Professional Documents

Culture Documents

Comprative Analysis of Aditya Birla Sunlife Equity Hybrid 95 Fund & Sebi Equity Hybrid Fund in Hubli City

Comprative Analysis of Aditya Birla Sunlife Equity Hybrid 95 Fund & Sebi Equity Hybrid Fund in Hubli City

Uploaded by

Sampath DontaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Comprative Analysis of Aditya Birla Sunlife Equity Hybrid 95 Fund & Sebi Equity Hybrid Fund in Hubli City

Comprative Analysis of Aditya Birla Sunlife Equity Hybrid 95 Fund & Sebi Equity Hybrid Fund in Hubli City

Uploaded by

Sampath DontaCopyright:

Available Formats

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND IN HUBLI CITY

EXECUTIVE SUMMARY

Vrushti investment & wealth management is founded in the year 2012, majorly in

Finance business from last 7 years Current chairperson is DIVYA VIKAS VIBHUTI &

the Wealth manager VIKAS VIBHUTI. We are one of the premier investment

consultancy firm know for creating wealth with un biased service VRUSHTI Investments

&wealth management is an authorized business associates of BMA WEALTH

CREATORS LTD a BMA Group.The 1000 cr BMA GROUP has created its forte by

promoting successful ventures in the fields of coal mining, refactoring, steel & ferro

alloys in the form of established names in the market such as BMA STAINLESS STEEL

prop.We at VRUSHTI Investments & wealth management make you realize your dreams,

financial needs, aspirations & concerns as closely as you do. We also implement the

strategic wealth creation ideas to create, enhance &preserve your wealth according to

your risk appetite & investment horizon.A Mutual Fund is a trust that pools the savings of

a number of investors who share a common financial goal. The money thus collected is

then invested in capital market instruments such as shares, debentures and other

securities. The income earned through these investments and the capital appreciation

realized is shared by its unit holders in proportion to the number of units owned by them.

Thus a Mutual Fund is the most suitable investment for the common man as it offers an

opportunity to invest in a diversified, professionally managed basket of securities at a

relatively low cost.

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE.

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND IN HUBLI CITY

CHAPTER 1

INTRODUCTION

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE.

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND IN HUBLI CITY

1.1 Topic Chosen for the Study

“A Study On Comparative Analysis Of Aditya Birla Sunlife Equity

Hybrid 95 Fund And SBI Equity Hybrid Fund in Hubli City”

1.2 Need of the study:

The main purpose of doing this project is to understand the two schemes such as

Aditya Birla Sun Life and SBI mutual fund.

To know the risk and return of Aditya Birla Sun Life and SBI mutual fund.

1.3 Objectives of the study:

To study about the mutual fund concepts.

To understand the various selected mutual fund schemes.

To evaluate and get idea about the risk and return of mutual funds of selected

schemes.

To analyze and compare the performance of two selected mutual funds.

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE.

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND IN HUBLI CITY

1.4 Significance of the project

This project involves evaluating the performance of two mutual fund scheme.

States the advantages and disadvantages to invest in the mutual fund.

This project will helps the company (i.e.“Vrushti investments and wealth

management”) to recommend the good scheme in selected two mutual fund

schemes.

In this project risk, return and performance measures are calculated, so that it will

be easy to recommend better scheme.

This project report helps the investor to understand the investment opportunities

in the mutual fund industry.

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE.

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND IN HUBLI CITY

1.5 RESEARCH METHODOLOGY

DATA COLLECTION:

Both primary and secondary data r required to the collection for the purpose of project on

“comparative analysis of two different schemes in mutual fund ”.

Data collection is process of collecting the required topic.

Two types of data collection :

a) Primary data

b) Secondary data

a) Primary data:

Data which r collected for the first time , directly from the field and

communicating with managerial person is called primary data.

The primary data collection done through the direct communicating with

the manager of Vrushti investments and wealth management The primary

data collected by personal visiting to the field and observation.

b) Secondary data :

Secondary data is the data which has been already collected and analyzed by

enumerators .secondary data is also called as second hand data.

Collected through fact sheets.

Collected through internet.

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE.

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND IN HUBLI CITY

1.6 LITERATURE REVIEW

Sahil Jain has measured the performance of equity-based mutual funds for 15 years. 45

schemes were studied over a period of 1997-2012 (15 years).The analysis was done on

the basis of beta risk, expected return calculated using Capital Asset Pricing Model.

Beta is calculated by regressing market return on a mutual fund scheme's return. And

then the expected returns are compared with the actual returns which show whether the

fund has over performed or underperformed or averagely performed. And on the basis

of risk beta and return performance analysis, it is observed that private sector mutual fund

schemes are better than public sector mutual fund schemes. (Jain, 2012)

Sharad Panwar and R. Madhumati studied the public sector and private sector mutual

fund schemes. The period under study is May 2002- May 2005. The study has analyzed

mean returns, standard deviation, variance and coefficient of variation. It reveals that

public sector mutual funds do not differentiate from private sector ones in terms of

mean returns. On the flip side, public sector mutual fund differentiate from the

private sector in terms of standard deviation, variance, and coefficient of variation.

(Sharad Panwar)

Prof. Prajapati and Prof. Patel have evaluated the performance of mutual fund schemes

between the period 2007 to 2011. The risk-return analysis is done. And Treynor

ratio, Sharpe's ratio, Jenson's measure are used for the comparison of mutual fund

schemes. The study concludes that HDFC and Reliance mutual fund has performed

better. But the ICICI and UTI are having lower risk than HDFC and

Reliance. (Prajapati & Patel, 2012)

Ms. Shalini and Ms. Dauly have focused on the journey of mutual fund industry in India

in their paper. The study has tried to predict what the future may hold for the mutual fund

investors in the long run. The study has concluded that the Indian economy is likely to

give high returns. Mutual fund organizations are needed to upgrade their skills and

technology. Mutual fund investors need to develop a sense of

timing and investment discipline. (Ms Shalini Goyal)

In the paper written by Arrathy, Aswathy, Anju, and Pravitha, factors affecting

investment in mutual fund is studied. And the study found that major factors

influencing the investment decision of retail investors are tax benefits, high return, price,

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE.

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND IN HUBLI CITY

and capital appreciation. Also, equity-based schemes are more preferred. (Arathy B,

2015)

Raghu Anand had analyzed the performance of various mutual fund schemes on the

basis of risk and returns. The study has selected to asset management companies HDFC

and SBI. The statistical tools used are CAGR (compounded annual growth rate), Alpha,

Beta, Standard deviation and Sharpe ratio. The period of study is 2005 to 2014. The

study found that mutual funds as an investment option has tremendous growth

potential. On the basis of CAGR study found that it is better to invest for 1 year. In

terms of risk analysis beta, HDFC seems to be a better fund to invest in. In

terms of expense ratio HDFC is giving better returns. (Anand, 2017)

Tariq Zafar, Chaubey and Syed Imran Nawab Ali have studied the application of

Sharpe's, Treynor’s and Jenson's ratio. Also, study analyses interdependence of funds

and Index. The study concludes that fund performs and is ranked differently. The same

fund may be best as per one criterion and maybe worst as per second criteria. Also, it

found that mutual fund in India has a bright future for a long run under

SEBI regulations. (S. M. Tariq Zafar, 2015)

Choudhary and Chawla have studied the various equity mutual fund schemes. Risk

and returns of mutual fund schemes are analyzed. For the analysis, Sharpe and Treynor

ratio is used. Also, beta, standard deviation, and coefficient of determination are

compared. The study concludes that as per standard deviation 62% schemes are less

risky than the market. And all schemes are having a beta less than 1. Seven out of eight

funds have shown superior performance under the Sharpe and Treynor ratio. (Chawla,

2014)

Chavan and CA Patil has studied the capital asset pricing model with reference to

the S&P BSE Sensex index. The study has empirically tested the validity of the CAPM

model in the Indian stock market with reference to the S&P BSE Sensex Index for the

period of 2011-2015. The study concludes that CAPM is not testable because the true

market portfolio cannot be measured. (Chavan & Patil , 2019)

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE.

