Professional Documents

Culture Documents

8 - FRM Question Bank - MID-2 Modified

8 - FRM Question Bank - MID-2 Modified

Uploaded by

Deva BeharaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

8 - FRM Question Bank - MID-2 Modified

8 - FRM Question Bank - MID-2 Modified

Uploaded by

Deva BeharaCopyright:

Available Formats

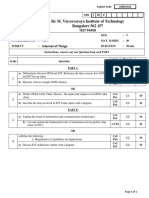

VIGNAN’S INSTITUTE OF INFORMATION TECHNOLOGY (A)

Name of the Subject : FINANCIAL RISK MANAGEMENT

Subject Code : 3099192253

Name of the Faculty: Srinu Madem Designation: Asst. Prof.

EMAIL : srinu.mbafin@gmail.com Phone No: 9440991310 Experience: 13 Years

2020 ADMITTED BATCH MBA (VR19) II Year- II Semester

QUESTION BANK FOR MID-2 EXAMS

UNIT –III

Level

of

Marks

Q. No Essay type Questions Bloom CO

(10 M)

Taxon

omy

1 What do you understand by hedging with suitable examples? L2 CO-2 10 M

2 Differentiate between hedging and Speculation L1 CO-2 10 M

3 What do you understand by Options and Options Market? L2 CO-2 10 M

Explain its significance in financial market?

4A What is the role of derivative securities to manage risk and L3 CO-2 10 M

exploit opportunities to enhance returns?

4B What is the difference between cash and physical delivery for L3 CO-2 10 M

future contract?

UNIT –IV

Level

of

Marks

Q. No Essay type Questions Bloom CO

(10 M)

Taxon

omy

1 Why does a bank become economically insolvent, if its net L2 CO-3 10 M

worth turns negative?

2 Who are the players and participants in the derivative market? L3 CO-3 10 M

3 Elucidate RBI guidelines for asset liability management L2 CO-3 10 M

4 Explain the overview of Risk management in Banks and L3 CO-3 10 M

regulatory framework

5 Explain the organizational structure for Market and Credit Risk L2 CO-3 10 M

6 Discuss the role of SEBI in risk management in securities L3 CO-3 10 M

market in India

7 Discuss the role of NHB in Housing Finance market in India L3 CO-3 10 M

8 What is Bank of International Settlement and explain its L3 CO-3 10 M

objectives and scope

9 What are the objectives of SEBI and explain L3 CO-3 10 M

10 What are the objectives of NHB and explain L3 CO-3 10 M

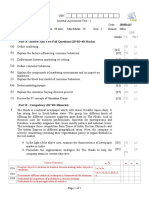

UNIT –V

Level

of

Marks

Q. No Essay type Questions Bloom CO

(10 M)

Taxon

omy

1 Explain the advanced Bond concepts of Risk Management L3 CO-4 10 M

2 Discuss about Black-Scholes Model of option pricing L3 CO-4 10 M

3 Explain Moody’s KMV portfolio manager L2 CO-4 10 M

4 Discuss the Future scenario of risk management in derivates L3 CO-4 10 M

5 Explain 1) Bond Duration 2) Yield to Maturity 3) Current Yield L3 CO-4 10 M

6 How do you calculate Value at Risk (VaR) using Manta Carlo L1 CO-4 10 M

Simulation approach?

7 Discuss the assumptions of Black-Scholes Model L1 CO-4 5M

8 Explain all the variables in Black-Scholes Model L2 CO-4 5M

9 Explain the advantages and Disadvantages of Black-Scholes Model L2 CO-4 5M

10 Describe the participants of Derivatives market in India L2 CO-4 5M

FACULTY NAME & SIGN HOD-MBA

You might also like

- Question bank-BBA 208-Income Tax by Dr. Preeti JindalDocument2 pagesQuestion bank-BBA 208-Income Tax by Dr. Preeti JindalDrPreeti JindalNo ratings yet

- CSE 2-2 MEFA Mid 2 QPDocument2 pagesCSE 2-2 MEFA Mid 2 QPlovelynani792No ratings yet

- TLP Brand Management AY 2022-23Document7 pagesTLP Brand Management AY 2022-23Amar PatroNo ratings yet

- Ia-2 Me QPDocument2 pagesIa-2 Me QPDeepa SamiyappanNo ratings yet

- 16mb750-Managerial Economics and Financial AnalysisDocument8 pages16mb750-Managerial Economics and Financial AnalysisKishan KumarNo ratings yet

- C++ Mid-1Document2 pagesC++ Mid-1Prasanna LathaNo ratings yet

- Assignment - MarketingDocument1 pageAssignment - MarketingSHAHULNo ratings yet

- Dme-II Mid-II QB Viit 25-04-23Document6 pagesDme-II Mid-II QB Viit 25-04-23Parrot ChilakaNo ratings yet

