% (1)

- ABC Analysis and Stock Levels: Mr. Rahul AnandDocument22 pagesABC Analysis and Stock Levels: Mr. Rahul AnandRahul AnandNo ratings yet

- The Myth of Asia's MiracleDocument18 pagesThe Myth of Asia's MiracleDavi ArrudaNo ratings yet

- Vanisha Patika Sari - c1c020055 - Tugas Minggu Ke 14 BingDocument7 pagesVanisha Patika Sari - c1c020055 - Tugas Minggu Ke 14 BingVanisha PatikaNo ratings yet

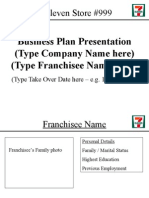

- New Franchise BPP TemplateDocument14 pagesNew Franchise BPP TemplateManoj KumarNo ratings yet

- Dissertation Proposal SampleDocument14 pagesDissertation Proposal Samplefemi1989100% (1)

- Financial Accounting: Theory & Practice Intangible AssetsDocument81 pagesFinancial Accounting: Theory & Practice Intangible AssetsXNo ratings yet

Advance Payment of Tax

Advance Payment of Tax

Uploaded by

Rasel AshrafulOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Advance Payment of Tax

Advance Payment of Tax

Uploaded by

Rasel AshrafulCopyright:

Available Formats

ADVANCE PAYMENT OF TAX

Ranjan Kumar Bhowmik r.*o

Member (Tax)

National Board of Revenue

Advance income tax is the tax which is to be paid by the assessee in advance either

by

deduction or collection of tax at source or by payment of quarterly instalments.

(1) Who is liable to paY advance tax?

Both existing and new assesses are liable to pay advance income tax' In case of

existing urr"ir". if his last assessed total income exceeds TK. 600,000/ [excluding

agricultu.al income and capital gain (other than capital gain from sale of share)] and

in case of new assessee if his current year's income likely to exceed TK. 600,000/

fexcluding agricultural income and capital gain (other than capital gain from sale of

share)] is also liable to pay advance tax.

(2)w

In case of existins assessee:

In case of existing assessee, advance tax is to be calculated on the basis of his

last assessed income. If his last assessed total income exceeds Tk. 600,000/

(other than capital gain from

lexcluding agricultural income and capital gain

sale ofshare)] he is required to pay advance tax. (See-64)

In case of new assessee:

A new assessee who has not previously been assessed shall also required to

pay advance tax if his current year's income [excluding agricultural income

and capital gain (other than capital gain from sale ofshare)l is likely to exceed

Tk. 600,000/ (See.68)

In case of cigarette manufacturer:

A cigarette manufacturer shall pay advancetax @3Yo on net sales in every

month. This monthly advance tax will be adjusted against quarterly

instalments.

The formula of net sale:A-B

Where A:Gross sale

B:VAT & SD (if anY)

(3)When and how advance tax is to be paid?

Advance tax is to be paid in the following 4 equal instalments on the basis of financial

year for which the tax is PaYable:

1st instalment : 15th SePtember

2nd instalment : 15th December

3rd instalment : 15th March

4th instalment : 15th .Iune

Provided that,if an assessment of the assessee is completed before 15th May. then on

that basis the payable amount of the rest instalment /instalments is/are to be

determined. (Sec.66)

(4)

Yes, withholding tax is also to be treated as advance payment of tax.

(s) What will hannen in case of excess pavment of advance tax?

Ifthe advance tax paid by the assessee exceeds the tax payable by him on regular

assessment, Govt. will pay simple interest on excess payment @10% per annum to be

calculated from l't July of the respective assessment year to the date of regular

assessment but not more than 2 years.

(6)Is there any scope to pay estimated amount of advance tax?

Yes, if any assessee feels, at any time during the year. that his tax is likely to be less

than the tax payable as per law, then he may submit an estimate to the DCT and pay

estimated amount of advance tax accordingly (Sec. 67). But at the time of assessment

if the DCT found that his estimate is wrong and tax actually comes higher, then

assessee will have to pay simple interest as per section 73.

(7)

The consequences are as follows:-

L Assessee will be treated as an assessee in default. (Sec' 69)

II. Simple interest @ l0% per annum will be chargeable on the amount falls short

fromT5o/o of the assessed tax to be calculated from 1st July of the assessment

year to the date of assessment but not more lhan 2 years. (Sec. 73).However

the rate of simple interest will be 50% higher if the return is not flled on or

before the "Tax daY"

m. DCT may also impose penalty up to 100% of the shortfall (Sec. 125).

