Professional Documents

Culture Documents

Cfas Chapter 25

Cfas Chapter 25

Uploaded by

Kristel FieldsCopyright:

Available Formats

You might also like

- TaxDocument8 pagesTaxClaire BarrettoNo ratings yet

- Accounting For Income Taxes SlidesDocument51 pagesAccounting For Income Taxes SlidesparmitchoudhuryNo ratings yet

- Accounting For Income TaxDocument3 pagesAccounting For Income Taxjunelledequina100% (1)

- Accounting For Income TaxationDocument8 pagesAccounting For Income Taxationangelian bagadiongNo ratings yet

- Income Tax AccountingDocument3 pagesIncome Tax Accountinghae1234No ratings yet

- Chapter 16Document5 pagesChapter 16Carla ValenciaNo ratings yet

- ACT150 Assignment DIMAAMPAODocument4 pagesACT150 Assignment DIMAAMPAOJeromeNo ratings yet

- BAFACR16 01 Problem IllustrationsDocument2 pagesBAFACR16 01 Problem Illustrationsmisssunshine112No ratings yet

- Solution - Accounting For Income TaxesDocument12 pagesSolution - Accounting For Income TaxesKlarissemay MontallanaNo ratings yet

- Manny Company: Required: Compute For The Balances of The Following On December 31, 2X14Document4 pagesManny Company: Required: Compute For The Balances of The Following On December 31, 2X14MauiNo ratings yet

- Topic 1: Accounting For Income TaxesDocument13 pagesTopic 1: Accounting For Income TaxesPillos Jr., ElimarNo ratings yet

- Problems Accouting For Deferred Taxes Webinar ReoDocument7 pagesProblems Accouting For Deferred Taxes Webinar ReocrookshanksNo ratings yet

- Tutorial 2: Exercise 12.2 Calculation of Current TaxDocument13 pagesTutorial 2: Exercise 12.2 Calculation of Current TaxKim FloresNo ratings yet

- Finacc 6 A3 1Document4 pagesFinacc 6 A3 1200617No ratings yet

- ACCY 200 - Tutorial 2Document5 pagesACCY 200 - Tutorial 2KaiWenNgNo ratings yet

- Finalchapter-16 2Document22 pagesFinalchapter-16 2Jud Rossette ArcebesNo ratings yet

- 30 - Aathifah Teta Fitranti - 195020307111072 - AKM 3Document2 pages30 - Aathifah Teta Fitranti - 195020307111072 - AKM 3Aathifah Teta FitrantiNo ratings yet

- BAAFM P30898 AFR Lecture Slides - TaxationDocument23 pagesBAAFM P30898 AFR Lecture Slides - TaxationGrace TanNo ratings yet

- Toaz - Info 89bf91d5 1612761367237 PRDocument7 pagesToaz - Info 89bf91d5 1612761367237 PRAEHYUN YENVYNo ratings yet

- Chapter 25 and 26Document10 pagesChapter 25 and 26Sittie Aisah AmpatuaNo ratings yet

- Accounting For Income TaxDocument6 pagesAccounting For Income TaxRyll BedasNo ratings yet

- Answers - Chapter 5 Vol 2Document5 pagesAnswers - Chapter 5 Vol 2jamfloxNo ratings yet

- Book 3Document1 pageBook 3Quincy Lawrence DimaanoNo ratings yet

- 10Document1 page10Bryan KenNo ratings yet

- AFA Class 11 Income Taxes Answers AllDocument18 pagesAFA Class 11 Income Taxes Answers AllaniaNo ratings yet

- Chapter 10 - Cash To Accrual Basis of AccountingDocument3 pagesChapter 10 - Cash To Accrual Basis of AccountingJEFFERSON CUTENo ratings yet

- Chapter 10 - Cash To Accrual Basis of AccountingDocument3 pagesChapter 10 - Cash To Accrual Basis of AccountingXienaNo ratings yet

- Chap 16 AitDocument26 pagesChap 16 AitLawrence NarvaezNo ratings yet

- Bai Tap - IAS 12 - Tu LuanDocument14 pagesBai Tap - IAS 12 - Tu LuanTrần Nguyễn Tuệ MinhNo ratings yet