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND IN HUBLI CITY

1.7 Limitations of the Study

The following are the limitations of the study:

The analysis based on secondary data only i,e. fact sheets.

The study is limited to the time period of 62 days.

The study is limited to the analysis of last 5 years data.

The study is made only for SBI and Aditya Birla Sun Life Mutual Funds.

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE.

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND IN HUBLI CITY

CHAPTER 2

INDUSTRY AND COMPANY PROFILE

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE.

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND IN HUBLI CITY

Industry

Mutual fund industry today is a booming investment sector with more than 30

players. And these players bring plenty of schemes to there investor. Some of them

gained the trust of there investors, and still some gained the mutual fund awards from the

industry. Between these healthy competitions the investors are getting some good

investment schemes. However with a plethora of schemes to choose from, the investor

faces many problems that is he will get struck in thinking that should I take more risk or

should I invest in some other investment sector for ex. In Banking.

World wide good mutual companies over are known by their AMC’s and this

fame is directly linked to their superior stocks selection skill. For mutual fund to grow,

AMC’s must be held accountable for their selection of stocks. In other words there must

be some performance indicator that will reveal th equality of stock selection of various

AMC’s

We have seen that many of the mutual fund schemes are giving good returns to its

investors, here we should not assume that the good return giving schemes are better to

invest, because return alone should not be consider as the basis of measuring of the

performance of a mutual fund sachem. It should also include the risk taken by the fund

manager, because as we know that the fund manager invest the pooled fund into

securities in this securities there are many companies like large cap companies small cap

companies and mid cap companies while investing into these share market the fund

10

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE.

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND IN HUBLI CITY

manager has to study the companies and invest, if he invest in high risk yielding

companies then there will be very risk in investing into such type of fund.

Risk associated with a fund, in a general, can be defined as variability or

fluctuations in the returns generated by it. The higher the fluctuation in the returns of a

fund during a given period, higher will be the risk associated with it. These fluctuations

in the returns generated by a fund are result of two guiding forces. First, general market

fluctuations, which affect all the securities, present in the market, called market risk or

systematic risk and second, fluctuations due to specific securities present In the portfolio

of the fund, called unsystematic risk.

The total risk of a given fund is sum of these two and is measured in terms of standard

deviation of returns of the fund. Systematic risk, on the other hand, is measured in terms

of BETA, which represents fluctuations in the NAV of the fund visa versa market. Beta is

calculated by relating the returns on a mutual fund with the returns in the market. While

unsystematic risk can be diversified through investments in a number of instruments, by

using risk return relationship, we try to assess the competitive strength of the mutual

funds visa versa one another in a better way.

11

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE.

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND IN HUBLI CITY

COMPANY PROFILE:-

Type : Franchise

Industry : VRUSHTI investment &Wealth management

Founded : 2012

Branch : Hubli

Area served : Dharwad, Belagum, Bangalore, and Mysore.

Founder : Divya.V

Key people : Vikas. S. Vibhuti. (Manager)

Service : Financial planning, Wealth management.

-: COMPANY PROFILE:-

We are one of the premier investment consultancy firm, known for creating wealth with

un based service and excellence. Vrushti investments and wealth management is an

authorized business associate of BMA WEALTH CREATORS LTD a BMA GROUP.

The 1000 crore BMA GROUP has created its forte by promoting successful ventures in

the field of coal mining, refractory steel and Ferro alloys in the form of established names

in the market such as BMA STAINLESSS STEEL (captain TMT Bars) prop. Snowed

Udyog ltd, Maintan smelters limited, and BMA international. Its continuous strive to

12

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE.

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND IN HUBLI CITY

achieve excellence and keeps it abreast of the latest in technology and business practices

there by making it customer oriented while forging alliance high quality standards and

proactive business standards.

We at VRUSHTI investment and wealth management make you realize your dreams,

financial needs, aspirants and concern as you do. We also implement the strategic wealth

creation ideas to create enhance and preserve your wealth according to your risk appetite

and investment horizon.

OUR APPROACH:

Research based investment advisory

We extremely value investors trust

Personalized investment solution

Wide range of network across all our product

Customized portfolios

Re balancing of existing portfolios

Personalized client servicing

Individually managed accounts

Integrity and honesty

VRUSHTI INVESTMENT AND WEALTH MANAGEMENT SERVICE

Enjoy your right to grow with stars of tomorrow by investing in emerging

companies carefully handpicked by expert to grow your wealth giving you your

right wealth giving you your right to better life. With the VRUSHTI- investments

and wealth management recommended you to invest into various kind of mutual

13

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE.

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND IN HUBLI CITY

fund and to beat the today’s monstrous inflation in an easiest way either by lump

sum or through (SIP) systematic investment plan route.

EQUITY:

Gone are the days where an individual used to invest in a bank fixed deposits.

FINANCIAL MARKETS history reveals there are number of LARGE CAP, MID

CAP, and SMALL CAP, companies which have delivered double digit returns and

dividend consistently. We serve you better by picking fundamentally and technically

sound companies to create your wealth for short term and long term and medium

term. We provide you both online and offline trading platforms to invest in equities

with NSE and BSE exchanges registered stockbroker.

PORTFLIO MANAGEMENT:

In today’s digital world its more difficult task to manage your investment

portfolio, PMS is studied for the investors who would like to diversify their

investment portfolio within board equity class. Who are in need of personalized

investment advice in tune with their specific requirements…

WEALTH MANAGEMENT:

We manage our client’s wealth in well-organized manner and keep you regularly

updated through our constant communication. We also provide you unique

platform where you can see all your investments like MUTUAL FUNND, SIP’S,

INSURANCE, DEPOSITS, RECURRING DEPOSITS, GOLD, PPF, NSE, TAX

SAVING, BONDS, CAPIRTAL GAIN BONDS, with accuracy.

14

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE.

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND IN HUBLI CITY

VRUSHTI INVESTMENTS SERVICES:

Risk management

Due diligence and research on policies available

Recommendation on a comprehensive insurance cover based on clients’ needs

Maintain proper records of clients policies

Assist client in paying premiums

Continuous monitoring of client account

Assist client in claim negotiation and settlement

SERVICE PROVIDES:

1. Mutual fund SIP

2. Portfolio management

3. Equity

4. IPO’s

5. Wealth management

6. NSE

7. Life insurance

8. PPF

9. KVP

10. General insurance

11. Tax planning advisory

15

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE.

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND IN HUBLI CITY

SBI MUTUAL FUND;

SBI Mutual Fund is India’s largest bank sponsored mutual fund and has an

enviable track record in judicious investments and consistent wealth creation.

