Professional Documents

Culture Documents

Coi - A.Y. 2017-2018 - Bharti Gohil

Coi - A.Y. 2017-2018 - Bharti Gohil

Uploaded by

Suman jhaCopyright:

Available Formats

You might also like

- Member Directory & Resource Guide: International Liquid Terminals AssociationDocument76 pagesMember Directory & Resource Guide: International Liquid Terminals Associationayşe çolak100% (1)

- Income Tax Worksheet For The Financial Year APR-2019 To MAR-2020Document1 pageIncome Tax Worksheet For The Financial Year APR-2019 To MAR-2020SHIBANI CHOUDHURYNo ratings yet

- Case Analysis 2012 Fuel Hedging at JetBlDocument3 pagesCase Analysis 2012 Fuel Hedging at JetBlPritam Karmakar0% (1)

- Computation of Total Income: Zenit - A KDK Software ProductDocument2 pagesComputation of Total Income: Zenit - A KDK Software ProductNitin PalNo ratings yet

- 20-21 COMPUTATION (1) Amarjit KaurDocument3 pages20-21 COMPUTATION (1) Amarjit KaurTanvi DhingraNo ratings yet

- ITR Computation ABOPD4303LDocument2 pagesITR Computation ABOPD4303LJIGNA NAKARNo ratings yet

- COMPUTATIONDocument2 pagesCOMPUTATIONjaredford913No ratings yet

- Comp FY 2019-2020Document2 pagesComp FY 2019-2020Tayal SahabNo ratings yet

- 19-20 ComputationDocument3 pages19-20 ComputationTanvi DhingraNo ratings yet

- Computation of Total Income: Zenit - A KDK Software ProductDocument2 pagesComputation of Total Income: Zenit - A KDK Software ProductNitin PalNo ratings yet

- Aman Sharma ITR AY2021Document3 pagesAman Sharma ITR AY2021Abhishek SaxenaNo ratings yet

- Coi Ay 2021-22 Nupur SinghalDocument2 pagesCoi Ay 2021-22 Nupur Singhalprateek gangwaniNo ratings yet

- Computation of Total Income (As Per 115bac) : Zenit - A KDK Software ProductDocument2 pagesComputation of Total Income (As Per 115bac) : Zenit - A KDK Software ProductSachin KumarNo ratings yet

- GAMDOORDocument2 pagesGAMDOORRashpreet PandiNo ratings yet

- Computation 22-23 AyDocument2 pagesComputation 22-23 AysonuNo ratings yet

- 19-20 Computation Amarjit KaurDocument3 pages19-20 Computation Amarjit KaurTanvi DhingraNo ratings yet

- Computation of Income Tax Sagar Panjwani FY 2016-17Document3 pagesComputation of Income Tax Sagar Panjwani FY 2016-17Amol vasanta dhakateNo ratings yet

- ComputationsDocument2 pagesComputationsJKMSMM BNo ratings yet

- Coi 23-24 Lalu YadavDocument2 pagesCoi 23-24 Lalu Yadavtejpalsinghyadav786No ratings yet

- Computation of Total Income: Zenit - A KDK Software Software ProductDocument2 pagesComputation of Total Income: Zenit - A KDK Software Software Productkunjal mistryNo ratings yet

- Mrs - Pelleti Sri LathaDocument2 pagesMrs - Pelleti Sri LathaKarthi KNo ratings yet

- Computation 21 22Document1 pageComputation 21 22aarushi singhNo ratings yet

- Coi Ay 2021-22 Kanta SinghalDocument2 pagesCoi Ay 2021-22 Kanta Singhalprateek gangwaniNo ratings yet

- Kapil Raj Mandavi Computation 23-24Document2 pagesKapil Raj Mandavi Computation 23-24khan khanNo ratings yet

- Ay2022 23 Ujjawal Dhawan Apypd6567j ComputationDocument2 pagesAy2022 23 Ujjawal Dhawan Apypd6567j ComputationAkshat MittalNo ratings yet

- CompDocument3 pagesCompTANMOY BISWASNo ratings yet

- BAISAKHADocument2 pagesBAISAKHARashpreet PandiNo ratings yet

- Computation of Total Income: Zenit - A KDK Software Software ProductDocument2 pagesComputation of Total Income: Zenit - A KDK Software Software ProductKartik RajputNo ratings yet