- Reg No:: Ce8020 - Maintenance, Repair and Rehabilitation of StructuresDocument2 pagesReg No:: Ce8020 - Maintenance, Repair and Rehabilitation of StructuresAvinash KumarNo ratings yet

- E Business Management QP 2 23.11.23Document3 pagesE Business Management QP 2 23.11.23Vasugi KumarNo ratings yet

- Entrepreneurship & Innovation: Department of Computer Science and Engineering - (R19)Document80 pagesEntrepreneurship & Innovation: Department of Computer Science and Engineering - (R19)Narendra Reddy VennaNo ratings yet

- Mine & Mineral EconomicsDocument6 pagesMine & Mineral EconomicsHanshuuNo ratings yet

- Anil Neerukonda Institute of Technology & Sciences (Ugc Autonomous)Document2 pagesAnil Neerukonda Institute of Technology & Sciences (Ugc Autonomous)R ChandrasekharNo ratings yet

- BBA 1 Investment Analysis and Portfolio Managment Set 3Document2 pagesBBA 1 Investment Analysis and Portfolio Managment Set 3ayush singhNo ratings yet

- A3Document1 pageA3Raghavendra NaikNo ratings yet

- PPS Unit3 (QB)Document1 pagePPS Unit3 (QB)turpatiesthariNo ratings yet

- MakeupDocument3 pagesMakeupvijay shetNo ratings yet

- III Semester CSE & CSTDocument11 pagesIII Semester CSE & CSTSuthari AmbikaNo ratings yet

- Time: 3 Hours Total Marks: 100 Note: 1. Attempt All Sections. If Require Any Missing DataDocument4 pagesTime: 3 Hours Total Marks: 100 Note: 1. Attempt All Sections. If Require Any Missing DataUjjwal SharmaNo ratings yet

- Be (R2018) Assignment 1Document1 pageBe (R2018) Assignment 1Rock VickyNo ratings yet

- AI Mid 1 Q PaperDocument2 pagesAI Mid 1 Q Paperlovelynani792No ratings yet

- Iot Mid2Document2 pagesIot Mid2githaa12112002No ratings yet

- Santhiram Engineering College:: Nandyal: Unit-Iii 1 (OR) 2 Unit-Iv 3 (OR) 4 Unit-V 5Document1 pageSanthiram Engineering College:: Nandyal: Unit-Iii 1 (OR) 2 Unit-Iv 3 (OR) 4 Unit-V 5CSE DEPARTMENTNo ratings yet

- EC QB Unit 5Document1 pageEC QB Unit 5Rohith TellaNo ratings yet

- Sir M. Visvesvaraya Institute of Technology Bangalore 562 157Document3 pagesSir M. Visvesvaraya Institute of Technology Bangalore 562 157Naveen KumarNo ratings yet

- ME-Assignment - 03Document1 pageME-Assignment - 03shubhibaghel200No ratings yet

- B. Tech. Assignment Questions OBE PatternDocument2 pagesB. Tech. Assignment Questions OBE PatternBalasani Surya PrakashNo ratings yet

- Iat - 1 QP - Mm-20mba15Document2 pagesIat - 1 QP - Mm-20mba15Mr. M. Sandeep KumarNo ratings yet

- Information Technology and Numerical Methods (Common To CSE and CIC)Document3 pagesInformation Technology and Numerical Methods (Common To CSE and CIC)Chain SmokerNo ratings yet

- Bifs 1Document2 pagesBifs 1connectjawapkNo ratings yet

- Eh Mid 2Document2 pagesEh Mid 2Vadlamudi DhyanamalikaNo ratings yet

- Assignment No. 3 Semester: VI: Sr. No. Title: Modern Formwork Systems CO Bloom' S LevelDocument1 pageAssignment No. 3 Semester: VI: Sr. No. Title: Modern Formwork Systems CO Bloom' S LevelMakhdoom NakadeNo ratings yet

- Mba 3 Sem Investment Analysis and Portfolio Management Kmbnfm01 2022Document2 pagesMba 3 Sem Investment Analysis and Portfolio Management Kmbnfm01 2022Nomaan TanveerNo ratings yet

- Ach Blaw Model PaperDocument2 pagesAch Blaw Model PaperKarthikNo ratings yet

- R17-Eee-Cse-Mefa QP 2Document2 pagesR17-Eee-Cse-Mefa QP 2kisnamohanNo ratings yet

- 3rd BTech 2022-23 MECH POE Ses-Q1Document2 pages3rd BTech 2022-23 MECH POE Ses-Q1CHINTADA MADHUSUDHANA RAONo ratings yet

- Research Methodology and IPRDocument1 pageResearch Methodology and IPRravikaran tripathiNo ratings yet

