Professional Documents

Culture Documents

CBRE - Singapore Market Outlook Q2 2022

CBRE - Singapore Market Outlook Q2 2022

Uploaded by

WCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CBRE - Singapore Market Outlook Q2 2022

CBRE - Singapore Market Outlook Q2 2022

Uploaded by

WCopyright:

Available Formats

FIGURES | SINGAPORE | Q2 2022

FIGURES | SINGAPORE | Q2 2022

Resilient despite headwinds

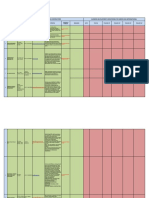

TABLE 1: Quick Figures

+3.7% +5.6% 1.9% Office Q2 2022 Q-o-Q Y-o-Y Residential Q2 2022 Q-o-Q Y-o-Y

GDP Growth Y-o-Y CPI Inflation Y-o-Y 3M SIBOR

(Q1 2022) (Jun 2022) Grade A Rent $11.30 +3.2% +7.6% Prime Rent $4.95 +8.3% +16.2%

(May 2022)

Capital Value $3,050 +1.7% +7.0% Capital Value $1,915 -2.3% +7.8%

Note: CBRE Research, Singstat, ABS, Q2 2022 Net Yield * 3.4% Net Yield 2.5%

Retail Q2 2022 Q-o-Q Y-o-Y Industrial* Q2 2022 Q-o-Q Y-o-Y

Prime Rent Prime Logistics

Executive Summary $34.20 0.0% -1.0% $1.53 +2.7% +7.0%

(Orchard) Rent

‒ Office: The pace for rental growth in Core CBD (Grade A) accelerated to 3.2% q-o-q in Q2

2022. This was also the fastest pace of increase since the recovery in Q2 2021. Capital Value $7,350 0.0% 2.1% Capital Value $213 +6.5% +15.1%

Net Yield 4.8% Yields 6.5%

‒ Business Parks: Occupier interest for business parks was relatively steady, though overall

leasing demand was capped by tight occupancies in the City Fringe submarket. Business Park Q2 2022 Q-o-Q Y-o-Y Investment** Q2 2022 Q-o-Q Y-o-Y

‒ Retail: Leasing activity remained stable in Q2 2022, with islandwide retail rents stabilising for Rent (City

$6.00 +0.8% +3.4% Total Volume $9.024 bn -11.3% +27.5%

the third consecutive quarter. Fringe)

‒ Residential: Following the lull period in Q1 2022, sales volumes in Q2 2022 saw an uptick as Source: CBRE Research, Q2 2022 Source: CBRE Research, Q2 2022

developers rolled out more new homes. Q2 2022 preliminary figures show that 2,370 new All capital values and yields stated as prime. Rents are quoted on a $ * 30-year prime logistics data provided.

homes were sold, picking up from 1,825 units sold in Q1 2022. psf per month basis and capital values on a $ psf basis. ** Investment volumes are preliminary. All transactions above S$10

* Yield calculation methodology revised based on an average of mil

‒ Industrial: Strong demand was capped by the lack of available space, particularly in the rolling eight quarter rents.

prime logistics segment.

‒ Investment: Preliminary real estate investment volumes in Singapore for Q2 2022 declined

11.3% q-o-q to $9.024 bn. This brought H1 2022 investment volumes to $19.193 bn, a 56.4%

increase y-o-y.

1 CBRE RESEARCH © 2022 CBRE, INC.

FIGURES | SINGAPORE | Q2 2022

COVID-19 Updates (Q2 2022 onwards)

A Timeline of Events

Apr 2022 May 2022

1 1

Transition to Vaccinated Travel Framework Removal of work permit requirement

Vaccinated Travel Framework replaced VTL Fully-vaccinated non-Malaysian Work Permit

scheme Holders no longer required to apply for entry

19 approvals to enter Singapore

All nightlife businesses allowed to fully

All fully vaccinated travellers, except those from

MOH’s restricted category, allowed to enter

reopen

Singapore quarantine-free Nightlife establishments allowed to fully reopen

with Safe Management Measures (SMMs) in place

Removal of quotas on number of daily arrivals

Jun 2022

Patrons required to produce a negative ART

before entry to nightlife establishments where

dancing is present 14

Further easing of SMMs

Capacity limit removed for nightlife

22 establishments with dancing among patrons.

