Professional Documents

Culture Documents

2022 Guj

2022 Guj

Uploaded by

javed rehmanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2022 Guj

2022 Guj

Uploaded by

javed rehmanCopyright:

Available Formats

Subject: Principles of Accounting Part: I Board: Punjab Board

Chapter No.: 6 Chapter Name: Bills of Exchange

Topic: Bills of Exchange Sub Topic: Bill retained and Honored

Board: Gujranwala Year: 2022 Group:

Long Question:

Q. On 1st June 2012, Kashif sold goods to Shakeel for Rs.7,000 on credit. Kashif drew a bill on Shakeel for

three months which was accepted by the Shakeel and returned it Kashif. On due date Shakeel met his

acceptance.

Required: Show entries in the books of Kashif and Shakeel.

Answer:

Kashif’s Journal

L Debit Credit

Date Particulars

F (Rs.) (Rs.)

2012 Shakeel Account --------------------------------------Dr. 7,000

June. 1 Sales Account 7,000

(Goods sold on credit)

Jan. 1 Bill receivable Account ----------------------------- Dr. 7,000

Shakeel Account 7,000

(Acceptance received for 3 months)

Sep. 4 Cash Account -----------------------------------------Dr. 7,000

Bill receivable Account

(Bill honored) 7,000

Shakeel’s Journal

L Debit Credit

Date Particulars

F (Rs.) (Rs.)

2012 Purchases Account -------------------------------------- 7,000

Dr.

June. 1 7,000

Kashif Account

(Goods bought on credit)

June.1 Kashif Account ------------------------------------------ 7,000

Dr.

7,000

Bill payable Account

(Acceptance given)

Sep. 4 Bill payable Account ---------------------------------- Dr. 7,000

Cash Account 7,000

(Amount of bill paid)

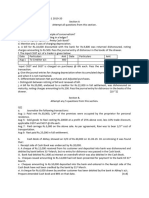

Q. From the following, Prepare Bank reconciliation statement :

1. Balance as per Cash book Rs.33,000.

2. Cheque deposited into bank Rs.4,000 but not cleared.

3. Cheque issued but not presented Rs.2,000.

4. A customer directly deposited Rs.1,000 into bank but not recorded in cash book.

5. Bank service charges debited by bank Rs.200.

Mr.--------------

Bank reconciliation statement

As

Debit Credit

Date Particulars

(Rs.) (Rs.)

Balance as per Cash book 33,000

Cheque deposited into bank but not cleared. 4,000

Cheque issued but not presented. 2,000

A customer directly deposited into bank but not recorded 1,000

in cash book.

200

Bank service charges debited by bank.

Balance as per Pass book

31,800

36,000 36,000

on---------

Subject: Principles of Accounting Part: I Board: Punjab Board

Chapter No.: 6 Chapter Name: Bills of Exchange

Topic: Bills of Exchange Sub Topic: Bill Discounted

Board: Faisalabad Year: 2022 Group:

Long Question:

Imran sold goods to Anwer on credit on 1st March,2020 for Rs.20,000. Imran drew a 3 months bill for the same

amount on Anwer. Anwer accepted the bill and returned to Imran. On 4th March 2020, Imran discounted the

bill from bank for Rs.19,000. On the due date bill is paid.

Required: Record the Journal entries in the books of Imran and Anwer.

Answer:

Imran’s Journal

L Debit Credit

Date Particulars

F (Rs.) (Rs.)

2020 Anwer Account --------------------------------------Dr. 20,000

Mar.1 Sales Account 20,000

(Goods sold on credit)

Mar.1 Bill receivable Account ----------------------------- Dr. 20,000

Anwer Account 20,000

(Acceptance received for 3 months)

June. 4 Bank Account -----------------------------------------Dr. 19,000

Discount Account ------------------------------------Dr. 1,000

Bill receivable Account 20,000

(Bill discounted)

Anwer’s Journal

L Debit Credit

Date Particulars

F (Rs.) (Rs.)

2020 Purchases Account -------------------------------------- 20,000

Dr.

