Professional Documents

Culture Documents

đề thi F7

đề thi F7

Uploaded by

Hoàng Yến LêOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

đề thi F7

đề thi F7

Uploaded by

Hoàng Yến LêCopyright:

Available Formats

ACADEMY OF FINANCE INTERNATIONAL FINANCIAL REPORTING STANDARDS

Code: 01/2022 Time: 2 days

Task 1:

Goldenkey has internally developed intangible assets comprising the capitalised expenses of the

acquisition and production of electronic map data which indicates the main fishing grounds in the

world.

The intangible assets generate revenue for the company in their use by the fishing fleet and are a

material asset in the statement of financial position.

Goldenkey had constructed a database of the electronic maps. The costs incurred in bringing the

information about a certain region of the world to a higher standard of performance are capitalised.

Required: Discuss the principles and practices to be used by Goldenkey in accounting for the

above valuation and recognition issues.

Task 2:

A company acquired new software for a robot that would revolutionise its manufacturing process.

The costs were:

Original cost of the software X1

Discount provided 5%

Staff training incurred in operating the robot 400

Testing of the software 100

Allocated administrative expenses 50

1. Provide relevant X1 and calculate the cost of this intangible asset?

2. The software was amortised at the rate of 20% using reducing balance method. After three years,

its fair value was X2 and estimated cost to sell was X3. The value in use of the software at that

time was X4. In the year, there was an economic crisis and the company wished to make an

impairment review for its assets.

Required: Provide relevant X2, X3, X4 so that there is an impairment loss of the software.

Calculate and explain your work.

Task 3:

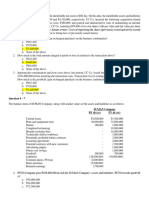

Paco Co purchased 1,450,000 ordinary shares in Suco Co in 20X0, when the general reserve of

Suco stood at 400,000 and there were no retained earnings.

The statements of financial position of the two companies as at 31 December 20X4 are set out

below. (Units: CU)

Ghi chú: Cán bộ coi thi không giải thích gì thêm

Paco Suco

000 000

Assets

Non current

Property, plant and equipment 8,868 1,787

Investment in Suco at cost 1,45

10,318 1,787

Current assets

Inventories 1,983 1,425

Receivables 1,462 1,307

Cash 25 16

3,47 2,748

Total assets 13,788 4,535

Equity and liabilities

Equity

Share capital (50c ordinary shares) 5,500 1,000

General reserve 1,200 800

Retained earnings 485 100

Total equity 7,185 1,900

Non-current liabilities

Borrowings 10% 4,000

Borrowings 15% - 500

Total non-current liabilities 4,000 500

Current liabilities

Bank overdraft 1,176 840

Trade payables 887 1,077

Taxation 540 218

Total current liabilities 2,603 2,135

Total liabilities 6,603 2,635

Total equity and liabilities 13,788 4,535

At the end of the reporting period the current account of Paco with Suco was agreed at X1 owed

by Suco. This account is included in the appropriate receivable and trade payable balances shown

above. There has been no impairment of goodwill since the date of acquisition. It is the group's

policy to value the non-controlling interest at its proportionate share of the fair value of the

subsidiary's net assets.

Required:

1/ Filling in X1 with reasonable data

2/ Prepare a consolidated statement of financial position for the Paco Suco Group at 31 December

20x4.

3/ Show the alterations necessary to the group statement of financial position if the intragroup

balance owed by Suco to Paco represented an invoice for goods sold by Paco to Suco at a mark-

up of 15% on cost, and still unsold by Suco at 31 December 20X4.

Ghi chú: Cán bộ coi thi không giải thích gì thêm

INTERNATIONAL FINANCIAL REPORTING STANDARDS

ACADEMY OF FINANCE Time: 2days

Code: 02/2022

Task 1:

Gasnature is finalising its financial statements for the year ended 31 August 20X5 and has

the following issues. Gasnature purchased a major refinery on 1 January 20X5 and the

directors estimate that a major overhaul is required every two years. The costs of the

overhaul are approximately $5 million which comprises $3 million for parts and equipment

and $2 million for labour.

