Professional Documents

Culture Documents

Metropolis 3R Aug11 2022

Metropolis 3R Aug11 2022

Uploaded by

Arka MitraOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Metropolis 3R Aug11 2022

Metropolis 3R Aug11 2022

Uploaded by

Arka MitraCopyright:

Available Formats

Viewpoint

Metropolis Healthcare Ltd

Disappointing Q1; reverting to sustainable growth path

Powered by the Sharekhan 3R Research Philosophy Pharmaceuticals Sharekhan code: METROPOLIS

3R MATRIX + = -

Reco/View: Positive CMP: Rs. 1,491 Upside potential: 16% â

Result Update

Right Sector (RS) ü á Upgrade Maintain â Downgrade

Right Quality (RQ) ü Summary

Right Valuation (RV) ü Metropolis’ Q1FY23 results were disappointing, marred by weak topline as well as weak

operating performance, due to higher costs and an adverse mix that sharply dragged down

+ Positive = Neutral – Negative margins.

Rising competition with new players entering diagnostics space (leading to possible margin

What has changed in 3R MATRIX pressures), normalisation of test volumes (as share of COVID tests reduces) are the key

factors that would slow down the growth in the near term

Old New Focus on B2C segment, expansion of laboratory and patient service centers and leveraging

of digital platforms to increase penetration would be key long-term growth drivers

RS Though there are apparent near-term challenges the long-term growth outlook stays intact

given the network expansion plans, the focus to grow the lucrative B2C segment. we retain

RQ our positive view on Metropolis Healthcare and expect an upside of 16% from current levels.

RV Metropolis Healthcare’s (Metropolis’) Q1FY23 results were disappointing, marred by weak

topline as well as weak operating performance, due to higher costs and an adverse mix that

sharply dragged down margins. Consequently, PAT declined by double digits and missed

estimates. Intensifying competitive pressures as new players have entered the diagnostic

ESG Disclosure Score NEW space, test mix shifting in favour of non-COVID tests would play near-term dampeners, while

management’s relentless focus on Transformation 3.0 journey, which includes the growing

ESG RISK RATING B2C segment, expansion of laboratory and patient service center network, leveraging digital

Updated Feb 08, 2022

17.87 platforms to increase the penetration would be key long-term growth drivers.

Low Risk Key positives

Non-COVID revenues grew strongly by 26% y-o-y and B2C segment’s revenues are up 28%

NEGL LOW MED HIGH SEVERE y-o-y

0-10 10-20 20-30 30-40 40+ Metropolis added 22 new labs and 631 service centers.

Source: Morningstar Key negatives

OPM contracted by 690 bps y-o-y due to higher employee cost and other expenses and

Company details operating de-leverage.

Management Commentary

Market cap: Rs. 7,631 cr

Metropolis is well on track to execute its expansion plans of adding 90 new labs and 1800

52-week high/low: Rs. 3,579 / 1,377 new service centers across regions in three years.

Given the heightened competitive pressures, adverse text mix and inflationary cost pressures

NSE volume: the margins for FY23 are likely to moderate with management guiding for 27-28% (FY22-

3.4 lakh

(No of shares) 27.9%).

BSE code: 542650 Metropolis expects normalisation to resume and eyes OPM at near pre-COVID levels,

implying an improvement of ~100 bps in Q2. Though after that, some turbulence is expected.

NSE code: METROPOLIS Revision in estimates – Q1FY23 results were disappointing marred by weak topline as well as

weak operating performance, due to higher costs and adverse mix which resulted in a sharp

Free float: drop in margins. Consequently, PAT declined by double digits and missed estimates. Basis this,

2.6 cr we have revised downwards our estimates by 9% / 11% for FY23E and FY24E, respectively.

(No of shares)

Our Call

Shareholding (%) Valuation – Long-term levers intact despite near-term concerns: Metropolis expects a soft

outlook in the near term after a strong performance in FY2022, benefiting from COVID-led

Promoters 49.5 opportunities. Increasing competition with new players entering the diagnostics space (leading

to possible margin pressures), normalization in test volumes (as the share of COVID tests

FII 30.4 reduces) are the key factors that would slow down the growth in the near term, hence FY23 is

expected to be a year of normalisation for Metropolis. At CMP, the stock trades at 42.5x/33.5x

DII 11.4 its FY23E/FY24E EPS. Further, though there are apparent near-term challenges the long-term

growth outlook stays intact given the network expansion plans, the focus to grow the lucrative

Others 8.8 B2C segment and synergies from acquisitions done, hence we retain our positive view on the

stock and expect an upside of 16% from current levels.

Price chart

Key Risks

3700

1) Slowdown in the network expansion plans and higher competitive intensity could impact

3100 growth prospects. 2) Adverse regulatory changes in the form of price capping can affect

earnings.

