Professional Documents

Culture Documents

Taxable Event and Supply: Presentation By: - Ranvir Singh Rahul Banger Rollno: - 2024550

Taxable Event and Supply: Presentation By: - Ranvir Singh Rahul Banger Rollno: - 2024550

Uploaded by

Gurinder Singh0 ratings0% found this document useful (0 votes)

12 views14 pagesThe document discusses taxable events and supply under the Goods and Services Tax (GST) in India. [1] A taxable event is any event or occurrence that results in a tax liability, such as the supply of goods or services. [2] Supply includes various transactions like sale, transfer, exchange during the course of business for consideration. [3] For a transaction to be considered a supply, it must be done for consideration and in the furtherance of business. Examples of different types of supplies like composite, mixed, and activities that are or aren't considered supply are provided.

Original Description:

Original Title

GST PPT

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses taxable events and supply under the Goods and Services Tax (GST) in India. [1] A taxable event is any event or occurrence that results in a tax liability, such as the supply of goods or services. [2] Supply includes various transactions like sale, transfer, exchange during the course of business for consideration. [3] For a transaction to be considered a supply, it must be done for consideration and in the furtherance of business. Examples of different types of supplies like composite, mixed, and activities that are or aren't considered supply are provided.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

12 views14 pagesTaxable Event and Supply: Presentation By: - Ranvir Singh Rahul Banger Rollno: - 2024550

Taxable Event and Supply: Presentation By: - Ranvir Singh Rahul Banger Rollno: - 2024550

Uploaded by

Gurinder SinghThe document discusses taxable events and supply under the Goods and Services Tax (GST) in India. [1] A taxable event is any event or occurrence that results in a tax liability, such as the supply of goods or services. [2] Supply includes various transactions like sale, transfer, exchange during the course of business for consideration. [3] For a transaction to be considered a supply, it must be done for consideration and in the furtherance of business. Examples of different types of supplies like composite, mixed, and activities that are or aren't considered supply are provided.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 14

TAXABLE EVENT AND SUPPLY

Presentation By :- * Ranvir Singh

*Rahul Banger

Rollno :- *2024550

*2024549

TAXABLE EVENT

▪ (a) Taxable- Liable to be taxed; subject to tax

▪ (b )Event:- A thing that happens or takesplace, especially one of importance.

(Source:- Oxford Dictionary)

▪ Taxable event:

A taxable event is any event or occurrence that results in a tax liability. Normally taxab

- le event means occurrence creates or attract the liability to be fixed.

▪ Taxable event under GST:

Tax will be levied when supply of Goods and/or services. Time of supply of goods and/or

services is more important under GST the liability to be fixed.

SUPPLY

▪ Supply includes sale,

transfer,exchange, barter, license,

rental,lease and disposal. If a person

undertakes either of these transactions

during the course or furtherance of

business for consideration, it will be

covered under the meaning of Supply

underGST.

ELEMENTS OF SUPPLY

▪ Supply has two important elements:

1. Supply is done for a consideration.

2. Supply is done in course of furtherance of business.

▪ If the aforementioned elements are not met with, it is not considered as a sale.

EXAMPLE OF THE SUPPLY

▪ For Example:

Mr.A buys a table for Rs.10,000 for his personal use

and sells it off after 10 months of use to a dealer. This

is not considered as supply under CGST as this is not

done by Mr A for the furtherance of business

Mrs. B provides free coaching to neighbouring

students as a hobby. This is not considered as supply

as this act is not performed for a consideration.

COMPONENTS OF SUPPLY

Place, value, and time are three elements of a GST supply that are used to determine

the tax due for that transaction.

▪ Place of Supply: This tell if you any transaction is an intra-state supply, inter-state

supply, or aforeign trade, in turn, telling you the type of GST to apply.

▪ Value of Supply: This sections tell you the taxable value of a supply and, the final

amount of the tax that one needs to pay.

▪ Time of Supply: It tells you when the applicable taxes and GST returns are due.

TYPES OF SUPPLY

There are a few supplies which are made together with two or more items. Such

supplies are further classified into Composite Supply and Mixed Supply.

