Professional Documents

Culture Documents

Morning Brief - October 07, 2022

Morning Brief - October 07, 2022

Uploaded by

ANKUR KIMTANIOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Morning Brief - October 07, 2022

Morning Brief - October 07, 2022

Uploaded by

ANKUR KIMTANICopyright:

Available Formats

Morning Brief – October 07, 2022

Global Domestic

• Retail sales in the Euro Area fell 0.3% m-o-m in • The S&P Global India services PMI slumped to a six-

August, marking a third consecutive monthly decline, month low of 54.3 in September from 57.2 in

as high inflation continued to weigh on consumers' August, led by a substantial easing in demand amid

affordability. high inflation.

• Factory orders in Germany fell by 2.4% m-o-m in • The World Bank lowered its FY23 GDP growth

August, shifting from an upwardly revised 1.9% forecast for India to 6.5%, from an earlier estimate

growth in the prior month and worse than market of 7.5%, citing deteriorating international

forecasts of a 0.7% decline. environment.

• OPEC+ agreed to further tighten global crude supply • India's sugar exports jumped 57% to 109.8 lakh

with a deal to slash production by about 2 million tonnes during 2021-22 marketing year ending

barrels per day, the largest reduction since 2020. September, making the country world’s 2nd largest

exporter of sugar, the food ministry said.

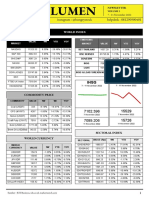

Global Indicators

05-10-2022 06-10-2022 % / bps change

Dow 30,274 29,927 -1.15

NASDAQ 11,149 11,073 -0.68

S & P 500 3,783 3,745 -1.02

Nikkei 225 27,121 27,311 0.70

FTSE 100 7,053 6,997 -0.78

US 10-yr (%) 3.76 3.82 7 bps

UK 10-yr (%) 4.03 4.17 14 bps

Germany 10-yr (%) 2.03 2.09 6 bps

Gold ($/t oz) 1,721 1,721 -0.56

Crude Oil-WTI ($/bbl) 87.76 88.45 1.43

Crude Oil-Brent ($/bbl) 93.37 94.42 1.71

$/€* 0.99 0.98 -1.02

¥/$* 144.69 145.14 0.38

$/£* 1.13 1.12 -1.29

*(-)Appreciation/(+)Depreciation; Source: WSJ

Equity and Currency Markets - Domestic

04-10-2022 06-10-2022 % change

Sensex 58,065 58,222 0.27

NIFTY 17,274 17,332 0.33

Rs/$* 81.52 81.89 0.45

Rs/€* 80.53 80.96 0.53

*(-)Appreciation/(+) Depreciation; Source: Mint

Money Market - Domestic

04-10-2022 06-10-2022

Avg. Call Rate (%) 5.75 5.73

Vol. Traded (Rs million) 1,07,568 1,13,319

Net banking system liquidity outstanding (Rs million)* (10,03,746) (7,42,146)

T-Bills 91 days (%) 6.05 6.06

182 days (%) NA 6.45

364 days (%) NA 6.68

G-sec 3 years (%) 7.22 7.29

5 years (%) 7.30 7.36

10 years (%) 7.42 7.49

*(+)Deficit/(-)Surplus (Net banking system liquidity outstanding = total repo+MSF+SLF – total reverse repo); Source: CEIC, CCIL

FPI and MFs Investment Flows - Domestic

Equity Debt

Total (Net)^

Net Net

Net FPI Flows (USD million)

Sep-22 (903) 328 (437)

Oct-22* 207 (267) (69)

04-Oct-22 156 (12) 143

06-Oct-22 238 (47) 189

MF Investments (Rs million)

Oct-22# (10,618) 4,849 (5,769)

*Latest data as of previous trading day; #Data till Oct 03, 2022; ^Total (Net) of equity, debt & hybrid; Source: CEIC