Mar.1 20,000

Imran Account

(Goods bought on credit)

Mar.1 Imran Account ------------------------------------------Dr. 20,000

Bill payable Account 20,000

(Acceptance given)

June. 4 Bill payable Account ---------------------------------- Dr. 20,000

Cash Account 20,000

(Amount of bill paid)

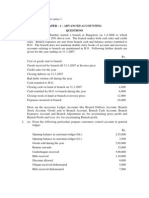

Bank balance as per Cash book 50,000

Cheque deposited into the bank but not yet credited 15,000

Q. From the

Cheque issued but not presented 10,000

Interest credited by bank but not recorded in cash book 500

Bank charges debited by the bank but not recorded in 100

cash book

The bank debited the account for service charges

275

Bank balance as per Pass book. (Cr.)

45,125

60,500 60,500

following, Prepare Bank reconciliation statement of Ahmad and Bros.:

(i) Bank balance as per Cash book Rs.50,000

(ii) Cheque deposited into the bank but not yet credited Rs.15,000

(iii) Cheque issued but not presented Rs.10,000

(iv) Interest credited by bank but not recorded in cash book Rs.500

(v) Bank charges debited by the bank but not recorded in cash book Rs.100

(vi) The bank debited the account for service charges Rs.275

Ahmad and bros.

Bank reconciliation statement

As on --------------

You might also like

- Principles of Microeconomics 8Th Asia Pacific Edition Joshua Gans All ChapterDocument67 pagesPrinciples of Microeconomics 8Th Asia Pacific Edition Joshua Gans All Chapterdavid.reese553100% (9)

- Food Service Organizations A Managerial and Systems Approach 8th Edition Gregoire Test BankDocument12 pagesFood Service Organizations A Managerial and Systems Approach 8th Edition Gregoire Test BankDeanPetersrpmik100% (16)

- Acc CH2Document4 pagesAcc CH2Trickster TwelveNo ratings yet

- 1 Accounting For Merchandising BusinessDocument23 pages1 Accounting For Merchandising BusinessKhay2 ManaliliDelaCruz100% (1)

- General Journal 05-09-23Document20 pagesGeneral Journal 05-09-23Tariq IqbalNo ratings yet

- Ednovate CAF Accounts UT 1 QDocument3 pagesEdnovate CAF Accounts UT 1 QROCKYNo ratings yet

- 11 Accounts Final First Assessment 1Document4 pages11 Accounts Final First Assessment 1khush marooNo ratings yet

- SolutionDocument23 pagesSolutionKavita WadhwaNo ratings yet

- Processing Accounting Information: QuestionsDocument57 pagesProcessing Accounting Information: QuestionsYousifNo ratings yet

- Baf1201 Financial Accounting I CatDocument5 pagesBaf1201 Financial Accounting I CatcyrusNo ratings yet

- Section A (Multiple Choice) : Unit-1,2,3 (Basic Accounting)Document10 pagesSection A (Multiple Choice) : Unit-1,2,3 (Basic Accounting)Magnolia KhineNo ratings yet

- Fundamentals of Financial AccountingDocument9 pagesFundamentals of Financial AccountingEmon EftakarNo ratings yet

- Class 11 Final MTSSDocument7 pagesClass 11 Final MTSSPranshu AgarwalNo ratings yet

- Accountancy 17Document12 pagesAccountancy 17Manav GargNo ratings yet

- Cash and Cash EquivalentsDocument4 pagesCash and Cash EquivalentsJohn Michael SorianoNo ratings yet

- MULTIPLE CHOICES-answer KeyDocument7 pagesMULTIPLE CHOICES-answer KeyLiaNo ratings yet

- Blossems Convent School CLASS: 11 Commerce Group Subject: Accoutancy Holidays AssignmentDocument3 pagesBlossems Convent School CLASS: 11 Commerce Group Subject: Accoutancy Holidays AssignmentPawanpreet KaurNo ratings yet

- Section "B" (Short-Answer Questions) (30 Marks) : Government Boys Degree College (M) Gulistan-E-Johar, KarachiDocument4 pagesSection "B" (Short-Answer Questions) (30 Marks) : Government Boys Degree College (M) Gulistan-E-Johar, KarachiArshad KhanNo ratings yet