The fund traces its lineage to SBI - India’s largest banking enterprise. The

institution has grown immensely since its inception and today it is India's largest bank,

patronized by over 80% of the top corporate houses of the country.

SBI Mutual Fund is a joint venture between the State Bank of India and Society

General Asset Management, one of the world’s leading fund management companies that

manages over US$ 330 Billion worldwide.

In eighteen years of operation, the fund has launched thirty-two schemes and

successfully redeemed fifteen of them. In the process it has rewarded it’s investors

handsomely with consistently high returns.

A total of over 3.5 million investors have reposed their faith in the wealth

generation expertise of the Mutual Fund. Schemes of the Mutual fund have

consistently outperformed benchmark indices and have emerged as the preferred

investment for millions of investors and HNI’s.

Today, the fund manages over Rs. 16500 crores of assets and has a diverse

profile of investors actively parking their investments across 30 active schemes.

16

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE.

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND IN HUBLI CITY

The fund serves this vast family of investors by reaching out to them through

network of 100 collection branches, 26 investor service centers, 28 investor service

desks and 52 districts organize

17

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE.

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

SBI MUTUAL FUND PRODUCTS

Equity scheme

The investments of these schemes will predominantly be in the stock markets and

endeavor will be to provide investors the opportunity to benefit from the higher returns

which stock markets can provide. However they are also exposed to the volatility and

attendant risks of stock markets and hence should be chosen only by such investors who

have high risk taking capacities and are willing to think long term. Equity Funds include

diversified Equity Funds, Sectoral Funds and Index Funds. Diversified Equity Funds

invest in various stocks across different sectors while sectoral funds which are specialized

Equity Funds restrict their investments only to shares of a particular sector and hence, are

riskier than Diversified Equity Funds. Index Funds invest passively only in the stocks of

a particular index and the performance of such funds move with the movements of the

index.

Magnum COMMA Fund

Magnum Equity Fund -growth

Magnum Global Fund

Magnum Index Fund

Magnum Midcap Fund

Magnum Multicap Fund

Magnum Sector Funds Umbrella

MSFU - FMCG Fund

MSFU - Emerging Businesses Fund

MSFU - IT Fund

MSFU - Pharma Fund

MSFU - Contra Fund

Magnum Multiplier Plus 1993

SBI Arbitrage Opportunities Fund

SBI Blue chip Fund

SBI Infrastructure Fund - Series I

SBI Magnum Tax gain Scheme 1993

SBI ONE India Fund

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 18

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

Selected Scheme in SBI Mutual Fund

Mutual Fund SBI Mutual Fund

Launch date 29-oct-93

Minimum Subscription Amount 1000

Objective of Scheme An open ended equity scheme, the

objective of the scheme is to provide the

investor long-term capital appreciation by

investing in high growth companies along

with the liquidity of an open-ended

scheme through investments primarily in

equities and the balance in debt and

money market instruments.

Scheme Category Growth

Scheme name Equity fund growth

Scheme type Open ended

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 19

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

SBI Mutual FUNDS AWARDS

LIPPER AWARD

THE LIPPER INDIA FUND AWARDS 2008

ICRA

MUTUAL FUND AWARDS 2008

OUTLOOK MONEY

NDTV PROFIT AWARDS

LIPPER AWARDS

THE LIPPER INDIA FUNDS AWARDS 2007

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 20

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

CNBC TV18 – CRISIL

MUTUAL FUND OF THE YEAR AWARD 2007

CNBC

AWAZ CONSUMER AWARDS 2006

LIPPER AWARDS

THE LIPPER INDIA FUND AWARDS 2006

ICRA

MUTUAL FUND AWARDS 2005

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 21

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

ADITYA BIRLA SUN LIFE

Aditya Birla Sun Life Mutual Fund was established in 1994 as a joint venture between

Aditya Birla Group and Sun Life Financial Inc. of Canada. The fund house deals in 4

main fund classes, namely, Equity Funds, Debt Funds, Income Funds and ELSS Funds,

all with good crisil rating. It has completed more than 20 years in its journey to offer

wealth creation solutions to its customers.

Whether you are a seasoned investor or a novice in this area, investing in ABSLMF is

made very simple with Clear Tax. You can visit Clear Tax to pick from a diverse list of

handpicked funds that are designed keeping in mind the risk profile and investment

objective of investors. You can be assured of a hassle-free quick process of selecting any

product from your favorite fund house – ABSLMF, with Clear tax. This requires just

one KYC formality that will take not more than 7 minutes of your time. Clear Tax makes

investing simple for you.

Money laundering and corruption can cripple the economy and the stability of our

country. Here, Know Your Customer (KYC) and In-Person Verification (IPV) can help a

financial institution significantly. However, Clear Tax doesn’t believe in inconveniencing

their investors. So they have enabled a way to do KYC in a quick and simple way.

What’s more, if investing via Clear Tax Save, the investor needs to do it only once for

their first investment.

KYC is necessary for all fund houses. If you are investing through Clear Tax, you need to

do your KYC just once. The same KYC will be used for all your future investments.

KYC verification through Clear Tax is a very simple process. You can verify by:

i. Using OTP sent to your Aadhaar-registered mobile number OR

ii. By uploading photos/scans of the required documents

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 22

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

Top 5 Funds: ABSLMF

Top 5 ABSLMF 1yr 3yr Return 5yr Return 10yr

Return Return

Aditya Birla Sun Life Advantage Fund 8.60 11.28 21.81 11.50

Aditya Birla Sun Life Equity Fund 9.89 12.87 21.55 11.93

Aditya Birla Sun Life Floating Rate 6.87 7.38 8.13 7.98

Fund

Aditya Birla Sun Life Focused Equity 7.49 8.73 16.90 12.01

Fund

Aditya Birla Sun Life Frontline Equity 8.41 9.08 16.35 12.62

Fund

<

ABSLMF: Equity

ABSLMF Equity Funds are medium to high-risk funds invested in stocks and equities

that offer investors dynamic returns on their investments. The schemes are designed

for long term capital appreciation and are curated to meet investment needs based on

individual risk appetite.

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 23

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

CHAPTER 3

THEROTICAL BACKGROUND OF THE

STUDY

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 24

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

Mutual Fund Concept

A Mutual Fund is a trust that pools the savings of a number of investors who

share a common financial goal. The money thus collected is then invested in capital

market instruments such as shares, debentures and other securities. The income

earned through these investments and the capital appreciation realized is shared by its

unit holders in proportion to the number of units owned by them. Thus a Mutual Fund

is the most suitable investment for the common man as it offers an opportunity to

invest in a diversified, professionally managed basket of securities at a relatively low

cost. The flow chart below describes broadly the working of a mutual fund

Schemes according to Maturity Period:

A mutual fund scheme can be classified into open-ended scheme or close-

ended scheme depending on its maturity period.

Open-ended Fund/ Scheme:

An open-ended fund or scheme is one that is available for subscription and

repurchase on a continuous basis. These schemes do not have a fixed maturity period.

Investors can conveniently buy and sell units at Net Asset Value (NAV) related prices

which are declared on a daily basis. The key feature of open-end schemes is liquidity.

