Professional Documents

Culture Documents

Black-Scholes Options Pricing Calculator: Effect of A Change in The Stock Price

Black-Scholes Options Pricing Calculator: Effect of A Change in The Stock Price

Uploaded by

Vinay KaraguppiCopyright:

Available Formats

You might also like

- Courtney Smith - How To Make A Living Trading Foreign ExchangeDocument35 pagesCourtney Smith - How To Make A Living Trading Foreign Exchangeduyphung1234100% (1)

- Group 1 American Greetings ReportDocument13 pagesGroup 1 American Greetings Reportshershah hassan100% (1)

- A Rhino Update (Aug '23)Document27 pagesA Rhino Update (Aug '23)manhphuho88No ratings yet

- Option Buying Setup: by - Jitendra JainDocument17 pagesOption Buying Setup: by - Jitendra JainmonucoolNo ratings yet

- Option Premium CalculatorDocument6 pagesOption Premium CalculatorAbhinavVermaNo ratings yet

- BANKNIFTY Options Open Interest AnalysisDocument20 pagesBANKNIFTY Options Open Interest AnalysisindianroadromeoNo ratings yet

- Open High Low Close H-O O-L Min ValueDocument5 pagesOpen High Low Close H-O O-L Min ValueJeniffer RayenNo ratings yet

- Max Pain AnalysisDocument3 pagesMax Pain Analysisanindya pal100% (1)

- Options Open Interest AnalysisDocument19 pagesOptions Open Interest AnalysisManish SharmaNo ratings yet

- CPR Formula ExcelsheetDocument2 pagesCPR Formula ExcelsheetHarshit KarnaniNo ratings yet

- Gann - Enthios CalculatorDocument13 pagesGann - Enthios CalculatorRaghavendra KNo ratings yet

- Rahul Mohindar Osc (RMO)Document2 pagesRahul Mohindar Osc (RMO)Marcelo Plaza0% (1)

- FM4, Exercises 17, Black-ScholesDocument54 pagesFM4, Exercises 17, Black-Scholeswenhao zhouNo ratings yet

- Hedging Breakeven CalculatorDocument11 pagesHedging Breakeven CalculatorjitendrasutarNo ratings yet

- Effect of Return and Volatility Calculation On Option Pricing: Using BankniftyDocument8 pagesEffect of Return and Volatility Calculation On Option Pricing: Using BankniftyKolekarMakrandMahadeoNo ratings yet

- Buy Level Buy LevelDocument9 pagesBuy Level Buy LevelJeniffer RayenNo ratings yet

- Call OI Strike Put OI Call Value Put Value Total StrikeDocument19 pagesCall OI Strike Put OI Call Value Put Value Total StrikejitendrasutarNo ratings yet

- Indicators Manual 2012Document117 pagesIndicators Manual 2012upkumaraNo ratings yet

- Intraday CALLS: For Long Call (Intraday) 2,000 125Document12 pagesIntraday CALLS: For Long Call (Intraday) 2,000 125DNYANESH MASKENo ratings yet

- Option Greeks 5 Tools To Measure RiskDocument23 pagesOption Greeks 5 Tools To Measure RiskdaksheduhubNo ratings yet

- Trader's Destination Intraday Calculators: Edit The Cells in Black Only, Dont Edit Any Other CellsDocument2 pagesTrader's Destination Intraday Calculators: Edit The Cells in Black Only, Dont Edit Any Other CellsKubera TradeNo ratings yet

- 0.1.JustNifty TA 1 (By Ilango)Document849 pages0.1.JustNifty TA 1 (By Ilango)Jeniffer RayenNo ratings yet

- Crudeoil 6pm StrategyDocument2 pagesCrudeoil 6pm StrategymohanNo ratings yet

- Nifty SignalDocument14 pagesNifty SignalmahendraboradeNo ratings yet

- Supertrend (7,3) BUY Signal Generated, Technical Analysis ScannerDocument2 pagesSupertrend (7,3) BUY Signal Generated, Technical Analysis ScannerSuryakant PatilNo ratings yet

- ShShort Straddle StrategyDocument6 pagesShShort Straddle StrategyDeepak RanaNo ratings yet

- Revision Live SessionsDocument19 pagesRevision Live SessionsYash GangwalNo ratings yet

- Student Trading Guide - IntroductionDocument39 pagesStudent Trading Guide - IntroductionB.R SinghNo ratings yet

- Call OI Strike Put OI Call Value Put Value Total StrikeDocument4 pagesCall OI Strike Put OI Call Value Put Value Total Striked_narnoliaNo ratings yet

- Nifty Intraday Levels TableDocument8 pagesNifty Intraday Levels TableManoj PalNo ratings yet

- Open Interest BasicsDocument20 pagesOpen Interest Basicskaran MNo ratings yet

- Trading Journal BRODocument21 pagesTrading Journal BROjobertNo ratings yet

- Wave CalculatorDocument2 pagesWave CalculatorArun VinodNo ratings yet

- NIFTY Options Open Interest AnalysisDocument26 pagesNIFTY Options Open Interest AnalysisindianroadromeoNo ratings yet

