Professional Documents

Culture Documents

Pridel Maha - 112021

Pridel Maha - 112021

Uploaded by

Harsh PunmiyaCopyright:

Available Formats

You might also like

- Engineering EconomyDocument55 pagesEngineering EconomyRoselyn MatienzoNo ratings yet

- This Paper Is Not To Be Removed From The Examination HallsDocument82 pagesThis Paper Is Not To Be Removed From The Examination HallsPutin PhyNo ratings yet

- San Diego Venture Capital FirmsDocument4 pagesSan Diego Venture Capital FirmsJoseph KymmNo ratings yet

- GSTR3B 37bcbpp5786l2zu 032022Document2 pagesGSTR3B 37bcbpp5786l2zu 032022sivapolesNo ratings yet

- GSTR3B 22achpa6960g1zx 022023Document3 pagesGSTR3B 22achpa6960g1zx 022023Akash GahlotNo ratings yet

- GSTR3B 21aywpa7472l1zz 112023Document3 pagesGSTR3B 21aywpa7472l1zz 112023prateek gangwaniNo ratings yet

- GSTR3B 09ajlpb9272d1z4 092023Document3 pagesGSTR3B 09ajlpb9272d1z4 092023acpandey.lawfirmNo ratings yet

- GSTR3B 22aaoca5812f1zy 062023Document3 pagesGSTR3B 22aaoca5812f1zy 062023Jai BajajNo ratings yet

- GSTR3B 27ajypp7786p1zj 032022Document2 pagesGSTR3B 27ajypp7786p1zj 032022pratik parmarNo ratings yet

- 11 Feb-22Document2 pages11 Feb-22yuvrajsinh jadejaNo ratings yet

- GSTR3B 19anmpk8638h1zd 062023Document3 pagesGSTR3B 19anmpk8638h1zd 062023kasim shekNo ratings yet

- GSTR3B 09CRCPK4850K1ZH 102022Document3 pagesGSTR3B 09CRCPK4850K1ZH 102022Gaurav JhaNo ratings yet

- GSTR3B 29aaoca4244p1zz 032022Document2 pagesGSTR3B 29aaoca4244p1zz 032022HEMANTH kumarNo ratings yet

- GSTR3B 06aadcg4814c1z3 122021Document2 pagesGSTR3B 06aadcg4814c1z3 122021akhil kwatraNo ratings yet

- GSTR3B 09abppy1435p1zo 032024Document3 pagesGSTR3B 09abppy1435p1zo 032024ssyadav2aNo ratings yet

- GSTR3B 01acppd9374f1zm 032022Document2 pagesGSTR3B 01acppd9374f1zm 032022pathaniagudia1996No ratings yet

- GSTR3B 18auupb9802f1ze 122023Document3 pagesGSTR3B 18auupb9802f1ze 122023bdebajit240No ratings yet

- GSTR3B 29aavpv0973c1z3 102021Document2 pagesGSTR3B 29aavpv0973c1z3 102021Hemanth KumarNo ratings yet

- GSTR3B 06aehpa7043l1zk 032022Document2 pagesGSTR3B 06aehpa7043l1zk 032022NITISH JAINNo ratings yet

- GSTR3B 27azgpt9919a1z1 122022Document3 pagesGSTR3B 27azgpt9919a1z1 122022Ishwarchandra KolheNo ratings yet

- GSTR3B 08hiipk7044f1z1 112022Document3 pagesGSTR3B 08hiipk7044f1z1 112022jainpranali22No ratings yet

- GSTR3B 33axxpa3486g1z8 122022Document3 pagesGSTR3B 33axxpa3486g1z8 122022solaciNo ratings yet

- Aprli 22 GSTR3BDocument2 pagesAprli 22 GSTR3Bkishan bhalodiyaNo ratings yet

- GSTR3B 06aadcg4814c1z3 032022Document2 pagesGSTR3B 06aadcg4814c1z3 032022akhil kwatraNo ratings yet

- GSTR3B 29aavpv0973c1z3 082021Document2 pagesGSTR3B 29aavpv0973c1z3 082021Hemanth KumarNo ratings yet

- GSTR3B 06aadcg4814c1z3 092021Document2 pagesGSTR3B 06aadcg4814c1z3 092021akhil kwatraNo ratings yet

- MARCH 23 GST 3B.pdf 1Document3 pagesMARCH 23 GST 3B.pdf 1Arun MotorsNo ratings yet

- GSTR3B 21DLSPM3799C1ZR 022024Document3 pagesGSTR3B 21DLSPM3799C1ZR 022024saubhagyatripathy61No ratings yet

- Dec 22Document3 pagesDec 22Aman JaiswalNo ratings yet

- GSTR3B 32aespk2384m1z0 012023Document3 pagesGSTR3B 32aespk2384m1z0 012023christous p kNo ratings yet

- GSTR3B June 23-24Document3 pagesGSTR3B June 23-24PL BLNo ratings yet

- GSTR3B 27CHRPS8386P1ZS 082023Document3 pagesGSTR3B 27CHRPS8386P1ZS 082023somnathnagare668No ratings yet