Close-ended Fund/ Scheme:

A close-ended fund or scheme has a stipulated maturity

period e.g. 5-7 years. The fund is open for subscription only during a specified period

at the time of launch of the scheme. Investors can invest in the scheme at the time of

the initial public issue and thereafter they can buy or sell the units of the scheme on

the stock exchanges where the units are listed. In order to provide an exit route to the

investors, some close-ended funds give an option of selling back the units to the

mutual fund through periodic repurchase at NAV related prices. SEBI Regulations

stipulate that at least one of the two exit routes is provided to the investor i.e. either

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 25

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

repurchase facility or through listing on stock exchanges. These mutual funds

schemes disclose NAV generally on weekly basis.

Schemes according to Investment Objective:

A scheme can also be classified as growth scheme, income scheme, or

balanced scheme considering its investment objective. Such schemes may be open-

ended or close-ended schemes as described earlier. Such schemes may be classified

mainly as follow

Equity Oriented Scheme:

The aim of growth funds is to provide capital appreciation over the medium to

long- term. Such schemes normally invest a major part of their corpus in equities.

Such funds have comparatively high risks. These schemes provide different options to

the investors like dividend option, capital appreciation, etc. and the investors may

choose an option depending on their preferences. The investors must indicate the

option in the application form. The mutual funds also allow the investors to change

the options at a later date. Growth schemes are good for investors having a long-term

outlook seeking appreciation over a period of time.

Income / Debt Oriented Scheme:

The aim of income funds is to provide regular and steady income to investors.

Such schemes generally invest in fixed income securities such as bonds, corporate

debentures, Government securities and money market instruments. Such funds are

less risky compared to equity schemes. These funds are not affected because of

fluctuations in equity markets. However, opportunities of capital appreciation are also

limited in such funds. The NAVs of such funds are affected because of change in

interest rates in the country. If the interest rates fall, NAVs of such funds are likely to

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 26

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

increase in the short run and vice versa. However, long term investors may not bother

about these fluctuations.

Balanced Fund

The aim of balanced funds is to provide both growth and regular income as

such schemes invest both in equities and fixed income securities in the proportion

indicated in their offer documents. These are appropriate for investors looking for

moderate growth. They generally invest 40-60% in equity and debt instruments.

These funds are also affected because of fluctuations in share prices in the stock

markets. However, NAVs of such funds are likely to be less volatile compared to pure

equity funds.

Money Market or Liquid Fund

These funds are also income funds and their aim is to provide easy liquidity,

preservation of capital and moderate income. These schemes invest exclusively in

safer short-term instruments such as treasury bills, certificates of deposit, commercial

paper and inter-bank call money, government securities, etc. Returns on these

schemes fluctuate much less compared to other funds. These funds are appropriate for

corporate and individual investors as a means to park their surplus funds for short

periods.

Gilt Fund:

These funds invest exclusively in government securities. Government

securities have no default risk. NAVs of these schemes also fluctuate due to change in

interest rates and other economic factors as is the case with income or debt oriented

schemes.

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 27

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

Index Funds:

Index Funds replicate the portfolio of a particular index such as the BSE

Sensitive index, S&P NSE 50 index (Nifty), etc These schemes invest in the securities

in the same weight age comprising of an index. NAVs of such schemes would rise or

fall in accordance with the rise or fall in the index, though not exactly by the same

percentage due to some factors known as "tracking error" in technical terms.

Necessary disclosures in this regard are made in the offer document of the mutual

fund scheme.

There are also exchange traded index funds launched by the mutual funds which are

traded on the stock exchanges.

Sector specific funds/schemes:

These are the funds/schemes which invest in the securities of only those

sectors or industries as specified in the offer documents. e.g. Pharmaceuticals,

Software, Fast Moving Consumer Goods (FMCG), Petroleum stocks, etc. The returns

in these funds are dependent on the performance of the respective sectors/industries.

While these funds may give higher returns, they are more risky compared to

diversified funds. Investors need to keep a watch on the performance of those

sectors/industries and must exit at an appropriate time. They may also seek advice of

an expert.

Tax Saving Schemes

These schemes offer tax rebates to the investors under specific provisions of

the Income Tax Act, 1961 as the Government offers tax incentives for investment in

specified avenues. e.g. Equity Linked Savings Schemes (ELSS). Pension schemes

launched by the mutual funds also offer tax benefits. These schemes are growth

oriented and invest pre-dominantly in equities. Their growth opportunities and risks

associated are like any equity-oriented scheme.

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 28

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

Fund of Funds (FOF) scheme:

A scheme that invests primarily in other schemes of the same mutual fund or

other mutual funds is known as a FoF scheme. An FoF scheme enables the investors

to achieve greater diversification through one scheme. It spreads risks across a greater

universe.

Load or no-load Fund:

A Load Fund is one that charges a percentage of NAV for entry or exit. That

is, each time one buys or sells units in the fund, a charge will be payable. This charge

is used by the mutual fund for marketing and distribution expenses. Suppose the NAV

per unit is Rs.10. If the entry as well as exit load charged is 1%, then the investors

who buy would be required to pay Rs.10.10 and those who offer their units for

repurchase to the mutual fund will get only Rs.9.90 per unit. The investors should

take the loads into consideration while making investment as these affect their

yields/returns. However, the investors should also consider the performance track

record and service standards of the mutual fund which are more important. Efficient

funds may give higher returns in spite of loads.

Benefits of mutual funds

Affordability:

Investors individually may lack sufficient funds to invest in high grade stocks.

A mutual fund because of its large corpus allows even a small investor to take the

benefits of its investment strategy.

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 29

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

Convenient administration:

Investment in mutual fund reduces paper work and helps in avoiding many

problems such as bad deliveries, delayed payments and follow up with brokers and

companies. Mutual fund saves time and makes investing easy and convenient.

Diversification:

Mutual funds invest in number of companies across a broad cross- section of

industries and sectors. This diversification reduces the risk

because seldom do all stocks decline at the same time and in the same proportion.

You achieve this diversification through a mutual fund with far less money than you

can do on your own.

Flexibility:

Through features such as regular investment plans, regular withdrawal plans

and dividend reinvestment plans you can systematically invest or withdraw funds

according to your needs and convenience.

Liquidity:

In open-end schemes, the investor gets the money back promptly at net asset value

related prices from the mutual fund. In closed-end schemes the units can be sold on a

stock exchange at the prevailing market price or the investor can avail of the facility

of direct repurchase at NAV related prices by the mutual fund.

Low costs:

Mutual funds are a relatively less expensive way to invest capital markets because the

benefits of scale in brokerage, custodial and other fees transaction into lower costs for

investors

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 30

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

Professional management:

Mutual funds provide the services of experienced and skilled professionals, backed by

a dedicated investment research team that analyses the performance and prospects of

companies and selects suitable investments to achieve the objectives of the scheme.

Return potential:

Over a medium to long term mutual funds have the potential to provide a higher

return as they invest in a diversified basket of selected securities.

Choice of scheme:

Mutual funds offer a family of schemes to suit your varying needs over a lifetime.

Transparency

You get regular information on the value of your investment in addition to

disclosure on the specific investments made by your scheme, the proportion invested

in each class of assets and the fund managers investment strategy and outlook

Well regulated:

All mutual funds are registered with SEBI and they function within the

provisions of strict regulations designed to protect the interest of investors. The

operations of mutual funds are regularly monitored by SEBI.