Bhpwnrik rcla,r as amendcd up to 03/8/2020 based on F'inance Act.2020 Pagc 2 ofJ

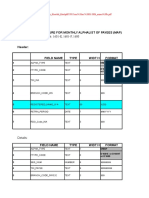

( 8 ) Adv an ce ta-t-a!-a-glance :.

lf the present lf the latest

income lil<ely to assessed

exceed Tk. income exceed

600,000 Tk.600,000

No Advance

Tax Payable

Does advance Advance Tax = Tax paid on the basis of last

tax paid plus assessed income - TDS, if anY

TDS 75% of

tax determined?

Does advance

tax paid plus TDS

:75% of tax

No simple interest, simPlY the determined?

balance tax will be paid

Assessee will pay the unpaid amount

of tax plus simple interest @ l0% lf No simple interest, simply the

such amount falls short than 75% of balance tax will be paid

assessed tax

Assessee will pay the unpaid amount

'tt

of tax plus simple interest @ l0%

such amount falls short than 75% of

assessed tax

You might also like

- Feasibility Report Amusement Park NRDADocument28 pagesFeasibility Report Amusement Park NRDANityaMurthy89% (9)

- Tax Planning and ManagementDocument23 pagesTax Planning and ManagementMinisha Gupta100% (19)

- Tax Deduction at SourceDocument62 pagesTax Deduction at SourcePallavisweet100% (1)

- Wilmington Trust Irrevocable Trust AgreementDocument14 pagesWilmington Trust Irrevocable Trust Agreementdiversified1100% (3)

- Advanced Payment of TaxDocument2 pagesAdvanced Payment of TaxEngr. Md. Ishtiak HossainNo ratings yet

- Tax Planning and Managerial DecisionDocument188 pagesTax Planning and Managerial Decisionkomal_nath2375% (4)

- Unit 1 - Advance Payment of TaxDocument4 pagesUnit 1 - Advance Payment of TaxAwesome AngelNo ratings yet

- Advance Tax PaymentDocument4 pagesAdvance Tax PaymentJaneesNo ratings yet

- Advance TaxDocument9 pagesAdvance TaxManvi JainNo ratings yet

- Module 07 - Overview of Regular Income TaxationDocument32 pagesModule 07 - Overview of Regular Income TaxationTrixie OnglaoNo ratings yet

- TaxationDocument12 pagesTaxationjanahh.omNo ratings yet

- Advance Tax, TDS, TCS - YVDocument34 pagesAdvance Tax, TDS, TCS - YVmuthuram2497No ratings yet

- Tax Deducted at SourceDocument5 pagesTax Deducted at SourceRajinder KaurNo ratings yet

- Advanced Tax (Math)Document1 pageAdvanced Tax (Math)Engr. Md. Ishtiak HossainNo ratings yet

- Unit 4 Return FillingDocument71 pagesUnit 4 Return FillingAnshu kumarNo ratings yet

- IFBPDocument11 pagesIFBPmohanraokp2279No ratings yet

- Module 07 Introduction To Regular Income TaxDocument21 pagesModule 07 Introduction To Regular Income TaxJeon KookieNo ratings yet

- Pay As You Earn PAYE Refunds 1Document2 pagesPay As You Earn PAYE Refunds 1bwalilubemba7No ratings yet

- Week 3 Income Tax AccountingDocument18 pagesWeek 3 Income Tax AccountingRavinesh Prasad100% (1)

- Advance Payment of TaxDocument2 pagesAdvance Payment of TaxMd.HasanNo ratings yet

- Note On Budget Proposals-2020Document7 pagesNote On Budget Proposals-2020Mayur VartakNo ratings yet

- Income Tax Law & Practice Unit 4Document8 pagesIncome Tax Law & Practice Unit 4MuskanNo ratings yet

- Income Tax 2024 - 25 5.14.24 PMDocument20 pagesIncome Tax 2024 - 25 5.14.24 PMAmal Living MiracleNo ratings yet

- Chapter-5 Advanced Payment of TaxesDocument25 pagesChapter-5 Advanced Payment of TaxesSumon iqbalNo ratings yet

- Advance TaxDocument2 pagesAdvance Tax1986anuNo ratings yet

- Chapter 10 - Carry Forward and AdjustmentsDocument14 pagesChapter 10 - Carry Forward and Adjustmentsanamul haqueNo ratings yet