2500

Valuation (Consolidated) Rs cr

1900 Particulars FY2021 FY2022 FY2023E FY2024E

1300 Total Sales 998.0 1228.3 1362.9 1557.4

Aug-21

Aug-22

Apr-22

Dec-21

Operating Profits 298.0 360.4 378.8 447.3

OPM (%) 28.7 27.9 26.4 27.4

Price performance Reported PAT 183.1 198.8 178.5 226.4

(%) 1m 3m 6m 12m EPS (Rs) 35.8 38.9 34.9 44.3

PER (x) 41.5 38.2 42.5 33.5

Absolute -34.5 -20.7 -46.6 -32.5

EV/Ebidta (x) 24.4 21.5 20.1 16.5

Relative to ROCE (%) 30.2 22.3 18.1 20.7

-29.5 -16.9 -38.0 -38.7

Sensex

RONW (%) 25.9 24.0 18.3 20.6

Sharekhan Research, Bloomberg

Source: Company; Sharekhan estimates

August 11, 2022 1

Viewpoint

Powered by the Sharekhan

3R Research Philosophy

Disappointing quarter; results miss estimates:

Q1FY23 results were disappointing marred by weak topline as well as weak operating performance, due

to higher costs and an adverse mix which resulted in a sharp drop in margins. Consequently, PAT declined

by double digits and missed estimates. The sales at Rs 279.9 crore declined 14.4% y-o-y and are below

estimates. The decline in sales could be attributable to a 8% decline in test volumes and a 7% y-o-y drop in

price per tests. Also the share of COVID led revenues stood at Rs. 12 crore as compared to Rs. 62.5 crore.

Operating profits, at Rs 68.4 crore declined by 33.2% y-o-y and missed estimates. OPM stood at 24.4% which

is decline of 690 bps y-o-y, largely due to change in the tests mix (as the share of COVID-led tests declined

y-o-y). OPM missed estimates. The depreciation for the quarter was higher by 59% y-o-y to Rs 21.1 crore.

Consequently, PAT at Rs. 33.5 crore, declined by 43.3% y-o-y and missed ours and the street’s estimates.

Q1FY2023 Concall highlights

Increased competitive intensity; normalisation of COVID test volumes to pressurise margins: Given the

increasing awareness of wellness testing and overall increasing preference towards home testing, demand

for diagnostics is increasing. Further in order to offer a bundled package which includes – medicines,

tele-consulting and diagnostics all under one roof. The demand for such services is expected to improve

further given the ease of access for the integrated offerings. Health tech players are increasingly showing

interest in foraying into the diagnostics space and acquiring an interest in the diagnostic companies.

Brands like Tata 1MG have been aggressively increasing their footprints across Indian markets and with

aggressive pricing. This in turn is expected to have a cascading impact on the existing players as well as

it could have an adverse impact on OPM. Secondly, with the covid cases easing out, the share of COVID

sales/tests has reduced substantially. The share of COVID-led sales for Q1 stood at 12 crore as compared

to 66% as of Q1FY22. Further given the government’s intervention on the pricing of the COVID-19 tests, the

margins have actually shrunk substantially for the covid tests as compared to the non-COVID tests. Also,

in order to improve its presence / built its brands in the company has been increasingly leveraging digital

platform to connect with the doctors, and patients and also to increase internal efficiencies. Collectively,

while heightened competition is expected to exert pressures on the pricing per tests, the falling share of

COVID tests and its prices point an adverse mix. This coupled with heightened digital spends is expected

to impact OPM, but the management expects the trends to normalize to pre covid times gradually going

ahead, it expects OPM to improve and be at 26-27% for FY23 and FY24. This compares with an OPM of

27.9% reported for FY22.

Aims for incremental share in B2C; higher penetration in focus cities to drive B2C growth: Metropolis

is a well-diversified diagnostic player with a presence across the B2B as well as the B2C segments.

Going ahead, the management is targeting to increase the share of B2C segment in the overall mix and

especially in the focus cities. The share of B2C revenues in focus cities is higher as compared to that of

overall sales. The growth in the B2C sales can be attributed to brand building initiatives, building doctor/

physician relations, increasing penetration in the focus cities and upselling opportunities for wellness

tests and bundled tests to existing as well as new customers. Further, the rising maturity of the patient

service centres in the focus cities also points at ample headroom for growth. Overall, B2C segment

constitutes 60% of the focus city’s sales as of FY22 and the management is aiming to take this up to 65%

going ahead, which bodes well for Metropolis as the B2C segment yields better margins as compared to

the B2B segment. Further along with the B2C to gain an increasing pie of the D2C (Direct 2 Costumer)

segment leveraging the wellness test, Metropolis aims to increase the share of revenues from the wellness

segment to 20% over the next 2 years as compared to 12% in Q1FY23 and 7% in Q1FY22. Increased health

awareness post COVID has resulted in the increased demand for well ness tests and Metropolis intends

to capitalise on the same.

August 11, 2022 2

Viewpoint

Powered by the Sharekhan

3R Research Philosophy

Hitech’s acquisition to push up the share of B2C sales in focus cities: Metropolis has completed the

acquisition of Chennai-based Hitech Diagnostics Center. The acquisition would yield synergies in the form

of a strengthening presence in the focus markets of Chennai and Bengaluru. Also, Hitech has a higher

share of revenues from the B2C segment (~60-65% of revenues) which is in line with Metropolis’ strategy

and would enable Metropolis to increase its share in the B2C segment. Also, the procurement and supply

chain synergies would be accrued to the merged entity. Metropolis plans to add 100 centres under the

Hitech business over the next year and this would enable to materially increase the share of the lucrative

B2C segment. In Q1FY23 the company has added 14 new service centers under Hitech. Over the long

term, management sees further synergies accruing over a three-year span with the chunk of the benefits

accruing in the third year.