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 31

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

History of Mutual Fund Industry

The origin of mutual fund industry in India is with the introduction of the concept

of mutual fund by UTI in the year 1963. Though the growth was slow, but it accelerated

from the year 1987 when non-UTI players entered the industry.

In the past decade, Indian mutual fund industry had seen dramatic improvements,

both quality wise as well as quantity wise. Before, the monopoly of the market had seen

an ending phase; the Assets under Management (AUM) were Rs. 67bn. The private sector

entry to the fund family raised the AUM to Rs. 470 bn in March 1993 and till April 2004;

it reached the height of 1,540 bn.

Putting the AUM of the Indian Mutual Funds Industry into comparison, the total

of it is less than the deposits of SBI alone, constitute less than 11% of the total deposits

held by the Indian banking industry. The main reason of its poor growth is that the

mutual fund industry in India is new in the country. Large sections of Indian investors are

yet to be

intellectuated with the concept. Hence, it is the prime responsibility of all mutual fund

companies, to market the product correctly abreast of selling.

The mutual fund industry can be broadly put into four phases according to the

development of the sector. Each phase is briefly described as under.

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 32

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

First Phase - 1964-87

Unit Trust of India (UTI) was established on 1963 by an Act of Parliament. It was set up

by the Reserve Bank of India and functioned under the Regulatory and administrative

control of the Reserve Bank of India. In 1978 UTI was de-linked from the RBI and the

Industrial Development Bank of India (IDBI) took over the regulatory and administrative

control in place of RBI. The first scheme launched by UTI was Unit Scheme 1964. At the

end of 1988 UTI had Rs.6, 700 crores of assets under management.

Second Phase - 1987-1993 (Entry of Public Sector Funds)

Entry of non-UTI mutual funds. SBI Mutual Fund was the first followed by

Canbank Mutual Fund (Dec 87), Punjab National Bank Mutual Fund (Aug 89), Indian

Bank Mutual Fund (Nov 89), Bank of India (Jun 90), Bank of Baroda Mutual Fund (Oct

92). LIC in 1989 and GIC in 1990. The end of 1993 marked Rs.47, 004 as assets under

management.

Third Phase - 1993-2003 (Entry of Private Sector Funds)

With the entry of private sector funds in 1993, a new era started in the Indian

mutual fund industry, giving the Indian investors a wider choice of fund families. Also,

1993 was the

year in which the first Mutual Fund Regulations came into being, under which all mutual

funds, except UTI were to be registered and governed. The erstwhile Kothari Pioneer

(now

merged with Franklin Templeton) was the first private sector mutual fund registered in

July 1993.

The 1993 SEBI (Mutual Fund) Regulations were substituted by a more

comprehensive and revised Mutual Fund Regulations in 1996. The industry now

functions under the SEBI (Mutual Fund) Regulations 1996.

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 33

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

The number of mutual fund houses went on increasing, with many foreign

mutual funds setting up funds in India and also the industry has witnessed several mergers

and acquisitions. As at the end of January 2003, there were 33 mutual funds with total

assets of Rs. 1,21,805 crores. The Unit Trust of India with Rs.44,541 crores of assets

under management was way ahead of other mutual funds.

Fourth Phase - since February 2003

This phase had bitter experience for UTI. It was bifurcated into two separate

entities. One is the Specified Undertaking of the Unit Trust of India with AUM of

Rs.29,835 crores (as on January 2003). The Specified Undertaking of Unit Trust of India,

functioning under an administrator and under the rules framed by Government of India

and does not come under the purview of the Mutual Fund Regulations.

The second is the UTI Mutual Fund Ltd, sponsored by SBI, PNB, BOB and

LIC. It is registered with SEBI and functions under the Mutual Fund Regulations. With

the bifurcation of the erstwhile UTI which had in March 2000 more than Rs.76,000 crores

of AUM and with the setting up of a UTI Mutual Fund, conforming to the SEBI Mutual

Fund Regulations, and with recent mergers taking place among different private sector

funds, the mutual fund industry has entered its current phase of consolidation and growth.

As at the end

of September, 2004, there were 29 funds, which manage assets of Rs.153108 crores under

421 schemes.

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 34

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

CHART SHOWING FUNCTIONING OF MUTUAL FUNDS IN INDIA

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 35

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

Asset Management Company:

It is a company set up primarily for managing the investment of mutual funds

and makes investment decisions in accordance with the scheme objectives, deed of

Trust and other provisions of the Investment Management Agreement. For Tata

Mutual Fund, Tata Asset Management Limited is the Asset Management Company.

SEBI Regulations:

Securities and Exchange Board of India (Mutual Funds) Regulations, 1996 or

such other SEBI (MF) Regulations as may be in force from time to time and would

include Circulars, Guidelines etc., unless specifically mentioned to the contrary.

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 36

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

MEAN:

The return on any investment measured over a given period of time is simply the sum

of its capital appreciation and any income generated divided by the original amount of

the investment, which is expressed as percentage .the term applied to this composite

calculation is total return.

Standard Deviation

The square root of the variance in a series. It shows how the data are spread

out. A measure of the dispersion of a set of data from its mean. The more spread apart

the data is, the higher the deviation.

In finance, standard deviation is applied to the annual rate of return of an

investment to measure the investment’s volatility (risk).

A volatile stock would have a high standard deviation. In mutual funds the

standard deviation tells us how much the return on the fund is deviating from the

expected normal returns. Standard deviation can also be calculated as the square root

of the variance. To determine how well a fund is maximizing the return received for

its volatility, you can compare the fund to another with a similar investment strategy

and similar returns. The fund with the lower standard deviation would. Be more

optimal because it is maximizing the return received for the amount of risk acquired

Variance

Variance (σ2) is a measurement of the spread between numbers in a data set. It

measures how far each number in the set is from the mean and is calculated by taking

the differences between each number in the set and the mean, squaring the differences

(to make them positive) and dividing the sum of the squares by the number of values

in the set.Variance is one of the key parameters in asset allocation. Along with

correlation, the variance of asset returns helps investors to develop optimal portfolios

by optimizing the return-volatility trade-off in investment portfolios.

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 37

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

The square root of variance is the standard deviation (σ).

RETURN ANALYSES OF MUTUAL FUNDS

The various methods for measuring mutual fund returns are as follows.

1. Percentage change in NAV

2. Simple total returns.

3. ROI or Total return with dividend re- investment.

1) Percentage change in NAV

Percentage change in NAV is an absolute measure of return, which finds the

NAV appreciation between two points of time, as a percentage.

Calculation is as follows

(Absolute change in NAV/NAV at the beginning)*100

In case the period is not equal to one year then there will be change calculation.

Converting a return value for a period other than one year, into a value for 1 year is

called as annualisation. In order to annualize a rate, we find out what the return would

be for a year, if the return behaved for a year, in the same manner it did, for any other

fractional period.

Calculation is as follows

(End period NAV/beginning period NAV)-1)*12/n*100

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 38

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

Pros and cons of the method:

This method is simple and very easy to calculate and understand. However,

examining return over a single period may not provide an indication of long term

returns. An important limitation also is that this method is more useful for computing

returns on growth options of mutual fund schemes. It may not be suitable for

computing returns on schemes with dividend distributions or withdrawal plans.

Simple total returns

It is customary to represent return as percent per annum. This makes it easier

to compare the returns from various investment options, for a standard holding period.

