Professional Documents

Culture Documents

Comments of Ministry of Power

Comments of Ministry of Power

Uploaded by

Rahul MathurOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Comments of Ministry of Power

Comments of Ministry of Power

Uploaded by

Rahul MathurCopyright:

Available Formats

9/7/2014 Comments of Ministry of Power on

Comments of Ministry of Power on Domestic Gas Pricing and Power Sector Crisis (June 2014)

(1) Entire gas-based capacity in the country is nearly stranded.

(2) Projects are on the verge of turning into NPAs, exposing investing from banks.

Comments of MoP:

The present gas based power generation capacity in the country is 18964 MW (1584.5 MW projects commissioned without gas) and 7525 MW projects

without gas allocation are ready for commissioning. Thus total existing gas based generation capacity is 26,489 MW. Out of this 17 projects amounting to

2340 MW are off grid and working at average PLF of approximately 60%. Rest of the projects, which accounts for 24,149 MW, are gas grid connected and

nearly stranded as they are operating at sub-optimal PLF because of non-availability of gas. The average PLF of this capacity is below 20%. During the

month of May, 2014 the gas availability for the existing capacity was 26.43 MMSCMD including 1.1 MMSCMD RLNG, which is only sufficient to operate the

already commissioned grid connected plants (19624 MW) at an average PLF of 25%. If ready to be commissioned plants are added (total 24,149 MW) then

the average PLF which can be achieved with this amount of gas is 20%. If additional gas at reasonable price is not made available to the plants dependent

predominantly on KG D6 gas as well as new plants without gas allocation, there are high chances of them being declared NPAs by the lenders. This may

cause huge damage to the economy. For instance, RGPPL is already on the verge of becoming NPA.

(3) Changes in the domestic gas pricing would make power tariffs unviable with not many off takers and may further cripple financially

beleaguered Discoms:

Comments on MoP: The proposed increase of gas price will have an adverse impact on the already deteriorating financial health of the gas based capacity

as there are lesser chances of the power being scheduled from these plants. The approximate calculation of the impact of the gas price hike on the per unit

generation cost of the gas based plants at 50% PLF is enclosed at Annexure. With lower PLFs fixed cost become higher and cost of gas based generation

will increase.

(4) Mainstreaming LNG in power market by implementation of bulk imports of LNG and adopting Gas Price pooling and ensuring off take for

gas-based power generated using price-pooled gas.

Comments of MoP: There is no doubt that mainstreaming LNG in power market by implementation of bulk imports of LNG and adopting Gas Price Pooling

Mechanism (GPPM) and taking necessary action within the power sector is an option to make the gas based generation viable as it is a cleaner fuel.

However, the weighted price of the pooled gas will again render these plants unviable.

In fact, for improving the utilization of stranded gas based generation capacity, Ministry of Power circulated a CCEA Note in October-September, 2013. The

proposal was for pooling of domestic gas with RLNG and subsidizing the difference between cost of generation and proposed tariff figures of INR 5.5 per unit

for FY 2013-14 (three months), INR 7 per unit for FY 2014-15 and INR 7.5 per unit for 2015-16. Total financial implication of the proposed subsidy for 2013-

14, 2014-15 and 2015-16 was INR 28,216 Crore and the proposal was not supported by the Ministry of Finance. This proposal stands withdrawn.

In view of above, after another round of deliberations, a fresh CCEA note was circulated in February, 2014. This scheme has two components i.e., Subsidy

component and financial package. In this scheme, effort was made to lower the subsidy while offering relief for the stranded gas based plants through

financial package.

i. The Power Plants covered in the subsidy scheme are the Gas based generation dependent primarily on APM Gas with installed capacity of 10,382

MW. Government of India will allocate subsidy for reimbursements to State DISCOMs. Subsidy is worked out on the basis of the difference in actual

tariff and INR 5.0/unit for 2014-15 and INR 5.50 for 2015-16. The indicative Subsidy to be borne by Government would be about INR 3621 Crore in

2014-15 and INR 2056 Crore in 2015-16 to support APM Gas based plants. Total Subsidy for the year 2014-16 works out to INR 5,677 Crore.