- Sr. No Course Outline Topics: Chapter - 7 Bank Reconciliation Statement (BRS)Document11 pagesSr. No Course Outline Topics: Chapter - 7 Bank Reconciliation Statement (BRS)muhammad zainNo ratings yet

- Incomplete Records QDocument34 pagesIncomplete Records Qcharliedry1920No ratings yet

- SAMPLE PAPER - (Solved) : For Examination March 2017Document13 pagesSAMPLE PAPER - (Solved) : For Examination March 2017ankush yadavNo ratings yet

- 4 5805514475188521062Document3 pages4 5805514475188521062eferem100% (6)

- Module 6 P2 Internal Control - BSA & BSMADocument14 pagesModule 6 P2 Internal Control - BSA & BSMAramosmikay0222No ratings yet

- INTERMEDIATE ACCOUNTING 1 EditedDocument18 pagesINTERMEDIATE ACCOUNTING 1 EditedApril Mae LomboyNo ratings yet

- Journal Ledger & Trial BalanceDocument11 pagesJournal Ledger & Trial BalanceTushar SahuNo ratings yet

- 16772BRSDocument47 pages16772BRSSketch KathayatNo ratings yet

- Assignment On Chapter 5 Cash Ad ReceivablesDocument3 pagesAssignment On Chapter 5 Cash Ad Receivablesdameregasa08No ratings yet

- Sample Paper For Class 11 Accountancy Set 1 QuestionsDocument6 pagesSample Paper For Class 11 Accountancy Set 1 Questionsrenu bhattNo ratings yet

- CashDocument6 pagesCashrosemariesollegue888No ratings yet

- Sample Paper Commerce Class 11th CBSEDocument6 pagesSample Paper Commerce Class 11th CBSEShreyansh DhruwNo ratings yet

- Gradable Assignment (30 Marks) : Subject: MAA Marks: 30 Prof. Lakshmi NarasimhanDocument4 pagesGradable Assignment (30 Marks) : Subject: MAA Marks: 30 Prof. Lakshmi NarasimhanNaveen KumarNo ratings yet

- VU Accounting Lesson 27Document5 pagesVU Accounting Lesson 27ranawaseemNo ratings yet

- Lecture 4Document44 pagesLecture 4Tanveer AhmedNo ratings yet

- Q2 FAR0 - 1st Sem 2019 20Document2 pagesQ2 FAR0 - 1st Sem 2019 20Ceejay Cruz TusiNo ratings yet

- SLLC - 2021 - Acc - Review Question - Set 05Document6 pagesSLLC - 2021 - Acc - Review Question - Set 05Chamela MahiepalaNo ratings yet

- 11 QP Final (2021-22)Document4 pages11 QP Final (2021-22)Flick OPNo ratings yet

- MAA AssignmentDocument2 pagesMAA AssignmentVineela PathapatiNo ratings yet

- Bank ReconciliationDocument4 pagesBank ReconciliationSimra RiyazNo ratings yet

- Accounting For Managers Model Question Paper-2: First Semester MBA Degree ExaminationDocument5 pagesAccounting For Managers Model Question Paper-2: First Semester MBA Degree ExaminationRohan Chaugule0% (1)

- Module 6 Part 2 Internal ControlDocument15 pagesModule 6 Part 2 Internal ControlKRISTINA CASSANDRA CUEVASNo ratings yet

- Classroom Exercises On Receivables AnswersDocument4 pagesClassroom Exercises On Receivables AnswersJohn Cedfrey Narne100% (1)

- CA Foundation Paper 1 Principles and Practice of Accounting SADocument24 pagesCA Foundation Paper 1 Principles and Practice of Accounting SAavula Venkatrao100% (1)

- Accounting Questions 27.04.2022Document5 pagesAccounting Questions 27.04.2022psree7281No ratings yet

- Accounting BooksDocument14 pagesAccounting BooksJamie ApostolNo ratings yet

- Template - Revision Exercise 1Document5 pagesTemplate - Revision Exercise 1Vimbai NyakudangaNo ratings yet

- Accounts Paper Class 11 Sem 1 2019Document4 pagesAccounts Paper Class 11 Sem 1 2019samarthj.9390No ratings yet