The investment in a mutual fund can choose to keep his investment for a period of

time, not necessarily 1 year. Therefore, if the holding period is different from 1 year,

we have to normalize the computation shown above, as % p.a.

The total return method takes into account the dividends distributed by

the mutual fund, and adds it to the NAV appreciation, to arrive at returns.

Calculation is as follows

(End period NAV- beginning period NAV)+dividend received) /beginning period

NAV)*100

This return is called the simple annualized return from investing in mutual fund.

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 39

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

Pros and cons of the method

The total return method takes into account the dividend distributions and is

therefore comparable across various kinds of mutual fund classes. The most important

limitation of this method is that it does not take into account the re – investment of

dividends received at the intervening period.

Total return with dividend re- investment

This method is also called the return of investment (ROI) method. In this

method, we assume that dividend are re- invested into the scheme as soon as they are

received at the then prevailing NAV (ex-dividend NAV).

Total returns with reinvestment are calculated as:

(Value of the holding at the end of the period/value of the holdings at the

beginning of the period)-1)* 100

Value of holding at the beginning of the period = number of units at the beginning *

beginning NAV.

Value of holding at the end of the period = number of units at the end * end NAV.

Number of units reinvested = dividends/ ex dividend NAV.

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 40

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

This methodology of computing returns is widely used by many mutual fund

tracking agencies.

SEBI regulations regarding reporting of returns by mutual funds

A return earned by a mutual fund scheme is a very important indicator used by

mutual funds in their publicity literature and advertisements. In order to ensure

uniformity and comparability across funds, SEBI has stipulated some norms for return

data that is published by mutual funds. These are.

1. Mutual funds can only use standard return computations such as annual

dividend on face value, annual yield on purchase price, and annual

compounded rate of return.

2. If the scheme has been in existence for over a year, compounded annual yield

is the accepted method of calculating return.

3. return calculations for funds with payouts should assume that dividend are

reinvested at the ex- dividend NAV

4. Return should be shown for the past 1,3 and 5 years of the scheme, or since

inception, which ever is lower.

5. For funds in existence for less than one year, total returns should be shown,

and such returns should not be annualize or compounded.

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 41

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

Some more related terms

Beta:

A beta less than 1.0 indicates that the investment will be less volatile than the market.

Correspondingly, a beta of more than 1.0 indicates that the investments price will be

more volatile than the market.

Sharpe Ratio:

The Sharpe Ratio is calculated by taking the return of the portfolio and subtracting the

risk- free return ,then dividing the result(the excess return) by standard deviation of

the portfolio return .Basically ,it is measuring excess return (over risk-free rate) per

unit of risk.

Annual Return:

The percentage of change in net asset value over a year's time, assuming

reinvestment of distribution such as dividend payment and bonuses.

Annualized Return:

This is the hypothetical rate of return, if the fund achieved it over a year's

time, would produce the same cumulative total return if the fund performed

consistently over the entire period. A total return is expressed in a percentage and tells

you how much money you have earned or lost on an investment over time, assuming

that all dividends and capital gains are reinvested.

Benchmark:

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 42

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

A parameter against which a scheme can be compared. For example, the

performance of a scheme can be benchmarked against an appropriate index.

Capital Appreciation:

As the value of the securities in a portfolio increases, a fund's Net Asset Value

(NAV) increases, meaning that the value of your investment rises. If you sell units at

a higher price than you paid for them, you make a profit, or capital gain. If you sell

units at a lower price than you paid for them, you'll have a capital loss.

Compounding:

When you deposit money in a bank, it earns interest. When that interest also

begins to earn interest, the result is compound interest. Compounding occurs if bond

income or dividends from stocks or mutual funds are reinvested. Because of

compounding, money has the potential to grow much faster.

Entry Load:

Load on purchases/ switch-out of units.

Equity Schemes:

Schemes where more than 50% of the investments are made in the equity

shares of various companies. The objective is to provide capital appreciation over a

period of time.

Exit Load:

Load that is charged on redemptions i.e. during the exit of the fund.

Fund Category:

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 43

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

It is a type of scheme which the mutual fund company invests its corpus in a

particular category. It could be a growth, debt, balanced, gilt or liquid scheme

Fund Family:

It is the AMC which manages the various types of funds.

Fund Management Costs:

It is the charge levied by an AMC on the investors for managing their funds.

Fund Manager:

The person who makes all the final decisions regarding investments of a

scheme, i.e. the person who makes all the investment decisions.

Investment Objective:

The identification of attributes associated with an investment or investment

strategy, designed to isolate and compare risks, define acceptable levels of risk, and

match investments with personal goals.

Load:

A charge that is levied as a percentage of NAV at the time of entry into the

Scheme/Plans or at the time of exiting from the Scheme/Plans.

No-Load Scheme:

A Scheme where there is no initial Entry or Exit Load.

Mutual Funds:

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 44

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

An investment company/trust that pools money from unitholders and invests

that money into a variety of securities, including stocks, bonds, and money-market

instruments in line with the funds objective.

Net Worth:

A person's net worth is equal to the total value of all possessions, such as a

house, stocks, bonds, and other securities, minus all outstanding debts, such as

mortgage and revolving credit lines.

Net Yield:

Rate of return on a security net of out-of-pocket costs associated with its

purchase, such as commissions or markups.

Offer Document Or Prospectus:

The official document issued by mutual funds prior to the launch of a fund

describing the characteristics of the proposed fund to all its prospective investors. It

contains all the information required as per the Securities and Exchange Board of

India, such as investment objective and policies, services, and fees. Individual

investors are encouraged to read and understand the fund's prospectus.

Risk Adjusted Returns%:

Generally, the expected returns from an investment are dependent on the risk

involved in the investment. For the purpose of comparing returns from investments

involving varying levels of risk, the returns are adjusted for the level of risk before

comparison. Such returns (reduced for the level of risk involved) are called risk-

adjusted returns.

Sale Price:

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 45

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

The price at which a fund offers to sell one unit of its scheme to investors.

This NAV is grossed up with the entry load applicable, if any.

Sales Charge:

Fee on the purchase of new shares of a mutual fund. A sales charge is similar

to paying a premium for a security in that the customer must pay a higher offering

price. Sometimes, it is called a load.

Scheme:

It is a fund or plan where the money contributed by the unit holders are maintained

and managed and the profit/loss from the scheme accrue only to the unit holders. A

mutual fund can launch more than one scheme.

Total Return%:

Return on an investment, taking into account capital appreciation, dividends or

interest, and individual tax considerations adjusted for present value and expressed on

an annual basis.

Unit:

Unit representing a share in the assets of the corresponding plan of the

Scheme.

Unit Holder:

A person who holds Unit(s) under any plan of the Scheme.

Valuation:

Calculating the market value of the assets of a mutual fund scheme at any

point of time.

Volatility:

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 46

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

In investing, volatility refers to the ups and downs of the price of an

investment. Greater the ups and downs, more volatile the investment is.

Volatility Measures:

Volatility measures the variability of historical returns. Relative Volatility,

Beta, and R2 compare a portfolio's total return to those of a relevant market,

represented by the benchmark index. Standard Deviation is calculated independent of

an index.

