Professional Documents

Culture Documents

02 Task Performance 1

02 Task Performance 1

Uploaded by

Clency dimasOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

02 Task Performance 1

02 Task Performance 1

Uploaded by

Clency dimasCopyright:

Available Formats

BM1904

NAME: DATE: SCORE: ____________

Financial Markets and Institutions (15 items x 5 points)

Assume that you recently graduated with a degree in finance and have just reported working as an investment

adviser at the brokerage firm of Mac Lyn Don & Co. Your first assignment is to explain the nature of the Philippine

financial markets to Pedro Juan, a professional basketball player who recently came to the Philippines from the

United States. Juan is a highly ranked basketball player who expects to invest substantial amounts of money

through Mac Lyn Don & Co. He would like to understand in general terms what will happen to his money. Your

boss has developed the following questions that you must use to explain the Philippine financial system to Juan.

1. What are the three (3) primary ways in which capital is transferred between savers and borrowers? Describe

each.

2. What is a market?

3. Differentiate the following types of markets:

a. physical asset markets vs. financial asset markets;

b. spot markets vs. futures markets;

c. money markets vs. capital markets;

d. primary markets vs. secondary markets; and

e. public markets vs. private markets.

4. Why are financial markets essential for a healthy economy and economic growth?

5. Briefly describe each of the following financial institutions: investment banks, commercial banks, financial

services corporations, pension funds, mutual funds, exchange-traded funds, hedge funds, and private

equity companies.

6. If Apple decided to issue additional common stock, and Juan purchased 100 shares of this stock from Mac

Lyn Don & Co., the underwriter, would this transaction be a primary or a secondary market transaction?

7. Would it make a difference if Juan purchased previously outstanding Apple stock in the dealer market?

Explain.

8. What does it mean for a market to be efficient? Explain why some stock prices may be more efficient than

others.

9. After your consultation with Pedro Juan, he wants to discuss these two (2) possible stock purchases:

a. While in the waiting room of your office, he overheard an analyst on a financial TV network say that a

particular medical research company just received Food and Drug Administration (FDA) approval for

one of its products. Based on this “hot” information, Pedro Juan wants to buy many shares of that

company’s stock. Assuming the stock market is highly efficient, what advice would you give him?

b. He has read several newspaper articles about a huge initial public offering (IPO) being carried out by a

leading technology company. He wants to purchase as many shares in the IPO as possible and would

even be willing to buy the shares in the open market immediately after the issue. What advice do you

have for him?

10. How does behavioral finance explain the real-world inconsistencies of the efficient markets hypothesis

(EMH)?

Rubric for Grading:

CRITERIA PERFORMANCE INDICATORS POINTS

Content Provided pieces of evidence, supporting details, and factual scenarios 2

Grammar Used correct grammar, punctuation, spelling, and capitalization 1

Organization of ideas Expressed the points in clear and logical arrangement of ideas in the paragraph 2

TOTAL 5

Reference

Brigham, E. F. & Houston, J. F. (2017). Fundamentals of financial management (concise) (9th ed.). Boston, MA: Cengage Learning.

02 Task Performance 1 *Property of STI

Page 1 of 1

You might also like

- 2020 Mock Exam - LIIIDocument143 pages2020 Mock Exam - LIIISteph O100% (2)

- Raising Capital: Get the Money You Need to Grow Your BusinessFrom EverandRaising Capital: Get the Money You Need to Grow Your BusinessRating: 3 out of 5 stars3/5 (1)

- Test Bank For Fundamentals of Investing 14th by SmartDocument25 pagesTest Bank For Fundamentals of Investing 14th by SmartPatrick Kavanaugh100% (44)

- FNCE 249: Assignment 1: InstructionsDocument8 pagesFNCE 249: Assignment 1: Instructionsmicrobiology biotechnology0% (1)

- Case QuestionsDocument5 pagesCase Questionsaditi_sharma_65No ratings yet

- Magnetar and Peloton QuestionsDocument1 pageMagnetar and Peloton QuestionsVinay GoyalNo ratings yet