- Howe Engineering Projects India PVT LTD: Earnings Amount Deductions Amount Perks/Other income/Exempton/RebatesDocument1 pageHowe Engineering Projects India PVT LTD: Earnings Amount Deductions Amount Perks/Other income/Exempton/RebatesSumantrra ChattopadhyayNo ratings yet

- Coi Ay 2021-22 Naveen KumarDocument3 pagesCoi Ay 2021-22 Naveen Kumarprateek gangwaniNo ratings yet

- Doc-20230725-Wa0011. (2)Document1 pageDoc-20230725-Wa0011. (2)s0026637No ratings yet

- Ss Ahuja Comp PDFDocument2 pagesSs Ahuja Comp PDFSwaran AhujaNo ratings yet

- Arvind Computation 20-21Document2 pagesArvind Computation 20-21BISHAL KCNo ratings yet

- Karmi Devi - ITR 22 23Document3 pagesKarmi Devi - ITR 22 23R C SHARMANo ratings yet

- Computationofincome2023 1Document2 pagesComputationofincome2023 1rtaxhelp helpNo ratings yet

- Draft Comp 23-24-1Document2 pagesDraft Comp 23-24-1Vishal SinghNo ratings yet

- Kailash 21-22 ComputationDocument2 pagesKailash 21-22 Computationmanoj.sharma110045No ratings yet

- Vasu Comp Ay 21-22Document2 pagesVasu Comp Ay 21-22Manikanta rajaNo ratings yet

- ComputationDocument2 pagesComputationnsispatna1No ratings yet

- August PDFDocument1 pageAugust PDFnivash chinnasamyNo ratings yet

- Pay Slip For The Month of January 2018: Earnings Deductons ReimbursementsDocument1 pagePay Slip For The Month of January 2018: Earnings Deductons ReimbursementsBHAUSAHEB KOKANENo ratings yet

- Sumeet Tiwari Comp 2024-2025Document2 pagesSumeet Tiwari Comp 2024-2025SHUBHAM YADAVNo ratings yet

- Paysliper Template Grid1Document2 pagesPaysliper Template Grid1MS InternationalNo ratings yet

- Kailash 22-23 ComputationDocument2 pagesKailash 22-23 Computationmanoj.sharma110045No ratings yet

- Computation of Shankar Sharma V2Document2 pagesComputation of Shankar Sharma V2akhil kwatraNo ratings yet

- Comp 2324Document2 pagesComp 2324ranjeetdecorater023No ratings yet

- Computation 22-23Document2 pagesComputation 22-23Raj DelhiNo ratings yet

- Arvind Computation 21-22Document2 pagesArvind Computation 21-22BISHAL KCNo ratings yet

- Summary 1689086671Document4 pagesSummary 1689086671Akshay SharmaNo ratings yet

- AY2021-22 ARUN KUMAR-DTTPK8285A-ComputationDocument2 pagesAY2021-22 ARUN KUMAR-DTTPK8285A-ComputationRaghav SharmaNo ratings yet

- Comp 22-23Document1 pageComp 22-23Rohit IrkalNo ratings yet

- AMRINDER2Document1 pageAMRINDER2amancommercialNo ratings yet

- April Payment SleepDocument1 pageApril Payment Sleepizajahamed1No ratings yet

- PL and Balance Sheet Detailed FormatDocument5 pagesPL and Balance Sheet Detailed FormatPradeep G MenonNo ratings yet

- VBRViewer PDFDocument1 pageVBRViewer PDFAmitraja DasNo ratings yet

- Mashood K ITR COMPUTATION AY 2022-23Document3 pagesMashood K ITR COMPUTATION AY 2022-23sidvikventuresNo ratings yet

- Shivansh WarehouseDocument1 pageShivansh WarehouseAccounts DepartmentNo ratings yet

- Pay SlipDocument1 pagePay SlipSonuNo ratings yet

- Aamir 22-23 Income StatementDocument1 pageAamir 22-23 Income StatementMohammed MoizNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Report 20220914150016Document2 pagesReport 20220914150016Suman jhaNo ratings yet

- Memorandum of AssociationDocument6 pagesMemorandum of AssociationSuman jhaNo ratings yet

