Professional Documents

Culture Documents

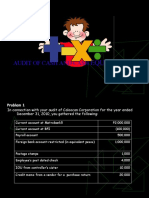

Audit of Cash

Audit of Cash

Uploaded by

a jCopyright:

Available Formats

You might also like

- Assign 2 and 10 Excel - 7edDocument17 pagesAssign 2 and 10 Excel - 7edNelson Gonzalez0% (2)

- Cash Problems Proof of CashDocument25 pagesCash Problems Proof of CashAnna Taylor75% (4)

- The Future of The State - HobsbawmDocument12 pagesThe Future of The State - Hobsbawmimvivi99967% (3)

- Auditing Quiz Audit of CashDocument4 pagesAuditing Quiz Audit of CashLoveli Breindaelyn Rivera0% (2)

- Praktikum Audit BANK RECONCILIATIONDocument2 pagesPraktikum Audit BANK RECONCILIATIONAstika Tamala Br TinjakNo ratings yet

- On Line Audit 2Document2 pagesOn Line Audit 2Nicolas ErnestoNo ratings yet

- Judith 2022 MidTerm Examinations Auditing II SEC BDocument6 pagesJudith 2022 MidTerm Examinations Auditing II SEC BAstika Tamala Br TinjakNo ratings yet

- Activity 2Document3 pagesActivity 2kathie alegarmeNo ratings yet

- 703E JAVsDocument3 pages703E JAVsEunice Jade JavilloNo ratings yet

- Debits and Credits - Bad DebtDocument25 pagesDebits and Credits - Bad DebtRevilyn Grace Bangayan100% (1)

- Proof of Cash Problems 4 PDF FreeDocument9 pagesProof of Cash Problems 4 PDF FreeAngieNo ratings yet

- AccountingDocument17 pagesAccountingKimberly Mae AriasNo ratings yet

- DocxDocument25 pagesDocxPhilip Castro67% (3)

- Actrivity 1Document4 pagesActrivity 1Glydell MapayeNo ratings yet

- Audit of Cash and Cash: EquivalentDocument14 pagesAudit of Cash and Cash: EquivalentJoseph SalidoNo ratings yet

- Self-Test Audit of CashDocument8 pagesSelf-Test Audit of CashShane TorrieNo ratings yet

- AUDIT OF LIABILITIES Part 2Document1 pageAUDIT OF LIABILITIES Part 2Katherine MagpantayNo ratings yet

- Competency AssessmentDocument5 pagesCompetency AssessmentMiracle FlorNo ratings yet

- Cash and Cash Equivalent: Problem 1Document4 pagesCash and Cash Equivalent: Problem 1Ab CNo ratings yet

- Statement of Changes in Equity andDocument8 pagesStatement of Changes in Equity andkrizalynvelascoNo ratings yet

- PROBLEM 6: CASH TO ACCRUAL: Enterprises Records All Transactions On The Cash BasisDocument4 pagesPROBLEM 6: CASH TO ACCRUAL: Enterprises Records All Transactions On The Cash Basischuchu tvNo ratings yet

- Intacc Quiz1Document15 pagesIntacc Quiz1Armina BagsicNo ratings yet

- Problem 9Document5 pagesProblem 9Tk KimNo ratings yet

- Assignment No. 2 - Bank ReconciliationDocument7 pagesAssignment No. 2 - Bank ReconciliationVincent AbellaNo ratings yet

- AP Preweek B94 - QuestionnaireDocument7 pagesAP Preweek B94 - QuestionnaireSilver LilyNo ratings yet

- Final ExaminationDocument16 pagesFinal ExaminationLorry Fe A. SargentoNo ratings yet

- Lembar Kerja Mengelola Buku Jurnal: Praktek Akuntansi Keuangan (Manual)Document24 pagesLembar Kerja Mengelola Buku Jurnal: Praktek Akuntansi Keuangan (Manual)Sri UtamiNo ratings yet

- Assignment MBA 1003Document34 pagesAssignment MBA 1003KAWongCy100% (1)

- BAFS Self-Set Question: RequiredDocument2 pagesBAFS Self-Set Question: RequiredSung Ho LeeNo ratings yet

- Bank Reconciliation Without SolutionDocument7 pagesBank Reconciliation Without SolutionEmma Mariz GarciaNo ratings yet

