Professional Documents

Culture Documents

Chapter 5 ABC System For Students

Chapter 5 ABC System For Students

Uploaded by

Nour Al KaddahOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 5 ABC System For Students

Chapter 5 ABC System For Students

Uploaded by

Nour Al KaddahCopyright:

Available Formats

Chapter Five: Activity-Based Costing System

In this chapter we will be looking at an alternative method of cost accumulation,

ABC. ABC is a modern alternative to absorption costing which attempts to overcome

the problems of costing in a modern manufacturing environment.

Traditional costing systems

Traditional costing systems use a single basis for absorbing all overheads into cost

units for a particular production department cost centre.

Activity based costing

Production overheads are by no means all volume-related and hence a single basis for

absorption, eg labour hours, would not adequately reflect the complexity of producing

certain products/cost units as opposed to others.

ABC is an extension of Traditional costing system specifically considering what

causes each type of overhead category to occur, ie what the cost drivers are. Each type

of overhead is absorbed using a different basis depending on the cost driver.

The ABC approach is to link overhead costs to the products or services that cause

them by absorbing overhead costs on the basis of activities that ‘drive’ costs (cost

drivers) rather than on the basis of production volume.

Activities Cost drivers

PRODUCTION SET UP COSTS NUMBER OF PRODUCTION SET UPS

SUPERVISOR SALARY TOTAL LABOUR HOURS

1Page Dr. Mahmoud Nassar /AAU

• A cost pool is an activity that consumes resources and for which overhead costs are

identified and allocated. For each cost pool, there should be a cost driver.

• A cost driver is a unit of activity that consumes resources. An alternative definition

of a cost driver is a factor influencing the level of cost.

Steps in ABC

(1) Group overheads into activities, according to how they are driven. These are

known as cost pools.

(2) Identify the cost drivers for each activity, ie what causes the activity cost to be

incurred.

(3) Calculate a cost per unit of cost driver.

(4) Absorb activity costs into production based on usage of cost drivers.

Advantages and disadvantages of ABC

ABC has a number of advantages:

• It provides much better insight into what drives overhead costs.

• ABC recognises that overhead costs are not all related to production and sales

volume.

• In many businesses, overhead costs are a significant proportion of total costs, and

management needs to understand the drivers of overhead costs in order to manage the

business properly. Overhead costs can be controlled by managing cost drivers.

• It can be applied to derive realistic costs in a complex business environment.

• ABC can be applied to all overhead costs, not just production overheads.

• ABC can be used just as easily in service costing as in product costing.

2Page Dr. Mahmoud Nassar /AAU

Criticisms of ABC:

• It is impossible to allocate all overhead costs to specific activities.

• ABC costs are based on assumptions and simplifications. The choice of both

activities and cost drivers might be inappropriate.

• ABC can be more complex to explain to the stakeholders of the costing exercise.

• The benefits obtained from ABC might not justify the costs.

The implications of switching to ABC

The use of ABC has potentially significant commercial implications:

• Pricing can be based on more realistic cost data.

• Sales strategy can be more soundly based.

• Performance management and decision making can be improved

3Page Dr. Mahmoud Nassar /AAU

Example 1

A company manufactures two products, P and Q. Monthly data relating to production

and sales are as follows.

Product P Product Q

Direct material cost per unit $15 $20

Direct labour hours per unit 1 hour 2 hours

Direct labour cost per unit $20 $40

Sales demand 100 units 950 units

Production overheads are $200,000 each month and are absorbed on a direct labour

hour basis. The OAR is $100 per direct labour hour.

The management accountant has produced a report on the potential value of ABC as a

preferred alternative to the traditional absorption costing system, and has found that

there are five main areas of activity that can be said to consume overhead costs. The

management accountant has gathered the following monthly information:

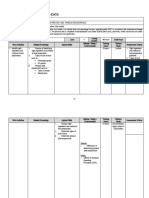

Activity Total cost Cost driver Total N P Q

Setting up 20000 Number of setups 4 1 3

Machining 80000 Machine hours 2000 100 1900

Order handling 20000 Number of orders 4 1 3

Quality control 20000 Number of inspections 5 1 4

Engineering 60000 Engineering hours 1000 500 500

Total 200000

Calculate the costs, in total and per unit, for Product P and Product Q, using ABC.