- GSTR3B 26aafcm3511j1zm 032023Document2 pagesGSTR3B 26aafcm3511j1zm 032023Jatin ShahNo ratings yet

- Pridel Maha - 082021Document2 pagesPridel Maha - 082021Harsh PunmiyaNo ratings yet

- GSTR3B 29aaacq3842r1zr 032023Document3 pagesGSTR3B 29aaacq3842r1zr 032023vasanth.sNo ratings yet

- GSTR3B Return 61 2023 2Document3 pagesGSTR3B Return 61 2023 2AKASH SENNo ratings yet

- GSTR3B 22aiopg3373q1zt 032023Document3 pagesGSTR3B 22aiopg3373q1zt 032023Akash GahlotNo ratings yet

- GSTR3B 01bropg6451k1zp 092023Document2 pagesGSTR3B 01bropg6451k1zp 092023Ishtiyaq RatherNo ratings yet

- GSTR3B 09afrpj0568g1z4 072022Document2 pagesGSTR3B 09afrpj0568g1z4 072022Suhail KhanNo ratings yet

- GSTR3B 04aaecc2134l1zy 122022Document3 pagesGSTR3B 04aaecc2134l1zy 122022Vineet KhuranaNo ratings yet

- GSTR3B 10BCSPC5671G1ZQ 062022Document2 pagesGSTR3B 10BCSPC5671G1ZQ 062022Kishan JaiswalNo ratings yet

- January 2023Document3 pagesJanuary 2023sbmsalesassociatsNo ratings yet

- GSTR3B Return 61 2023 12Document3 pagesGSTR3B Return 61 2023 12AKASH SENNo ratings yet

- GSTR3B 07aadpa4245q1zm 042023Document3 pagesGSTR3B 07aadpa4245q1zm 042023meenakshi08071983No ratings yet

- GSTR3B 01aelpk0229g1z1 092022Document3 pagesGSTR3B 01aelpk0229g1z1 092022Kaka KushalNo ratings yet

- GSTR3B 29aavpv0973c1z3 022022Document2 pagesGSTR3B 29aavpv0973c1z3 022022Hemanth KumarNo ratings yet

- GSTR3B 07ahepk2148n1z5 122022Document2 pagesGSTR3B 07ahepk2148n1z5 122022PKCL027 Rishabh JainNo ratings yet

- GSTR3B 23apjps3159l1zg 032022Document2 pagesGSTR3B 23apjps3159l1zg 032022sales candoNo ratings yet

- GSTR3B 07aadpa4245q1zm 112022Document3 pagesGSTR3B 07aadpa4245q1zm 112022meenakshi08071983No ratings yet

- GSTR3B Matha MobilesDocument2 pagesGSTR3B Matha MobilesBRIGHT TAX CENTERNo ratings yet

- GSTR3B 36bmypp9150m1zx 062022Document2 pagesGSTR3B 36bmypp9150m1zx 062022RAJESH DNo ratings yet

- GSTR3B 06aehpa7043l1zk 122021Document2 pagesGSTR3B 06aehpa7043l1zk 122021NITISH JAINNo ratings yet

- GSTR3B 33CVMPS7640R1ZK 032023Document2 pagesGSTR3B 33CVMPS7640R1ZK 032023hakkim satharNo ratings yet

- GSTR3B - 22-23 JanDocument3 pagesGSTR3B - 22-23 Janprateek gangwaniNo ratings yet

- GSTR3B 09aanfg8262b1z9 092022Document3 pagesGSTR3B 09aanfg8262b1z9 092022AdityaNo ratings yet

- GSTR3B May - 2022Document2 pagesGSTR3B May - 2022HEMANTH kumarNo ratings yet

- Pridel Guj - 112021Document2 pagesPridel Guj - 112021Harsh PunmiyaNo ratings yet

- 6 Sep GSTR3B - 27acvpi6787r1z5 - 092022Document3 pages6 Sep GSTR3B - 27acvpi6787r1z5 - 092022mailbox400043No ratings yet

- GSTR3B 29aaoca4244p1zz 092021Document2 pagesGSTR3B 29aaoca4244p1zz 092021HEMANTH kumarNo ratings yet

- April 23Document3 pagesApril 23Aman JaiswalNo ratings yet

- Afsar EnterprisesDocument2 pagesAfsar EnterprisesMohitNo ratings yet

- Capstone Corporate AdvisorsDocument1 pageCapstone Corporate AdvisorsHarsh PunmiyaNo ratings yet

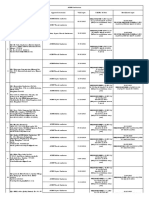

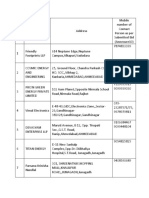

- Vendor List Updated As On 28.02.2022Document25 pagesVendor List Updated As On 28.02.2022Harsh PunmiyaNo ratings yet

