Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

7 viewsA Case Study (Demand)

A Case Study (Demand)

Uploaded by

Tannu GuptaThe sharp rise in inflation and weakening of the rupee could negatively impact festive season demand for smartphones in India. Market trackers are cutting their annual shipment estimates and expect a weaker festive season, which usually accounts for a third of annual sales. The weak rupee is increasing smartphone production costs for brands. Additionally, the inclusion of essential goods under GST and high inflation are squeezing consumer budgets, reducing upgrades of smartphones. Some brands may delay new launches and focus on flagship models to drive sales during the festive season.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Mobile Phones in The PhilippinesDocument9 pagesMobile Phones in The PhilippinesGelo GonzalesNo ratings yet

- Fiesta Gifts Mending The SpendingDocument23 pagesFiesta Gifts Mending The SpendingPushpesh JoshiNo ratings yet

- Allstate/McKinsey Bates H000001010Document495 pagesAllstate/McKinsey Bates H0000010104207west59th100% (3)

- Movie Recommendation SystemDocument41 pagesMovie Recommendation SystemSowmya Srinivasan100% (3)

- NitinolDocument20 pagesNitinolTamara PricilaNo ratings yet

- UCO Reporter 2022, March Edition, February 27, 2022Document44 pagesUCO Reporter 2022, March Edition, February 27, 2022ucopresidentNo ratings yet

- Capstone Project - Launching A Premium Category Smartphone For The Indian Market PDFDocument11 pagesCapstone Project - Launching A Premium Category Smartphone For The Indian Market PDFSudip Issac SamNo ratings yet

- Amazon's Foray Into India - ReportDocument21 pagesAmazon's Foray Into India - ReportSomdeb BanerjeeNo ratings yet

- 66 Job Interview Questions For Data ScientistsDocument10 pages66 Job Interview Questions For Data ScientistsRavi RanjanNo ratings yet

- CCU Basic Operations CourseDocument116 pagesCCU Basic Operations CourseRene GutierrezNo ratings yet

- Northern Research GroupDocument2 pagesNorthern Research GroupTeam GuidoNo ratings yet

- Smartphones A Must-Buy Even in Slowdown Season: Navadha Pandey New DelhiDocument4 pagesSmartphones A Must-Buy Even in Slowdown Season: Navadha Pandey New DelhiTulsi GovaniNo ratings yet

- A Study To Understand Consumer Preference of Mobile Phones: NAME: Vibhor Rathi Class: B. Com (Honors) 3 YearDocument22 pagesA Study To Understand Consumer Preference of Mobile Phones: NAME: Vibhor Rathi Class: B. Com (Honors) 3 YearShivam PatelNo ratings yet

- Sector Capsule: Wearable Electronics in Nigeria: HeadlinesDocument2 pagesSector Capsule: Wearable Electronics in Nigeria: HeadlinesAnonymous 2X8yWQTNo ratings yet

- Royal Enfield KWKWKDocument55 pagesRoyal Enfield KWKWKE01202114-MUHAMMED ISMAIL K BBA CANo ratings yet

- Worldwide Mobile Phone 2015-2019 Forecast and AnalysisDocument25 pagesWorldwide Mobile Phone 2015-2019 Forecast and AnalysisRafsun FaizNo ratings yet

- Indian Mobile Industry AnalysisDocument15 pagesIndian Mobile Industry AnalysisHarveyNo ratings yet

- Mobile Phones in IndiaDocument9 pagesMobile Phones in IndiaShivajiNo ratings yet

- 037 - Shadab Ansari - A Study On Parameters of Brand Preference ofDocument95 pages037 - Shadab Ansari - A Study On Parameters of Brand Preference ofShadab AnsariNo ratings yet

- Authored Article - Smartphone Re-Commerce in IndiaDocument4 pagesAuthored Article - Smartphone Re-Commerce in IndiaSanjay MalaraNo ratings yet

- Mobile Phones in Malaysia: Euromonitor International August 2019Document8 pagesMobile Phones in Malaysia: Euromonitor International August 2019Patricia OoiNo ratings yet

- Customer Brand Preference of Mobile Phones at Hyderabad, IndiaDocument9 pagesCustomer Brand Preference of Mobile Phones at Hyderabad, IndiaKameswara Rao PorankiNo ratings yet

- Research Background - SampleDocument1 pageResearch Background - Samplesourav84No ratings yet

- ME Research Paper 1 FinalDocument20 pagesME Research Paper 1 Finalmohiyuddinsakhib3260No ratings yet

- HorseDocument2 pagesHorseanupNo ratings yet

- Mobile Phones in Vietnam: Euromonitor International October 2020Document9 pagesMobile Phones in Vietnam: Euromonitor International October 2020Nhi ThuầnNo ratings yet

- Mobile Industry IndiaDocument4 pagesMobile Industry IndiasantoshsequeiraNo ratings yet

- Hair Appliance ToolDocument23 pagesHair Appliance ToolWawire WycliffeNo ratings yet

- Electronics and Appliance Specialist Retailers in IndiaDocument9 pagesElectronics and Appliance Specialist Retailers in IndiaNikita NathNo ratings yet

