Professional Documents

Culture Documents

Somerset JD

Somerset JD

Uploaded by

Heta ShahCopyright:

Available Formats

You might also like

- S6 Case - Zara in China and IndiaDocument25 pagesS6 Case - Zara in China and IndiaHeta ShahNo ratings yet

- StudyGuide Chapter3Document28 pagesStudyGuide Chapter3Adil AnwarNo ratings yet

- Emerge On T24Document10 pagesEmerge On T24wpedro2013No ratings yet

- Single Entry, Cash and Accrual BasisDocument36 pagesSingle Entry, Cash and Accrual BasisAbby Navarro50% (2)

- Equity Research ResumeDocument7 pagesEquity Research Resumel1pelulygon3100% (1)

- Steward Research Analyst PEF Job Posting 2021Document3 pagesSteward Research Analyst PEF Job Posting 2021davidtollNo ratings yet

- Job Description - Acuity Knowledge PartnersDocument3 pagesJob Description - Acuity Knowledge PartnersSachin ShikotraNo ratings yet

- Eqyuty Research PapersDocument1 pageEqyuty Research PapersfilthypirateNo ratings yet

- Vista Equity Partners - 2017 Analyst PositionDocument4 pagesVista Equity Partners - 2017 Analyst PositionJonathan StewartNo ratings yet

- HSBC Investment AnalystDocument5 pagesHSBC Investment AnalystSanjana SinghNo ratings yet

- Investment Research Analyst - JDDocument2 pagesInvestment Research Analyst - JDTanya SinghNo ratings yet

- Associate Financial AnalystDocument2 pagesAssociate Financial AnalystAlexandra BercheșugNo ratings yet

- Unit IV-3Document43 pagesUnit IV-3prashansa.yadav.1274No ratings yet

- How To Build A Portfolio With Indian StartupsDocument5 pagesHow To Build A Portfolio With Indian Startupsalvira.apcNo ratings yet

- Investor Relations With Stock Regulations & Strategy For Stock Volume and Price IncreaseDocument53 pagesInvestor Relations With Stock Regulations & Strategy For Stock Volume and Price IncreaselulenduNo ratings yet

- How To Choose The Right Indian Startup To Invest inDocument5 pagesHow To Choose The Right Indian Startup To Invest inalvira.apcNo ratings yet

- Recruitment Notice February 2024Document14 pagesRecruitment Notice February 2024tejasrg21.pumbaNo ratings yet

- Unit 5: Growing New VentureDocument8 pagesUnit 5: Growing New VentureMezmure KebedeNo ratings yet

- Executive SummaryDocument65 pagesExecutive SummaryTahir HussainNo ratings yet

- Lokesh Rathotre Sap CV Aug-10Document4 pagesLokesh Rathotre Sap CV Aug-10dinesh_ch_nigam2757No ratings yet

- JD - Prudent CorporateDocument1 pageJD - Prudent CorporateSaurabh MirchandaniNo ratings yet

- Thesis Fund Management LLCDocument5 pagesThesis Fund Management LLCmitzilarrickakron100% (2)

- Manager - Life SciencesDocument4 pagesManager - Life SciencesPraveen KumarNo ratings yet

- Product Manager Role ICICIDocument5 pagesProduct Manager Role ICICIVIVEK GUPTANo ratings yet

- RA CertificationDocument10 pagesRA CertificationBidhinNo ratings yet

- AccentureDocument7 pagesAccentureKaniz Fatima100% (1)

- JD Manager HealthcareDocument3 pagesJD Manager HealthcareVennila AnandNo ratings yet

- JD Caspian Impact Investments Associate Manager Investments FI Sep 2022Document2 pagesJD Caspian Impact Investments Associate Manager Investments FI Sep 2022Tanmay AgrawalNo ratings yet

- JD For Investmen AnalystDocument2 pagesJD For Investmen AnalystMumtazNo ratings yet

- Business Development Executive - Docx JDDocument3 pagesBusiness Development Executive - Docx JDVIJENDRA KAVATALKARNo ratings yet