- Nabl 500Document134 pagesNabl 500Harsh PunmiyaNo ratings yet

- 75th NGF Exhibitors List of Mens Wear 08.07.22Document14 pages75th NGF Exhibitors List of Mens Wear 08.07.22Harsh PunmiyaNo ratings yet

- H-Conductor - June 22Document2 pagesH-Conductor - June 22Harsh PunmiyaNo ratings yet

- 6SRT AgencyListDocument69 pages6SRT AgencyListHarsh PunmiyaNo ratings yet

- Data SKDocument4 pagesData SKHarsh PunmiyaNo ratings yet

- Aditya Birla DataDocument2,692 pagesAditya Birla DataHarsh PunmiyaNo ratings yet

- TT Mag Oct Nov Digital 20 50 N 2Document29 pagesTT Mag Oct Nov Digital 20 50 N 2Harsh PunmiyaNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument112 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceHarsh PunmiyaNo ratings yet

- Currently Empanelled Vendors LSTK Contractors 180712Document42 pagesCurrently Empanelled Vendors LSTK Contractors 180712Harsh PunmiyaNo ratings yet

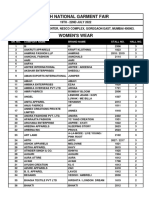

- 75th NGF Exhibitors List of Womens Wear 08.07.2022Document16 pages75th NGF Exhibitors List of Womens Wear 08.07.2022Harsh PunmiyaNo ratings yet

- New DataDocument4 pagesNew DataHarsh PunmiyaNo ratings yet

- Pridel Guj - 112021Document2 pagesPridel Guj - 112021Harsh PunmiyaNo ratings yet

- Pridel Maha - 082021Document2 pagesPridel Maha - 082021Harsh PunmiyaNo ratings yet

- Pridel Maha - 052021Document2 pagesPridel Maha - 052021Harsh PunmiyaNo ratings yet

- Pridel Guj - 122021Document2 pagesPridel Guj - 122021Harsh PunmiyaNo ratings yet

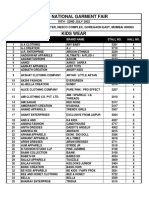

- 75TH NGF Exhibitors List of Kids Wear 08.07.2022Document9 pages75TH NGF Exhibitors List of Kids Wear 08.07.2022Harsh PunmiyaNo ratings yet

- 75TH NGF Exhibitors List of Mens Wear 08.07.22Document6 pages75TH NGF Exhibitors List of Mens Wear 08.07.22Harsh PunmiyaNo ratings yet

- Alfa MLG (Audit Report) 2019-20Document41 pagesAlfa MLG (Audit Report) 2019-20Harsh PunmiyaNo ratings yet

- Pridel Maha - 072021Document2 pagesPridel Maha - 072021Harsh PunmiyaNo ratings yet

- 75TH NGF Exhibitors List of Womens Wear 08.07.2022Document7 pages75TH NGF Exhibitors List of Womens Wear 08.07.2022Harsh PunmiyaNo ratings yet

- Llpreg 1990Document369 pagesLlpreg 1990Harsh PunmiyaNo ratings yet

- List of Companies/Llps Registered During The Year 1982Document156 pagesList of Companies/Llps Registered During The Year 1982Harsh PunmiyaNo ratings yet

- List of Companies/Llps Registered During The Year 1984Document203 pagesList of Companies/Llps Registered During The Year 1984Harsh PunmiyaNo ratings yet

- List of Companies/Llps Registered During The Year 1983Document162 pagesList of Companies/Llps Registered During The Year 1983Harsh PunmiyaNo ratings yet

- List of Companies/Llps Registered During The Year 1981Document147 pagesList of Companies/Llps Registered During The Year 1981Harsh PunmiyaNo ratings yet

- Polytechnic University of The Philippines Office of The Pup Graduate School Dean G/F M.H. Delpilar Campus Sta. Mesa, ManilaDocument11 pagesPolytechnic University of The Philippines Office of The Pup Graduate School Dean G/F M.H. Delpilar Campus Sta. Mesa, ManilaJennybabe SantosNo ratings yet

- Mankiw Chapter 12 Mundell Fleming Model Is LM and ErDocument40 pagesMankiw Chapter 12 Mundell Fleming Model Is LM and Erbasirunjie86No ratings yet

- Far Eastern University Mba - Thesis 060517Document2 pagesFar Eastern University Mba - Thesis 060517Lex AcadsNo ratings yet

- Islamic-Finance-Book Volume 4 Web PDFDocument166 pagesIslamic-Finance-Book Volume 4 Web PDFlarbiNo ratings yet

- Accounting For Intangible Assets (PAS 38) : UE UEDocument106 pagesAccounting For Intangible Assets (PAS 38) : UE UEJay-L TanNo ratings yet

- Introduction To Quantity SurveyingDocument41 pagesIntroduction To Quantity SurveyingJohn Mofire100% (1)

- 1 SGD To IDR - Google Search in 2016Document2 pages1 SGD To IDR - Google Search in 2016Fekonsos Skills SpecializationNo ratings yet

- Chapter-01: Page - 1Document50 pagesChapter-01: Page - 1Md Khaled NoorNo ratings yet

