Professional Documents

Culture Documents

Roadmap

Roadmap

Uploaded by

lamslam0 ratings0% found this document useful (0 votes)

21 views2 pagesThis document provides an overview and roadmap for financial statements including the balance sheet, income statement, statement of cash flows, and statement of changes in equity. It outlines the key components of each financial statement, such as assets, liabilities, equity, revenue, expenses, cash flows from operating, investing and financing activities. It also discusses accounting concepts like stock vs flow accounts, accounting equations, debit and credit rules, and provides examples of transactions that increase or decrease different accounts.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides an overview and roadmap for financial statements including the balance sheet, income statement, statement of cash flows, and statement of changes in equity. It outlines the key components of each financial statement, such as assets, liabilities, equity, revenue, expenses, cash flows from operating, investing and financing activities. It also discusses accounting concepts like stock vs flow accounts, accounting equations, debit and credit rules, and provides examples of transactions that increase or decrease different accounts.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

21 views2 pagesRoadmap

Roadmap

Uploaded by

lamslamThis document provides an overview and roadmap for financial statements including the balance sheet, income statement, statement of cash flows, and statement of changes in equity. It outlines the key components of each financial statement, such as assets, liabilities, equity, revenue, expenses, cash flows from operating, investing and financing activities. It also discusses accounting concepts like stock vs flow accounts, accounting equations, debit and credit rules, and provides examples of transactions that increase or decrease different accounts.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

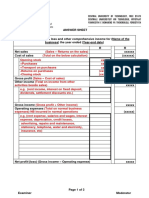

Roadmap ACCT 642-G1, G2, G4

Prepared by Professor Chang

Balance Sheet (aka Statement of Financial Position)

As of December 31, 2018 Statement of Changes in Equity

Asset Liability For the year ended December 31, 2018

Current Assets Accounts Payable Equity, Beginning of the Year xxx

Cash Unearned Revenue Stock Issuance xxx

Marketable Securities Accrued Liability Treasury Stock (xxx)

Accounts Receivable Bonds Payable Net Income xxx

Prepaid Expense Dividend Declared (xxx)

Inventory Equity, End of the Year xxx

Non-current Assets Equity

Long-term Investment Share Capital

PP&E Retained Earnings

Intangibles

Other Assets

Statement of Comprehensive Income

For the year ended December 31, 2018

Sales (aka Revenue) xxx Revenue, net (= sales – sales discount, return, allowance)

Cost of Goods Sold (xxx)

Gross Margin (aka Gross Profit) xxx

Operating Expenses (xxx) e.g., SG&A, bad debt expense, and depreciation expense

Operating Income (aka Operating Profit) xxx Income

Other Income & Gain xxx e.g., interest income, gain on sale of PP&E Statement

Other Expense & Loss (xxx) e.g., interest expense, loss on early retirement of bonds

Income Tax (xxx)

Net Income xxx

EPS (Basic & Diluted EPS) xxx

Other Comprehensive Income xxx e.g., foreign currency translation adj.

Comprehensive Income xxx

Statement of Cash Flows

For the year ended December 31, 2018

Cash Generated by Operating Activities xxx Note: OCF can be computed using either a direct or an indirect method.

Cash Used in Investing Activities (xxx)

Cash Used in Financing Activities (xxx)

Increase or Decrease in Cash xxx

Cash, Beginning of the Year xxx

Cash, End of the Year xxx

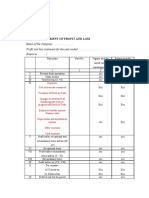

Roadmap ACCT 642-G1, G2, G4

Prepared by Professor Chang

• Stock vs. Flow accounts

• Accounting equations:

1) Asset = Liability + Equity

2) Net Income = Revenue – Expense; Ending Retained Earnings = Beginning Retained Earnings + Net Income – Dividend

• Debit and credit rules

- Business transactions include two parts (giving and receiving) and thus accounting is based on a double entry system.

- Debit is on the left and credit is on the right.

- An increase in Asset, Expense, and Dividend is on debit; An increase in Liability, Equity, and Revenue is on credit.