- Income TaxesDocument3 pagesIncome TaxesCENTENO, JOAN R.No ratings yet

- Activity 1 Calculations Using The Tax-Payable MethodDocument10 pagesActivity 1 Calculations Using The Tax-Payable MethodJohn TomNo ratings yet

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocument4 pagesSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureNoorodden50% (2)

- DocxDocument5 pagesDocxJohn Vincent CruzNo ratings yet

- Ege, Kenneth M. Bsa22A1Document3 pagesEge, Kenneth M. Bsa22A1Kenneth Marcial Ege IINo ratings yet

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocument5 pagesSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureClarisse AlimotNo ratings yet

- AaaaaDocument2 pagesAaaaaMondays AndNo ratings yet

- Class Activities (Millan, 2019) : Requirements: A. How Much Is The Income Tax Expense For 2003? SolutionDocument6 pagesClass Activities (Millan, 2019) : Requirements: A. How Much Is The Income Tax Expense For 2003? SolutionPrincess TaizeNo ratings yet

- Untitled SpreadsheetDocument9 pagesUntitled SpreadsheetMiguel BautistaNo ratings yet

- ACC-ACF2100 Lecture 2 HandoutDocument9 pagesACC-ACF2100 Lecture 2 HandoutDanNo ratings yet

- Example Deferred TaxDocument7 pagesExample Deferred TaxTEIK LOONG KHORNo ratings yet

- Lamagan, Kyla T. BSA 401 Intermediate Acct. 2 Final Output Problem 16-13 (IAA)Document14 pagesLamagan, Kyla T. BSA 401 Intermediate Acct. 2 Final Output Problem 16-13 (IAA)lana del reyNo ratings yet

- Accounting For Income Tax Comprehensive Problem 1: Additional InformationDocument1 pageAccounting For Income Tax Comprehensive Problem 1: Additional InformationAngel Keith MercadoNo ratings yet

- A. Journal Entries For 2020Document6 pagesA. Journal Entries For 2020Ollid Kline Jayson JNo ratings yet

- Answer Key - Quizzer On AJEDocument2 pagesAnswer Key - Quizzer On AJEClarissa De GuzmanNo ratings yet

- Accounting For Taxes Employee BenefitsDocument6 pagesAccounting For Taxes Employee BenefitsBess Tuico MasanqueNo ratings yet

- Appendix D Accounting For Deferred Income TaxesDocument2 pagesAppendix D Accounting For Deferred Income TaxesLan Hương Trần ThịNo ratings yet

- Chapter 19 Accounting For Income Tax Problem 19-1Document5 pagesChapter 19 Accounting For Income Tax Problem 19-1nicole bancoroNo ratings yet

- Other Taxpayers ProblemsDocument12 pagesOther Taxpayers ProblemsRaiNo ratings yet

- Insurance Expense Allocated To The Quarter: SolutionDocument4 pagesInsurance Expense Allocated To The Quarter: Solutionasdfghjkl zxcvbnmNo ratings yet

- Quiz Accounting For Income TaxDocument5 pagesQuiz Accounting For Income TaxCmNo ratings yet

- Solvay Adv Acc Exercises Case 3 Deferred - Taxes IAS 12 - SolutionDocument9 pagesSolvay Adv Acc Exercises Case 3 Deferred - Taxes IAS 12 - SolutionlolaNo ratings yet

- VOL 2 16. Accounting For Income TaxationDocument15 pagesVOL 2 16. Accounting For Income TaxationdmangiginNo ratings yet

- Sample Test (Extract)Document6 pagesSample Test (Extract)Julie KimNo ratings yet

- Task Performance 1Document1 pageTask Performance 1JanixxxNo ratings yet

- Divine Company Began OperationsDocument1 pageDivine Company Began OperationsQueen ValleNo ratings yet

- Deferred Tax AnswerDocument2 pagesDeferred Tax Answerjohn ashleyNo ratings yet

- ABC Co. Started Its OperationsDocument1 pageABC Co. Started Its OperationsQueen ValleNo ratings yet