- Mobilizing The Indo-Pacific Infrastructure Response To China S Belt and Road Initiative in Southeast AsiaDocument15 pagesMobilizing The Indo-Pacific Infrastructure Response To China S Belt and Road Initiative in Southeast AsiaValentina SadchenkoNo ratings yet

- Do It!: SolutionDocument9 pagesDo It!: Solutionaura fitrah auliya SomantriNo ratings yet

- Wealth and Happiness by David GellerDocument224 pagesWealth and Happiness by David GellerPatrick WestonNo ratings yet

- Exchange Rate Regimes of The WorldDocument14 pagesExchange Rate Regimes of The WorldPaavni SharmaNo ratings yet

- Steel SecuritiesDocument86 pagesSteel SecuritiesKella PradeepNo ratings yet

- Best Resume Format Finance JobsDocument7 pagesBest Resume Format Finance Jobssbbftinbf100% (2)

- Merger & AcquisitionDocument29 pagesMerger & AcquisitionHamizar HassanNo ratings yet

- The Company That You Manage Has InvestedDocument2 pagesThe Company That You Manage Has InvestedtahmeemNo ratings yet

- Press Release - Asian Paints Q2-FY21 ResultsDocument2 pagesPress Release - Asian Paints Q2-FY21 ResultsVishvajit PatilNo ratings yet

- Testsigma Invoice 16BeUbTwydVvAKtVDocument1 pageTestsigma Invoice 16BeUbTwydVvAKtVAnurag AnandNo ratings yet

- GH2 3264Document2 pagesGH2 3264Saso MohNo ratings yet

- What's Stock Market Volatility?Document6 pagesWhat's Stock Market Volatility?Prathap PratapNo ratings yet

- 7.4 Annuities Spreadsheet ExcelDocument2 pages7.4 Annuities Spreadsheet ExcelNam NguyenNo ratings yet

- LLMC PDFDocument9 pagesLLMC PDFRajeshNairNo ratings yet

- Ccris BNM BookletDocument11 pagesCcris BNM BookletMuhamad AzmirNo ratings yet

- WTPC Sept Dec2019 11.26.2019Document20 pagesWTPC Sept Dec2019 11.26.2019Duy DangNo ratings yet

- S.No S.No Wise S.no Sector Sector Appendix Coordinator Rep - From Initial Name Designation OrganisationDocument6 pagesS.No S.No Wise S.no Sector Sector Appendix Coordinator Rep - From Initial Name Designation OrganisationRishab WahalNo ratings yet

- Mobile Banking Dissertation TopicsDocument4 pagesMobile Banking Dissertation TopicsWritingPaperServicesSingapore100% (1)

- How To Trade Stocks and BondsDocument28 pagesHow To Trade Stocks and Bondsmohitjainrocks100% (1)

Pridel Maha - 112021

Pridel Maha - 112021

Uploaded by

Harsh PunmiyaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pridel Maha - 112021

Pridel Maha - 112021

Uploaded by

Harsh PunmiyaCopyright:

Available Formats

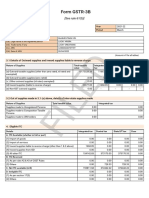

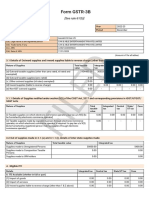

Form GSTR-3B

[See rule 61(5)]

Year 2021-22

Period November

1. GSTIN 27AADCG2669P1ZZ

2(a). Legal name of the registered person PRIDEL PRIVATE LIMITED

2(b). Trade name, if any PRIDEL PRIVATE LIMITED

2(c). ARN AB271121345470M

2(d). Date of ARN 20/12/2021

(Amount in ₹ for all tables)

3.1 Details of Outward supplies and inward supplies liable to reverse charge

Nature of Supplies Total taxable Integrated Central State/UT Cess

exempted)

(b) Outward taxable supplies (zero rated)

(c ) Other outward supplies (nil rated, exempted)

(d) Inward supplies (liable to reverse charge)

(e) Non-GST outward supplies

ED

(a) Outward taxable supplies (other than zero rated, nil rated and

value

21284105.07

3605579.97

3.2 Out of supplies made in 3.1 (a) above, details of inter-state supplies made

23560.00

0.00

0.00

tax

174419.82

-

0.00

93.00

tax

409774.84

-

-

543.00

-

tax

409774.84

-

-

543.00

-

0.00

0.00

0.00

-

-

FIL

Nature of Supplies Total taxable value Integrated tax

Supplies made to Unregistered Persons 0.00 0.00

Supplies made to Composition Taxable 0.00 0.00

Persons

Supplies made to UIN holders 0.00 0.00

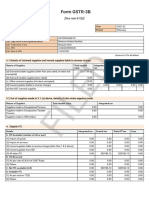

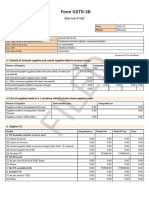

4. Eligible ITC

Details Integrated tax Central tax State/UT tax Cess

A. ITC Available (whether in full or part)

(1) Import of goods 0.00 0.00 0.00 0.00

(2) Import of services 0.00 0.00 0.00 0.00

(3) Inward supplies liable to reverse charge (other than 1 & 2 above) 93.00 543.00 543.00 0.00

