Professional Documents

Culture Documents

Final HO 1 MOB

Final HO 1 MOB

Uploaded by

Parth0 ratings0% found this document useful (0 votes)

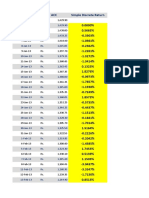

4 views1 pageThe document provides financial data for XYZ National Bank for the fiscal year ending March 31, 2022. It includes details of the bank's share capital, reserves, deposits, loans, cash reserves, and liquidity position. The key figures are total deposits of Rs. 1,487.12 crore, required cash reserve ratio of 4.5% which is Rs. 66.92 crore but current amount held is Rs. 37.88 crore leaving a deficit of Rs. 30.96 crore, and total liquid assets of Rs. 691.54 crore against the required statutory liquidity ratio of 18% of deposits (Rs. 267.68 crore) showing excess liquidity.

Original Description:

MOB

Original Title

Final HO 1 MOB

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides financial data for XYZ National Bank for the fiscal year ending March 31, 2022. It includes details of the bank's share capital, reserves, deposits, loans, cash reserves, and liquidity position. The key figures are total deposits of Rs. 1,487.12 crore, required cash reserve ratio of 4.5% which is Rs. 66.92 crore but current amount held is Rs. 37.88 crore leaving a deficit of Rs. 30.96 crore, and total liquid assets of Rs. 691.54 crore against the required statutory liquidity ratio of 18% of deposits (Rs. 267.68 crore) showing excess liquidity.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

4 views1 pageFinal HO 1 MOB

Final HO 1 MOB

Uploaded by

ParthThe document provides financial data for XYZ National Bank for the fiscal year ending March 31, 2022. It includes details of the bank's share capital, reserves, deposits, loans, cash reserves, and liquidity position. The key figures are total deposits of Rs. 1,487.12 crore, required cash reserve ratio of 4.5% which is Rs. 66.92 crore but current amount held is Rs. 37.88 crore leaving a deficit of Rs. 30.96 crore, and total liquid assets of Rs. 691.54 crore against the required statutory liquidity ratio of 18% of deposits (Rs. 267.68 crore) showing excess liquidity.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

IMI New Delhi MOB HO 1 Dr Deepak Tandon

The following is the data given for XYZ National Bank for FY ending 31.03.2022 ( Rs Cr )

Bill for collection 18.10

All figures in Crores Dr Cr

Acceptance & Other 14.12

Share capital 198.00

endorsements

19,80,000 shares of Rs 10 each

Claims against the Bank not 0.55

acknowledged as debt Statutory reserves 231.00

Depreciation Charges – 1.10 Net Profit before appropriation 150.00

Premises Profit and Loss account 412.00

Furniture 0.78 Fixed deposit account 517.00

Savings Deposit account 450.00

Current accounts 28.00 520.12

50% of the Term Loans are secured by Bills payable 0.10

government guarantees Cash credit 812.10

Borrowings from other banks 110.00

10% of Cash Credit is unsecured . Transfer 25% Cash in hand 160.15

of the profit to the reserve fund Cash with RBI 37.88

Cash with other Banks 155.87

NOTE : Cash reserve is required as on 4.5% of Money at call 210.12

NDTL ;Liquid reserves required 18 % of NDTL Gold 55.23

Government securities 110.17

Premises 155.70

Furniture 70.12

(I) As per Sch 3 Calculate total deposits CA + SB + FD = Rs

1487.12 Cr

(II) What is CRR required ? As given is 4.5 % = 1487.12 X 4.5 %

= 66.92 Cr

(III) Is the position of CRR satisfactory? No . Required 69.92

given is 37.88 need 30.96 to be given to RBI to maintain CRR

(IV) Total Liquid assets ? = Cash + Money at Call + Gold + GOI

securities = Rs 691.54

(V) What is excess or deficit liquidity of the Bank in terms of SLR ?