- Live Trading Session With Rishikesh SirDocument6 pagesLive Trading Session With Rishikesh SirYash GangwalNo ratings yet

- Bajaj AutoDocument4 pagesBajaj AutoSathyamurthy RamanujamNo ratings yet

- Elliot Wave Calaculator ForexDocument3 pagesElliot Wave Calaculator ForexAlvin CardonaNo ratings yet

- Option ExampleDocument7 pagesOption ExampleKaren LiuNo ratings yet

- Previous Day'S Price: Projection For TodayDocument5 pagesPrevious Day'S Price: Projection For TodaycratnanamNo ratings yet

- Shruti Jain Smart Task 02Document7 pagesShruti Jain Smart Task 02shruti jainNo ratings yet

- Implied Volatility and Profit vs. Loss: 1-888-OPTIONSDocument35 pagesImplied Volatility and Profit vs. Loss: 1-888-OPTIONSkaruthi_1979No ratings yet

- Indicator Vs Market ConditionsDocument1 pageIndicator Vs Market ConditionsbrijeshagraNo ratings yet

- Folio Dashboard: PolarisDocument28 pagesFolio Dashboard: PolarisJeniffer RayenNo ratings yet

- Nifty Intraday OptionsDocument63 pagesNifty Intraday OptionsmuthureNo ratings yet

- Option Chain-20-01-2022Document10 pagesOption Chain-20-01-2022vpritNo ratings yet

- Shiv Trend FinderDocument15 pagesShiv Trend FinderstelsoftNo ratings yet

- Level For Long Level For ShortDocument2 pagesLevel For Long Level For ShortPulkit AgarwalNo ratings yet

- Technical Analysis EnglishDocument30 pagesTechnical Analysis EnglishRAJESH KUMARNo ratings yet

- Options Open Interest AnalysisDocument19 pagesOptions Open Interest AnalysisMan ZealNo ratings yet

- Final Webinar TWKJ July2020 PDFDocument58 pagesFinal Webinar TWKJ July2020 PDFRohit PurandareNo ratings yet

- Sanjeevani Forex Education RewDocument34 pagesSanjeevani Forex Education RewfaiyazaslamNo ratings yet

- 9 Option Strategies CH 11Document35 pages9 Option Strategies CH 11RLG631No ratings yet

- Technical Indicator ExplanationDocument4 pagesTechnical Indicator ExplanationfranraizerNo ratings yet

- Technical Analysis GuideDocument38 pagesTechnical Analysis Guidealay2986100% (1)

- Financial Option Trading Data AnalysisDocument25 pagesFinancial Option Trading Data AnalysisPranav SinghNo ratings yet

- Option PDFDocument4 pagesOption PDFjallwynaldrinNo ratings yet

- The Only HEIKIN ASHI Day Trading StrategyDocument3 pagesThe Only HEIKIN ASHI Day Trading StrategySurya Ningrat0% (1)

- Share Chart Option StrategiesDocument24 pagesShare Chart Option StrategiespdservicesNo ratings yet

- MCX Strategy (By Bhavesh Bhavsar)Document1 pageMCX Strategy (By Bhavesh Bhavsar)honeyvijayNo ratings yet

- SAP Dictionary HRDocument714 pagesSAP Dictionary HRFilippos StamatiadisNo ratings yet

- CCPSDocument2 pagesCCPSelitevaluation2022No ratings yet

- Reserve Bank of India - Notifications DEAF PDFDocument1 pageReserve Bank of India - Notifications DEAF PDF9901754662No ratings yet

- The Wealthy Barber 1Document11 pagesThe Wealthy Barber 1api-526752866No ratings yet

- Income Tax: Dr. Sandeep Kumar Department of Commerce, St. Xavier's College, RanchiDocument23 pagesIncome Tax: Dr. Sandeep Kumar Department of Commerce, St. Xavier's College, Ranchinirman chawlaNo ratings yet

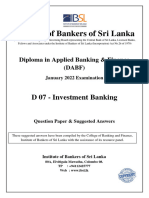

- Institute of Bankers of Sri Lanka: D 07 - Investment BankingDocument17 pagesInstitute of Bankers of Sri Lanka: D 07 - Investment BankingSuvindu DulhanNo ratings yet

- Complaint Against Zions BankDocument56 pagesComplaint Against Zions BankThe Salt Lake TribuneNo ratings yet

- Green River Rodmakers ETP3000 S07Document10 pagesGreen River Rodmakers ETP3000 S07Vlad George PopescuNo ratings yet

- Far410 Dec 2019Document8 pagesFar410 Dec 2019NurulHuda Auni Binti Ab RahmanNo ratings yet

- Chapter 10 Decentralization: Responsibility Accounting, Performance Evaluation, and Transfer PricingDocument70 pagesChapter 10 Decentralization: Responsibility Accounting, Performance Evaluation, and Transfer PricingEninta SebayangNo ratings yet

- ReceiptsDocument9 pagesReceiptsinfoNo ratings yet

- Collateral Allocation MechanismsDocument3 pagesCollateral Allocation MechanismsaNo ratings yet

- Actuarial MathematicsDocument32 pagesActuarial MathematicsAhsan HabibNo ratings yet

