Professional Documents

Culture Documents

Module 1-3 Exercises AY 2021 - 2022

Module 1-3 Exercises AY 2021 - 2022

Uploaded by

Andrea Joy PekOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Module 1-3 Exercises AY 2021 - 2022

Module 1-3 Exercises AY 2021 - 2022

Uploaded by

Andrea Joy PekCopyright:

Available Formats

BA 99.

1 EXERCISES: ADJUSTING THE ACCOUNTS

E3.2 (Weygandt et al., 2015)

Grollo Concepts accumulates the following adjustment data at December 31. Indicate (a) the type of

adjustment (prepaid expense, unearned revenue, accrued expense, accrued revenue), and (b) status of

accounts before adjustment (for example, “assets understated, and revenue understated”).

Account Type of Adjustment Accounts before

adjustment

1 Supplies of €150 are on hand.

2 Services performed but not recorded total

€900.

3 Interest of €200 has accumulated on a note

payable.

4 Rent collected in advance totaling €850 has

been earned.

E3.4 modified (Weygandt et al., 2019)

Yilmaz A.S. encountered the following situations:

1. Yilmaz collected $1,300 from a customer in 2020. 75% of services was performed by the end of

2020.

2. Yilmaz paid $2,800 rent on December 1 for the 4 months starting December 1.

3. Yilmaz’s employees worked 4 days by the end of 2020 but will only be paid in 2021. The total 5-

day work week pay amounts to $1,200.

4. Yilmaz performed consulting services for a client in December 2020. On December 31, it had not

billed the client for services provided of $1,200.

5. Yilmaz purchased $900 of supplies in 2020; at year-ed, $400 of supplies remain unused.

6. Yilmaz purchased equipment amounting $4,200 on August 1, 2020. The equipment is estimated

to be used over 5 years.

7. Yilmaz borrowed $12,000 on October 1, 2020, signing an 8% one-year note payable.

Use the chart of accounts below:

YILMAZ A.S.

Chart of Accounts

Assets Owner’s Equity

101 Cash 301 S. Yilmaz, Capital

102 Accounts Receivable 306 S. Yilmaz, Drawings

110 Supplies 350 Income Summary

122 Prepaid Rent Revenue

157 Equipment 400 Service Revenue

158 Accumulated Depreciation – Equipment Expenses

Liabilities 631 Supplies Expense

201 Accounts Payable 711 Depreciation Expense

203 Salaries Payable 726 Salaries Expense

204 Interest Payable 729 Rent Expense

BA 99.1 EXERCISES: ADJUSTING THE ACCOUNTS

210 Unearned Service Revenue 810 Utilities Expense

250 Notes Payable 851 Interest Expense

Required:

a. Journalize adjusting entries (omit explanations).

b. Journalize adjusting entries assuming alternative treatment of prepayments was used.

E 3.15 (Weygandt et al., 2019)

Action Quest Games adjusts its accounts annually. The following information is available for the year

ended December 31, 2020.

1. Purchased a 1-year insurance policy on June 1, for $1,800 cash.

2. Paid $6,500 on August 31, for 5-months’ rent in advance.

3. On September 4, received $3,600 cash in advance from a company to sponsor a game each

month (starting September) for a total of 9 months for the most improved students at a local

school.

4. Signed a contract for cleaning services starting December 1 for $1,000 per month. Paid for the

first 2 months on November 30.

5. On December 5, received $1,500 in advance from a gaming club. Determined that on December

31, $475 of these games had not yet been played.

