Professional Documents

Culture Documents

Note On Tax Rebate On Takaful Contribution 2019 20 Salaried

Note On Tax Rebate On Takaful Contribution 2019 20 Salaried

Uploaded by

Roy Estate (Sajila Roy)Copyright:

Available Formats

You might also like

- AFF's Tax Memorandum On Changes in FB 2024Document13 pagesAFF's Tax Memorandum On Changes in FB 2024Hussain Afzal100% (5)

- Potato Corner Sample BreakevenDocument1 pagePotato Corner Sample BreakevenOver Mango50% (2)

- Case 5Document12 pagesCase 5JIAXUAN WANGNo ratings yet

- Note On Tax Rebate On Takaful Contribution 2019 20 Other Than SalariedDocument1 pageNote On Tax Rebate On Takaful Contribution 2019 20 Other Than Salariedsyed aamir shahNo ratings yet

- SFAD Week 1Document4 pagesSFAD Week 1Talha SiddiquiNo ratings yet

- 3-5yr ProjectionDocument2 pages3-5yr ProjectionKamille SumaoangNo ratings yet

- Main Menu Inputs Income Statement Balance Sheet Loan Fixed Asset ScheduleDocument12 pagesMain Menu Inputs Income Statement Balance Sheet Loan Fixed Asset ScheduleHussain ImranNo ratings yet

- Activity 2 MIlca BSA 3 3Document6 pagesActivity 2 MIlca BSA 3 3kyrie IrvingNo ratings yet

- 2014a 2015a 2016e 2017e 2018e 2019e 2020e 2021eDocument1 page2014a 2015a 2016e 2017e 2018e 2019e 2020e 2021evivianclementNo ratings yet

- Financial AnalysisDocument5 pagesFinancial AnalysisEdeline MitrofanNo ratings yet

- Gate of Aden Plan 2020Document1 pageGate of Aden Plan 2020Mohammad HanafyNo ratings yet

- Potato Corner Sample BreakevenDocument1 pagePotato Corner Sample Breakevenphuri.siaNo ratings yet

- Excel Crash Course - Book1 - Complete: Strictly ConfidentialDocument5 pagesExcel Crash Course - Book1 - Complete: Strictly ConfidentialEsani DeNo ratings yet

- 2014A 2015A 2016E 2017E 2018E 2019E 2020E: Income Statement Revenue 181,500.0 199,650.0 219,615.0 241,576.5 265,734.2Document2 pages2014A 2015A 2016E 2017E 2018E 2019E 2020E: Income Statement Revenue 181,500.0 199,650.0 219,615.0 241,576.5 265,734.2raskaNo ratings yet

- AST LTCC ComputationDocument9 pagesAST LTCC ComputationeiraNo ratings yet

- Excel Crash Course - Book1 - Blank: Strictly ConfidentialDocument4 pagesExcel Crash Course - Book1 - Blank: Strictly ConfidentialtehreemNo ratings yet

- Financial Analysis ModelDocument5 pagesFinancial Analysis ModelShanaya JainNo ratings yet

- Calculate New Salary Tax by Ather SaleemDocument2 pagesCalculate New Salary Tax by Ather Saleemabdul_348No ratings yet

- 3 Months PlanDocument8 pages3 Months PlanWaleed ZakariaNo ratings yet

- CFI ModelDocument5 pagesCFI ModelSidharth SainiNo ratings yet

- CFI ModelDocument5 pagesCFI ModelSidharth SainiNo ratings yet

- Project RequirementDocument4 pagesProject RequirementAlina Binte EjazNo ratings yet

- Financial PlanDocument14 pagesFinancial Planagotevan0No ratings yet

- NPS Calculator Free Download ExcelDocument7 pagesNPS Calculator Free Download Excelgroup 19No ratings yet

- Financial Model 1Document1 pageFinancial Model 1ahmedmostafaibrahim22No ratings yet

- Current Year Base Year Base Year X 100Document4 pagesCurrent Year Base Year Base Year X 100Kathlyn TajadaNo ratings yet

- PDF Balance General El Restaurante Quotdel Pasoquot - CompressDocument2 pagesPDF Balance General El Restaurante Quotdel Pasoquot - CompressHassan Vasquez LuisNo ratings yet

- Excel Crash Course - Book1 - Blank: Strictly ConfidentialDocument7 pagesExcel Crash Course - Book1 - Blank: Strictly ConfidentialআসিফহাসানখানNo ratings yet