On track for expanding network by FY24E: The company operations encompass regional reference

labs, other labs and patient service centres, in addition to a global reference lab. Over FY2017 to FY2021

Metropolis has added around 1,670 patient service centres and 30 new laboratories, which has enabled it

to either tap new geography or fortify its presence in the existing regions. Going ahead, to fuel the growth,

the company has lined up substantial expansion plans, to add ~90 new laboratories and around 1800

new patient service centres over the next three years, starting FY22. As of March 2022, the company

has added 16 labs and has added 509 new patient service centers and in Q1FY23 Metropolis has added

631 service centers and 22 new labs across geographies and expects a faster break even for these new

added centers. A majority of the growth is expected to be driven by the asset light franchise models (92%

of centers and 17% of labs under the asset light model) which enables the company to rapidly scale up its

performance whilst keeping a tab on incremental costs. Overall, investments envisaged for the overall

expansion plan is around 25-35 crore and is on track to add 90 labs and 1800 collection centres over

FY22-FY24 and in FY23 plans to add 30 new labs. Collectively, network expansion is largely driven by

the asset light franchise model and complemented by omni-channel presence, which augurs well for

Metropolis from a growth perspective.

Results (Consolidated) Rs cr

Particulars Q1FY23 Q1FY22 Y-o-Y % Q4FY22 Q-o-Q %

Total Income 279.9 326.8 -14.4 305.9 -8.5

Operating profit 68.4 102.4 -33.2 74.9 -8.6

Other income 3.0 3.8 -19.3 5.7 -46.5

EBIDTA 71.4 106.1 -32.7 80.5 -11.3

Interest 7.5 5.6 33.4 6.1 24.1

Depreciation 21.2 13.3 59.1 18.0 17.7

PBT 42.7 87.2 -51.0 56.5 -24.3

Tax 9.3 28.2 -67.1 16.3 -43.2

Reported PAT 33.5 59.0 -43.3 40.2 -16.6

Margins BPS BPS

OPM (%) 24.4 31.3 -688.7 24.5 -2.9

Net profit margin (%) 12.0 18.1 -610.1 13.1 -116.6

Source: Company; Sharekhan Research

August 11, 2022 3

Viewpoint

Powered by the Sharekhan

3R Research Philosophy

Outlook and Valuation

n Sector View – Indian diagnostics industry to clock double-digit CAGR: With diagnostics services becoming

the cornerstone for recommending requisite treatments, as well as monitoring recovery post treatment, the

industry has posted healthy growth over the past few years. The Indian diagnostics industry has emerged as an

attractive arena in India’s growing healthcare sector. Albeit in FY2021, due to COVID-19, growth in the overall

diagnostics industry slowed. However, going ahead, the industry is expected to register a growth of double

digits. Changes in demographics, rise in lifestyle diseases, higher income levels across all strata of society,

rise in preventive testing, deeper penetration with asset-light expansion, and spread of healthcare services

and insurance are the growth levers for diagnostics markets. In addition to the above, the government’s thrust

on the healthcare sector, launch of National Digital Health Mission coupled with an expected increase in

post-COVID-19 tests for well-being could propel growth of diagnostics players.

n Company Outlook – On a strong growth path: Metropolis, is a leading player in the diagnostics space

with a pan India presence with the South and West Indian regions constituting more than 80% of the overall

sales as of FY2022. Underpinned by strong growth drivers and governments’ focus on healthcare services,

the diagnostics industry is expected to benefit, especially for players such as Metropolis with a pan-India

presence and capabilities to process highly-specialized tests could benefit substantially. Backed by plans to

expand its network, services centres and leveraging digital platforms, the company aims to grow the lucrative

and high margins B2C business. In the focus cities, Metropolis plans to increase the share of B2C revenues

to ~65% from around 60% as of FY22. This would also strengthen Metropolis’ brand position. As of FY2021,

Metropolis has around 125 laboratories pan-India and 2555 service centers, which would be expanded by 90

new laboratories and ~1800 service centers over the next three years. Higher penetration could translate in

to better revenues growth for the company. In addition, Metropolis’ share of revenues from the seeding cities

(8 cities classified as seeding cities) is increasing and given its wide tests portfolio and positive outlook, the

company looks to convert few of the seeding cities to focus cities, where the company has a sizeable market

share. Overall, change in test mix, inflationary cost pressures and heightened competitive pressures coupled

with high base in FY22 points at moderation in growth in FY23E.

n Valuation – Retain Positive View and expect 16% upside: Metropolis expects a soft outlook in the near

term after a strong performance in FY2022, benefiting from COVID-led opportunities. Increasing competition

with new players entering the diagnostics space (leading to possibly margin pressures), normalization in test

volumes (as the share of covid tests reduces) are the key factors that would slow down the growth in the near

term, hence FY23 is expected to be a year of normalisation for Metropolis. Over the long term, management’s

thrust to grow the lucrative B2C segment, expand the network and leverage the digital platform would be

key growth drivers for Metropolis. Metropolis’ Q1FY23 results were disappointing marred by weak topline

as well as weak operating performance, due to higher costs and adverse mix which resulted in a sharp

drop in margins. Consequently, PAT declined by double digits and missed estimates. Basis this we have

revised downwards our estimates by 9% / 11% for FY23E and Fy24E respectively. At CMP, the stock trades at

42.5x/33.5x its FY23E/FY24E EPS. Further, though there are apparent near-term challenges the long-term

growth outlook stays intact given the network expansion plans, the focus to grow the lucrative B2C segment

and synergies from acquisitions, hence we retain our positive view on the stock and expect an upside of 16%

from the current levels.