- Working CapitalDocument9 pagesWorking CapitalLakshya AgrawalNo ratings yet

- Analysis Kisumu-County 2023 FinalDocument20 pagesAnalysis Kisumu-County 2023 FinaluongozifreshNo ratings yet

- B Com Hons Sem 2 EditedDocument22 pagesB Com Hons Sem 2 EditedShikha GoyalNo ratings yet

- Midterm Assignment 6: Frando, Maria Teresa S. OL33E63Document3 pagesMidterm Assignment 6: Frando, Maria Teresa S. OL33E63Maria Teresa Frando CahandingNo ratings yet

- Draft AtapDocument9 pagesDraft AtapMuhd ArifNo ratings yet

- Project Report On: Submitted byDocument47 pagesProject Report On: Submitted byManoj ParabNo ratings yet

- Aber Report 2020 - en - 4Document92 pagesAber Report 2020 - en - 4ForkLogNo ratings yet

- Capital BudgetingDocument12 pagesCapital BudgetingKhadar50% (4)

- Fundamentals of Computer Problem Solving: Assignment 3Document7 pagesFundamentals of Computer Problem Solving: Assignment 3Nor Syahirah Mohd NorNo ratings yet

- Definition of Capital AllowancesDocument9 pagesDefinition of Capital AllowancesAdesolaNo ratings yet

- Foreign Capital and Economic Growth of IndiaDocument23 pagesForeign Capital and Economic Growth of IndiaMitesh ShahNo ratings yet

- India - MS Economics Aug 2022Document11 pagesIndia - MS Economics Aug 2022Salim MiyaNo ratings yet

- BOP Category Guide PDFDocument29 pagesBOP Category Guide PDFsimbamikeNo ratings yet

- A Project Report HDFC BANKDocument48 pagesA Project Report HDFC BANKVikas SinghNo ratings yet

- Draft Requirements For Tax Declaration TranferDocument4 pagesDraft Requirements For Tax Declaration TranfercarmanvernonNo ratings yet

Black-Scholes Options Pricing Calculator: Effect of A Change in The Stock Price

Black-Scholes Options Pricing Calculator: Effect of A Change in The Stock Price

Uploaded by

Vinay KaraguppiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Black-Scholes Options Pricing Calculator: Effect of A Change in The Stock Price

Black-Scholes Options Pricing Calculator: Effect of A Change in The Stock Price

Uploaded by

Vinay KaraguppiCopyright:

Available Formats

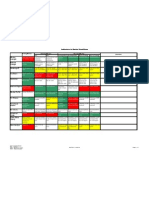

Black-Scholes Options Pricing Calculator

Effect of a Change in the Stock Price

Volatility

(Std Dev)

30%

30%

30%

30%

30%

30%

30%

30%

30%

30%

30%

30%

30%

30%

30%

30%

d1

-0.195

-0.148

-0.101

-0.055

-0.009

0.037

0.082

0.126

0.170

0.214

0.257

0.300

0.343

0.385

0.427

0.468

d2

-0.406

-0.358

-0.312

-0.265

-0.219

-0.174

-0.129

-0.084

-0.040

0.003

0.047

0.090

0.132

0.175

0.216

0.258

BlackScholes

Call Value

$5.78

$6.22

$6.67

$7.14

$7.62

$8.13

$8.65

$9.19

$9.75

$10.33

$10.92

$11.53

$12.16

$12.80

$13.46

$14.13

Change this number to see how option prices change as the stock price changes by:

You may change these cells without changing spreadsheet formulas

BlackScholes

Put Value

$12.31

$11.75

$11.20

$10.67

$10.15

$9.66

$9.18

$8.72

$8.28

$7.86

$7.45

$7.06

$6.69

$6.33

$5.99

$5.66

$1

Effect of Stock price change on Option value

$16

$14

$12

$10

$8

$

Stock

Price

$100

$101

$102

$103

$104

$105

$106

$107

$108

$109

$110

$111

$112

$113

$114

$115

Exercise

or Strike

Days to

Treasury

Price

Expiration Return

$110

180

6.5%

$110

180

6.5%

$110

180

6.5%

$110

180

6.5%

$110

180

6.5%

$110

180

6.5%

$110

180

6.5%

$110

180

6.5%

$110

180

6.5%

$110

180

6.5%

$110

180

6.5%

$110

180

6.5%

$110

180

6.5%

$110

180

6.5%

$110

180

6.5%

$110

180

6.5%

$6

$4

$2

$0

$101 $103 $105 $107 $109 $111 $113 $115

$100 $102 $104 $106 $108 $110 $112 $114

Stock Price

Column H

Column I

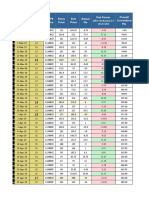

Black-Scholes Options Pricing Calculator

Effect of a Change in the Exercise (Strike) Price

Effect of Strike price on option value

Exercise Days to

or Strike Expiratio Treasury Volatility

Price

n

Return (Std Dev)