- Financial Accounting I Test BankDocument5 pagesFinancial Accounting I Test BankKim Cristian MaañoNo ratings yet

- Audit of RecivableDocument5 pagesAudit of RecivableayanegadNo ratings yet

- Babita Paul BSPL 22-23Document1 pageBabita Paul BSPL 22-23Pritam RoyNo ratings yet

- The Custodian Is Not Authorized To Cash ChecksDocument3 pagesThe Custodian Is Not Authorized To Cash Checkselsana philipNo ratings yet

- Audapp1 Quiz#2Document3 pagesAudapp1 Quiz#2Raymund CabidogNo ratings yet

- Bank Reconciliation Practice ProblemDocument2 pagesBank Reconciliation Practice ProblemMikee RizonNo ratings yet

- Seven Up Bottling Co PLC: For The Ended 31 March, 2014Document4 pagesSeven Up Bottling Co PLC: For The Ended 31 March, 2014Gina FelyaNo ratings yet

- Solutions To Activity 3A and 3BDocument2 pagesSolutions To Activity 3A and 3B박은하No ratings yet

- Statement of Cash Flow HIZBA 14 FEB 2023 XI AK 1Document1 pageStatement of Cash Flow HIZBA 14 FEB 2023 XI AK 1Hizba SabilillahNo ratings yet

- LJ Zalia - TutorialDocument104 pagesLJ Zalia - TutorialFuji Rachfiani PutriNo ratings yet

- Ap 9002-1-LiabilitiesDocument4 pagesAp 9002-1-LiabilitiesSirNo ratings yet

- CAT Exam 1 1Document5 pagesCAT Exam 1 1YeppeuddaNo ratings yet

- Acctg 205A Cash & Receivables Quiz 10-10-20Document3 pagesAcctg 205A Cash & Receivables Quiz 10-10-20Darynn LinggonNo ratings yet

- 5 6248879817396060958Document6 pages5 6248879817396060958Jeff GonzalesNo ratings yet

- Audit Drills Bank ReconDocument1 pageAudit Drills Bank ReconGirl langNo ratings yet

- Audit of Cash and Cash EquivalentsDocument6 pagesAudit of Cash and Cash Equivalentsphoebelyn acdogNo ratings yet

- Module 10 Financial StatementsDocument17 pagesModule 10 Financial StatementsChristine CariñoNo ratings yet

- 25,860 $1,003,360 $1,003,360 (A) Journalize The Adjusting EntriesDocument5 pages25,860 $1,003,360 $1,003,360 (A) Journalize The Adjusting Entriesmohitgaba19No ratings yet

- Uj 21868+SOURCE1+SOURCE1.1Document8 pagesUj 21868+SOURCE1+SOURCE1.1munenebrigaliaNo ratings yet

- Afs LTCFDocument7 pagesAfs LTCFJiah Mae GamoloNo ratings yet

- Auditing Practice Problem 5Document2 pagesAuditing Practice Problem 5Maria Fe FerrarizNo ratings yet

- Aud AnswerDocument4 pagesAud AnswerjoyhhazelNo ratings yet

- Statement of Cash Flow (Azkha Lifia)Document1 pageStatement of Cash Flow (Azkha Lifia)Poetra Sang FadjarNo ratings yet

- Annual Financial StatementDocument4 pagesAnnual Financial Statementcalmcreation127No ratings yet

- Final BASIC AcctgDocument3 pagesFinal BASIC AcctgFiona Concepcion100% (1)

- Financial Position 2019 2020Document1 pageFinancial Position 2019 2020Anacristina PincaNo ratings yet

- Soal A - Home Office Vs Branch (40%) : DimintaDocument2 pagesSoal A - Home Office Vs Branch (40%) : DimintaAlvin Prabu WNo ratings yet

- CAT Level 1 Mock Examination-1Document4 pagesCAT Level 1 Mock Examination-1Nadine ReidNo ratings yet

- Financial Statements - Lesson 02 (Part 2) QuestionsDocument3 pagesFinancial Statements - Lesson 02 (Part 2) QuestionsNirmal JayakodyNo ratings yet

- Audit Probs 2 Cash and Bank ReconDocument3 pagesAudit Probs 2 Cash and Bank ReconYameteKudasaiNo ratings yet