- Module 07 Introduction To Regular Income Tax 3 2Document21 pagesModule 07 Introduction To Regular Income Tax 3 2Joshua BazarNo ratings yet

- Indian Income Tax Calculator: Double Click The IT Calculator - IT Will Automatically Calculate The Taxable AmountDocument23 pagesIndian Income Tax Calculator: Double Click The IT Calculator - IT Will Automatically Calculate The Taxable AmountshankarinsideNo ratings yet

- With Holding Tax-CompressedDocument8 pagesWith Holding Tax-CompressedNGANJANI WALTERNo ratings yet

- Income Tax TheoryDocument28 pagesIncome Tax Theorynextgensolution44No ratings yet

- TDS On SalaryDocument5 pagesTDS On SalaryAato AatoNo ratings yet

- P N 0 TH H T - T o H T: Module 36 Taxes: Co O ATEDocument3 pagesP N 0 TH H T - T o H T: Module 36 Taxes: Co O ATEZeyad El-sayedNo ratings yet

- 1035 Withholding TaxDocument8 pages1035 Withholding TaxViren GandhiNo ratings yet

- Merits of GST:: Compensation To Loss Making States For Five Years: It Has Been Proposed That TheDocument10 pagesMerits of GST:: Compensation To Loss Making States For Five Years: It Has Been Proposed That TheJyoti SinghNo ratings yet

- POWIBA NOTICE CORPORATE TAX AssessmentDocument2 pagesPOWIBA NOTICE CORPORATE TAX AssessmentHassan OmaryNo ratings yet

- Income Tax Calculations On Salaries and Other Income For The Assessment Year 2024Document20 pagesIncome Tax Calculations On Salaries and Other Income For The Assessment Year 2024ManoharanR Rajamanikam0% (1)

- Advance TaxDocument3 pagesAdvance TaxRia SarkarNo ratings yet

- Presentation ON TDS Advanced Tax Self Assesment TaxDocument15 pagesPresentation ON TDS Advanced Tax Self Assesment TaxVaishali ChouhanNo ratings yet

- Income Tax in IndiaDocument19 pagesIncome Tax in IndiaConcepts TreeNo ratings yet

- Income Tax - TRAINDocument27 pagesIncome Tax - TRAINSteveNo ratings yet

- M6 - Deductions P2 Students'Document53 pagesM6 - Deductions P2 Students'micaella pasionNo ratings yet

- 1 Accounting For Taxation: Section OverviewDocument36 pages1 Accounting For Taxation: Section Overviewsimran jeswaniNo ratings yet

- Tax Liab. of Ind.Document13 pagesTax Liab. of Ind.Arun SwamiNo ratings yet

- Itlp Question Bank 2019Document22 pagesItlp Question Bank 2019HimanshuNo ratings yet

- A. The Constitution and The Income Tax: Federal Income Tax Professor Morrison Fall 2003 CHAPTER 1: IntroductionDocument67 pagesA. The Constitution and The Income Tax: Federal Income Tax Professor Morrison Fall 2003 CHAPTER 1: IntroductioncjleopNo ratings yet

- Income Tax Basics - July 2023Document6 pagesIncome Tax Basics - July 2023maharajabby81No ratings yet

- Withholding TaxDocument8 pagesWithholding TaxNabbaale hanifahNo ratings yet

- Basic Concepts - SummaryDocument10 pagesBasic Concepts - SummarybadalNo ratings yet

- Advance Payment of TaxDocument3 pagesAdvance Payment of TaxSalman AnsariNo ratings yet

- Advance Tax Tds Tcs DtaaDocument43 pagesAdvance Tax Tds Tcs DtaaarafatNo ratings yet

- Pro Pyme GeneralDocument11 pagesPro Pyme GeneralSofia OgaldeNo ratings yet

- UntitledDocument30 pagesUntitledRavi BanothNo ratings yet

- Module 07 - Introduction To Regular Income TaxDocument25 pagesModule 07 - Introduction To Regular Income TaxJANELLE NUEZNo ratings yet

- NIRC V. TRAInDocument11 pagesNIRC V. TRAInJin De GuzmanNo ratings yet

- Law and Procedure (TDS, TCS APT) Unit-4Document26 pagesLaw and Procedure (TDS, TCS APT) Unit-4Varsh SharmaNo ratings yet

- PAS 12 Accounting For Income TaxDocument17 pagesPAS 12 Accounting For Income TaxReynaldNo ratings yet