▪ COMPOSITE SUPPLY :

When goods and services are supplied as a bundle, in conjunction with each other,

in the ordinary course of business, one of which is a principal supply, it is considered

a composite supply. These are generally the necessities combined, and even the

customer perceives to receive such goods and services as a package.Composite

supplies are generally advertised as a package, and the supplies cannot be sold

individually. In the case of composite supplies, the rate of supply is the rate

applicable to the Principal Supply. For example, a charger supplied with amobile

phone or a laptop.

▪ Mixed Supply :

Mixed Supplies are when two or more taxable individual supplies are supplied in

combination. Such supplies are individual and are not naturally bundled. The supply

that attracts the highest tax rate for Mixed Supplies is applied to the entire mixed

supply. For example, a Diwali gift package consisting of Chocolates, candies, dry

fruits,sweets, balloons.

ACTIVITIES OR TRANSACTIONS TREATED

AS SUPPLY OF GOODS AND SERVICES

S. No Transaction Supply of

goods/Supply of

services

1. Transfer of title in goods Supply of goods

2. Transfer of rights in goods Supply of services

without the transfer of title

3. Lease, tenancy, Supply of services

rental,easement of land or

equipment

S. No Transaction Supply of goods

/Supply of services

4. Treatment or process Supply of Services

applied on goods

5. Goods of business are Supply of goods

transferred or disposed off

so that they don't form part of

the business anymore

6. Goods are made available to Supply of Services

another person for any

purpose other than business

under the person’s directions

carrying on a business

7. Development, designing Suppy of Services

programming,enhancement

of any IT software

8. Temporary transfer of rights Supply of services

to Immovable properties

ACTIVITIES NEITHER SUPPLY OF GOODS

NOR SUPPLY OF SERVICES

There are some activities mentioned in (Schedule ll) which shall treated neither

assupply of goods nor supply of services.

▪ Services by employee to employer in course of his employment.

▪ Services by court or tribunal.

▪ Functions performed by MLA, MP, Member of Panchayat, Member of Municipalities.

▪ Services of Funeral, burial etc.including transportation of deceased.

▪ Sale of land and, subject to Paru.5(b) of schedule l, sale of building.

▪ Actionable claim other than Lottery, betting and gambling.

▪ High sea-scale.

Thank you

You might also like

- My Payslips 2022-11-07Document16 pagesMy Payslips 2022-11-07Ildikó Pető-Jánosi0% (1)

- Definition of Supply Under GSTDocument8 pagesDefinition of Supply Under GSTRohit Bajpai100% (1)

- The Meaning and Scope of Supply NewDocument3 pagesThe Meaning and Scope of Supply NewRicha RajpalNo ratings yet

- Place of Supply Under GST ActDocument16 pagesPlace of Supply Under GST ActSaatwik100% (1)

- How to have a Brilliant Career in Estate Agency: The ultimate guide to success in the property industry.From EverandHow to have a Brilliant Career in Estate Agency: The ultimate guide to success in the property industry.Rating: 5 out of 5 stars5/5 (1)

- Taxable Event and Supply: Presentation By: - Ranvir Singh Rahul Banger Rollno: - 2024550Document14 pagesTaxable Event and Supply: Presentation By: - Ranvir Singh Rahul Banger Rollno: - 2024550Gurinder SinghNo ratings yet

- Supply Between Related Persons or Distinct PersonsDocument3 pagesSupply Between Related Persons or Distinct PersonsRohit BajpaiNo ratings yet

- SUPPLY UNDER GST-Unit 2Document56 pagesSUPPLY UNDER GST-Unit 2niveditaNo ratings yet

- GST Notes For Vi SemesterDocument55 pagesGST Notes For Vi SemesterNagashree RANo ratings yet

- Supply: Meaning and ScopeDocument32 pagesSupply: Meaning and Scopesaket kumarNo ratings yet

- Participant's Note - Meaning and Scope of Supply and Time and Valuation of SupplyDocument20 pagesParticipant's Note - Meaning and Scope of Supply and Time and Valuation of SupplyaskNo ratings yet