- Coc Level 3 4TH RoundDocument15 pagesCoc Level 3 4TH Roundsolomon asfawNo ratings yet

- 11 Accountancy Lyp 2015 16 Set1Document10 pages11 Accountancy Lyp 2015 16 Set1biswajitbose40No ratings yet

- FAR - Final Preboard CPAR 92Document14 pagesFAR - Final Preboard CPAR 92joyhhazelNo ratings yet

- 5 D35 J1 XIzyh 2 HN 4 C OI59 N PVLG ISz 8 e Re CG TOm UTGbm WHWD WYhthrce 0Document14 pages5 D35 J1 XIzyh 2 HN 4 C OI59 N PVLG ISz 8 e Re CG TOm UTGbm WHWD WYhthrce 0ramosmikay0222No ratings yet

- Home Assinment 2021-22new Microsoft Office Word DocumentDocument4 pagesHome Assinment 2021-22new Microsoft Office Word DocumentGanesh AdhalraoNo ratings yet

- Delhi Pubic School, Nacharam Accountancy - Xi Question BankDocument9 pagesDelhi Pubic School, Nacharam Accountancy - Xi Question BanklasyaNo ratings yet

- Journal To Trial BalanceDocument19 pagesJournal To Trial BalanceIrfan Ul HaqNo ratings yet

- LHU8Q Olopr DaisyAcountXIDocument35 pagesLHU8Q Olopr DaisyAcountXIDido MuczNo ratings yet

- Date: 06-03-2021 Subject:Book Keeping & Time: 3 Hrs. Class:XII Com Marks: 80 Syllabus: Full SyllabusDocument5 pagesDate: 06-03-2021 Subject:Book Keeping & Time: 3 Hrs. Class:XII Com Marks: 80 Syllabus: Full SyllabusPranit PanditNo ratings yet

- Test PaperDocument27 pagesTest PaperAnand BandhuNo ratings yet

- Unit 2: Ledgers: Learning OutcomesDocument12 pagesUnit 2: Ledgers: Learning OutcomesTanya100% (1)

- Advanced Accounting Keybook Solution Sohail Afzal PDFDocument206 pagesAdvanced Accounting Keybook Solution Sohail Afzal PDFMuhammad Rehan100% (2)

- P6 June 2023 SY23Document5 pagesP6 June 2023 SY23Shivam GuptaNo ratings yet

- Account Past Questions Compilation (2009june - 2022 June)Document319 pagesAccount Past Questions Compilation (2009june - 2022 June)Arjun AdhikariNo ratings yet

- Assigment BBM Finacial AccountingDocument6 pagesAssigment BBM Finacial Accountingtripathi_indramani5185No ratings yet

- New Doc 07-25-2022 09.06Document28 pagesNew Doc 07-25-2022 09.06javed rehmanNo ratings yet

- Bs English 4th QuizDocument1 pageBs English 4th Quizjaved rehmanNo ratings yet

- New Doc 07-20-2022 11.16Document21 pagesNew Doc 07-20-2022 11.16javed rehmanNo ratings yet

- Pakistan StudiesDocument16 pagesPakistan Studiesjaved rehmanNo ratings yet

- O Key Comp - ExamDocument1 pageO Key Comp - Examjaved rehmanNo ratings yet

- Pakistan StudiesDocument19 pagesPakistan Studiesjaved rehmanNo ratings yet

- BBA 7thDocument1 pageBBA 7thjaved rehmanNo ratings yet

- BBA 5thDocument1 pageBBA 5thjaved rehmanNo ratings yet

- Test 1Document7 pagesTest 1javed rehmanNo ratings yet

- English QB 8 (C)Document3 pagesEnglish QB 8 (C)javed rehmanNo ratings yet

- Banking Db-1Document3 pagesBanking Db-1javed rehmanNo ratings yet

- (C) Coal 2. Best Quality of Coal Is: (D) Anthracite 3. Types of Coal in The World Are: (C) 4Document12 pages(C) Coal 2. Best Quality of Coal Is: (D) Anthracite 3. Types of Coal in The World Are: (C) 4javed rehmanNo ratings yet

- O Objective-Converted-MergedDocument16 pagesO Objective-Converted-Mergedjaved rehmanNo ratings yet

