Professional Documents

Culture Documents

Form16 (2021-2022)

Form16 (2021-2022)

Uploaded by

Anushka PoddarCopyright:

Available Formats

You might also like

- The Indiantown Cogeneration ProjectDocument11 pagesThe Indiantown Cogeneration Projectbubbles180167% (3)

- 1120s PDFDocument5 pages1120s PDFBreann MorrisNo ratings yet

- Form16 (2020-2021)Document2 pagesForm16 (2020-2021)Saras ShendeNo ratings yet

- PART B (Annexure)Document4 pagesPART B (Annexure)AnbarasanNo ratings yet

- Form No. 16: (See Rule 31 (1) (A) )Document5 pagesForm No. 16: (See Rule 31 (1) (A) )amit kr AdhikaryNo ratings yet

- Form 1615012023 135230 PDFDocument3 pagesForm 1615012023 135230 PDFSahil ThakurNo ratings yet

- Certificate No. Last Updated On Name and Address of The Employer Name and Address of The Employee Govt Ayurvedic College Dr. Prabhat Kumar DwivediDocument5 pagesCertificate No. Last Updated On Name and Address of The Employer Name and Address of The Employee Govt Ayurvedic College Dr. Prabhat Kumar DwivediprabhatNo ratings yet

- Form 16 - 1617 PDFDocument3 pagesForm 16 - 1617 PDFAbhilashNo ratings yet

- Od 116705815912325000Document1 pageOd 116705815912325000SunnyNo ratings yet

- Tax Invoice: Igst 0% 0.00 CGST 2.5% Sgst/Utgst 2.5% 11.55 11.55Document1 pageTax Invoice: Igst 0% 0.00 CGST 2.5% Sgst/Utgst 2.5% 11.55 11.55Ankit SinghNo ratings yet

- serviceCustomerInvoice 2297 2023 06 21 serviceCustomerInvoice-1dfd227a-2297-2b19c693 925c 42ab 8718 6a63c1bb14e2Vp0CohH6dc-4946758209Document1 pageserviceCustomerInvoice 2297 2023 06 21 serviceCustomerInvoice-1dfd227a-2297-2b19c693 925c 42ab 8718 6a63c1bb14e2Vp0CohH6dc-4946758209kuldeep singhNo ratings yet

- Shipping & Billing Address: Giraj: Date: 29/03/2023Document2 pagesShipping & Billing Address: Giraj: Date: 29/03/2023Giraj Prasad goyalNo ratings yet

- Form16Document5 pagesForm16er_ved06No ratings yet

- Ticket Coimbatore-Hyderabad 22 SepDocument3 pagesTicket Coimbatore-Hyderabad 22 SepHyuNo ratings yet

- Service Customer in VoiceDocument1 pageService Customer in VoiceAshok GuptaNo ratings yet

- Form 16Document9 pagesForm 16Ponns KarnanNo ratings yet

- Form 16 - TCSDocument3 pagesForm 16 - TCSBALANo ratings yet

- Form16 2021Document8 pagesForm16 2021Mahammad HachanNo ratings yet

- Tax Invoice: State Name: Gujarat, Code: 24Document1 pageTax Invoice: State Name: Gujarat, Code: 24jayshah_26No ratings yet

- Tax Invoice/Bill of Supply: Shreyash Retail Private LimitedDocument1 pageTax Invoice/Bill of Supply: Shreyash Retail Private LimitedRealme 2 proNo ratings yet

- Your Money Master Savings Account Summary: Here's What Happened in Your Account This Statement PeriodDocument2 pagesYour Money Master Savings Account Summary: Here's What Happened in Your Account This Statement PeriodVISHAL BANSALNo ratings yet

- Order FL0132916786: Mode of Payment: CODDocument2 pagesOrder FL0132916786: Mode of Payment: CODJagruc MahantNo ratings yet

- Invoice: Pest Kare (India) PVT - LTDDocument1 pageInvoice: Pest Kare (India) PVT - LTDAnonymous rNqW9p3No ratings yet