- Mobile - Phones - in - India - Analysis - Euromonitor Aug 2018Document4 pagesMobile - Phones - in - India - Analysis - Euromonitor Aug 2018Aaryan AgrawalNo ratings yet

- Fiesta Gifts Mending The Spending CaseDocument21 pagesFiesta Gifts Mending The Spending CaseSaurabh Sahu0% (1)

- Impact of Flash Sales On E-Commerce Industry in IndiaDocument9 pagesImpact of Flash Sales On E-Commerce Industry in IndiaIJRASETPublicationsNo ratings yet

- Leather Goods Market SizeDocument11 pagesLeather Goods Market SizeShahadul SotejNo ratings yet

- India Mobile Accessories Market 2020Document13 pagesIndia Mobile Accessories Market 2020Expeditous Research and Consulting88% (8)

- Introduction To SectorDocument6 pagesIntroduction To Sectoranon_503118700No ratings yet

- Asian Smartphone Market by IDC India 2014Document3 pagesAsian Smartphone Market by IDC India 2014Xico ShazzadNo ratings yet

- Stepping Into A Bigger, Better Future: A Report On India's Footwear MarketDocument8 pagesStepping Into A Bigger, Better Future: A Report On India's Footwear MarketKomal AroraNo ratings yet

- The Smartphone Industry Analysis in SingaporeDocument19 pagesThe Smartphone Industry Analysis in SingaporeNicholas TanNo ratings yet

- Footwear MarketDocument8 pagesFootwear MarketKomal AroraNo ratings yet

- Sr. No. Topic Page Number: IndexDocument5 pagesSr. No. Topic Page Number: IndexArman ShaikhNo ratings yet

- Footwear Market Set To Enter Rs. 1 Lakh Crore in 2 Years: 08 March 2019 Issue No. 718Document4 pagesFootwear Market Set To Enter Rs. 1 Lakh Crore in 2 Years: 08 March 2019 Issue No. 718Shivam NagpalNo ratings yet

- Footwear Market Set To Enter Rs. 1 Lakh Crore in 2 Years: 08 March 2019 Issue No. 718Document4 pagesFootwear Market Set To Enter Rs. 1 Lakh Crore in 2 Years: 08 March 2019 Issue No. 718GOPAL SINGHNo ratings yet

- iGR - PR NewReport Smartpohone ForecastDocument3 pagesiGR - PR NewReport Smartpohone Forecastbobo_onlyNo ratings yet

- Consumer BehAviourDocument37 pagesConsumer BehAviouranon_757894592No ratings yet

- India - Credit Cards, April 2020Document26 pagesIndia - Credit Cards, April 2020GunjanNo ratings yet

- Case Study by Shikhar ShrivastavaDocument21 pagesCase Study by Shikhar ShrivastavaShikhar ShrivastavaNo ratings yet

- Trendy Low CostDocument5 pagesTrendy Low Costlakshya24gargNo ratings yet

- Bab I - Apple Iphone Market SegmentationDocument2 pagesBab I - Apple Iphone Market SegmentationSena OddyNo ratings yet

- Mobile Phone Accessories Market India 2020Document10 pagesMobile Phone Accessories Market India 2020Expeditous Research and Consulting0% (3)

- JETIRTHE2036Document41 pagesJETIRTHE2036sushantnanaware2000No ratings yet

- Telecom Insider: Latin AmericaDocument17 pagesTelecom Insider: Latin AmericalwaingartenNo ratings yet

- 2019 SE Asia App Engagement ReportDocument25 pages2019 SE Asia App Engagement Reportjefcheung19No ratings yet

- Consumers Share Changed BehaviorDocument10 pagesConsumers Share Changed Behaviorzeynep1312No ratings yet

- Final Report On Nikon Camera: Submitted By: NAME: C.B. Sujeeth Bharadwaj C13Document22 pagesFinal Report On Nikon Camera: Submitted By: NAME: C.B. Sujeeth Bharadwaj C13Sujeeth BharadwajNo ratings yet

- Buying Behavior of Mobile PhoneDocument10 pagesBuying Behavior of Mobile PhoneShashank Kumar BaranwalNo ratings yet

- Journal of Management (Jom) : ©iaemeDocument7 pagesJournal of Management (Jom) : ©iaemeIAEME PublicationNo ratings yet

- From Feature Phones To Smartphones, The Road AheadDocument3 pagesFrom Feature Phones To Smartphones, The Road AheadAydin KaraerNo ratings yet

- Sudha Jaiswar ResearchDocument6 pagesSudha Jaiswar ResearchVinay J YadavNo ratings yet

- JK Paper ReportDocument9 pagesJK Paper ReportNaveen Chander DharNo ratings yet

- Quikr: Unlocking The Value of Used Goods MarketDocument3 pagesQuikr: Unlocking The Value of Used Goods MarketSam DhuriNo ratings yet

- Dd202a Edited احمد بسام2Document10 pagesDd202a Edited احمد بسام2ahmedNo ratings yet