- Read Legislative Text of Senate GOP's Tax Overhaul LegislationDocument515 pagesRead Legislative Text of Senate GOP's Tax Overhaul Legislationkballuck1100% (1)

- Terms and Conditions: Atria Convergence Technologies Limited, Due Date: 15/11/2020Document2 pagesTerms and Conditions: Atria Convergence Technologies Limited, Due Date: 15/11/2020MaayaBimbamNo ratings yet

- Big 4Document21 pagesBig 4mohhmameddNo ratings yet

- Chopra Scm6 Inppt 14Document56 pagesChopra Scm6 Inppt 14Alaa Al HarbiNo ratings yet

- Axis Bank Debit and Credit Card1234Document81 pagesAxis Bank Debit and Credit Card1234VaishnaviNo ratings yet

- Iv Report%2Document64 pagesIv Report%2yashNo ratings yet

- Example Subsidiary Journals FACDocument3 pagesExample Subsidiary Journals FACNonhlanhla DlaminiNo ratings yet

- Cboec e 2021 02297Document3 pagesCboec e 2021 02297RatanaRoulNo ratings yet

- Dubai Silicon Oasis Authority Signs Agreement With International Free Zone AuthoDocument4 pagesDubai Silicon Oasis Authority Signs Agreement With International Free Zone AuthoKommu RohithNo ratings yet

- Technological Changes in Agricultural SectorDocument14 pagesTechnological Changes in Agricultural SectorDivya KomanNo ratings yet

- c4g The Impact of Covid 19 On African Smmes Operations OnlineDocument20 pagesc4g The Impact of Covid 19 On African Smmes Operations OnlineOlerato MothibediNo ratings yet

- ScribDocument22 pagesScribNadeem ManzoorNo ratings yet

- Industrial Relations and Labour LawsDocument15 pagesIndustrial Relations and Labour LawsMukesh Kumar YadavNo ratings yet

- Impact of Cash Holding On Firm Performance: A Case Study of Non-Financial Listed Firms of KSEDocument12 pagesImpact of Cash Holding On Firm Performance: A Case Study of Non-Financial Listed Firms of KSEYounes HouryNo ratings yet

- Pearson LCCI Certificate in Accounting (VRQ) Level 3Document19 pagesPearson LCCI Certificate in Accounting (VRQ) Level 3Aung Zaw HtweNo ratings yet

- Plastic Carry BagsDocument8 pagesPlastic Carry BagsRavi PrakashNo ratings yet

- Economic Feasibility Analysis of Highway Project Using Highway Development and Management (HDM-4) ModelDocument4 pagesEconomic Feasibility Analysis of Highway Project Using Highway Development and Management (HDM-4) ModelSUMIT KUMARNo ratings yet

- Annamalai University - Ba - Principles of Comm Erce (Ancillary 5040 FRDocument2 pagesAnnamalai University - Ba - Principles of Comm Erce (Ancillary 5040 FRAshish GejoNo ratings yet

- Sibelco Environmental, Social and Governance Version 3 October 2022 SRDocument24 pagesSibelco Environmental, Social and Governance Version 3 October 2022 SRJazmin Anabella CrognaleNo ratings yet

- Toyota Forklift ManualDocument12 pagesToyota Forklift Manualfabio andres albor del villarNo ratings yet

- Presentation On Under: CAB Model New Pension SystemDocument39 pagesPresentation On Under: CAB Model New Pension SystemKarthikeyan JagannathanNo ratings yet

- Adam SmithDocument6 pagesAdam SmithNathaniel LepasanaNo ratings yet

- MACHETE COMPLAN UpdatedDocument30 pagesMACHETE COMPLAN UpdatedRonald MacheteNo ratings yet

- Kế Hoạch Học PMPDocument4 pagesKế Hoạch Học PMPKhacNam NguyễnNo ratings yet

- ProjectDocument25 pagesProjectshubham agarwalNo ratings yet

- What Is The Thesis (Main Idea) of Generation JoblessDocument7 pagesWhat Is The Thesis (Main Idea) of Generation Joblessmarialackarlington100% (2)

- Six Sigma: High Quality Can Lower Costs and Raise Customer SatisfactionDocument5 pagesSix Sigma: High Quality Can Lower Costs and Raise Customer SatisfactionsukhpreetbachhalNo ratings yet

- LK Spto 2018 - Q4Document104 pagesLK Spto 2018 - Q4siput_lembekNo ratings yet

- PM Checklist Large Projects v2.1Document4 pagesPM Checklist Large Projects v2.1Giridhar DungaNo ratings yet

Audit of Cash

Audit of Cash

Uploaded by

a jOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Audit of Cash

Audit of Cash

Uploaded by

a jCopyright:

Available Formats

MEC 54.