ii. The power plants covered in the scheme for financial package are:

a. For above mentioned Gas based generation dependent primarily on APM Gas: 10,382 MW

b. For projects mainly dependent on KG D6 Gas: 6996.5 MW

c. For projects with no Gas allocation: 1797.5 MW

iii. For projects mainly dependent on KG D6 Gas, it is proposed to allocate all additional NELP gas that becomes available to the Power sector to these

plants only. For 2014-15 it is proposed to be allocated to RGPPL.

iv. For projects with no Gas allocation, till sufficient domestic gas is made available to these projects, it is proposed that these power producers may

procure RLNG and generate power for direct sale to customers. (Note: In cases, where the generator has entered into contracts for supply of RLNG

and PPAs with consumers, further loan facility would be available from PFC on its normal terms and conditions)

v. The financial restructuring package mainly consists of the relaxations in ECB/Trade Credit like extension in COD, additional 3 years moratorium and

waiver of interest (for low PLF projects), & capitalization of interest.

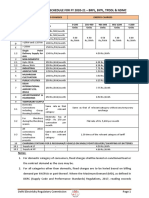

Annexure

Calculation of Impact of Gas Prices on Power sector

1 Btu 0.2522 Kcal

Considering 1$ INR 60

1$/MMBTU INR 60/MMBTU

1/2

9/7/2014 Comments of Ministry of Power on

1$/MMBTU INR 60/MMBTU

1$/MMBTU (1*60/0.2522)/10^6 INR/Kcal

Therefore 1$/MMBTU 0.000238 INR/Kcal

Considered Station heat rate 2000 Kcal/Kwh

Variable cost of generation for 1$/MMBTU Gas Price = 2000 x 0.000238 = INR 0.48/kwh

= INR 50/kwh

Fixed Cost of Generation INR 1.00/kwh at 85% PLF

Fixed Cost of generation at 50% PLF will be INR 1.70/kwh

With gas price of 6 $/MMBTU, considering Taxes and Transportation costs at the farthest end to be US$ 2 /MMBTU delivered Gas price may be

around US$ 8/MMBTU

Variable cost or Fuel cost of generation (FCOG) INR 4.00/Unit.

Total Cost of generation INR 5.70/Unit at 50% PLF

With gas price of 7 $/MMBTU, considering Taxes and Transportation costs at the farthest end to be US$ 2 /MMBTU delivered Gas price may be

around US$ 9/MMBTU

Variable cost or Fuel cost of generation (FCOG) INR 4.50/Unit.

With gas price of 8 $/MMBTU, considering Taxes and Transportation costs at the farthest end to be US$ 2 /MMBTU delivered Gas price may be

around US$ 10/MMBTU

Variable cost or Fuel cost of generation (FCOG) INR 5.00/Unit.

2/2

You might also like

- Public and Private Management Compared. Escrito Por Hal G. Rainey & Young Han ChunDocument19 pagesPublic and Private Management Compared. Escrito Por Hal G. Rainey & Young Han ChunmceciliagomesNo ratings yet

- Approach To Bank Audit DNS 17 18 FinalDocument45 pagesApproach To Bank Audit DNS 17 18 FinalSowmya GuptaNo ratings yet

- Transportation and Food: The Importance of AccessDocument8 pagesTransportation and Food: The Importance of AccessNeroulidi854No ratings yet

- Importance of Social Cost Benefit AnalysisDocument9 pagesImportance of Social Cost Benefit AnalysisMohan RaoNo ratings yet

- Brief Note On Stranded Gas Based Power PlantDocument3 pagesBrief Note On Stranded Gas Based Power PlantRahul MathurNo ratings yet

- GERC - Corrigendum To Order No. 4 of 2013 Dated 08.08.2013Document5 pagesGERC - Corrigendum To Order No. 4 of 2013 Dated 08.08.2013rahul patelNo ratings yet

- Towards A Sustainable Coal PowerDocument10 pagesTowards A Sustainable Coal PowerAkhtar AliNo ratings yet

- Tariff Schedule Fy 2019-20Document8 pagesTariff Schedule Fy 2019-20Sharma ShiviNo ratings yet

- Electricity Generation 2020Document20 pagesElectricity Generation 2020Muhammad Muneeb Ullah SandhuNo ratings yet

- PNGRBDocument94 pagesPNGRBPreshitNo ratings yet

- Tariff PVVNL 2016-17Document7 pagesTariff PVVNL 2016-17assistant engineerNo ratings yet