Required: Discuss, with reference to International Financial Reporting Standards, how

Gasnature should account for the above agreement and contract, and the issues raised by

the directors

Task 2:

Mocy Co acquired a subsidiary on 1 January 20X9 for $ X1 million. The fair value of the net assets

of the subsidiary acquired were $ X2 million. Mocy Co acquired 80% of the shares of the

subsidiary. The non controlling interest was fair valued at $ X3 million.

Required:

1/Give necessary information in X1, X2, X3

2/Calculate goodwill based on the partial and full goodwill methods under IFRS 3 (including

comments on these two methods)

Task 3:

Paco Co purchased 1,450,000 ordinary shares in Suco Co in 20X0, when the general reserve of

Suco stood at 400,000 and there were no retained earnings.

The statements of financial position of the two companies as at 31 December 20X4 are set out

below. (Units: CU)

Ghi chú: Cán bộ coi thi không giải thích gì thêm

Paco Suco

000 000

Assets

Non current

Property, plant and equipment 8,868 1,787

Investment in Suco at cost 1,45

10,318 1,787

Current assets

Inventories 1,983 1,425

Receivables 1,462 1,307

Cash 25 16

3,47 2,748

Total assets 13,788 4,535

Equity and liabilities

Equity

Share capital (50c ordinary shares) 5,500 1,000

General reserve 1,200 800

Retained earnings 485 100

Total equity 7,185 1,900

Non-current liabilities

Borrowings 10% 4,000

Borrowings 15% - 500

Total non-current liabilities 4,000 500

Current liabilities

Bank overdraft 1,176 840

Trade payables 887 1,077

Taxation 540 218

Total current liabilities 2,603 2,135

Total liabilities 6,603 2,635

Total equity and liabilities 13,788 4,535

At the end of the reporting period the current account of Paco with Suco was agreed at X1 owed

by Suco. This account is included in the appropriate receivable and trade payable balances shown

above. There has been no impairment of goodwill since the date of acquisition. It is the group's

policy to value the non-controlling interest at its proportionate share of the fair value of the

subsidiary's net assets.

Required:

1/ Filling in X1 with reasonable data

2/ Prepare a consolidated statement of financial position for the Paco Suco Group at 31 December

20x4.

3/ Show the alterations necessary to the group statement of financial position if the intragroup

balance owed by Suco to Paco represented an invoice for goods sold by Paco to Suco at a mark-

up of 15% on cost, and still unsold by Suco at 31 December 20X4.

Ghi chú: Cán bộ coi thi không giải thích gì thêm

ACADEMY OF FINANCE INTERNATIONAL FINANCIAL REPORTING STANDARDS

Code: 03/2022 Time: 2days

Task 1:

Header PLC has decided to close one its overseas branches. A board meeting was held on 30 April

20X7 when a detailed formal plan was presented to the board. The plan was formalized and

accepted at that meeting. Letters were sent out to customers, suppliers and workers on 15 May

20X7 and meetings was held prior to the year end to determine the issues involved in the closure.

The plan is to be implemented on June 20X7. The company wishes to provide $8 million for the

restructuring but is unsure as to whether this is permissible.

Additionally there was an issue raised at one of the meetings. The operations of the branch are to

be moved to another country from June 20X7 but the operating lease on the present buildings of

the branch is non-cancellable and runs for another two years, until 31 May 20X9. The annual rent

of the buildings is $150,000 payable in arreas on 31 May and the lessor has offered to take a single

payment of $190,000 on 31 May 20X8 to settle the outstanding amount owing and terminate the

lease on that date. Header has additionally obtained permission to sublet the building at a rental of

$100,000 per year, payable in advance on 1 June.

A discount rate of 8% should be used where necessary.

Required: Discuss the accounting treatments of the above items in the financial statements for the

year ended 31 May 20X7.

Task 2:

A company acquired new software for a robot that would revolutionise its manufacturing process.

The costs were:

Original cost of the software X1

Discount provided 5%

Staff training incurred in operating the robot 400

Testing of the software 100

Allocated administrative expenses 50

1. Provide relevant X1 and calculate the cost of this intangible asset?

2. The software was amortised at the rate of 20% using reducing balance method. After three years,

its fair value was X2 and estimated cost to sell was X3. The value in use of the software at that

time was X4. In the year, there was an economic crisis and the company wished to make an

impairment review for its assets.