August 11, 2022 4

Viewpoint

Powered by the Sharekhan

3R Research Philosophy

One-year forward P/E (x) band

90

80

70

60

50

P/E (x)

40

30

20

10

0

Aug-19

Aug-20

Aug-21

Aug-22

Feb-20

Feb-21

Feb-22

P/E (x) Avg. P/E (x) Peak P/E (x) Trough P/E (x)

Source: Company, Sharekhan Research

Peer valuation

CMP O/S P/E (x) EV/EBITDA (x) RoE (%)

MCAP

Particulars (Rs / Shares

(Rs Cr) FY22 FY23E FY24E FY22 FY23E FY24E FY22 FY23E FY24E

Share) (Cr)

Metropolis 1,491.0 5.1 7,631.0 38.2 42.5 33.5 21.5 20.1 16.5 24.0 18.3 20.6

Healthcare

Dr Lal Path Labs* 2434 8.33 20,286 41.3 41.2 52.7 32.6 32.7 26.8 25.0 21.4 23.7

Source: Company, Sharekhan estimates

August 11, 2022 5

Viewpoint

Powered by the Sharekhan

3R Research Philosophy

About company

Metropolis Healthcare (Metropolis), incorporated in 1980, is among the leading diagnostics players in India, with a

dominant share in the country’s western and southern regions. It also has a presence in other countries of South Asia,

Africa and the Middle East. Metropolis offers a comprehensive range of 4,000+ clinical laboratory tests and is among

the leaders. Various test combinations, specific to a disease or disorder and wellness profiles used for health and

fitness screening are a part of the offerings. These tests are used for prediction, early detection, diagnostic screening,

confirmation and/or monitoring of different diseases. It is the third-largest player in the diagnostics space with a presence

across the B2B as well as B2C space and provides tests to individual patients, hospitals, other healthcare providers and

corporates. The company enjoys a loyal customer base, reflecting its strength as a brand offering superior diagnostic

tests and services. Metropolis has a strong presence in the west & South region and is expanding its presence in the

North and the eastern regions. The west accounts for 58% of the overall sales, followed by the South (24%). North and

East regions constitute around 10% and 5% each respectively. As of FY2021, the company has a total of 125 laboratories

including 13 reference labs and 112 other laboratories. Apart from this, the company has around 2555 patient service

centres. Over the years, the company has grown through a mix of the organic and inorganic routes, with the acquisitions

having played a vital part in the growth of Metropolis healthcare.

Investment theme

Metropolis is a leading player in the diagnostics space with a pan India presence with south and west regions constituting

more than 80% of the overall sales as of Fy2021. Underpinned by strong growth drivers and governments’ focus on

healthcare services, the diagnostics industry is expected to benefit, especially players such as Metropolis with a pan

India presence and capabilities to process highly specialized tests could benefit substantially. Backed by plans to

expand its network, services centres and leveraging digital platforms, the company aims to grow the lucrative and high

margins B2C business. As of FY2021, Metropolis has around 125 laboratories pan India and 2555 service centres, which

would be expanded by 90 new laboratories and ~1800 service centres over the next three years. Higher penetration

could translate into better revenue growth for the company. Also Metropolis’ share of revenues from the seeding cities

is up by 2% over the past 2-3 years to 21% as of Fy2021 and on the basis of its wide tests portfolio and positive outlook,

the company looks to convert a few of the seeding cities to focus cities, where the company has a sizeable market share.

Key Risks

Any slowdown in the network expansion plans and higher competitive intensity could impact growth prospects.

Any adverse regulatory changes in the form of price capping can affect the earnings

Additional Data

Key management personnel

Mr Sushil Shah Chairman & Executive Director

Ms Amera Shah Managing Director

Mr Vijendar Singh Chief Executive Officer

Mr Rakesh Agarwal Chief Financial Officer

Source: Company Website

Top 10 shareholders

Sr. No. Holder Name Holding (%)

1 Smallcap world Fund 6.9

2 Capital Group Cos inc 6.9

3 UTI Asset Management Company 4.1

4 Grandeur Peak Global Advisors LLC 4.1

5 Aditya Birla Sunlife Asset Management Co 3.9

6 Bright Star Investment 1.5

7 Vangaurd Group Inc 1.5

8 Wasatch Advisors Inc 1.2

9 Fundsmith LLP 1.1

10 First State Investment ICVC 1.0

Source: Bloomberg

Sharekhan Limited, its analyst or dependant(s) of the analyst might be holding or having a position in the companies mentioned in the article.

August 11, 2022 6

Understanding the Sharekhan 3R Matrix

Right Sector

Positive Strong industry fundamentals (favorable demand-supply scenario, consistent

industry growth), increasing investments, higher entry barrier, and favorable

government policies

Neutral Stagnancy in the industry growth due to macro factors and lower incremental

investments by Government/private companies

Negative Unable to recover from low in the stable economic environment, adverse

government policies affecting the business fundamentals and global challenges

(currency headwinds and unfavorable policies implemented by global industrial

institutions) and any significant increase in commodity prices affecting profitability.

Right Quality

Positive Sector leader, Strong management bandwidth, Strong financial track-record,

Healthy Balance sheet/cash flows, differentiated product/service portfolio and

Good corporate governance.