Stepdown of DORSCON level Patrons no longer needed a negative ART

Step down of the Disease Outbreak Response result to enter the venues

System Condition (DORSCON) framework from

Orange to Yellow

Relaxation of community measures 26

Group size limit removed. Optional mask Relaxation of border measures

wearing outdoors. Safe distancing no longer Fully-vaccinated and well travellers no longer

required needed to be tested before entering Singapore

Relaxation of workplace measures

All employees may return to the workplace

Source: CBRE Research, Various news articles, MOH, Apr to Jul 2022

2 CBRE RESEARCH © 2022 CBRE, INC.

FIGURES | SINGAPORE | Q2 2022

Office FIGURE 1: Office Supply-Demand (Islandwide)

mil sq. ft. Vacancy

Demand for office space still healthy 1.5 8%

The positive momentum from 2021 and Q1 2022 carried over to Q2 2022 as Singapore eased 1.1

workplace restrictions, announcing that 100% of employees may return to the office from 26 Apr 6%

2022. In Q2 2022, AXA Tower commenced demolition works and was removed from CBRE 0.7

Research’s office stock. Excluding the effect of AXA Tower’s removal, islandwide net absorption 4%

remained positive for the quarter. 0.3

2%

Fastest pace of rental increase since Q2 2021 -0.1

-0.5 0%

Vacancies in Core CBD (Grade A) submarket further tightened to 4.4%. This has emboldened

Q2 20

Q2 21

Q2 22

Q3 20

Q3 21

Q2 17

Q2 18

Q2 19

Q1 20

Q4 20

Q3 17

Q1 21

Q4 21

Q1 22

Q3 18

Q3 19

Q4 17

Q1 18

Q4 18

Q1 19

Q4 19

landlords to raise their rental expectations. Thus, the pace for rental growth in Core CBD (Grade

A) accelerated from 1.4% q-o-q in Q1 2022 to 3.2% q-o-q in Q2 2022. This was also the fastest

pace of increase since the recovery in Q2 2021. In addition, the confidence spilt over to other Net Supply Net Absorption Vacancy rate (RHA)

submarkets, resulting in a broad-based rental recovery islandwide. Source: CBRE Research, Q2 2022

Non-bank FI and legal sectors as active demand drivers

TABLE 2: Office Vacancy Rates TABLE 3: Singapore Office Rents

Vacancy rates for Core CBD inched up to 6.4% in Q2 2022, attributed to the turnover of

secondary office space, which is likely to be backfilled in the following quarters. In the Q4 21 Q1 22 Q2 22 Q2 22 Q-o-Q Y-o-Y

Decentralised areas, the completion of Rochester Commons, which was fully committed,

Core CBD 4.5% 4.5% 4.4% Core CBD $11.30 3.2% 7.6%

contributed to the positive net absorption of 0.22 mil sq. ft. in Q2 2022. Leasing transactions

(Grade A) (Grade A)

were largely driven by renewals, though there was also activity by new set-ups in the legal sector

and non-bank financial institutions. Islandwide 6.3% 5.8% 6.0% Core CBD $8.40 3.7% 5.7%

Prospects still positive despite near term volatility Core CBD 6.7% 6.2% 6.4% Core CBD $8.15 3.8% 5.2%

(Grade B)

Fringe CBD 6.7% 6.2% 6.8%

The recent tech market volatility may have raised concerns of demand cooling for office space in Islandwide $7.55 3.4% 5.6%

Singapore, but CBRE Research expects well established and financially-sound tech companies to Decentralised 4.9% 4.5% 4.3% (Grade B)

continue to grow their footprint in Singapore as their long-term prospects remain intact. Core Source: CBRE Research, Q2 2022

Source: CBRE Research, Q2 2022

CBD (Grade A) rents have grown by 4.6% year-to-date. With a stable domestic economic outlook,

alongside a back-to-office recovery and limited new supply pipeline, CBRE Research expects

Core CBD (Grade A) office rents to grow 8.3% for the full year, compared to 3.8% for 2021.