• Examples

- A decrease in PP&E

- An increase in Sales

- A decrease in Interest Revenue

- An increase in Rent Expense

- An increase in Dividend

You might also like

- Micro Notes On A2 IAL AccountingDocument15 pagesMicro Notes On A2 IAL AccountingRajibul Haque Shumon100% (2)

- Preparation of Financial Statement For A Sole TraderDocument8 pagesPreparation of Financial Statement For A Sole TraderDebbie Debz100% (3)

- Part 6Document8 pagesPart 6Amr YoussefNo ratings yet

- Ias 1-Presentation of Financial StatementsDocument21 pagesIas 1-Presentation of Financial StatementsChumani GqadaNo ratings yet

- Template For Financial Statements and Question 2 Sept 2023Document4 pagesTemplate For Financial Statements and Question 2 Sept 2023Mohammed akbarNo ratings yet

- Cash Flow Statement Cpale BoardDocument2 pagesCash Flow Statement Cpale BoardSharon CarilloNo ratings yet

- Notes of Financial Statements or Final AccountsDocument11 pagesNotes of Financial Statements or Final Accountsrxcha.josephNo ratings yet

- Company Financials - Cash FlowDocument17 pagesCompany Financials - Cash FlowJack SangNo ratings yet

- 10532lectuer 5 FADocument28 pages10532lectuer 5 FANajia SalmanNo ratings yet

- Eng - F AccDocument41 pagesEng - F AccRana MahmoudNo ratings yet

- Di Bawah Ini Disajikan Contoh Penyajian Laporan Laba Rugi Dan Penghasilan Lain Secara Lengkap Yang Sesuai Dengan PSAK 1 Sebagai BerikutDocument2 pagesDi Bawah Ini Disajikan Contoh Penyajian Laporan Laba Rugi Dan Penghasilan Lain Secara Lengkap Yang Sesuai Dengan PSAK 1 Sebagai Berikutnoviliaa7No ratings yet

- Accountancy All FormulaDocument23 pagesAccountancy All FormulaThe Unknown vlogger100% (1)

- Financial StatementsDocument6 pagesFinancial Statementsasandantlumayo77No ratings yet

- Business Finance: Session 3: Financial StatementsDocument45 pagesBusiness Finance: Session 3: Financial StatementsXia AlliaNo ratings yet

- 06 Handout 1Document19 pages06 Handout 1Johnlloyd CahuloganNo ratings yet

- Cash Flow StatementDocument16 pagesCash Flow Statementrajesh337masssNo ratings yet

- Fund Flow:: Working CapitalDocument19 pagesFund Flow:: Working CapitalAlex JayachandranNo ratings yet

- Company Final AccountsDocument13 pagesCompany Final Accountsshanthala mNo ratings yet

- ACTBFAR - Unit 1 - Manufacturing - Part 3 - Financial Statements - Study Guide PDFDocument7 pagesACTBFAR - Unit 1 - Manufacturing - Part 3 - Financial Statements - Study Guide PDFAlyx Gabrielle GocoNo ratings yet

- CAB AcctDocument9 pagesCAB AcctA.J. ChuaNo ratings yet

- Reviewer FarDocument3 pagesReviewer FarJadine pabloNo ratings yet

- Study Session 05: Shemal MustaphaDocument11 pagesStudy Session 05: Shemal MustaphafirefxyNo ratings yet

- Cash Flow Statement - FormatDocument2 pagesCash Flow Statement - FormatHassan AsgharNo ratings yet

- A. Statement of Financial Position (Balance Sheet)Document5 pagesA. Statement of Financial Position (Balance Sheet)Majane TognoNo ratings yet

- Chapter 21 IAS 1Document4 pagesChapter 21 IAS 1Chandan SamalNo ratings yet

- Chapter 3 - Statement of Comprehensive IncomeDocument7 pagesChapter 3 - Statement of Comprehensive IncomeKarylle EntinoNo ratings yet

- Statement of Profit and Loss (As Per Division I of Schedule Iii)Document7 pagesStatement of Profit and Loss (As Per Division I of Schedule Iii)Yash GoyalNo ratings yet

- Cash Flow StatementDocument5 pagesCash Flow StatementDebaditya SenguptaNo ratings yet

- IAS 1 Presentation of Financial Statements (2021)Document17 pagesIAS 1 Presentation of Financial Statements (2021)Tawanda Tatenda Herbert100% (1)