Required: Provide relevant X2, X3, X4 so that there is an impairment loss of the software.

Calculate and explain your work.

Task 3:

Paco Co purchased 1,450,000 ordinary shares in Suco Co in 20X0, when the general reserve of

Suco stood at 400,000 and there were no retained earnings. The statements of financial position of

the two companies as at 31 December 20X4 are set out below. (Units: CU)

Ghi chú: Cán bộ coi thi không giải thích gì thêm

Paco Suco

000 000

Assets

Non current

Property, plant and equipment 8,868 1,787

Investment in Suco at cost 1,45

10,318 1,787

Current assets

Inventories 1,983 1,425

Receivables 1,462 1,307

Cash 25 16

3,47 2,748

Total assets 13,788 4,535

Equity and liabilities

Equity

Share capital (50c ordinary shares) 5,500 1,000

General reserve 1,200 800

Retained earnings 485 100

Total equity 7,185 1,900

Non-current liabilities

Borrowings 10% 4,000

Borrowings 15% - 500

Total non-current liabilities 4,000 500

Current liabilities

Bank overdraft 1,176 840

Trade payables 887 1,077

Taxation 540 218

Total current liabilities 2,603 2,135

Total liabilities 6,603 2,635

Total equity and liabilities 13,788 4,535

At the end of the reporting period the current account of Paco with Suco was agreed at X1 owed

by Suco. This account is included in the appropriate receivable and trade payable balances shown

above. There has been no impairment of goodwill since the date of acquisition. It is the group's

policy to value the non-controlling interest at its proportionate share of the fair value of the

subsidiary's net assets.

Required:

1/ Filling in X1 with reasonable data

2/ Prepare a consolidated statement of financial position for the Paco Suco Group at 31 December

20x4.

3/ Show the alterations necessary to the group statement of financial position if the intragroup

balance owed by Suco to Paco represented an invoice for goods sold by Paco to Suco at a mark-

up of 15% on cost, and still unsold by Suco at 31 December 20X4.

Ghi chú: Cán bộ coi thi không giải thích gì thêm

INTERNATIONAL FINANCIAL REPORTING STANDARDS

ACADEMY OF FINANCE Time: 2days

Code: 04/2022

Task 1:

A vendor enters into a contract with a customer to supply a licence for a standard ‘off the shelf’

software package, install the software, and to provide unspecified software updates and technical

support for a period of two years. The vendor sells the licence and technical support separately,

and the installation service is routinely provided by a number of other unrelated vendors. The

software will remain functional without the software updates and technical support.

Question: Provide your own assumption, then show how to recognize revenue in each

circumstance.

Task 2:

Mocy Co acquired a subsidiary on 1 January 20X9 for $ X1 million. The fair value of the net assets

of the subsidiary acquired were $ X2 million. Mocy Co acquired 80% of the shares of the

subsidiary. The non controlling interest was fair valued at $ X3 million.

Required:

1/Give necessary information in X1, X2, X3

2/Calculate goodwill based on the partial and full goodwill methods under IFRS 3 (including

comments on these two methods)

Task 3:

Paco Co purchased 1,450,000 ordinary shares in Suco Co in 20X0, when the general reserve of

Suco stood at 400,000 and there were no retained earnings.

The statements of financial position of the two companies as at 31 December 20X4 are set out

below. (Units: CU)

Paco Suco

000 000

Assets

Non current

Property, plant and equipment 8,868 1,787

Investment in Suco at cost 1,45

10,318 1,787

Current assets

Inventories 1,983 1,425

Receivables 1,462 1,307

Cash 25 16

3,47 2,748

Total assets 13,788 4,535

Ghi chú: Cán bộ coi thi không giải thích gì thêm

Equity and liabilities

Equity

Share capital (50c ordinary shares) 5,500 1,000

General reserve 1,200 800

Retained earnings 485 100

Total equity 7,185 1,900

Non-current liabilities

Borrowings 10% 4,000

Borrowings 15% - 500

Total non-current liabilities 4,000 500

Current liabilities

Bank overdraft 1,176 840

Trade payables 887 1,077

Taxation 540 218

Total current liabilities 2,603 2,135

Total liabilities 6,603 2,635

Total equity and liabilities 13,788 4,535

At the end of the reporting period the current account of Paco with Suco was agreed at X1 owed

by Suco. This account is included in the appropriate receivable and trade payable balances shown

above. There has been no impairment of goodwill since the date of acquisition. It is the group's

policy to value the non-controlling interest at its proportionate share of the fair value of the

subsidiary's net assets.

