Professional Documents

Culture Documents

Introduction To Value Added Tax

Introduction To Value Added Tax

Uploaded by

NYSHAN JOFIELYN TABBAYOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Introduction To Value Added Tax

Introduction To Value Added Tax

Uploaded by

NYSHAN JOFIELYN TABBAYCopyright:

Available Formats

INTRODUCTION TO VALUE ADDED TAX

BUSINESS TAXATION

Introduction to Value Added Tax (VAT) - The excess of input over output VAT is

tax refundable or creditable

The value-added tax (VAT) is a form of

consumption tax (from 0% to 12% imposed on each 4. Tax burden:

1. Sale, barter, exchange, or lease of goods,

properties, or services in the course of trade - VAT is a sales tax designed to be borned

or business in the Philippines and by the consumers, with sellers acting

2. Importation of goods into the Philippines, merely as tax collectors

whether or not in the course of trade or

business 5. Legal liability:

Nature and Rationale of VAT - The VAT-registered seller is legally liable

for the payment of VAT;

VAT involves the following basic principles: - however, he can shift the burden of VAT

to the buyer. This makes VAT as an

1. Imposition of VAT. indirect tax

- In general, VAT is imposed on business

transactions by a VAT-registered Characteristics of VAT

taxpayer, or vatable persons whose

annual gross sales or receipts exceeds a. It is imposed on business transactions

P3,000,000. b. It follows the consumption/destination

principle

2. Treatment of VAT c. It is an indirect tax, a privilege tax and an

ad-valorem tax

- Standpoint of buyer d. It is cumulative

-is a tax added on the purchase price e. It employs tax credit method and basically a

of goods or services payable to the VAT- tax on gross margin

registered seller. Called Input tax or f. It follows the tax principle of no double

Input VAT, treated as Current Asset as taxation

advance payment of sales tax.

- Seller’s perspective Objects of VAT

-is a tax added on the value of

product or service sold collectible from 1. Sale of goods or properties

the buyer, termed as Output Tax or 2. Sale of services or lease of properties

Output VAT recognized by VAT- 3. Importation

registered seller as Current Liability to be

remitted to the BIR. OUTPUT VAT

3. Tax payable. The Output VAT is the value-added tax on

sales of goods or services passed on to the buyer

- If the taxpayer-seller is VAT-registered, whether VAT-registered or not.

only the excess of output VAT over input It is collected and to be treated as current tax

VAT is payable to the BIR. liability.

The output VAT can only be imposed and The gross sales/receipts include VAT, if it is

recognized when: expressed in the following:

1. There is sale (actual or deemed sale) and 2. Total VAT sales invoice or VAT purchase

2. The seller-taxpayer is VAT-registered. invoice amount

RATES OF OUTPUT VAT Gross sales per VAT invoice or gross receipts per

VAT invoice

The output VAT rates that may be applied to a. Sales or receipts, gross of VAT

sales or exchange of goods or services are b. Purchases from VAT person, gross of

VAT

1. Regular VAT rate of 12% on domestic sales; c. Sales, inclusive of VAT

2. Zero percent (0%) VAT on d. Purchases, inclusive of VAT

a. Export sales

b. Zero-rated sales Computation:

c. Effectively zero-rated sales

Given amount x 12/112 = VAT or

Given amount/9.333 = VAT

Computation of VAT

a. VAT exclusive method Computation of Net VAT pay payable

b. VAT inclusive method

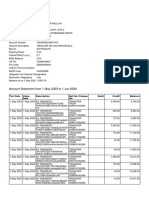

Output VAT on sales or gross receipts P XX

Determination of VAT amount Less:

Input VAT on purchases and services (XXX)

How to know whether that gross sales or gross Creditable VAT withheld (XXX)

receipts include the12% VAT? Net VAT payable (refundable) P XXX

1. The gross sales/receipts DO NOT include

VAT, if it is expressed in the following: THE INPUT VAT

a. Sales or gross receipts An Input tax is a value-added tax due from

b. Sales or gross receipts before VAT or paid by a VAT-registered person in the course of

c. Purchases from VAT person, before his trade or business on local purchases of goods or

VAT services, including lease or use of property from a

d. Sales, net of VAT VAT-registered person.

e. Sales or purchases from VAT person,

exclusive of VAT

FUNCTIONS OF INPUT VAT

Computation:

1. Tax credit against output VAT

Given amount x 12% = VAT 2. Input VAT carry over

(Given amount multiplied by 12% equals VAT)