- (For Individuals and Hufs Having Income From Profits and Gains Business or Profession) (Please See Rule 12 of The Income-Tax Rules, 1962)Document58 pages(For Individuals and Hufs Having Income From Profits and Gains Business or Profession) (Please See Rule 12 of The Income-Tax Rules, 1962)Suman jhaNo ratings yet

- Image (27) - 2Document1 pageImage (27) - 2Suman jhaNo ratings yet

- Udyam Registration Certificate HSC FULLDocument3 pagesUdyam Registration Certificate HSC FULLSuman jhaNo ratings yet

- Haridarshan-Steel-Corporation. GSTDocument3 pagesHaridarshan-Steel-Corporation. GSTSuman jhaNo ratings yet

- Acknowledgement Number 981933260051221Document90 pagesAcknowledgement Number 981933260051221Suman jhaNo ratings yet

- GST Certificate Piyush PatelDocument3 pagesGST Certificate Piyush PatelSuman jhaNo ratings yet

- (For Individuals and Hufs Having Income From Profits and Gains Business or Profession) (Please See Rule 12 of The Income-Tax Rules, 1962)Document60 pages(For Individuals and Hufs Having Income From Profits and Gains Business or Profession) (Please See Rule 12 of The Income-Tax Rules, 1962)Suman jhaNo ratings yet

- Image (27) - 3Document1 pageImage (27) - 3Suman jhaNo ratings yet

- Last Month Bank StatementDocument2 pagesLast Month Bank StatementSuman jhaNo ratings yet

- Udyam MSME 2021Document2 pagesUdyam MSME 2021Suman jhaNo ratings yet

- Detailstatement - 21 4 2022@18 58 11Document8 pagesDetailstatement - 21 4 2022@18 58 11Suman jhaNo ratings yet

- GST Certificate ElcabDocument3 pagesGST Certificate ElcabSuman jhaNo ratings yet

- DSC Authorisation FormDocument2 pagesDSC Authorisation FormSuman jhaNo ratings yet

- Incon Tax Return (Last Year)Document1 pageIncon Tax Return (Last Year)Suman jhaNo ratings yet

- Image (27) - 5Document1 pageImage (27) - 5Suman jhaNo ratings yet

- Form GST REG-06: (Amended)Document3 pagesForm GST REG-06: (Amended)Suman jhaNo ratings yet

- Acct Statement - FEBRUARYDocument3 pagesAcct Statement - FEBRUARYSuman jhaNo ratings yet

- Itr Ay 2021Document57 pagesItr Ay 2021Suman jhaNo ratings yet

- Elcab PanDocument1 pageElcab PanSuman jhaNo ratings yet

- 6.GSTIN Dhriti EnvirocareDocument3 pages6.GSTIN Dhriti EnvirocareSuman jhaNo ratings yet

- Form GST REG-06: /Mehboobkj-Ian Faridkha N Pa Tha N If Arhana de CoraDocument2 pagesForm GST REG-06: /Mehboobkj-Ian Faridkha N Pa Tha N If Arhana de CoraSuman jhaNo ratings yet

- Divya Designo Tiles 201920 Itr - 1Document79 pagesDivya Designo Tiles 201920 Itr - 1Suman jhaNo ratings yet

- 9.itr 2017-18Document2 pages9.itr 2017-18Suman jhaNo ratings yet

- Divya Designo Tiles 201920 Itr - 1Document64 pagesDivya Designo Tiles 201920 Itr - 1Suman jhaNo ratings yet

- Divya Designo Tiles 201920 ItrDocument61 pagesDivya Designo Tiles 201920 ItrSuman jhaNo ratings yet

- 10.udyam Registration Certificate Udyam Gj-22-0004105Document2 pages10.udyam Registration Certificate Udyam Gj-22-0004105Suman jhaNo ratings yet

- 8.itr 2018-19Document4 pages8.itr 2018-19Suman jhaNo ratings yet

- Crystal Statement - 1Document7 pagesCrystal Statement - 1Suman jhaNo ratings yet

- Bkar3033 Financial Accounting and Reporting Iii: Dr. Halimah at Nasibah Binti AhmadDocument23 pagesBkar3033 Financial Accounting and Reporting Iii: Dr. Halimah at Nasibah Binti AhmadezwanNo ratings yet

- July 25, 2022Document77 pagesJuly 25, 2022Debasish DashNo ratings yet

- Wong Kim Choong Chief Executive Officer UOBM Corporate Day 4 - 5 September 2014Document21 pagesWong Kim Choong Chief Executive Officer UOBM Corporate Day 4 - 5 September 2014Gopalakrishnan SekharanNo ratings yet