(4) Inward supplies from ISD 0.00 0.00 0.00 0.00

(5) All other ITC 11824.41 108929.01 108929.01 0.00

B. ITC Reversed

(1) As per rules 42 & 43 of CGST Rules 0.00 0.00 0.00 0.00

(2) Others 0.00 0.00 0.00 0.00

C. Net ITC available (A-B) 11917.41 109472.01 109472.01 0.00

D. Ineligible ITC 0.00 0.00 0.00 0.00

(1) As per section 17(5) 0.00 0.00 0.00 0.00

(2) Others 0.00 0.00 0.00 0.00

5 Values of exempt, nil-rated and non-GST inward supplies

Nature of Supplies Inter- State supplies Intra- State supplies

From a supplier under composition scheme, Exempt, Nil rated supply 0.00 0.00

Non GST supply 0.00 0.00

5.1 Interest and Late fee for previous tax period

Details Integrated tax Central tax State/UT tax Cess

System computed - - - -

Interest

Interest Paid 0.00 0.00 0.00 0.00

Late fee - 0.00 0.00 -

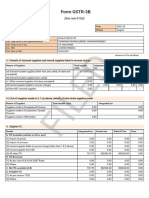

6.1 Payment of tax

Description Total tax Tax paid through ITC Tax paid in Interest paid in Late fee paid in

tax

Central tax

State/UT tax

Cess

payable

(A) Other than reverse charge

Integrated

(B) Reverse charge

Integrated

174420.00

409775.00

409775.00

0.00

93.00

Integrated

tax

11917.00

-

0.00

0.00

ED

Central

tax

109472.00

-

-

-

0.00

State/UT

tax

-

109472.00

-

-

0.00

Cess

-

-

0.00

-

cash

162503.00

300303.00

300303.00

0.00

93.00

cash

-

0.00

0.00

0.00

0.00

cash

-

0.00

0.00

FIL

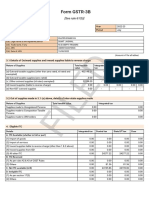

tax

Central tax 543.00 - - - - 543.00 - -

State/UT tax 543.00 - - - - 543.00 - -

Cess 0.00 - - - - 0.00 - -

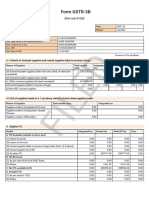

Breakup of tax liability declared (for interest computation)

Period Integrated tax Central tax State/UT tax Cess

November 2021 174513.00 410318.00 410318.00 0.00

Verification:

I hereby solemnly affirm and declare that the information given herein above is true and correct to the best of my knowledge and belief and

nothing has been concealed there from.

Date: 20/12/2021 Name of Authorized Signatory

ASIT GUPTA

Designation /Status

DIRECTOR

You might also like

- Engineering EconomyDocument55 pagesEngineering EconomyRoselyn MatienzoNo ratings yet

- This Paper Is Not To Be Removed From The Examination HallsDocument82 pagesThis Paper Is Not To Be Removed From The Examination HallsPutin PhyNo ratings yet

- San Diego Venture Capital FirmsDocument4 pagesSan Diego Venture Capital FirmsJoseph KymmNo ratings yet

- GSTR3B 37bcbpp5786l2zu 032022Document2 pagesGSTR3B 37bcbpp5786l2zu 032022sivapolesNo ratings yet

- GSTR3B 22achpa6960g1zx 022023Document3 pagesGSTR3B 22achpa6960g1zx 022023Akash GahlotNo ratings yet

- GSTR3B 21aywpa7472l1zz 112023Document3 pagesGSTR3B 21aywpa7472l1zz 112023prateek gangwaniNo ratings yet

- GSTR3B 09ajlpb9272d1z4 092023Document3 pagesGSTR3B 09ajlpb9272d1z4 092023acpandey.lawfirmNo ratings yet

- GSTR3B 22aaoca5812f1zy 062023Document3 pagesGSTR3B 22aaoca5812f1zy 062023Jai BajajNo ratings yet

- GSTR3B 27ajypp7786p1zj 032022Document2 pagesGSTR3B 27ajypp7786p1zj 032022pratik parmarNo ratings yet

- 11 Feb-22Document2 pages11 Feb-22yuvrajsinh jadejaNo ratings yet

- GSTR3B 19anmpk8638h1zd 062023Document3 pagesGSTR3B 19anmpk8638h1zd 062023kasim shekNo ratings yet

- GSTR3B 09CRCPK4850K1ZH 102022Document3 pagesGSTR3B 09CRCPK4850K1ZH 102022Gaurav JhaNo ratings yet

- GSTR3B 29aaoca4244p1zz 032022Document2 pagesGSTR3B 29aaoca4244p1zz 032022HEMANTH kumarNo ratings yet

- GSTR3B 06aadcg4814c1z3 122021Document2 pagesGSTR3B 06aadcg4814c1z3 122021akhil kwatraNo ratings yet