AUDIT OF CASH

The bank statement for the current account of Oracle Co. showed a December 31,

2018, balance of P585,284. Information that might be useful in preparing a bank

reconciliation is as follows:

a) Outstanding checks were P52,810

b) The December 31, 2018, cash receipts of P23,000 were not deposited in the

bank until January 2, 2019.

c) One check written in payment of rent P8,940 was correctly recorded by the

bank but was recorded by Oracle Co. as a P9,840 disbursement.

d) In accordance with prior authorization, the bank withdrew P18,000 directly

from the current account as payment on a mortgage note payable. The interest

portion of that payment was P14,000. Oracle Co. has made no entry to record

the automatic payment.

e) Bank service charges of P740 were listed on the bank statement.

f) A deposit of P35,000 was recorded by the bank on December 12, but it did

not belong to Oracle Co.

g) The bank statement included a charge of P3,400 for a not-sufficient-fund

check. The company will seek payment from the customer.

h) Oracle Co. maintains an P8,000 petty cash fund that was appropriately

reimbursed at the end of December.

i) According to instructions from Oracle Co. on December 30, the bank withdrew

P40,000 from the account and purchased treasury bills for Oracle Co. The

company recorded the transaction in its books on December 31 when it

received notice from the bank. Half of the treasury bills mature in three

months and the other half in six months.

Required:

1. What is the cash in bank balance per books on December 31, 2018?

2. What is the adjusted cash in bank balance on December 31, 2018?

3. What amount of cash and cash equivalents should be shown under current

assets on December 31, 2018?

The following information pertains to Beihold Corp.:

Beihold Corp.

BANK RECONCILIATION

November 30, 2018

Balance per bank statement P435,000

Less: Outstanding checks

No. 4321 P6,000

4329 15,000

4340 1,700

4341 4,675 27,375

P407,625

Add: Deposit in transit 16,200

Balance per books P423,825

CHECK REGISTER

December 2018

Date Payee No. Vouchers Payable Discount Cash

Dec 1 San Beda, Inc. 4342 P10,000 P500 P9,500

3 Miriam Corp. 4343 4,200 - 4,200

7 UE Enterprises 4344 3,755 - 3,755

12 PSBA Corp. 4345 12,000 120 11,880

15 Payroll 4346 96,000 - 96,000

16 BU, Inc. 4347 6,300 - 6,300

18 New Era Co. 4348 14,200 142 14,058

21 UST, Inc. 4349 7,000 - 7,000

22 Petty cash fund 4350 10,000 - 10,000

28 Payroll 4351 98,000 - 98,000

P261,455 P762 P260,693

BANK STATEMENT

BANKABLE BANK Page 1 of 1

PERIOD: NOVEMBER 30, 2018 – DECEMBER 31, 2018

No.: 001-43-44

Check

Date Description Number Debit Credit Balance

Balance last statement P435,000

Dec 1 Cash deposit P16,200 451,200

1 Check issued 4329 P15,000 436,200

4 Check issued 4342 9,500 426,700

4 Check issued 4341 4,675 422,025

5 Check deposit 49,000 471,025

6 Check issued 4343 4,200 466,825

8 Check deposit 14,000 480,825

10 Check issued 4344 3,755 477,070

15 Encashment 4346 96,000 381,070

22 Encashment 4350 10,000 371,070

28 Encashment 4351 98,000 273,070

29 Debit memo – service charge 1,000 272,070

29 Credit memo - interest 1,550 273,620

Deposits in transit at December 31 totaled P49,000.

