Professional Documents

Culture Documents

Final Withholding Taxes 2

Final Withholding Taxes 2

Uploaded by

Gerald Santos0 ratings0% found this document useful (0 votes)

19 views1 pageThe document provides information about the income received by taxpayer P. Ramos during the year, including income from profession, rent, interest, prizes, winnings, dividends, and royalties. It then asks a series of multiple choice questions about calculating the taxpayer's taxable income, creditable withholding taxes, income tax payable, and final withholding taxes based on whether the taxpayer is a resident or nonresident citizen.

Original Description:

Original Title

FINAL WITHHOLDING TAXES 2

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides information about the income received by taxpayer P. Ramos during the year, including income from profession, rent, interest, prizes, winnings, dividends, and royalties. It then asks a series of multiple choice questions about calculating the taxpayer's taxable income, creditable withholding taxes, income tax payable, and final withholding taxes based on whether the taxpayer is a resident or nonresident citizen.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

19 views1 pageFinal Withholding Taxes 2

Final Withholding Taxes 2

Uploaded by

Gerald SantosThe document provides information about the income received by taxpayer P. Ramos during the year, including income from profession, rent, interest, prizes, winnings, dividends, and royalties. It then asks a series of multiple choice questions about calculating the taxpayer's taxable income, creditable withholding taxes, income tax payable, and final withholding taxes based on whether the taxpayer is a resident or nonresident citizen.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

FINAL WITHHOLDING TAXES

Taxpayer P. Ramos received the following income during the year:

Income from profession (gross of 2% CWT) P 500,000

Cost of services 150,000

Rent, Philippines (gross of 5% CWT) 140,000

Depreciation 20,000

Rent, Hongkong 200,000

Interest, peso deposit, MBTC 2,000

Interest, US$ deposit, BDO 3,000

Prize (cash) won in a local contest 8,000

Winnings, won in a local lottery valued at 50,000

Lotto winning in US 10,000

Dividend, AB Corp., domestic 60,000

Dividend, YZ Corp., foreign 20,000

Royalty as author of tax book 300,000

1. If the taxpayer is a resident citizen, his taxable income is:

a. P470,000 c. P478,000 e. None of the above

b. P708,000 d. P538,000

2. The total creditable withholding taxes is

a. P17,000 c. P16,000 e. None of the above

b. P10,000 d. P 7,000

3. The income tax payable is

a. P470,000 c. P 90,000 e. None of the above

b. P 91,000 d. P107,000

4. If the taxpayer is a nonresident citizen or resident alien his taxable income is:

a. P470,000 c. P478,000 e. None of the above

b. P708,000 d. P538,000

5. In the preceding item, the income tax payable is

a. P 32,500 c. P478,000 e. None of the above

b. P 49,500 d. P538,000

6. The total income subject to final tax if the taxpayer is a resident citizen is

a. P470,000 c. P415,000 e. None of the above

b. P708,000 d. P538,000

7. The total final withholding taxes is

a. P470,000 c. P415,000 e. None of the above

b. P 50,450 d. P 46,850

You might also like

- TAXDocument10 pagesTAXJeana Segumalian100% (3)

- Taxation - Corporation - Quizzer - 2018Document4 pagesTaxation - Corporation - Quizzer - 2018Kenneth Bryan Tegerero Tegio100% (4)

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Taxation - Gross Income - Quizzer - 2018 - MayDocument5 pagesTaxation - Gross Income - Quizzer - 2018 - MayKenneth Bryan Tegerero TegioNo ratings yet

- Application - Regular Income Tax On Individuals and CorporationsDocument8 pagesApplication - Regular Income Tax On Individuals and CorporationsElla Marie Lopez0% (1)

- Taxation Cup SeriesDocument5 pagesTaxation Cup SeriesGlaiza Atillo Batuto Orgino100% (1)

- ANSWERS Post Test Regular Income Taxation For PartnershipsDocument8 pagesANSWERS Post Test Regular Income Taxation For Partnershipslena cpa100% (1)

- A. Taxable in The PhilippinesDocument20 pagesA. Taxable in The PhilippinesJohn Patrick GuingabNo ratings yet