- Excel Crash Course - Book1 - Complete: Strictly ConfidentialDocument5 pagesExcel Crash Course - Book1 - Complete: Strictly ConfidentialGaurav KumarNo ratings yet

- Ishika GuptaDocument5 pagesIshika GuptaGarvit JainNo ratings yet

- Edited FSDocument40 pagesEdited FShello kitty black and whiteNo ratings yet

- Financial AnalysisDocument9 pagesFinancial AnalysisSam SumoNo ratings yet

- Banking - Prof. Rafael Schiozer - Exercícios de Aula - Aulas 5 A 9 - SoluçõesDocument5 pagesBanking - Prof. Rafael Schiozer - Exercícios de Aula - Aulas 5 A 9 - SoluçõesCaioGamaNo ratings yet

- Muskan Nagar - FM AssignmentDocument33 pagesMuskan Nagar - FM AssignmentMuskan NagarNo ratings yet

- PG IncentivesDocument2 pagesPG IncentivesIRFAN JURIFANNo ratings yet

- FS Kopi Montong UpdatedDocument2 pagesFS Kopi Montong UpdatedArip Irpanudin,SENo ratings yet

- Three Statement Model 14-07-2021 (F3)Document16 pagesThree Statement Model 14-07-2021 (F3)Vaibhav BorateNo ratings yet

- Income Statement: USD $000s 2014A 2015A 2016E 2017E 2018EDocument3 pagesIncome Statement: USD $000s 2014A 2015A 2016E 2017E 2018EAgyei DanielNo ratings yet

- Workings 23apr24Document4 pagesWorkings 23apr24Thomas DevaNo ratings yet

- Module 1 - Cherry Alfuerte - Train LawDocument41 pagesModule 1 - Cherry Alfuerte - Train Lawgerry dacerNo ratings yet

- Salary Tax Calculator Pak-2019-20Document2 pagesSalary Tax Calculator Pak-2019-20Usman HabibNo ratings yet

- Abubaker, ID 15854 Mid TermDocument3 pagesAbubaker, ID 15854 Mid TermrtsaccofficerNo ratings yet

- BurisDocument1 pageBurisLyra EscosioNo ratings yet

- Accounting ModelingDocument7 pagesAccounting Modelingdanielabera046No ratings yet

- Financial AnalysisDocument1 pageFinancial Analysisjay kudiNo ratings yet

- Proposal Project AyamDocument14 pagesProposal Project AyamIrvan PamungkasNo ratings yet

- Acctg. 9 Prefi Quiz 1 KeyDocument3 pagesAcctg. 9 Prefi Quiz 1 KeyRica CatanguiNo ratings yet

- Depreciation Exercise - SolutionDocument2 pagesDepreciation Exercise - SolutionSwiss Han100% (2)

- Financial Discussion Year OneDocument4 pagesFinancial Discussion Year OneShaza ZulfiqarNo ratings yet

- XYZ SDN - Bhd. Cash Budget From July - September 2011 MAY June JulyDocument4 pagesXYZ SDN - Bhd. Cash Budget From July - September 2011 MAY June JulynurainNo ratings yet

- Financials of StartupDocument31 pagesFinancials of StartupJanine PadillaNo ratings yet

- Complete Investment Appraisal - 2Document7 pagesComplete Investment Appraisal - 2Reagan SsebbaaleNo ratings yet

- Quiz BusFinHVRJULIANA VILLANUEVA ABM201-1Document10 pagesQuiz BusFinHVRJULIANA VILLANUEVA ABM201-1Juliana Angela VillanuevaNo ratings yet

- Calculate New Salary Tax by ShajarDocument2 pagesCalculate New Salary Tax by Shajarshajar-abbasNo ratings yet

- Aspira 2 Sum FinDocument5 pagesAspira 2 Sum FinYork Daily Record/Sunday NewsNo ratings yet

- Case 1: Market PriceDocument6 pagesCase 1: Market PriceNoor ul HudaNo ratings yet

- AF Ch. 4 - Analysis FS - ExcelDocument9 pagesAF Ch. 4 - Analysis FS - ExcelAlfiandriAdinNo ratings yet