Required:

1/ Filling in X1 with reasonable data

2/ Prepare a consolidated statement of financial position for the Paco Suco Group at 31 December

20x4.

3/ Show the alterations necessary to the group statement of financial position if the intragroup

balance owed by Suco to Paco represented an invoice for goods sold by Paco to Suco at a mark-

up of 15% on cost, and still unsold by Suco at 31 December 20X4.

Ghi chú: Cán bộ coi thi không giải thích gì thêm

INTERNATIONAL FINANCIAL REPORTING STANDARDS

ACADEMY OF FINANCE

Code: 05/2022 Time: 2days

Task 1:

The definitions of an asset and a liability are discussed in the Framework of IFRS. IASB revised

the following definitions:

(a) an asset is a present economic resource controlled by the entity as a result of past events.

(b) a liability is a present obligation of the entity to transfer an economic resource as a result of

past events.

(c) an economic resource is a right, or other source of value, that is capable of producing economic

benefits.

Do you agree with these definitions? Why or why not?

Task 2:

A company acquired new software for a robot that would revolutionise its manufacturing process.

The costs were:

Original cost of the software X1

Discount provided 5%

Staff training incurred in operating the robot 400

Testing of the software 100

Allocated administrative expenses 50

1. Provide relevant X1 and calculate the cost of this intangible asset?

2. The software was amortised at the rate of 20% using reducing balance method. After three years,

its fair value was X2 and estimated cost to sell was X3. The value in use of the software at that

time was X4. In the year, there was an economic crisis and the company wished to make an

impairment review for its assets.

Required: Provide relevant X2, X3, X4 so that there is an impairment loss of the software.

Calculate and explain your work.

Task 3:

Paco Co purchased 1,450,000 ordinary shares in Suco Co in 20X0, when the general reserve of

Suco stood at 400,000 and there were no retained earnings.

The statements of financial position of the two companies as at 31 December 20X4 are set out

below. (Units: CU)

Ghi chú: Cán bộ coi thi không giải thích gì thêm

Paco Suco

000 000

Assets

Non current

Property, plant and equipment 8,868 1,787

Investment in Suco at cost 1,45

10,318 1,787

Current assets

Inventories 1,983 1,425

Receivables 1,462 1,307

Cash 25 16

3,47 2,748

Total assets 13,788 4,535

Equity and liabilities

Equity

Share capital (50c ordinary shares) 5,500 1,000

General reserve 1,200 800

Retained earnings 485 100

Total equity 7,185 1,900

Non-current liabilities

Borrowings 10% 4,000

Borrowings 15% - 500

Total non-current liabilities 4,000 500

Current liabilities

Bank overdraft 1,176 840

Trade payables 887 1,077

Taxation 540 218

Total current liabilities 2,603 2,135

Total liabilities 6,603 2,635

Total equity and liabilities 13,788 4,535

At the end of the reporting period the current account of Paco with Suco was agreed at X1 owed

by Suco. This account is included in the appropriate receivable and trade payable balances shown

above. There has been no impairment of goodwill since the date of acquisition. It is the group's

policy to value the non-controlling interest at its proportionate share of the fair value of the

subsidiary's net assets.

Required:

1/ Filling in X1 with reasonable data

2/ Prepare a consolidated statement of financial position for the Paco Suco Group at 31 December

20x4.

3/ Show the alterations necessary to the group statement of financial position if the intragroup

balance owed by Suco to Paco represented an invoice for goods sold by Paco to Suco at a mark-

up of 15% on cost, and still unsold by Suco at 31 December 20X4.