- Tax 01 Prefinals Sept 9 2018 BSA4 Answer KeyDocument11 pagesTax 01 Prefinals Sept 9 2018 BSA4 Answer KeyJohn Carlo Dela CruzNo ratings yet

- Final and Capital Gains TaxDocument7 pagesFinal and Capital Gains TaxElla Marie LopezNo ratings yet

- Answer Key TaxDocument12 pagesAnswer Key TaxLocklaim Cardinoza100% (1)

- Tax On Individuals Quiz - ProblemsDocument3 pagesTax On Individuals Quiz - ProblemsJP Mirafuentes100% (1)

- 1 Taxation PreweekDocument25 pages1 Taxation PreweekJc Quismundo100% (1)

- Guzman Cruz Cpas and Co.: Guideline For BIR Tax Deadlines During Enhanced Community Quarantine (ECQ) PeriodDocument2 pagesGuzman Cruz Cpas and Co.: Guideline For BIR Tax Deadlines During Enhanced Community Quarantine (ECQ) PeriodGerald SantosNo ratings yet

- BSMA Taxation of IndividualsDocument32 pagesBSMA Taxation of IndividualsAngela CanayaNo ratings yet

- HO3 Pre Test 1Document3 pagesHO3 Pre Test 1Lovely Mae LariosaNo ratings yet

- Activity 6Document4 pagesActivity 6Mystic LoverNo ratings yet

- Im Tax Week2Document56 pagesIm Tax Week2Elaiza Marie YnzonNo ratings yet

- Individual Tax Payer - TeachersDocument8 pagesIndividual Tax Payer - TeachersKhervin EvangelistaNo ratings yet

- Taxation Review Final Income TaxDocument4 pagesTaxation Review Final Income TaxGendyBocoNo ratings yet

- Tax 1st Preboard A LUDocument9 pagesTax 1st Preboard A LUAnonymous 7HGskNNo ratings yet

- ExampleDocument2 pagesExamplezeref dragneelNo ratings yet

- 8.2 Assignment - Regular Income Tax For IndividualsDocument8 pages8.2 Assignment - Regular Income Tax For Individualssam imperialNo ratings yet

- Quiz Tax On IndividualsDocument2 pagesQuiz Tax On IndividualsAirah Shane B. DianaNo ratings yet

- INCTAXA (Basic Income Tax, Final Tax On Passive Income and Capital Gains Tax) - 2Document7 pagesINCTAXA (Basic Income Tax, Final Tax On Passive Income and Capital Gains Tax) - 2Erlle AvllnsaNo ratings yet

- 8.2 Assignment - Regular Income Tax For Individuals (For Discussion)Document8 pages8.2 Assignment - Regular Income Tax For Individuals (For Discussion)Roselyn LumbaoNo ratings yet

- Taxation 109Document2 pagesTaxation 109Bisag AsaNo ratings yet

- Individual Taxpayers (Tabag2021)Document14 pagesIndividual Taxpayers (Tabag2021)Veel Creed100% (1)

- Ackdog 333Document18 pagesAckdog 333Czarina DonatoNo ratings yet

- Chapter 7 Regular Income Tax Activity Valdez KJ PDFDocument5 pagesChapter 7 Regular Income Tax Activity Valdez KJ PDFBisag Asa50% (4)

- CORPORATION Passive Income With IllustrationsDocument30 pagesCORPORATION Passive Income With Illustrations2023200285No ratings yet

- Final Tax PDFDocument3 pagesFinal Tax PDFGianJoshuaDayrit0% (1)

- INCOME TAXATION Drills With AnswersDocument5 pagesINCOME TAXATION Drills With AnswersViky Rose EballeNo ratings yet

- Midterm Exam Principles of Taxation and Income TaxationDocument6 pagesMidterm Exam Principles of Taxation and Income TaxationKitagawa, Misia Sophia Jan B.No ratings yet

- Income Tax For IndividualsDocument11 pagesIncome Tax For IndividualsJoel Christian Mascariña100% (1)

- Tax QuizDocument3 pagesTax QuizLora Mae JuanitoNo ratings yet

- TaxationDocument10 pagesTaxationSteven Mark MananguNo ratings yet

- Taxation - Final ExamDocument4 pagesTaxation - Final ExamKenneth Bryan Tegerero Tegio100% (1)