- Finacial LabDocument3 pagesFinacial LabGarvit JainNo ratings yet

- Alison Is Qualifies To Income Tax From Business and Compensation, OSD and 8% Fixed Tax RateDocument7 pagesAlison Is Qualifies To Income Tax From Business and Compensation, OSD and 8% Fixed Tax RateNichole TumulakNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- CFC DetailsDocument2 pagesCFC DetailsRoy Estate (Sajila Roy)No ratings yet

- Ice Mall BrochureDocument17 pagesIce Mall BrochureRoy Estate (Sajila Roy)No ratings yet

- Avalon CityDocument16 pagesAvalon CityRoy Estate (Sajila Roy)No ratings yet

- Metro City GK Payment Plans and BrochuresDocument13 pagesMetro City GK Payment Plans and BrochuresRoy Estate (Sajila Roy)No ratings yet

- FGEHA v. Ednan Syed Etc ICA No 527 of 2016 637794913003752016Document64 pagesFGEHA v. Ednan Syed Etc ICA No 527 of 2016 637794913003752016Roy Estate (Sajila Roy)No ratings yet

- Park View CityDocument9 pagesPark View CityRoy Estate (Sajila Roy)No ratings yet

- Lop PRDocument1 pageLop PRRoy Estate (Sajila Roy)No ratings yet

- SHEIKH Mohamed Akram - CV - ENDocument3 pagesSHEIKH Mohamed Akram - CV - ENRoy Estate (Sajila Roy)No ratings yet

- MCGK BrochureDocument10 pagesMCGK BrochureRoy Estate (Sajila Roy)No ratings yet

- Essay Structure (2019)Document2 pagesEssay Structure (2019)Roy Estate (Sajila Roy)No ratings yet

- ED250698Document11 pagesED250698Roy Estate (Sajila Roy)No ratings yet

- Faisal Town Phase 2 Payment PlanDocument1 pageFaisal Town Phase 2 Payment PlanRoy Estate (Sajila Roy)No ratings yet

- Project ProposalDocument5 pagesProject ProposalRoy Estate (Sajila Roy)No ratings yet

- Interior BroucherDocument13 pagesInterior BroucherRoy Estate (Sajila Roy)No ratings yet

- BrochureDocument6 pagesBrochureRoy Estate (Sajila Roy)No ratings yet

- Book 2Document5 pagesBook 2Roy Estate (Sajila Roy)No ratings yet

- Best Probiotics of WomenDocument4 pagesBest Probiotics of WomenRoy Estate (Sajila Roy)No ratings yet

- V-MAKE Broucher October 2021Document32 pagesV-MAKE Broucher October 2021Roy Estate (Sajila Roy)No ratings yet

- Faculty Development Programme: Security and Privacy in Big Data AnalyticsDocument2 pagesFaculty Development Programme: Security and Privacy in Big Data AnalyticsBhedivya PanchNo ratings yet

- Markov Chain PoetryDocument24 pagesMarkov Chain PoetryBea MillwardNo ratings yet

- Electric Charges and FieldsDocument3 pagesElectric Charges and FieldsAMoghNo ratings yet

- SV - ComplaintDocument72 pagesSV - ComplaintĐỗ Trà MyNo ratings yet

- The Unreveiled Secrets of The World of CakesDocument10 pagesThe Unreveiled Secrets of The World of CakesCake SquareNo ratings yet

- Building The Divided City - Class, Race and Housing in Inner London 1945-1997Document31 pagesBuilding The Divided City - Class, Race and Housing in Inner London 1945-1997Harold Carter100% (1)

- India Today 09.11.2020Document66 pagesIndia Today 09.11.2020sures108No ratings yet

- Officeg Corporation Time Time by Within Other The The Act Registered Time TheDocument26 pagesOfficeg Corporation Time Time by Within Other The The Act Registered Time TheNigil josephNo ratings yet

- AC Checklist of ToolsDocument4 pagesAC Checklist of ToolsTvet AcnNo ratings yet

- Assignment 01 MemberManagementDocument9 pagesAssignment 01 MemberManagementDinh Huu Khang (K16HCM)No ratings yet

- Chelsea Vs Newcastle - Google SearchDocument1 pageChelsea Vs Newcastle - Google SearchfortniteplayerzerobuildNo ratings yet

- CivilPro Cases 37 and 38 Full Texts - AyingDocument15 pagesCivilPro Cases 37 and 38 Full Texts - Ayingvienuell ayingNo ratings yet

- Education Lesson Inventory: CoursesDocument21 pagesEducation Lesson Inventory: CoursesIshan SaneNo ratings yet