- 06 Taxation - Deferred s20 Final-1Document44 pages06 Taxation - Deferred s20 Final-150902849No ratings yet

- Tax Practice Quiz QuestionsDocument3 pagesTax Practice Quiz QuestionsDanji MisoNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Wealth Management Planning: The UK Tax PrinciplesFrom EverandWealth Management Planning: The UK Tax PrinciplesRating: 4.5 out of 5 stars4.5/5 (2)

- ch5 6Document39 pagesch5 6Kristel FieldsNo ratings yet

- ch 8-9Document21 pagesch 8-9Kristel FieldsNo ratings yet

- SECTION 3. — Special Provisions forDocument9 pagesSECTION 3. — Special Provisions forKristel FieldsNo ratings yet

- Market ApproachDocument24 pagesMarket ApproachKristel FieldsNo ratings yet

- CH 9Document4 pagesCH 9Kristel FieldsNo ratings yet

- CH 7Document91 pagesCH 7Kristel FieldsNo ratings yet

- Take Home QuizDocument18 pagesTake Home QuizKristel FieldsNo ratings yet

- Chapter 3 LOSDocument3 pagesChapter 3 LOSKristel FieldsNo ratings yet

- DCFDocument46 pagesDCFKristel FieldsNo ratings yet

- Midterm Long QuizDocument2 pagesMidterm Long QuizKristel FieldsNo ratings yet

- IA1 8 Intangible AssetDocument51 pagesIA1 8 Intangible AssetKristel FieldsNo ratings yet

- Rizal Pre Fi Chapter 17-18-19 NewDocument59 pagesRizal Pre Fi Chapter 17-18-19 NewKristel FieldsNo ratings yet

- Chapter 4 ValuationDocument23 pagesChapter 4 ValuationKristel FieldsNo ratings yet

- LQ ContempoDocument2 pagesLQ ContempoKristel FieldsNo ratings yet

- Quiz 4 - Answer3Document1 pageQuiz 4 - Answer3Kristel FieldsNo ratings yet

- Paranoid Company Journal Entries: Date Account Title and ExplanationDocument8 pagesParanoid Company Journal Entries: Date Account Title and ExplanationKristel FieldsNo ratings yet

- Quiz 4Document1 pageQuiz 4Kristel FieldsNo ratings yet

- Prob 12 LiquidationDocument1 pageProb 12 LiquidationKristel FieldsNo ratings yet

- Ia MCDocument5 pagesIa MCKristel FieldsNo ratings yet

- EXAMPLE 12.1 (Current Tax Liability)Document8 pagesEXAMPLE 12.1 (Current Tax Liability)KaiWenNgNo ratings yet

- Unit 3-Statement of Changes in Equity (2023)Document13 pagesUnit 3-Statement of Changes in Equity (2023)Chalé DarwinNo ratings yet

- Chapter 23 IAS 12 Income TaxesDocument26 pagesChapter 23 IAS 12 Income TaxesKelvin Chu JY100% (1)

- Income Taxes: International Accounting Standard 12Document49 pagesIncome Taxes: International Accounting Standard 12leda_cecilia08No ratings yet

- Balakrishnan 2011Document67 pagesBalakrishnan 2011novie endi nugrohoNo ratings yet

- Chương 4Document9 pagesChương 4Hồ Trần Minh ThưNo ratings yet

- Chapter 22 Deferred Tax Asset and LiabilityDocument8 pagesChapter 22 Deferred Tax Asset and LiabilityCheesca Macabanti - 12 Euclid-Digital ModularNo ratings yet

- Accrev1 FINAL EXAM 19 20 NO ANSWERSDocument15 pagesAccrev1 FINAL EXAM 19 20 NO ANSWERSGray JavierNo ratings yet

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocument5 pagesSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureClarisse AlimotNo ratings yet

- Advance I Ch-IDocument61 pagesAdvance I Ch-IBamlak WenduNo ratings yet

- SOCI Financial Statements Per 31 Dec 2022Document125 pagesSOCI Financial Statements Per 31 Dec 2022KhresnaNo ratings yet