- Preparation of Published Financial StatementsDocument19 pagesPreparation of Published Financial StatementsRuth Nyawira100% (1)

- Chap-7, 8 & 9 (Income Statemnet & Statement of Financial Position)Document17 pagesChap-7, 8 & 9 (Income Statemnet & Statement of Financial Position)7a4374 hisNo ratings yet

- Explanations On StatementsDocument3 pagesExplanations On StatementsSimphiwe NandoNo ratings yet

- Chap-7, 8 & 9 (Income Statemnet & Statement of Financial Position)Document18 pagesChap-7, 8 & 9 (Income Statemnet & Statement of Financial Position)7a4374 hisNo ratings yet

- Part Ii - Statement of Profit and LossDocument3 pagesPart Ii - Statement of Profit and LossSaumyajit DeyNo ratings yet

- POA FormatsDocument7 pagesPOA FormatsWilliNo ratings yet

- Formats of Income Statement, Balance Sheet & Cash Flow StatementDocument3 pagesFormats of Income Statement, Balance Sheet & Cash Flow StatementAli RazaNo ratings yet

- 1-Cash Flow StatementDocument21 pages1-Cash Flow StatementOvais Zia100% (1)

- General Format For Final AccountsDocument2 pagesGeneral Format For Final AccountsGokulCj GroveNo ratings yet

- Chapter 18 - Accounts of Clubs and Society-2Document3 pagesChapter 18 - Accounts of Clubs and Society-2abeggmprt 1303No ratings yet

- Working Capital Management Formula SheetDocument2 pagesWorking Capital Management Formula SheetAnonymous SJ4xSoIvbNo ratings yet

- Actg101 Fs Prepa TemplateDocument16 pagesActg101 Fs Prepa TemplateJaira ClavoNo ratings yet

- Accounts Chapter 8Document10 pagesAccounts Chapter 8R.mNo ratings yet

- CHAPTER 2 StudentDocument10 pagesCHAPTER 2 Studentfelicia tanNo ratings yet

- Unit 02 Preparation of Financial Statement As Per IND AS 01Document13 pagesUnit 02 Preparation of Financial Statement As Per IND AS 01Deepak LNo ratings yet

- Cash Flow Statements6Document28 pagesCash Flow Statements6kimuli FreddieNo ratings yet

- Diya 1Document4 pagesDiya 1Vipul I PanchasarNo ratings yet

- CF StatementDocument3 pagesCF StatementSukumarVenkataNo ratings yet

- FSs For CompaniesDocument9 pagesFSs For CompaniesFarid UddinNo ratings yet

- Fundamentals of Accounting and Business ManagementDocument4 pagesFundamentals of Accounting and Business ManagementSan Juan Ezthie100% (1)

- Final Account of Sole TradersDocument16 pagesFinal Account of Sole Tradersheena mohnaniNo ratings yet

- Ias 1Document8 pagesIas 1daniloorestmarijaniNo ratings yet

- SUBJECT:-Management Accounting Unit II: Fund Flow StatementDocument12 pagesSUBJECT:-Management Accounting Unit II: Fund Flow Statementganeshteggihalli7022No ratings yet

- Cash Flow StatementDocument19 pagesCash Flow StatementCharu100% (1)

- Accounting & Financial Systems (Lecture 7)Document20 pagesAccounting & Financial Systems (Lecture 7)Right Karl-Maccoy HattohNo ratings yet

- Accounting FormatsDocument21 pagesAccounting FormatsAsima ZubairNo ratings yet

- Illustrative Financial StatementsDocument17 pagesIllustrative Financial Statementstariqdiyani05No ratings yet

- Cash Flow Statement Ias 7Document5 pagesCash Flow Statement Ias 7JOSEPH LUBEMBANo ratings yet

- ACCOUNTINGDocument2 pagesACCOUNTINGMarie OrbetaNo ratings yet

- Capital Asset Investment: Strategy, Tactics and ToolsFrom EverandCapital Asset Investment: Strategy, Tactics and ToolsRating: 1 out of 5 stars1/5 (1)

- 2022 Property Tax Exemption FormDocument5 pages2022 Property Tax Exemption FormsplouffevachonNo ratings yet