$100

180

6.5%

30%

$101

180

6.5%

30%

$102

180

6.5%

30%

$103

180

6.5%

30%

$104

180

6.5%

30%

$105

180

6.5%

30%

$106

180

6.5%

30%

$107

180

6.5%

30%

$108

180

6.5%

30%

$109

180

6.5%

30%

$110

180

6.5%

30%

$111

180

6.5%

30%

$112

180

6.5%

30%

$113

180

6.5%

30%

$114

180

6.5%

30%

$115

180

6.5%

30%

d1

0.257

0.210

0.163

0.117

0.071

0.026

-0.019

-0.064

-0.108

-0.152

-0.195

-0.238

-0.280

-0.323

-0.364

-0.406

d2

0.047

0.000

-0.047

-0.093

-0.139

-0.185

-0.230

-0.274

-0.318

-0.362

-0.406

-0.449

-0.491

-0.533

-0.575

-0.617

BlackBlackScholes Scholes

Call Value Put Value

$9.93

$6.77

$9.44

$7.25

$8.96

$7.74

$8.50

$8.25

$8.06

$8.78

$7.64

$9.33

$7.24

$9.89

$6.85

$10.47

$6.48

$11.07

$6.12

$11.69

$5.78

$12.31

$5.46

$12.96

$5.15

$13.62

$4.86

$14.29

$4.58

$14.98

$4.31

$15.68

$16.00

$14.00

$12.00

$10.00

Stock

Price

$100

$100

$100

$100

$100

$100

$100

$100

$100

$100

$100

$100

$100

$100

$100

$100

$18.00

$8.00

$6.00

$4.00

$2.00

$0.00

$101

$103

$105

$107

$109

$111

$113

$115

$100

$102

$104

$106

$108

$110

$112

$114

Exercise (strike) Price

Change this # to see how option prices change as the stock price changes by:

You may change the pink cells without changing spreadsheet formulas

$1

Column H

Column I

Black-Scholes Options Pricing Calculator

Effect of a Change in days to expiration

Effect of days to expiration on option values

Stock

Price

$100

$100

$100

$100

$100

$100

$100

$100

$100

$100

$100

$100

$100

$100

$100

$100

Exercise Days to

or Strike Expiratio Treasury Volatility

Price

n

Return (Std Dev)

$110

180

6.5%

30%

$110

170

6.5%

30%

$110

160

6.5%

30%

$110

150

6.5%

30%

$110

140

6.5%

30%

$110

130

6.5%

30%

$110

120

6.5%

30%

$110

110

6.5%

30%

$110

100

6.5%

30%

$110

90

6.5%

30%

$110

80

6.5%

30%

$110

70

6.5%

30%

$110

60

6.5%

30%

$110

50

6.5%

30%

$110

40

6.5%

30%

$110

30

6.5%

30%

d1

-0.195

-0.215

-0.237

-0.261

-0.286

-0.314

-0.344

-0.377

-0.415

-0.458

-0.507

-0.565

-0.635

-0.723

-0.838

-1.003

d2

-0.406

-0.420

-0.436

-0.453

-0.472

-0.493

-0.516

-0.542

-0.572

-0.607

-0.647

-0.696

-0.757

-0.834

-0.938

-1.089

BlackBlackScholes Scholes

Call Value Put Value

$5.78

$12.31

$5.49

$12.21

$5.19

$12.10

$4.88

$11.98

$4.57

$11.86

$4.25

$11.73

$3.93

$11.60

$3.59

$11.46

$3.26

$11.31

$2.91

$11.16

$2.56

$11.00

$2.19

$10.83

$1.82

$10.66

$1.45

$10.47

$1.06

$10.28

$0.69

$10.10

Change this # to see how option prices change as days to expiration changes by:

You may change the pink cells without changing spreadsheet formulas

-10

$14.00

$12.00

$10.00

$8.00

$6.00

$4.00

$2.00

$0.00

180 170 160 150 140 130 120 110 100 90 80 70 60 50 40 30

Days to Expiration

Column H

Column I

Black-Scholes Options Pricing Calculator

Effect of a Change in the Treasury rate

Effect of Treasury rate on option value

$16.00

Stock

Price

$100

$100

$100

$100

$100

$100

$100

$100

$100

$100

$100

$100

$100

$100

$100

$100

Exercise Days to

or Strike Expiratio Treasury Volatility

Price

n

Return (Std Dev)

$110

180

6.5%

30%

$110

180

6.3%

30%

$110

180

6.1%

30%

$110

180

5.9%

30%

$110

180

5.7%

30%

$110

180

5.5%

30%

$110

180

5.3%

30%

$110

180

5.1%

30%

$110

180

4.9%

30%

$110

180

4.7%

30%

$110

180

4.5%

30%

$110

180

4.3%

30%

$110

180

4.1%

30%

$110

180

3.9%

30%

$110

180

3.7%

30%

$110

180

3.5%

30%

d1

-0.195

-0.200

-0.204

-0.209

-0.214

-0.218

-0.223

-0.228

-0.232

-0.237

-0.242

-0.246

-0.251

-0.256

-0.260

-0.265

d2

-0.406

-0.410

-0.415

-0.420

-0.424

-0.429

-0.434

-0.438

-0.443

-0.448

-0.452

-0.457

-0.462

-0.466

-0.471

-0.476

BlackBlackScholes Scholes

Call Value Put Value

$5.78

$12.31

$5.75

$12.38

$5.71

$12.45

$5.68

$12.52

$5.64

$12.59

$5.61

$12.66

$5.57

$12.73

$5.54

$12.80

$5.50

$12.87

$5.47

$12.95

$5.43

$13.02

$5.40

$13.09

$5.36

$13.16

$5.33

$13.23

$5.29

$13.31

$5.26

$13.38

Change this number to see how option prices change as the Treasury return changes by:

You may change the pink cells without changing spreadsheet formulas

$14.00

$12.00

$10.00

$8.00

$6.00

$4.00

$2.00

$0.00

6.3% 5.9% 5.5% 5.1% 4.7% 4.3% 3.9% 3.5%

6.5% 6.1% 5.7% 5.3% 4.9% 4.5% 4.1% 3.7%

Treasury bill rate

Column H

-0.2%

Column I

Black-Scholes Options Pricing Calculator

Effect of a Change in the Volatility

Effect of volatility on option value

Stock

Price

$100

$100

$100

$100

$100

$100

$100

$100

$100

$100

$100

$100

$100

$100

$100

$100

Exercise Days to

or Strike Expiratio Treasury Volatility

Price

n

Return (Std Dev)

$110

180

6.5%

30%

$110

180

6.5%

29%

$110

180

6.5%

28%

$110

180

6.5%

27%

$110

180

6.5%

26%

$110

180

6.5%

25%

$110

180

6.5%

24%

$110

180

6.5%

23%

$110

180

6.5%

22%

$110

180

6.5%

21%

$110

180

6.5%

20%

$110

180

6.5%

19%

$110

180

6.5%

18%

$110

180

6.5%

17%

$110

180

6.5%

16%

$110

180

6.5%

15%

d1

-0.195

-0.209

-0.223

-0.239

-0.255

-0.273

-0.291

-0.311

-0.332

-0.355

-0.380

-0.407

-0.437

-0.470

-0.507

-0.548

d2

-0.406

-0.412

-0.420

-0.428

-0.438

-0.448

-0.460

-0.472

-0.487

-0.503

-0.521

-0.541

-0.564

-0.590

-0.619

-0.653

BlackBlackScholes Scholes

Call Value Put Value

$5.78

$12.31

$5.51

$12.04

$5.24

$11.77

$4.96

$11.49

$4.69

$11.22

$4.42

$10.95

$4.15

$10.68

$3.88

$10.41

$3.62

$10.15

$3.35

$9.88

$3.09

$9.62

$2.83

$9.36

$2.58

$9.11

$2.32

$8.85

$2.07

$8.60

$1.83

$8.36

Change this number to see how option prices change as volatility changes by:

-1.0%

$14.00

$12.00

$10.00

$8.00

$6.00

$4.00

$2.00

$0.00

29%

27%

25%

23%

21%

19%

17%

15%

30%

28%

26%

24%

22%

20%

18%

16%

Volatility

Column H

You may change the pink cells without changing spreadsheet formulas

Column I

Black-Scholes Options Pricing Calculator: Collar

Currently own common stock. Form a hedge as follows:

Sell a call with a high exercise price and buy a put with a low exercise price.

Make these equal for a zero-cost collar

Exercise or Days to

Stock Price Strike Price Expiration

$100

$120

180

$110

$120

160

$120

$120

140

$130

$120

120

$140

$120

100

$150

$120

80

$160

$120

60

$170

$120

40

$180

$120

20

Treasury

Return

6.5%

6.5%

6.5%

6.5%

6.5%

6.5%

6.5%

6.5%

6.5%

Volatility (Std

Dev)

30%

30%

30%

30%

30%

30%

30%

30%

30%

d1

-0.608

-0.195

0.227

0.676

1.174

1.760

2.514

3.629

5.860

d2

-0.819

-0.394

0.041

0.504

1.017

1.620

2.392

3.529

5.789

BlackBlackScholes Call Scholes Put

Value

Value

$3.16

$19.38

$6.03

$12.66

$10.33

$7.37

$16.18

$3.64

$23.51

$1.39

$32.05

$0.35

$41.31

$0.04

$50.85

$0.00

$60.43

$0.00

d2

0.523

1.029

1.563

2.147

2.817

3.633

4.716

6.376

9.815

BlackBlack+ initial call

Scholes Call Scholes Put initial put

+

Value

Value

Put- Call+Stock

$15.57

$3.16

$100.00

$23.35

$1.26

$105.23

$32.17

$0.39

$110.06

$41.54

$0.08

$113.90

$51.16

$0.01

$116.50

$60.83

$0.00

$117.95

$70.51

$0.00

$118.68

$80.19

$0.00

$119.15

$89.87

$0.00

$119.57

Change in collar value over time

$200.00

$180.00

$160.00

$140.00

$120.00

Exercise or Days to

Stock Price Strike Price Expiration

$100

$90.45

180

$110

$90.45

160

$120

$90.45

140

$130

$90.45

120

$140

$90.45

100

$150

$90.45

80

$160

$90.45

60

$170

$90.45

40

$180

$90.45

20

Treasury

Return

6.5%

6.5%

6.5%

6.5%

6.5%

6.5%

6.5%

6.5%

6.5%

Volatility (Std

Dev)