- CH 19Document101 pagesCH 19Miranti NurulNo ratings yet

- Spotify Technology S.A.: United States Securities and Exchange CommissionDocument48 pagesSpotify Technology S.A.: United States Securities and Exchange CommissionSunday AyomideNo ratings yet

- Ias 12Document69 pagesIas 12Md SaifulNo ratings yet

- 2017TAtA Steel Annual ReportDocument8 pages2017TAtA Steel Annual ReportHeadshot's GameNo ratings yet

- Discussion Problems: FAR.2935-Income Taxes OCTOBER 2020Document4 pagesDiscussion Problems: FAR.2935-Income Taxes OCTOBER 2020Alexander DimaliposNo ratings yet

- QateelDocument6 pagesQateelmaham rasheedNo ratings yet

- CACC031 Mock Test 1 SSDocument11 pagesCACC031 Mock Test 1 SSMartia NongNo ratings yet

- Accounting Standard 22Document12 pagesAccounting Standard 22Rupesh MoreNo ratings yet

- PAS 12 Income TaxesDocument24 pagesPAS 12 Income TaxesPatawaran, Janelle S.No ratings yet

- Chapter 2Document20 pagesChapter 2Coursehero PremiumNo ratings yet

- Tutorial 2: Exercise 12.2 Calculation of Current TaxDocument13 pagesTutorial 2: Exercise 12.2 Calculation of Current TaxKim FloresNo ratings yet

- Philippine Accounting StandardsDocument168 pagesPhilippine Accounting StandardsJessica Lyka AquinoNo ratings yet

- Audit of LiabilitiesDocument14 pagesAudit of LiabilitiesJustine UngabNo ratings yet

- Presentation On Beximco PharmaceuticalsDocument42 pagesPresentation On Beximco PharmaceuticalsQuazi Aritra Reyan100% (1)

- FA2 Question BookDocument59 pagesFA2 Question BookNam LêNo ratings yet

- Liabilities and EquityDocument23 pagesLiabilities and Equityadmiral spongebobNo ratings yet

- Item Carrying Value Tax Base: in Class Exercise - Chapter 5 Deferred TaxDocument6 pagesItem Carrying Value Tax Base: in Class Exercise - Chapter 5 Deferred TaxRubiatul AdawiyahNo ratings yet

Cfas Chapter 25

Cfas Chapter 25

Uploaded by

Kristel FieldsOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cfas Chapter 25

Cfas Chapter 25

Uploaded by

Kristel FieldsCopyright:

Available Formats

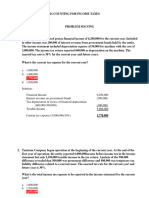

ABC Company

Journal Entries

Date Account Titles and Explanation PR Debit Credit

Dec 31 Income tax expense 450,000

Income tax payable (1,500,000 x 30%) 450,000

To record the current tax expense

Dec 31 Income tax expense 150,000

Deferred tax liability (500,000 x 30%) 150,000

To record the deferred tax liability

Dec 31 Income tax payable 200,000

Cash 200,000

To record the estimated tax payment

Current Tax Expense 450,000

Deferred Tax Expense 150,000

Total Income Tax Expense 600,000

Zeus Company

Journal Entries

Date Account Titles and Explanation PR Debit Credit

Dec 31 Income tax expense 1,200,000

Income tax payable (4,000,000 x 30%) 1,200,000

To record the current tax expense

Dec 31 Deferred tax asset (1,000,000x30%) 300,000

Income tax benefit 300,000

To record the deferred tax asset

Dec 31 Income tax payable 500,000

Cash 500,000

To record the estimated tax payment

Current Tax Expense 1,200,000

Income Tax Benefit -300,000

Total Income Tax Expense 900,000

Zeus Company Income tax statement

Journal Entries

Date-2020 Account Titles and Explanation PR Debit Credit Income before tax

Dec 31 Income tax expense 2,100,000 Income tax Expense

Income tax payable (7,000,000 x 30%) 2,100,000

To record the current tax expense

Net income

Dec 31 Deferred tax asset (1,000,000x30%) 300,000

Income tax benefit 300,000

To record the deferred tax asset

Date-2021 Account Titles and Explanation PR Debit Credit Income tax statement

Dec 31 Income tax expense 2,400,000

Income tax payable (8,000,000 x 30%) 2,400,000 Income before tax

To record the current tax expense Income tax Expense

Dec 31 Income tax expense 300,000

Deferred tax asset (1,000,000x30%) 300,000 Net income

To record the deferred tax asset

Income tax statement presentation for 2020

Income before tax 6,000,000

Income tax Expense

Current Tax Expense 2,100,000

Income tax benefit -300,000 1,800,000

Net income 4,200,000

Income tax statement presentation for 2021

Income before tax 9,000,000

Income tax Expense

Current Tax Expense 2,400,000

Income tax benefit 300,000 2,700,000

Net income 6,300,000

Colombo Company

Journal Entries Income tax statemen

Date 2020 Account Titles and Explanation PR Debit Credit

Dec 31 Income tax expense 1,500,000 Income before tax

Income tax payable (5,000,000 x 30%) 1,500,000 Income tax Expense

To record the current tax expense

Dec 31 Income tax expense 150,000 Net income

Deferred tax liability (500,000 x 30%) 150,000

To record the deferred tax liability

Date 2021 Account Titles and Explanation PR Debit Credit Income tax statemen

Dec 31 Income tax expense 2,250,000

Income tax payable (7,500,000 x 30%) 2,250,000 Income before tax

To record the current tax expense Income tax Expense

Dec 31 Deferred tax liability 150,000

Income tax expense 150,000 Net income

To record the deferred tax liability

Income tax statement presentation for 2020

Income before tax 5,500,000

Income tax Expense

Current Tax Expense 1,500,000

Deferred tax expense 150,000 1,650,000

Net income 3,850,000

Income tax statement presentation for 2021

Income before tax 7,000,000

Income tax Expense

Current Tax Expense 2,250,000

Decrease in deferred tax liability -150,000 2,100,000

Net income 4,900,000

You might also like

- TaxDocument8 pagesTaxClaire BarrettoNo ratings yet

- Accounting For Income Taxes SlidesDocument51 pagesAccounting For Income Taxes SlidesparmitchoudhuryNo ratings yet

- Accounting For Income TaxDocument3 pagesAccounting For Income Taxjunelledequina100% (1)

- Accounting For Income TaxationDocument8 pagesAccounting For Income Taxationangelian bagadiongNo ratings yet

- Income Tax AccountingDocument3 pagesIncome Tax Accountinghae1234No ratings yet

- Chapter 16Document5 pagesChapter 16Carla ValenciaNo ratings yet

- ACT150 Assignment DIMAAMPAODocument4 pagesACT150 Assignment DIMAAMPAOJeromeNo ratings yet

- BAFACR16 01 Problem IllustrationsDocument2 pagesBAFACR16 01 Problem Illustrationsmisssunshine112No ratings yet

- Solution - Accounting For Income TaxesDocument12 pagesSolution - Accounting For Income TaxesKlarissemay MontallanaNo ratings yet

- Manny Company: Required: Compute For The Balances of The Following On December 31, 2X14Document4 pagesManny Company: Required: Compute For The Balances of The Following On December 31, 2X14MauiNo ratings yet

- Topic 1: Accounting For Income TaxesDocument13 pagesTopic 1: Accounting For Income TaxesPillos Jr., ElimarNo ratings yet

- Problems Accouting For Deferred Taxes Webinar ReoDocument7 pagesProblems Accouting For Deferred Taxes Webinar ReocrookshanksNo ratings yet

- Tutorial 2: Exercise 12.2 Calculation of Current TaxDocument13 pagesTutorial 2: Exercise 12.2 Calculation of Current TaxKim FloresNo ratings yet

- Finacc 6 A3 1Document4 pagesFinacc 6 A3 1200617No ratings yet

- ACCY 200 - Tutorial 2Document5 pagesACCY 200 - Tutorial 2KaiWenNgNo ratings yet

- Finalchapter-16 2Document22 pagesFinalchapter-16 2Jud Rossette ArcebesNo ratings yet