- 2019 Counterpoint Wingtech, Huaqin and Longcheer Continued To Dominate The World's Smartphone ODMIDH LandscapeDocument3 pages2019 Counterpoint Wingtech, Huaqin and Longcheer Continued To Dominate The World's Smartphone ODMIDH Landscapespring pengNo ratings yet

- Group-Project Part-A SmartphonesDocument2 pagesGroup-Project Part-A SmartphonesHai Au NguyenNo ratings yet

- Indian Consumer MarketsDocument12 pagesIndian Consumer Marketsvishal1723No ratings yet

- Inventory Management Volume 2: And Some Observations About the Future of the Automotive AftermarketFrom EverandInventory Management Volume 2: And Some Observations About the Future of the Automotive AftermarketNo ratings yet

- Making Big Data Work for Your Business: A guide to effective Big Data analyticsFrom EverandMaking Big Data Work for Your Business: A guide to effective Big Data analyticsNo ratings yet

- Asia Crises 1994Document24 pagesAsia Crises 1994Tannu GuptaNo ratings yet

- Definition of DisasterDocument6 pagesDefinition of DisasterTannu GuptaNo ratings yet

- Alternate FuelDocument22 pagesAlternate FuelTannu GuptaNo ratings yet

- What Is Soil DegradationDocument9 pagesWhat Is Soil DegradationTannu GuptaNo ratings yet

- AseanDocument31 pagesAseanTannu GuptaNo ratings yet

- Case Study MDDDocument13 pagesCase Study MDDTannu GuptaNo ratings yet

- AcknowledgmentDocument12 pagesAcknowledgmentTannu GuptaNo ratings yet

- Chemistry Project On Foaming Capacity of SoapsDocument13 pagesChemistry Project On Foaming Capacity of SoapsTannu GuptaNo ratings yet

- Commerce Project 1 (1) FinalDocument19 pagesCommerce Project 1 (1) FinalTannu GuptaNo ratings yet

- Role of Castes in PoliticsDocument12 pagesRole of Castes in PoliticsTannu GuptaNo ratings yet

- Curriculum VitaeDocument1 pageCurriculum VitaeTannu GuptaNo ratings yet

- Mental Health During CovidDocument3 pagesMental Health During CovidTannu GuptaNo ratings yet

- Character Is The Key of LifeDocument11 pagesCharacter Is The Key of LifeTannu GuptaNo ratings yet

- QUESTIONNAIR1Document2 pagesQUESTIONNAIR1Tannu GuptaNo ratings yet

- Ways To PromoteDocument1 pageWays To PromoteTannu GuptaNo ratings yet

- Status of Working WomenDocument17 pagesStatus of Working WomenTannu GuptaNo ratings yet

- Usha MartinDocument21 pagesUsha MartinTannu GuptaNo ratings yet

- Agriculture RevolutionDocument28 pagesAgriculture RevolutionTannu GuptaNo ratings yet

- CRIMEDocument6 pagesCRIMETannu GuptaNo ratings yet

- An Internal CrisisDocument7 pagesAn Internal CrisisTannu GuptaNo ratings yet

- Marketing Statery of Ferrari and LamborghiniDocument51 pagesMarketing Statery of Ferrari and LamborghiniTannu GuptaNo ratings yet

- Child LabourDocument12 pagesChild LabourTannu GuptaNo ratings yet

- Social Impact of PandemicDocument55 pagesSocial Impact of PandemicTannu GuptaNo ratings yet

- Impact of Social Media On Human Behavior and AttitudeDocument7 pagesImpact of Social Media On Human Behavior and AttitudeTannu GuptaNo ratings yet

- 2000 Stock Exchange CrashDocument25 pages2000 Stock Exchange CrashTannu GuptaNo ratings yet

- International OrganizatonDocument16 pagesInternational OrganizatonTannu GuptaNo ratings yet

- A Project Report Peer PressureDocument17 pagesA Project Report Peer PressureTannu GuptaNo ratings yet

- A - Project - Report - On - Birth 2Document28 pagesA - Project - Report - On - Birth 2Tannu GuptaNo ratings yet

- Impact of Social Media On Human Behavior and Attitudes2022Document17 pagesImpact of Social Media On Human Behavior and Attitudes2022Tannu GuptaNo ratings yet

- Sanitary NapkinDocument11 pagesSanitary NapkinTannu GuptaNo ratings yet

- Course Syllabus Electrical Machines II Summer SemesterDocument4 pagesCourse Syllabus Electrical Machines II Summer SemesterMahmoud Alshar'eNo ratings yet

- Athul AjiDocument5 pagesAthul AjiAsif SNo ratings yet

- MatchmakerDocument43 pagesMatchmakerMatthew MckayNo ratings yet

- Notice of Meeting-1st MDC Ldip Alignment Meeting & WsDocument5 pagesNotice of Meeting-1st MDC Ldip Alignment Meeting & WsByaheng CawayanNo ratings yet

- NJM072B/082B/072/082: Dual J-Fet Input Operational AmplifierDocument5 pagesNJM072B/082B/072/082: Dual J-Fet Input Operational Amplifieryuni supriatinNo ratings yet