- InvoiceDocument1 pageInvoiceMohan KumarNo ratings yet

- EfewaraweDocument1 pageEfewarawesunil kumarNo ratings yet

- Form 16: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument4 pagesForm 16: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalarySyedNo ratings yet

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument2 pagesBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountAbhishekNo ratings yet

- Form 16 Part B 2016-17Document4 pagesForm 16 Part B 2016-17atulsharmaNo ratings yet

- Lucknow To Ahmedabad B3Dmfi: Go First G8-138Document3 pagesLucknow To Ahmedabad B3Dmfi: Go First G8-138RaamNo ratings yet

- Flipkart Labels 30 Jul 2020 10 11 PDFDocument3 pagesFlipkart Labels 30 Jul 2020 10 11 PDFShakti MalikNo ratings yet

- Vipin Form 16Document5 pagesVipin Form 16Jagdish Sharma CANo ratings yet

- Form16 PDFDocument9 pagesForm16 PDFHarish KumarNo ratings yet

- Salary Slip JulyDocument1 pageSalary Slip Julyankurrawat693No ratings yet

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument2 pagesBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountSubhra ranjan PanigrahiNo ratings yet

- UPLKO15134150000010067 NewDocument2 pagesUPLKO15134150000010067 Newravi kumarNo ratings yet

- Inv 000001Document1 pageInv 000001kenishaNo ratings yet

- SUDDICK CY JAMES XDocument3 pagesSUDDICK CY JAMES XITNo ratings yet

- SV Roofing 2067Document1 pageSV Roofing 2067bikkumalla shivaprasadNo ratings yet

- 7479Document1 page7479Prakash RajNo ratings yet

- Old Scheme: Radhamani K SDocument4 pagesOld Scheme: Radhamani K SSUREMAN FINANCIAL SERVICESNo ratings yet

- Bill Oct 16Document1 pageBill Oct 16deeNo ratings yet

- Ajio 1630037974463Document1 pageAjio 1630037974463sandeep kumarNo ratings yet

- Kaushik Sarkar Form 16 DynProDocument5 pagesKaushik Sarkar Form 16 DynProKaushik SarkarNo ratings yet

- Arul PDFDocument1 pageArul PDFraman73No ratings yet

- InvoiceDocument1 pageInvoiceUNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearNarayan KumbharNo ratings yet

- Shipping & Billing Address: Ishika Ghosh: Date: 27/09/2022Document2 pagesShipping & Billing Address: Ishika Ghosh: Date: 27/09/2022Ishika GhoshNo ratings yet

- Invoice of Realme U1Document1 pageInvoice of Realme U1Shruti SharmaNo ratings yet

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument3 pagesBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total Amountsanjay patidarNo ratings yet

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument2 pagesBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountPadma GouteNo ratings yet

- Nhiel - Serentas Payroll PayslipSelfService ExternalPayslipPDFProcessPHDocument1 pageNhiel - Serentas Payroll PayslipSelfService ExternalPayslipPDFProcessPHnhiel anthony SerentasNo ratings yet

- Realme 2 Invoice PDFDocument1 pageRealme 2 Invoice PDFarjun bishtNo ratings yet

- InvoiceDocument1 pageInvoicerajkumawat2708No ratings yet

- Tax Invoice For: Your Telstra BillDocument3 pagesTax Invoice For: Your Telstra BillPeter SmythNo ratings yet

- InvoiceDocument1 pageInvoiceBeHappyNo ratings yet

- Tax Invoice - Intra StateDocument84 pagesTax Invoice - Intra StateAnshul GuptaNo ratings yet

- Piperine 2Document1 pagePiperine 2vasavi reddyNo ratings yet

- Your Personal Chequing Account StatementDocument1 pageYour Personal Chequing Account Statementwalid djelataNo ratings yet

- Passbookstmt PDFDocument3 pagesPassbookstmt PDFPáRth JhãNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryShantru RautNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryNavneet SharmaNo ratings yet

- STRIDE Conference BrochureDocument5 pagesSTRIDE Conference BrochureAnushka PoddarNo ratings yet