3. Tax refund

4. Tax credit certificate

Sources and Rates of Input VAT Computation of Duties and Taxes for Imported

Goods

1. Regular 12% VAT on

Basic formula

▪ Purchases of goods/properties or

services to other VAT-registered Custom Duty (CD) P XXX

business; (Dutiable (custom) value in foreign currency X

▪ Purchases of goods or services from Foreign exchange rate)

non-VAT seller issuing VAT invoice or VAT XXX

receipt; Import Processing fee (IPF) XXX

▪ Purchases of capital goods subject to Excise Tax (ET), if applicable XXX

depreciation, the input VAT of which is Total duties and taxes P XXX

subject to amortization (deferred input

VAT);

▪ Construction in progress; and Additional information

▪ Importation of goods (for business use or

for sale locally)

2. Zero-rated (0%) on

▪ Zero-rated purchases; or

▪ Effectively zero-rated purchases

3. Transitional Input VAT rate of 2%

4. Presumptive input VAT rate of 4%

5. Input VAT on sales to the government

▪ Final withholding VAT of 5% on sales of

goods or services to government; and

▪ Standard input VAT of 7% allowed on

sales of goods or services to the

government.

Input VAT on Depreciable Capital Goods

a. Input VAT deductible in full amount

b. Input VAT subject to amortization (Deferred

Input VAT)

Input VAT on importation

All importation of goods in the Philippines

are subject to VAT, whether or not intended for

business, except those mentioned under Section 109

of NIRC

PRESUMPTIVE INPUT VAT

(On VAT-exempt Prime Materials)

Is an amount allowed by the tax code as

input tax on purchases of a VAT-registered person

despite that there is no actual VAT payment made on

VAT-exempt transactions.

PIV is 4% of the gross value in money of

their purchases of primary agricultural products

which are used as inputs in the production of:

▪ Sardines, mackerel

▪ Milk

▪ Refined sugar

▪ Cooking oil; and

▪ Packed noodle based instant meals

VAT Refund or Tax Credit Certificate

Allowed for VAT Refund or Tax Credit Certificate

▪ Those with zero-rated and effectively zero

rated sales

▪ Those who would be cancelling their VAT

TRANSITIONAL INPUT VAT

registration.

Transitional Input VAT (TIV) is allowed on

Not allowed for VAT Refund or Tax Credit

the inventory on hand (goods, materials of supplies)

Certificates (TCC)

of a person who, for the first time becomes liable to

VAT or elects to be VAT-registered.

▪ Presumptive Input VAT

TIV is equivalent to 2% of the value of such

inventory or the actual input VAT paid on such ▪ Transitional Input VAT

inventory, whichever is higher. ▪ Actual input VAT on capital goods,

Goods exempt from VAT shall be excluded in importation, or purchases of continuing

the computation of TIV VAT-registered persons to the extent of their

sales not subject to zero-rated, effectively

Illustration: zero-rated or business cancelling their VAT

registration.

A business firm has just registered as VAT

business. On that date, it has inventory stock of

P100,000. A portion of its inventory was from PERIOD OF VAT REFUND OR TCC

purchases which were taxed with P1,000 VAT. The

input VAT allowed would be: A VAT-registered person may apply for input

VAT refund or issuance of TCC within two (2) years

TIV (P100,000 x 2%), higher P2,000. after the close of the taxable quarter when the sales

were made.

The commissioner shall grant a refund

within 120 days from the date of submission of

complete documents to support the application of

VAT refund or TCC.

For denial of applications within the 120

days period, the taxpayer may appeal to the Court

of Tax Appeal (CTA) within 30 days from the

receipt of the denial; otherwise the decision will

become final.

If the commissioner does not give decision

within 120-day period, the taxpayer may file an

appeal with the CTA without waiting for the

expiration of the 120-day period, if the 2-year

period is about to lapse.

VALUE-ADDED TAX DECLARATION

BIR Form 2550M must be filed and paid on

or before the 20th day of the month following the

taxable month for the first two months of the

quarter.

The quarterly VAT return (BIR Form 2550Q)

is to filed on or before the 25th of the month

following the close of the quarter.