- BRPL Tariff Schedule 2019 20Document10 pagesBRPL Tariff Schedule 2019 20Atul SharmaNo ratings yet

- LNG Demande in PakistanDocument21 pagesLNG Demande in PakistanAnonymous icnhaNsFNo ratings yet

- Sr. No. Category Fixed Charges Energy Charges Domestic: AnnexureDocument5 pagesSr. No. Category Fixed Charges Energy Charges Domestic: AnnexureAam aadmiNo ratings yet

- Economic Analysis A. Macroeconomic Context: Yap Renewable Energy Development Project (RRP FSM 44469)Document5 pagesEconomic Analysis A. Macroeconomic Context: Yap Renewable Energy Development Project (RRP FSM 44469)AhmedNo ratings yet

- Cs Distr Steam Methane ReformDocument5 pagesCs Distr Steam Methane ReformJuan Antonio SánchezNo ratings yet

- Pakistan'S Gas Shortage - Is A Moratorium On Gas Supply To Captive Power Plants (CPPS) The Solution? An Article by Mr. Shahid Sattar and Mr. Saad Umar, AptmaDocument4 pagesPakistan'S Gas Shortage - Is A Moratorium On Gas Supply To Captive Power Plants (CPPS) The Solution? An Article by Mr. Shahid Sattar and Mr. Saad Umar, AptmaArslan RashidNo ratings yet

- 3 Economics Gas Generation CrisDocument0 pages3 Economics Gas Generation CrissajjanmishraNo ratings yet

- CNG Price OrderDocument5 pagesCNG Price OrderabdullahiqbalNo ratings yet

- Tariff Schedule 2020-21Document9 pagesTariff Schedule 2020-21Yuva RajNo ratings yet

- Tariff Schedule PDFDocument32 pagesTariff Schedule PDFRizwan 106No ratings yet

- Bangladesh Electricity Tariff AnalysisDocument10 pagesBangladesh Electricity Tariff AnalysisAsif KhanNo ratings yet

- AR 2013 14 Infra-ReviewDocument12 pagesAR 2013 14 Infra-ReviewHarshal PhuseNo ratings yet

- Economic and Financial Evaluation: TH RDDocument11 pagesEconomic and Financial Evaluation: TH RDYasir IqbalNo ratings yet

- Bses Delhi Tariff - Schedule - FY - 2020 - 21Document10 pagesBses Delhi Tariff - Schedule - FY - 2020 - 21Pankaj KumarNo ratings yet

- Tariff Schedule 2020-21Document22 pagesTariff Schedule 2020-21JAYACHANDRAN PRAKASHNo ratings yet

- Popularizing Liquefied Petroleum Gas (LPG) As An Alternative To Piped Natural Gas For Domestic Use: Bangladesh PerspectiveDocument5 pagesPopularizing Liquefied Petroleum Gas (LPG) As An Alternative To Piped Natural Gas For Domestic Use: Bangladesh PerspectiveImran KarimNo ratings yet

- Dakshin Haryana Bijli Vitran Nigam Sales Circular No. D-26/2014Document5 pagesDakshin Haryana Bijli Vitran Nigam Sales Circular No. D-26/2014pkgoyal1983No ratings yet

- 8336Document4 pages8336Hendro HooNo ratings yet

- Tariff Press Note March 2020Document3 pagesTariff Press Note March 2020Roohi KatnoriaNo ratings yet

- TRF-359 NPPMCL Fpa April 2024 14-05-2024 6820-24Document3 pagesTRF-359 NPPMCL Fpa April 2024 14-05-2024 6820-24TahaMujahidNo ratings yet

- Tariff Regulation 16-17 RercDocument48 pagesTariff Regulation 16-17 Rercarpit99990No ratings yet

- Updates On Electricity Tariff Regulation in Peninsular MalaysiaDocument20 pagesUpdates On Electricity Tariff Regulation in Peninsular MalaysiaDavid FooNo ratings yet

- Small Biomass Based Grid Interactive ProjectsDocument3 pagesSmall Biomass Based Grid Interactive Projectsanu141No ratings yet

- Chapter - 4: Compliance of Directives Issued by The CommissionDocument32 pagesChapter - 4: Compliance of Directives Issued by The CommissionManoj KumarNo ratings yet