30%

30%

30%

30%

30%

30%

30%

30%

30%

d1

0.734

1.228

1.749

2.319

2.974

3.773

4.838

6.475

9.885

Change this number to see how the value of the hedged position changes as the stock price changes by:

$10

Change this number to see how the value of the hedged position changes as the days to expiration change by:

-20

You may change the pink cells without changing spreadsheet formulas

$100.00

$80.00

$60.00

$40.00

$20.00

$0.00

180

160

Column A

140

120

Column H

100

80

Column I

60

40

Column J

20

Black-Scholes Options Pricing Calculator: Collar

Currently own common stock. Form a hedge as follows:

Sell a call with a high exercise price and buy a put with a low exercise price.

Make these equal for a zero-cost collar

Exercise or Days to

Stock Price Strike Price Expiration

$100

$120

180

$90

$120

160

$80

$120

140

$70

$120

120

$60

$120

100

$50

$120

80

$40

$120

60

$30

$120

40

$20

$120

20

Treasury

Return

6.5%

6.5%

6.5%

6.5%

6.5%

6.5%

6.5%

6.5%

6.5%

Volatility (Std

Dev)

30%

30%

30%

30%

30%

30%

30%

30%

30%

Exercise or Days to

Stock Price Strike Price Expiration

$100

$90.45

180

$90

$90.45

160

$80

$90.45

140

$70

$90.45

120

$60

$90.45

100

$50

$90.45

80

$40

$90.45

60

$30

$90.45

40

$20

$90.45

20

Treasury

Return

6.5%

6.5%

6.5%

6.5%

6.5%

6.5%

6.5%

6.5%

6.5%

Volatility (Std

Dev)

30%

30%

30%

30%

30%

30%

30%

30%

30%

d1

-0.608

-1.206

-1.955

-2.923

-4.222

-6.062

-8.884

-13.837

-25.429

d1

0.734

0.218

-0.434

-1.280

-2.422

-4.049

-6.559

-10.991

-21.403

d2

-0.819

-1.404

-2.141

-3.095

-4.379

-6.202

-9.005

-13.937

-25.499

BlackBlackScholes Call Scholes Put

Value

Value

$3.16

$19.38

$0.91

$27.54

$0.13

$37.18

$0.01

$47.47

$0.00

$57.88

$0.00

$68.30

$0.00

$78.72

$0.00

$89.15

$0.00

$99.57

d2

0.523

0.019

-0.619

-1.452

-2.579

-4.189

-6.681

-11.090

-21.473

BlackBlack+ initial call

Scholes Call Scholes Put initial put

+

Value

Value

Put- Call+Stock

$15.57

$3.16

$100.00

$8.13

$6.04

$95.13

$2.95

$11.18

$91.04

$0.53

$19.07

$89.06

$0.02

$28.88

$88.87

$0.00

$39.17

$89.17

$0.00

$49.49

$89.49

$0.00

$59.81

$89.81

$0.00

$70.13

$90.13

Change in collar value over time

$120.00

$100.00

$80.00

Change this number to see how the value of the hedged position changes as the stock price changes by:

-$10

Change this number to see how the value of the hedged position changes as the days to expiration change by:

-20

You may change the pink cells without changing spreadsheet formulas

$60.00

$40.00

$20.00

$0.00

180

160

Column A

140

120

Column H

100

80

Column I

60

40

Column J

20

You might also like

- Courtney Smith - How To Make A Living Trading Foreign ExchangeDocument35 pagesCourtney Smith - How To Make A Living Trading Foreign Exchangeduyphung1234100% (1)

- Group 1 American Greetings ReportDocument13 pagesGroup 1 American Greetings Reportshershah hassan100% (1)

- A Rhino Update (Aug '23)Document27 pagesA Rhino Update (Aug '23)manhphuho88No ratings yet

- Option Buying Setup: by - Jitendra JainDocument17 pagesOption Buying Setup: by - Jitendra JainmonucoolNo ratings yet

- Option Premium CalculatorDocument6 pagesOption Premium CalculatorAbhinavVermaNo ratings yet

- BANKNIFTY Options Open Interest AnalysisDocument20 pagesBANKNIFTY Options Open Interest AnalysisindianroadromeoNo ratings yet

- Open High Low Close H-O O-L Min ValueDocument5 pagesOpen High Low Close H-O O-L Min ValueJeniffer RayenNo ratings yet

- Max Pain AnalysisDocument3 pagesMax Pain Analysisanindya pal100% (1)

- Options Open Interest AnalysisDocument19 pagesOptions Open Interest AnalysisManish SharmaNo ratings yet

- CPR Formula ExcelsheetDocument2 pagesCPR Formula ExcelsheetHarshit KarnaniNo ratings yet

- Gann - Enthios CalculatorDocument13 pagesGann - Enthios CalculatorRaghavendra KNo ratings yet

- Rahul Mohindar Osc (RMO)Document2 pagesRahul Mohindar Osc (RMO)Marcelo Plaza0% (1)