- Unit - Iv Cost and Management AccountingDocument12 pagesUnit - Iv Cost and Management AccountingRamakrishna RoshanNo ratings yet

- 1 CT Unit 1 CSSDocument96 pages1 CT Unit 1 CSSKiran AnvattiNo ratings yet

- XLS EngDocument3 pagesXLS EngSalmaNo ratings yet

- Balance Sheet ProvisionalDocument2 pagesBalance Sheet ProvisionalRaja AdhikariNo ratings yet

- Akuntansi Pengantar 2Document4 pagesAkuntansi Pengantar 2Lingga ArgianitaNo ratings yet

- Loyola College (Autonomous), Chennai - 600 034: APRIL 2016 Co 6608 - Financial ManagementDocument3 pagesLoyola College (Autonomous), Chennai - 600 034: APRIL 2016 Co 6608 - Financial ManagementvivekNo ratings yet

- 65 - COMMERCE - FINANCIAL ACCOUNTING - 653 - (13-12-2019 07 - 47 - 17 - 372 AM) Mahesh4Document9 pages65 - COMMERCE - FINANCIAL ACCOUNTING - 653 - (13-12-2019 07 - 47 - 17 - 372 AM) Mahesh4Mahesh KharatNo ratings yet

- Income Statement Common SizeDocument3 pagesIncome Statement Common SizeJuliet ToriagaNo ratings yet

- AP14e ch03 Solutions ManualDocument5 pagesAP14e ch03 Solutions Manual22004079No ratings yet

- Policyon Joining Transfer BenefitsDocument5 pagesPolicyon Joining Transfer BenefitsKanav MahajanNo ratings yet

- Chapter 8 Tax AdministrationDocument14 pagesChapter 8 Tax AdministrationHazlina Hussein100% (1)

- COA (Odoo Egypt)Document8 pagesCOA (Odoo Egypt)menams2010No ratings yet

- Lecture 1-Financial Statements I-SDocument75 pagesLecture 1-Financial Statements I-SjamesbinstrateNo ratings yet

- LLP BSPLDocument17 pagesLLP BSPLKiran KumarNo ratings yet

- Cpa Review School of The Philippines ManilaDocument2 pagesCpa Review School of The Philippines ManilaAlliah Mae ArbastoNo ratings yet

- A201 Mid Assessment QDocument5 pagesA201 Mid Assessment QSanthiya MogenNo ratings yet

- 4.2 - Cost of Equity - ExerciseDocument7 pages4.2 - Cost of Equity - ExerciseHTNo ratings yet

- Donor Scholarship FormDocument2 pagesDonor Scholarship FormNitish GuptaNo ratings yet

- Financial LiteracyDocument30 pagesFinancial LiteracyRegine Mae MabulayNo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal DetailsHarsh Gandhi0% (1)

- Inclass P Chapter 2 Accng Income Vs Cash Flow BDocument4 pagesInclass P Chapter 2 Accng Income Vs Cash Flow BZhuka TemirbulatovaNo ratings yet

- Financial Accounting (D.com-II)Document6 pagesFinancial Accounting (D.com-II)Basit RehmanNo ratings yet

- Module 8 and 9 EntrepDocument16 pagesModule 8 and 9 EntrepmarieenriquezsalitaNo ratings yet

- AFAR Reminders by Atty - LacoDocument1 pageAFAR Reminders by Atty - LacoAlexandra IbaleNo ratings yet

- Chapter 1 PowerPointDocument23 pagesChapter 1 PowerPointth3hackerssquadNo ratings yet

- Tax Credit Certificate 2023 9552312947779Document2 pagesTax Credit Certificate 2023 9552312947779Toni rogers CardosoNo ratings yet

- Chapter 2 - PartnershipDocument20 pagesChapter 2 - PartnershipNgNo ratings yet

- Excel Workbook For In-Class Demonstrations and Self-Practice With Solutions - Chapter 9 Part 1 of 8Document29 pagesExcel Workbook For In-Class Demonstrations and Self-Practice With Solutions - Chapter 9 Part 1 of 8Dante CardonaNo ratings yet

- Shapiro Chapter 20 SolutionsDocument13 pagesShapiro Chapter 20 SolutionsRuiting ChenNo ratings yet