Neutral Macro slowdown affecting near term growth profile, Untoward events such as

natural calamities resulting in near term uncertainty, Company specific events

such as factory shutdown, lack of positive triggers/events in near term, raw

material price movement turning unfavourable

Negative Weakening growth trend led by led by external/internal factors, reshuffling of

key management personal, questionable corporate governance, high commodity

prices/weak realisation environment resulting in margin pressure and detoriating

balance sheet

Right Valuation

Positive Strong earnings growth expectation and improving return ratios but valuations

are trading at discount to industry leaders/historical average multiples, Expansion

in valuation multiple due to expected outperformance amongst its peers and

Industry up-cycle with conducive business environment.

Neutral Trading at par to historical valuations and having limited scope of expansion in

valuation multiples.

Negative Trading at premium valuations but earnings outlook are weak; Emergence of

roadblocks such as corporate governance issue, adverse government policies

and bleak global macro environment etc warranting for lower than historical

valuation multiple.

Source: Sharekhan Research

Know more about our products and services

For Private Circulation only

Disclaimer: This document has been prepared by Sharekhan Ltd. (SHAREKHAN) and is intended for use only by the person or entity

to which it is addressed to. This Document may contain confidential and/or privileged material and is not for any type of circulation

and any review, retransmission, or any other use is strictly prohibited. This Document is subject to changes without prior notice.

This document does not constitute an offer to sell or solicitation for the purchase or sale of any financial instrument or as an official

confirmation of any transaction. Though disseminated to all customers who are due to receive the same, not all customers may

receive this report at the same time. SHAREKHAN will not treat recipients as customers by virtue of their receiving this report.

The information contained herein is obtained from publicly available data or other sources believed to be reliable and SHAREKHAN

has not independently verified the accuracy and completeness of the said data and hence it should not be relied upon as such. While

we would endeavour to update the information herein on reasonable basis, SHAREKHAN, its subsidiaries and associated companies,

their directors and employees (“SHAREKHAN and affiliates”) are under no obligation to update or keep the information current. Also,

there may be regulatory, compliance, or other reasons that may prevent SHAREKHAN and affiliates from doing so. This document is

prepared for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Recipients

of this report should also be aware that past performance is not necessarily a guide to future performance and value of investments

can go down as well. The user assumes the entire risk of any use made of this information. Each recipient of this document should

make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies

referred to in this document (including the merits and risks involved), and should consult its own advisors to determine the merits and

risks of such an investment. The investment discussed or views expressed may not be suitable for all investors. We do not undertake to

advise you as to any change of our views. Affiliates of Sharekhan may have issued other reports that are inconsistent with and reach

different conclusions from the information presented in this report.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any

locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation

or which would subject SHAREKHAN and affiliates to any registration or licensing requirement within such jurisdiction. The securities

described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession

this document may come are required to inform themselves of and to observe such restriction.

The analyst certifies that the analyst has not dealt or traded directly or indirectly in securities of the company and that all of the

views expressed in this document accurately reflect his or her personal views about the subject company or companies and its or

their securities and do not necessarily reflect those of SHAREKHAN. The analyst and SHAREKHAN further certifies that neither he

or his relatives or Sharekhan associates has any direct or indirect financial interest nor have actual or beneficial ownership of 1% or

more in the securities of the company at the end of the month immediately preceding the date of publication of the research report

nor have any material conflict of interest nor has served as officer, director or employee or engaged in market making activity of the

company. Further, the analyst has also not been a part of the team which has managed or co-managed the public offerings of the

company and no part of the analyst’s compensation was, is or will be, directly or indirectly related to specific recommendations or

views expressed in this document. Sharekhan Limited or its associates or analysts have not received any compensation for investment

banking, merchant banking, brokerage services or any compensation or other benefits from the subject company or from third party

in the past twelve months in connection with the research report.

Either, SHAREKHAN or its affiliates or its directors or employees / representatives / clients or their relatives may have position(s), make

market, act as principal or engage in transactions of purchase or sell of securities, from time to time or may be materially interested

in any of the securities or related securities referred to in this report and they may have used the information set forth herein before

publication. SHAREKHAN may from time to time solicit from, or perform investment banking, or other services for, any company

mentioned herein. Without limiting any of the foregoing, in no event shall SHAREKHAN, any of its affiliates or any third party involved

in, or related to, computing or compiling the information have any liability for any damages of any kind.

Compliance Officer: Ms. Priya Sonavane; Tel: 022–61150000; email id: compliance@sharekhan.com;

For any queries or grievances kindly email igc@sharekhan.com or contact: myaccount@sharekhan.com

Registered Office: Sharekhan Limited, The Ruby, 18th Floor, 29 Senapati Bapat Marg, Dadar (West), Mumbai–400028,

Maharashtra, INDIA, Tel: 022–67502000 / Fax: 022–24327343. Sharekhan Ltd.: SEBI Regn. Nos.: BSE / NSE / MSEI (CASH / F&O

/ CD) / MCX - Commodity: INZ000171337; DP: NSDL/CDSL-IN-DP-365-2018; PMS: INP000005786; Mutual Fund: ARN 20669;

Research Analyst: INH000006183.

Disclaimer: Client should read the Risk Disclosure Document issued by SEBI & relevant exchanges and the T&C on www.sharekhan.com;

Investment in securities market are subject to market risks, read all the related documents carefully before investing.