Required:

1. What is the total book receipts for December?

2. What is the cas balance per books on December 31, 2018?

3. What is the total outstanding checks on December 31, 2018?

4. What is the adjusted cash balance on November 30, 2018?

5. What is the adjusted cash balance on December 31, 2018?

You might also like

- Assign 2 and 10 Excel - 7edDocument17 pagesAssign 2 and 10 Excel - 7edNelson Gonzalez0% (2)

- Cash Problems Proof of CashDocument25 pagesCash Problems Proof of CashAnna Taylor75% (4)

- The Future of The State - HobsbawmDocument12 pagesThe Future of The State - Hobsbawmimvivi99967% (3)

- Auditing Quiz Audit of CashDocument4 pagesAuditing Quiz Audit of CashLoveli Breindaelyn Rivera0% (2)

- Praktikum Audit BANK RECONCILIATIONDocument2 pagesPraktikum Audit BANK RECONCILIATIONAstika Tamala Br TinjakNo ratings yet

- On Line Audit 2Document2 pagesOn Line Audit 2Nicolas ErnestoNo ratings yet

- Judith 2022 MidTerm Examinations Auditing II SEC BDocument6 pagesJudith 2022 MidTerm Examinations Auditing II SEC BAstika Tamala Br TinjakNo ratings yet

- Activity 2Document3 pagesActivity 2kathie alegarmeNo ratings yet

- 703E JAVsDocument3 pages703E JAVsEunice Jade JavilloNo ratings yet

- Debits and Credits - Bad DebtDocument25 pagesDebits and Credits - Bad DebtRevilyn Grace Bangayan100% (1)

- Proof of Cash Problems 4 PDF FreeDocument9 pagesProof of Cash Problems 4 PDF FreeAngieNo ratings yet

- AccountingDocument17 pagesAccountingKimberly Mae AriasNo ratings yet

- DocxDocument25 pagesDocxPhilip Castro67% (3)

- Actrivity 1Document4 pagesActrivity 1Glydell MapayeNo ratings yet

- Audit of Cash and Cash: EquivalentDocument14 pagesAudit of Cash and Cash: EquivalentJoseph SalidoNo ratings yet

- Self-Test Audit of CashDocument8 pagesSelf-Test Audit of CashShane TorrieNo ratings yet

- AUDIT OF LIABILITIES Part 2Document1 pageAUDIT OF LIABILITIES Part 2Katherine MagpantayNo ratings yet

- Competency AssessmentDocument5 pagesCompetency AssessmentMiracle FlorNo ratings yet

- Cash and Cash Equivalent: Problem 1Document4 pagesCash and Cash Equivalent: Problem 1Ab CNo ratings yet

- Statement of Changes in Equity andDocument8 pagesStatement of Changes in Equity andkrizalynvelascoNo ratings yet

- PROBLEM 6: CASH TO ACCRUAL: Enterprises Records All Transactions On The Cash BasisDocument4 pagesPROBLEM 6: CASH TO ACCRUAL: Enterprises Records All Transactions On The Cash Basischuchu tvNo ratings yet

- Intacc Quiz1Document15 pagesIntacc Quiz1Armina BagsicNo ratings yet

- Problem 9Document5 pagesProblem 9Tk KimNo ratings yet

- Assignment No. 2 - Bank ReconciliationDocument7 pagesAssignment No. 2 - Bank ReconciliationVincent AbellaNo ratings yet

- AP Preweek B94 - QuestionnaireDocument7 pagesAP Preweek B94 - QuestionnaireSilver LilyNo ratings yet

- Final ExaminationDocument16 pagesFinal ExaminationLorry Fe A. SargentoNo ratings yet

- Lembar Kerja Mengelola Buku Jurnal: Praktek Akuntansi Keuangan (Manual)Document24 pagesLembar Kerja Mengelola Buku Jurnal: Praktek Akuntansi Keuangan (Manual)Sri UtamiNo ratings yet

- Assignment MBA 1003Document34 pagesAssignment MBA 1003KAWongCy100% (1)

- BAFS Self-Set Question: RequiredDocument2 pagesBAFS Self-Set Question: RequiredSung Ho LeeNo ratings yet

- Bank Reconciliation Without SolutionDocument7 pagesBank Reconciliation Without SolutionEmma Mariz GarciaNo ratings yet

- Financial Accounting I Test BankDocument5 pagesFinancial Accounting I Test BankKim Cristian MaañoNo ratings yet

- Audit of RecivableDocument5 pagesAudit of RecivableayanegadNo ratings yet

- Babita Paul BSPL 22-23Document1 pageBabita Paul BSPL 22-23Pritam RoyNo ratings yet