- Consumer Redress: Fair Trade Enforcement BureauDocument47 pagesConsumer Redress: Fair Trade Enforcement BureauMaria LovesongorNo ratings yet

- D H Reid - Organic Compounds of Sulphur, Selenium, and Tellurium Vol 1-Royal Society of Chemistry (1970)Document518 pagesD H Reid - Organic Compounds of Sulphur, Selenium, and Tellurium Vol 1-Royal Society of Chemistry (1970)julianpellegrini860No ratings yet

- Decision Utah LighthouseDocument28 pagesDecision Utah LighthousemschwimmerNo ratings yet

- PRELIM Fire Technology and Arson InvestigationDocument6 pagesPRELIM Fire Technology and Arson InvestigationIgnacio Burog RazonaNo ratings yet

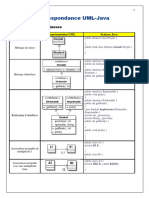

- 8 - Correspondance UML-JAVADocument3 pages8 - Correspondance UML-JAVAoussama sfiriNo ratings yet

- Global Warming Holiday HomeworkDocument25 pagesGlobal Warming Holiday HomeworkAnanyaNo ratings yet

- PointersDocument147 pagesPointersSoumya VijoyNo ratings yet

- GSB Samaj Foundation - List of Goud Saraswat Brahmin SurnamesDocument2 pagesGSB Samaj Foundation - List of Goud Saraswat Brahmin SurnamesShree Vishnu ShastriNo ratings yet

- Myanmar Companies Law 2017Document188 pagesMyanmar Companies Law 2017Let's Save Myanmar100% (1)

- Daftar Harga: Digital PrintingDocument4 pagesDaftar Harga: Digital PrintingHikmatus Shoimah Firdausi NuzulaNo ratings yet

- 4 Differently Able Persons ActDocument7 pages4 Differently Able Persons Actumer plays gameNo ratings yet

- Topic 6:sustainability & Green EngineeringDocument5 pagesTopic 6:sustainability & Green EngineeringyanNo ratings yet

- Shah Fahad (editor), Osman Sönmez (editor), Shah Saud (editor), Depeng Wang (editor), Chao Wu (editor), Muhammad Adnan (editor), Muhammad Arif (editor), Amanullah (editor) - Engineering Tolerance in C.pdfDocument311 pagesShah Fahad (editor), Osman Sönmez (editor), Shah Saud (editor), Depeng Wang (editor), Chao Wu (editor), Muhammad Adnan (editor), Muhammad Arif (editor), Amanullah (editor) - Engineering Tolerance in C.pdfTri4alNo ratings yet

- Connorm Edid6507-Assign 2Document27 pagesConnorm Edid6507-Assign 2api-399872156No ratings yet

- Wbcviii PDFDocument1,192 pagesWbcviii PDFDaniel PinheiroNo ratings yet

- CA ProjectDocument21 pagesCA Projectkalaswami100% (1)

- Gagas 2018Document233 pagesGagas 2018UnggulRajevPradanaNo ratings yet

- Samsung RF27T5501Document164 pagesSamsung RF27T5501Brian MasseyNo ratings yet

A Case Study (Demand)

A Case Study (Demand)

Uploaded by

Tannu Gupta0 ratings0% found this document useful (0 votes)

7 views3 pagesThe sharp rise in inflation and weakening of the rupee could negatively impact festive season demand for smartphones in India. Market trackers are cutting their annual shipment estimates and expect a weaker festive season, which usually accounts for a third of annual sales. The weak rupee is increasing smartphone production costs for brands. Additionally, the inclusion of essential goods under GST and high inflation are squeezing consumer budgets, reducing upgrades of smartphones. Some brands may delay new launches and focus on flagship models to drive sales during the festive season.

Original Description:

Original Title

A CASE STUDY (DEMAND)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe sharp rise in inflation and weakening of the rupee could negatively impact festive season demand for smartphones in India. Market trackers are cutting their annual shipment estimates and expect a weaker festive season, which usually accounts for a third of annual sales. The weak rupee is increasing smartphone production costs for brands. Additionally, the inclusion of essential goods under GST and high inflation are squeezing consumer budgets, reducing upgrades of smartphones. Some brands may delay new launches and focus on flagship models to drive sales during the festive season.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

7 views3 pagesA Case Study (Demand)

A Case Study (Demand)

Uploaded by

Tannu GuptaThe sharp rise in inflation and weakening of the rupee could negatively impact festive season demand for smartphones in India. Market trackers are cutting their annual shipment estimates and expect a weaker festive season, which usually accounts for a third of annual sales. The weak rupee is increasing smartphone production costs for brands. Additionally, the inclusion of essential goods under GST and high inflation are squeezing consumer budgets, reducing upgrades of smartphones. Some brands may delay new launches and focus on flagship models to drive sales during the festive season.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

A CASE STUDY

FALL IN VALUE OF RUPEE, HIGH INFLATION

COULD HIT FESTIVE SEASON DEMAND FOR

SMARTPHONES

The sharp rise in the value of the

rupee against the dollar and high

inflation could hit festive season

demand for smartphone makers.