- 30 - Aathifah Teta Fitranti - 195020307111072 - AKM 3Document2 pages30 - Aathifah Teta Fitranti - 195020307111072 - AKM 3Aathifah Teta FitrantiNo ratings yet

- BAAFM P30898 AFR Lecture Slides - TaxationDocument23 pagesBAAFM P30898 AFR Lecture Slides - TaxationGrace TanNo ratings yet

- Toaz - Info 89bf91d5 1612761367237 PRDocument7 pagesToaz - Info 89bf91d5 1612761367237 PRAEHYUN YENVYNo ratings yet

- Chapter 25 and 26Document10 pagesChapter 25 and 26Sittie Aisah AmpatuaNo ratings yet

- Accounting For Income TaxDocument6 pagesAccounting For Income TaxRyll BedasNo ratings yet

- Answers - Chapter 5 Vol 2Document5 pagesAnswers - Chapter 5 Vol 2jamfloxNo ratings yet

- Book 3Document1 pageBook 3Quincy Lawrence DimaanoNo ratings yet

- 10Document1 page10Bryan KenNo ratings yet

- AFA Class 11 Income Taxes Answers AllDocument18 pagesAFA Class 11 Income Taxes Answers AllaniaNo ratings yet

- Chapter 10 - Cash To Accrual Basis of AccountingDocument3 pagesChapter 10 - Cash To Accrual Basis of AccountingJEFFERSON CUTENo ratings yet

- Chapter 10 - Cash To Accrual Basis of AccountingDocument3 pagesChapter 10 - Cash To Accrual Basis of AccountingXienaNo ratings yet

- Chap 16 AitDocument26 pagesChap 16 AitLawrence NarvaezNo ratings yet

- Bai Tap - IAS 12 - Tu LuanDocument14 pagesBai Tap - IAS 12 - Tu LuanTrần Nguyễn Tuệ MinhNo ratings yet

- Income TaxesDocument3 pagesIncome TaxesCENTENO, JOAN R.No ratings yet

- Activity 1 Calculations Using The Tax-Payable MethodDocument10 pagesActivity 1 Calculations Using The Tax-Payable MethodJohn TomNo ratings yet

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocument4 pagesSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureNoorodden50% (2)

- DocxDocument5 pagesDocxJohn Vincent CruzNo ratings yet

- Ege, Kenneth M. Bsa22A1Document3 pagesEge, Kenneth M. Bsa22A1Kenneth Marcial Ege IINo ratings yet

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocument5 pagesSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureClarisse AlimotNo ratings yet

- AaaaaDocument2 pagesAaaaaMondays AndNo ratings yet

- Class Activities (Millan, 2019) : Requirements: A. How Much Is The Income Tax Expense For 2003? SolutionDocument6 pagesClass Activities (Millan, 2019) : Requirements: A. How Much Is The Income Tax Expense For 2003? SolutionPrincess TaizeNo ratings yet

- Untitled SpreadsheetDocument9 pagesUntitled SpreadsheetMiguel BautistaNo ratings yet

- ACC-ACF2100 Lecture 2 HandoutDocument9 pagesACC-ACF2100 Lecture 2 HandoutDanNo ratings yet

- Example Deferred TaxDocument7 pagesExample Deferred TaxTEIK LOONG KHORNo ratings yet

- Lamagan, Kyla T. BSA 401 Intermediate Acct. 2 Final Output Problem 16-13 (IAA)Document14 pagesLamagan, Kyla T. BSA 401 Intermediate Acct. 2 Final Output Problem 16-13 (IAA)lana del reyNo ratings yet

- Accounting For Income Tax Comprehensive Problem 1: Additional InformationDocument1 pageAccounting For Income Tax Comprehensive Problem 1: Additional InformationAngel Keith MercadoNo ratings yet

- A. Journal Entries For 2020Document6 pagesA. Journal Entries For 2020Ollid Kline Jayson JNo ratings yet

- Answer Key - Quizzer On AJEDocument2 pagesAnswer Key - Quizzer On AJEClarissa De GuzmanNo ratings yet