Ghi chú: Cán bộ coi thi không giải thích gì thêm

You might also like

- Class Problems CH 4Document9 pagesClass Problems CH 4Eduardo Negrete100% (2)

- Training Program: Subject:: Final ProjectDocument6 pagesTraining Program: Subject:: Final ProjectSuraj Apex0% (1)

- Case: Molson Coors and AcquisitionsDocument5 pagesCase: Molson Coors and AcquisitionsJas100% (1)

- The Balance Sheet and Income StatementDocument3 pagesThe Balance Sheet and Income Statementdhanya1995100% (1)

- IR 2 - Mod 6 Bus Combi FinalDocument4 pagesIR 2 - Mod 6 Bus Combi FinalLight Desire0% (1)

- Product Management Bootstrapper: Curated List of PM-related Articles & Videos Shaped Into A 14-Day Program For BeginnersDocument36 pagesProduct Management Bootstrapper: Curated List of PM-related Articles & Videos Shaped Into A 14-Day Program For BeginnersMalayaj MishraNo ratings yet

- Contoh Soal Pelaporan KorporatDocument4 pagesContoh Soal Pelaporan Korporatirma cahyani kawi0% (1)

- Pa2 M-1415Document4 pagesPa2 M-1415Ronnelson PascualNo ratings yet

- IA 3 Final Assessment PDFDocument5 pagesIA 3 Final Assessment PDFJoy Miraflor Alinood100% (1)

- Auditing Problems3Document32 pagesAuditing Problems3Kimberly Milante100% (2)

- Midterm Exam in FMDocument10 pagesMidterm Exam in FMROB101512No ratings yet

- Problem No. 1: Business Combination Quiz No. 2Document2 pagesProblem No. 1: Business Combination Quiz No. 2Caelah Jamie TubleNo ratings yet

- Task 3Document6 pagesTask 3trthph2001No ratings yet

- Soal Latihan Analisis Rasio KeuanganDocument7 pagesSoal Latihan Analisis Rasio Keuanganjoeng jaehyunNo ratings yet

- 2019 Completing The Audit Financial Statements PDFDocument2 pages2019 Completing The Audit Financial Statements PDFNics VenturaNo ratings yet

- 2019 Reconstruction or Reorganisation of CompaniesDocument5 pages2019 Reconstruction or Reorganisation of CompaniesBotho MetsiNo ratings yet

- Tutorial Questions - Trimester - 2210.Document26 pagesTutorial Questions - Trimester - 2210.premsuwaatiiNo ratings yet

- Pract 1 - Exam2Document2 pagesPract 1 - Exam2Sharmaine Rivera MiguelNo ratings yet

- Heriot-Watt University Accounting - June 2016 Section II Case Studies Case Study 1Document5 pagesHeriot-Watt University Accounting - June 2016 Section II Case Studies Case Study 1sanosyNo ratings yet

- Quiz 1.1Document2 pagesQuiz 1.1Annalie Cono0% (1)

- AFAR Corporate LiquidationDocument4 pagesAFAR Corporate LiquidationAndres, Rebecca PaulaNo ratings yet

- Classroom Exercises On Business Combinations and Consolidation - Date of AcquisitionDocument6 pagesClassroom Exercises On Business Combinations and Consolidation - Date of AcquisitionalyssaNo ratings yet

- Additional Cash Flow ProblemsDocument3 pagesAdditional Cash Flow ProblemsChelle HullezaNo ratings yet

- Financial Midterm ExaminationDocument3 pagesFinancial Midterm ExaminationHanabusa Kawaii IdouNo ratings yet

- FINANCIAL REPORTING - PDF May 2012Document9 pagesFINANCIAL REPORTING - PDF May 2012Catherine dumenuNo ratings yet

- Cpareviewschoolofthephilippines ChanchanDocument8 pagesCpareviewschoolofthephilippines ChanchanDavid David100% (1)

- FAR Activity Feb 19 With AnswersDocument16 pagesFAR Activity Feb 19 With AnswersCybill AiraNo ratings yet

- Consolidated FS at Date of AcquisitionDocument2 pagesConsolidated FS at Date of AcquisitionRafael BarbinNo ratings yet

- Advanced Accounting 2BDocument4 pagesAdvanced Accounting 2BHarusiNo ratings yet