3 CBRE RESEARCH © 2022 CBRE, INC.

FIGURES | SINGAPORE | Q2 2022

Business Parks FIGURE 2: Business Park Supply-Demand (Islandwide)

mil sq. ft. Vacancy

Further improvement in the City Fringe occupancy 0.6 14%

14%

Occupier interest for business parks was relatively steady, though overall leasing demand was 0.4

capped by tight occupancies in the City Fringe submarket. This led islandwide net absorption to 13%

increase slightly by 13,178 sq. ft. in Q2 2022. The vacancy rate for the City Fringe submarket 0.2 13%

declined for the fourth consecutive quarter to 4.4% in Q2 2022, from 4.7% in Q1 2022 while that

12%

for Rest of Island submarket inched up to 18.2%. This caused a further widening of performance 0.0

between the two submarkets. CBRE Research also observed that some developments in the 12%

Rest of Island submarket were undergoing AEIs to improve occupancies.

-0.2 11%

Q2 20

Q2 21

Q2 22

Q3 20

Q3 21

Q2 17

Q2 18

Q2 19

Q1 20

Q4 20

Q1 21

Q4 21

Q1 22

Q3 17

Q3 18

Q3 19

Q4 17

Q1 18

Q4 18

Q1 19

Q4 19

Steady interest from pharmaceutical and biomedical companies

Net Supply Net Absorption Vacancy Rate (%)

Similar to previous quarters, there was steady leasing interest from pharmaceutical and

biomedical companies which were actively seeking to expand their R&D and lab facilities. It was Source: CBRE Research, Q2 2022

noted that their preference was mainly confined within the City Fringe. Less downsizing activity

was seen for renewals among the banking sector, which is a positive sign for the overall FIGURE 3: Business Park Vacancy TABLE 4: Singapore Business Park Rents

business park sentiment.

Vacancy

Q2 22 Q-o-Q Y-o-Y

Widening rental gap between City Fringe and Rest of Island 20%

City Fringe $6.00 0.8% 3.4%

Continued take-up in the City Fringe submarket led rents to increase for the fifth consecutive 16%

Rest of Island $3.65 0.0% 0.0%

quarter by 0.8% q-o-q to $6.00 psf/month. For the Rest of Island submarket, rental performance 12%

was more muted with rents maintaining at $3.65 psf/month as landlords continued to prioritise TABLE 5: Known Business Park Pipeline (sq. ft.)

8%

raising occupancy.

4% City Fringe Rest of Island

High supply concentration risk in Rest of Island

0% 2022 0.00 mil 1.46 mil

Q2 20

Q2 22

Q3 20

Q2 21

Q3 21

Q2 17

Q2 18

Q2 19

Q1 20

Q4 20

Q1 21

Q4 21

Q1 22

Q3 17

Q3 18

Q3 19

Q4 17

Q1 18

Q4 18

Q1 19

Q4 19

The average annual pipeline supply over the next three years will be at a historical high at 1.53 2023 0.30 mil 0.43 mil

mil sq. ft. per annum, with higher concentration risk in the Rest of Island submarket. This could

potentially exert more pressure on Rest of Island rents. On the other hand, rents in City Fringe Rest of Island City Fringe

2024 0.00 mil 2.41 mil

are expected to remain resilient given the lack of new options. Looking further ahead, business

Source: CBRE Research, Q2 2022 Source: CBRE Research, Q2 2022

parks could benefit from the strong office rental recovery, where the widening rental gap

between office and business parks could lend additional support to the latter.

4 CBRE RESEARCH © 2022 CBRE, INC.

FIGURES | SINGAPORE | Q2 2022

Retail FIGURE 4: Retail Economic Indicators

y-o-y change (2017=100) mil

Demand indicators surpassed pre-pandemic levels 50% 6.0

Retail indicators continued to improve alongside the easing of border restrictions and measures 5.0

for dine-in, entertainment and social events from 1 Apr 2022. Retail sales (excluding motor 25%

vehicles) for Apr and May 2022 grew by 2.0% and 4.7% m-o-m respectively, surpassing pre- 4.0

pandemic levels. Singstat’s Business Expectations Survey reported that retailers expect 0% 3.0

business conditions to be slower for the period of Apr – Sep 2022, compared with the previous

six months which coincided with the year-end festive period. Conversely, the F&B sector 2.0