Use the chart of accounts below:

ACTION QUEST GAMES

Chart of Accounts

Assets Owner’s Equity

101 Cash 301 R. Tendo, Capital

102 Accounts Receivable 306 R. Tendo, Drawings

122 Prepaid Rent 350 Income Summary

123 Prepaid Cleaning Revenue

127 Prepaid Insurance 400 Service Revenue

157 Equipment Expenses

158 Accumulated Depreciation – Equipment 631 Supplies Expense

Liabilities 711 Depreciation Expense

201 Accounts Payable 726 Salaries Expense

203 Salaries Payable 729 Rent Expense

204 Interest Payable 732 Insurance Expense

210 Unearned Service Revenue 735 Repairs and Maintenance Expense

250 Notes Payable 810 Utilities Expense

851 Interest Expense

Required: For each of the above transactions,

a. Prepare the journal entry to record the initial transaction.

b. Prepare the adjusting entry that is required on December 31. (Note: Use the account Service

Revenue for item 3 and Repairs and Maintenance Expense for item 4)

c. Post the journal entries to T-accounts and determining the final balance in each account (Note:

Posting to the Cash account is not required)

BA 99.1 EXERCISES: ADJUSTING THE ACCOUNTS

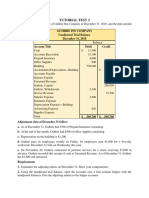

P3.1 modified (Weygandt et al., 2019)

Sadie Cuono started her own consulting firm, Cuono Consulting, on May 1, 2020. The trial balance at

May 31 is as follows:

CUONO CONSULTING

Trial Balance

May 31 2020

Debit Credit

101 Cash € 3,500

112 Accounts receivable 6,000

126 Supplies 1,900

130 Prepaid Insurance 3,600

149 Equipment 11,400

150 Accumulated Depreciation - Equipment € -

201 Accounts payable 4,500

209 Unearned Service Revenue 2,000

212 Salaries and Wages Payable -

301 S. Cuono, Capital 18,700

302 S. Cuono, Drawings 1,000

400 Service Revenue 9,500

631 Supplies Expense -

717 Depreciation Expense -

722 Insurance Expense -

726 Salaries and Wages Expense 6,400

729 Rent Expense 900

732 Utilities Expense - _________

34,700 34,700

Other data:

1. € 900 of supplies have been used during the month.

2. Utilities expense incurred but not paid on May 31, 2020, € 250.

3. The insurance policy is for 2 years.

4. € 400 of the balance in the unearned service revenue account remains unearned at the end of

the month.

5. May 31 is a Wednesday, and employees are paid on Fridays. Cuono Consulting has two

employees who are paid € 920 each for a 5-day work week.

6. The equipment has a 5-year life with no residual value. It is depreciated at € 190 per month for

60 months.

7. Invoice representing € 1,700 of services performed during the month has not been recorded as

of May 31.

Required:

a. Prepare the adjusting entries for the month of May.

b. Prepare the adjusted trial balance.

c. Prepare the income statement for the month ending May 31, 2020.

You might also like

- CH 3 HomeworkDocument6 pagesCH 3 HomeworkAxel OngNo ratings yet

- Assignmet For Practice Session StudentsDocument5 pagesAssignmet For Practice Session StudentsYasir Ahmed Siddiqui0% (1)

- CH 03Document4 pagesCH 03flrnciairnNo ratings yet

- 01 - FINC 0200 IP - Assignment Units 1 - 6 Questions - Winter 2022Document6 pages01 - FINC 0200 IP - Assignment Units 1 - 6 Questions - Winter 2022hermitpassiNo ratings yet

- CH 03Document4 pagesCH 03Rabie HarounNo ratings yet

- Pembahasan CH 3 4 5Document30 pagesPembahasan CH 3 4 5bella0% (1)

- PA-1 Adjusments and Worksheet (Problems)Document5 pagesPA-1 Adjusments and Worksheet (Problems)Safira ChairunnisaNo ratings yet

- Summarizing (Trial Balance) : (Go Through The Reference Books For Details)Document6 pagesSummarizing (Trial Balance) : (Go Through The Reference Books For Details)sujitNo ratings yet

- Homework Chapter 4Document17 pagesHomework Chapter 4Trung Kiên Nguyễn100% (1)

- Accounting Assignment 04A 207Document10 pagesAccounting Assignment 04A 207Aniyah's RanticsNo ratings yet

- Adjusting Entries: Asistensi Pengantar Akuntansi IDocument4 pagesAdjusting Entries: Asistensi Pengantar Akuntansi Isinta agnes100% (1)