- Accounting For Taxes Employee BenefitsDocument6 pagesAccounting For Taxes Employee BenefitsBess Tuico MasanqueNo ratings yet

- Appendix D Accounting For Deferred Income TaxesDocument2 pagesAppendix D Accounting For Deferred Income TaxesLan Hương Trần ThịNo ratings yet

- Chapter 19 Accounting For Income Tax Problem 19-1Document5 pagesChapter 19 Accounting For Income Tax Problem 19-1nicole bancoroNo ratings yet

- Other Taxpayers ProblemsDocument12 pagesOther Taxpayers ProblemsRaiNo ratings yet

- Insurance Expense Allocated To The Quarter: SolutionDocument4 pagesInsurance Expense Allocated To The Quarter: Solutionasdfghjkl zxcvbnmNo ratings yet

- Quiz Accounting For Income TaxDocument5 pagesQuiz Accounting For Income TaxCmNo ratings yet

- Solvay Adv Acc Exercises Case 3 Deferred - Taxes IAS 12 - SolutionDocument9 pagesSolvay Adv Acc Exercises Case 3 Deferred - Taxes IAS 12 - SolutionlolaNo ratings yet

- VOL 2 16. Accounting For Income TaxationDocument15 pagesVOL 2 16. Accounting For Income TaxationdmangiginNo ratings yet

- Sample Test (Extract)Document6 pagesSample Test (Extract)Julie KimNo ratings yet

- Task Performance 1Document1 pageTask Performance 1JanixxxNo ratings yet

- Divine Company Began OperationsDocument1 pageDivine Company Began OperationsQueen ValleNo ratings yet

- Deferred Tax AnswerDocument2 pagesDeferred Tax Answerjohn ashleyNo ratings yet

- ABC Co. Started Its OperationsDocument1 pageABC Co. Started Its OperationsQueen ValleNo ratings yet

- 06 Taxation - Deferred s20 Final-1Document44 pages06 Taxation - Deferred s20 Final-150902849No ratings yet

- Tax Practice Quiz QuestionsDocument3 pagesTax Practice Quiz QuestionsDanji MisoNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Wealth Management Planning: The UK Tax PrinciplesFrom EverandWealth Management Planning: The UK Tax PrinciplesRating: 4.5 out of 5 stars4.5/5 (2)

- ch5 6Document39 pagesch5 6Kristel FieldsNo ratings yet

- ch 8-9Document21 pagesch 8-9Kristel FieldsNo ratings yet

- SECTION 3. — Special Provisions forDocument9 pagesSECTION 3. — Special Provisions forKristel FieldsNo ratings yet

- Market ApproachDocument24 pagesMarket ApproachKristel FieldsNo ratings yet

- CH 9Document4 pagesCH 9Kristel FieldsNo ratings yet

- CH 7Document91 pagesCH 7Kristel FieldsNo ratings yet

- Take Home QuizDocument18 pagesTake Home QuizKristel FieldsNo ratings yet

- Chapter 3 LOSDocument3 pagesChapter 3 LOSKristel FieldsNo ratings yet

- DCFDocument46 pagesDCFKristel FieldsNo ratings yet

- Midterm Long QuizDocument2 pagesMidterm Long QuizKristel FieldsNo ratings yet

- IA1 8 Intangible AssetDocument51 pagesIA1 8 Intangible AssetKristel FieldsNo ratings yet

- Rizal Pre Fi Chapter 17-18-19 NewDocument59 pagesRizal Pre Fi Chapter 17-18-19 NewKristel FieldsNo ratings yet

- Chapter 4 ValuationDocument23 pagesChapter 4 ValuationKristel FieldsNo ratings yet

- LQ ContempoDocument2 pagesLQ ContempoKristel FieldsNo ratings yet

- Quiz 4 - Answer3Document1 pageQuiz 4 - Answer3Kristel FieldsNo ratings yet

- Paranoid Company Journal Entries: Date Account Title and ExplanationDocument8 pagesParanoid Company Journal Entries: Date Account Title and ExplanationKristel FieldsNo ratings yet