-25%

expects business conditions to improve for the same period. 1.0

-50% 0.0

Stable leasing demand, reconfiguration of trade mix

Q2 20

Q2 21

Q3 20

Q3 21

Q2 17

Q2 18

Q2 19

Q1 20

Q4 20

Q1 21

Q4 21

Q1 22

Q3 17

Q3 18

Q3 19

Q4 17

Q1 18

Q4 18

Q1 19

Q4 19

Leasing activity remained stable in Q2 2022. More pop-up stores opened in the quarter, Visitor Arrivals (RHA) Change in Retail Sales Index in Chained Volume Terms (excludes car sales)

featuring collaborations and experiential concepts. F&B operators continued to drive demand,

while supermarkets and gyms expanded their presence. However, due to changing consumer Source: STB, MTI, CBRE Research, Q2 2022

preferences and competition, there were some notable closures in Q2 2022, including Vhive

(furniture) and consolidations of Cathay Cineplex (entertainment) and Kinokuniya (books).

TABLE 6: Prime Retail Rents TABLE 7: Estimated Gross New Supply

Islandwide retail rents stabilised for the third consecutive quarter

Q2 22 Q-o-Q Y-o-Y Estimated NLA (sq. ft.)

Although borders have reopened and visitor arrivals have seen a sharp increase, retailers are

Islandwide $24.75 0.0% -0.6% Q3 – Q4 2022 0.34 mil

cautiously optimistic about an eventual return of tourist spending in view of uncertain economic

growth and rising inflation. As such, prime retail rents for Orchard Road, City Hall/Marina Centre Orchard Road $34.20 0.0% -1.0% 2023 0.46 mil

and Fringe areas remained stable in Q2 2022. Meanwhile, the suburban market continued to

register healthy reversionary rents as availability remains extremely limited. Suburban $30.20 0.2% 1.3% 2024 0.41 mil

Source: CBRE Research, Q2 2022 Source: CBRE Research, URA, Q2 2022

Manpower shortage and rising costs temper retailers’ optimism Note: Projects with a NLA of less than 20,000 sq. ft. are

excluded

While domestic and travel restrictions have eased and shopper traffic has improved, retailers

are now facing manpower shortage as well as rising input costs, putting a lid to landlords’

capacity to raise rents in the near term. Nonetheless, with below-historical average new retail

supply in the next few years, CBRE Research expects a more meaningful retail rent recovery

after H2 2022.

5 CBRE RESEARCH © 2022 CBRE, INC.

FIGURES | SINGAPORE | Q2 2022

Industrial FIGURE 5: Manufacturing Indices

56 30%

Positive industrial sentiment holding up 54 20%

52 10%

Manufacturing output increased by 13.8% y-o-y in May 2022, on the back of increased

50 0%

semiconductor production. This comes from the strong demand from 5G markets and data

centres. Despite some volatility, overall manufacturing sentiment held up, as evident from 48 -10%

positive performance in the NODX and SIPMM’s PMI indicators. 46 -20%

Leasing momentum continued, but constrained by lack of available space 44 -30%

Aug-20

Nov-20

Aug-21

Nov-21

May-19

Aug-19

Nov-19

Feb-20

Feb-21

Feb-22

May-20

May-21

May-22

In light of the current supply chain disruption, increased freight cost and inflationary pressures,

it was observed that demand related to occupiers’ “just-in-case” inventory has increased and PMI-Contract PMI-Expand Mfg Output NODX

firms were inclined to bring in a higher volume of manufacturing inputs now rather than later.

However, the strong demand was capped by the lack of available space, particularly for the Source: Singstat, SIPMM, CBRE Research, Q2 2022

prime logistics segment. Leasing demand has benefitted from the increase in inventory for food

staples, 3PLs, semiconductor manufacturers and electronics companies. The pharmaceutical TABLE 8: Industrial Rents TABLE 9: Significant Future Developments

and biomedical sectors also remained resilient.