SLR = Liquid assets / NDTL X100

Liquid assets = SLR X NDTL X 100

Given is 18 % SLR

18 % X 1487,12 = 267.68 Cr

__________________________________________________________________________________

_

You might also like

- QuestionnaireDocument4 pagesQuestionnaireBishu BiswasNo ratings yet

- Canara BankDocument11 pagesCanara BankParthNo ratings yet

- Chart of Account (Sample Co.,)Document20 pagesChart of Account (Sample Co.,)hassan TariqNo ratings yet

- Banking CompanyDocument1 pageBanking CompanyHilary GaureaNo ratings yet

- Unit 6 Banking Companies Final AccDocument79 pagesUnit 6 Banking Companies Final Acctimoni5707No ratings yet

- 66651bos53803 Cp8u6Document39 pages66651bos53803 Cp8u6Siddhant GuptaNo ratings yet

- Financial Stateemnt of BanksDocument42 pagesFinancial Stateemnt of BanksshajiNo ratings yet

- Unit II Analysis and Interpretation of Financial Statements Vertical Balance Sheet Balance Sheet As On 31/3/2022 Liabilities Rs. Assets RsDocument9 pagesUnit II Analysis and Interpretation of Financial Statements Vertical Balance Sheet Balance Sheet As On 31/3/2022 Liabilities Rs. Assets RsKirti RawatNo ratings yet

- Advanced Accounting 2BDocument4 pagesAdvanced Accounting 2BHarusiNo ratings yet

- Valuation of Goodwill (Akshit)Document12 pagesValuation of Goodwill (Akshit)akshit jainNo ratings yet

- LDB FS End of 2012Document2 pagesLDB FS End of 2012ThinkingPinoyNo ratings yet

- Format Jurnal Perusahaan JasaDocument20 pagesFormat Jurnal Perusahaan JasasainahNo ratings yet

- 027 Practice Test 09 Accounting Test Solution Subjective Udesh RegularDocument6 pages027 Practice Test 09 Accounting Test Solution Subjective Udesh Regulardeathp006No ratings yet

- Case StudiesDocument19 pagesCase StudiesEthan DanielNo ratings yet

- Aani FluorotechDocument8 pagesAani FluorotechDinesh NNo ratings yet

- Assignment of Banking Company 22-23Document6 pagesAssignment of Banking Company 22-23DARK KING GamersNo ratings yet

- Luzon Development Bank: Published Balance SheetDocument2 pagesLuzon Development Bank: Published Balance SheetThinkingPinoyNo ratings yet

- Adobe Scan 30-May-2024Document12 pagesAdobe Scan 30-May-2024ajayrajachoosNo ratings yet

- Fixed Deposit Transaction Details: Dear Davinder KaurDocument1 pageFixed Deposit Transaction Details: Dear Davinder KaurSimrat SachdevaNo ratings yet

- QP - Financial AccountingDocument3 pagesQP - Financial AccountingVaibhav SinghNo ratings yet

- Financial Statements Re Binh Minh TMC Co, LTD 2020Document3 pagesFinancial Statements Re Binh Minh TMC Co, LTD 2020nam.vinabisNo ratings yet

- BranchDocument2 pagesBranchRohit JainNo ratings yet

- BS ANA Wasim KhanDocument14 pagesBS ANA Wasim KhanRama KrishnaNo ratings yet

- Unit 4 - Mutual Fund and Bond Valuatio - Mutual Fund Problem 1: Rs. (In Lakhs)Document4 pagesUnit 4 - Mutual Fund and Bond Valuatio - Mutual Fund Problem 1: Rs. (In Lakhs)Paulomi LahaNo ratings yet

- CMA DATA (Bhargav Roadways)Document7 pagesCMA DATA (Bhargav Roadways)Mahim DangiNo ratings yet

- Basic Consol - Tutorial Q 82022Document10 pagesBasic Consol - Tutorial Q 82022ZhaoYing TanNo ratings yet

- Intermediate Acctg A 1 10Document10 pagesIntermediate Acctg A 1 10Leonila RiveraNo ratings yet

- Redemption of DebenturesDocument11 pagesRedemption of DebenturesUmang NagarNo ratings yet

- Ratio Analysis 20 OctDocument7 pagesRatio Analysis 20 OctYogesh BandiNo ratings yet

- LHU8Q Olopr DaisyAcountXIDocument35 pagesLHU8Q Olopr DaisyAcountXIDido MuczNo ratings yet

- Fsa Solutions NewDocument13 pagesFsa Solutions Newritika.saxena23hNo ratings yet

- BNK 603 - Tutorial 2 2020Document3 pagesBNK 603 - Tutorial 2 2020Stylez 2707No ratings yet

- Image 1646906033506Document4 pagesImage 1646906033506Sanaullah M SultanpurNo ratings yet