You might also like

- India Diagnostics Sector 01 Mar 2023Document32 pagesIndia Diagnostics Sector 01 Mar 2023RJNo ratings yet

- Healthcare Global Enterprises: Drivers in Place To Achieve Consistent GrowthDocument9 pagesHealthcare Global Enterprises: Drivers in Place To Achieve Consistent GrowthShArp ,No ratings yet

- Healthcare Global - Initiating Coverage - Axis Sec - 291121Document18 pagesHealthcare Global - Initiating Coverage - Axis Sec - 291121Ravi KumarNo ratings yet

- Axis Securities Sees 33% UPSIDE in CreditAccess Grameen LTD StrongDocument8 pagesAxis Securities Sees 33% UPSIDE in CreditAccess Grameen LTD StrongJerry ZaidiNo ratings yet

- 2020-08, Ambit Insights - Laurus LabsDocument19 pages2020-08, Ambit Insights - Laurus LabsKarthikNo ratings yet

- P.I. Industries (PI IN) : Q1FY20 Result UpdateDocument7 pagesP.I. Industries (PI IN) : Q1FY20 Result UpdateMax BrenoNo ratings yet

- 2016 June Motilal OswalDocument5 pages2016 June Motilal Oswalvalueinvestor123No ratings yet

- Quarterly Update Report Laurus Labs Q1 FY24Document8 pagesQuarterly Update Report Laurus Labs Q1 FY24RAHUL NIMMAGADDANo ratings yet

- ICICI Securities Tarsons Re Initiating CoverageDocument14 pagesICICI Securities Tarsons Re Initiating CoverageGaurav ChandnaNo ratings yet

- ACMELAB Short Equity Note 29012023Document7 pagesACMELAB Short Equity Note 29012023Raihan SobhanNo ratings yet

- Axis Securities Sees 12% UPSIDE in Dalmia Bharat Limited in LineDocument9 pagesAxis Securities Sees 12% UPSIDE in Dalmia Bharat Limited in LinemisfitmedicoNo ratings yet

- TVS Motor Company LTD: ESG Disclosure ScoreDocument7 pagesTVS Motor Company LTD: ESG Disclosure ScorePiyush ParagNo ratings yet

- Suven Pharmaceuticals Topline Declines FocusingDocument4 pagesSuven Pharmaceuticals Topline Declines FocusingKoushik SircarNo ratings yet

- CMP: INR3,210: FY23 AR Analysis - Re-Energising The Core in A Tough TimeDocument14 pagesCMP: INR3,210: FY23 AR Analysis - Re-Energising The Core in A Tough TimeSameer MaradiaNo ratings yet

- HealthCare Global-3R-Sept16 2021Document12 pagesHealthCare Global-3R-Sept16 2021Pragesh SatijaNo ratings yet

- Scientific and Medical Equipment House - Al Rajhi CapitalDocument18 pagesScientific and Medical Equipment House - Al Rajhi Capitalikhan809No ratings yet

- National Medical Care Co - Al Jazira Capital PDFDocument2 pagesNational Medical Care Co - Al Jazira Capital PDFikhan809No ratings yet

- SHAREKHANDocument11 pagesSHAREKHANRajesh SharmaNo ratings yet

- Axis Securities TCS ResultUpdateDocument9 pagesAxis Securities TCS ResultUpdateRakshit JainNo ratings yet

- Jubilant Pharmova 07 06 2021 IciciDocument6 pagesJubilant Pharmova 07 06 2021 IciciBhagwat RautelaNo ratings yet

- SRF LTD Fundamental Monthly PickDocument3 pagesSRF LTD Fundamental Monthly PickAyushi ShahNo ratings yet

- Praj Industries LTD - Q1FY24 Result Update - 28072023 - 28-07-2023 - 11Document8 pagesPraj Industries LTD - Q1FY24 Result Update - 28072023 - 28-07-2023 - 11samraatjadhavNo ratings yet

- IDBI Capital Sees 5% DOWNSIDE in Birlasoft Long Term Growth IntactDocument13 pagesIDBI Capital Sees 5% DOWNSIDE in Birlasoft Long Term Growth IntactmisfitmedicoNo ratings yet

- The Benefits of Diversification: Peoplein (Ppe)Document9 pagesThe Benefits of Diversification: Peoplein (Ppe)Muhammad ImranNo ratings yet

- GSL Goldman 130921 EBRDocument27 pagesGSL Goldman 130921 EBRnitinmuthaNo ratings yet

- BANCO SAFRA MRV & CoDocument7 pagesBANCO SAFRA MRV & CoJoão FrancoNo ratings yet

- Aarti Industries - Company Update - 170921Document19 pagesAarti Industries - Company Update - 170921darshanmaldeNo ratings yet

- TCS RR 12042022 - Retail 12 April 2022 1386121995Document13 pagesTCS RR 12042022 - Retail 12 April 2022 1386121995uefqyaufdQNo ratings yet

- Aarti 3R Aug11 - 2022Document7 pagesAarti 3R Aug11 - 2022Arka MitraNo ratings yet

- Wonderla Holidays - Monarch ReportsDocument9 pagesWonderla Holidays - Monarch ReportsSANDIP MISHRANo ratings yet

- 7204 D&O KENANGA 2023-08-24 SELL 2.30 DOGreenTechnologiesSluggishNewOrders - 167722211Document4 pages7204 D&O KENANGA 2023-08-24 SELL 2.30 DOGreenTechnologiesSluggishNewOrders - 167722211Nicholas ChehNo ratings yet

- Axis_Securities_sees_11%_UPSIDE_in_J_Kumar_Infraprojects_Ltd_CompanyDocument8 pagesAxis_Securities_sees_11%_UPSIDE_in_J_Kumar_Infraprojects_Ltd_Companymanitjainm21No ratings yet