Est. GFA

Prime logistics registered the highest rental growth Q2 22 Q-o-Q Y-o-Y Development

(mil sf)

Among all segments, the prime logistics segment experienced the highest rental growth of 2.7% Factory (Grd Flr) $1.56 0.6% 3.3% Kranji Green 1.43

q-o-q this quarter, following the 1.4% q-o-q increase in Q1 2022. Vacancies in the prime logistics Factory (Upp Flr) $1.21 0.8% 2.5% TimMac @ Kranji 1.54

basket remained tight despite the addition of LOGOS Penjuru Logistics Centre as it completed

with full occupancy. Meanwhile, average warehouse rents increased by 1.8% q-o-q, and factory Warehouse (Grd Flr) $1.71 1.8% 6.9% Soilbuild 2 Pioneer Sector 1 0.73

rents increased 0.6% q-o-q in Q2 2022. Tee Yih Jia Food Hub 1.06

Warehouse (Upp Flr) $1.27 1.6% 5.0%

New industrial land supply to help alleviate shortage in longer term Prime Logistics $1.53 2.7% 7.0%

Year-to-date, prime logistics rentals have grown by 4.1%, attributed to positive leasing demand Source: CBRE Research, Q2 2022 Source: CBRE Research, JTC, Q2 2022

and the acute shortage of quality warehouse space. While the government is looking to ramp up

industrial land supply via the H2 2022 IGLS Programme, completions would only be realised two

to three years later. Thus, following the strong rental increase in 2021, further rental increases

can be expected in the prime logistics segment in the near term.

6 CBRE RESEARCH © 2022 CBRE, INC.

FIGURES | SINGAPORE | Q2 2022

Residential FIGURE 6: New Private Residential Units Take-up & URA Price Index (incl. ECs)

No. of units

New home sales picked up with attractive new launches 25,000 200

22,500 180

Following the lull period in Q1 2022, sales volumes in Q2 2022 saw an uptick as developers rolled 20,000 160

out more new homes. Q2 2022 preliminary figures show that 2,370 new homes were sold, picking 17,500 140

up from 1,825 units sold in Q1 2022. Sales volumes were bolstered by the successful launches of 15,000 120

new City Fringe projects Liv@MB and Piccadilly Grand, which saw brisk take-up of over 70% on 12,500 100

22,197

their first launch weekend despite high median unit pricing of above S$2,000 psf. 10,000 80

7,500 14,948 60

13,027

5,000 10,566 9,912 9,982 40

Private home price growth accelerated despite cooling measures, rising rates 7,316 7,440 7,972 8,795

1,825 2,370

2,500 20

Flash estimates showed that URA’s All Private Residential Price Index registered a 3.2% q-o-q 0 0

2020

2021

Q1 22

Q2 22*

2012

2013

2014

2015

2016

2017

2018

2019

increase in Q2 2022, after the 0.7% q-o-q rise in Q1 2022. This was led by new project launches

in the City Fringe (RCR) – which set new benchmark prices – as developers held firm on their

No. of Units Sold URA (All) Residential Price index

asking prices amid higher construction costs and low unsold inventory. On the other hand,

Source: URA, CBRE Research, Q2 2022

landed homes saw price growth moderate to 2.9% q-o-q in Q2 2022, slower than the 4.2% q-o-q Note: *Preliminary figures (excl. ECs) for Q2 2022 based on Realis caveats as of 12 Jul 2022

increase observed in Q1 2022, as sellers and buyers’ price gap widened.

FIGURE 7: Non-landed Median psf Rents by Market Segment TABLE 10: Top 3 Projects (New Sale) in Q2 2022

Private residential rents poised to rise further after Q1 2022’s record high $psf/mth

5.50

Based on the URA Rental Index for all private residential properties, rents increased by 4.2% q- 4.88 Piccadilly Normanton

5.00 Project Liv@MB

o-q and 12.1% y-o-y in Q1 2022, reaching a new high. Following the reopening of Singapore’s Grand Park

borders, median psf rents for non-landed properties rose at an accelerated pace in Apr and May 4.50

4.05

2022. This was likely due to increased demand from inbound travellers and recent homesellers 4.00

whose new home completions have been affected by construction delays. This upward rental Tenure 99y 99y 99y

3.50

trend is likely to sustain until more supply is completed in 2023. 3.52

3.00 Median Price

Positive sentiment but significant headwinds loom ($psf) in $2,175 $2,408 $1,868

2.50

quarter

Strong economic growth, upgraders’ demand and rising rents have underpinned the private and 2.00

public residential market thus far. However, rising macroeconomic uncertainties and mortgage 2017 2018 2019 2020 2021 Apr-22 May-22

Units sold in

rates may deter potential homebuyers moving forward. CBRE Research maintains its 2022 new CCR RCR OCR 325 231 112

quarter

home sales forecast at 9,000 – 10,000 units, from 13,027 units in 2021. In view of the stronger-

Source: URA, CBRE Research, Q2 2022 Source: URA, CBRE Research, Q2 2022

than-expected pick-up in home prices in Q2 2022, 2022’s full-year price forecast has been raised Note: For non-landed residential units only. Based on Realis caveats as Note: Based on Realis caveats as of 12 Jul 2022

from 3% to 5%, which still represents a slowdown from the 10.6% increase in 2021. of 12 Jul 2022.