- Experienced Private Equity ResumeDocument7 pagesExperienced Private Equity Resumepqdgddifg100% (2)

- IBEP - Project 3Document7 pagesIBEP - Project 3hritik.dad01No ratings yet

- 2021 Equities Investing Directing Graduate Job DescriptionDocument3 pages2021 Equities Investing Directing Graduate Job DescriptionKhalid SulaimanNo ratings yet

- Job Description: Risk/Internal Audit: About EYDocument6 pagesJob Description: Risk/Internal Audit: About EYJiss PalelilNo ratings yet

- Auxesia BrochureDocument7 pagesAuxesia Brochurenirbhaya24No ratings yet

- Startup FactoryDocument11 pagesStartup Factoryr.h.anik1596No ratings yet

- MFS Exam SummaryDocument15 pagesMFS Exam Summarysamddy9889No ratings yet

- ADD (WEB) FinalDocument4 pagesADD (WEB) FinalalibuxsoomroNo ratings yet

- Callahan Analyst 2021Document3 pagesCallahan Analyst 2021callahan.jonathan2727No ratings yet

- Brochure For Insight Equity - FINAL January 2018Document18 pagesBrochure For Insight Equity - FINAL January 2018jiayi1No ratings yet

- Raising Venture Capital: For Private Circulation OnlyDocument18 pagesRaising Venture Capital: For Private Circulation OnlyCma Pankaj JainNo ratings yet

- Thesis Venture CapitalDocument7 pagesThesis Venture CapitalDaniel Wachtel100% (2)

- Head - Investments and M&A, Kotak Mahindra BankDocument32 pagesHead - Investments and M&A, Kotak Mahindra BankRahulNo ratings yet

- How To Manage Risks When Investing in Indian StartupsDocument6 pagesHow To Manage Risks When Investing in Indian Startupsalvira.apcNo ratings yet

- CIE Unit 3 PIMR (FT)Document51 pagesCIE Unit 3 PIMR (FT)Rudraksh SharmaNo ratings yet

- Finance InternshipDocument6 pagesFinance InternshipRoshni JasujaNo ratings yet

- Ide AssignmentDocument6 pagesIde AssignmentVaishnav . K JNo ratings yet

- Steward Senior Fund Accountant Job Posting 2021Document3 pagesSteward Senior Fund Accountant Job Posting 2021davidtollNo ratings yet

- Investment Banking 2020Document14 pagesInvestment Banking 2020Phạm Hồng HuếNo ratings yet

- Group Project Requirement FNCE6045Document2 pagesGroup Project Requirement FNCE6045Frank YinNo ratings yet

- Healthcare Consultant ResumeDocument5 pagesHealthcare Consultant Resumeafiwhwlwx100% (2)

- Thesis InvestmentDocument8 pagesThesis Investmentcatherinebitkerrochester100% (2)

- FUNDINGDocument9 pagesFUNDINGRishika SinghNo ratings yet

- Job Title: Associate LocationDocument6 pagesJob Title: Associate LocationKhushboo KhandelwalNo ratings yet

- 2023 India Commercial Graduate ProgrammeDocument4 pages2023 India Commercial Graduate Programmesmack tripathiNo ratings yet

- JD_IA Insurance_All LevelsDocument2 pagesJD_IA Insurance_All LevelsPriya RaoNo ratings yet

- Finlatics IBEP Project 3Document4 pagesFinlatics IBEP Project 3Angel Aliya0% (1)

- Mobikwik - Corporate DevDocument3 pagesMobikwik - Corporate DevSahil KumrahNo ratings yet

- Auditor - BangaloreDocument2 pagesAuditor - Bangaloreravi kiranNo ratings yet

- ESBM Notes Unit-4Document37 pagesESBM Notes Unit-4satyamtiwari44003No ratings yet

- Insurance Job ResumeDocument8 pagesInsurance Job Resumefupbxmjbf100% (2)

