Professional Documents

Culture Documents

Fixed Income Market Report - 10.10.2022

Fixed Income Market Report - 10.10.2022

Uploaded by

Fuaad Dodoo0 ratings0% found this document useful (0 votes)

71 views1 page- At Ghana's last treasury bill auction, bids exceeded the target amount by GH¢181.39 million, though accepted bids were slightly lower at GH¢1,357.21 million.

- Interest rates on 91-day and 182-day bills increased slightly to 30.96% and 31.94% respectively, reflecting inflationary pressures.

- The target for the next auction is GH¢1,088 million in 91-day, 182-day and 364-day bills, to be held on October 14th with settlement on October 17th.

Original Description:

Fixed Income Market Report_10.10.2022

Original Title

Fixed Income Market Report_10.10.2022

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document- At Ghana's last treasury bill auction, bids exceeded the target amount by GH¢181.39 million, though accepted bids were slightly lower at GH¢1,357.21 million.

- Interest rates on 91-day and 182-day bills increased slightly to 30.96% and 31.94% respectively, reflecting inflationary pressures.

- The target for the next auction is GH¢1,088 million in 91-day, 182-day and 364-day bills, to be held on October 14th with settlement on October 17th.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

71 views1 pageFixed Income Market Report - 10.10.2022

Fixed Income Market Report - 10.10.2022

Uploaded by

Fuaad Dodoo- At Ghana's last treasury bill auction, bids exceeded the target amount by GH¢181.39 million, though accepted bids were slightly lower at GH¢1,357.21 million.

- Interest rates on 91-day and 182-day bills increased slightly to 30.96% and 31.94% respectively, reflecting inflationary pressures.

- The target for the next auction is GH¢1,088 million in 91-day, 182-day and 364-day bills, to be held on October 14th with settlement on October 17th.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

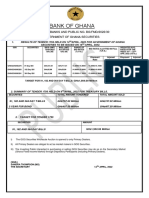

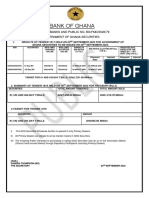

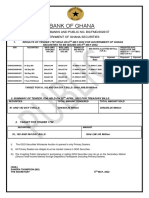

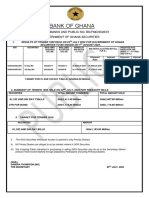

10TH OCTOBER, 2022 TENDER #1819

FIXED INCOME MARKET REPORT

FIXED INCOME MARKET HIGHLIGHTS TREASURY RATES YIELD (3rd Oct. – 7th Oct. 2022)

At last week’sZ auction, bids tendered exceeded

Government’s target by GH¢181.39 million. However,

accepted bids were marginally below tendered bids as

GH¢1156.28 million was raised in 91-Day Bills and GH¢200.93

million in 182-Day Bills as compared to GH¢717.22 million raised

in 91-Day Bills, GH¢145.60 million in 182-Day Bills and

GH¢137.04 million 364-Day Bills at the previous auction.

Interest rates on government securities in the primary market

continued to nudge up as investors focus on the short-term

securities, reflecting current Inflationary pressures to settle at

30.96% and 31.94% for the 91-Day Bills and 182-Day Bills

respectively. ss

The target for the next auction (Tender #1820) is GH¢1,088.00

million in 91-Day Bills, 182-Day Bills and 364-Day Bills. RESULTS OF LAST WEEK’S TREASURY BILL AUCTION

GOG Treasuries Current Previous Change

91-Day Bills and 182-Day Bills 91-Day T-Bills 30.96% 30.45% 0.510%

182-Day T-Bills 31.94% 31.57% 0.370%

BOG Offer 1,176.00

s BREAKDOWN OF TOTAL AMOUNT RAISED THIS WEEK

Tendered 1,357.39

182-Day Bill

Accepted 1,357.21 15%

BREAKDOWN OF TOTAL AMOUNT RAISED THIS WEEK

Treasuries Bids Tendered Bids Accepted

(GH¢ MN) (GH¢ MN)

91-Day T-Bill 1156.46 1156.28

182-Day T-Bill 200.93 200.93 91-Day Bill

TOTAL 1,357.39 1,357.21 85%

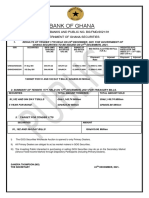

SUMMARY OF SEPTEMBER 2022 GFIM ACTIVITIES

GHANA FIXED INCOME MARKET NEXT AUCTION DETAILS

YEAR September 2022 September 2021 Change Treasuries Bids Tendered (GH¢ MN)