7 CBRE RESEARCH © 2022 CBRE, INC.

FIGURES | SINGAPORE | Q2 2022

Investments FIGURE 8: Total Transaction Volume by Sector

Billions (S$) Billions (S$)

Strong investment volumes in Q2 2022 $12.0 $48.0

$11.0 $44.0

Preliminary real estate investment volumes in Singapore for Q2 2022 declined 11.3% q-o-q to $9.024 $10.0 $40.0

$9.0 $36.0

bn. It is, nonetheless, an increase of 27.5% y-o-y, and the second highest quarterly investment

$8.0 $32.0

volumes in four years, boosted by a few large office and mixed-use transactions. This brought H1 $7.0 $28.0

2022 investment volumes to $19.193 bn, a 56.4% increase y-o-y. $6.0 $24.0

$5.0 $20.0

Office investment activity moderated but remained firm $4.0 $16.0

$3.0 $12.0

$2.0 $8.0

Office investment volumes moderated to $1.227 bn in Q2 2022, after a strong Q1 2022. Investor $1.0 $4.0

interest in the office sector remained firm. Kajima acquired Nehsons Building for $111.10 mil ($2,200 $0.0 $0.0

psf ppr), following its unit’s acquisition of 55 Market Street in Q1 2022. Active capital recycling by

Q2 20

Q2 21

Q3 20

Q3 21

Q2 17

Q2 18

Q2 19

Q1 20

Q4 20

Q1 21

Q4 21

Q1 22

Q2 22*

Q3 17

Q3 18

Q3 19

Q4 17

Q1 18

Q4 18

Q1 19

Q4 19

large real estate investors was also witnessed from AEW’s purchase of Westgate Tower from Sun

Venture Group for $680.00 mil ($2,230 psf), after divesting Twenty Anson in Q1 2022. Excluding Hotel Industrial Mixed Office Others Residential Retail 4QRT

residential transactions which were mainly boosted by GLS sales, the office sector accounted for the

largest proportion of investment volumes in H1 2022 at $4.610bn, up 75.4% y-o-y. Source: CBRE Research, Q2 2022 , *Preliminary figures

FIGURE 9: Capital Values Index

Rebound in investment volumes in industrial, mixed-use and hotel sectors

120

Industrial investment volumes rose six-fold q-o-q mainly on the transfer of ARA LOGOS Logistics

110

Trust’s nine Singapore properties for approximately $0.8 bn to ESR-REIT, while the collective sale of

Golden Mile Complex for $700.00 mil boosted Q2 2022 mixed-use investment volumes to $1.270 bn,

100

a 46.3% q-o-q increase. Hotel investment volumes also tripled on increased sales of hotels as

investors positioned for a travel recovery. 90

Ample liquidity and strong fundamentals to support investment volumes 80

While investor sentiment has softened due to rising interest rates, investment volumes in Q2 2022 70

Q2 20

Q2 21

Q2 22

Q3 20

Q3 21

Q2 17

Q2 19

Q1 20

Q4 20

Q1 21

Q4 21

Q1 22

Q3 17

Q3 19

Q4 17

Q1 18

Q4 18

Q1 19

Q4 19

stayed resilient due to ample liquidity and recovering rentals. Singapore’s safe haven status has also

continued to attract investors seeking wealth preservation. As such, capital values and yields have

remained mostly firm. With some sizeable deals now under negotiation or recently concluded, Grade A Office Prime Retail Prime Logistics Leasehold Prime Residential

investment outlook for H2 2022 remains positive. CBRE Research expects 2022 investment volumes Source: CBRE Research, Q2 2022

to grow by up to 10% from the year before, led by commercial and industrial sales.