CHAPTER 4

DATA ANALSIS AND INTERPRETATION

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 47

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

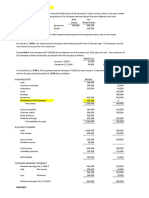

4.1 MEAN CALCULATION :

The return on any investment measured over a given period of time is simply the sum

of its capital appreciation and any income generated divided by the original amount of

the investment, which is expressed as percentage .the term applied to this composite

calculation is total return.

ADITYA BIRLA SUN LIFE EQUITY HYBRID 95 FUND

FUND

YEAR RETURN X

2015 2.98

2016 8.36 -2.69

2017 25.2 -8.42

2018 -4.64 14.92

2019 4.62 -4.63

2020 11.47 -3.425

Total -4.245

Mean -0.849

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 48

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

SBI EQUITY HYBRID FUND

Year Fund X

Return

2015 6.57

2016 3.24 1.665

2017 27.35 -12.055

2018 0.31 13.52

2019 13.23 -6.46

2020 12.75 0.24

Total -3.09

Mean -0.618

INTERPRETATION:

Above calculation shows the returns (mean) of ADITYA BIRLA SUN LIFE Equity

fund and SBI equity hybrid fund. The return of ADITYA BIRLA SUN LIFE Equity

fund is -0.849 and return in SBI equity fund is -0.618. So we can say that the return

of SBI Equity Hybrid fund is more than ADITYA BIRLA SUN LIFE Equity fund.

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 49

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

4.2 VARIANCE CALCULATION:

Variance (σ2) is a measurement of the spread between numbers in a data set. It

measures how far each number in the set is from the mean and is calculated by taking

the differences between each number in the set and the mean, squaring the differences

(to make them positive) and dividing the sum of the squares by the number of values

in the set. Variance is one of the key parameters in asset allocation. Along with

correlation, the variance of asset returns helps investors to develop optimal portfolios

by optimizing the return-volatility trade-off in investment portfolios.

ADITYA BIRLA SUN LIFE EQUITY HYBRID 95 FUND

X- (X-

YEAR X MEAN MEAN)2

2016 -1.841 3.3892

-2.69

2017 -7.571 57.3200

-8.42

2018 15.769 248.6613

14.92

2019 -3.781 14.2959

-4.63

2020 -2.576 6.6357

-3.425

TOTAL 330.3021

-4.245

MEAN -0.849

VARIANCE 66.06

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 50

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

SBI EQUITY HYBRID FUND

X-

YEAR X MEAN (X-MEAN)2

2016 1.665 2.283 5.2121

2017 -12.055 -11.437 130.8049

2018 13.52 14.138 199.8830

2019 -6.46 -5.842 34.1289

2020 0.24 0.858 0.7361

Total -3.09 370.765

Mean -0.618

Variance 74.153

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 51

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

INTERPRETATION:

Above calculation shows the risk (Fluctuations) i,e. variance of ADITYA BIRLA

SUN LIFE equity fund and SBI hybrid equity fund. The risk of ADITYA BIRLA

SUN LIFE equity fund is 66.06 and SBI hybrid equity fund 74.153. It shows less

fluctuations in ADITYA BIRLA SUN LIFE equity fund. And more fluctuations in

ADITYA BIRLA SUN LIFE equity fund So investor can prefer ADITYA BIRLA

SUN LIFE equity fund to invest.

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 52

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

4.3 STANDARD DEVIATION CALCULATION:

The square root of the variance in a series. It shows how the data are spread out. A

measure of the dispersion of a set of data from its mean. The more spread apart the

data is the higher the deviation.

ADITYA BIRLA SUN LIFE EQUITY HYBRID 95 FUND

X- (X-

YEAR X MEAN MEAN)2

2016 -1.841 3.3892

-2.69

2017 -7.571 57.3200

-8.42

2018 15.769 248.6613

14.92

2019 -3.781 14.2959

-4.63

2020 -2.576 6.6357

-3.425

TOTAL 330.3021

-4.245

MEAN -0.849

VARIANCE 66.06

SD 9.08

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 53

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

SBI EQUITY HYBRID FUND(G)

X- (X-

YEAR X MEAN MEAN)2

2016 1.665 2.283 5.2121

2017 -12.055 -11.437 130.8049

2018 13.52 14.138 199.8830

2019 -6.46 -5.842 34.1289

2020 0.24 0.858 0.7361

Total -3.09 370.765

Mean -0.618

Variance 74.153

SD 9.62

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 54

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

INTERPRETATION:

As seen in the above calculation ADITYA BIRLA SUN LIFE EQUITY FUND

standard deviation (risk) 9.08% and SBI hybrid equity fund risk is 9.62% ,that means

SBI hybrid equity fund has more risk than ADITYA BIRLA SUN LIFE equity fund.

So investor can invest in SBI hybrid equity fund which is having less risk.

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 55

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

ADITYA BIRLA SUN LIFE EQUITY HYBRID 95 FUND

(Present value updated on July 2021)

Beta value 1.04

Sharpe ratio 0.98

SBI EQUITY HYBRID FUND

(Present value updated on July 2021)

Beta value 1.1

Sharpe ratio 0.74

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 56

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

CHAPTER 5

SUMMARRY OF FINDINGS,

SUGGESTIONS AND CONCLUSION

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 57

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

5.1 FINDINGS

1. Here between the chosen schemes SBI HYBRID EQUITY FUND is having

higher return as compared to ADITYA BIRLA SUN LIFE Equity fund. So it

is obvious to say that SBI HYBRID EQUITY FUND is on an average

performing well, in terms of average daily return.

2. Variance of SBI HYBRID EQUITY FUND is more than ADITYA BIRLA

SUN LIFE Equity fund. As the SBI HYBRID EQUITY FUND fluctuation is

more compared to ADITYA BIRLA SUN LIFE Equity fund which has less

fluctuations.

3. It reveals that ADITYA BIRLA SUN LIFE Equity fund standard deviation

(risk) is less compared to SBI HYBRID EQUITY FUND.

4. So it should be noted that SBI HYBRID EQUITY FUND having high risk

and more return as compared to ADITYA BIRLA SUN LIFE Equity fund

which is having high risk and less return

5. SBI HYBRID EQUITY MUTUAL FUND beta value is greater than ADITYA

BIRLA SUN LIFE Equity fund beta value. So we can consider that high

volitality and high risk.in the long term horizon is in the present scenario.

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 58

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

5.2 SUGGESTIONS

1. Here I would like to suggest, the Investors should consider the risk and

returns while investing into the company.

2. From this project report it is clear that the investors who want to take high risk

and higher return they can go for SBI HYBRID EQUITY MUTUAL FUND -

Growth.

3. Here I also suggest the company to make some awareness campaign because

most of the people who are interested to earn through investment in companies

are not aware about the concept of mutual fund.

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 59

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

5.3 CONCLUSION

In the conclusion part I have compared the two schemes with each other and

suggested that which schemes is having less risk and high return compare to other

scheme.

From the project report we can conclude that SBI hybrid equity Fund is having

high risk with high returns and also performing good compared to ADITYA BIRLA

SUN LIFE Equity Fund is having high risk and less return compare to SBI hybrid

equity Fund.

At present both schemes are performing good and are meeting the investor’s

expectations. SBI hybrid equity Fund is more volatile than that of ADITYA BIRLA

SUN LIFE Equity Fund.

From the overall study we can conclude that SBI hybrid equity Fund . is safe

investment for the investors who are looking for long term investment.