- B. Com - (H) 2020Document14 pagesB. Com - (H) 2020Gurleen Kaur KohliNo ratings yet

- 3562 Question PaperDocument3 pages3562 Question PaperKimberly MataruseNo ratings yet

- Fa 10092023Document7 pagesFa 10092023Vaibhav SinghNo ratings yet

- Class 10-11Document38 pagesClass 10-11Asif HussainNo ratings yet

- Financial StatementsDocument2 pagesFinancial StatementsMaria Teresa VillamayorNo ratings yet

- MBA AFM Probs On FS Analysis, Ratio Analysis and Com SizeDocument6 pagesMBA AFM Probs On FS Analysis, Ratio Analysis and Com SizeAngelsony AmmuNo ratings yet

- FAR - Final Preboard CPAR 92Document14 pagesFAR - Final Preboard CPAR 92joyhhazelNo ratings yet

- Balance Sheet ExerciseDocument4 pagesBalance Sheet ExercisevijayjhingaNo ratings yet

- Санхүүгийн Тайлангийн МАЯГТ Англи Хэл ДээрDocument13 pagesСанхүүгийн Тайлангийн МАЯГТ Англи Хэл Дээрmunkhtsetseg.tsogooNo ratings yet

- Corporate AccontingDocument4 pagesCorporate AccontingIshita GuptaNo ratings yet

- Anil Banjare Compu 2024-25Document2 pagesAnil Banjare Compu 2024-25Priyanshu tripathiNo ratings yet

- FA2 - SFP and SCI-Answers 1Document5 pagesFA2 - SFP and SCI-Answers 1Angel AtirazanNo ratings yet

- Module+2+-+Assignment+on+SFP+and+Notes+to+FS Bettina+Flores 3A8Document5 pagesModule+2+-+Assignment+on+SFP+and+Notes+to+FS Bettina+Flores 3A8Bettina Alec Francesca FloresNo ratings yet

- Redemption of DebenturesDocument13 pagesRedemption of DebenturesVasu JainNo ratings yet

- Redemption of Debentures (Inter CA) PDFDocument4 pagesRedemption of Debentures (Inter CA) PDFvenkata srikanth topalliNo ratings yet

- Bsheet Sawhney MotorsDocument1 pageBsheet Sawhney MotorsAkshita BhattNo ratings yet

- FAR Final Exam - QuestionnaireDocument10 pagesFAR Final Exam - QuestionnairemavsgamingguildNo ratings yet

- NBFC Nov-23 Amended NotesDocument9 pagesNBFC Nov-23 Amended Notesrtaxhelp helpNo ratings yet

- 1b Final Accounts of Companies - StdtsDocument4 pages1b Final Accounts of Companies - StdtsGodson0% (1)

- Practice Problem in General Accounting Ytac, Bacalso, MajaduconDocument25 pagesPractice Problem in General Accounting Ytac, Bacalso, Majaduconeunice demaclid100% (1)

- Valuation CA Final Financial Reporting JNPPJTL4Document1,266 pagesValuation CA Final Financial Reporting JNPPJTL4rahulNo ratings yet

- Becdos Food & BeveragesDocument7 pagesBecdos Food & BeveragesShazzadul HussainNo ratings yet

- Corporate LiquidationDocument6 pagesCorporate LiquidationAngelieNo ratings yet

- Chap 005Document8 pagesChap 005Anass BNo ratings yet

- 21 To 26Document62 pages21 To 26JorniNo ratings yet

- Solutions To Activity 1 A, 1B, 1C and 1DDocument2 pagesSolutions To Activity 1 A, 1B, 1C and 1DPrincess Mae ArabitNo ratings yet

- Accounts Payable: A Guide to Running an Efficient DepartmentFrom EverandAccounts Payable: A Guide to Running an Efficient DepartmentNo ratings yet

- Mob NpaDocument44 pagesMob NpaParthNo ratings yet

- 5 Key Financial Tips To For A Stable FutureDocument9 pages5 Key Financial Tips To For A Stable FutureParthNo ratings yet

- CHEQUESDocument5 pagesCHEQUESParthNo ratings yet

- SAPM Group 4Document12 pagesSAPM Group 4ParthNo ratings yet

- BrochureDocument3 pagesBrochureParthNo ratings yet

- Ho 4Document16 pagesHo 4ParthNo ratings yet

- Sapm Marketing Pitch Submission Group 12Document9 pagesSapm Marketing Pitch Submission Group 12ParthNo ratings yet