- Case QuestionsDocument5 pagesCase Questionschoijin9870% (1)

- Activity: Jollibee Foods Corporation (JFC)Document2 pagesActivity: Jollibee Foods Corporation (JFC)Palileo KidsNo ratings yet

- Expectancy: What Is Expectancy in A Nutshell?Document3 pagesExpectancy: What Is Expectancy in A Nutshell?rafa manggala100% (1)

- Time Warner, Inc., Is Playing Games With Stockholders.Document12 pagesTime Warner, Inc., Is Playing Games With Stockholders.WolfManNo ratings yet

- 02 Performance Task 1Document1 page02 Performance Task 1Janrey RomanNo ratings yet

- ASSIGNMENT 2 Financial Market &institution - Docx To BeDocument2 pagesASSIGNMENT 2 Financial Market &institution - Docx To BealemayehuNo ratings yet

- BCom - Third Year (External) Annual PatternDocument15 pagesBCom - Third Year (External) Annual PatternAshwini kumarNo ratings yet

- Malinao, Chatty Bsa 3 - 1A: Name: Date: ScoreDocument3 pagesMalinao, Chatty Bsa 3 - 1A: Name: Date: ScoreChatty MalinaoNo ratings yet

- Sem IV Ib Specialisation AssignmentsDocument2 pagesSem IV Ib Specialisation AssignmentssalafNo ratings yet

- 01 Task Performance 12Document3 pages01 Task Performance 12Adrasteia ZachryNo ratings yet

- Page - 1Document7 pagesPage - 1Collins ManalaysayNo ratings yet

- Business Finance - LAS - q1 - w2 - Finance and The Activities of Financial Manager and Financial Institutions and MarketsDocument5 pagesBusiness Finance - LAS - q1 - w2 - Finance and The Activities of Financial Manager and Financial Institutions and MarketsVon Violo BuenavidesNo ratings yet

- BUS 5111 - Financial Management - Written Assignment Unit 6Document7 pagesBUS 5111 - Financial Management - Written Assignment Unit 6LaVida LocaNo ratings yet

- Solution of Chapter 1Document3 pagesSolution of Chapter 1Văn TạNo ratings yet

- Fixed Income (5 Points)Document3 pagesFixed Income (5 Points)lecruzcNo ratings yet

- UntitledDocument11 pagesUntitledhariNo ratings yet

- Project Report Primary Market Investors Views PDFDocument14 pagesProject Report Primary Market Investors Views PDFDines Kumar0% (1)

- 18mb9016 - Indian Economy & PolicyDocument8 pages18mb9016 - Indian Economy & PolicyKhari haranNo ratings yet

- MFP 1Document2 pagesMFP 1rykaNo ratings yet

- Banking and Finance 1. Individual Assignment (Word Limit: 2,500 WordsDocument3 pagesBanking and Finance 1. Individual Assignment (Word Limit: 2,500 WordsSamrah QamarNo ratings yet

- Financial Markets: Online Assessment October 30, 2020Document12 pagesFinancial Markets: Online Assessment October 30, 2020Krimstix SuperstixNo ratings yet

- 1 Financial Reporting N Acc StandardsDocument35 pages1 Financial Reporting N Acc StandardsRafli ErnawaNo ratings yet

- MBA-2 Sem-III: Management of Financial ServicesDocument17 pagesMBA-2 Sem-III: Management of Financial ServicesDivyang VyasNo ratings yet

- Course Guide-Financial Market-2020 PDFDocument6 pagesCourse Guide-Financial Market-2020 PDFMellanie SerranoNo ratings yet

- MEFA Most Important QuestionsDocument2 pagesMEFA Most Important QuestionsNARESHNo ratings yet

- April 2006, Part B (Question 1b) April 2009, Part B (Question 1b)Document6 pagesApril 2006, Part B (Question 1b) April 2009, Part B (Question 1b)Atiqah ShamsuddinNo ratings yet

- Department of Management Studies: Prepared byDocument11 pagesDepartment of Management Studies: Prepared byrijaNo ratings yet