- Aakash Byju'S - JDDocument1 pageAakash Byju'S - JDAnushka PoddarNo ratings yet

- Laghoo CompleteDocument6 pagesLaghoo CompleteAnushka PoddarNo ratings yet

- Barriers To CommunicationDocument19 pagesBarriers To CommunicationAnushka PoddarNo ratings yet

- Business License Code Reforms - June 12, 2015Document12 pagesBusiness License Code Reforms - June 12, 2015nicholas.phillipsNo ratings yet

- Review of Financial Statement Preparation Analysis and Interpretation Pt.8Document6 pagesReview of Financial Statement Preparation Analysis and Interpretation Pt.8ADRIANO, Glecy C.No ratings yet

- Soft Skills Bootcamp 1 Sept EdDocument4 pagesSoft Skills Bootcamp 1 Sept Edamr al sayedNo ratings yet

- Accounting What The Numbers Mean 11th Edition Marshall Solutions ManualDocument25 pagesAccounting What The Numbers Mean 11th Edition Marshall Solutions ManualElizabethBautistadazi100% (51)

- GAC02A2 AO1 Scenario and Required.Document7 pagesGAC02A2 AO1 Scenario and Required.Nandi MliloNo ratings yet

- Oshpd Merged Power PointsDocument73 pagesOshpd Merged Power PointsGreg IkeNo ratings yet

- Global Vacation Rental Report 2022Document60 pagesGlobal Vacation Rental Report 2022Walter HidalgoNo ratings yet

- Greetings From GSP Finance CompanyDocument1 pageGreetings From GSP Finance CompanyZahidul IslamNo ratings yet

- Project Management Guide 2022-23Document26 pagesProject Management Guide 2022-23Yeah BoiNo ratings yet

- Anush IpDocument24 pagesAnush IpAnsh SharmaNo ratings yet

- Marketing Maverics-Toyota's Recall CrisisDocument7 pagesMarketing Maverics-Toyota's Recall Crisissurya mundriNo ratings yet

- Bowes ExploringInnovationinHousing 2018CFRDocument97 pagesBowes ExploringInnovationinHousing 2018CFRCecil SolomonNo ratings yet

- PGP14 T3 HRM S1Document9 pagesPGP14 T3 HRM S1Aryan BokdeNo ratings yet

- Module II. Business Combination - Date of Acquisition (Consolidation)Document3 pagesModule II. Business Combination - Date of Acquisition (Consolidation)Melanie Samsona100% (1)

- PromoterDocument17 pagesPromotervaibhavNo ratings yet

- COVID-19 Assistance To Restart Enterprises (CARES) Program: Loan ApplicationDocument2 pagesCOVID-19 Assistance To Restart Enterprises (CARES) Program: Loan Applicationramir batongbakalNo ratings yet

- ch18 Derivatives and Risk ManagementDocument32 pagesch18 Derivatives and Risk ManagementGonzalo Jr. RualesNo ratings yet

- CISO Sales DeckDocument10 pagesCISO Sales DeckAlessandro PazNo ratings yet

- Risk Management Slides - Part 3Document9 pagesRisk Management Slides - Part 3nhloniphointelligenceNo ratings yet

- Hit Greece EngDocument196 pagesHit Greece EnggoldenmariaNo ratings yet

- Senior Engineer, System Engineering PerformanceDocument5 pagesSenior Engineer, System Engineering PerformanceJohnNo ratings yet

- Public Finance 02Document7 pagesPublic Finance 02Shusanta DevnathNo ratings yet

- Job Order Costing & Process Costing: Seminar QuestionsDocument18 pagesJob Order Costing & Process Costing: Seminar QuestionselmudaaNo ratings yet

- Taxation LawDocument7 pagesTaxation LawAliNo ratings yet

- Banana WarDocument94 pagesBanana Warcendy.rosal17No ratings yet

- GSR2022 Full Report PDFDocument309 pagesGSR2022 Full Report PDFMuhammad Zakky ZulfikarNo ratings yet

- JIS School FeesDocument4 pagesJIS School FeesAgnesNo ratings yet

- KMF BearingDocument126 pagesKMF BearingMechilNo ratings yet

- Sale Deed SumairaDocument4 pagesSale Deed SumairaIbrahim MalikNo ratings yet

Form16 (2021-2022)

Form16 (2021-2022)

Uploaded by

Anushka PoddarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form16 (2021-2022)

Form16 (2021-2022)

Uploaded by

Anushka PoddarCopyright:

Available Formats

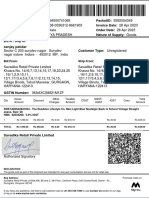

FORM NO.