- Unit 5 TaxDocument15 pagesUnit 5 TaxVijay GiriNo ratings yet

- Law of Taxation ShivaniDocument29 pagesLaw of Taxation ShivaniShivani Singh ChandelNo ratings yet

- DTC - FinalDocument18 pagesDTC - FinalvjranavjNo ratings yet

- Ease of Paying TaxDocument3 pagesEase of Paying TaxjhnplmcsNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- 2017 MJDocument4 pages2017 MJRasel AshrafulNo ratings yet

- QIO Note On Mastefeed Agrotec LTDDocument2 pagesQIO Note On Mastefeed Agrotec LTDRasel AshrafulNo ratings yet

- ACME Pesticide Ltd. 28.09.2021Document239 pagesACME Pesticide Ltd. 28.09.2021Rasel AshrafulNo ratings yet

- Transfer Pricing Handout With Text - Lesson 2Document32 pagesTransfer Pricing Handout With Text - Lesson 2Rasel AshrafulNo ratings yet

- Answer - Investment AppraisalDocument3 pagesAnswer - Investment AppraisalRasel AshrafulNo ratings yet

- Amendment On Public Issues (Rules 2015) - Notification - 31.08.21Document4 pagesAmendment On Public Issues (Rules 2015) - Notification - 31.08.21Rasel AshrafulNo ratings yet

- IFRS 15 in Practice 2020 2021 - BDODocument127 pagesIFRS 15 in Practice 2020 2021 - BDORasel AshrafulNo ratings yet

- Attachment C Ifrs16 Illustrative Examples Ie 01 16Document61 pagesAttachment C Ifrs16 Illustrative Examples Ie 01 16Rasel AshrafulNo ratings yet

- Annul Report - 2019-2020 - AppexDocument48 pagesAnnul Report - 2019-2020 - AppexRasel AshrafulNo ratings yet

- 2019 Compliance Report With The Corporate Governance CodeDocument17 pages2019 Compliance Report With The Corporate Governance CodeRasel AshrafulNo ratings yet

- Nialco Fs Year End 2018 2019Document27 pagesNialco Fs Year End 2018 2019Rasel AshrafulNo ratings yet

- Online SalesDocument2 pagesOnline SalesRasel AshrafulNo ratings yet

- Notice 1Document1 pageNotice 1Rasel AshrafulNo ratings yet

- Nialco Fs Year End 2019 2020Document34 pagesNialco Fs Year End 2019 2020Rasel AshrafulNo ratings yet

- Finance Act 2011Document105 pagesFinance Act 2011Rasel AshrafulNo ratings yet

- Deffered TaxDocument20 pagesDeffered TaxRasel AshrafulNo ratings yet

- Finance Act 2012Document143 pagesFinance Act 2012Rasel AshrafulNo ratings yet

- Annual Report 2020 2021 Bengal BuiscuitsDocument33 pagesAnnual Report 2020 2021 Bengal BuiscuitsRasel AshrafulNo ratings yet

- Rebate On Transport Bills Nothi 367 Dated 28 Oct 2019Document1 pageRebate On Transport Bills Nothi 367 Dated 28 Oct 2019Rasel AshrafulNo ratings yet

- GO-17 - Mandatory Registration.Document6 pagesGO-17 - Mandatory Registration.Rasel AshrafulNo ratings yet

- Finance Act 2010Document100 pagesFinance Act 2010Rasel AshrafulNo ratings yet

- Transfer Pricing Handout With Text - Lesson 1Document20 pagesTransfer Pricing Handout With Text - Lesson 1Rasel AshrafulNo ratings yet

- Chapter 3 - Imposition of VAT - SBDocument50 pagesChapter 3 - Imposition of VAT - SBRasel AshrafulNo ratings yet

- VAT Laws Summary Covering Finance Act 2020Document58 pagesVAT Laws Summary Covering Finance Act 2020Rasel AshrafulNo ratings yet

- SRO 79 - Central VAT RegistrationDocument5 pagesSRO 79 - Central VAT RegistrationRasel AshrafulNo ratings yet

- Go 03 2020Document4 pagesGo 03 2020Rasel AshrafulNo ratings yet

- Tax Return - Mr. X - AY 2022-23Document12 pagesTax Return - Mr. X - AY 2022-23Rasel AshrafulNo ratings yet