Market trackers are already

cutting annual shipment

estimates for smartphones,

fearing a weaker-than-usual

festive season, which accounts

for a third of annual sales. Counterpoint Research is now estimating

its annual forecast to be 175-177 million units from its initial 181

million estimates. IDC India is also considering a downward revision

from its initial 5% annual growth estimates. "Smartphone makers will

have to pass on the increased costs to end consumers at a time when

consumers are holding on to their purchases. It makes the upcoming

festive season sales even more difficult for the brands," said Tarun

Pathak, research director at Counterpoint Research. The pessimism

stems from a weak rupee against the dollar, which is impacting the

cost of production of smartphones. Despite a strong manufacturing

base in India, most of the components are sourced from other

countries, traded in dollars. Pathak said that as a result, brands may

delay the sourcing of components for a while, adding that the rupee

downfall may ease by mid-August to September. This could then lead

to delayed launches, or brands focusing more on the so-called ‘hero’

launches to have enough brand recall during the festive sales.

The recent inclusion of essential commodities like pre-packed flour,

paneer and curd under the GST regime has also added to the worries

of smartphone brands.

"If my monthly budget goes up on essentials, I don't have much

money to dispose of on other things. While smartphones are

essential today, the upgrades are dependent on an individual's

budget and how much you can shell out additionally," said Faisal

Kawoosa, co-founder at TechArc. “So, while earlier some would

upgrade their phones every year, that might get pinched due to the

price hikes in essential commodities.”

Smartphone shipments in India have been declining month over

month, with demand hurt mainly due to inflation. Shipments

contracted 9.2% month-on-month in May as brands struggled to

clear off inventories, both in the offline and online channels.

Besides inflation, analysts say the demand for smartphones is weaker

also due to fewer launches in the budget segment, which accounts

for the highest volumes in sales in the price-conscious India market.

Brands have moved up the price ladder this year, pushing the

average selling price to Rs 16,000, due to supply chain constraints, a

shortage of 4G chips, and high logistics costs.

Some experts say the smartphone makers can’t afford to hike rates

across all segments for the fear of hitting demand.

"Brands operating in the premium and mid-tier segment have the

cushion to offset the increased costs by hiking prices in the premium

segment. But they will not have much wiggle room in the under-Rs

30,000 segment," said Kawoosa.

Abhilash Kumar, senior analyst at Strategy Analytics, added that

brands may have no choice but to absorb the increased costs for now

to prevent any further impact on the demand.

"They may take away the existing discounts on the devices or even if

the hike happens, it will be very nominal (within 1%)," said Kumar.

Bibliography

https://economictimes.indiatimes.com/

You might also like

- Mobile Phones in The PhilippinesDocument9 pagesMobile Phones in The PhilippinesGelo GonzalesNo ratings yet

- Fiesta Gifts Mending The SpendingDocument23 pagesFiesta Gifts Mending The SpendingPushpesh JoshiNo ratings yet

- Allstate/McKinsey Bates H000001010Document495 pagesAllstate/McKinsey Bates H0000010104207west59th100% (3)

- Movie Recommendation SystemDocument41 pagesMovie Recommendation SystemSowmya Srinivasan100% (3)

- NitinolDocument20 pagesNitinolTamara PricilaNo ratings yet

- UCO Reporter 2022, March Edition, February 27, 2022Document44 pagesUCO Reporter 2022, March Edition, February 27, 2022ucopresidentNo ratings yet

- Capstone Project - Launching A Premium Category Smartphone For The Indian Market PDFDocument11 pagesCapstone Project - Launching A Premium Category Smartphone For The Indian Market PDFSudip Issac SamNo ratings yet

- Amazon's Foray Into India - ReportDocument21 pagesAmazon's Foray Into India - ReportSomdeb BanerjeeNo ratings yet

- 66 Job Interview Questions For Data ScientistsDocument10 pages66 Job Interview Questions For Data ScientistsRavi RanjanNo ratings yet

- CCU Basic Operations CourseDocument116 pagesCCU Basic Operations CourseRene GutierrezNo ratings yet

- Northern Research GroupDocument2 pagesNorthern Research GroupTeam GuidoNo ratings yet

- Smartphones A Must-Buy Even in Slowdown Season: Navadha Pandey New DelhiDocument4 pagesSmartphones A Must-Buy Even in Slowdown Season: Navadha Pandey New DelhiTulsi GovaniNo ratings yet

- A Study To Understand Consumer Preference of Mobile Phones: NAME: Vibhor Rathi Class: B. Com (Honors) 3 YearDocument22 pagesA Study To Understand Consumer Preference of Mobile Phones: NAME: Vibhor Rathi Class: B. Com (Honors) 3 YearShivam PatelNo ratings yet

- Sector Capsule: Wearable Electronics in Nigeria: HeadlinesDocument2 pagesSector Capsule: Wearable Electronics in Nigeria: HeadlinesAnonymous 2X8yWQTNo ratings yet

- Royal Enfield KWKWKDocument55 pagesRoyal Enfield KWKWKE01202114-MUHAMMED ISMAIL K BBA CANo ratings yet