VOLUME 14,950,734,214 14,057,207,982 6.35%

Tender No. 1820

VALUE (GH¢) 13,249,005,111.26 14,512,762,458.47 -8.70% Target Size GH¢1,088.00 million

NO. OF TRADES 41,843 37,168 12.57% Auction Date 14th October, 2022

Source: Ghana Stock Exchange Settlement Date 17th October, 2022

KEY ECONOMIC INDICATORS

Securities on offer 91-Day, 182-Day & 364-Day T-Bills

Indicator Current Previous

Monetary Policy Rate August 2022 24.50% 22.00% ANALYSTS

Real GDP Growth December 2021 5.40% 0.40% Godwin Kojo Odoom: Senior Research Analyst

Inflation August 2022 33.9% 31.7% Obed Owusu Sackey: Analyst

Reference rate September 2022 27.44% 26.50% Wisdom Kwame Asigbetse: Analyst

Source: GSS, BOG, GBA

Disclaimer - SIC Brokerage and its employees do not make any guarantee or other promise as to any results that may be obtained from using our content. No one should make any investment

decision without first consulting his or her own Investment advisor and conducting his or her own research and due diligence. SIC Brokerage disclaims any and all liabilities in the event that any

Information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses.

You might also like

- Fixed Income Market Report - 12.09.2022Document1 pageFixed Income Market Report - 12.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 26.09.2022Document1 pageFixed Income Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 19.09.2022Document1 pageFixed Income Market Report - 19.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 22.08.2022Document1 pageFixed Income Market Report - 22.08.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 03.10.2022Document1 pageFixed Income Market Report - 03.10.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 12.07.2022Document1 pageFixed Income Market Report - 12.07.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 30.05.2022Document1 pageFixed Income Market Report - 30.05.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 04.07.2022Document1 pageFixed Income Market Report - 04.07.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 18.07.2022Document1 pageFixed Income Market Report - 18.07.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 01.08.2022Document1 pageFixed Income Market Report - 01.08.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 04.05.2022Document1 pageFixed Income Market Report - 04.05.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 21.02.2022Document1 pageFixed Income Market Report - 21.02.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 29.08.2022Document1 pageFixed Income Market Report - 29.08.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 17.01.2022Document1 pageFixed Income Market Report - 17.01.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 31.01.2022Document1 pageFixed Income Market Report - 31.01.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 19.04.2022Document1 pageFixed Income Market Report - 19.04.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 25.04.2022Document1 pageFixed Income Market Report - 25.04.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 08.08.2022Document1 pageFixed Income Market Report - 08.08.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 28.02.2022Document1 pageFixed Income Market Report - 28.02.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 25.07.2022Document1 pageFixed Income Market Report - 25.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 20.07.2022Document1 pageDaily Equity Market Report - 20.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 02.06.2022Document1 pageDaily Equity Market Report - 02.06.2022Fuaad DodooNo ratings yet

- BOG Notice No 06 FMD T Bills Auctresults 1782 21st Jan 2022Document1 pageBOG Notice No 06 FMD T Bills Auctresults 1782 21st Jan 2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 13.09.2022Document1 pageDaily Equity Market Report - 13.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 01.03.2022Document1 pageDaily Equity Market Report - 01.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 14.09.2022Document1 pageDaily Equity Market Report - 14.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 18.08.2022 2022-08-18Document1 pageDaily Equity Market Report 18.08.2022 2022-08-18Fuaad DodooNo ratings yet

- Daily Equity Market Report - 08.02.2022Document1 pageDaily Equity Market Report - 08.02.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 07.06.2022 2022-06-07Document1 pageDaily Equity Market Report 07.06.2022 2022-06-07Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.07.2022Document1 pageDaily Equity Market Report - 28.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 02.08.2022Document1 pageDaily Equity Market Report - 02.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.09.2022Document1 pageDaily Equity Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 22.09.2022Document1 pageDaily Equity Market Report - 22.09.2022Fuaad DodooNo ratings yet

- Auctresults 1800Document1 pageAuctresults 1800Fuaad DodooNo ratings yet

- Daily Equity Market Report - 02.03.2022Document1 pageDaily Equity Market Report - 02.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.09.2022Document1 pageDaily Equity Market Report - 28.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 09.06.2022Document1 pageDaily Equity Market Report - 09.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 01.06.2022 2022-06-01Document1 pageDaily Equity Market Report 01.06.2022 2022-06-01Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 18.03.2022Document2 pagesWeekly Capital Market Report - Week Ending 18.03.2022Fuaad DodooNo ratings yet