- In For The Long Haul: Initiation: Gland Pharma LTD (GLAND IN)Document31 pagesIn For The Long Haul: Initiation: Gland Pharma LTD (GLAND IN)Doshi VaibhavNo ratings yet

- Wipro - Initiating Coverage - 08122020 - 08-12-2020 - 08Document15 pagesWipro - Initiating Coverage - 08122020 - 08-12-2020 - 08Devaansh RakhechaNo ratings yet

- MAXHEALT 23jun22Document67 pagesMAXHEALT 23jun22addondrive2No ratings yet

- Syngene International: Discovery Services Driving Growth Outlook UpbeatDocument11 pagesSyngene International: Discovery Services Driving Growth Outlook Upbeatsanketsabale26No ratings yet

- SCMA - The Worst Might Be OverDocument5 pagesSCMA - The Worst Might Be OverBrilliant Indra KNo ratings yet

- Aavas Financiers: Credit Growth Gaining Traction IT Transformation Happening As PlannedDocument10 pagesAavas Financiers: Credit Growth Gaining Traction IT Transformation Happening As PlannedrakeshNo ratings yet

- Kirloskar 3R Feb10 2023Document7 pagesKirloskar 3R Feb10 2023sushant panditaNo ratings yet

- About Syngene InternationalDocument15 pagesAbout Syngene Internationalalkanm750No ratings yet

- Ipca 3R Aug11 - 2022Document7 pagesIpca 3R Aug11 - 2022Arka MitraNo ratings yet

- Maxis BHD Market Perform : 1HFY20 Within ExpectationsDocument4 pagesMaxis BHD Market Perform : 1HFY20 Within ExpectationsSarah AriffNo ratings yet

- Valiant Organics LTD.: Eureka in The LabDocument11 pagesValiant Organics LTD.: Eureka in The LabAJNo ratings yet

- Max Healthcare - ARA - HSIE-202109271256551024709Document24 pagesMax Healthcare - ARA - HSIE-202109271256551024709Prajwal WakhareNo ratings yet

- Technologies+ +greshmaDocument6 pagesTechnologies+ +greshmaParin GalaNo ratings yet

- Top Glove Corporation: Malaysia Company GuideDocument13 pagesTop Glove Corporation: Malaysia Company GuideAshokNo ratings yet

- DolatCapitalMarketPvtLtd MPS-Q2FY22ResultUpdate (Buy) Oct 31 2021Document10 pagesDolatCapitalMarketPvtLtd MPS-Q2FY22ResultUpdate (Buy) Oct 31 2021Reshmi GanapathyNo ratings yet

- Bluedart Express: Strategic Investments Continue To Weigh On MarginsDocument9 pagesBluedart Express: Strategic Investments Continue To Weigh On MarginsYash AgarwalNo ratings yet

- DCB Bank Limited: Investing For Growth BUYDocument4 pagesDCB Bank Limited: Investing For Growth BUYdarshanmadeNo ratings yet

- FY2024AnalystPresL&T Q1FY24 Analyst PresentationDocument32 pagesFY2024AnalystPresL&T Q1FY24 Analyst PresentationSHREYA NAIRNo ratings yet

- Investor's Eye: December 22, 2020Document21 pagesInvestor's Eye: December 22, 2020Juan Daniel Garcia VeigaNo ratings yet

- ICICI Securities Tata Power Company UpdateDocument10 pagesICICI Securities Tata Power Company UpdateRojalin SwainNo ratings yet

- Pentamaster 4QCY21Document5 pagesPentamaster 4QCY21nishio fdNo ratings yet

- Redknee Solutions Inc. Write-UpDocument4 pagesRedknee Solutions Inc. Write-Upjohnny_alves7No ratings yet

- Cognizant Q2 2017 Earnings Supplement FinalDocument11 pagesCognizant Q2 2017 Earnings Supplement FinalBela SoniNo ratings yet

- Succeeding As A Telecom Challenger: Beyond MainstreamDocument12 pagesSucceeding As A Telecom Challenger: Beyond MainstreamdereklmsitNo ratings yet

- ISGEC Q1 Result UpdateDocument6 pagesISGEC Q1 Result UpdateAryan SharmaNo ratings yet

- Shareholder Deck Q1 2023 FINALDocument34 pagesShareholder Deck Q1 2023 FINALBrandon Gonzalez cNo ratings yet

- Humanica Company Ipo ReportDocument15 pagesHumanica Company Ipo ReportVk VirataNo ratings yet

- Agile Procurement: Volume II: Designing and Implementing a Digital TransformationFrom EverandAgile Procurement: Volume II: Designing and Implementing a Digital TransformationNo ratings yet

- Sobha 3R Aug11 - 2022Document7 pagesSobha 3R Aug11 - 2022Arka MitraNo ratings yet

- Pidilite 3R Aug11 2022Document8 pagesPidilite 3R Aug11 2022Arka MitraNo ratings yet

- Ipca 3R Aug11 - 2022Document7 pagesIpca 3R Aug11 - 2022Arka MitraNo ratings yet

- CuminsIndia 3R Aug11 2022Document7 pagesCuminsIndia 3R Aug11 2022Arka MitraNo ratings yet

- Ashoka Buidcon 3R Aug11 2022Document7 pagesAshoka Buidcon 3R Aug11 2022Arka MitraNo ratings yet

- Aarti 3R Aug11 - 2022Document7 pagesAarti 3R Aug11 - 2022Arka MitraNo ratings yet