8 CBRE RESEARCH © 2022 CBRE, INC.

FIGURES | SINGAPORE | Q2 2022

Singapore Research

Tricia Song Goh Jia Ling

Head of Research, SEA Senior Manager

Office Research Business Parks & Industrial Research

tricia.song@cbre.com jialing.goh@cbre.com

Teo Ling Yan Gerald Tan

Manager Analyst

Economic & Retail Research Capital Markets & Residential Research

lingyan.teo@cbre.com gerald.tan@cbre.com

Global Research

Richard Barkham, Ph.D. Neil Blake, Ph.D. Henry Chin, Ph.D.

MRICS Global Head of Forecasting and Global Head of Investor Thought

Analytics Leadership

Global Chief Economist & Head of

neil.blake@cbre.com Head of Research, APAC

Americas Research

henry.chin@cbre.com.hk

richard.barkham@cbre.com

© Copyright 2022. All rights reserved. This report has been prepared in good faith, based on CBRE’s current anecdotal and evidence based views of the commercial real estate market. Although CBRE believes its views reflect market conditions on the date of this presentation, they are

subject to significant uncertainties and contingencies, many of which are beyond CBRE’s control. In addition, many of CBRE’s views are opinion and/or projections based on CBRE’s subjective analyses of current market circumstances. Other firms may have different opinions, projections

and analyses, and actual market conditions in the future may cause CBRE’s current views to later be incorrect. CBRE has no obligation to update its views herein if its opinions, projections, analyses or market circumstances later change.

Nothing in this report should be construed as an indicator of the future performance of CBRE’s securities or of the performance of any other company’s securities. You should not purchase or sell securities—of CBRE or any other company—based on the views herein. CBRE disclaims all

liability for securities purchased or sold based on information herein, and by viewing this report, you waive all claims against CBRE as well as against CBRE’s affiliates, officers, directors, employees, agents, advisers and representatives arising out of the accuracy, completeness,

adequacy or your use of the information herein.

9 CBRE RESEARCH © 2022 CBRE, INC.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Understanding Contract-Law and You WinDocument4 pagesUnderstanding Contract-Law and You WinRhonda Peoples100% (7)

- Mayer Induction Hob MMIH302HS - User ManualDocument10 pagesMayer Induction Hob MMIH302HS - User ManualWNo ratings yet

- A STUDY On Industrial RelationsDocument53 pagesA STUDY On Industrial RelationsVenkat66% (29)

- New Government Cooling Measures (September 2022)Document3 pagesNew Government Cooling Measures (September 2022)WNo ratings yet

- Singapore Office Market Review Q1 2022Document9 pagesSingapore Office Market Review Q1 2022WNo ratings yet

- PropNex - Residential Property Market Outlook Research Report 2022Document11 pagesPropNex - Residential Property Market Outlook Research Report 2022WNo ratings yet

- HDB Resale EligibilityDocument2 pagesHDB Resale EligibilityWNo ratings yet

- ICDL X SHOPEE CASE STUDY Stapled 2-SidedDocument17 pagesICDL X SHOPEE CASE STUDY Stapled 2-SidedWNo ratings yet

- BCD Travel 2021 Sustainability ReportDocument82 pagesBCD Travel 2021 Sustainability ReportWNo ratings yet

- Annex C - Phasing Out of SFQADocument2 pagesAnnex C - Phasing Out of SFQAWNo ratings yet

- PropertyGuru - Singapore Property Market Outlook 2022Document22 pagesPropertyGuru - Singapore Property Market Outlook 2022WNo ratings yet

- OrangeTee - Property Market Outlook 2022Document11 pagesOrangeTee - Property Market Outlook 2022WNo ratings yet

- OrangeTee - Private Residential Market Report For Q2 2022Document9 pagesOrangeTee - Private Residential Market Report For Q2 2022WNo ratings yet

- JLL - Singapore Property Market Monitor 1Q 2022Document2 pagesJLL - Singapore Property Market Monitor 1Q 2022WNo ratings yet

- Property Management Industry Report 2022Document92 pagesProperty Management Industry Report 2022WNo ratings yet

- Increase Organizational Effectiveness Through Customer Relationship and Business Process ManagementDocument8 pagesIncrease Organizational Effectiveness Through Customer Relationship and Business Process ManagementHai Duc NguyenNo ratings yet