4Page Dr. Mahmoud Nassar /AAU

Solution (1)

Activity Total Cost $ Cost driver P$ Q$

Setting up 20,000 Cost per setup 5,000 5,000 15,000

Machining 80,000 Cost per machine hour 40 4,000 76,000

Order handling 20,000 Cost per order 5,000 5,000 15,000

Quality control 20,000 Cost per inspection 4,000 4,000 16,000

Engineering 60,000 Cost per engineering hour 60 30,000 30,000

––––– ––––– –––––

200,000 48,000 152,000

––––– ––––– –––––

Product

Product

P Q

$ $

Direct materials 1,500 19,000

Direct labour 2,000 38,000

Overheads 48,000 152,000

––––– –––––

Total cost 51,500 209,000

––––– –––––

Number of units 100 950

Cost per unit $515 $220

5Page Dr. Mahmoud Nassar /AAU

Solution (1)

Activity Total Cost $ Cost driver P$ Q$

Setting up Cost per setup

Machining Cost per machine hour

Order handling Cost per order

Quality control Cost per inspection

Engineering Cost per engineering hour

––––– ––––– –––––

––––– ––––– –––––

Product Product

P Q

$ $

Direct materials

Direct labour

Overheads

––––– –––––

Total cost

––––– –––––

Number of units

Cost per unit $ $

6Page Dr. Mahmoud Nassar /AAU

Example 2

Cabal makes and sells two products, Plus and Doubleplus. The direct costs of

production are $12 for one unit of Plus and $24 per unit of Doubleplus. Information

relating to annual production and sales is as follows:

Plus Doubleplus

Annual production and sales 24,000 units 24,000 units

Direct labour hours per unit 1.0 1.5

Number of orders 10 140

Number of batches 12 240

Number of setups per batch 1 3

Special parts per unit 1 4

Information relating to production overhead costs is as follows:

Cost driver Annual cost $

Setup costs Number of setups 73,200

Special parts handling Number of special parts 60,000

Other materials handling Number of batches 63,000

Order handling Number of orders 19,800

Other overheads 216,000

––––––––

432,000

Other overhead costs do not have an identifiable cost driver, and in an ABC system,

these overheads would be recovered on a direct labour hours basis.

(a) Calculate the production cost per unit of Plus and of Doubleplus if the

company uses traditional absorption costing and the overheads are recovered

on a direct labour hours basis.

(b) Calculate the production cost per unit of Plus and of Doubleplus if the

company uses ABC.

7Page Dr. Mahmoud Nassar /AAU

Solution (2)

A Traditional absorption costing

Budgeted direct labour hours 60,000

(24,000 × 1.0) + (24,000 × 1.5) /

Budgeted overhead costs $432,000

Recovery rate per direct labour hour $7.20

Plus Doubleplus

$ $

Direct costs 12.00 24.00

Production overhead 7.20 10.80

––––– –––––

19.20 34.80

Full production cost ––––– ––––

B ABC

Plus Doubleplus Total

Batches 12 240 252

Setups 12 720 732

Special parts 24,000 96,000 120,000

Orders 10 140 150

Direct labour hours 24,000 36,000 60,000

Cost driver rates

Setup costs $73,200/732 $100 per setup

Special parts handling $60,000/120,000 $0.50 per part

Order handling $19,800/150 $132 per order

Materials handling $63,000/252 $250 per batch

Other overheads $216,000/60,000 $3.60 per hour

Plus Doubleplus Total

Setup costs 1,200 72,000 73,200

Special parts handling costs 12,000 48,000 60,000

Order handling costs 1,320 18,480 19,800

Materials handling costs 3,000 60,000 63,000

Other overheads 86,400 129,600 216,000

_______ _______

103,920 328,080 432,000

_______ _______ _______

Number of units 24,000 24,000

Direct cost 12.00 24.00

Overhead cost per unit 4.33 13.67

_______ _______

Full cost 16.33 37.67

8Page Dr. Mahmoud Nassar /AAU

Note: In the example above the full production costs were:

Plus Doubleplus

• Using traditional absoprtion costing $19.20 $34.80

• Using ABC $16.33 $37.67

• Assume the selling prices are $25.00 $40.00

• Using absorption costing sales margins are 3.2% 13.0%

• ABC sales margins are 34.7% 5.8%

Thus, using ABC it is apparent that Plus is approximately 6 times as profitable as

Doubleplus and should therefore, subject to any other considerations, be given much

greater emphasis than Doubleplus in terms of sales and production.