- 1.90 IAS 7 CFL Omnium 22 - 23 IAS 33 EpsDocument3 pages1.90 IAS 7 CFL Omnium 22 - 23 IAS 33 Epsarmaan ryanNo ratings yet

- Chapter 13 Homework Assignment #2 QuestionsDocument8 pagesChapter 13 Homework Assignment #2 QuestionsCole Doty0% (1)

- Business Combination NotesDocument3 pagesBusiness Combination NotesKenneth Calzado67% (3)

- Financial PositionDocument2 pagesFinancial PositionKatherine BorjaNo ratings yet

- Intermediate Accounting 3 Second Grading Quiz: Name: Date: Professor: Section: ScoreDocument2 pagesIntermediate Accounting 3 Second Grading Quiz: Name: Date: Professor: Section: ScoreGrezel NiceNo ratings yet

- FAR2Document8 pagesFAR2Kenneth DiabordoNo ratings yet

- Example Problems W Solutions in SFP & SCFDocument7 pagesExample Problems W Solutions in SFP & SCFQueen Valle100% (1)

- Total Liabilities 2,533,900Document2 pagesTotal Liabilities 2,533,900Noriejean LaboresNo ratings yet

- Note 5: PPE: Acc. Dep. Book Value Acquisition CostDocument5 pagesNote 5: PPE: Acc. Dep. Book Value Acquisition CostSabel LagoNo ratings yet

- Chapter 46 Cash Flow ComprehensiveDocument8 pagesChapter 46 Cash Flow ComprehensiveCheesca Macabanti - 12 Euclid-Digital ModularNo ratings yet

- 648235Document5 pages648235mohitgaba19No ratings yet

- Acc113 P1 QuizDocument5 pagesAcc113 P1 QuizEDELYN PoblacionNo ratings yet

- CPA 1 - Financial Accounting March 2021Document9 pagesCPA 1 - Financial Accounting March 2021Asaba GloriaNo ratings yet

- Straight ProblemsDocument12 pagesStraight Problemsnana100% (2)

- Statement of CF - Callow LTD - Introduction Level ExerciseDocument5 pagesStatement of CF - Callow LTD - Introduction Level ExerciseNhư QuỳnhNo ratings yet

- Citn & Icag-13Document1 pageCitn & Icag-13AKINROYEJE TEMITOPENo ratings yet

- MSC F & A Test One SolutionDocument7 pagesMSC F & A Test One Solutionsebastian mlingwaNo ratings yet

- Final Proj Sy2022-23 Agrigulay Corp.Document4 pagesFinal Proj Sy2022-23 Agrigulay Corp.Jan Elaine CalderonNo ratings yet

- The Following Trial Balance Was Extracted From The Books of Craz LTD As at 31 Dec 2014Document5 pagesThe Following Trial Balance Was Extracted From The Books of Craz LTD As at 31 Dec 2014Pham TrangNo ratings yet

- Financial Accounting 19 PDF FreeDocument6 pagesFinancial Accounting 19 PDF FreeLyka Kristine Jane PacardoNo ratings yet

- Additional Problems On MergerDocument6 pagesAdditional Problems On MergerkakeguruiNo ratings yet

- FRS 107 Ie 2016BBDocument10 pagesFRS 107 Ie 2016BBAmelia RahmawatiNo ratings yet

- Cash Flow Tutorial QnsDocument13 pagesCash Flow Tutorial QnsCristian Renatus100% (1)

- AFAR 1.3 - Corporate LiquidationDocument5 pagesAFAR 1.3 - Corporate LiquidationKile Rien MonsadaNo ratings yet

- IAS 7 - Statement of CashflowsDocument7 pagesIAS 7 - Statement of CashflowsidarausungNo ratings yet

- Adv Acc Asg 3Document4 pagesAdv Acc Asg 3JerichoNo ratings yet

- Prob 7Document1 pageProb 7Angelia TNo ratings yet

- Sessions 8 - 9 - BS - SentDocument11 pagesSessions 8 - 9 - BS - SentAjay DesaleNo ratings yet

- AA 4101 Midterm With AnswersDocument9 pagesAA 4101 Midterm With AnswersAlyssa AnnNo ratings yet