- Aditya Birla CapitalDocument5 pagesAditya Birla CapitalYash KhandelwalNo ratings yet

- Real Estate ConsultantDocument2 pagesReal Estate ConsultantMarshay HallNo ratings yet

- Ethical Valuation: Navigating the Future of Startup InvestmentsFrom EverandEthical Valuation: Navigating the Future of Startup InvestmentsNo ratings yet

- Associate Product Manager - JDDocument1 pageAssociate Product Manager - JDHeta ShahNo ratings yet

- Category Manager - JDDocument1 pageCategory Manager - JDHeta ShahNo ratings yet

- Coca Cola 100 Years StrategyDocument10 pagesCoca Cola 100 Years StrategyHeta ShahNo ratings yet

- CIB R&A - Global Research - AnalystDocument2 pagesCIB R&A - Global Research - AnalystHeta ShahNo ratings yet

- Gillete Case StudyDocument3 pagesGillete Case StudyHeta ShahNo ratings yet

- Employee'S Provident Fund: Electronic Challan Cum Return (Ecr)Document3 pagesEmployee'S Provident Fund: Electronic Challan Cum Return (Ecr)manicsenthilNo ratings yet

- Sales Return, Credit, and Debit MemoDocument2 pagesSales Return, Credit, and Debit MemoKnp ChowdaryNo ratings yet

- KhiyarsDocument3 pagesKhiyarsnadeemuzairNo ratings yet

- Acct Statement XX1708 26082022Document4 pagesAcct Statement XX1708 26082022Firoz KhanNo ratings yet

- Coporate Governance Presentation 1Document10 pagesCoporate Governance Presentation 1nellaNo ratings yet

- F9 Acowtancy Notes PDFDocument202 pagesF9 Acowtancy Notes PDFKodwoPNo ratings yet

- Ch13 - Supply Chain Resilience in The Fourth Industrial RevolutionDocument15 pagesCh13 - Supply Chain Resilience in The Fourth Industrial Revolutiontrangntm919396No ratings yet

- Administration GlossaryDocument113 pagesAdministration GlossarySebastiánNo ratings yet

- Business Studies Worksheet Test PDFDocument5 pagesBusiness Studies Worksheet Test PDFAhmad naveed100% (1)

- AS SBM - Strategic ChoiceDocument38 pagesAS SBM - Strategic ChoicesajedulNo ratings yet

- OppoDocument4 pagesOppoAnandNo ratings yet

- The Definition of MarketingDocument3 pagesThe Definition of Marketingluckyg1122No ratings yet

- Eighth Plan EngDocument419 pagesEighth Plan EngMurahari ParajuliNo ratings yet

- Economics 11th Edition Arnold Solutions Manual 1Document36 pagesEconomics 11th Edition Arnold Solutions Manual 1shirleycoopercmkgzintjx100% (33)

- Session04 Case ParkBar - Signature SellerDocument4 pagesSession04 Case ParkBar - Signature SellerRaghav MittalNo ratings yet

- Accenture Global Delivery Network Services OverviewDocument4 pagesAccenture Global Delivery Network Services OverviewKasim Mohammad100% (1)

- ISO 26000 - Tool - Issue - MatrixDocument8 pagesISO 26000 - Tool - Issue - Matrixadistira jsNo ratings yet

- DR Ahmad - Manual of Training and Advisory Requirements 2023Document5 pagesDR Ahmad - Manual of Training and Advisory Requirements 2023Ahmad Tarabilsy100% (1)

- WWF Strategic Plan 2014-2018Document30 pagesWWF Strategic Plan 2014-2018Anisa Hapsari KusumastutiNo ratings yet

- Invoice 92013866 9100011081 MapalDocument2 pagesInvoice 92013866 9100011081 MapalSaulo TrejoNo ratings yet

- MIS Case StudiesDocument3 pagesMIS Case StudiesAshutosh AgalNo ratings yet

- Introduction - Wine Market in India - Swot Analysis - Summary - QueriesDocument6 pagesIntroduction - Wine Market in India - Swot Analysis - Summary - QueriesAnuj VermaNo ratings yet