- Quiz 1 - StrataxDocument3 pagesQuiz 1 - Strataxspongebob SquarepantsNo ratings yet

- Instruction: Write The Letter of Your Choice On The Space Provided Before The NumberDocument4 pagesInstruction: Write The Letter of Your Choice On The Space Provided Before The NumberASDDD100% (2)

- TaxDocument24 pagesTaxAnonymous aRheeMNo ratings yet

- TAXN 2000 SECOND TERM EXAM SY22 23 QuestionnaireDocument15 pagesTAXN 2000 SECOND TERM EXAM SY22 23 QuestionnaireGrace Love Yzyry LuNo ratings yet

- Taxation Individuals-QUESTIONSDocument2 pagesTaxation Individuals-QUESTIONSAB CloydNo ratings yet

- Preparation of Income Tax Return IndividualDocument2 pagesPreparation of Income Tax Return IndividualFRAULIEN GLINKA FANUGAONo ratings yet

- Taxation Midterm Exam With Answer KeyDocument25 pagesTaxation Midterm Exam With Answer Keychelissamaerojas100% (1)

- DE TaxationDocument22 pagesDE TaxationHappy MagdangalNo ratings yet

- Taxation Elims 1Document3 pagesTaxation Elims 1Valerie Faye BadajosNo ratings yet

- BAM 031 Income Taxation QuizDocument4 pagesBAM 031 Income Taxation Quizbrmo.amatorio.uiNo ratings yet

- INCOTAX - Multiple Choices - Problems Part 1Document3 pagesINCOTAX - Multiple Choices - Problems Part 1Harvey100% (1)

- Chapter8 TaxationonindividualsDocument12 pagesChapter8 TaxationonindividualsChristine Joy Rapi MarsoNo ratings yet

- Tax Final TaxDocument19 pagesTax Final TaxSittie Aisah AmpatuaNo ratings yet

- 5.2 Answer Key - FWT and CGTDocument6 pages5.2 Answer Key - FWT and CGTRezhel Vyrneth Turgo100% (1)

- Lecture NotesDocument4 pagesLecture NotesVinDiesel Balag-eyNo ratings yet

- 8.6 Assignment - Regular Income Tax On CorporationsDocument3 pages8.6 Assignment - Regular Income Tax On CorporationsRoselyn LumbaoNo ratings yet

- Quiz 3 Key To CorrectionDocument5 pagesQuiz 3 Key To CorrectionanimeilaaaaNo ratings yet

- Reference: 2019 Edition Philippine Income Tax Volume 1 by C. Llamado and J. de Vera)Document26 pagesReference: 2019 Edition Philippine Income Tax Volume 1 by C. Llamado and J. de Vera)Aira PartiNo ratings yet

- Cases On Taxation For Individualss AnswersDocument11 pagesCases On Taxation For Individualss AnswersMitchie Faustino100% (2)

- Project Taxation (Ouano)Document16 pagesProject Taxation (Ouano)GuiltyCrownNo ratings yet

- Wealth Management Planning: The UK Tax PrinciplesFrom EverandWealth Management Planning: The UK Tax PrinciplesRating: 4.5 out of 5 stars4.5/5 (2)

- Estate TaxDocument1 pageEstate TaxGerald SantosNo ratings yet

- Other Percentage TaxDocument2 pagesOther Percentage TaxGerald SantosNo ratings yet

- RMC No. 117-2021 Clarification On Submission of 2307 and 2316Document2 pagesRMC No. 117-2021 Clarification On Submission of 2307 and 2316Gerald SantosNo ratings yet

- Shunt Active Filter For Power Quality ImprovementDocument13 pagesShunt Active Filter For Power Quality ImprovementJulio GonzalesNo ratings yet

- List of Illegal Projects, Schemes & Societies in Malir, KarachiDocument7 pagesList of Illegal Projects, Schemes & Societies in Malir, KarachiMuhammad Hanef ShaikhNo ratings yet

- Agreement - IDP - Transformation Institute - 2023Document16 pagesAgreement - IDP - Transformation Institute - 2023Elite ProgramNo ratings yet