16 Signature Not Verified

Digitally signed by Kamleshkumar R.

Borkar

[See rule 31(1)(a)] Date: 2022.06.01 11:07:50 IST

Reason: Form16 Authorization

Location: ipas

Certificate under section 203 of the Income-tax Act, 1961 for tax

deducted at source on Salary .

Name and address of the Employer Name, EmpNo, Bill Unit and designation of the Employee

Ministry of Railways, Govt. of India, MAHESH M.GUPTA, 39511AE0196, 3405208, (RUN)SR.TM(GOODS)

Rail Bhawan

PAN of the TAN of the PAN of the Employee.

Deductor. Deductor.

NGPS04721D AKEPG3083D

CIT(TDS) Period

Assessment Year

Address: From To

City: Pin Code: 2022-2023 01/APR/2021 31/MAR/2022

PART B( Refer Note 1 )

Details of Salary paid and any other income and tax deducted.

1. Gross salary

(a) Salary as per provisions contained 909237

in sec. 17(1)

(b) Value of perquisites u/s 17(2) (as 0

per Form No.12BA, wherever applicable)

(c) Profits in lieu of salary u/s

17(3) (as per Form No.12BA,wherever 0

applicable)

(d) Total 909237

2. Less : Allowance to the extent

exempt u/s 10

(a)House Rent Allowance 0

(b)Education and Hostel Allowances For 2400

Child

(c) STANDARD DEDUCTION U/s 16(a) 50000

Total 52400

3. Balance (1-2) 856837

4. Deductions :

(a) Entertainment allowance 0

(b) Tax on Employment 2300

5. Aggregate of 4 (a) and (b) 2300

6. Income chargeable under the head. 854537

Salaries (3 - 5)

7. Add : Any other income reported by

the employee

Total 0

8. Gross total income (6 + 7) 854537

9. Deductions under Chapter VIA

(A) sections 80C, 80CCC and 80CCD Gross Amount Deductible Amount

(a) section 80C

(1) NPS 63485

(2) GIS 360

Total 63845 63845

(b) section 80CCC 0 0

(c) section 80CCD(2)(GOVT CONTRIBUTION 88879 88879

REBATE)

Note : 1. aggregate amount deductible under section 80C shall not exceed one lakh fifty

thousand rupees

2. aggregate amount deductible under three sections, i.e., 80C, 80CCC and 80CCD,shall not

exceed one lakh fifty thousand rupees

(B) other sections (for e.g., 80E, 80G Gross Amount Qualifying Amount Deductible Amount

etc.) under Chapter VIA

Total 0 0 0

10. Aggregate of deductible amounts 152724

under Chapter VI-A

11. Total income (8-10) 701810

12. Tax on total income 52862

13. Education Cess @ 3%(on tax 2114

computed at S. No. 12 )

14. Tax payable (12+13) 54976

15. Less: Relief under section 89 0

(attach details)

16. Tax payable (14-15) 54976

17. Total Tax Paid 54976

18. Tax payable/Refundable (16-17) 0

I, KAMLESHKUMAR R BORKAR son/daughter of .............................. working in the

capacity of ASST. PERS. OFFICER-A do hereby certify that a sum of Rs. 54976 [Rs. Rs. Fifty

Four Thousand Nine Hundred Seventy Six Only Only (in words)] has been deducted at source and

paid to the credit of the Central Government. I further certify that the information given

above is true and correct based on the books of account, documents and other available records.

Place: NAGPUR

Date: 17/05/2022 Signature of the person responsible for deduction of tax

Full Name: KAMLESHKUMAR R BORKAR

Designation: ASST. PERS. OFFICER-A

(*)Since this is a system generated-report and has been digitally signed,no separate signatures

are required.