- FM4, Exercises 17, Black-ScholesDocument54 pagesFM4, Exercises 17, Black-Scholeswenhao zhouNo ratings yet

- Hedging Breakeven CalculatorDocument11 pagesHedging Breakeven CalculatorjitendrasutarNo ratings yet

- Effect of Return and Volatility Calculation On Option Pricing: Using BankniftyDocument8 pagesEffect of Return and Volatility Calculation On Option Pricing: Using BankniftyKolekarMakrandMahadeoNo ratings yet

- Buy Level Buy LevelDocument9 pagesBuy Level Buy LevelJeniffer RayenNo ratings yet

- Call OI Strike Put OI Call Value Put Value Total StrikeDocument19 pagesCall OI Strike Put OI Call Value Put Value Total StrikejitendrasutarNo ratings yet

- Indicators Manual 2012Document117 pagesIndicators Manual 2012upkumaraNo ratings yet

- Intraday CALLS: For Long Call (Intraday) 2,000 125Document12 pagesIntraday CALLS: For Long Call (Intraday) 2,000 125DNYANESH MASKENo ratings yet

- Option Greeks 5 Tools To Measure RiskDocument23 pagesOption Greeks 5 Tools To Measure RiskdaksheduhubNo ratings yet

- Trader's Destination Intraday Calculators: Edit The Cells in Black Only, Dont Edit Any Other CellsDocument2 pagesTrader's Destination Intraday Calculators: Edit The Cells in Black Only, Dont Edit Any Other CellsKubera TradeNo ratings yet

- 0.1.JustNifty TA 1 (By Ilango)Document849 pages0.1.JustNifty TA 1 (By Ilango)Jeniffer RayenNo ratings yet

- Crudeoil 6pm StrategyDocument2 pagesCrudeoil 6pm StrategymohanNo ratings yet

- Nifty SignalDocument14 pagesNifty SignalmahendraboradeNo ratings yet

- Supertrend (7,3) BUY Signal Generated, Technical Analysis ScannerDocument2 pagesSupertrend (7,3) BUY Signal Generated, Technical Analysis ScannerSuryakant PatilNo ratings yet

- ShShort Straddle StrategyDocument6 pagesShShort Straddle StrategyDeepak RanaNo ratings yet

- Revision Live SessionsDocument19 pagesRevision Live SessionsYash GangwalNo ratings yet

- Student Trading Guide - IntroductionDocument39 pagesStudent Trading Guide - IntroductionB.R SinghNo ratings yet

- Call OI Strike Put OI Call Value Put Value Total StrikeDocument4 pagesCall OI Strike Put OI Call Value Put Value Total Striked_narnoliaNo ratings yet

- Nifty Intraday Levels TableDocument8 pagesNifty Intraday Levels TableManoj PalNo ratings yet

- Open Interest BasicsDocument20 pagesOpen Interest Basicskaran MNo ratings yet

- Trading Journal BRODocument21 pagesTrading Journal BROjobertNo ratings yet

- Wave CalculatorDocument2 pagesWave CalculatorArun VinodNo ratings yet

- NIFTY Options Open Interest AnalysisDocument26 pagesNIFTY Options Open Interest AnalysisindianroadromeoNo ratings yet

- Live Trading Session With Rishikesh SirDocument6 pagesLive Trading Session With Rishikesh SirYash GangwalNo ratings yet

- Bajaj AutoDocument4 pagesBajaj AutoSathyamurthy RamanujamNo ratings yet

- Elliot Wave Calaculator ForexDocument3 pagesElliot Wave Calaculator ForexAlvin CardonaNo ratings yet

- Option ExampleDocument7 pagesOption ExampleKaren LiuNo ratings yet

- Previous Day'S Price: Projection For TodayDocument5 pagesPrevious Day'S Price: Projection For TodaycratnanamNo ratings yet

- Shruti Jain Smart Task 02Document7 pagesShruti Jain Smart Task 02shruti jainNo ratings yet

- Implied Volatility and Profit vs. Loss: 1-888-OPTIONSDocument35 pagesImplied Volatility and Profit vs. Loss: 1-888-OPTIONSkaruthi_1979No ratings yet

- Indicator Vs Market ConditionsDocument1 pageIndicator Vs Market ConditionsbrijeshagraNo ratings yet

- Folio Dashboard: PolarisDocument28 pagesFolio Dashboard: PolarisJeniffer RayenNo ratings yet

- Nifty Intraday OptionsDocument63 pagesNifty Intraday OptionsmuthureNo ratings yet

- Option Chain-20-01-2022Document10 pagesOption Chain-20-01-2022vpritNo ratings yet

- Shiv Trend FinderDocument15 pagesShiv Trend FinderstelsoftNo ratings yet

- Level For Long Level For ShortDocument2 pagesLevel For Long Level For ShortPulkit AgarwalNo ratings yet

- Technical Analysis EnglishDocument30 pagesTechnical Analysis EnglishRAJESH KUMARNo ratings yet

- Options Open Interest AnalysisDocument19 pagesOptions Open Interest AnalysisMan ZealNo ratings yet