- Definition of Supply Under GSTDocument16 pagesDefinition of Supply Under GSTanon_443392752No ratings yet

- Levy and Collection of Tax: Indirect TaxationDocument11 pagesLevy and Collection of Tax: Indirect TaxationTejasNo ratings yet

- Levy and Charges of GST: Items Exempted Under GSTDocument6 pagesLevy and Charges of GST: Items Exempted Under GSTGauharNo ratings yet

- GST Unit IiDocument20 pagesGST Unit IiMani Maran123No ratings yet

- Business Taxation-2Document33 pagesBusiness Taxation-2Pranjal pandeyNo ratings yet

- Project of Law of Taxation-Ii (Indirect Taxes) : Submitted To and Under Guidance of Dr. Kamlesh Kumar Shukla SirDocument17 pagesProject of Law of Taxation-Ii (Indirect Taxes) : Submitted To and Under Guidance of Dr. Kamlesh Kumar Shukla SirShivani Singh ChandelNo ratings yet

- Anil's Commerce +3 3Rd Yr Unit - 3Document26 pagesAnil's Commerce +3 3Rd Yr Unit - 3Justin ChanduNo ratings yet

- GST Act 2017Document23 pagesGST Act 2017Deepak NimmojiNo ratings yet

- Meaning and Scope of Supply and Time and Valuation of SupplyDocument81 pagesMeaning and Scope of Supply and Time and Valuation of Supplyshivam beniwalNo ratings yet

- Taxation SupplyDocument21 pagesTaxation SupplybruhNo ratings yet

- 5 6203841922746810452 PDFDocument22 pages5 6203841922746810452 PDFBhavy GandhiNo ratings yet

- Levy and Charges of GSTDocument16 pagesLevy and Charges of GSTMoosa ZaidiNo ratings yet

- Than Money and Securities But Includes Actionable Claim, Growing CropsDocument8 pagesThan Money and Securities But Includes Actionable Claim, Growing Cropssuyash dugarNo ratings yet

- Chapter 4 Supply Under GSTDocument83 pagesChapter 4 Supply Under GSTMitanshi KhannaNo ratings yet

- SUPPLY UNDER GSTDocument94 pagesSUPPLY UNDER GSTVishal AnandNo ratings yet

- Tax, GST, Transfer PricingDocument11 pagesTax, GST, Transfer Pricingbiplav2uNo ratings yet

- Service Tax 2012Document9 pagesService Tax 2012CA Ashish BochiaNo ratings yet

- Definition of Supply Under GST: AnalysisDocument3 pagesDefinition of Supply Under GST: Analysisrenu tomarNo ratings yet

- InDirect Tax Notes - Xavier'sDocument42 pagesInDirect Tax Notes - Xavier'sPallabi Mishra100% (1)

- UntitledDocument17 pagesUntitledsuyash dugarNo ratings yet

- Indirect Taxation: ExceptionDocument6 pagesIndirect Taxation: ExceptionPapu SahooNo ratings yet

- Pace and Supply Under GSTDocument14 pagesPace and Supply Under GSTRohit BajpaiNo ratings yet

- 026 - D - Dhairya ShahDocument15 pages026 - D - Dhairya ShahDHAIRYA09No ratings yet

- Supply Under The Goods and Services TaxDocument10 pagesSupply Under The Goods and Services TaxgriefernjanNo ratings yet

- Chapter 2 - Supply Under GST - NotesDocument48 pagesChapter 2 - Supply Under GST - NotesHarsh SawantNo ratings yet

- 3.concept of SupplyDocument3 pages3.concept of SupplyBhuvaneswari karuturiNo ratings yet

- Meaning and Scope of Supply Under GSTDocument5 pagesMeaning and Scope of Supply Under GSTRohit BajpaiNo ratings yet

- FAQ On Meaning and Scope of Supply Under GSTDocument3 pagesFAQ On Meaning and Scope of Supply Under GSTRajula Gurva ReddyNo ratings yet