- The Post Offering Performance of Ipos From The Banking IndustryDocument20 pagesThe Post Offering Performance of Ipos From The Banking IndustrypradeepchoudharyNo ratings yet

- BIOINFO Financial ManagementDocument8 pagesBIOINFO Financial Managementletagemechu29No ratings yet

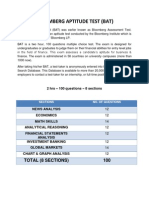

- Bloomberg Aptitude Test (BAT)Document10 pagesBloomberg Aptitude Test (BAT)Shivgan Joshi100% (1)

- Ketan Parekh CaseDocument30 pagesKetan Parekh CaseKushan KhatriNo ratings yet

- Bài Tập Và Đáp Án Chương 1Document9 pagesBài Tập Và Đáp Án Chương 1nguyenductaiNo ratings yet

- Fin 1107 - Midterm - DalDocument3 pagesFin 1107 - Midterm - DalDyan LuceroNo ratings yet

- Notes From Berkshire Meeting 2012Document12 pagesNotes From Berkshire Meeting 2012scottleeyNo ratings yet

- Case Discussion Questions Fall 2010Document6 pagesCase Discussion Questions Fall 2010j_zaikovskayaNo ratings yet

- W BUSINESS ANALYTICS (14MBA14) - QUESTION PAPERDocument2 pagesW BUSINESS ANALYTICS (14MBA14) - QUESTION PAPERsaravananNo ratings yet

- Quiz Laguitao FinancialMarket BSA501Document3 pagesQuiz Laguitao FinancialMarket BSA501Catherine LaguitaoNo ratings yet

- Thesis Topics Related To Stock MarketDocument6 pagesThesis Topics Related To Stock Marketmichelledavisvirginiabeach100% (2)

- Assientment 6Document6 pagesAssientment 6anvithapremagowdaNo ratings yet

- BBA 3005 Corporate Finance (Assignment)Document17 pagesBBA 3005 Corporate Finance (Assignment)VentusNo ratings yet

- Tutorial 3 bnk501Document4 pagesTutorial 3 bnk501Veronica MishraNo ratings yet

- FM03 Security Analysis and Portfolio Management: Assignment No.IDocument3 pagesFM03 Security Analysis and Portfolio Management: Assignment No.Ianon_187970231No ratings yet

- 11 Quiz 1Document3 pages11 Quiz 1Arvin DegraciaNo ratings yet

- Mini Case: An Overview of Financial Management and The Financial EnvironmentDocument1 pageMini Case: An Overview of Financial Management and The Financial Environmentadrien_ducaillouNo ratings yet

- Final Research ProjectDocument11 pagesFinal Research Projectvaibhav katkarNo ratings yet

- Newsletter April 20 PDFDocument3 pagesNewsletter April 20 PDFSindhu Arauvinth RaajNo ratings yet

- Marketing Financial ServicesDocument5 pagesMarketing Financial ServicesshijinallepillyNo ratings yet

- Foundations - Of.finance.8th - Ed. Keown 10Document5 pagesFoundations - Of.finance.8th - Ed. Keown 10ardagrbwNo ratings yet

- Ccil Debt MarketDocument27 pagesCcil Debt MarketABHAYNo ratings yet

- Article On Indian Bond Market PDFDocument27 pagesArticle On Indian Bond Market PDFchat.anitaNo ratings yet

- Map Financial MarketesDocument3 pagesMap Financial MarketesBryan Ivann MacasinagNo ratings yet

- Test Bank For Fundamentals of Investing 12th Edition by Smart ISBN 0133075354 9780133075359Document36 pagesTest Bank For Fundamentals of Investing 12th Edition by Smart ISBN 0133075354 9780133075359JamesFosterisfn100% (27)

- The Economics of Money, Banking, and Financial Markets: Twelfth Edition, Global EditionsDocument29 pagesThe Economics of Money, Banking, and Financial Markets: Twelfth Edition, Global EditionsOtgoo HNo ratings yet

- List of Things To SearchDocument3 pagesList of Things To SearchMorajkar VaishnaviNo ratings yet