- Marketing Mid TermsDocument11 pagesMarketing Mid TermsSasay DiamanteNo ratings yet

- Associate Attorney Resume ExampleDocument1 pageAssociate Attorney Resume ExamplemjpcrooNo ratings yet

- S A F E SchemeDocument1 pageS A F E SchemeThe LoanWalaNo ratings yet

- 8.cash Flow StatementDocument16 pages8.cash Flow Statementnarangdiya602No ratings yet

- Question Bank - Third Sem B.com Computer Applications & TaxationDocument47 pagesQuestion Bank - Third Sem B.com Computer Applications & TaxationsnehaNo ratings yet

Somerset JD

Somerset JD

Uploaded by

Heta ShahOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Somerset JD

Somerset JD

Uploaded by

Heta ShahCopyright:

Available Formats

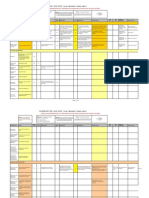

Somerset Private Equity Internship Program

Somerset Indus Capital Partners is a Healthcare Focused Private Equity Fund involved in providing

Growth Stage Equity Capital to fast growing companies within the Healthcare space especially in

sectors like – Healthcare Delivery, Diagnostics, Pharma and Lifesciences, Biotech, Med-Tech,

Wellness & Nutrition, Healthcare Financing, Digital Health etc.

Somerset’s investment theme is centered around creating a sustainable impact in the healthcare

ecosystem with responsible ESG investing.

Website: https://somersetinduscap.com/

LinkedIn: https://www.linkedin.com/company/somerset-indus-capital-partners/

We are looking for a candidate with analytical and operational skills to add value in investments,

operations, portfolio management, ESG and reporting functions. Candidate should be open for a cross-

functional role which may give her/him a flavour of PE Fund over life cycle of investments and

emerging trends in the PE industry.

Job description:

• Provide support to the investment team during the entire investment cycle, including but not

limited to development of industry thesis, deal evaluation, performing due diligence, financial

modelling & analysis, valuation, industry, and company research

• Provide analytics & research support for broader sector & private equity trends as well as

specific issues impacting portfolio companies

• Assist the ESG function in streamlining E&S requirements and tracking impact metrics for

potential investments along with existing Portfolio Companies.

• Assist in implementation of E&S policy within the fund and across our portfolio companies

• Assist in Finance and Operations role on an as-need basis

• Provide support to prepare investor reports

• Assist in creating marketing materials for fund raising for the fund

• Help in creating reports with insights related to healthcare sector, investor relations, portfolio

monitoring and provide need-based support in reporting and compliances

Qualifications:

• Exposure to Private Equity/ Investment Banking/ Consulting/ Environmental Projects and/or

experience in Pharma/ Healthcare would be desirable

• Excellent knowledge of MS Excel, MS PowerPoint, and MS Word

• Analytical & quantitative skills - Understanding of accounting and financial modelling aspects

• Hands on in interpersonal skills, teamwork, and timely communication.

Schedule and Location: Minimum 2-month commitment onsite in our Mumbai office

What's on Offer

• Excellent opportunity to get buy side exposure

• Chance to get hands on exposure to healthcare companies/site visits

• Competitive Compensation

• Good exposure to a leading sector - Healthcare

You might also like

- S6 Case - Zara in China and IndiaDocument25 pagesS6 Case - Zara in China and IndiaHeta ShahNo ratings yet

- StudyGuide Chapter3Document28 pagesStudyGuide Chapter3Adil AnwarNo ratings yet

- Emerge On T24Document10 pagesEmerge On T24wpedro2013No ratings yet

- Single Entry, Cash and Accrual BasisDocument36 pagesSingle Entry, Cash and Accrual BasisAbby Navarro50% (2)

- Equity Research ResumeDocument7 pagesEquity Research Resumel1pelulygon3100% (1)