- GSTR3B 09abppy1435p1zo 032024Document3 pagesGSTR3B 09abppy1435p1zo 032024ssyadav2aNo ratings yet

- GSTR3B 01acppd9374f1zm 032022Document2 pagesGSTR3B 01acppd9374f1zm 032022pathaniagudia1996No ratings yet

- GSTR3B 18auupb9802f1ze 122023Document3 pagesGSTR3B 18auupb9802f1ze 122023bdebajit240No ratings yet

- GSTR3B 29aavpv0973c1z3 102021Document2 pagesGSTR3B 29aavpv0973c1z3 102021Hemanth KumarNo ratings yet

- GSTR3B 06aehpa7043l1zk 032022Document2 pagesGSTR3B 06aehpa7043l1zk 032022NITISH JAINNo ratings yet

- GSTR3B 27azgpt9919a1z1 122022Document3 pagesGSTR3B 27azgpt9919a1z1 122022Ishwarchandra KolheNo ratings yet

- GSTR3B 08hiipk7044f1z1 112022Document3 pagesGSTR3B 08hiipk7044f1z1 112022jainpranali22No ratings yet

- GSTR3B 33axxpa3486g1z8 122022Document3 pagesGSTR3B 33axxpa3486g1z8 122022solaciNo ratings yet

- Aprli 22 GSTR3BDocument2 pagesAprli 22 GSTR3Bkishan bhalodiyaNo ratings yet

- GSTR3B 06aadcg4814c1z3 032022Document2 pagesGSTR3B 06aadcg4814c1z3 032022akhil kwatraNo ratings yet

- GSTR3B 29aavpv0973c1z3 082021Document2 pagesGSTR3B 29aavpv0973c1z3 082021Hemanth KumarNo ratings yet

- GSTR3B 06aadcg4814c1z3 092021Document2 pagesGSTR3B 06aadcg4814c1z3 092021akhil kwatraNo ratings yet

- MARCH 23 GST 3B.pdf 1Document3 pagesMARCH 23 GST 3B.pdf 1Arun MotorsNo ratings yet

- GSTR3B 21DLSPM3799C1ZR 022024Document3 pagesGSTR3B 21DLSPM3799C1ZR 022024saubhagyatripathy61No ratings yet

- Dec 22Document3 pagesDec 22Aman JaiswalNo ratings yet

- GSTR3B 32aespk2384m1z0 012023Document3 pagesGSTR3B 32aespk2384m1z0 012023christous p kNo ratings yet

- GSTR3B June 23-24Document3 pagesGSTR3B June 23-24PL BLNo ratings yet

- GSTR3B 27CHRPS8386P1ZS 082023Document3 pagesGSTR3B 27CHRPS8386P1ZS 082023somnathnagare668No ratings yet

- GSTR3B 26aafcm3511j1zm 032023Document2 pagesGSTR3B 26aafcm3511j1zm 032023Jatin ShahNo ratings yet

- Pridel Maha - 082021Document2 pagesPridel Maha - 082021Harsh PunmiyaNo ratings yet

- GSTR3B 29aaacq3842r1zr 032023Document3 pagesGSTR3B 29aaacq3842r1zr 032023vasanth.sNo ratings yet

- GSTR3B Return 61 2023 2Document3 pagesGSTR3B Return 61 2023 2AKASH SENNo ratings yet

- GSTR3B 22aiopg3373q1zt 032023Document3 pagesGSTR3B 22aiopg3373q1zt 032023Akash GahlotNo ratings yet

- GSTR3B 01bropg6451k1zp 092023Document2 pagesGSTR3B 01bropg6451k1zp 092023Ishtiyaq RatherNo ratings yet

- GSTR3B 09afrpj0568g1z4 072022Document2 pagesGSTR3B 09afrpj0568g1z4 072022Suhail KhanNo ratings yet

- GSTR3B 04aaecc2134l1zy 122022Document3 pagesGSTR3B 04aaecc2134l1zy 122022Vineet KhuranaNo ratings yet

- GSTR3B 10BCSPC5671G1ZQ 062022Document2 pagesGSTR3B 10BCSPC5671G1ZQ 062022Kishan JaiswalNo ratings yet

- January 2023Document3 pagesJanuary 2023sbmsalesassociatsNo ratings yet

- GSTR3B Return 61 2023 12Document3 pagesGSTR3B Return 61 2023 12AKASH SENNo ratings yet

- GSTR3B 07aadpa4245q1zm 042023Document3 pagesGSTR3B 07aadpa4245q1zm 042023meenakshi08071983No ratings yet

- GSTR3B 01aelpk0229g1z1 092022Document3 pagesGSTR3B 01aelpk0229g1z1 092022Kaka KushalNo ratings yet

- GSTR3B 29aavpv0973c1z3 022022Document2 pagesGSTR3B 29aavpv0973c1z3 022022Hemanth KumarNo ratings yet

- GSTR3B 07ahepk2148n1z5 122022Document2 pagesGSTR3B 07ahepk2148n1z5 122022PKCL027 Rishabh JainNo ratings yet