- Final Webinar TWKJ July2020 PDFDocument58 pagesFinal Webinar TWKJ July2020 PDFRohit PurandareNo ratings yet

- Sanjeevani Forex Education RewDocument34 pagesSanjeevani Forex Education RewfaiyazaslamNo ratings yet

- 9 Option Strategies CH 11Document35 pages9 Option Strategies CH 11RLG631No ratings yet

- Technical Indicator ExplanationDocument4 pagesTechnical Indicator ExplanationfranraizerNo ratings yet

- Technical Analysis GuideDocument38 pagesTechnical Analysis Guidealay2986100% (1)

- Financial Option Trading Data AnalysisDocument25 pagesFinancial Option Trading Data AnalysisPranav SinghNo ratings yet

- Option PDFDocument4 pagesOption PDFjallwynaldrinNo ratings yet

- The Only HEIKIN ASHI Day Trading StrategyDocument3 pagesThe Only HEIKIN ASHI Day Trading StrategySurya Ningrat0% (1)

- Share Chart Option StrategiesDocument24 pagesShare Chart Option StrategiespdservicesNo ratings yet

- MCX Strategy (By Bhavesh Bhavsar)Document1 pageMCX Strategy (By Bhavesh Bhavsar)honeyvijayNo ratings yet

- SAP Dictionary HRDocument714 pagesSAP Dictionary HRFilippos StamatiadisNo ratings yet

- CCPSDocument2 pagesCCPSelitevaluation2022No ratings yet

- Reserve Bank of India - Notifications DEAF PDFDocument1 pageReserve Bank of India - Notifications DEAF PDF9901754662No ratings yet

- The Wealthy Barber 1Document11 pagesThe Wealthy Barber 1api-526752866No ratings yet

- Income Tax: Dr. Sandeep Kumar Department of Commerce, St. Xavier's College, RanchiDocument23 pagesIncome Tax: Dr. Sandeep Kumar Department of Commerce, St. Xavier's College, Ranchinirman chawlaNo ratings yet

- Institute of Bankers of Sri Lanka: D 07 - Investment BankingDocument17 pagesInstitute of Bankers of Sri Lanka: D 07 - Investment BankingSuvindu DulhanNo ratings yet

- Complaint Against Zions BankDocument56 pagesComplaint Against Zions BankThe Salt Lake TribuneNo ratings yet

- Green River Rodmakers ETP3000 S07Document10 pagesGreen River Rodmakers ETP3000 S07Vlad George PopescuNo ratings yet

- Far410 Dec 2019Document8 pagesFar410 Dec 2019NurulHuda Auni Binti Ab RahmanNo ratings yet

- Chapter 10 Decentralization: Responsibility Accounting, Performance Evaluation, and Transfer PricingDocument70 pagesChapter 10 Decentralization: Responsibility Accounting, Performance Evaluation, and Transfer PricingEninta SebayangNo ratings yet

- ReceiptsDocument9 pagesReceiptsinfoNo ratings yet

- Collateral Allocation MechanismsDocument3 pagesCollateral Allocation MechanismsaNo ratings yet

- Actuarial MathematicsDocument32 pagesActuarial MathematicsAhsan HabibNo ratings yet

- Working CapitalDocument9 pagesWorking CapitalLakshya AgrawalNo ratings yet

- Analysis Kisumu-County 2023 FinalDocument20 pagesAnalysis Kisumu-County 2023 FinaluongozifreshNo ratings yet

- B Com Hons Sem 2 EditedDocument22 pagesB Com Hons Sem 2 EditedShikha GoyalNo ratings yet

- Midterm Assignment 6: Frando, Maria Teresa S. OL33E63Document3 pagesMidterm Assignment 6: Frando, Maria Teresa S. OL33E63Maria Teresa Frando CahandingNo ratings yet

- Draft AtapDocument9 pagesDraft AtapMuhd ArifNo ratings yet

- Project Report On: Submitted byDocument47 pagesProject Report On: Submitted byManoj ParabNo ratings yet

- Aber Report 2020 - en - 4Document92 pagesAber Report 2020 - en - 4ForkLogNo ratings yet

- Capital BudgetingDocument12 pagesCapital BudgetingKhadar50% (4)

- Fundamentals of Computer Problem Solving: Assignment 3Document7 pagesFundamentals of Computer Problem Solving: Assignment 3Nor Syahirah Mohd NorNo ratings yet

- Definition of Capital AllowancesDocument9 pagesDefinition of Capital AllowancesAdesolaNo ratings yet

- Foreign Capital and Economic Growth of IndiaDocument23 pagesForeign Capital and Economic Growth of IndiaMitesh ShahNo ratings yet

- India - MS Economics Aug 2022Document11 pagesIndia - MS Economics Aug 2022Salim MiyaNo ratings yet

- BOP Category Guide PDFDocument29 pagesBOP Category Guide PDFsimbamikeNo ratings yet

- A Project Report HDFC BANKDocument48 pagesA Project Report HDFC BANKVikas SinghNo ratings yet

- Draft Requirements For Tax Declaration TranferDocument4 pagesDraft Requirements For Tax Declaration TranfercarmanvernonNo ratings yet