- Teaching Guide: Ismat RiazDocument56 pagesTeaching Guide: Ismat RiazAbid GandapurNo ratings yet

- Alegoria Dictadura MilitarDocument292 pagesAlegoria Dictadura MilitarFernando Daniel Bruno100% (1)

- Freeman v. Grain Processing Corp., No. 13-0723 (Iowa June 13, 2014)Document63 pagesFreeman v. Grain Processing Corp., No. 13-0723 (Iowa June 13, 2014)RHTNo ratings yet

- Stiff Demand Drives Gains in Jobs, Wages: For Personal, Non-Commercial Use OnlyDocument58 pagesStiff Demand Drives Gains in Jobs, Wages: For Personal, Non-Commercial Use OnlyRazvan Catalin CostinNo ratings yet

- Social Science PortfolioDocument2 pagesSocial Science Portfoliorajesh duaNo ratings yet

- Start-Up Success Story PresentationDocument15 pagesStart-Up Success Story PresentationSamarth MittalNo ratings yet

- NDTDocument2 pagesNDTTiến TrungNo ratings yet

- Interlinking of RiverDocument15 pagesInterlinking of RiverDIPAK VINAYAK SHIRBHATENo ratings yet

- Top Picks - Axis-November2021Document79 pagesTop Picks - Axis-November2021Tejesh GoudNo ratings yet

- (02.08.07) Coletânea de Provas de Inglês Fundação Getúlio VargasDocument115 pages(02.08.07) Coletânea de Provas de Inglês Fundação Getúlio VargasJosé Maurício FreireNo ratings yet

- Mission - List Codigos Commandos 2Document3 pagesMission - List Codigos Commandos 2Cristian Andres0% (1)

- Quiz - BRITISH AMERICAN CULTUREDocument16 pagesQuiz - BRITISH AMERICAN CULTUREK28 Chuyên Tin CHLNo ratings yet

- In The Days of Your YouthDocument3 pagesIn The Days of Your YouthGideonNo ratings yet

- UntitledDocument18 pagesUntitledjeralyn juditNo ratings yet

- Nguyen Duc Viet-FTU - English CVDocument2 pagesNguyen Duc Viet-FTU - English CVNgô Trí Tuấn AnhNo ratings yet

- Cash and Cash Equivalents (Problems)Document9 pagesCash and Cash Equivalents (Problems)IAN PADAYOGDOGNo ratings yet

- Definition:: Handover NotesDocument3 pagesDefinition:: Handover NotesRalkan KantonNo ratings yet

Note On Tax Rebate On Takaful Contribution 2019 20 Salaried

Note On Tax Rebate On Takaful Contribution 2019 20 Salaried

Uploaded by

Roy Estate (Sajila Roy)Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Note On Tax Rebate On Takaful Contribution 2019 20 Salaried

Note On Tax Rebate On Takaful Contribution 2019 20 Salaried

Uploaded by

Roy Estate (Sajila Roy)Copyright:

Available Formats

Note on Tax Rebate available on Takaful Contribution (Salaried)

A person deriving income chargeable to tax under the head “salary” or “income from business” can

reduce his tax liability by claiming a tax credit on Takaful Contribution/Life insurance premium paid

in a tax year.

This credit is allowed under section 62(1) of the Income Tax Ordinance, 2001 (the Ordinance), in

respect of any Takaful Contribution/Life Insurance premium paid on a policy to a life insurance

company registered by the Securities & Exchange Commission of Pakistan under the Insurance

Ordinance, 2000 (XXXIX of 2000).

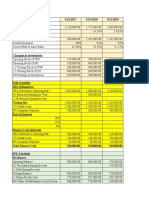

Formula for calculation of rebate:

The rebate calculation as given in section 62(2) of the Ordinance is based on the following formula,

namely:

(A/B) x C

Where-

A is the amount of tax assessed to the person for the tax year before allowance of any tax

credit;

B is the person’s taxable income for the tax year; and

C is the lessor of -

a) The total contribution or premium paid by the person;

b) Twenty percent of the person’s taxable income for the tax year; or

c) Two million rupees.

An employer is authorized to give this tax credit to an employee while deducting tax on salary under

section 149(1) of the Ordinance. A certificate issued by the takaful/insurance company for collection

of contribution/premium in a tax year would suffice as a documentary evidence for giving this credit

as required u/s 149(1) of the Ordinance.