- GSTR3B 23apjps3159l1zg 032022Document2 pagesGSTR3B 23apjps3159l1zg 032022sales candoNo ratings yet

- GSTR3B 07aadpa4245q1zm 112022Document3 pagesGSTR3B 07aadpa4245q1zm 112022meenakshi08071983No ratings yet

- GSTR3B Matha MobilesDocument2 pagesGSTR3B Matha MobilesBRIGHT TAX CENTERNo ratings yet

- GSTR3B 36bmypp9150m1zx 062022Document2 pagesGSTR3B 36bmypp9150m1zx 062022RAJESH DNo ratings yet

- GSTR3B 06aehpa7043l1zk 122021Document2 pagesGSTR3B 06aehpa7043l1zk 122021NITISH JAINNo ratings yet

- GSTR3B 33CVMPS7640R1ZK 032023Document2 pagesGSTR3B 33CVMPS7640R1ZK 032023hakkim satharNo ratings yet

- GSTR3B - 22-23 JanDocument3 pagesGSTR3B - 22-23 Janprateek gangwaniNo ratings yet

- GSTR3B 09aanfg8262b1z9 092022Document3 pagesGSTR3B 09aanfg8262b1z9 092022AdityaNo ratings yet

- GSTR3B May - 2022Document2 pagesGSTR3B May - 2022HEMANTH kumarNo ratings yet

- Pridel Guj - 112021Document2 pagesPridel Guj - 112021Harsh PunmiyaNo ratings yet

- 6 Sep GSTR3B - 27acvpi6787r1z5 - 092022Document3 pages6 Sep GSTR3B - 27acvpi6787r1z5 - 092022mailbox400043No ratings yet

- GSTR3B 29aaoca4244p1zz 092021Document2 pagesGSTR3B 29aaoca4244p1zz 092021HEMANTH kumarNo ratings yet

- April 23Document3 pagesApril 23Aman JaiswalNo ratings yet

- Afsar EnterprisesDocument2 pagesAfsar EnterprisesMohitNo ratings yet

- Capstone Corporate AdvisorsDocument1 pageCapstone Corporate AdvisorsHarsh PunmiyaNo ratings yet

- Vendor List Updated As On 28.02.2022Document25 pagesVendor List Updated As On 28.02.2022Harsh PunmiyaNo ratings yet

- Nabl 500Document134 pagesNabl 500Harsh PunmiyaNo ratings yet

- 75th NGF Exhibitors List of Mens Wear 08.07.22Document14 pages75th NGF Exhibitors List of Mens Wear 08.07.22Harsh PunmiyaNo ratings yet

- H-Conductor - June 22Document2 pagesH-Conductor - June 22Harsh PunmiyaNo ratings yet

- 6SRT AgencyListDocument69 pages6SRT AgencyListHarsh PunmiyaNo ratings yet

- Data SKDocument4 pagesData SKHarsh PunmiyaNo ratings yet

- Aditya Birla DataDocument2,692 pagesAditya Birla DataHarsh PunmiyaNo ratings yet

- TT Mag Oct Nov Digital 20 50 N 2Document29 pagesTT Mag Oct Nov Digital 20 50 N 2Harsh PunmiyaNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument112 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceHarsh PunmiyaNo ratings yet

- Currently Empanelled Vendors LSTK Contractors 180712Document42 pagesCurrently Empanelled Vendors LSTK Contractors 180712Harsh PunmiyaNo ratings yet

- 75th NGF Exhibitors List of Womens Wear 08.07.2022Document16 pages75th NGF Exhibitors List of Womens Wear 08.07.2022Harsh PunmiyaNo ratings yet

- New DataDocument4 pagesNew DataHarsh PunmiyaNo ratings yet

- Pridel Guj - 112021Document2 pagesPridel Guj - 112021Harsh PunmiyaNo ratings yet

- Pridel Maha - 082021Document2 pagesPridel Maha - 082021Harsh PunmiyaNo ratings yet

- Pridel Maha - 052021Document2 pagesPridel Maha - 052021Harsh PunmiyaNo ratings yet

- Pridel Guj - 122021Document2 pagesPridel Guj - 122021Harsh PunmiyaNo ratings yet

- 75TH NGF Exhibitors List of Kids Wear 08.07.2022Document9 pages75TH NGF Exhibitors List of Kids Wear 08.07.2022Harsh PunmiyaNo ratings yet

- 75TH NGF Exhibitors List of Mens Wear 08.07.22Document6 pages75TH NGF Exhibitors List of Mens Wear 08.07.22Harsh PunmiyaNo ratings yet

- Alfa MLG (Audit Report) 2019-20Document41 pagesAlfa MLG (Audit Report) 2019-20Harsh PunmiyaNo ratings yet

- Pridel Maha - 072021Document2 pagesPridel Maha - 072021Harsh PunmiyaNo ratings yet

- 75TH NGF Exhibitors List of Womens Wear 08.07.2022Document7 pages75TH NGF Exhibitors List of Womens Wear 08.07.2022Harsh PunmiyaNo ratings yet