INPUT VAT TREATED AS EXPENSES OF COSTS

a. Input VAT of non-VAT registered taxpayers

b. Input VAT of VAT-exempt taxpayers

c. Excess of actual input VAT over the standard

input VAT on sales to government

d. Expired input VAT

You might also like

- TAXATION 2 Chapter 10 Value Added TaxDocument7 pagesTAXATION 2 Chapter 10 Value Added TaxKim Cristian MaañoNo ratings yet

- Employee Non Disclosure, Non Solicitation and Non Compete AgreementDocument4 pagesEmployee Non Disclosure, Non Solicitation and Non Compete AgreementkratiNo ratings yet

- BSTX Reviewer (Midterm)Document7 pagesBSTX Reviewer (Midterm)alaine daphneNo ratings yet

- Module Author: Charles C. Onda, MD, CpaDocument9 pagesModule Author: Charles C. Onda, MD, CpaCSJNo ratings yet

- Gruba Tax 2 NotesDocument13 pagesGruba Tax 2 NotesPJezrael Arreza FrondozoNo ratings yet

- Chapter 1 Tax 2Document5 pagesChapter 1 Tax 2Hazel Jane EsclamadaNo ratings yet

- Tax 2 - BanggawanDocument175 pagesTax 2 - BanggawanJessica IslaNo ratings yet

- Lecture On VAT Output Vat PDFDocument7 pagesLecture On VAT Output Vat PDFCarl's Aeto DomingoNo ratings yet

- Value Added Tax NotesDocument12 pagesValue Added Tax NotesAimeeNo ratings yet

- Jpia-Hau: Business and Transfer TaxationDocument12 pagesJpia-Hau: Business and Transfer Taxationronniel tiglaoNo ratings yet

- 1 Basics of Value Added TaxDocument58 pages1 Basics of Value Added TaxHazel Andrea Garduque LopezNo ratings yet

- Input VAT ch9 IncompleteDocument3 pagesInput VAT ch9 IncompleteMarionne GNo ratings yet

- VatDocument50 pagesVatnikolaevnavalentinaNo ratings yet

- Introduction To Business TaxesDocument3 pagesIntroduction To Business Taxesyatot carbonelNo ratings yet

- Tax 43 - Vat PayableDocument6 pagesTax 43 - Vat PayableFemie AmazonaNo ratings yet

- Comprehensive VAT TaxationDocument172 pagesComprehensive VAT TaxationIan JameroNo ratings yet

- Business TaxationDocument6 pagesBusiness TaxationPATRICK JAMES BALOGBOG ROSARIONo ratings yet

- Vat & OptDocument14 pagesVat & OptDaphnie BoloNo ratings yet

- Business TaxesDocument20 pagesBusiness TaxesAnime ScreenshotsNo ratings yet

- Tax Midterms Reviewer - VatDocument8 pagesTax Midterms Reviewer - VatAgot GaidNo ratings yet

- Value-Added Tax: Who Are Liable To VAT? Formula in Computing Vat PayableDocument15 pagesValue-Added Tax: Who Are Liable To VAT? Formula in Computing Vat PayablePrimo WilliamsNo ratings yet

- Value Added TaxesDocument75 pagesValue Added TaxesLEILALYN NICOLAS100% (1)

- Intro To Consumption TaxesDocument9 pagesIntro To Consumption TaxesAnna CynNo ratings yet

- Bustax Chapter 1Document9 pagesBustax Chapter 1Pineda, Paula MarieNo ratings yet

- Lec 7 - VATDocument82 pagesLec 7 - VATShaun LeeNo ratings yet

- Output Tax and Input TaxDocument12 pagesOutput Tax and Input TaxKiro ParafrostNo ratings yet

- Notes On VATDocument15 pagesNotes On VATRica BlancaNo ratings yet

- Value-Added Tax: Vat On Sale of Goods or PropertiesDocument11 pagesValue-Added Tax: Vat On Sale of Goods or PropertiesUbalda AbuboNo ratings yet

- Introduction To Consumption Tax PDFDocument20 pagesIntroduction To Consumption Tax PDFShamae Duma-anNo ratings yet

- VALUE ADDED TAX and EXCISE TAXDocument18 pagesVALUE ADDED TAX and EXCISE TAXTrisha Nicole Flores0% (1)

- Tax 301 - Midterm Activity 1Document4 pagesTax 301 - Midterm Activity 1Nicole TeruelNo ratings yet

- A. VatDocument5 pagesA. VatKaye L. Dela CruzNo ratings yet

- MIDTERMS Business and Transfer TaxationDocument13 pagesMIDTERMS Business and Transfer Taxationabrylle opinianoNo ratings yet

- Value Added TaxDocument15 pagesValue Added TaxJoshua PeraltaNo ratings yet

- VAT Handouts TaxDocument9 pagesVAT Handouts TaxRenmar CruzNo ratings yet

- Value-Added Tax: Vat On Sale of Goods or PropertiesDocument11 pagesValue-Added Tax: Vat On Sale of Goods or PropertiesJune Baricanosa AlvarezNo ratings yet