- The Custodian Is Not Authorized To Cash ChecksDocument3 pagesThe Custodian Is Not Authorized To Cash Checkselsana philipNo ratings yet

- Audapp1 Quiz#2Document3 pagesAudapp1 Quiz#2Raymund CabidogNo ratings yet

- Bank Reconciliation Practice ProblemDocument2 pagesBank Reconciliation Practice ProblemMikee RizonNo ratings yet

- Seven Up Bottling Co PLC: For The Ended 31 March, 2014Document4 pagesSeven Up Bottling Co PLC: For The Ended 31 March, 2014Gina FelyaNo ratings yet

- Solutions To Activity 3A and 3BDocument2 pagesSolutions To Activity 3A and 3B박은하No ratings yet

- Statement of Cash Flow HIZBA 14 FEB 2023 XI AK 1Document1 pageStatement of Cash Flow HIZBA 14 FEB 2023 XI AK 1Hizba SabilillahNo ratings yet

- LJ Zalia - TutorialDocument104 pagesLJ Zalia - TutorialFuji Rachfiani PutriNo ratings yet

- Ap 9002-1-LiabilitiesDocument4 pagesAp 9002-1-LiabilitiesSirNo ratings yet

- CAT Exam 1 1Document5 pagesCAT Exam 1 1YeppeuddaNo ratings yet

- Acctg 205A Cash & Receivables Quiz 10-10-20Document3 pagesAcctg 205A Cash & Receivables Quiz 10-10-20Darynn LinggonNo ratings yet

- 5 6248879817396060958Document6 pages5 6248879817396060958Jeff GonzalesNo ratings yet

- Audit Drills Bank ReconDocument1 pageAudit Drills Bank ReconGirl langNo ratings yet

- Audit of Cash and Cash EquivalentsDocument6 pagesAudit of Cash and Cash Equivalentsphoebelyn acdogNo ratings yet

- Module 10 Financial StatementsDocument17 pagesModule 10 Financial StatementsChristine CariñoNo ratings yet

- 25,860 $1,003,360 $1,003,360 (A) Journalize The Adjusting EntriesDocument5 pages25,860 $1,003,360 $1,003,360 (A) Journalize The Adjusting Entriesmohitgaba19No ratings yet

- Uj 21868+SOURCE1+SOURCE1.1Document8 pagesUj 21868+SOURCE1+SOURCE1.1munenebrigaliaNo ratings yet

- Afs LTCFDocument7 pagesAfs LTCFJiah Mae GamoloNo ratings yet

- Auditing Practice Problem 5Document2 pagesAuditing Practice Problem 5Maria Fe FerrarizNo ratings yet

- Aud AnswerDocument4 pagesAud AnswerjoyhhazelNo ratings yet

- Statement of Cash Flow (Azkha Lifia)Document1 pageStatement of Cash Flow (Azkha Lifia)Poetra Sang FadjarNo ratings yet

- Annual Financial StatementDocument4 pagesAnnual Financial Statementcalmcreation127No ratings yet

- Final BASIC AcctgDocument3 pagesFinal BASIC AcctgFiona Concepcion100% (1)

- Financial Position 2019 2020Document1 pageFinancial Position 2019 2020Anacristina PincaNo ratings yet

- Soal A - Home Office Vs Branch (40%) : DimintaDocument2 pagesSoal A - Home Office Vs Branch (40%) : DimintaAlvin Prabu WNo ratings yet

- CAT Level 1 Mock Examination-1Document4 pagesCAT Level 1 Mock Examination-1Nadine ReidNo ratings yet

- Financial Statements - Lesson 02 (Part 2) QuestionsDocument3 pagesFinancial Statements - Lesson 02 (Part 2) QuestionsNirmal JayakodyNo ratings yet

- Audit Probs 2 Cash and Bank ReconDocument3 pagesAudit Probs 2 Cash and Bank ReconYameteKudasaiNo ratings yet

- Read Legislative Text of Senate GOP's Tax Overhaul LegislationDocument515 pagesRead Legislative Text of Senate GOP's Tax Overhaul Legislationkballuck1100% (1)