You might also like

- The Indiantown Cogeneration ProjectDocument11 pagesThe Indiantown Cogeneration Projectbubbles180167% (3)

- 1120s PDFDocument5 pages1120s PDFBreann MorrisNo ratings yet

- Form16 (2020-2021)Document2 pagesForm16 (2020-2021)Saras ShendeNo ratings yet

- PART B (Annexure)Document4 pagesPART B (Annexure)AnbarasanNo ratings yet

- Form No. 16: (See Rule 31 (1) (A) )Document5 pagesForm No. 16: (See Rule 31 (1) (A) )amit kr AdhikaryNo ratings yet

- Form 1615012023 135230 PDFDocument3 pagesForm 1615012023 135230 PDFSahil ThakurNo ratings yet

- Certificate No. Last Updated On Name and Address of The Employer Name and Address of The Employee Govt Ayurvedic College Dr. Prabhat Kumar DwivediDocument5 pagesCertificate No. Last Updated On Name and Address of The Employer Name and Address of The Employee Govt Ayurvedic College Dr. Prabhat Kumar DwivediprabhatNo ratings yet

- Form 16 - 1617 PDFDocument3 pagesForm 16 - 1617 PDFAbhilashNo ratings yet

- Od 116705815912325000Document1 pageOd 116705815912325000SunnyNo ratings yet

- Tax Invoice: Igst 0% 0.00 CGST 2.5% Sgst/Utgst 2.5% 11.55 11.55Document1 pageTax Invoice: Igst 0% 0.00 CGST 2.5% Sgst/Utgst 2.5% 11.55 11.55Ankit SinghNo ratings yet

- serviceCustomerInvoice 2297 2023 06 21 serviceCustomerInvoice-1dfd227a-2297-2b19c693 925c 42ab 8718 6a63c1bb14e2Vp0CohH6dc-4946758209Document1 pageserviceCustomerInvoice 2297 2023 06 21 serviceCustomerInvoice-1dfd227a-2297-2b19c693 925c 42ab 8718 6a63c1bb14e2Vp0CohH6dc-4946758209kuldeep singhNo ratings yet

- Shipping & Billing Address: Giraj: Date: 29/03/2023Document2 pagesShipping & Billing Address: Giraj: Date: 29/03/2023Giraj Prasad goyalNo ratings yet

- Form16Document5 pagesForm16er_ved06No ratings yet

- Ticket Coimbatore-Hyderabad 22 SepDocument3 pagesTicket Coimbatore-Hyderabad 22 SepHyuNo ratings yet

- Service Customer in VoiceDocument1 pageService Customer in VoiceAshok GuptaNo ratings yet

- Form 16Document9 pagesForm 16Ponns KarnanNo ratings yet

- Form 16 - TCSDocument3 pagesForm 16 - TCSBALANo ratings yet

- Form16 2021Document8 pagesForm16 2021Mahammad HachanNo ratings yet

- Tax Invoice: State Name: Gujarat, Code: 24Document1 pageTax Invoice: State Name: Gujarat, Code: 24jayshah_26No ratings yet

- Tax Invoice/Bill of Supply: Shreyash Retail Private LimitedDocument1 pageTax Invoice/Bill of Supply: Shreyash Retail Private LimitedRealme 2 proNo ratings yet

- Your Money Master Savings Account Summary: Here's What Happened in Your Account This Statement PeriodDocument2 pagesYour Money Master Savings Account Summary: Here's What Happened in Your Account This Statement PeriodVISHAL BANSALNo ratings yet

- Order FL0132916786: Mode of Payment: CODDocument2 pagesOrder FL0132916786: Mode of Payment: CODJagruc MahantNo ratings yet

- Invoice: Pest Kare (India) PVT - LTDDocument1 pageInvoice: Pest Kare (India) PVT - LTDAnonymous rNqW9p3No ratings yet

- InvoiceDocument1 pageInvoiceMohan KumarNo ratings yet

- EfewaraweDocument1 pageEfewarawesunil kumarNo ratings yet

- Form 16: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument4 pagesForm 16: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalarySyedNo ratings yet