- Commodities-Daily Technical ReportDocument7 pagesCommodities-Daily Technical ReportArka MitraNo ratings yet

- Central Nervous SystemDocument16 pagesCentral Nervous SystemArka MitraNo ratings yet

- General Surgery Questions: Chandra RayidiDocument42 pagesGeneral Surgery Questions: Chandra RayidiArka MitraNo ratings yet

- Most Market Outlook: Morning UpdateDocument9 pagesMost Market Outlook: Morning UpdateArka MitraNo ratings yet

- 5 6154586374507856628 PDFDocument1 page5 6154586374507856628 PDFArka MitraNo ratings yet

- Atmanirbhar Bharat Package 3.0: 12 November 2020 Ministry of FinanceDocument26 pagesAtmanirbhar Bharat Package 3.0: 12 November 2020 Ministry of FinanceArka MitraNo ratings yet

- Usdinr: Technical OutlookDocument5 pagesUsdinr: Technical OutlookArka MitraNo ratings yet

- Usdinr: Technical OutlookDocument5 pagesUsdinr: Technical OutlookArka MitraNo ratings yet

- Squirrels of Indian SubcontinentDocument14 pagesSquirrels of Indian SubcontinentAkshay MotiNo ratings yet

- Abcp Offering CircularDocument2 pagesAbcp Offering Circulartom99922No ratings yet

- La Bugal V RamosDocument141 pagesLa Bugal V Ramosabo8008No ratings yet

- Gayatri MantraDocument2 pagesGayatri MantraAnandh ShankarNo ratings yet

- Group2 Non Executive ResultsDocument3 pagesGroup2 Non Executive ResultsGottimukkala MuralikrishnaNo ratings yet

- NARA T733 R4 Guide 60 PDFDocument140 pagesNARA T733 R4 Guide 60 PDFKurt MeyerNo ratings yet

- (Lovebook care - Anh) Đề thi thử THPTQG trường THPT Chuyên Cao Bằng lần 1Document16 pages(Lovebook care - Anh) Đề thi thử THPTQG trường THPT Chuyên Cao Bằng lần 1Dương Viết ĐạtNo ratings yet

- Đề Số 6Document6 pagesĐề Số 6tungcamap2006No ratings yet

- B1.1-Self-Study Đã Sài XongDocument5 pagesB1.1-Self-Study Đã Sài XongVy CẩmNo ratings yet

- CHAPTER 2 Understanding LanguageDocument14 pagesCHAPTER 2 Understanding LanguageKarl Lennard CortezNo ratings yet

- My Job at The Crescent Falls Diner and EssayDocument6 pagesMy Job at The Crescent Falls Diner and EssayAsya Faudhatul InayyahNo ratings yet

- Adhd Add Individualized Education Program GuideDocument40 pagesAdhd Add Individualized Education Program Guidelogan0% (1)

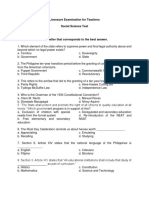

- Licensure Examination For TeachersDocument14 pagesLicensure Examination For Teachersonin saspaNo ratings yet

- Enterprise Resource PlanningDocument20 pagesEnterprise Resource Planningapi-3831939No ratings yet

- What A Body Can DoDocument26 pagesWhat A Body Can DoMariana Romero Bello100% (1)

- I Love Algorithms - Machine Learning CardsDocument6 pagesI Love Algorithms - Machine Learning CardsCarlos Manuel Ventura MatosNo ratings yet

- Prince Ganai NuclearDocument30 pagesPrince Ganai Nuclearprince_ganaiNo ratings yet

- B412 TM Vol 1 Bell 412 EPDocument288 pagesB412 TM Vol 1 Bell 412 EPAri100% (1)

- HetzerDocument4 pagesHetzerGustavo Urueña ANo ratings yet

- ARMSTRONG-Introduction To The Study of Organic Chemistry-The Chemistry of Carbon and Its Compounds (1 Ed) (1874) PDFDocument371 pagesARMSTRONG-Introduction To The Study of Organic Chemistry-The Chemistry of Carbon and Its Compounds (1 Ed) (1874) PDFJuanManuelAmaroLuisNo ratings yet

- Lesson Plans For English Form 5Document2 pagesLesson Plans For English Form 5Hajar Binti Md SaidNo ratings yet

- Permanent Hair Dye ColorantsDocument37 pagesPermanent Hair Dye ColorantsAntonio Perez MolinaNo ratings yet

- Marketing Approach To Promoting Banking ServicesDocument8 pagesMarketing Approach To Promoting Banking Servicessubbaiah aNo ratings yet

- Maestro 2 Manual Eng2Document16 pagesMaestro 2 Manual Eng2danielinigobanosNo ratings yet

- Routing CodesDocument4 pagesRouting CodesScribdTranslationsNo ratings yet

- 1999 Aversion Therapy-BEDocument6 pages1999 Aversion Therapy-BEprabhaNo ratings yet

- Renesas Application Note AN1340Document6 pagesRenesas Application Note AN1340Rip_BarNo ratings yet

- Final NHD Annotated BibliographyDocument7 pagesFinal NHD Annotated Bibliographyapi-616585007No ratings yet

- Invitation & RepliesDocument36 pagesInvitation & Repliesap831884No ratings yet

- ManualOperacion SerialCommunicationsUnits PDFDocument739 pagesManualOperacion SerialCommunicationsUnits PDFSergio Eu CaNo ratings yet