- Steward Research Analyst PEF Job Posting 2021Document3 pagesSteward Research Analyst PEF Job Posting 2021davidtollNo ratings yet

- Job Description - Acuity Knowledge PartnersDocument3 pagesJob Description - Acuity Knowledge PartnersSachin ShikotraNo ratings yet

- Eqyuty Research PapersDocument1 pageEqyuty Research PapersfilthypirateNo ratings yet

- Vista Equity Partners - 2017 Analyst PositionDocument4 pagesVista Equity Partners - 2017 Analyst PositionJonathan StewartNo ratings yet

- HSBC Investment AnalystDocument5 pagesHSBC Investment AnalystSanjana SinghNo ratings yet

- Investment Research Analyst - JDDocument2 pagesInvestment Research Analyst - JDTanya SinghNo ratings yet

- Associate Financial AnalystDocument2 pagesAssociate Financial AnalystAlexandra BercheșugNo ratings yet

- Unit IV-3Document43 pagesUnit IV-3prashansa.yadav.1274No ratings yet

- How To Build A Portfolio With Indian StartupsDocument5 pagesHow To Build A Portfolio With Indian Startupsalvira.apcNo ratings yet

- Investor Relations With Stock Regulations & Strategy For Stock Volume and Price IncreaseDocument53 pagesInvestor Relations With Stock Regulations & Strategy For Stock Volume and Price IncreaselulenduNo ratings yet

- How To Choose The Right Indian Startup To Invest inDocument5 pagesHow To Choose The Right Indian Startup To Invest inalvira.apcNo ratings yet

- Recruitment Notice February 2024Document14 pagesRecruitment Notice February 2024tejasrg21.pumbaNo ratings yet

- Unit 5: Growing New VentureDocument8 pagesUnit 5: Growing New VentureMezmure KebedeNo ratings yet

- Executive SummaryDocument65 pagesExecutive SummaryTahir HussainNo ratings yet

- Lokesh Rathotre Sap CV Aug-10Document4 pagesLokesh Rathotre Sap CV Aug-10dinesh_ch_nigam2757No ratings yet

- JD - Prudent CorporateDocument1 pageJD - Prudent CorporateSaurabh MirchandaniNo ratings yet

- Thesis Fund Management LLCDocument5 pagesThesis Fund Management LLCmitzilarrickakron100% (2)

- Manager - Life SciencesDocument4 pagesManager - Life SciencesPraveen KumarNo ratings yet

- Product Manager Role ICICIDocument5 pagesProduct Manager Role ICICIVIVEK GUPTANo ratings yet

- RA CertificationDocument10 pagesRA CertificationBidhinNo ratings yet

- AccentureDocument7 pagesAccentureKaniz Fatima100% (1)

- JD Manager HealthcareDocument3 pagesJD Manager HealthcareVennila AnandNo ratings yet

- JD Caspian Impact Investments Associate Manager Investments FI Sep 2022Document2 pagesJD Caspian Impact Investments Associate Manager Investments FI Sep 2022Tanmay AgrawalNo ratings yet

- JD For Investmen AnalystDocument2 pagesJD For Investmen AnalystMumtazNo ratings yet

- Business Development Executive - Docx JDDocument3 pagesBusiness Development Executive - Docx JDVIJENDRA KAVATALKARNo ratings yet

- Experienced Private Equity ResumeDocument7 pagesExperienced Private Equity Resumepqdgddifg100% (2)

- IBEP - Project 3Document7 pagesIBEP - Project 3hritik.dad01No ratings yet

- 2021 Equities Investing Directing Graduate Job DescriptionDocument3 pages2021 Equities Investing Directing Graduate Job DescriptionKhalid SulaimanNo ratings yet

- Job Description: Risk/Internal Audit: About EYDocument6 pagesJob Description: Risk/Internal Audit: About EYJiss PalelilNo ratings yet