9Page Dr. Mahmoud Nassar /AAU

Solution (2)

A Traditional absorption costing

Budgeted direct labour hours

( )+( ) /

Budgeted overhead costs $

Recovery rate per direct labour hour $

Plus Doubleplus

$ $

Direct costs

Production overhead

––––– –––––

Full production cost ––––– ––––

B ABC

Plus Doubleplus Total

Batches

Setups

Special parts

Orders

Direct labour hours

Cost driver rates

Setup costs $ / $ per setup

Special parts handling $ / $ per part

Order handling $ / $ per order

Materials handling $ / $ per batch

Other overheads $ / $ per hour

Plus Doubleplus Total

Setup costs

Special parts handling costs

Order handling costs

Materials handling costs

Other overheads

_______ _______ _______

_______ _______ _______

Number of units

Direct cost

Overhead cost per unit

_______ _______

Full cost

10Page Dr. Mahmoud Nassar /AAU

Case 1:

Hettich Corporation uses an activity-based costing system with the following three

activity cost pools:

Activity Cost Pool Total Activity

Fabrication 20,000 machine-hours

Order processing 200 orders

Other Not applicable

The Other activity cost pool is used to accumulate costs of idle capacity and

organization-sustaining costs.

The company has provided the following data concerning its costs:

Wages and salaries $480,000

Depreciation 120,000

Occupancy 200,000

Total $800,000

The distribution of resource consumption across activity cost pools is given below:

Activity Cost Pools

Fabrication Order Processing Other Total

Wages and salaries 55% 20% 25% 100%

Depreciation 10% 45% 45% 100%

Occupancy 25% 40% 35% 100%

The activity rate for the Order Processing activity cost pool is closest to:

A) $1,400 per order B) $1,600 per order C) $1,150 per order D) $800 per order

11Page Dr. Mahmoud Nassar /AAU

Case 2:

Poskey Corporation uses an activity-based costing system with three activity cost

pools. The company has provided the following data concerning its costs and its

activity based costing system:

Costs:

Wages and salaries $400,000

Depreciation 160,000

Utilities 100,000

Total $660,000

Distribution of resource consumption:

Activity Cost Pools

Assembly Setting Up Other Total

Wages and salaries 40% 40% 20% 100%

Depreciation 20% 35% 45% 100%

Utilities 25% 55% 20% 100%

How much cost, in total, would be allocated in the first-stage allocation to the

Assembly activity cost pool?

A) $187,000 B) $264,000 C) $217,000 D) $165,000

12Page Dr. Mahmoud Nassar /AAU

Case 3:

Radakovich Corporation has provided the following data from its activity-based

costing system:

Activity Cost Pool Total Cost Total Activity

Assembly $436,240 28,000 machine-hours

Processing orders $60,896 1,600 orders

Inspection $82,767 1,410 inspection-hours

The company makes 230 units of product F60N a year, requiring a total of 480

machine-hours, 50 orders, and 30 inspection-hours per year. The product's direct

materials cost is $12.70 per unit and its direct labor cost is $45.93 per unit. The

product sells for $126.60 per unit.

According to the activity-based costing system, the product margin for product F60N

is:

A) $6,251.70 per unit B) $4,490.70 per unit

C) $6,393.70 per unit D) $15,633.10 per unit

13Page Dr. Mahmoud Nassar /AAU

Case 4:

Rosenbrook Corporation has provided the following data from its activity-based

costing system:

Activity Cost Pool Total Cost Total Activity

Assembly $710,770 37,000 machine-hours

Processing orders $39,690 1,800 orders

Inspection $119,116 1,940 inspection-hours

Data concerning one of the company’s products, Product H73N, appear below:

Selling price per unit $125.10

Direct materials cost per unit $34.94

Direct labor cost per unit $49.21

Annual unit production and sales 460

Annual machine-hours 510

Annual orders 80

Annual inspections 10

According to the activity-based costing system, the product margin for product H73N

is:

A) $7,275.90 per unit B) $6,661.90 per unit

C) $18,837.00 per unit D) $8,425.90 per unit

14Page Dr. Mahmoud Nassar /AAU

You might also like

- Chapter 1-Introduction To Cost Accounting: Multiple ChoiceDocument22 pagesChapter 1-Introduction To Cost Accounting: Multiple ChoiceTricia Mae Fernandez0% (1)

- Aafr Ias 12 Icap Past Paper With SolutionDocument17 pagesAafr Ias 12 Icap Past Paper With SolutionAqib Sheikh100% (1)

- Activity No 1Document2 pagesActivity No 1Makeyc Stis100% (1)

- Far Set2 A Basic Reviewer For Financial Accounting and Reporting 1Document6 pagesFar Set2 A Basic Reviewer For Financial Accounting and Reporting 1AShley NIcole0% (1)

- T1 - Tutorial MaDocument10 pagesT1 - Tutorial Matylee970% (1)

- Chapter 11&12 QuestionsDocument8 pagesChapter 11&12 QuestionsMya B. Walker100% (1)

- Absorption & Marginal CostingDocument17 pagesAbsorption & Marginal CostingAhmed Ali KhanNo ratings yet

- PM January 2021 Lecture 4 Worked Examples Questions (Drury (2012), P. 451, 17.17)Document6 pagesPM January 2021 Lecture 4 Worked Examples Questions (Drury (2012), P. 451, 17.17)KAY PHINE NGNo ratings yet

- Section A - ALL 15 Questions Are Compulsory and MUST Be AttemptedDocument17 pagesSection A - ALL 15 Questions Are Compulsory and MUST Be AttemptedAdnan SiddiquiNo ratings yet

- 0462Document277 pages0462Tahseen Raza100% (1)

- Chapter 3 System Design Job Order Costing SystemDocument76 pagesChapter 3 System Design Job Order Costing SystemMulugeta GirmaNo ratings yet

- Activity Base Costing (ABC Costing)Document12 pagesActivity Base Costing (ABC Costing)SantNo ratings yet

- Job and Batch CostingDocument7 pagesJob and Batch CostingDeepak R GoradNo ratings yet

- AcFN 3151 CH, 5 CONSOLIDATED FINANCIAL STATEMENTS IFRS 10Document41 pagesAcFN 3151 CH, 5 CONSOLIDATED FINANCIAL STATEMENTS IFRS 10Bethelhem100% (1)

- CH 6 - Activity Based Costing UpdatedDocument16 pagesCH 6 - Activity Based Costing UpdatedAli OptimisticNo ratings yet

- Quiz 3 CADocument30 pagesQuiz 3 CAbasilnaeem7No ratings yet

- ACCA Paper F2 ACCA Paper F2 Management Accounting: Saa Global Education Centre Pte LTDDocument17 pagesACCA Paper F2 ACCA Paper F2 Management Accounting: Saa Global Education Centre Pte LTDEjaz KhanNo ratings yet

- Breakeven Analysis PDFDocument16 pagesBreakeven Analysis PDFTeja VenkatNo ratings yet

- Cost Accounting Assignment 1Document2 pagesCost Accounting Assignment 1manoj dNo ratings yet

- Financial Reporting Final Mock: Barcelona Madrid Non-Current AssetsDocument7 pagesFinancial Reporting Final Mock: Barcelona Madrid Non-Current AssetsMuhammad AsadNo ratings yet

- Cost Assignment I For Royal UDocument6 pagesCost Assignment I For Royal Ufitsum100% (1)

- Cost Assignment IDocument5 pagesCost Assignment Ifitsum100% (1)

- JOB, BATCH AND SERVICE COSTING-lesson 11Document22 pagesJOB, BATCH AND SERVICE COSTING-lesson 11Kj NayeeNo ratings yet

- 1 CVP RelationshipDocument22 pages1 CVP RelationshipmedrekNo ratings yet

- Problem Solving 16Document11 pagesProblem Solving 16Ehab M. Abdel HadyNo ratings yet

- CH 22 Exercises ProblemsDocument3 pagesCH 22 Exercises ProblemsAhmed El Khateeb100% (1)

- Cost Accounting Notes Fall 19-1Document11 pagesCost Accounting Notes Fall 19-1AnoshiaNo ratings yet