- Supply Under GSTDocument14 pagesSupply Under GSTVasu NarangNo ratings yet

- Chapter 2 GSTDocument5 pagesChapter 2 GSTbratati.dharNo ratings yet

- Chapter 2Document9 pagesChapter 2Adethri AdethriNo ratings yet

- GST Unit 2Document30 pagesGST Unit 2SANSKRITI YADAV 22DM236No ratings yet

- Supply Under GST by CA Divakar VijayasarthyDocument30 pagesSupply Under GST by CA Divakar VijayasarthyGreat@2025No ratings yet

- Nandini 19305A0008 Concept of SupplyDocument7 pagesNandini 19305A0008 Concept of SupplyNandini GuptaNo ratings yet

- Write Back Amount Vs GSTDocument8 pagesWrite Back Amount Vs GSTashim1No ratings yet

- Article On SCOPE OF SUPPLYDocument7 pagesArticle On SCOPE OF SUPPLYAkarshan SrivastavaNo ratings yet

- Indirect Tax and GST - Unit IIIDocument43 pagesIndirect Tax and GST - Unit IIIPRATIK JAINNo ratings yet

- GST Sem 6 Important Questions With AnswersDocument92 pagesGST Sem 6 Important Questions With Answersshareeffardeen9No ratings yet

- GST Notes 12Document19 pagesGST Notes 12Wenlang SwerNo ratings yet

- E-Text Unit 2: Concept of SupplyDocument29 pagesE-Text Unit 2: Concept of SupplyrajneeshkarloopiaNo ratings yet

- E-Text Unit 2: Concept of SupplyDocument29 pagesE-Text Unit 2: Concept of SupplyrajneeshkarloopiaNo ratings yet

- Supply and Its TypesDocument30 pagesSupply and Its TypesAmit GuptaNo ratings yet

- Chapter 4Document46 pagesChapter 4Clove Wall100% (1)

- SCOPE OF SUPPLY (1) (Read-Only)Document24 pagesSCOPE OF SUPPLY (1) (Read-Only)rathnamano186No ratings yet

- Value Added Tax NotesDocument15 pagesValue Added Tax NotesGODBARNo ratings yet

- Tax - II Short N SweetDocument16 pagesTax - II Short N SweetAkash Ranjan TiwariNo ratings yet

- TaxationDocument12 pagesTaxationUwuNo ratings yet

- Chapter 2 - GST Part ADocument19 pagesChapter 2 - GST Part APooja D AcharyaNo ratings yet

- Panel Discussion On Union Budget 2022Document2 pagesPanel Discussion On Union Budget 2022Gurinder SinghNo ratings yet

- Press Note On One Week FDP Program On Research MethodologyDocument2 pagesPress Note On One Week FDP Program On Research MethodologyGurinder SinghNo ratings yet

- HackathonDocument3 pagesHackathonGurinder SinghNo ratings yet

- Introduction To orDocument51 pagesIntroduction To orGurinder SinghNo ratings yet

- Press Note On E - Symposium On National Youth DayDocument6 pagesPress Note On E - Symposium On National Youth DayGurinder SinghNo ratings yet

- World Environment DayDocument5 pagesWorld Environment DayGurinder SinghNo ratings yet

- Grey THRDocument2 pagesGrey THRGurinder SinghNo ratings yet

- greytHR 1Document2 pagesgreytHR 1Gurinder SinghNo ratings yet

- Pyramid College of Business and Technology, PhagwaraDocument10 pagesPyramid College of Business and Technology, PhagwaraGurinder SinghNo ratings yet

- Taxable Event and Supply: Presentation By: - Ranvir Singh Rahul Banger Rollno: - 2024550Document14 pagesTaxable Event and Supply: Presentation By: - Ranvir Singh Rahul Banger Rollno: - 2024550Gurinder SinghNo ratings yet

- Investment ManagementDocument35 pagesInvestment ManagementGurinder SinghNo ratings yet

- Indirect Tax Before GSTDocument7 pagesIndirect Tax Before GSTGurinder SinghNo ratings yet