- Auxesia BrochureDocument7 pagesAuxesia Brochurenirbhaya24No ratings yet

- Startup FactoryDocument11 pagesStartup Factoryr.h.anik1596No ratings yet

- MFS Exam SummaryDocument15 pagesMFS Exam Summarysamddy9889No ratings yet

- ADD (WEB) FinalDocument4 pagesADD (WEB) FinalalibuxsoomroNo ratings yet

- Callahan Analyst 2021Document3 pagesCallahan Analyst 2021callahan.jonathan2727No ratings yet

- Brochure For Insight Equity - FINAL January 2018Document18 pagesBrochure For Insight Equity - FINAL January 2018jiayi1No ratings yet

- Raising Venture Capital: For Private Circulation OnlyDocument18 pagesRaising Venture Capital: For Private Circulation OnlyCma Pankaj JainNo ratings yet

- Thesis Venture CapitalDocument7 pagesThesis Venture CapitalDaniel Wachtel100% (2)

- Head - Investments and M&A, Kotak Mahindra BankDocument32 pagesHead - Investments and M&A, Kotak Mahindra BankRahulNo ratings yet

- How To Manage Risks When Investing in Indian StartupsDocument6 pagesHow To Manage Risks When Investing in Indian Startupsalvira.apcNo ratings yet

- CIE Unit 3 PIMR (FT)Document51 pagesCIE Unit 3 PIMR (FT)Rudraksh SharmaNo ratings yet

- Finance InternshipDocument6 pagesFinance InternshipRoshni JasujaNo ratings yet

- Ide AssignmentDocument6 pagesIde AssignmentVaishnav . K JNo ratings yet

- Steward Senior Fund Accountant Job Posting 2021Document3 pagesSteward Senior Fund Accountant Job Posting 2021davidtollNo ratings yet

- Investment Banking 2020Document14 pagesInvestment Banking 2020Phạm Hồng HuếNo ratings yet

- Group Project Requirement FNCE6045Document2 pagesGroup Project Requirement FNCE6045Frank YinNo ratings yet

- Healthcare Consultant ResumeDocument5 pagesHealthcare Consultant Resumeafiwhwlwx100% (2)

- Thesis InvestmentDocument8 pagesThesis Investmentcatherinebitkerrochester100% (2)

- FUNDINGDocument9 pagesFUNDINGRishika SinghNo ratings yet

- Job Title: Associate LocationDocument6 pagesJob Title: Associate LocationKhushboo KhandelwalNo ratings yet

- 2023 India Commercial Graduate ProgrammeDocument4 pages2023 India Commercial Graduate Programmesmack tripathiNo ratings yet

- JD_IA Insurance_All LevelsDocument2 pagesJD_IA Insurance_All LevelsPriya RaoNo ratings yet

- Finlatics IBEP Project 3Document4 pagesFinlatics IBEP Project 3Angel Aliya0% (1)

- Mobikwik - Corporate DevDocument3 pagesMobikwik - Corporate DevSahil KumrahNo ratings yet

- Auditor - BangaloreDocument2 pagesAuditor - Bangaloreravi kiranNo ratings yet

- ESBM Notes Unit-4Document37 pagesESBM Notes Unit-4satyamtiwari44003No ratings yet

- Insurance Job ResumeDocument8 pagesInsurance Job Resumefupbxmjbf100% (2)

- Aditya Birla CapitalDocument5 pagesAditya Birla CapitalYash KhandelwalNo ratings yet

- Real Estate ConsultantDocument2 pagesReal Estate ConsultantMarshay HallNo ratings yet

- Ethical Valuation: Navigating the Future of Startup InvestmentsFrom EverandEthical Valuation: Navigating the Future of Startup InvestmentsNo ratings yet

- Associate Product Manager - JDDocument1 pageAssociate Product Manager - JDHeta ShahNo ratings yet

- Category Manager - JDDocument1 pageCategory Manager - JDHeta ShahNo ratings yet

- Coca Cola 100 Years StrategyDocument10 pagesCoca Cola 100 Years StrategyHeta ShahNo ratings yet