Bond Spreads over G-Sec (PP)*- Domestic G-Sec Yields (%) - Domestic

PSU, FIs

10 Year NBFCs Corporates 10

& Banks

AAA 0.20 0.50 0.55

8

AA+ 0.69 1.02 0.93

AA 0.98 1.31 1.30

6

%

AA- 1.46 1.77 1.74

A+ 2.21 3.52 2.99

4

A 2.46 3.77 3.24

A- 2.71 4.02 3.49 2

BBB+ 3.21 4.52 4.24 1 2 5 10 15 20 30

BBB 3.46 4.77 4.49 Years

BBB- 3.96 5.27 4.99 31-Mar-22 30-Jun-22 06-Oct-22

*As of October 04, 2022; Source: FIMMDA Source: CCIL

Contact

Akanksha Bhende Associate Economist akanksha.bhende@careedge.in +91 - 22 - 6754 3424

CARE Ratings Limited

Corporate Office: 4th Floor, Godrej Coliseum, Somaiya Hospital Road, Off Eastern Express Highway, Sion (East), Mumbai - 400 022

Phone: +91-22-6754 3456 l CIN: L67190MH1993PLC071691

Disclaimer: This report has been prepared by CareEdge (CARE Ratings Limited). CareEdge has taken utmost care to ensure accuracy and objectivity based on information available in the public domain.

However, neither the accuracy nor completeness of the information contained in this report is guaranteed. CareEdge is not responsible for any errors or omissions in analysis/inferences/views or for results

obtained from the use of the information contained in this report and especially states that CareEdge has no financial liability whatsoever to the user of this report.

You might also like

- Morning Brief - October 07, 2022Document1 pageMorning Brief - October 07, 2022ANKUR KIMTANINo ratings yet

- Morning Brief - September 22, 2022Document1 pageMorning Brief - September 22, 2022ANKUR KIMTANINo ratings yet

- Morning Brief - September 23, 2022Document1 pageMorning Brief - September 23, 2022ANKUR KIMTANINo ratings yet

- Morning Brief - September 26, 2022Document1 pageMorning Brief - September 26, 2022ANKUR KIMTANINo ratings yet

- Morning Brief - September 07, 2022Document1 pageMorning Brief - September 07, 2022ANKUR KIMTANINo ratings yet

- LIVE-PGT-7th Oct, 2022 Global & Domestic News LetterDocument1 pageLIVE-PGT-7th Oct, 2022 Global & Domestic News LetterANKUR KIMTANINo ratings yet

- Morning Cuppa 12-JanDocument2 pagesMorning Cuppa 12-JanSaroNo ratings yet

- Morning Cuppa 20-DecDocument3 pagesMorning Cuppa 20-DecSaroNo ratings yet

- Morning Cuppa 06-JanDocument2 pagesMorning Cuppa 06-JanSaroNo ratings yet

- Morning Cuppa 24-JanDocument2 pagesMorning Cuppa 24-JanSaroNo ratings yet

- Morning Cuppa 14-DecDocument2 pagesMorning Cuppa 14-DecKeshav KhetanNo ratings yet

- LIVE-PGT-26th Sep, 2022 Global & Domestic News LetterDocument1 pageLIVE-PGT-26th Sep, 2022 Global & Domestic News LetterANKUR KIMTANINo ratings yet

- Morning Cuppa 09-JanDocument2 pagesMorning Cuppa 09-JanWhaosidqNo ratings yet

- Morning Cuppa 17-AugDocument2 pagesMorning Cuppa 17-AugSourav PalNo ratings yet

- Morning Cuppa 08-Oct-202110080838430715214Document2 pagesMorning Cuppa 08-Oct-202110080838430715214flying400No ratings yet

- Morning Cuppa 22-FebDocument2 pagesMorning Cuppa 22-FebNitin ChauhanNo ratings yet

- Morning Cuppa 05-JanDocument2 pagesMorning Cuppa 05-Jankishan.p.borivaliNo ratings yet