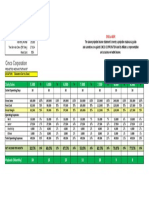

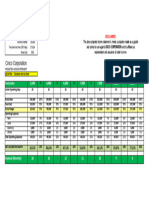

Below is an illustration of rebate allowed on various levels of salary income, based on the tax rates

applicable for Tax Year 2020 (01-Jul-19 to 30-Jun-20).

Rupees

Annual Annual Takaful

Rebate

Taxable Average Tax Contribution Net tax

allowed

Income Tax rate Liability allowed payable

=(A/B) x C

(B) (A) (C)

800,000 1.25 % 10,000 160,000 2,000 8,000

1,000,000 2.00 % 20,000 200,000 4,000 16,000

1,200,000 2.50 % 30,000 240,000 6,000 24,000

1,500,000 4.00 % 60,000 300,000 12,000 48,000

1,800,000 5.00 % 90,000 360,000 18,000 72,000

2,000,000 6.00 % 120,000 400,000 24,000 96,000

2,300,000 7.17 % 165,000 460,000 33,000 132,000

2,500,000 7.80 % 195,000 500,000 39,000 156,000

2,700,000 8.52 % 230,000 540,000 46,000 184,000

3,000,000 9.42 % 282,500 600,000 56,500 226,000

3,500,000 10.57 % 370,000 700,000 74,000 296,000

4,000,000 11.75 % 470,000 800,000 94,000 376,000

5,000,000 13.40 % 670,000 1,000,000 134,000 536,000

6,000,000 14.92 % 895,000 1,200,000 179,000 716,000

7,000,000 16.00 % 1,120,000 1,400,000 224,000 896,000

8,000,000 16.81 % 1,345,000 1,600,000 269,000 1,076,000

9,000,000 17.72 % 1,595,000 1,800,000 319,000 1,276,000

10,000,000 18.45 % 1,845,000 2,000,000 369,000 1,476,000

11,000,000 19.05 % 2,095,000 2,000,000 380,909 1,714,091

You might also like

- AFF's Tax Memorandum On Changes in FB 2024Document13 pagesAFF's Tax Memorandum On Changes in FB 2024Hussain Afzal100% (5)

- Potato Corner Sample BreakevenDocument1 pagePotato Corner Sample BreakevenOver Mango50% (2)

- Case 5Document12 pagesCase 5JIAXUAN WANGNo ratings yet

- Note On Tax Rebate On Takaful Contribution 2019 20 Other Than SalariedDocument1 pageNote On Tax Rebate On Takaful Contribution 2019 20 Other Than Salariedsyed aamir shahNo ratings yet

- SFAD Week 1Document4 pagesSFAD Week 1Talha SiddiquiNo ratings yet

- 3-5yr ProjectionDocument2 pages3-5yr ProjectionKamille SumaoangNo ratings yet

- Main Menu Inputs Income Statement Balance Sheet Loan Fixed Asset ScheduleDocument12 pagesMain Menu Inputs Income Statement Balance Sheet Loan Fixed Asset ScheduleHussain ImranNo ratings yet

- Activity 2 MIlca BSA 3 3Document6 pagesActivity 2 MIlca BSA 3 3kyrie IrvingNo ratings yet

- 2014a 2015a 2016e 2017e 2018e 2019e 2020e 2021eDocument1 page2014a 2015a 2016e 2017e 2018e 2019e 2020e 2021evivianclementNo ratings yet

- Financial AnalysisDocument5 pagesFinancial AnalysisEdeline MitrofanNo ratings yet

- Gate of Aden Plan 2020Document1 pageGate of Aden Plan 2020Mohammad HanafyNo ratings yet

- Potato Corner Sample BreakevenDocument1 pagePotato Corner Sample Breakevenphuri.siaNo ratings yet

- Excel Crash Course - Book1 - Complete: Strictly ConfidentialDocument5 pagesExcel Crash Course - Book1 - Complete: Strictly ConfidentialEsani DeNo ratings yet

- 2014A 2015A 2016E 2017E 2018E 2019E 2020E: Income Statement Revenue 181,500.0 199,650.0 219,615.0 241,576.5 265,734.2Document2 pages2014A 2015A 2016E 2017E 2018E 2019E 2020E: Income Statement Revenue 181,500.0 199,650.0 219,615.0 241,576.5 265,734.2raskaNo ratings yet