- Worldwide Mobile Phone 2015-2019 Forecast and AnalysisDocument25 pagesWorldwide Mobile Phone 2015-2019 Forecast and AnalysisRafsun FaizNo ratings yet

- Indian Mobile Industry AnalysisDocument15 pagesIndian Mobile Industry AnalysisHarveyNo ratings yet

- Mobile Phones in IndiaDocument9 pagesMobile Phones in IndiaShivajiNo ratings yet

- 037 - Shadab Ansari - A Study On Parameters of Brand Preference ofDocument95 pages037 - Shadab Ansari - A Study On Parameters of Brand Preference ofShadab AnsariNo ratings yet

- Authored Article - Smartphone Re-Commerce in IndiaDocument4 pagesAuthored Article - Smartphone Re-Commerce in IndiaSanjay MalaraNo ratings yet

- Mobile Phones in Malaysia: Euromonitor International August 2019Document8 pagesMobile Phones in Malaysia: Euromonitor International August 2019Patricia OoiNo ratings yet

- Customer Brand Preference of Mobile Phones at Hyderabad, IndiaDocument9 pagesCustomer Brand Preference of Mobile Phones at Hyderabad, IndiaKameswara Rao PorankiNo ratings yet

- Research Background - SampleDocument1 pageResearch Background - Samplesourav84No ratings yet

- ME Research Paper 1 FinalDocument20 pagesME Research Paper 1 Finalmohiyuddinsakhib3260No ratings yet

- HorseDocument2 pagesHorseanupNo ratings yet

- Mobile Phones in Vietnam: Euromonitor International October 2020Document9 pagesMobile Phones in Vietnam: Euromonitor International October 2020Nhi ThuầnNo ratings yet

- Mobile Industry IndiaDocument4 pagesMobile Industry IndiasantoshsequeiraNo ratings yet

- Hair Appliance ToolDocument23 pagesHair Appliance ToolWawire WycliffeNo ratings yet

- Electronics and Appliance Specialist Retailers in IndiaDocument9 pagesElectronics and Appliance Specialist Retailers in IndiaNikita NathNo ratings yet

- Mobile - Phones - in - India - Analysis - Euromonitor Aug 2018Document4 pagesMobile - Phones - in - India - Analysis - Euromonitor Aug 2018Aaryan AgrawalNo ratings yet

- Fiesta Gifts Mending The Spending CaseDocument21 pagesFiesta Gifts Mending The Spending CaseSaurabh Sahu0% (1)

- Impact of Flash Sales On E-Commerce Industry in IndiaDocument9 pagesImpact of Flash Sales On E-Commerce Industry in IndiaIJRASETPublicationsNo ratings yet

- Leather Goods Market SizeDocument11 pagesLeather Goods Market SizeShahadul SotejNo ratings yet

- India Mobile Accessories Market 2020Document13 pagesIndia Mobile Accessories Market 2020Expeditous Research and Consulting88% (8)

- Introduction To SectorDocument6 pagesIntroduction To Sectoranon_503118700No ratings yet

- Asian Smartphone Market by IDC India 2014Document3 pagesAsian Smartphone Market by IDC India 2014Xico ShazzadNo ratings yet

- Stepping Into A Bigger, Better Future: A Report On India's Footwear MarketDocument8 pagesStepping Into A Bigger, Better Future: A Report On India's Footwear MarketKomal AroraNo ratings yet

- The Smartphone Industry Analysis in SingaporeDocument19 pagesThe Smartphone Industry Analysis in SingaporeNicholas TanNo ratings yet

- Footwear MarketDocument8 pagesFootwear MarketKomal AroraNo ratings yet

- Sr. No. Topic Page Number: IndexDocument5 pagesSr. No. Topic Page Number: IndexArman ShaikhNo ratings yet

- Footwear Market Set To Enter Rs. 1 Lakh Crore in 2 Years: 08 March 2019 Issue No. 718Document4 pagesFootwear Market Set To Enter Rs. 1 Lakh Crore in 2 Years: 08 March 2019 Issue No. 718Shivam NagpalNo ratings yet

- Footwear Market Set To Enter Rs. 1 Lakh Crore in 2 Years: 08 March 2019 Issue No. 718Document4 pagesFootwear Market Set To Enter Rs. 1 Lakh Crore in 2 Years: 08 March 2019 Issue No. 718GOPAL SINGHNo ratings yet

- iGR - PR NewReport Smartpohone ForecastDocument3 pagesiGR - PR NewReport Smartpohone Forecastbobo_onlyNo ratings yet

- Consumer BehAviourDocument37 pagesConsumer BehAviouranon_757894592No ratings yet

- India - Credit Cards, April 2020Document26 pagesIndia - Credit Cards, April 2020GunjanNo ratings yet

- Case Study by Shikhar ShrivastavaDocument21 pagesCase Study by Shikhar ShrivastavaShikhar ShrivastavaNo ratings yet

- Trendy Low CostDocument5 pagesTrendy Low Costlakshya24gargNo ratings yet

- Bab I - Apple Iphone Market SegmentationDocument2 pagesBab I - Apple Iphone Market SegmentationSena OddyNo ratings yet