- MGB Ignition FeedbackDocument3 pagesMGB Ignition Feedbacktrouble monkeyNo ratings yet

- Gate Ques DbmsDocument10 pagesGate Ques DbmsBrinda BMNo ratings yet

- IGPSA PresentationDocument11 pagesIGPSA Presentationisrael espinozaNo ratings yet

- Human Development Foundation: Kainat Arif MalikDocument8 pagesHuman Development Foundation: Kainat Arif MalikUzair Rasheed BaigNo ratings yet

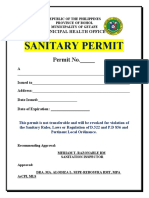

- SANITARY PERMIT YampleDocument6 pagesSANITARY PERMIT Yamplekimmy100% (1)

- Magneto Optical Current TransformerDocument23 pagesMagneto Optical Current Transformersushilkumarbhoi2897No ratings yet

- ICOM IC-R6 Manual (EN)Document96 pagesICOM IC-R6 Manual (EN)Mandu CerianoNo ratings yet

- Hydrostatic Test Procedure: 1. ScopeDocument5 pagesHydrostatic Test Procedure: 1. ScopeHassan SleemNo ratings yet

- Miet 2420 Tutorial 01 - Rolling Element BearingsDocument2 pagesMiet 2420 Tutorial 01 - Rolling Element BearingsIsaac MahlabNo ratings yet

- Book of Ideas A Journal of Creative Direction and Graphic DesignDocument283 pagesBook of Ideas A Journal of Creative Direction and Graphic DesigndizainmdgNo ratings yet

- Overleaf Keyboard ShortcutsDocument2 pagesOverleaf Keyboard ShortcutsJBBARNo ratings yet

- 5 Lb. Book of GRE Practice Problems (2nd Edition - Latest)Document191 pages5 Lb. Book of GRE Practice Problems (2nd Edition - Latest)MRAAKNo ratings yet

- Week 5 - TBM ExcavationDocument16 pagesWeek 5 - TBM ExcavationNilakshiManawaduNo ratings yet

- A Specter of Global DeflationDocument1 pageA Specter of Global DeflationAnaliza MagallanesNo ratings yet

- Arsi University ICT Directorate ICT Club Formation ProposalDocument8 pagesArsi University ICT Directorate ICT Club Formation ProposalMilion NugusieNo ratings yet

- How To Negotiate SourcingDocument11 pagesHow To Negotiate SourcingTehzeeb FaizanNo ratings yet

- 3D Printing Business PlanDocument49 pages3D Printing Business Planjesicalarson123100% (2)

- Glass Loading Data Sheet 7.2Document10 pagesGlass Loading Data Sheet 7.2iulistefanNo ratings yet

- Roland Berger The Second National Tourism Development Plan 2017 2021Document112 pagesRoland Berger The Second National Tourism Development Plan 2017 2021suzNo ratings yet

- Pisaycom NotesDocument7 pagesPisaycom NotesAmelia Ria CanlasNo ratings yet

- Elsie W. Rudisill and Coal, Feed and Lumber Company, Inc. v. Southern Railway Company, 548 F.2d 488, 4th Cir. (1977)Document2 pagesElsie W. Rudisill and Coal, Feed and Lumber Company, Inc. v. Southern Railway Company, 548 F.2d 488, 4th Cir. (1977)Scribd Government DocsNo ratings yet

- Anand Balachandran Nair Jelaja - ResumeDocument6 pagesAnand Balachandran Nair Jelaja - ResumeSaradh ThotaNo ratings yet

- E SRKRPORTALuploadsSyllabus ModelPapersModel R17 B.tech MECH 69Document33 pagesE SRKRPORTALuploadsSyllabus ModelPapersModel R17 B.tech MECH 69prasadNo ratings yet

- Ipo Historic TableDocument10 pagesIpo Historic TableHemanta majhiNo ratings yet

- (CQHP) Guidelines For Sanitary PDFDocument33 pages(CQHP) Guidelines For Sanitary PDFZEC LIMITED100% (4)

- Chicco Cortina Stroller Owner's Manual PDFDocument36 pagesChicco Cortina Stroller Owner's Manual PDFRoss Imperial CruzNo ratings yet