- Llpreg 1990Document369 pagesLlpreg 1990Harsh PunmiyaNo ratings yet

- List of Companies/Llps Registered During The Year 1982Document156 pagesList of Companies/Llps Registered During The Year 1982Harsh PunmiyaNo ratings yet

- List of Companies/Llps Registered During The Year 1984Document203 pagesList of Companies/Llps Registered During The Year 1984Harsh PunmiyaNo ratings yet

- List of Companies/Llps Registered During The Year 1983Document162 pagesList of Companies/Llps Registered During The Year 1983Harsh PunmiyaNo ratings yet

- List of Companies/Llps Registered During The Year 1981Document147 pagesList of Companies/Llps Registered During The Year 1981Harsh PunmiyaNo ratings yet

- Polytechnic University of The Philippines Office of The Pup Graduate School Dean G/F M.H. Delpilar Campus Sta. Mesa, ManilaDocument11 pagesPolytechnic University of The Philippines Office of The Pup Graduate School Dean G/F M.H. Delpilar Campus Sta. Mesa, ManilaJennybabe SantosNo ratings yet

- Mankiw Chapter 12 Mundell Fleming Model Is LM and ErDocument40 pagesMankiw Chapter 12 Mundell Fleming Model Is LM and Erbasirunjie86No ratings yet

- Far Eastern University Mba - Thesis 060517Document2 pagesFar Eastern University Mba - Thesis 060517Lex AcadsNo ratings yet

- Islamic-Finance-Book Volume 4 Web PDFDocument166 pagesIslamic-Finance-Book Volume 4 Web PDFlarbiNo ratings yet

- Accounting For Intangible Assets (PAS 38) : UE UEDocument106 pagesAccounting For Intangible Assets (PAS 38) : UE UEJay-L TanNo ratings yet

- Introduction To Quantity SurveyingDocument41 pagesIntroduction To Quantity SurveyingJohn Mofire100% (1)

- 1 SGD To IDR - Google Search in 2016Document2 pages1 SGD To IDR - Google Search in 2016Fekonsos Skills SpecializationNo ratings yet

- Chapter-01: Page - 1Document50 pagesChapter-01: Page - 1Md Khaled NoorNo ratings yet

- Mobilizing The Indo-Pacific Infrastructure Response To China S Belt and Road Initiative in Southeast AsiaDocument15 pagesMobilizing The Indo-Pacific Infrastructure Response To China S Belt and Road Initiative in Southeast AsiaValentina SadchenkoNo ratings yet

- Do It!: SolutionDocument9 pagesDo It!: Solutionaura fitrah auliya SomantriNo ratings yet

- Wealth and Happiness by David GellerDocument224 pagesWealth and Happiness by David GellerPatrick WestonNo ratings yet

- Exchange Rate Regimes of The WorldDocument14 pagesExchange Rate Regimes of The WorldPaavni SharmaNo ratings yet

- Steel SecuritiesDocument86 pagesSteel SecuritiesKella PradeepNo ratings yet

- Best Resume Format Finance JobsDocument7 pagesBest Resume Format Finance Jobssbbftinbf100% (2)

- Merger & AcquisitionDocument29 pagesMerger & AcquisitionHamizar HassanNo ratings yet

- The Company That You Manage Has InvestedDocument2 pagesThe Company That You Manage Has InvestedtahmeemNo ratings yet

- Press Release - Asian Paints Q2-FY21 ResultsDocument2 pagesPress Release - Asian Paints Q2-FY21 ResultsVishvajit PatilNo ratings yet

- Testsigma Invoice 16BeUbTwydVvAKtVDocument1 pageTestsigma Invoice 16BeUbTwydVvAKtVAnurag AnandNo ratings yet

- GH2 3264Document2 pagesGH2 3264Saso MohNo ratings yet

- What's Stock Market Volatility?Document6 pagesWhat's Stock Market Volatility?Prathap PratapNo ratings yet

- 7.4 Annuities Spreadsheet ExcelDocument2 pages7.4 Annuities Spreadsheet ExcelNam NguyenNo ratings yet

- LLMC PDFDocument9 pagesLLMC PDFRajeshNairNo ratings yet

- Ccris BNM BookletDocument11 pagesCcris BNM BookletMuhamad AzmirNo ratings yet

- WTPC Sept Dec2019 11.26.2019Document20 pagesWTPC Sept Dec2019 11.26.2019Duy DangNo ratings yet

- S.No S.No Wise S.no Sector Sector Appendix Coordinator Rep - From Initial Name Designation OrganisationDocument6 pagesS.No S.No Wise S.no Sector Sector Appendix Coordinator Rep - From Initial Name Designation OrganisationRishab WahalNo ratings yet

- Mobile Banking Dissertation TopicsDocument4 pagesMobile Banking Dissertation TopicsWritingPaperServicesSingapore100% (1)

- How To Trade Stocks and BondsDocument28 pagesHow To Trade Stocks and Bondsmohitjainrocks100% (1)