- Unit 1 & Ii QbankDocument4 pagesUnit 1 & Ii QbankNetaji GandiNo ratings yet

- Indian Financial SystemDocument2 pagesIndian Financial SystemgetfitonlineytNo ratings yet

- WT AssignmentDocument1 pageWT AssignmentBalasani Surya PrakashNo ratings yet

- FCS Question Bank 2021-22Document4 pagesFCS Question Bank 2021-22Dhananjay SinghNo ratings yet

- IoT ELE Model Question Paper 2Document2 pagesIoT ELE Model Question Paper 2Sathish SinghNo ratings yet

- USN CS822: B. E. Degree (Autonomous) Eighth Semester End Examination (SEE), May 2018/june 2018Document2 pagesUSN CS822: B. E. Degree (Autonomous) Eighth Semester End Examination (SEE), May 2018/june 2018SobjianNo ratings yet

- DM - BloomDocument1 pageDM - BloomBalajiNo ratings yet

- PPSUC 1MS3 EceDocument1 pagePPSUC 1MS3 EcenandanNo ratings yet

- Assignment QuestionsDocument2 pagesAssignment QuestionsDhananjay SinghNo ratings yet

- PRINT1Document10 pagesPRINT1Sudha PNo ratings yet

- Mba 3 Sem Web Technology and e Commerce Kmbit02 2020Document2 pagesMba 3 Sem Web Technology and e Commerce Kmbit02 2020tushaar B'ramaniNo ratings yet

- Gojan School of Business and Technology, Chennai-52: Reg. NoDocument2 pagesGojan School of Business and Technology, Chennai-52: Reg. Nomercy santhiyaguNo ratings yet

- Investment Management VTU Question PapersDocument4 pagesInvestment Management VTU Question PapersVishnu PrasannaNo ratings yet

- This Question Bank Corresponds To Unit No. 1Document8 pagesThis Question Bank Corresponds To Unit No. 1Phani KumarNo ratings yet

- Signal Paper 3Document3 pagesSignal Paper 3imvuuser1No ratings yet

- Acfroga P59vvk2hchmlsjuktfyk7nokrhcgoc5m2r4xcelxxa3qkdrav2q3heik4gh9g834exnyn9mt6y-Z7ikeu Twxn4z2uqcopjthdeh-D9q-H 0oq7 Yxkzvhmzfzroqbeuk4exjvkae65iDocument3 pagesAcfroga P59vvk2hchmlsjuktfyk7nokrhcgoc5m2r4xcelxxa3qkdrav2q3heik4gh9g834exnyn9mt6y-Z7ikeu Twxn4z2uqcopjthdeh-D9q-H 0oq7 Yxkzvhmzfzroqbeuk4exjvkae65iHaricharan SNo ratings yet

- OOAD Mid-1 QB Material 20-24Document200 pagesOOAD Mid-1 QB Material 20-24dhanush janasenaniNo ratings yet

- Mid Sem 1Document5 pagesMid Sem 1uttkarsh singhNo ratings yet

- 19MCMS017012 ARUN REDDY Comm Skills II Assignment (BBA Summer Sem)Document4 pages19MCMS017012 ARUN REDDY Comm Skills II Assignment (BBA Summer Sem)ArUn ReDdyNo ratings yet

- Model Paper With Solution Kmbn201Document25 pagesModel Paper With Solution Kmbn201DivyaNo ratings yet

- Bifs 2Document1 pageBifs 2connectjawapkNo ratings yet

- 1-21CS54 Ia Paper-First IaDocument1 page1-21CS54 Ia Paper-First IaNANDEESH SANJAYNo ratings yet

- DN 0124 0506Document10 pagesDN 0124 0506Deva BeharaNo ratings yet

- Consumer Behaviour Unit-1Document14 pagesConsumer Behaviour Unit-1Deva BeharaNo ratings yet

- LSCM Mid - 2 Unit - 3Document7 pagesLSCM Mid - 2 Unit - 3Deva BeharaNo ratings yet

- RiskmanagementchapterDocument16 pagesRiskmanagementchapterDeva BeharaNo ratings yet

- Unit 3 CB PresentationDocument30 pagesUnit 3 CB PresentationDeva BeharaNo ratings yet

- SM - MID-QUESTION BANK - StudentDocument2 pagesSM - MID-QUESTION BANK - StudentDeva BeharaNo ratings yet

- Ed Mid 2Document16 pagesEd Mid 2Deva BeharaNo ratings yet

- Unit 4 NotesDocument16 pagesUnit 4 NotesDeva BeharaNo ratings yet

- Services Marketing Mid 2Document14 pagesServices Marketing Mid 2Deva BeharaNo ratings yet

- IFM U5Document19 pagesIFM U5Deva BeharaNo ratings yet