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument2 pagesBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountAbhishekNo ratings yet

- Form 16 Part B 2016-17Document4 pagesForm 16 Part B 2016-17atulsharmaNo ratings yet

- Lucknow To Ahmedabad B3Dmfi: Go First G8-138Document3 pagesLucknow To Ahmedabad B3Dmfi: Go First G8-138RaamNo ratings yet

- Flipkart Labels 30 Jul 2020 10 11 PDFDocument3 pagesFlipkart Labels 30 Jul 2020 10 11 PDFShakti MalikNo ratings yet

- Vipin Form 16Document5 pagesVipin Form 16Jagdish Sharma CANo ratings yet

- Form16 PDFDocument9 pagesForm16 PDFHarish KumarNo ratings yet

- Salary Slip JulyDocument1 pageSalary Slip Julyankurrawat693No ratings yet

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument2 pagesBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountSubhra ranjan PanigrahiNo ratings yet

- UPLKO15134150000010067 NewDocument2 pagesUPLKO15134150000010067 Newravi kumarNo ratings yet

- Inv 000001Document1 pageInv 000001kenishaNo ratings yet

- SUDDICK CY JAMES XDocument3 pagesSUDDICK CY JAMES XITNo ratings yet

- SV Roofing 2067Document1 pageSV Roofing 2067bikkumalla shivaprasadNo ratings yet

- 7479Document1 page7479Prakash RajNo ratings yet

- Old Scheme: Radhamani K SDocument4 pagesOld Scheme: Radhamani K SSUREMAN FINANCIAL SERVICESNo ratings yet

- Bill Oct 16Document1 pageBill Oct 16deeNo ratings yet

- Ajio 1630037974463Document1 pageAjio 1630037974463sandeep kumarNo ratings yet

- Kaushik Sarkar Form 16 DynProDocument5 pagesKaushik Sarkar Form 16 DynProKaushik SarkarNo ratings yet

- Arul PDFDocument1 pageArul PDFraman73No ratings yet

- InvoiceDocument1 pageInvoiceUNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearNarayan KumbharNo ratings yet

- Shipping & Billing Address: Ishika Ghosh: Date: 27/09/2022Document2 pagesShipping & Billing Address: Ishika Ghosh: Date: 27/09/2022Ishika GhoshNo ratings yet

- Invoice of Realme U1Document1 pageInvoice of Realme U1Shruti SharmaNo ratings yet

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument3 pagesBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total Amountsanjay patidarNo ratings yet

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument2 pagesBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountPadma GouteNo ratings yet

- Nhiel - Serentas Payroll PayslipSelfService ExternalPayslipPDFProcessPHDocument1 pageNhiel - Serentas Payroll PayslipSelfService ExternalPayslipPDFProcessPHnhiel anthony SerentasNo ratings yet

- Realme 2 Invoice PDFDocument1 pageRealme 2 Invoice PDFarjun bishtNo ratings yet

- InvoiceDocument1 pageInvoicerajkumawat2708No ratings yet

- Tax Invoice For: Your Telstra BillDocument3 pagesTax Invoice For: Your Telstra BillPeter SmythNo ratings yet

- InvoiceDocument1 pageInvoiceBeHappyNo ratings yet

- Tax Invoice - Intra StateDocument84 pagesTax Invoice - Intra StateAnshul GuptaNo ratings yet

- Piperine 2Document1 pagePiperine 2vasavi reddyNo ratings yet

- Your Personal Chequing Account StatementDocument1 pageYour Personal Chequing Account Statementwalid djelataNo ratings yet

- Passbookstmt PDFDocument3 pagesPassbookstmt PDFPáRth JhãNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryShantru RautNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryNavneet SharmaNo ratings yet

- STRIDE Conference BrochureDocument5 pagesSTRIDE Conference BrochureAnushka PoddarNo ratings yet