- AST LTCC ComputationDocument9 pagesAST LTCC ComputationeiraNo ratings yet

- Excel Crash Course - Book1 - Blank: Strictly ConfidentialDocument4 pagesExcel Crash Course - Book1 - Blank: Strictly ConfidentialtehreemNo ratings yet

- Financial Analysis ModelDocument5 pagesFinancial Analysis ModelShanaya JainNo ratings yet

- Calculate New Salary Tax by Ather SaleemDocument2 pagesCalculate New Salary Tax by Ather Saleemabdul_348No ratings yet

- 3 Months PlanDocument8 pages3 Months PlanWaleed ZakariaNo ratings yet

- CFI ModelDocument5 pagesCFI ModelSidharth SainiNo ratings yet

- CFI ModelDocument5 pagesCFI ModelSidharth SainiNo ratings yet

- Project RequirementDocument4 pagesProject RequirementAlina Binte EjazNo ratings yet

- Financial PlanDocument14 pagesFinancial Planagotevan0No ratings yet

- NPS Calculator Free Download ExcelDocument7 pagesNPS Calculator Free Download Excelgroup 19No ratings yet

- Financial Model 1Document1 pageFinancial Model 1ahmedmostafaibrahim22No ratings yet

- Current Year Base Year Base Year X 100Document4 pagesCurrent Year Base Year Base Year X 100Kathlyn TajadaNo ratings yet

- PDF Balance General El Restaurante Quotdel Pasoquot - CompressDocument2 pagesPDF Balance General El Restaurante Quotdel Pasoquot - CompressHassan Vasquez LuisNo ratings yet

- Excel Crash Course - Book1 - Blank: Strictly ConfidentialDocument7 pagesExcel Crash Course - Book1 - Blank: Strictly ConfidentialআসিফহাসানখানNo ratings yet

- Excel Crash Course - Book1 - Complete: Strictly ConfidentialDocument5 pagesExcel Crash Course - Book1 - Complete: Strictly ConfidentialGaurav KumarNo ratings yet

- Ishika GuptaDocument5 pagesIshika GuptaGarvit JainNo ratings yet

- Edited FSDocument40 pagesEdited FShello kitty black and whiteNo ratings yet

- Financial AnalysisDocument9 pagesFinancial AnalysisSam SumoNo ratings yet

- Banking - Prof. Rafael Schiozer - Exercícios de Aula - Aulas 5 A 9 - SoluçõesDocument5 pagesBanking - Prof. Rafael Schiozer - Exercícios de Aula - Aulas 5 A 9 - SoluçõesCaioGamaNo ratings yet

- Muskan Nagar - FM AssignmentDocument33 pagesMuskan Nagar - FM AssignmentMuskan NagarNo ratings yet

- PG IncentivesDocument2 pagesPG IncentivesIRFAN JURIFANNo ratings yet

- FS Kopi Montong UpdatedDocument2 pagesFS Kopi Montong UpdatedArip Irpanudin,SENo ratings yet

- Three Statement Model 14-07-2021 (F3)Document16 pagesThree Statement Model 14-07-2021 (F3)Vaibhav BorateNo ratings yet

- Income Statement: USD $000s 2014A 2015A 2016E 2017E 2018EDocument3 pagesIncome Statement: USD $000s 2014A 2015A 2016E 2017E 2018EAgyei DanielNo ratings yet

- Workings 23apr24Document4 pagesWorkings 23apr24Thomas DevaNo ratings yet

- Module 1 - Cherry Alfuerte - Train LawDocument41 pagesModule 1 - Cherry Alfuerte - Train Lawgerry dacerNo ratings yet

- Salary Tax Calculator Pak-2019-20Document2 pagesSalary Tax Calculator Pak-2019-20Usman HabibNo ratings yet

- Abubaker, ID 15854 Mid TermDocument3 pagesAbubaker, ID 15854 Mid TermrtsaccofficerNo ratings yet

- BurisDocument1 pageBurisLyra EscosioNo ratings yet

- Accounting ModelingDocument7 pagesAccounting Modelingdanielabera046No ratings yet

- Financial AnalysisDocument1 pageFinancial Analysisjay kudiNo ratings yet

- Proposal Project AyamDocument14 pagesProposal Project AyamIrvan PamungkasNo ratings yet