- Simplified SFM Ques Bank by Finance Acharya Jatin Nagpal CA, FRMDocument378 pagesSimplified SFM Ques Bank by Finance Acharya Jatin Nagpal CA, FRMKushagra SoniNo ratings yet

- Tutorial 5 - Marginal and Absorption Costing QuestionsDocument3 pagesTutorial 5 - Marginal and Absorption Costing QuestionsAnonymous 9GgsGYEf100% (1)

- 6.2 Standard Costing & Variance Anlysis: Cost Accounting 341Document25 pages6.2 Standard Costing & Variance Anlysis: Cost Accounting 341sadhaya rajanNo ratings yet

- Process Costing and Hybrid Product-Costing SystemsDocument17 pagesProcess Costing and Hybrid Product-Costing SystemsWailNo ratings yet

- Cost and Management Accounting 2 CHAPTER 3Document34 pagesCost and Management Accounting 2 CHAPTER 3Abebe GosuNo ratings yet

- Practice Questions For Ias 16Document6 pagesPractice Questions For Ias 16Uman Imran,56No ratings yet

- Chapter 3 - Statement of Financial Position and Income StatementDocument28 pagesChapter 3 - Statement of Financial Position and Income Statementshemida75% (4)

- IAS 20 Accounting For Government Grants and Disclosure of Government AssistanceDocument5 pagesIAS 20 Accounting For Government Grants and Disclosure of Government Assistancemanvi jainNo ratings yet

- Basic Characteristics of Process CostingDocument1 pageBasic Characteristics of Process CostingMeghan Kaye LiwenNo ratings yet

- Absorption and Marginal Costing Worked ExamplesDocument5 pagesAbsorption and Marginal Costing Worked ExamplesSUHRIT BISWASNo ratings yet

- F2-06 Accounting For Labour PDFDocument22 pagesF2-06 Accounting For Labour PDFJaved ImranNo ratings yet

- Cost 2021-MayDocument8 pagesCost 2021-MayDAVID I MUSHINo ratings yet

- Breakeven QuestionDocument14 pagesBreakeven QuestionALI HAMEED0% (1)

- Cma Past PapersDocument437 pagesCma Past PapersTooba Maqbool100% (1)

- IAS - 16 Property, Plant and EquipmentDocument11 pagesIAS - 16 Property, Plant and EquipmentArm ButtNo ratings yet

- Managerial Accounting: Tools For Business Decision-MakingDocument56 pagesManagerial Accounting: Tools For Business Decision-MakingdavidNo ratings yet

- Job Order CostingDocument4 pagesJob Order CostingBrooke CarterNo ratings yet

- Limiting Factors & Linear ProgrammingDocument8 pagesLimiting Factors & Linear ProgrammingMohammad Faizan Farooq Qadri AttariNo ratings yet

- Symbiosis Center For Management & HRDDocument3 pagesSymbiosis Center For Management & HRDKUMAR ABHISHEKNo ratings yet

- Cost and Managerial Accounting: Assignment 2Document5 pagesCost and Managerial Accounting: Assignment 2haseeb shaikhNo ratings yet

- QA AssignmentDocument2 pagesQA AssignmentvijayendrambaNo ratings yet

- Marginal and Absorption CostingDocument8 pagesMarginal and Absorption CostingEniola OgunmonaNo ratings yet

- Marginal Costing and Absorption CostingDocument10 pagesMarginal Costing and Absorption Costingferos100% (12)

- Process Costing Increase and Loss StudentsDocument6 pagesProcess Costing Increase and Loss StudentsArah OpalecNo ratings yet

- Accounting For Incomplete Accounting RecordsDocument49 pagesAccounting For Incomplete Accounting RecordskimringineNo ratings yet

- Absorption and Marginal CostingDocument4 pagesAbsorption and Marginal CostingJonathan Smoko100% (1)

- Inventory: COST OF PRODUCTIONDocument104 pagesInventory: COST OF PRODUCTIONHAFIZ MUHAMMAD UMAR FAROOQ RANA100% (1)

- Workshop F2 May 2011Document18 pagesWorkshop F2 May 2011roukaiya_peerkhanNo ratings yet

- CH1: Management Accounting in ContextDocument21 pagesCH1: Management Accounting in ContextÝ ThủyNo ratings yet