- Ni Act MCQDocument7 pagesNi Act MCQParthNo ratings yet

- Monthly Share Prices and ReturnsDocument52 pagesMonthly Share Prices and ReturnsParthNo ratings yet

- Additivity of Log ReturnsDocument78 pagesAdditivity of Log ReturnsParthNo ratings yet

- ExerciseDocument5 pagesExerciseParthNo ratings yet

- Baboukar BusinessDocument3 pagesBaboukar BusinessAhmed AdemNo ratings yet

- Annual Report 2013 14Document224 pagesAnnual Report 2013 14vinayakbunNo ratings yet

- Donghua Double Pitch ChainDocument611 pagesDonghua Double Pitch ChainErliana IndahNo ratings yet

- Inform Practice Note #16: ContentDocument6 pagesInform Practice Note #16: ContentTSHEPO DIKOTLANo ratings yet

- Management Strategies For Almarai Company (Order ID 275889)Document12 pagesManagement Strategies For Almarai Company (Order ID 275889)unveiledtopicsNo ratings yet

- PESTEL ScotiabankDocument3 pagesPESTEL ScotiabankSridhar PantNo ratings yet

- PBL Session 2Document3 pagesPBL Session 2Muhammad ZulhisyamNo ratings yet

- MIC15691-CAL-Md Riyad HasanDocument2 pagesMIC15691-CAL-Md Riyad Hasanmonir.saseduNo ratings yet

- Converse SwotDocument5 pagesConverse SwotAsif FazlaniNo ratings yet

- Understanding Reg CC WPDocument18 pagesUnderstanding Reg CC WPJeff WayneNo ratings yet

- Case Study On Planning FinanceDocument4 pagesCase Study On Planning FinanceShivNo ratings yet

- Canon Sus 2019 eDocument136 pagesCanon Sus 2019 eSameer AdnanNo ratings yet

- Ratio AnalysisDocument23 pagesRatio AnalysishbijoyNo ratings yet

- Joint Venture Template FinalDocument7 pagesJoint Venture Template FinalPeterChotoMNo ratings yet

- QUIZ 4-Philippine Politics and GovernanceDocument4 pagesQUIZ 4-Philippine Politics and GovernanceKaguraNo ratings yet

- Products of UblDocument19 pagesProducts of UblAtiq MaliKNo ratings yet

- Basic Finance Assignment Bsa 1Document4 pagesBasic Finance Assignment Bsa 1Albert PetranNo ratings yet

- Inbound: OOCL - Tariff & Rates EnquiryDocument9 pagesInbound: OOCL - Tariff & Rates EnquiryPham Tran Anh QuanNo ratings yet

- Moving Ahead Time of Use RatesDocument27 pagesMoving Ahead Time of Use RatesMICHEL MUÑOZNo ratings yet

- Software Quality ConceptsDocument38 pagesSoftware Quality Conceptskiran reddyNo ratings yet

- Group Assignment Supply Chain Management. Nabeel Munir, Muhammad Amin, Faizan Mustaq, Arslan AliDocument7 pagesGroup Assignment Supply Chain Management. Nabeel Munir, Muhammad Amin, Faizan Mustaq, Arslan AliNabil MuneerNo ratings yet

- Credit Rating Report Update 2020Document17 pagesCredit Rating Report Update 2020Zubair RazaNo ratings yet

- Abm G3Document32 pagesAbm G3Chrizelle Mariece Escalante KaguingNo ratings yet

- Strategic Business Analysis Assignment 1Document4 pagesStrategic Business Analysis Assignment 1PewdsNo ratings yet

- Valuation: (Professional Practice)Document5 pagesValuation: (Professional Practice)Pragya ChattreeNo ratings yet

- UTS Into Microeconomics 2020 - Kunci Jawaban FinalDocument4 pagesUTS Into Microeconomics 2020 - Kunci Jawaban FinalayyasNo ratings yet

- Riosa v. Tabaco La Suerte CorporationDocument3 pagesRiosa v. Tabaco La Suerte CorporationJay jogs100% (1)

- Portes Five AnalysisDocument7 pagesPortes Five AnalysisDotecho Jzo EyNo ratings yet

- Agreement Form F2Document10 pagesAgreement Form F2the creationNo ratings yet