- FAQs Re Submission of Sworn Declaration and COR SLOCPI SLAMCI SLFPIDocument6 pagesFAQs Re Submission of Sworn Declaration and COR SLOCPI SLAMCI SLFPIifpauditNo ratings yet

- Itr-V Asnpp1028l 2023-24 448120190130723Document1 pageItr-V Asnpp1028l 2023-24 448120190130723harsh sethiNo ratings yet

- p15 PDFDocument69 pagesp15 PDFDaniel LevineNo ratings yet

- Henderson V CollectorDocument3 pagesHenderson V CollectorViolet ParkerNo ratings yet

- Oven FreshDocument2 pagesOven FreshGopinath gopiNo ratings yet

- PDF Payment Summary 2022 - 2023Document1 pagePDF Payment Summary 2022 - 2023Izzy BaeNo ratings yet

- Time Card Template - Pies en La Arena-Template TCDocument1 pageTime Card Template - Pies en La Arena-Template TCValeria GonzálezNo ratings yet

- Sspofadv 4Document1 pageSspofadv 4Antoni Zelaya0% (1)

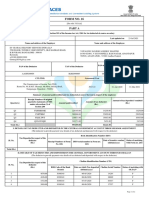

- Form No. 16: Part ADocument6 pagesForm No. 16: Part AVinuthna ChinnapaNo ratings yet

- Pooja 2Document2 pagesPooja 2KAPASAN DEKHONo ratings yet

- Bir Ruling (Da-373-05)Document4 pagesBir Ruling (Da-373-05)Rester John NonatoNo ratings yet

- Receipt CS-6686456Document1 pageReceipt CS-6686456Jean OrsayNo ratings yet

- Tutorial 3 (Q)Document4 pagesTutorial 3 (Q)szh saNo ratings yet

- Intacc2 Assignment 6.1 AnswersDocument6 pagesIntacc2 Assignment 6.1 AnswersMingNo ratings yet

- QC TreasurerDocument2 pagesQC TreasurerFrozen RawNo ratings yet

- Benfitsform Starbucks BeanstockDocument1 pageBenfitsform Starbucks BeanstockAndrew Christopher CaseNo ratings yet

- Guidelines and Instructions For BIR Form No. 1707-A Annual Capital Gains Tax ReturnDocument1 pageGuidelines and Instructions For BIR Form No. 1707-A Annual Capital Gains Tax ReturnKylie sheena MendezNo ratings yet

- TAXATION ON CORPORATIONS Lecture NotesDocument5 pagesTAXATION ON CORPORATIONS Lecture NotesLucille Rose MamburaoNo ratings yet

- Invoice 24-25Document2 pagesInvoice 24-25kapalyaNo ratings yet

- Chapter 5 - Passive Foreign Investment Companies and Mutual FundsDocument5 pagesChapter 5 - Passive Foreign Investment Companies and Mutual FundsGANYA JOKERNo ratings yet

- Quiz 7 - Dealings in PropertyDocument8 pagesQuiz 7 - Dealings in PropertyCarlo manejaNo ratings yet

- InvoiceDocument1 pageInvoiceAbhay Pratap SinghNo ratings yet

- Chapter 8-1. ProblemsDocument10 pagesChapter 8-1. Problemsiamjan_101No ratings yet

- Atwork Butuan or and Ar May 2023Document4 pagesAtwork Butuan or and Ar May 2023AXZEEN SECURITY AGENCY BUTUANNo ratings yet

- Income From Other Sources-NotesDocument4 pagesIncome From Other Sources-Notes6804 Anushka GhoshNo ratings yet

- 07 15 2018 PayDocument2 pages07 15 2018 PayB.ShivaniNo ratings yet

- Cargo Agent Presentation For GST March 2018Document13 pagesCargo Agent Presentation For GST March 2018rishi pandeyNo ratings yet

- Tax Deficiency and Tax DeliquencyDocument4 pagesTax Deficiency and Tax DeliquencyJanelleNo ratings yet

- Certificate of Tax Exemption No. 005-19Document3 pagesCertificate of Tax Exemption No. 005-19Lheo KisimNo ratings yet