- Aakash Byju'S - JDDocument1 pageAakash Byju'S - JDAnushka PoddarNo ratings yet

- Laghoo CompleteDocument6 pagesLaghoo CompleteAnushka PoddarNo ratings yet

- Barriers To CommunicationDocument19 pagesBarriers To CommunicationAnushka PoddarNo ratings yet

- Business License Code Reforms - June 12, 2015Document12 pagesBusiness License Code Reforms - June 12, 2015nicholas.phillipsNo ratings yet

- Review of Financial Statement Preparation Analysis and Interpretation Pt.8Document6 pagesReview of Financial Statement Preparation Analysis and Interpretation Pt.8ADRIANO, Glecy C.No ratings yet

- Soft Skills Bootcamp 1 Sept EdDocument4 pagesSoft Skills Bootcamp 1 Sept Edamr al sayedNo ratings yet

- Accounting What The Numbers Mean 11th Edition Marshall Solutions ManualDocument25 pagesAccounting What The Numbers Mean 11th Edition Marshall Solutions ManualElizabethBautistadazi100% (51)

- GAC02A2 AO1 Scenario and Required.Document7 pagesGAC02A2 AO1 Scenario and Required.Nandi MliloNo ratings yet

- Oshpd Merged Power PointsDocument73 pagesOshpd Merged Power PointsGreg IkeNo ratings yet

- Global Vacation Rental Report 2022Document60 pagesGlobal Vacation Rental Report 2022Walter HidalgoNo ratings yet

- Greetings From GSP Finance CompanyDocument1 pageGreetings From GSP Finance CompanyZahidul IslamNo ratings yet

- Project Management Guide 2022-23Document26 pagesProject Management Guide 2022-23Yeah BoiNo ratings yet

- Anush IpDocument24 pagesAnush IpAnsh SharmaNo ratings yet

- Marketing Maverics-Toyota's Recall CrisisDocument7 pagesMarketing Maverics-Toyota's Recall Crisissurya mundriNo ratings yet

- Bowes ExploringInnovationinHousing 2018CFRDocument97 pagesBowes ExploringInnovationinHousing 2018CFRCecil SolomonNo ratings yet

- PGP14 T3 HRM S1Document9 pagesPGP14 T3 HRM S1Aryan BokdeNo ratings yet

- Module II. Business Combination - Date of Acquisition (Consolidation)Document3 pagesModule II. Business Combination - Date of Acquisition (Consolidation)Melanie Samsona100% (1)

- PromoterDocument17 pagesPromotervaibhavNo ratings yet

- COVID-19 Assistance To Restart Enterprises (CARES) Program: Loan ApplicationDocument2 pagesCOVID-19 Assistance To Restart Enterprises (CARES) Program: Loan Applicationramir batongbakalNo ratings yet

- ch18 Derivatives and Risk ManagementDocument32 pagesch18 Derivatives and Risk ManagementGonzalo Jr. RualesNo ratings yet

- CISO Sales DeckDocument10 pagesCISO Sales DeckAlessandro PazNo ratings yet

- Risk Management Slides - Part 3Document9 pagesRisk Management Slides - Part 3nhloniphointelligenceNo ratings yet

- Hit Greece EngDocument196 pagesHit Greece EnggoldenmariaNo ratings yet

- Senior Engineer, System Engineering PerformanceDocument5 pagesSenior Engineer, System Engineering PerformanceJohnNo ratings yet

- Public Finance 02Document7 pagesPublic Finance 02Shusanta DevnathNo ratings yet

- Job Order Costing & Process Costing: Seminar QuestionsDocument18 pagesJob Order Costing & Process Costing: Seminar QuestionselmudaaNo ratings yet

- Taxation LawDocument7 pagesTaxation LawAliNo ratings yet

- Banana WarDocument94 pagesBanana Warcendy.rosal17No ratings yet

- GSR2022 Full Report PDFDocument309 pagesGSR2022 Full Report PDFMuhammad Zakky ZulfikarNo ratings yet

- JIS School FeesDocument4 pagesJIS School FeesAgnesNo ratings yet

- KMF BearingDocument126 pagesKMF BearingMechilNo ratings yet

- Sale Deed SumairaDocument4 pagesSale Deed SumairaIbrahim MalikNo ratings yet