- Garing, Aireen - Sa No.12 - Anya's Cleaning ServicesDocument17 pagesGaring, Aireen - Sa No.12 - Anya's Cleaning ServicesAireen GaringNo ratings yet

- CH03Document3 pagesCH03Fuyiko Kaneshiro HosanaNo ratings yet

- HW3 - CH3 Adjustment AccountingDocument13 pagesHW3 - CH3 Adjustment Accountingvico lorenzoNo ratings yet

- (Adjusting Entries) The Ledger of Chopin Rental Agency On March 31 of The Current YearDocument3 pages(Adjusting Entries) The Ledger of Chopin Rental Agency On March 31 of The Current YearFlorencia IrenaNo ratings yet

- Roshita Desthi Nurimah - A20 - Tugas BAB 3Document12 pagesRoshita Desthi Nurimah - A20 - Tugas BAB 3Roshita Desthi NurimahNo ratings yet

- 03 Posting in The General Ledger and Preparation of The Unadjusted Trial BalanceDocument6 pages03 Posting in The General Ledger and Preparation of The Unadjusted Trial BalanceLilian LagrimasNo ratings yet

- Soal Latihan DDADocument1 pageSoal Latihan DDAMutia AzzahraNo ratings yet

- Exercise 2ADocument3 pagesExercise 2A31231020764No ratings yet

- PART B - SET A (Odd Groups - 1,3,5,7,9)Document4 pagesPART B - SET A (Odd Groups - 1,3,5,7,9)ngocanhhlee.11No ratings yet

- FundAcct I @2015 AssignmntDocument6 pagesFundAcct I @2015 AssignmntGedion FeredeNo ratings yet

- Chapter 3 Practice QuestionsDocument3 pagesChapter 3 Practice QuestionsFamily PicturesNo ratings yet

- Accounting MathDocument4 pagesAccounting Mathhabib50% (2)

- Group Assignment 1ST YR MBADocument5 pagesGroup Assignment 1ST YR MBASosi SissayNo ratings yet

- Topic 4 Class Discussion Question SolutionDocument3 pagesTopic 4 Class Discussion Question Solutionsyedimranmasood100No ratings yet

- Homework - Chapter 3Document3 pagesHomework - Chapter 3JunnieNo ratings yet

- Exercise Chapter 3Document7 pagesExercise Chapter 3leen attilyNo ratings yet

- Item (A) Type of Adjustment (B) Accounts Before AdjustmentDocument11 pagesItem (A) Type of Adjustment (B) Accounts Before Adjustmentsuci monalia putriNo ratings yet

- Exercise Chap 3Document28 pagesExercise Chap 3JF FNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Arab Final 90% Fall2021 (YS)Document8 pagesArab Final 90% Fall2021 (YS)ahmed abuzedNo ratings yet

- Assignment # 2 Name: 26. STUDENT26 DateDocument2 pagesAssignment # 2 Name: 26. STUDENT26 DateHashir HabibNo ratings yet

- Principles of Accounting (ACC-1101)Document4 pagesPrinciples of Accounting (ACC-1101)hojegaNo ratings yet

- Preparing Financial Statements: Key Terms and Concepts To KnowDocument27 pagesPreparing Financial Statements: Key Terms and Concepts To KnowMohammed AkramNo ratings yet

- Tutorial Test 3 - QDocument2 pagesTutorial Test 3 - QSakamoto HiyoriNo ratings yet

- Preparing Financial Statements: Key Terms and Concepts To KnowDocument27 pagesPreparing Financial Statements: Key Terms and Concepts To KnowTrisha Monique VillaNo ratings yet

- Examples Ch3 SolutionDocument7 pagesExamples Ch3 SolutionNajwa Al-khateebNo ratings yet

- ACCT10002 Tutorial 2 Exercises, 2020 SM1Document6 pagesACCT10002 Tutorial 2 Exercises, 2020 SM1JING NIENo ratings yet

- Tugas Personal Ke-1 Week 2: Soal 1Document14 pagesTugas Personal Ke-1 Week 2: Soal 1meifangNo ratings yet

- Exam Revision - 3 & 4 SolDocument6 pagesExam Revision - 3 & 4 SolNguyễn Minh ĐứcNo ratings yet