- Service Sector in India - A SWOT AnalysisDocument12 pagesService Sector in India - A SWOT AnalysisMohammad Miyan0% (1)

- Invt Chapter 2Document29 pagesInvt Chapter 2Khadar MaxamedNo ratings yet

- Munhumutapa School of Commerce Name Student Number Course Title & Code Lecturer Task DateDocument5 pagesMunhumutapa School of Commerce Name Student Number Course Title & Code Lecturer Task DateNeoline Chipo DzirutsvaNo ratings yet

- 3 - T4 - Business Model & Marketing - enDocument12 pages3 - T4 - Business Model & Marketing - enMera AnaNo ratings yet

- 2018 - Kuldeep Bishnoi - NLU NagpurDocument2 pages2018 - Kuldeep Bishnoi - NLU NagpurLife Hacks Stunt PerfectNo ratings yet

- Cas Persuasive EssayDocument10 pagesCas Persuasive Essayapi-217920829No ratings yet

- Convertible Promissory Note Template 1Document6 pagesConvertible Promissory Note Template 1David Jay Mor100% (5)

- SchemesTap Old - February 2023 Lyst3129Document60 pagesSchemesTap Old - February 2023 Lyst3129Bhanu RaghavNo ratings yet

- Group 6 - BurberryDocument8 pagesGroup 6 - BurberryHasan AshrafNo ratings yet

- Contract-No.-4 FOB Contract For Processed Palm Oil Products in DrumsDocument7 pagesContract-No.-4 FOB Contract For Processed Palm Oil Products in DrumsbillNo ratings yet

- Terms of Reference Levuka Wharf Rehab ProjDocument11 pagesTerms of Reference Levuka Wharf Rehab ProjVinodh KumarNo ratings yet

- 1006 Quality Management PlanDocument35 pages1006 Quality Management PlanSalaNo ratings yet

- SSIS Integration Toolkit For Marketo Help ManualDocument28 pagesSSIS Integration Toolkit For Marketo Help ManualGanesh KamtheNo ratings yet

- Audit of Receivables PSPDocument6 pagesAudit of Receivables PSPMarriel Fate CullanoNo ratings yet

- 2356940-ESTEPHANIA ALVAREZ (Something I Will Always Treasure)Document3 pages2356940-ESTEPHANIA ALVAREZ (Something I Will Always Treasure)Dani OrtizNo ratings yet

- Lipat Vs Pacific BankingDocument10 pagesLipat Vs Pacific BankingYvon BaguioNo ratings yet

- OTC Medicines ListDocument78 pagesOTC Medicines ListBethelhem HabtamuNo ratings yet

- Single-Entry Approach (Sena) : National Conciliation and Mediation BoardDocument7 pagesSingle-Entry Approach (Sena) : National Conciliation and Mediation BoardUNEXPECTEDNo ratings yet

- Shop Leave and License AgreementDocument4 pagesShop Leave and License AgreementDonald Gonsalves60% (10)

- Notification OFK Danger Building Worker PostsDocument11 pagesNotification OFK Danger Building Worker Postssipuns827No ratings yet

- Campus Activewear ProjectDocument17 pagesCampus Activewear Projectscreener0991No ratings yet

- The Procedure of Imports & Exports in Foreign Payment: For BhelDocument72 pagesThe Procedure of Imports & Exports in Foreign Payment: For Bhelsajuthomas1987No ratings yet

- Shanti Business School Operations Management Notes Post Graduate Diploma in Management (PGDM) Module I: Introduction To Operations ManagementDocument18 pagesShanti Business School Operations Management Notes Post Graduate Diploma in Management (PGDM) Module I: Introduction To Operations ManagementYash PatidarNo ratings yet

- 1 HRMP OL Cap Performance p69 Mo Hinh Hooi2020 XemDocument24 pages1 HRMP OL Cap Performance p69 Mo Hinh Hooi2020 XemPhạm NhungNo ratings yet

- Coca Cola Training BookletDocument22 pagesCoca Cola Training BookletrameelNo ratings yet

Coi - A.Y. 2017-2018 - Bharti Gohil

Coi - A.Y. 2017-2018 - Bharti Gohil

Uploaded by

Suman jhaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Coi - A.Y. 2017-2018 - Bharti Gohil