- Mobile Phone Accessories Market India 2020Document10 pagesMobile Phone Accessories Market India 2020Expeditous Research and Consulting0% (3)

- JETIRTHE2036Document41 pagesJETIRTHE2036sushantnanaware2000No ratings yet

- Telecom Insider: Latin AmericaDocument17 pagesTelecom Insider: Latin AmericalwaingartenNo ratings yet

- 2019 SE Asia App Engagement ReportDocument25 pages2019 SE Asia App Engagement Reportjefcheung19No ratings yet

- Consumers Share Changed BehaviorDocument10 pagesConsumers Share Changed Behaviorzeynep1312No ratings yet

- Final Report On Nikon Camera: Submitted By: NAME: C.B. Sujeeth Bharadwaj C13Document22 pagesFinal Report On Nikon Camera: Submitted By: NAME: C.B. Sujeeth Bharadwaj C13Sujeeth BharadwajNo ratings yet

- Buying Behavior of Mobile PhoneDocument10 pagesBuying Behavior of Mobile PhoneShashank Kumar BaranwalNo ratings yet

- Journal of Management (Jom) : ©iaemeDocument7 pagesJournal of Management (Jom) : ©iaemeIAEME PublicationNo ratings yet

- From Feature Phones To Smartphones, The Road AheadDocument3 pagesFrom Feature Phones To Smartphones, The Road AheadAydin KaraerNo ratings yet

- Sudha Jaiswar ResearchDocument6 pagesSudha Jaiswar ResearchVinay J YadavNo ratings yet

- JK Paper ReportDocument9 pagesJK Paper ReportNaveen Chander DharNo ratings yet

- Quikr: Unlocking The Value of Used Goods MarketDocument3 pagesQuikr: Unlocking The Value of Used Goods MarketSam DhuriNo ratings yet

- Dd202a Edited احمد بسام2Document10 pagesDd202a Edited احمد بسام2ahmedNo ratings yet

- 2019 Counterpoint Wingtech, Huaqin and Longcheer Continued To Dominate The World's Smartphone ODMIDH LandscapeDocument3 pages2019 Counterpoint Wingtech, Huaqin and Longcheer Continued To Dominate The World's Smartphone ODMIDH Landscapespring pengNo ratings yet

- Group-Project Part-A SmartphonesDocument2 pagesGroup-Project Part-A SmartphonesHai Au NguyenNo ratings yet

- Indian Consumer MarketsDocument12 pagesIndian Consumer Marketsvishal1723No ratings yet

- Inventory Management Volume 2: And Some Observations About the Future of the Automotive AftermarketFrom EverandInventory Management Volume 2: And Some Observations About the Future of the Automotive AftermarketNo ratings yet

- Making Big Data Work for Your Business: A guide to effective Big Data analyticsFrom EverandMaking Big Data Work for Your Business: A guide to effective Big Data analyticsNo ratings yet

- Asia Crises 1994Document24 pagesAsia Crises 1994Tannu GuptaNo ratings yet

- Definition of DisasterDocument6 pagesDefinition of DisasterTannu GuptaNo ratings yet

- Alternate FuelDocument22 pagesAlternate FuelTannu GuptaNo ratings yet

- What Is Soil DegradationDocument9 pagesWhat Is Soil DegradationTannu GuptaNo ratings yet

- AseanDocument31 pagesAseanTannu GuptaNo ratings yet

- Case Study MDDDocument13 pagesCase Study MDDTannu GuptaNo ratings yet

- AcknowledgmentDocument12 pagesAcknowledgmentTannu GuptaNo ratings yet

- Chemistry Project On Foaming Capacity of SoapsDocument13 pagesChemistry Project On Foaming Capacity of SoapsTannu GuptaNo ratings yet

- Commerce Project 1 (1) FinalDocument19 pagesCommerce Project 1 (1) FinalTannu GuptaNo ratings yet

- Role of Castes in PoliticsDocument12 pagesRole of Castes in PoliticsTannu GuptaNo ratings yet

- Curriculum VitaeDocument1 pageCurriculum VitaeTannu GuptaNo ratings yet

- Mental Health During CovidDocument3 pagesMental Health During CovidTannu GuptaNo ratings yet

- Character Is The Key of LifeDocument11 pagesCharacter Is The Key of LifeTannu GuptaNo ratings yet

- QUESTIONNAIR1Document2 pagesQUESTIONNAIR1Tannu GuptaNo ratings yet

- Ways To PromoteDocument1 pageWays To PromoteTannu GuptaNo ratings yet

- Status of Working WomenDocument17 pagesStatus of Working WomenTannu GuptaNo ratings yet

- Usha MartinDocument21 pagesUsha MartinTannu GuptaNo ratings yet

- Agriculture RevolutionDocument28 pagesAgriculture RevolutionTannu GuptaNo ratings yet