- Acctg. 9 Prefi Quiz 1 KeyDocument3 pagesAcctg. 9 Prefi Quiz 1 KeyRica CatanguiNo ratings yet

- Depreciation Exercise - SolutionDocument2 pagesDepreciation Exercise - SolutionSwiss Han100% (2)

- Financial Discussion Year OneDocument4 pagesFinancial Discussion Year OneShaza ZulfiqarNo ratings yet

- XYZ SDN - Bhd. Cash Budget From July - September 2011 MAY June JulyDocument4 pagesXYZ SDN - Bhd. Cash Budget From July - September 2011 MAY June JulynurainNo ratings yet

- Financials of StartupDocument31 pagesFinancials of StartupJanine PadillaNo ratings yet

- Complete Investment Appraisal - 2Document7 pagesComplete Investment Appraisal - 2Reagan SsebbaaleNo ratings yet

- Quiz BusFinHVRJULIANA VILLANUEVA ABM201-1Document10 pagesQuiz BusFinHVRJULIANA VILLANUEVA ABM201-1Juliana Angela VillanuevaNo ratings yet

- Calculate New Salary Tax by ShajarDocument2 pagesCalculate New Salary Tax by Shajarshajar-abbasNo ratings yet

- Aspira 2 Sum FinDocument5 pagesAspira 2 Sum FinYork Daily Record/Sunday NewsNo ratings yet

- Case 1: Market PriceDocument6 pagesCase 1: Market PriceNoor ul HudaNo ratings yet

- AF Ch. 4 - Analysis FS - ExcelDocument9 pagesAF Ch. 4 - Analysis FS - ExcelAlfiandriAdinNo ratings yet

- Finacial LabDocument3 pagesFinacial LabGarvit JainNo ratings yet

- Alison Is Qualifies To Income Tax From Business and Compensation, OSD and 8% Fixed Tax RateDocument7 pagesAlison Is Qualifies To Income Tax From Business and Compensation, OSD and 8% Fixed Tax RateNichole TumulakNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- CFC DetailsDocument2 pagesCFC DetailsRoy Estate (Sajila Roy)No ratings yet

- Ice Mall BrochureDocument17 pagesIce Mall BrochureRoy Estate (Sajila Roy)No ratings yet

- Avalon CityDocument16 pagesAvalon CityRoy Estate (Sajila Roy)No ratings yet

- Metro City GK Payment Plans and BrochuresDocument13 pagesMetro City GK Payment Plans and BrochuresRoy Estate (Sajila Roy)No ratings yet

- FGEHA v. Ednan Syed Etc ICA No 527 of 2016 637794913003752016Document64 pagesFGEHA v. Ednan Syed Etc ICA No 527 of 2016 637794913003752016Roy Estate (Sajila Roy)No ratings yet

- Park View CityDocument9 pagesPark View CityRoy Estate (Sajila Roy)No ratings yet

- Lop PRDocument1 pageLop PRRoy Estate (Sajila Roy)No ratings yet

- SHEIKH Mohamed Akram - CV - ENDocument3 pagesSHEIKH Mohamed Akram - CV - ENRoy Estate (Sajila Roy)No ratings yet

- MCGK BrochureDocument10 pagesMCGK BrochureRoy Estate (Sajila Roy)No ratings yet

- Essay Structure (2019)Document2 pagesEssay Structure (2019)Roy Estate (Sajila Roy)No ratings yet

- ED250698Document11 pagesED250698Roy Estate (Sajila Roy)No ratings yet

- Faisal Town Phase 2 Payment PlanDocument1 pageFaisal Town Phase 2 Payment PlanRoy Estate (Sajila Roy)No ratings yet

- Project ProposalDocument5 pagesProject ProposalRoy Estate (Sajila Roy)No ratings yet

- Interior BroucherDocument13 pagesInterior BroucherRoy Estate (Sajila Roy)No ratings yet

- BrochureDocument6 pagesBrochureRoy Estate (Sajila Roy)No ratings yet

- Book 2Document5 pagesBook 2Roy Estate (Sajila Roy)No ratings yet

- Best Probiotics of WomenDocument4 pagesBest Probiotics of WomenRoy Estate (Sajila Roy)No ratings yet

- V-MAKE Broucher October 2021Document32 pagesV-MAKE Broucher October 2021Roy Estate (Sajila Roy)No ratings yet