- Terms and Conditions: Atria Convergence Technologies Limited, Due Date: 15/11/2020Document2 pagesTerms and Conditions: Atria Convergence Technologies Limited, Due Date: 15/11/2020MaayaBimbamNo ratings yet

- Big 4Document21 pagesBig 4mohhmameddNo ratings yet

- Chopra Scm6 Inppt 14Document56 pagesChopra Scm6 Inppt 14Alaa Al HarbiNo ratings yet

- Axis Bank Debit and Credit Card1234Document81 pagesAxis Bank Debit and Credit Card1234VaishnaviNo ratings yet

- Iv Report%2Document64 pagesIv Report%2yashNo ratings yet

- Example Subsidiary Journals FACDocument3 pagesExample Subsidiary Journals FACNonhlanhla DlaminiNo ratings yet

- Cboec e 2021 02297Document3 pagesCboec e 2021 02297RatanaRoulNo ratings yet

- Dubai Silicon Oasis Authority Signs Agreement With International Free Zone AuthoDocument4 pagesDubai Silicon Oasis Authority Signs Agreement With International Free Zone AuthoKommu RohithNo ratings yet

- Technological Changes in Agricultural SectorDocument14 pagesTechnological Changes in Agricultural SectorDivya KomanNo ratings yet

- c4g The Impact of Covid 19 On African Smmes Operations OnlineDocument20 pagesc4g The Impact of Covid 19 On African Smmes Operations OnlineOlerato MothibediNo ratings yet

- ScribDocument22 pagesScribNadeem ManzoorNo ratings yet

- Industrial Relations and Labour LawsDocument15 pagesIndustrial Relations and Labour LawsMukesh Kumar YadavNo ratings yet

- Impact of Cash Holding On Firm Performance: A Case Study of Non-Financial Listed Firms of KSEDocument12 pagesImpact of Cash Holding On Firm Performance: A Case Study of Non-Financial Listed Firms of KSEYounes HouryNo ratings yet

- Pearson LCCI Certificate in Accounting (VRQ) Level 3Document19 pagesPearson LCCI Certificate in Accounting (VRQ) Level 3Aung Zaw HtweNo ratings yet

- Plastic Carry BagsDocument8 pagesPlastic Carry BagsRavi PrakashNo ratings yet

- Economic Feasibility Analysis of Highway Project Using Highway Development and Management (HDM-4) ModelDocument4 pagesEconomic Feasibility Analysis of Highway Project Using Highway Development and Management (HDM-4) ModelSUMIT KUMARNo ratings yet

- Annamalai University - Ba - Principles of Comm Erce (Ancillary 5040 FRDocument2 pagesAnnamalai University - Ba - Principles of Comm Erce (Ancillary 5040 FRAshish GejoNo ratings yet

- Sibelco Environmental, Social and Governance Version 3 October 2022 SRDocument24 pagesSibelco Environmental, Social and Governance Version 3 October 2022 SRJazmin Anabella CrognaleNo ratings yet

- Toyota Forklift ManualDocument12 pagesToyota Forklift Manualfabio andres albor del villarNo ratings yet

- Presentation On Under: CAB Model New Pension SystemDocument39 pagesPresentation On Under: CAB Model New Pension SystemKarthikeyan JagannathanNo ratings yet

- Adam SmithDocument6 pagesAdam SmithNathaniel LepasanaNo ratings yet

- MACHETE COMPLAN UpdatedDocument30 pagesMACHETE COMPLAN UpdatedRonald MacheteNo ratings yet

- Kế Hoạch Học PMPDocument4 pagesKế Hoạch Học PMPKhacNam NguyễnNo ratings yet

- ProjectDocument25 pagesProjectshubham agarwalNo ratings yet

- What Is The Thesis (Main Idea) of Generation JoblessDocument7 pagesWhat Is The Thesis (Main Idea) of Generation Joblessmarialackarlington100% (2)

- Six Sigma: High Quality Can Lower Costs and Raise Customer SatisfactionDocument5 pagesSix Sigma: High Quality Can Lower Costs and Raise Customer SatisfactionsukhpreetbachhalNo ratings yet

- LK Spto 2018 - Q4Document104 pagesLK Spto 2018 - Q4siput_lembekNo ratings yet

- PM Checklist Large Projects v2.1Document4 pagesPM Checklist Large Projects v2.1Giridhar DungaNo ratings yet