- CRIMEDocument6 pagesCRIMETannu GuptaNo ratings yet

- An Internal CrisisDocument7 pagesAn Internal CrisisTannu GuptaNo ratings yet

- Marketing Statery of Ferrari and LamborghiniDocument51 pagesMarketing Statery of Ferrari and LamborghiniTannu GuptaNo ratings yet

- Child LabourDocument12 pagesChild LabourTannu GuptaNo ratings yet

- Social Impact of PandemicDocument55 pagesSocial Impact of PandemicTannu GuptaNo ratings yet

- Impact of Social Media On Human Behavior and AttitudeDocument7 pagesImpact of Social Media On Human Behavior and AttitudeTannu GuptaNo ratings yet

- 2000 Stock Exchange CrashDocument25 pages2000 Stock Exchange CrashTannu GuptaNo ratings yet

- International OrganizatonDocument16 pagesInternational OrganizatonTannu GuptaNo ratings yet

- A Project Report Peer PressureDocument17 pagesA Project Report Peer PressureTannu GuptaNo ratings yet

- A - Project - Report - On - Birth 2Document28 pagesA - Project - Report - On - Birth 2Tannu GuptaNo ratings yet

- Impact of Social Media On Human Behavior and Attitudes2022Document17 pagesImpact of Social Media On Human Behavior and Attitudes2022Tannu GuptaNo ratings yet

- Sanitary NapkinDocument11 pagesSanitary NapkinTannu GuptaNo ratings yet

- Course Syllabus Electrical Machines II Summer SemesterDocument4 pagesCourse Syllabus Electrical Machines II Summer SemesterMahmoud Alshar'eNo ratings yet

- Athul AjiDocument5 pagesAthul AjiAsif SNo ratings yet

- MatchmakerDocument43 pagesMatchmakerMatthew MckayNo ratings yet

- Notice of Meeting-1st MDC Ldip Alignment Meeting & WsDocument5 pagesNotice of Meeting-1st MDC Ldip Alignment Meeting & WsByaheng CawayanNo ratings yet

- NJM072B/082B/072/082: Dual J-Fet Input Operational AmplifierDocument5 pagesNJM072B/082B/072/082: Dual J-Fet Input Operational Amplifieryuni supriatinNo ratings yet

- Consumer Redress: Fair Trade Enforcement BureauDocument47 pagesConsumer Redress: Fair Trade Enforcement BureauMaria LovesongorNo ratings yet

- D H Reid - Organic Compounds of Sulphur, Selenium, and Tellurium Vol 1-Royal Society of Chemistry (1970)Document518 pagesD H Reid - Organic Compounds of Sulphur, Selenium, and Tellurium Vol 1-Royal Society of Chemistry (1970)julianpellegrini860No ratings yet

- Decision Utah LighthouseDocument28 pagesDecision Utah LighthousemschwimmerNo ratings yet

- PRELIM Fire Technology and Arson InvestigationDocument6 pagesPRELIM Fire Technology and Arson InvestigationIgnacio Burog RazonaNo ratings yet

- 8 - Correspondance UML-JAVADocument3 pages8 - Correspondance UML-JAVAoussama sfiriNo ratings yet

- Global Warming Holiday HomeworkDocument25 pagesGlobal Warming Holiday HomeworkAnanyaNo ratings yet

- PointersDocument147 pagesPointersSoumya VijoyNo ratings yet

- GSB Samaj Foundation - List of Goud Saraswat Brahmin SurnamesDocument2 pagesGSB Samaj Foundation - List of Goud Saraswat Brahmin SurnamesShree Vishnu ShastriNo ratings yet

- Myanmar Companies Law 2017Document188 pagesMyanmar Companies Law 2017Let's Save Myanmar100% (1)

- Daftar Harga: Digital PrintingDocument4 pagesDaftar Harga: Digital PrintingHikmatus Shoimah Firdausi NuzulaNo ratings yet

- 4 Differently Able Persons ActDocument7 pages4 Differently Able Persons Actumer plays gameNo ratings yet

- Topic 6:sustainability & Green EngineeringDocument5 pagesTopic 6:sustainability & Green EngineeringyanNo ratings yet

- Shah Fahad (editor), Osman Sönmez (editor), Shah Saud (editor), Depeng Wang (editor), Chao Wu (editor), Muhammad Adnan (editor), Muhammad Arif (editor), Amanullah (editor) - Engineering Tolerance in C.pdfDocument311 pagesShah Fahad (editor), Osman Sönmez (editor), Shah Saud (editor), Depeng Wang (editor), Chao Wu (editor), Muhammad Adnan (editor), Muhammad Arif (editor), Amanullah (editor) - Engineering Tolerance in C.pdfTri4alNo ratings yet

- Connorm Edid6507-Assign 2Document27 pagesConnorm Edid6507-Assign 2api-399872156No ratings yet

- Wbcviii PDFDocument1,192 pagesWbcviii PDFDaniel PinheiroNo ratings yet

- CA ProjectDocument21 pagesCA Projectkalaswami100% (1)

- Gagas 2018Document233 pagesGagas 2018UnggulRajevPradanaNo ratings yet

- Samsung RF27T5501Document164 pagesSamsung RF27T5501Brian MasseyNo ratings yet