- CIB R&A - Global Research - AnalystDocument2 pagesCIB R&A - Global Research - AnalystHeta ShahNo ratings yet

- Gillete Case StudyDocument3 pagesGillete Case StudyHeta ShahNo ratings yet

- Employee'S Provident Fund: Electronic Challan Cum Return (Ecr)Document3 pagesEmployee'S Provident Fund: Electronic Challan Cum Return (Ecr)manicsenthilNo ratings yet

- Sales Return, Credit, and Debit MemoDocument2 pagesSales Return, Credit, and Debit MemoKnp ChowdaryNo ratings yet

- KhiyarsDocument3 pagesKhiyarsnadeemuzairNo ratings yet

- Acct Statement XX1708 26082022Document4 pagesAcct Statement XX1708 26082022Firoz KhanNo ratings yet

- Coporate Governance Presentation 1Document10 pagesCoporate Governance Presentation 1nellaNo ratings yet

- F9 Acowtancy Notes PDFDocument202 pagesF9 Acowtancy Notes PDFKodwoPNo ratings yet

- Ch13 - Supply Chain Resilience in The Fourth Industrial RevolutionDocument15 pagesCh13 - Supply Chain Resilience in The Fourth Industrial Revolutiontrangntm919396No ratings yet

- Administration GlossaryDocument113 pagesAdministration GlossarySebastiánNo ratings yet

- Business Studies Worksheet Test PDFDocument5 pagesBusiness Studies Worksheet Test PDFAhmad naveed100% (1)

- AS SBM - Strategic ChoiceDocument38 pagesAS SBM - Strategic ChoicesajedulNo ratings yet

- OppoDocument4 pagesOppoAnandNo ratings yet

- The Definition of MarketingDocument3 pagesThe Definition of Marketingluckyg1122No ratings yet

- Eighth Plan EngDocument419 pagesEighth Plan EngMurahari ParajuliNo ratings yet

- Economics 11th Edition Arnold Solutions Manual 1Document36 pagesEconomics 11th Edition Arnold Solutions Manual 1shirleycoopercmkgzintjx100% (33)

- Session04 Case ParkBar - Signature SellerDocument4 pagesSession04 Case ParkBar - Signature SellerRaghav MittalNo ratings yet

- Accenture Global Delivery Network Services OverviewDocument4 pagesAccenture Global Delivery Network Services OverviewKasim Mohammad100% (1)

- ISO 26000 - Tool - Issue - MatrixDocument8 pagesISO 26000 - Tool - Issue - Matrixadistira jsNo ratings yet

- DR Ahmad - Manual of Training and Advisory Requirements 2023Document5 pagesDR Ahmad - Manual of Training and Advisory Requirements 2023Ahmad Tarabilsy100% (1)

- WWF Strategic Plan 2014-2018Document30 pagesWWF Strategic Plan 2014-2018Anisa Hapsari KusumastutiNo ratings yet

- Invoice 92013866 9100011081 MapalDocument2 pagesInvoice 92013866 9100011081 MapalSaulo TrejoNo ratings yet

- MIS Case StudiesDocument3 pagesMIS Case StudiesAshutosh AgalNo ratings yet

- Introduction - Wine Market in India - Swot Analysis - Summary - QueriesDocument6 pagesIntroduction - Wine Market in India - Swot Analysis - Summary - QueriesAnuj VermaNo ratings yet

- Marketing Mid TermsDocument11 pagesMarketing Mid TermsSasay DiamanteNo ratings yet

- Associate Attorney Resume ExampleDocument1 pageAssociate Attorney Resume ExamplemjpcrooNo ratings yet

- S A F E SchemeDocument1 pageS A F E SchemeThe LoanWalaNo ratings yet

- 8.cash Flow StatementDocument16 pages8.cash Flow Statementnarangdiya602No ratings yet

- Question Bank - Third Sem B.com Computer Applications & TaxationDocument47 pagesQuestion Bank - Third Sem B.com Computer Applications & TaxationsnehaNo ratings yet