- Chapter-2: Information For Budgeting, Planning and Control Purposes (Master Budget) BudgetDocument35 pagesChapter-2: Information For Budgeting, Planning and Control Purposes (Master Budget) Budgetፍቅር እስከ መቃብርNo ratings yet

- 602 Assignment 1Document8 pages602 Assignment 1Irina ShamaievaNo ratings yet

- Handout Activity Based Costing 2020Document2 pagesHandout Activity Based Costing 2020Nicah AcojonNo ratings yet

- Activity Based Costing ER - NewDocument14 pagesActivity Based Costing ER - NewFadillah LubisNo ratings yet

- ABC AssignmentDocument3 pagesABC AssignmentSunil ThapaNo ratings yet

- Cost Accounting Hilton 13Document10 pagesCost Accounting Hilton 13Vin TenNo ratings yet

- Dll-5th-Week - EntrepreneurshipDocument8 pagesDll-5th-Week - EntrepreneurshipJose A. Leuterio Jr.No ratings yet

- CU Cost ControlDocument13 pagesCU Cost ControltutcNo ratings yet

- CHAPTER 7 Joint Product and By-Product CostingDocument21 pagesCHAPTER 7 Joint Product and By-Product CostingMudassar Hassan100% (1)

- This Study Resource Was: Strategic Cost Management Master BudgetDocument5 pagesThis Study Resource Was: Strategic Cost Management Master BudgetNCTNo ratings yet

- QuizletDocument2 pagesQuizletJaceNo ratings yet

- Cost Accounting ExamDocument29 pagesCost Accounting ExamErina AusriaNo ratings yet

- BEC Demo CompanionDocument23 pagesBEC Demo Companionalik711698100% (1)

- Absorption and Variable CostingDocument4 pagesAbsorption and Variable Costingj financeNo ratings yet

- Test Bank Accounting 25th Editon Warren Chapter 22 BudgetingDocument94 pagesTest Bank Accounting 25th Editon Warren Chapter 22 BudgetingAngely May Jordan100% (1)

- Harrison Chapter 5 Student 6 CeDocument46 pagesHarrison Chapter 5 Student 6 CeAliyan AmjadNo ratings yet

- Methods of Estimating InventoryDocument46 pagesMethods of Estimating Inventoryone formanyNo ratings yet

- HahahDocument13 pagesHahahSuzaka - ChanNo ratings yet

- Script in Cash FlowDocument7 pagesScript in Cash FlowMaxine Ayesha GabrielNo ratings yet

- Admas University: A Senior Essay Submitted TotheDocument19 pagesAdmas University: A Senior Essay Submitted TotheHabteweld EdluNo ratings yet

- Acc 223a CH 5 AnswersDocument13 pagesAcc 223a CH 5 Answersjr centenoNo ratings yet

- Standard Costing - A LevelDocument3 pagesStandard Costing - A LevelMUSTHARI KHANNo ratings yet

- Thesis Gollis 2012Document27 pagesThesis Gollis 2012drmohamednor100% (2)

- Quiz 1 Cost AccountingDocument3 pagesQuiz 1 Cost AccountingKryss Clyde TabliganNo ratings yet

- Cost Accounting EntriesDocument4 pagesCost Accounting EntriesSibgha100% (1)

- Soal Akuntansi ManajemenDocument7 pagesSoal Akuntansi ManajemenInten RosmalinaNo ratings yet

- Variable Costing & Segmented Reporting (Module 7-C)Document9 pagesVariable Costing & Segmented Reporting (Module 7-C)Ghaill CruzNo ratings yet

- 1-HW BinderDocument6 pages1-HW Bindermrsmad123No ratings yet

- Unit 1 AnswersDocument119 pagesUnit 1 AnswersSafaetplayzNo ratings yet

- Managerial Accounting 16th Edition Garrison Solutions Manual 1Document36 pagesManagerial Accounting 16th Edition Garrison Solutions Manual 1codyhines04081997tja100% (36)

- Standard Costs and Variance Analysis CR - 102Document20 pagesStandard Costs and Variance Analysis CR - 102Princess Corine BurgosNo ratings yet

- Chapter 10 Relevant InformDocument31 pagesChapter 10 Relevant InformCostAcct1No ratings yet

- Chapter 2 - Correction of Errors PDFDocument12 pagesChapter 2 - Correction of Errors PDFRonald90% (10)