- Daily Commodity, Currency & Money Market Update - 28th Dec 2023Document4 pagesDaily Commodity, Currency & Money Market Update - 28th Dec 2023S.M Abdulla ShuvoNo ratings yet

- Morning Cuppa 30-MayDocument2 pagesMorning Cuppa 30-MayAkshay ChaudhryNo ratings yet

- Morning Cuppa 11-MayDocument2 pagesMorning Cuppa 11-MayShashank MisraNo ratings yet

- Morning Cuppa 20-JanDocument2 pagesMorning Cuppa 20-JanSaroNo ratings yet

- TD Economics: The Weekly Bottom LineDocument6 pagesTD Economics: The Weekly Bottom LinePaola VerdiNo ratings yet

- Weekly Report - 3 Aug 2007Document5 pagesWeekly Report - 3 Aug 2007api-3840085No ratings yet

- Morning Cuppa 30-OctDocument2 pagesMorning Cuppa 30-OctKeshavNo ratings yet

- Import Dropped Due To Covid-19 Disruption 16 Mar 2020Document3 pagesImport Dropped Due To Covid-19 Disruption 16 Mar 2020botoy26No ratings yet

- Morning Cuppa 12-DecDocument2 pagesMorning Cuppa 12-DecSaroNo ratings yet

- LIVE-PGT-22nd Sep, 2022 Global & Domestic News LetterDocument1 pageLIVE-PGT-22nd Sep, 2022 Global & Domestic News LetterANKUR KIMTANINo ratings yet

- Markets Today!: 10 January 2022Document8 pagesMarkets Today!: 10 January 2022prajwalbhatNo ratings yet

- Today's Top Research Idea: Maruti Suzuki: Weak Performance in A Tough Quarter Good Demand RecoveryDocument32 pagesToday's Top Research Idea: Maruti Suzuki: Weak Performance in A Tough Quarter Good Demand RecoveryTarun RahejaNo ratings yet

- Morning Cuppa 31-OctDocument2 pagesMorning Cuppa 31-OctKeshavNo ratings yet

- SPDR Gold Etfs Quarterly DashboardDocument6 pagesSPDR Gold Etfs Quarterly DashboardMicahNo ratings yet

- Morning Cuppa 23-JanDocument2 pagesMorning Cuppa 23-JanSaroNo ratings yet

- India Daily 22082022 BKDocument71 pagesIndia Daily 22082022 BKRohan RustagiNo ratings yet

- Fund Performance MetlifeDocument11 pagesFund Performance MetlifeDeepak DharmarajNo ratings yet

- TD Q3 PreviewDocument14 pagesTD Q3 PreviewForexliveNo ratings yet

- Morning Cuppa 14-JulyDocument2 pagesMorning Cuppa 14-JulyAjish CJ 2015No ratings yet

- Morning Cuppa 5-Jun-1Document2 pagesMorning Cuppa 5-Jun-1Harsh GandhiNo ratings yet

- Morning - India Motilal Oswal ResearchDocument16 pagesMorning - India Motilal Oswal Researchvikalp123123No ratings yet

- AUG 09 Danske IMM PositioningDocument8 pagesAUG 09 Danske IMM PositioningMiir ViirNo ratings yet

- AP Newsletter Moderate September19Document15 pagesAP Newsletter Moderate September19sujeet panditNo ratings yet

- Saudi Aramco q3 2021 Interim Report EnglishDocument38 pagesSaudi Aramco q3 2021 Interim Report EnglishQasim AliNo ratings yet

- Lumen Vol 2Document6 pagesLumen Vol 2Daniel AldianNo ratings yet

- Morning Cuppa 29-May-2Document2 pagesMorning Cuppa 29-May-2satyen4sk2015No ratings yet

- Morning Cuppa 27-OctDocument2 pagesMorning Cuppa 27-OctKeshavNo ratings yet

- Investor Digest: Equity Research - 24 January 2022Document5 pagesInvestor Digest: Equity Research - 24 January 2022Radityo Hari WibowoNo ratings yet