- Analysis of Projection of Women in Advertisements On SocietyDocument4 pagesAnalysis of Projection of Women in Advertisements On SocietyTarun AbrahamNo ratings yet

- (PABLO) SA 2 - Colourette Social Media Plan ReportDocument11 pages(PABLO) SA 2 - Colourette Social Media Plan ReportVictorBaguilatNo ratings yet

- Company Profile - BravoFabsDocument14 pagesCompany Profile - BravoFabssong.anarNo ratings yet

- Post-Commencement Analysis of The Dutch Mission-Oriented Topsector and Innovation Policy' StrategyDocument55 pagesPost-Commencement Analysis of The Dutch Mission-Oriented Topsector and Innovation Policy' StrategyjlskdfjNo ratings yet

- Total Experience:-6 Years (5 Years in Die Casting.) : Deepak A Jagzap Diploma IN Mechanical EnggDocument3 pagesTotal Experience:-6 Years (5 Years in Die Casting.) : Deepak A Jagzap Diploma IN Mechanical EnggSmart TradingNo ratings yet

- Assignment 3Document7 pagesAssignment 3Dat DoanNo ratings yet

- Bill October 1Document2 pagesBill October 1Muhammad RashidNo ratings yet

- Middle East ContractorsDocument8 pagesMiddle East ContractorsDeepak Nair100% (1)

- FM Assignment 4 - Group 4Document6 pagesFM Assignment 4 - Group 4Puspita RamadhaniaNo ratings yet

- Istqb: Question & AnswersDocument5 pagesIstqb: Question & AnswersAdministrator BussinesNo ratings yet

- Analisis Varians Dan Standar Products CostsDocument4 pagesAnalisis Varians Dan Standar Products CostsAhad KamisNo ratings yet

- PT2SB-HR-TD-002 Employee Training and Development PolicyDocument29 pagesPT2SB-HR-TD-002 Employee Training and Development PolicyCristobal CherigoNo ratings yet

- 2019-01 Digital Online Music in ChinaDocument40 pages2019-01 Digital Online Music in ChinaLê Trương Bảo QuânNo ratings yet

- TEST 10 - Unit 3, 4, 5 (45 Minutes)Document3 pagesTEST 10 - Unit 3, 4, 5 (45 Minutes)Dương Đức BútNo ratings yet

- B.tech 7th Sem ProjectDocument19 pagesB.tech 7th Sem ProjectSanskriti GuptaNo ratings yet

- 467 - Age222-Introduction To Farm Machinery-2unitsDocument8 pages467 - Age222-Introduction To Farm Machinery-2unitsAnonymous 1XBCMXNo ratings yet

- Stephanie LetterDocument3 pagesStephanie Letterroshayyan24No ratings yet

- Calendar FY18 For Any CompanyDocument1 pageCalendar FY18 For Any CompanyburnoutcandleNo ratings yet

- 16 Major LossesDocument23 pages16 Major LossesRanga Bhuvana BalajiNo ratings yet

- Final Exam MAT1004 Summer Code 1Document3 pagesFinal Exam MAT1004 Summer Code 1Anh NguyễnNo ratings yet

- Hair Color Consumer BehaviourDocument28 pagesHair Color Consumer Behaviourhitesh100% (2)

- TYBAF Black Book TopicDocument2 pagesTYBAF Black Book Topicmahekpurohit1800No ratings yet

- FAR 4202 Discontinued Operation NCA Held For SaleDocument4 pagesFAR 4202 Discontinued Operation NCA Held For SaleMaximusNo ratings yet

- Asif Ahmed Ayon 1712987630 - Human Resource Management - Alternative Individual AssessmentDocument9 pagesAsif Ahmed Ayon 1712987630 - Human Resource Management - Alternative Individual AssessmentValak100% (1)

- Yashika Colgate PalmoliveDocument2 pagesYashika Colgate Palmoliveyashika vohraNo ratings yet

- LESSON 2 - Basic Economic ProblemsDocument19 pagesLESSON 2 - Basic Economic Problemsalleah tapilNo ratings yet

- BUS407 Chapter 13 CSR and Community RelationsDocument44 pagesBUS407 Chapter 13 CSR and Community RelationssaidahNo ratings yet