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 60

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

BIBLIOGRAPHY

Books:-

1. Investment analysis and portfolio management ----

Prasanna Chandra

2. Security Analysis and portfolio management---

Donald E. Fischer

Ronald J. Jordan

Web sites:-

www.amfiindia.com

www.mutualfundsindia.com

www.bseindia.com

www.nseindia.com

www.ask.com

www.icicipru.com

www.hdfcfund.com

www.fundsindia.com

News papers:-

Business lines

Business standard

Mutual Fund Insight

Reference:-

1)Anuja Magdu & CA. Girish A.Samant in “ A Comparative Study on Mutual

Fund Schemes of Selected AMC’s in India” 117, March 2019, 2456-6470

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 61

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

ANNEXURE

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 62

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 63

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 64

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 65

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 66

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 67

A STUDY ON COMPARATIVE ANALYSIS OF ADITYA BIRLA SUNLIFE EQUITY HYBRID 95

FUND AND SBI EQUITY HYBRID FUND

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE. 68

You might also like

- Statements 3750Document6 pagesStatements 3750ytprem agu100% (2)

- A Synopsis On: "Project Report On Comparative Analysis On Mutual Funds of Reliance Mutual Funds & HDFC Mutual FundsDocument6 pagesA Synopsis On: "Project Report On Comparative Analysis On Mutual Funds of Reliance Mutual Funds & HDFC Mutual FundsNeeraj Agarwal0% (1)

- 6 - Pat & Sat Co. - PALACIODocument7 pages6 - Pat & Sat Co. - PALACIOPinky DaisiesNo ratings yet

- Lxami KoujageriDocument79 pagesLxami KoujageriAvinash ChannalNo ratings yet

- Chapter-I: A Comparative Study of HDFC and ICICI Mutual FundDocument52 pagesChapter-I: A Comparative Study of HDFC and ICICI Mutual FundSarva ShivaNo ratings yet

- Pratim SIP FinalDocument74 pagesPratim SIP Finalpratim shindeNo ratings yet

- Comparative Study Between Equity and Mutual Fund InvestmentDocument60 pagesComparative Study Between Equity and Mutual Fund InvestmentKrupanshi MevchaNo ratings yet

- Financial Market, Institutions and Services: Submitted To: Prof. Vinay DuttaDocument6 pagesFinancial Market, Institutions and Services: Submitted To: Prof. Vinay DuttaGautamNo ratings yet

- Performance EvaluationDocument14 pagesPerformance EvaluationAsit kumar BeheraNo ratings yet

- Literure RewiveDocument6 pagesLiterure RewiveprakhardwivediNo ratings yet

- Anjali JaiswalDocument4 pagesAnjali JaiswalAnjali JaiswalNo ratings yet

- A Study On Performance Evaluation of Selected Balanced Funds in Karvy Stock Broking LTD., TirupatiDocument7 pagesA Study On Performance Evaluation of Selected Balanced Funds in Karvy Stock Broking LTD., Tirupatisree anugraphicsNo ratings yet

- Performance of Mutual Funds in India: A Comparative Analysis of SBI Mutual Funds and HDFC Mutual FundsDocument8 pagesPerformance of Mutual Funds in India: A Comparative Analysis of SBI Mutual Funds and HDFC Mutual FundsAman VarshneyNo ratings yet

- Sip and Mutual FundDocument69 pagesSip and Mutual FundDavinder SinghNo ratings yet

- Paper PublicationDocument14 pagesPaper PublicationdeeepshahhNo ratings yet

- Summer Project ReportDocument103 pagesSummer Project ReportamittaveraNo ratings yet

- Performance Analysis of Mutual Fund: A Comparative Study of The Selected Debt Mutual Fund Scheme in IndiaDocument5 pagesPerformance Analysis of Mutual Fund: A Comparative Study of The Selected Debt Mutual Fund Scheme in IndiaaqsakhanaljedeelNo ratings yet

- Comparative Analysis of ICICI and SBI Mutual FundDocument21 pagesComparative Analysis of ICICI and SBI Mutual FundNitish KharatNo ratings yet

- A Study On Mutual Funds: Bhavesh M. PopatDocument30 pagesA Study On Mutual Funds: Bhavesh M. PopatBhavesh PopatNo ratings yet

- Sbi PDFDocument9 pagesSbi PDFRoshan ElizabathNo ratings yet

- Bhavesh - Mutual FundsDocument30 pagesBhavesh - Mutual FundsBhavesh PopatNo ratings yet

- Bharti Project ReportDocument107 pagesBharti Project ReportBharti SinghNo ratings yet

- ArticlesDocument5 pagesArticlesShivamitra ChiruthaniNo ratings yet

- A SYNOPSIS ON Mutual FundsDocument9 pagesA SYNOPSIS ON Mutual FundsPavan Pavi100% (1)

- Main ProjectDocument60 pagesMain ProjectRAJA SHEKHARNo ratings yet

- Analysis of Mutual Funds With Reference To Equity FundsDocument8 pagesAnalysis of Mutual Funds With Reference To Equity FundsAbhishekNo ratings yet

- Desertation ReportDocument51 pagesDesertation ReportMahesh Prasad PandeyNo ratings yet

- ResearchPaper PDFDocument13 pagesResearchPaper PDFKiran Kumar NNo ratings yet

- HDFC Vs SbipdfDocument13 pagesHDFC Vs SbipdfNishchay SinghNo ratings yet

- A Study On The Performance of Large Cap Equity Mutual Funds in IndiaDocument16 pagesA Study On The Performance of Large Cap Equity Mutual Funds in IndiaAbhinav AgrawalNo ratings yet

- A Study On The Performance of Large Cap Equity Mutual Funds in India PDFDocument16 pagesA Study On The Performance of Large Cap Equity Mutual Funds in India PDFAbhinav AgrawalNo ratings yet

- AbcdyhhjDocument64 pagesAbcdyhhjAruna TalapatiNo ratings yet

- Finance RPDocument8 pagesFinance RPNandini BhansaliNo ratings yet

- Chapter IDocument83 pagesChapter IAruna TalapatiNo ratings yet

- J0609017385 PDFDocument13 pagesJ0609017385 PDFSanskar YadavNo ratings yet

- J0609017385 PDFDocument13 pagesJ0609017385 PDFSanskar YadavNo ratings yet

- A Comparative Analysis On Various Mutual Fund Schemes of HDFC and SBI As An Investment Option For Retail Investors in IndiaDocument13 pagesA Comparative Analysis On Various Mutual Fund Schemes of HDFC and SBI As An Investment Option For Retail Investors in IndiaAnkita RanaNo ratings yet

- A Study Report On Risk and Returns of HDFC and IciciDocument63 pagesA Study Report On Risk and Returns of HDFC and IciciRajesh BathulaNo ratings yet

- Mutual FundsDocument11 pagesMutual FundsTapan JariwalaNo ratings yet

- Comparative Analysis On Mutual FundsDocument51 pagesComparative Analysis On Mutual FundsAjay RocksonNo ratings yet

- 23162C1158 Mutual Funds in IndiaDocument25 pages23162C1158 Mutual Funds in Indiamrcrazy244466666No ratings yet

- Performance Evaluation of Selected Open-Ended Mutual Fund Schemes in IndiaDocument10 pagesPerformance Evaluation of Selected Open-Ended Mutual Fund Schemes in IndiaIJRASETPublicationsNo ratings yet