- Exam Revision - Chapter 3 4Document6 pagesExam Revision - Chapter 3 4Vũ Thị NgoanNo ratings yet

- Accounting Chap 2Document3 pagesAccounting Chap 2Nguyễn Ngọc MaiNo ratings yet

- Acr 4.2Document21 pagesAcr 4.2ASIKIN AJA0% (1)

- Jawaban KuisDocument3 pagesJawaban KuisWidad NadiaNo ratings yet

- Group Assignment - Questions - RevisedDocument6 pagesGroup Assignment - Questions - Revised31231023949No ratings yet

- 3B Adjusting EntriesDocument2 pages3B Adjusting EntriesRyoma EchizenNo ratings yet

- ACCT 1005 - Worksheet - 2Document12 pagesACCT 1005 - Worksheet - 2Rick SimmsNo ratings yet

- Chapter: Income Statement: - Adjusting EntriesDocument20 pagesChapter: Income Statement: - Adjusting Entriesaishwarya joshiNo ratings yet

- CH 3Document10 pagesCH 3Mohammed mostafaNo ratings yet

- 助教課講義 Ch.3 (A4雙面)Document10 pages助教課講義 Ch.3 (A4雙面)5213adamNo ratings yet

- 3 2aDocument9 pages3 2aHumna IlyasNo ratings yet

- Tutorial Test 3Document2 pagesTutorial Test 3b1112014041No ratings yet

- Homework 4題目Document2 pagesHomework 4題目劉百祥No ratings yet

- BX2011 Topic06 Workshop Solutions 2022Document10 pagesBX2011 Topic06 Workshop Solutions 2022yanboliu96No ratings yet

- FMA Assignment 01Document5 pagesFMA Assignment 01Dejen TagelewNo ratings yet

- Adjustments Short CasesDocument1 pageAdjustments Short CasesMahmoud OkashaNo ratings yet

- Q4. Module 1Document5 pagesQ4. Module 1Azadeh AkbariNo ratings yet

- JEROME LEGASPI Activity Sheet 10Document3 pagesJEROME LEGASPI Activity Sheet 10RICARDO JOSE VALENCIANo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- 2.1 Eratosthenes - Measuring The Circumference of The Earth in 240 BC-WMDocument5 pages2.1 Eratosthenes - Measuring The Circumference of The Earth in 240 BC-WMAndrea Joy PekNo ratings yet

- 2.0 Shape Size Mass and Density of The Earth-WMDocument22 pages2.0 Shape Size Mass and Density of The Earth-WMAndrea Joy PekNo ratings yet

- 2.6 LecDocument194 pages2.6 LecAndrea Joy PekNo ratings yet

- 1.8 LecDocument106 pages1.8 LecAndrea Joy PekNo ratings yet

- 1.2 LecDocument197 pages1.2 LecAndrea Joy PekNo ratings yet

- 1.1 LecDocument138 pages1.1 LecAndrea Joy PekNo ratings yet

- Module 2-3 Exercise Solutions AY 2021 - 2022Document16 pagesModule 2-3 Exercise Solutions AY 2021 - 2022Andrea Joy PekNo ratings yet

- AccountingDocument5 pagesAccountingAndrea Joy PekNo ratings yet

- Solutions To Module 3-1 Accounts Receivable ExercisesDocument4 pagesSolutions To Module 3-1 Accounts Receivable ExercisesAndrea Joy PekNo ratings yet

- AccountingDocument4 pagesAccountingAndrea Joy PekNo ratings yet

- REVIEWER IN HBN 123 Lesson 1Document4 pagesREVIEWER IN HBN 123 Lesson 1Andrea Joy PekNo ratings yet

- HBN123 - Lesson 1 - Part 1 - External Sources of Business OpportunitiesDocument24 pagesHBN123 - Lesson 1 - Part 1 - External Sources of Business OpportunitiesAndrea Joy PekNo ratings yet

- They Say / I Say ActivityDocument1 pageThey Say / I Say ActivityAndrea Joy PekNo ratings yet