- Transfer Pricing Sheet PrintDocument11 pagesTransfer Pricing Sheet PrintRasel AshrafulNo ratings yet

- Penalty and ProsecutionDocument6 pagesPenalty and ProsecutionRasel AshrafulNo ratings yet

- Alternative Dispute Resolution (ADR)Document2 pagesAlternative Dispute Resolution (ADR)Rasel AshrafulNo ratings yet

- SK Forms - Budget PrepDocument45 pagesSK Forms - Budget Prepsteven orillaneda50% (2)

- CAT Previous Paper 20021 PDFDocument22 pagesCAT Previous Paper 20021 PDFAshokrajaNo ratings yet

- BIR Forms (Official)Document10 pagesBIR Forms (Official)annNo ratings yet

- InternationalMarketing Rohinmalhotra PGP08245Document6 pagesInternationalMarketing Rohinmalhotra PGP08245angel enterprisesNo ratings yet

- Week 01 Orientation Accounting BasicsDocument34 pagesWeek 01 Orientation Accounting BasicsJM Balano0% (1)

- Compendium-June, 2017: International Appointments-National/InternationalDocument52 pagesCompendium-June, 2017: International Appointments-National/InternationalChirag BatraNo ratings yet

- Company BackgroundDocument2 pagesCompany BackgroundMary Grace Dela CruzNo ratings yet

- Aptitude TestSeries DI 3Q&ADocument7 pagesAptitude TestSeries DI 3Q&APrateek JainNo ratings yet

- Ia Midterm ExamDocument2 pagesIa Midterm ExamResty VillaroelNo ratings yet

- Activity 4 - Job Order CostingDocument2 pagesActivity 4 - Job Order CostingBea GarciaNo ratings yet

- Journal On FACTORS AFFECTING VOLUNTARY COMPLIANCE PDFDocument16 pagesJournal On FACTORS AFFECTING VOLUNTARY COMPLIANCE PDFFasika AbedomNo ratings yet

- Icai CocDocument50 pagesIcai CocHarsha OjhaNo ratings yet

- YPF Investor Day 2018 PDFDocument43 pagesYPF Investor Day 2018 PDFAndres GoldbaumNo ratings yet

- 04 - IP - UK - Development - of - Centre - For - Wellness - and - AYUSH - Treatment - (AYUSH Gram)Document25 pages04 - IP - UK - Development - of - Centre - For - Wellness - and - AYUSH - Treatment - (AYUSH Gram)Rupally Sharma0% (1)

- Liquidity RatioDocument3 pagesLiquidity RatioMusfequr Rahman (191051015)No ratings yet

- RTP Group-1 For May-2020 (CA Final New Course)Document144 pagesRTP Group-1 For May-2020 (CA Final New Course)Jayendrakumar KatariyaNo ratings yet

- Đ C An - BTVN Bu I 1 Task 1Document5 pagesĐ C An - BTVN Bu I 1 Task 1Phuong NguyenNo ratings yet

- Reen LawnsDocument8 pagesReen LawnsAshish BhallaNo ratings yet

- Lecture15 - Error CorrectionDocument2 pagesLecture15 - Error Correctionjsus22No ratings yet

- Arpita BajajDocument92 pagesArpita BajajPradyumn DixitNo ratings yet

- Colgate Cash FlowsDocument2 pagesColgate Cash FlowsChetan DhuriNo ratings yet

- Ashutosh Sohil Salary 2020-03 PDFDocument1 pageAshutosh Sohil Salary 2020-03 PDFMohit Sharma100% (1)

- ABC Analysis and Stock Levels: Mr. Rahul AnandDocument22 pagesABC Analysis and Stock Levels: Mr. Rahul AnandRahul AnandNo ratings yet

- The Myth of Asia's MiracleDocument18 pagesThe Myth of Asia's MiracleDavi ArrudaNo ratings yet

- Vanisha Patika Sari - c1c020055 - Tugas Minggu Ke 14 BingDocument7 pagesVanisha Patika Sari - c1c020055 - Tugas Minggu Ke 14 BingVanisha PatikaNo ratings yet

- New Franchise BPP TemplateDocument14 pagesNew Franchise BPP TemplateManoj KumarNo ratings yet

- Dissertation Proposal SampleDocument14 pagesDissertation Proposal Samplefemi1989100% (1)

- Financial Accounting: Theory & Practice Intangible AssetsDocument81 pagesFinancial Accounting: Theory & Practice Intangible AssetsXNo ratings yet