- Morning - India 20210831 Mosl Mi PG010Document10 pagesMorning - India 20210831 Mosl Mi PG010vikalp123123No ratings yet

- Nomura - Oil & Gas, Chemicals 30 Sept 2010Document21 pagesNomura - Oil & Gas, Chemicals 30 Sept 2010ppt46No ratings yet

- Morning - India 20220425 Mosl Mi PG022Document22 pagesMorning - India 20220425 Mosl Mi PG022Deepak KhatwaniNo ratings yet

- Top Story:: Banking Sector: S&P Flags Risks On Philippine BanksDocument4 pagesTop Story:: Banking Sector: S&P Flags Risks On Philippine BanksJNo ratings yet

- Myanmar Weekly: Selected Stock IndicesDocument13 pagesMyanmar Weekly: Selected Stock IndicesWai Mar ThantNo ratings yet

- Oil and Gas - Taking A More Cautious View - 10/6/2010Document9 pagesOil and Gas - Taking A More Cautious View - 10/6/2010Rhb InvestNo ratings yet

- Top Story:: WLCON: WLCON To Have 63 Stores by End-2020Document3 pagesTop Story:: WLCON: WLCON To Have 63 Stores by End-2020JNo ratings yet

- IndiaMorningBrief 15dec2023Document10 pagesIndiaMorningBrief 15dec2023Deepul WadhwaNo ratings yet

- Morning Market Snapshot - 12 Nov 2018Document2 pagesMorning Market Snapshot - 12 Nov 2018BALMERNo ratings yet

- International Developed Equity Allocation FundDocument2 pagesInternational Developed Equity Allocation Fundb1OSphereNo ratings yet

- Morning Brief: JCI Index JCI MovementDocument8 pagesMorning Brief: JCI Index JCI MovementPutu Chantika Putri DhammayantiNo ratings yet

- Morning Wrap 20231215Document9 pagesMorning Wrap 20231215Anurag PharkyaNo ratings yet

- Economic Highlights - Fuel and Sugar Prices Were Raised To Reduce - 16/7/2010Document3 pagesEconomic Highlights - Fuel and Sugar Prices Were Raised To Reduce - 16/7/2010Rhb InvestNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2022: Volume I: Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2022: Volume I: Country and Regional ReviewsNo ratings yet

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- Morning Brief - October 07, 2022Document1 pageMorning Brief - October 07, 2022ANKUR KIMTANINo ratings yet

- LIVE-PGT-7th Oct, 2022 Global & Domestic News LetterDocument1 pageLIVE-PGT-7th Oct, 2022 Global & Domestic News LetterANKUR KIMTANINo ratings yet

- LIVE-PGT-22nd Sep, 2022 Global & Domestic News LetterDocument1 pageLIVE-PGT-22nd Sep, 2022 Global & Domestic News LetterANKUR KIMTANINo ratings yet

- Morning Brief - September 07, 2022Document1 pageMorning Brief - September 07, 2022ANKUR KIMTANINo ratings yet

- Gsec Parking ABC Limited Deal Con 06-10-22Document2 pagesGsec Parking ABC Limited Deal Con 06-10-22ANKUR KIMTANINo ratings yet

- Brokerage Structure Premeium October 2022Document1 pageBrokerage Structure Premeium October 2022ANKUR KIMTANINo ratings yet

- Morning Brief - September 22, 2022Document1 pageMorning Brief - September 22, 2022ANKUR KIMTANINo ratings yet

- Morning Brief - September 26, 2022Document1 pageMorning Brief - September 26, 2022ANKUR KIMTANINo ratings yet

- Morning Brief - September 23, 2022Document1 pageMorning Brief - September 23, 2022ANKUR KIMTANINo ratings yet

- LIVE-PGT-26th Sep, 2022 Global & Domestic News LetterDocument1 pageLIVE-PGT-26th Sep, 2022 Global & Domestic News LetterANKUR KIMTANINo ratings yet