- QUESTIONSDocument3 pagesQUESTIONSCarmela JimenezNo ratings yet

- PHD Thesis On Performance Evaluation of Indian Mutual FundsDocument7 pagesPHD Thesis On Performance Evaluation of Indian Mutual Fundsjennysmithportland100% (2)

- Vimal Dairy MbaDocument81 pagesVimal Dairy MbaViral Chaudhari0% (1)

- Margin of SafetyDocument10 pagesMargin of Safetybig aceNo ratings yet

- Sustainable Value Creation For All Stakeholders: June 11, 2018Document48 pagesSustainable Value Creation For All Stakeholders: June 11, 2018K BNo ratings yet

- 06 ChapterDocument222 pages06 Chaptermohd ameerNo ratings yet

- Code of Ethics Conduct ValeDocument12 pagesCode of Ethics Conduct ValeDedi Tista AmijayaNo ratings yet

- Comp-XM Basix Guide PDFDocument6 pagesComp-XM Basix Guide PDFJai PhookanNo ratings yet

- Corporate Governance and Social Responsibility Assignment: Name: Ravneet Rehal 2 Year Section A Roll No. 36Document14 pagesCorporate Governance and Social Responsibility Assignment: Name: Ravneet Rehal 2 Year Section A Roll No. 36ravneetNo ratings yet

- MergerDocument16 pagesMergeralysonmicheaalaNo ratings yet

- Test BankDocument14 pagesTest BankB1111815167 WSBNo ratings yet

- Ethics Policy of KrogerDocument21 pagesEthics Policy of Krogerkidskumar0% (1)

- SalesDocument221 pagesSalesAriane Kae EspinaNo ratings yet

- CA Final DT LMR PDFDocument315 pagesCA Final DT LMR PDFCA Mopidevi BharadwajaNo ratings yet

- DionyMed - CSE Form 2A - Listing Application ConformedDocument479 pagesDionyMed - CSE Form 2A - Listing Application ConformeddesigndreamNo ratings yet

- FAR16 Share Capital Transactions - For PrintDocument9 pagesFAR16 Share Capital Transactions - For PrintAJ CresmundoNo ratings yet

- MSC - Finance - Brochure - PDF Imperial College of LondonDocument8 pagesMSC - Finance - Brochure - PDF Imperial College of Londonwahajbond007No ratings yet

- IPS Slides S12Document17 pagesIPS Slides S12mundal minatiNo ratings yet

- RR No. 11-2018Document47 pagesRR No. 11-2018Micah Adduru - RoblesNo ratings yet

- BDM - Corporate Finance, OptionsDocument105 pagesBDM - Corporate Finance, OptionsMatlab ECAMNo ratings yet

- All About Stock Market - Read ItDocument53 pagesAll About Stock Market - Read ItravinyseNo ratings yet

- Mergers and Amalgamations-The Concepts: Chapter-IvDocument44 pagesMergers and Amalgamations-The Concepts: Chapter-IvDilwar HussainNo ratings yet

- Register Free: Syllabus Revision 20% Guaranteed Score Doubt Solving NasaDocument16 pagesRegister Free: Syllabus Revision 20% Guaranteed Score Doubt Solving NasaKavita SinghNo ratings yet

- RSK4803 Janfeb 2021 MemoDocument15 pagesRSK4803 Janfeb 2021 Memobradley.malachiclark11No ratings yet

- EifrigDocument15 pagesEifrigHNmaichoi100% (1)

- (David L. Goetsch Stanley Davis) Introduction ToDocument196 pages(David L. Goetsch Stanley Davis) Introduction ToThyya Chemmuet100% (1)

- PT. Unilever Indonesia TBK.: Head OfficeDocument1 pagePT. Unilever Indonesia TBK.: Head OfficeLinaNo ratings yet

- 7 Audit of Shareholders Equity and Related Accounts Dlsau Integ t31920Document5 pages7 Audit of Shareholders Equity and Related Accounts Dlsau Integ t31920Heidee ManliclicNo ratings yet