- CTT Examination Reviewer (Notes) Page A - 30Document13 pagesCTT Examination Reviewer (Notes) Page A - 30Seneca GonzalesNo ratings yet

- 01 BustaxDocument10 pages01 BustaxJake Raphael Cruz CalaguasNo ratings yet

- Chapter 9 Input VatDocument2 pagesChapter 9 Input Vatnewlymade641No ratings yet

- Vat & OptDocument10 pagesVat & OptCay-cay CañadillaNo ratings yet

- Input Taxes SummaryDocument8 pagesInput Taxes SummaryMichael AquinoNo ratings yet

- Value-Added Tax: Vat On Sale of Goods or PropertiesDocument12 pagesValue-Added Tax: Vat On Sale of Goods or PropertiesWin TambongNo ratings yet

- Input:Output Tax ReviewerDocument2 pagesInput:Output Tax ReviewerHiedi SugamotoNo ratings yet

- Chapter 9 - Input VatDocument1 pageChapter 9 - Input VatPremium AccountsNo ratings yet

- Chapter 9 - Input VatDocument1 pageChapter 9 - Input VatPremium AccountsNo ratings yet

- Chapter 9 - Input VatDocument1 pageChapter 9 - Input VatPremium AccountsNo ratings yet

- Chapter 9 - Input VatDocument1 pageChapter 9 - Input VatPremium AccountsNo ratings yet

- Chapter 9 - Input VatDocument1 pageChapter 9 - Input VatPremium AccountsNo ratings yet

- Effectively Zero-Rated SalesDocument2 pagesEffectively Zero-Rated Salesgeraldjohn.mondejarNo ratings yet

- 2020 Bustax - VAT - Part1 - Handouts PDFDocument13 pages2020 Bustax - VAT - Part1 - Handouts PDFMila MercadoNo ratings yet

- (G5 P1) VatDocument41 pages(G5 P1) VatFiliusdeiNo ratings yet

- Tax II PremidDocument24 pagesTax II PremidVincent john NacuaNo ratings yet

- Module 1 & 2: at The End of This Topic, We Should Be Able To Learn The FollowingDocument33 pagesModule 1 & 2: at The End of This Topic, We Should Be Able To Learn The FollowingAlicia FelicianoNo ratings yet

- Taxation Report2Document22 pagesTaxation Report2Ritchelyn ArbonNo ratings yet

- VAT Output TaxesDocument7 pagesVAT Output TaxesJocelyn Verbo-AyubanNo ratings yet

- Business Tax Chapter 1Document3 pagesBusiness Tax Chapter 1Mamin ChanNo ratings yet

- Module 7 - Introduction To Business TaxesDocument6 pagesModule 7 - Introduction To Business TaxesKyrah Angelica DionglayNo ratings yet

- Lecture 6 - Value-Added TaxDocument7 pagesLecture 6 - Value-Added TaxPiyey LlarenaNo ratings yet

- Very Awkward Tax: A bite-size guide to VAT for small businessFrom EverandVery Awkward Tax: A bite-size guide to VAT for small businessNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Week 4-5Document2 pagesWeek 4-5NYSHAN JOFIELYN TABBAYNo ratings yet

- RFLI311Document9 pagesRFLI311NYSHAN JOFIELYN TABBAYNo ratings yet

- Project ManagementDocument2 pagesProject ManagementNYSHAN JOFIELYN TABBAYNo ratings yet

- Frontier TechnologyDocument1 pageFrontier TechnologyNYSHAN JOFIELYN TABBAYNo ratings yet

- Sale of Goods or PropertiesDocument2 pagesSale of Goods or PropertiesNYSHAN JOFIELYN TABBAYNo ratings yet

- Chapter Ii - RRLDocument2 pagesChapter Ii - RRLNYSHAN JOFIELYN TABBAYNo ratings yet

- FERTILITY AWARENESS LegaspiDocument2 pagesFERTILITY AWARENESS LegaspiNYSHAN JOFIELYN TABBAYNo ratings yet

- Gold Standard and Its Advantages and Limitations DefinitionDocument15 pagesGold Standard and Its Advantages and Limitations DefinitionVishal AnandNo ratings yet

- 1 Food Security: Title Name Institution of Affiliation Course Instructor's Name DateDocument8 pages1 Food Security: Title Name Institution of Affiliation Course Instructor's Name DateKenneth BoquingNo ratings yet