Coi - A.Y. 2017-2018 - Bharti Gohil

Uploaded by

Suman jhaCopyright:

Available Formats

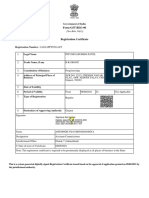

Code :- 532

Name : BHARTI OGHADBHAI GOHIL

Father's Name : OGHADBHAI GOHIL

Address(O) : 116, MANAV NAGAR, NR.PICNIK PARK, VATVA, AHMEDABAD, GUJARAT-380001

Permanent Account No : BMFPG3909L Date of Birth : 02/02/1981

Sex : Female

Status : Individual Resident Status Resident

Previous year : 2016-2017 Assessment Year : 2017-2018

Ward/Circle : Return : ORIGINAL

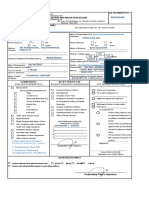

Computation of Total Income

Income Heads Income Income After

Before Set off Set off

Income from Salary 148453 148453

Income from House Property 0 0

Income From Business or Profession 133975 133975

Income from Capital Gains 0 0

Income from Other Sources 0 0

Gross Total Income 282428

Less : Deduction under Chapter VIA 15000

Total Income 267428

Rounding off u/s 288A 267430

Income Taxable at Normal Rate 267430

Income Taxable at Special Rate 0

TAX CALCULATION

Basic Exemption Limit Rs. 250000

Tax at Normal Rates 1743

Total Tax 1743

Less : Tax Rebate u/s 87A 1743

Tax Payable 0

Amount Payable 0

Tax Rounded Off u/s 288 B 0

COMPREHENSIVE DETAIL

Income from salary 148453

Name of employer : Gupta Traders

Period : From 01/04/2016 To 31/03/2017

Particular Total Exempted Taxable

Amount Amount Amount

Gross Salary 167653 0 167653

Allowance :

Allowances Exempt u/s 10 :

Transport Allowance u/s 10(14)(ii) 19200 0

Total 167653 19200 148453

Total Taxable Salary 148453

Income from Business & Profession Details

133975

Business Income u/s 44AD

Gross Receipts (Banking channel) 0

Gross Receipts (Other mode) 535900

Total Gross Receipts 535900

Actual Profit 133975

ZenIT - A KDK Software Product

Actual Profit %age is 25%

Deemed Profit @6% on Gross Receipts 0

(Banking channel)

Deemed Profit @8% on Gross Receipts (Other 42872

mode)

Deemed Profit against Turnover 42872

Higher of Assessable profit 133975

Business Income From 44AD 133975

Total of Business & Profession 133975

Deductions Under Chapter VIA 15000

Description Gross Deductable

Amount Amount

u/s 80C In Respect of Investments 15000 15000

Life Insurance Premium 15000

44AD Turnover Detail

Description Turnover(Non Turnover Gross Actual Profit Actual Profit

Banking) (Banking Turnover (%)

Channel)

Business -1 535900 0 535900 133975 25.00

Total 535900 0 535900 133975

Return Filing Due Date : 31/07/2017 Return Filing Section :

Due Date Extended upto : 05/08/2017 Notification No :

Interest Calculated Upto : 10/02/2018

Verified By : BHARTI OGHADBHAI GOHIL

ZenIT - A KDK Software Product

You might also like

- Member Directory & Resource Guide: International Liquid Terminals AssociationDocument76 pagesMember Directory & Resource Guide: International Liquid Terminals Associationayşe çolak100% (1)

- Income Tax Worksheet For The Financial Year APR-2019 To MAR-2020Document1 pageIncome Tax Worksheet For The Financial Year APR-2019 To MAR-2020SHIBANI CHOUDHURYNo ratings yet

- Case Analysis 2012 Fuel Hedging at JetBlDocument3 pagesCase Analysis 2012 Fuel Hedging at JetBlPritam Karmakar0% (1)

- Computation of Total Income: Zenit - A KDK Software ProductDocument2 pagesComputation of Total Income: Zenit - A KDK Software ProductNitin PalNo ratings yet

- 20-21 COMPUTATION (1) Amarjit KaurDocument3 pages20-21 COMPUTATION (1) Amarjit KaurTanvi DhingraNo ratings yet