- BIR Ruling DA - (C-267) 672-09Document3 pagesBIR Ruling DA - (C-267) 672-09Marlene TongsonNo ratings yet

- PM BECKER Mock 1 Que.Document14 pagesPM BECKER Mock 1 Que.SHIVAM BARANWALNo ratings yet

- ECO 501 - Assignment 5Document2 pagesECO 501 - Assignment 5NAVID ANJUM KHANNo ratings yet

- History of ShezanDocument5 pagesHistory of ShezanammmmmiNo ratings yet

- Lonkham Boruah - Geography - UG II Sem (HC) - Age-Sex StructureDocument8 pagesLonkham Boruah - Geography - UG II Sem (HC) - Age-Sex Structure3056 KuldeepNo ratings yet

- Case Study - 1 A-Strategic - Deep-Dive-Into-Pricing-To-Capture-Unrealized-Profit-Across-Business-Units-2020Document2 pagesCase Study - 1 A-Strategic - Deep-Dive-Into-Pricing-To-Capture-Unrealized-Profit-Across-Business-Units-2020Dr.Lalitha B S “Dr.LalithaBS SSMRV” SSMRVNo ratings yet

- Agility To Action: Operationalizing A Value-Driven Agile BlueprintDocument5 pagesAgility To Action: Operationalizing A Value-Driven Agile BlueprintdlokNo ratings yet

- PC AccountingDocument15 pagesPC AccountingDianne SantiagoNo ratings yet

- PunjabDocument441 pagesPunjabAmit Mishra100% (1)

- IEX MarketDocument23 pagesIEX MarketSuvam PatelNo ratings yet

- Market-Presentation-Honey en 0Document20 pagesMarket-Presentation-Honey en 0fanni921No ratings yet

- Module 2 (Sales Organization)Document77 pagesModule 2 (Sales Organization)Sarthak YadavNo ratings yet

- Deputation PolicyDocument38 pagesDeputation PolicyHumayoun Ahmad FarooqiNo ratings yet

- Lect11 PDFDocument18 pagesLect11 PDFHanamant HunashikattiNo ratings yet

- How Do You Account For That - Oracle Payables 11iDocument18 pagesHow Do You Account For That - Oracle Payables 11iJasbir WarringNo ratings yet

- 02 Questions F3 INT LRPDocument54 pages02 Questions F3 INT LRPshabiumer100% (1)

- WEEK6LESSONTCWDocument30 pagesWEEK6LESSONTCWEmily Despabiladeras DulpinaNo ratings yet

- Module 1 APPLIED ECONOMICSDocument15 pagesModule 1 APPLIED ECONOMICSJamaicka Hawili100% (2)

- Usaid Ict Assessment InsDocument139 pagesUsaid Ict Assessment InsbudimahNo ratings yet

- SITXMGT001 Student Assessment Task 1 Subeen ShresthaDocument47 pagesSITXMGT001 Student Assessment Task 1 Subeen ShresthaRamesh Adhikari100% (3)

- Lagura - Ass04 Statement of Comprehensive IncomeDocument7 pagesLagura - Ass04 Statement of Comprehensive IncomeShane LaguraNo ratings yet

- Pricing - Chapter 5Document26 pagesPricing - Chapter 5tmpk1973No ratings yet

- Demonstra??es Financeiras em Padr?es InternacionaisDocument73 pagesDemonstra??es Financeiras em Padr?es InternacionaisKlabin_RINo ratings yet

- Slide6 CapBud Risk AnalysisDocument82 pagesSlide6 CapBud Risk AnalysisFaisal KarimNo ratings yet

- KS Pulp Partnership DeedDocument4 pagesKS Pulp Partnership Deedatul guptaNo ratings yet

- Co-Operative Banking ProjecT2Document38 pagesCo-Operative Banking ProjecT2manindersingh9490% (1)

- 1.04 Probability Trees and Conditional ExpectationsDocument14 pages1.04 Probability Trees and Conditional ExpectationsThe SpectreNo ratings yet

- Bloomberg Apalla RPDocument52 pagesBloomberg Apalla RPRalph ApallaNo ratings yet