- Kcci Oerc Order Power Tarrif 2024Document3 pagesKcci Oerc Order Power Tarrif 2024Sanjay GuptaNo ratings yet

- Financial Impact of Delay in Implementation of Power PlantsDocument5 pagesFinancial Impact of Delay in Implementation of Power PlantslkwriterNo ratings yet

- DGVCL Tariff CirDocument27 pagesDGVCL Tariff CirWojaNo ratings yet

- Tariff Schedule For2017-18Document33 pagesTariff Schedule For2017-18Kiran MatariyaNo ratings yet

- H&M EnergyDocument14 pagesH&M EnergyMd. Fayez RefaetNo ratings yet

- Gujarat State Wind Power ProfileDocument7 pagesGujarat State Wind Power ProfileBinjal BhavsarNo ratings yet

- Press Release TPC D EnglishDocument12 pagesPress Release TPC D EnglishSahyadri HospitalsNo ratings yet

- Tariff 09 IIDocument4 pagesTariff 09 IINaidu UdianNo ratings yet

- Tariff Determination - Write UpDocument12 pagesTariff Determination - Write UpsureshpahariaNo ratings yet

- Mekotex Tariff PetitionDocument60 pagesMekotex Tariff Petitionchejoman1979No ratings yet

- ICWAI Gas PriceDocument3 pagesICWAI Gas PriceA Prabu DasNo ratings yet

- Effective From 1 April, 2020: Tariff Schedule For Supply of ElectricityDocument34 pagesEffective From 1 April, 2020: Tariff Schedule For Supply of ElectricityAlphaNo ratings yet

- Pricing of Products in GAILDocument32 pagesPricing of Products in GAILSimmi SharmaNo ratings yet

- Tariff ScheduleDocument23 pagesTariff ScheduleshirishNo ratings yet

- 1569051386IDEAS WP2 Final PDFDocument25 pages1569051386IDEAS WP2 Final PDFlance carterNo ratings yet

- Why Pakistan's Power Woes Will Get Worse: Problems That Need To Be AddressedDocument11 pagesWhy Pakistan's Power Woes Will Get Worse: Problems That Need To Be AddressedAimen JahangirNo ratings yet

- Figure 1: Energy ConsumptionDocument9 pagesFigure 1: Energy ConsumptionRaju NairNo ratings yet

- Name: Ramchandra V NesariDocument10 pagesName: Ramchandra V NesarirvnesariNo ratings yet

- Urea Policy (Pricing and Administration) and Urea Pricing Policy SectionDocument5 pagesUrea Policy (Pricing and Administration) and Urea Pricing Policy SectionAnonymous w6TIxI0G8lNo ratings yet

- Press Release AEML EnglishDocument11 pagesPress Release AEML EnglishSahyadri HospitalsNo ratings yet

- Brief Anlysis Cost of Generation 2017Document2 pagesBrief Anlysis Cost of Generation 2017thisaru.dana123No ratings yet

- Indonesia Issues Carbon Pricing and Trading Regime For Power GenerationDocument10 pagesIndonesia Issues Carbon Pricing and Trading Regime For Power GenerationOktasari Dyah AnggrainiNo ratings yet

- Tariff Effective From 1st April 2022 27-04-22Document28 pagesTariff Effective From 1st April 2022 27-04-22Manish TiwariNo ratings yet

- Only Tariff Schedule 030421Document26 pagesOnly Tariff Schedule 030421priyank.h.p.digitalNo ratings yet

- TRF-122 Uch-Ii Fpa 18-04-2024 5236-40Document3 pagesTRF-122 Uch-Ii Fpa 18-04-2024 5236-40TahaMujahidNo ratings yet

- Mygov 149300716733022984Document21 pagesMygov 149300716733022984Keyur MakwanaNo ratings yet

- Commonsr2023 24volume 6 (KPTCL, Escoms&Pwdele)Document522 pagesCommonsr2023 24volume 6 (KPTCL, Escoms&Pwdele)govinda rajuNo ratings yet

- Renewable Energy Tariffs and Incentives in Indonesia: Review and RecommendationsFrom EverandRenewable Energy Tariffs and Incentives in Indonesia: Review and RecommendationsNo ratings yet