- Practical Accounting 1-SIR SALVADocument366 pagesPractical Accounting 1-SIR SALVASofia SanchezNo ratings yet

- Chapter 12 3 Bài DàiDocument6 pagesChapter 12 3 Bài DàiMai Lâm LêNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Capital Asset Investment: Strategy, Tactics and ToolsFrom EverandCapital Asset Investment: Strategy, Tactics and ToolsRating: 1 out of 5 stars1/5 (1)

- Final Exam MBL PKP VettedDocument4 pagesFinal Exam MBL PKP VettedRaihah Nabilah HashimNo ratings yet

- JAN24 Assginment Answer Business CommunicationDocument6 pagesJAN24 Assginment Answer Business Communicationanjnaprohike26No ratings yet

- Hengyuan2017 PDFDocument143 pagesHengyuan2017 PDFChee Haw YapNo ratings yet

- Unit4 Trademarks FinalDocument24 pagesUnit4 Trademarks FinalChuNo ratings yet

- Module 2 - Misstatements in The Financial StatementsDocument11 pagesModule 2 - Misstatements in The Financial StatementsIvan LandaosNo ratings yet

- Shivani Singh PresentationDocument13 pagesShivani Singh PresentationVaibhav BhatnagarNo ratings yet

- Marketing PlanDocument6 pagesMarketing Planapi-711511353No ratings yet

- Individual Determinants of Consumer Behaviour LearningDocument40 pagesIndividual Determinants of Consumer Behaviour Learningnikupadhyay25No ratings yet

- Nelkins Tour and ConsultDocument3 pagesNelkins Tour and ConsultNellie KarrenNo ratings yet

- Business Ethics 3 ND Edition 2017Document18 pagesBusiness Ethics 3 ND Edition 2017tknowledgeNo ratings yet

- Entrepreneur Journeys (Volume One) Prologue For India EditionDocument6 pagesEntrepreneur Journeys (Volume One) Prologue For India EditionsramanaNo ratings yet

- Mẫu PODocument15 pagesMẫu POKhoa NguyenNo ratings yet

- Horngren PricingDocument41 pagesHorngren Pricingpresentasi1No ratings yet

- Chapter 6 ETHICAL ISSUES AND SOCIAL RESPONSIBILITY OF ENTREPRENEURS Chapter 6Document4 pagesChapter 6 ETHICAL ISSUES AND SOCIAL RESPONSIBILITY OF ENTREPRENEURS Chapter 6Kariuki CharlesNo ratings yet

- Research Report For Praedico GlobalDocument3 pagesResearch Report For Praedico GlobalAbhishek PatilNo ratings yet

- ASSIGNMENT 3 Domino PizzaDocument2 pagesASSIGNMENT 3 Domino Pizzaevi tzouNo ratings yet

- CRMDocument27 pagesCRMNasrul HodaNo ratings yet

- Agricultural Marketing ReviewDocument147 pagesAgricultural Marketing ReviewVanshence neosilverNo ratings yet

- Booth Casebook 2004 PDFDocument168 pagesBooth Casebook 2004 PDFAnqi ZhouNo ratings yet

- Module 11 ICT 141Document3 pagesModule 11 ICT 141Janice SeterraNo ratings yet

- Chethan G JK BFRDocument74 pagesChethan G JK BFRNachiketha D NNo ratings yet

- A Study of Brand Marketing in Emerging Markets in United KingdomDocument49 pagesA Study of Brand Marketing in Emerging Markets in United KingdomDr Waseem CNo ratings yet

- Coc 2016Document4 pagesCoc 2016AudzkieNo ratings yet

- Journalize The Following Transactions That Occurred in February 2016 For PDFDocument1 pageJournalize The Following Transactions That Occurred in February 2016 For PDFhassan taimourNo ratings yet

- Assignment 3 FRSADocument7 pagesAssignment 3 FRSACma Pushparaj KulkarniNo ratings yet

- Celebration Candles Confronting Growth Challenges - TNDocument5 pagesCelebration Candles Confronting Growth Challenges - TNTanya RajNo ratings yet

- Burberry Final DraftDocument11 pagesBurberry Final Draftmax yeangNo ratings yet