- Tutti Frutti 1Document12 pagesTutti Frutti 1Saurabh basediyaNo ratings yet

- Vacancy Annoucement MCA Indonesia IIDocument2 pagesVacancy Annoucement MCA Indonesia IIpelangi tuppyNo ratings yet

- Drivers Application Form For GuyanaDocument76 pagesDrivers Application Form For GuyanaRandy & BobNo ratings yet

- Marketing Strategy of FMCG Product: A Case Study of Hindustan Unilever LimitedDocument3 pagesMarketing Strategy of FMCG Product: A Case Study of Hindustan Unilever LimitedSundaramNo ratings yet

- Final ExamDocument18 pagesFinal ExamHarryNo ratings yet

- Presented To:prof. Rashmi Menon & Class Prepared By: Valay Chaya (07) Nikul Maheshwari (28) Anis Vohra (56) Ravi Vyas (57) Nilesh JainDocument57 pagesPresented To:prof. Rashmi Menon & Class Prepared By: Valay Chaya (07) Nikul Maheshwari (28) Anis Vohra (56) Ravi Vyas (57) Nilesh JainAnis VohraNo ratings yet

- Finding Financial Freedom: The Biblical Road To WealthDocument25 pagesFinding Financial Freedom: The Biblical Road To Wealthivantrax116No ratings yet

- Marketpeak Pitchdeck PDFDocument11 pagesMarketpeak Pitchdeck PDFJerome YaraNo ratings yet

- VP Marketing Business Operations in Portland OR Resume Kathy StrombergDocument3 pagesVP Marketing Business Operations in Portland OR Resume Kathy StrombergKathyStrombergNo ratings yet

- Global Detergents (C) /FM-II/003Document3 pagesGlobal Detergents (C) /FM-II/003PRATIK MUKHERJEENo ratings yet

- Cuenta Romero Generali InternationalDocument2 pagesCuenta Romero Generali InternationalMaria ClaraNo ratings yet

- Meed Fa Construction Crane-Survey-Dubai 022016 PDFDocument32 pagesMeed Fa Construction Crane-Survey-Dubai 022016 PDFSithick MohamedNo ratings yet

- International Chamber of Commerce: Foreign Exchange and Risk ManagementDocument25 pagesInternational Chamber of Commerce: Foreign Exchange and Risk ManagementHusnain NazirNo ratings yet

- Shailesh ChaurasiyaDocument107 pagesShailesh ChaurasiyaPrîthvî PârmârNo ratings yet

- 11 Del Pilar Academy vs. Del Pilar Academy Employees Union G.R. No. 170112Document1 page11 Del Pilar Academy vs. Del Pilar Academy Employees Union G.R. No. 170112Monica FerilNo ratings yet

- Multiple Choice QuestionsDocument13 pagesMultiple Choice QuestionsVictor CharlesNo ratings yet

- Chapter 8 - Marketing ManagementDocument5 pagesChapter 8 - Marketing ManagementSobhi BraidyNo ratings yet

- Public Investment Fund - Saudi ArabiaDocument92 pagesPublic Investment Fund - Saudi Arabiaace187100% (2)

- Entrep Module 6Document7 pagesEntrep Module 6Marie VillanuevaNo ratings yet

- Foreign Exchange Markets: Parvesh AghiDocument79 pagesForeign Exchange Markets: Parvesh AghiParvesh AghiNo ratings yet

- The Manager's Role Inside The Organization: Are Hierarchies of TitlesDocument2 pagesThe Manager's Role Inside The Organization: Are Hierarchies of TitlesArafatNo ratings yet

- The Emerging Biomedico Industrial Cluster in North Jutland: Wishful Thinking or Reality?Document30 pagesThe Emerging Biomedico Industrial Cluster in North Jutland: Wishful Thinking or Reality?Chic Moments DecorNo ratings yet

- Fabindia HRM Change in DynamicsDocument7 pagesFabindia HRM Change in DynamicsSampurnaNo ratings yet

- 02 CVP Analysis PDFDocument5 pages02 CVP Analysis PDFJunZon VelascoNo ratings yet

- Inter 2Document3 pagesInter 2mahamNo ratings yet

- Neighbour Hood PlanningDocument9 pagesNeighbour Hood PlanningNupur MishraNo ratings yet

- RP Yth 4 Ak 3 U Co RDHTDocument15 pagesRP Yth 4 Ak 3 U Co RDHTasmath mohammedNo ratings yet