- Assignment 7Document2 pagesAssignment 7Priyadarshini BalamuruganNo ratings yet

- China Poverty 2011Document33 pagesChina Poverty 2011solikearoseNo ratings yet

- 4.1 4.2 Government InterventionDocument16 pages4.1 4.2 Government Intervention李楠鑫No ratings yet

- Ethanol From Sugar - Gareth Forber AOF2022Document18 pagesEthanol From Sugar - Gareth Forber AOF2022Parush PatelNo ratings yet

- Forign Trade Procedure and DocumentationDocument68 pagesForign Trade Procedure and DocumentationDinesh.KNo ratings yet

- European Semester Thematic Factsheet Active Labour Market Policies en 0Document13 pagesEuropean Semester Thematic Factsheet Active Labour Market Policies en 0Vișan Rareș Vișan RareșNo ratings yet

- Understanding Economic Development and Institutional Change: East Asian Development Model Reconsidered With Implications For ChinaDocument21 pagesUnderstanding Economic Development and Institutional Change: East Asian Development Model Reconsidered With Implications For ChinaPhòng Cung cấp Thông tinNo ratings yet

- ABCs of Affordable Housing in Kenya Good - pk9lEH0oDocument21 pagesABCs of Affordable Housing in Kenya Good - pk9lEH0oMujjo Sahb100% (1)

- The Political Economy of Growth Macinhes MOLOTCH 1993Document25 pagesThe Political Economy of Growth Macinhes MOLOTCH 1993raulNo ratings yet

- 0309 Energy Transition and The Electricity MarketDocument70 pages0309 Energy Transition and The Electricity MarketFenhia RivasNo ratings yet

- Macroeconomics Tuto c2Document1 pageMacroeconomics Tuto c2Nazri AnaszNo ratings yet

- Argumentative Essay Number 4Document2 pagesArgumentative Essay Number 4Shao GamingNo ratings yet

- Approved CAE GuidelineDocument50 pagesApproved CAE GuidelineamanNo ratings yet

- Essay For Child LabourDocument5 pagesEssay For Child Labourb71g37ac100% (2)

- Kaplan Entering Chile - Timothy Raditya SolichinDocument24 pagesKaplan Entering Chile - Timothy Raditya SolichinTimothy RSNo ratings yet

- Financial Economic Analysis Shadow Pricing Apr2013 PDFDocument13 pagesFinancial Economic Analysis Shadow Pricing Apr2013 PDFAlfred PatrickNo ratings yet

- Mittal School of Business Faculty of BBA Name of The Faculty Member MR. JIVANJOT SINGHDocument11 pagesMittal School of Business Faculty of BBA Name of The Faculty Member MR. JIVANJOT SINGHHarshit GuptaNo ratings yet

- Rural Godown Scheme (RGS) or Gramin Bhandaran Yojana: Objective of The SchemeDocument3 pagesRural Godown Scheme (RGS) or Gramin Bhandaran Yojana: Objective of The SchemeSiddhartha SharmaNo ratings yet

- RIngkasan Teori Perdagangan InternasionalDocument5 pagesRIngkasan Teori Perdagangan Internasionall a t h i f a hNo ratings yet

- History of CottonDocument17 pagesHistory of CottonRebeccaMastertonNo ratings yet

- SIDBI Scheme: Subsidy & Non-SubsidyDocument19 pagesSIDBI Scheme: Subsidy & Non-SubsidyhappytiwariNo ratings yet

- Fiscal Responsibility and Budget Management Act (FRBMA) 2003Document29 pagesFiscal Responsibility and Budget Management Act (FRBMA) 2003swaroopa sapdhareNo ratings yet

- Ministrty of ShippingDocument81 pagesMinistrty of ShippingEshwar BabuNo ratings yet

- ForumIAS CSAT Test 10 SolutionDocument46 pagesForumIAS CSAT Test 10 SolutionanilNo ratings yet

- FYBA Economics English Semester I 1Document104 pagesFYBA Economics English Semester I 1Aditya LokhandeNo ratings yet

- Gartner 2013 11 Forecast The Internet of Things, Worldwide, 2013 - 259115Document19 pagesGartner 2013 11 Forecast The Internet of Things, Worldwide, 2013 - 259115Gaurav BagariaNo ratings yet