- Auctresults 1794Document1 pageAuctresults 1794Fuaad DodooNo ratings yet

- Daily Equity Market Report - 14.07.2022Document1 pageDaily Equity Market Report - 14.07.2022Fuaad DodooNo ratings yet

- Auctresults 1778Document1 pageAuctresults 1778Fuaad DodooNo ratings yet

- Daily Equity Market Report - 08.06.2022Document1 pageDaily Equity Market Report - 08.06.2022Fuaad DodooNo ratings yet

- Payroll Activity Details: Bay Beak Co. From 1 January 2022 To 31 January 2022Document2 pagesPayroll Activity Details: Bay Beak Co. From 1 January 2022 To 31 January 2022Janine Leigh BacalsoNo ratings yet

- Daily Equity Market Report - 03.03.2022Document1 pageDaily Equity Market Report - 03.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.01.2022Document1 pageDaily Equity Market Report - 04.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 27.09.2022Document1 pageDaily Equity Market Report - 27.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.05.2022Document1 pageDaily Equity Market Report - 26.05.2022Fuaad DodooNo ratings yet

- Auctresults 1817Document1 pageAuctresults 1817Fuaad DodooNo ratings yet

- Auctresults 1797Document1 pageAuctresults 1797Fuaad DodooNo ratings yet

- Auctresults 1809Document1 pageAuctresults 1809Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.07.2022Document1 pageDaily Equity Market Report - 05.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.07.2022Document1 pageDaily Equity Market Report - 26.07.2022Fuaad DodooNo ratings yet

- Auctresults 1816Document1 pageAuctresults 1816Fuaad DodooNo ratings yet

- Daily Equity Market Report - 16.02.2022Document1 pageDaily Equity Market Report - 16.02.2022Fuaad DodooNo ratings yet

- Restated Balance Dec 31 2022Document5 pagesRestated Balance Dec 31 2022Oleksandyr UsykNo ratings yet

- Daily Equity Market Report 20.09.2022 2022-09-20Document1 pageDaily Equity Market Report 20.09.2022 2022-09-20Fuaad DodooNo ratings yet

- Value for Money in Public–Private Partnerships: An Infrastructure Governance ApproachFrom EverandValue for Money in Public–Private Partnerships: An Infrastructure Governance ApproachNo ratings yet

- Daily Equity Market Report - 18.10.2022Document1 pageDaily Equity Market Report - 18.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- 19th Edition of The Ghana Club 100 Rankings OutcomeDocument3 pages19th Edition of The Ghana Club 100 Rankings OutcomeFuaad DodooNo ratings yet

- Daily Equity Market Report - 11.10.2022Document1 pageDaily Equity Market Report - 11.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 07.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 07.10.2022Fuaad DodooNo ratings yet

- Press Release 2Document1 pagePress Release 2Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.10.2022Fuaad DodooNo ratings yet

- Substandard (Contaminated) Paediatric Medicines Identified in WHODocument4 pagesSubstandard (Contaminated) Paediatric Medicines Identified in WHOFuaad DodooNo ratings yet

- R9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Document4 pagesR9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.10.2022Document1 pageDaily Equity Market Report - 06.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 03.10.2022 2022-10-03Document1 pageDaily Equity Market Report 03.10.2022 2022-10-03Fuaad DodooNo ratings yet

- Press ReleaseDocument1 pagePress ReleaseFuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Regulatory Order To ECG - 221004 - 180752Document6 pagesRegulatory Order To ECG - 221004 - 180752Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 30.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 30.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 03.10.2022Document1 pageFixed Income Market Report - 03.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.09.2022Document1 pageDaily Equity Market Report - 28.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 27.09.2022Document1 pageDaily Equity Market Report - 27.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 29.09.2022Document1 pageDaily Equity Market Report - 29.09.2022Fuaad DodooNo ratings yet

- Imf MeetingDocument1 pageImf MeetingFuaad DodooNo ratings yet

- Fixed Income Market Report - 26.09.2022Document1 pageFixed Income Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 20.09.2022 2022-09-20Document1 pageDaily Equity Market Report 20.09.2022 2022-09-20Fuaad DodooNo ratings yet

- Auctresults 1817Document1 pageAuctresults 1817Fuaad DodooNo ratings yet

- Nimed Financial Market Review (16.09.2022)Document4 pagesNimed Financial Market Review (16.09.2022)Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.09.2022Document1 pageDaily Equity Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 22.09.2022Document1 pageDaily Equity Market Report - 22.09.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 23.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 23.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 19.09.2022Document1 pageFixed Income Market Report - 19.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 19.09.2022Document1 pageDaily Equity Market Report - 19.09.2022Fuaad DodooNo ratings yet