- Faculty Development Programme: Security and Privacy in Big Data AnalyticsDocument2 pagesFaculty Development Programme: Security and Privacy in Big Data AnalyticsBhedivya PanchNo ratings yet

- Markov Chain PoetryDocument24 pagesMarkov Chain PoetryBea MillwardNo ratings yet

- Electric Charges and FieldsDocument3 pagesElectric Charges and FieldsAMoghNo ratings yet

- SV - ComplaintDocument72 pagesSV - ComplaintĐỗ Trà MyNo ratings yet

- The Unreveiled Secrets of The World of CakesDocument10 pagesThe Unreveiled Secrets of The World of CakesCake SquareNo ratings yet

- Building The Divided City - Class, Race and Housing in Inner London 1945-1997Document31 pagesBuilding The Divided City - Class, Race and Housing in Inner London 1945-1997Harold Carter100% (1)

- India Today 09.11.2020Document66 pagesIndia Today 09.11.2020sures108No ratings yet

- Officeg Corporation Time Time by Within Other The The Act Registered Time TheDocument26 pagesOfficeg Corporation Time Time by Within Other The The Act Registered Time TheNigil josephNo ratings yet

- AC Checklist of ToolsDocument4 pagesAC Checklist of ToolsTvet AcnNo ratings yet

- Assignment 01 MemberManagementDocument9 pagesAssignment 01 MemberManagementDinh Huu Khang (K16HCM)No ratings yet

- Chelsea Vs Newcastle - Google SearchDocument1 pageChelsea Vs Newcastle - Google SearchfortniteplayerzerobuildNo ratings yet

- CivilPro Cases 37 and 38 Full Texts - AyingDocument15 pagesCivilPro Cases 37 and 38 Full Texts - Ayingvienuell ayingNo ratings yet

- Education Lesson Inventory: CoursesDocument21 pagesEducation Lesson Inventory: CoursesIshan SaneNo ratings yet

- Teaching Guide: Ismat RiazDocument56 pagesTeaching Guide: Ismat RiazAbid GandapurNo ratings yet

- Alegoria Dictadura MilitarDocument292 pagesAlegoria Dictadura MilitarFernando Daniel Bruno100% (1)

- Freeman v. Grain Processing Corp., No. 13-0723 (Iowa June 13, 2014)Document63 pagesFreeman v. Grain Processing Corp., No. 13-0723 (Iowa June 13, 2014)RHTNo ratings yet

- Stiff Demand Drives Gains in Jobs, Wages: For Personal, Non-Commercial Use OnlyDocument58 pagesStiff Demand Drives Gains in Jobs, Wages: For Personal, Non-Commercial Use OnlyRazvan Catalin CostinNo ratings yet

- Social Science PortfolioDocument2 pagesSocial Science Portfoliorajesh duaNo ratings yet

- Start-Up Success Story PresentationDocument15 pagesStart-Up Success Story PresentationSamarth MittalNo ratings yet

- NDTDocument2 pagesNDTTiến TrungNo ratings yet

- Interlinking of RiverDocument15 pagesInterlinking of RiverDIPAK VINAYAK SHIRBHATENo ratings yet

- Top Picks - Axis-November2021Document79 pagesTop Picks - Axis-November2021Tejesh GoudNo ratings yet

- (02.08.07) Coletânea de Provas de Inglês Fundação Getúlio VargasDocument115 pages(02.08.07) Coletânea de Provas de Inglês Fundação Getúlio VargasJosé Maurício FreireNo ratings yet

- Mission - List Codigos Commandos 2Document3 pagesMission - List Codigos Commandos 2Cristian Andres0% (1)

- Quiz - BRITISH AMERICAN CULTUREDocument16 pagesQuiz - BRITISH AMERICAN CULTUREK28 Chuyên Tin CHLNo ratings yet

- In The Days of Your YouthDocument3 pagesIn The Days of Your YouthGideonNo ratings yet

- UntitledDocument18 pagesUntitledjeralyn juditNo ratings yet

- Nguyen Duc Viet-FTU - English CVDocument2 pagesNguyen Duc Viet-FTU - English CVNgô Trí Tuấn AnhNo ratings yet

- Cash and Cash Equivalents (Problems)Document9 pagesCash and Cash Equivalents (Problems)IAN PADAYOGDOGNo ratings yet

- Definition:: Handover NotesDocument3 pagesDefinition:: Handover NotesRalkan KantonNo ratings yet