- Quiz 4Document1 pageQuiz 4Kristel FieldsNo ratings yet

- Prob 12 LiquidationDocument1 pageProb 12 LiquidationKristel FieldsNo ratings yet

- Ia MCDocument5 pagesIa MCKristel FieldsNo ratings yet

- EXAMPLE 12.1 (Current Tax Liability)Document8 pagesEXAMPLE 12.1 (Current Tax Liability)KaiWenNgNo ratings yet

- Unit 3-Statement of Changes in Equity (2023)Document13 pagesUnit 3-Statement of Changes in Equity (2023)Chalé DarwinNo ratings yet

- Chapter 23 IAS 12 Income TaxesDocument26 pagesChapter 23 IAS 12 Income TaxesKelvin Chu JY100% (1)

- Income Taxes: International Accounting Standard 12Document49 pagesIncome Taxes: International Accounting Standard 12leda_cecilia08No ratings yet

- Balakrishnan 2011Document67 pagesBalakrishnan 2011novie endi nugrohoNo ratings yet

- Chương 4Document9 pagesChương 4Hồ Trần Minh ThưNo ratings yet

- Chapter 22 Deferred Tax Asset and LiabilityDocument8 pagesChapter 22 Deferred Tax Asset and LiabilityCheesca Macabanti - 12 Euclid-Digital ModularNo ratings yet

- Accrev1 FINAL EXAM 19 20 NO ANSWERSDocument15 pagesAccrev1 FINAL EXAM 19 20 NO ANSWERSGray JavierNo ratings yet

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocument5 pagesSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureClarisse AlimotNo ratings yet

- Advance I Ch-IDocument61 pagesAdvance I Ch-IBamlak WenduNo ratings yet

- SOCI Financial Statements Per 31 Dec 2022Document125 pagesSOCI Financial Statements Per 31 Dec 2022KhresnaNo ratings yet

- CH 19Document101 pagesCH 19Miranti NurulNo ratings yet

- Spotify Technology S.A.: United States Securities and Exchange CommissionDocument48 pagesSpotify Technology S.A.: United States Securities and Exchange CommissionSunday AyomideNo ratings yet

- Ias 12Document69 pagesIas 12Md SaifulNo ratings yet

- 2017TAtA Steel Annual ReportDocument8 pages2017TAtA Steel Annual ReportHeadshot's GameNo ratings yet

- Discussion Problems: FAR.2935-Income Taxes OCTOBER 2020Document4 pagesDiscussion Problems: FAR.2935-Income Taxes OCTOBER 2020Alexander DimaliposNo ratings yet

- QateelDocument6 pagesQateelmaham rasheedNo ratings yet

- CACC031 Mock Test 1 SSDocument11 pagesCACC031 Mock Test 1 SSMartia NongNo ratings yet

- Accounting Standard 22Document12 pagesAccounting Standard 22Rupesh MoreNo ratings yet

- PAS 12 Income TaxesDocument24 pagesPAS 12 Income TaxesPatawaran, Janelle S.No ratings yet

- Chapter 2Document20 pagesChapter 2Coursehero PremiumNo ratings yet

- Tutorial 2: Exercise 12.2 Calculation of Current TaxDocument13 pagesTutorial 2: Exercise 12.2 Calculation of Current TaxKim FloresNo ratings yet

- Philippine Accounting StandardsDocument168 pagesPhilippine Accounting StandardsJessica Lyka AquinoNo ratings yet

- Audit of LiabilitiesDocument14 pagesAudit of LiabilitiesJustine UngabNo ratings yet

- Presentation On Beximco PharmaceuticalsDocument42 pagesPresentation On Beximco PharmaceuticalsQuazi Aritra Reyan100% (1)

- FA2 Question BookDocument59 pagesFA2 Question BookNam LêNo ratings yet

- Liabilities and EquityDocument23 pagesLiabilities and Equityadmiral spongebobNo ratings yet

- Item Carrying Value Tax Base: in Class Exercise - Chapter 5 Deferred TaxDocument6 pagesItem Carrying Value Tax Base: in Class Exercise - Chapter 5 Deferred TaxRubiatul AdawiyahNo ratings yet