- New Rantal PDFDocument1 pageNew Rantal PDFNARESH GANDHAM0% (1)

- Comparative Economic PlanningDocument12 pagesComparative Economic PlanningANGELICA PONSICANo ratings yet

- 1macroeconomics Under Graduate Course Chapters 123Document159 pages1macroeconomics Under Graduate Course Chapters 123fiker tesfaNo ratings yet

- A Chip On Your ShoulderDocument1 pageA Chip On Your Shoulder90JDSF8938JLSNF390J3No ratings yet

- MacroeconomicsDocument18 pagesMacroeconomicsbigdottyonendzNo ratings yet

- Macroeconomics Canadian 15th Edition Blanchard Solutions ManualDocument3 pagesMacroeconomics Canadian 15th Edition Blanchard Solutions Manualdrusilladaisyvlz9a100% (21)

- Eae 404 Economics of Public Enterprises-1Document86 pagesEae 404 Economics of Public Enterprises-1janeNo ratings yet

- Math Project-2 Section CDocument6 pagesMath Project-2 Section CMeena LadlaNo ratings yet

- Marxist Approach PPT (NOPASS)Document12 pagesMarxist Approach PPT (NOPASS)France Nathaniel Canale100% (1)

- Chapter 1 PowerPoint SlidesDocument19 pagesChapter 1 PowerPoint SlidessamimiacademyNo ratings yet

- Economics Lesson 3Document16 pagesEconomics Lesson 3Ashleigh JarrettNo ratings yet

- Title Gold Loan 2Document3 pagesTitle Gold Loan 2LuciferNo ratings yet

- Tutorial 1 - Questions - Topic 1-2Document3 pagesTutorial 1 - Questions - Topic 1-2Xasiyev IbrahimNo ratings yet

- 856 Economics QPDocument4 pages856 Economics QPMojahid AnsariNo ratings yet

- Kami Export - Madison Tayor Unit 4 Study GuideDocument2 pagesKami Export - Madison Tayor Unit 4 Study GuideMadison TNo ratings yet

- Labor Case AssignmentsDocument3 pagesLabor Case AssignmentsKrystalynne AguilarNo ratings yet

- FullStmt 1663500693764 3730232321929 Malikaliawan12Document16 pagesFullStmt 1663500693764 3730232321929 Malikaliawan12Malikali AwanNo ratings yet

- PPTs On Reserve Bank of India (Unit - 1-2)Document21 pagesPPTs On Reserve Bank of India (Unit - 1-2)Ravi saxenaNo ratings yet

- Say S Law of MarketsDocument8 pagesSay S Law of MarketsAnmol SharmaNo ratings yet

- MFM Chap-03Document12 pagesMFM Chap-03VEDANT XNo ratings yet

- Split-Pdf-Down-The-Middle - Chesnais Livro Finance Capital Today 2016-1Document308 pagesSplit-Pdf-Down-The-Middle - Chesnais Livro Finance Capital Today 2016-1Diego Vieira de QueirozNo ratings yet

- Irving FisherDocument12 pagesIrving Fisherthomas555No ratings yet

- Principles of Macroeconomics - FullDocument375 pagesPrinciples of Macroeconomics - FullHafsa YusifNo ratings yet

- Socialism in Europe and The Russian RevolutionDocument3 pagesSocialism in Europe and The Russian RevolutionzainabNo ratings yet

- 05 Task Performance 1 THAKURDocument1 page05 Task Performance 1 THAKURArianne Najah ThakurNo ratings yet

- JosephineDocument6 pagesJosephineJosephine Cabo BravaNo ratings yet

- Macroeconomics Canadian 4th Edition Williamson Solutions Manual Full Chapter PDFDocument31 pagesMacroeconomics Canadian 4th Edition Williamson Solutions Manual Full Chapter PDFqueeningalgatestrq0100% (14)

- Regulations and Financial StabilityDocument7 pagesRegulations and Financial StabilityRelaxation MusicNo ratings yet

- Maths Class Notes Simple Interest Mission & KSS Institute, JaipurDocument29 pagesMaths Class Notes Simple Interest Mission & KSS Institute, JaipurNamn SuNo ratings yet

- Eposé PDFDocument3 pagesEposé PDFIhaddadeneNo ratings yet