- ITR Computation ABOPD4303LDocument2 pagesITR Computation ABOPD4303LJIGNA NAKARNo ratings yet

- COMPUTATIONDocument2 pagesCOMPUTATIONjaredford913No ratings yet

- Comp FY 2019-2020Document2 pagesComp FY 2019-2020Tayal SahabNo ratings yet

- 19-20 ComputationDocument3 pages19-20 ComputationTanvi DhingraNo ratings yet

- Computation of Total Income: Zenit - A KDK Software ProductDocument2 pagesComputation of Total Income: Zenit - A KDK Software ProductNitin PalNo ratings yet

- Aman Sharma ITR AY2021Document3 pagesAman Sharma ITR AY2021Abhishek SaxenaNo ratings yet

- Coi Ay 2021-22 Nupur SinghalDocument2 pagesCoi Ay 2021-22 Nupur Singhalprateek gangwaniNo ratings yet

- Computation of Total Income (As Per 115bac) : Zenit - A KDK Software ProductDocument2 pagesComputation of Total Income (As Per 115bac) : Zenit - A KDK Software ProductSachin KumarNo ratings yet

- GAMDOORDocument2 pagesGAMDOORRashpreet PandiNo ratings yet

- Computation 22-23 AyDocument2 pagesComputation 22-23 AysonuNo ratings yet

- 19-20 Computation Amarjit KaurDocument3 pages19-20 Computation Amarjit KaurTanvi DhingraNo ratings yet

- Computation of Income Tax Sagar Panjwani FY 2016-17Document3 pagesComputation of Income Tax Sagar Panjwani FY 2016-17Amol vasanta dhakateNo ratings yet

- ComputationsDocument2 pagesComputationsJKMSMM BNo ratings yet

- Coi 23-24 Lalu YadavDocument2 pagesCoi 23-24 Lalu Yadavtejpalsinghyadav786No ratings yet

- Computation of Total Income: Zenit - A KDK Software Software ProductDocument2 pagesComputation of Total Income: Zenit - A KDK Software Software Productkunjal mistryNo ratings yet

- Mrs - Pelleti Sri LathaDocument2 pagesMrs - Pelleti Sri LathaKarthi KNo ratings yet

- Computation 21 22Document1 pageComputation 21 22aarushi singhNo ratings yet

- Coi Ay 2021-22 Kanta SinghalDocument2 pagesCoi Ay 2021-22 Kanta Singhalprateek gangwaniNo ratings yet

- Kapil Raj Mandavi Computation 23-24Document2 pagesKapil Raj Mandavi Computation 23-24khan khanNo ratings yet

- Ay2022 23 Ujjawal Dhawan Apypd6567j ComputationDocument2 pagesAy2022 23 Ujjawal Dhawan Apypd6567j ComputationAkshat MittalNo ratings yet

- CompDocument3 pagesCompTANMOY BISWASNo ratings yet

- BAISAKHADocument2 pagesBAISAKHARashpreet PandiNo ratings yet

- Computation of Total Income: Zenit - A KDK Software Software ProductDocument2 pagesComputation of Total Income: Zenit - A KDK Software Software ProductKartik RajputNo ratings yet

- Howe Engineering Projects India PVT LTD: Earnings Amount Deductions Amount Perks/Other income/Exempton/RebatesDocument1 pageHowe Engineering Projects India PVT LTD: Earnings Amount Deductions Amount Perks/Other income/Exempton/RebatesSumantrra ChattopadhyayNo ratings yet

- Coi Ay 2021-22 Naveen KumarDocument3 pagesCoi Ay 2021-22 Naveen Kumarprateek gangwaniNo ratings yet

- Doc-20230725-Wa0011. (2)Document1 pageDoc-20230725-Wa0011. (2)s0026637No ratings yet

- Ss Ahuja Comp PDFDocument2 pagesSs Ahuja Comp PDFSwaran AhujaNo ratings yet

- Arvind Computation 20-21Document2 pagesArvind Computation 20-21BISHAL KCNo ratings yet

- Karmi Devi - ITR 22 23Document3 pagesKarmi Devi - ITR 22 23R C SHARMANo ratings yet

- Computationofincome2023 1Document2 pagesComputationofincome2023 1rtaxhelp helpNo ratings yet

- Draft Comp 23-24-1Document2 pagesDraft Comp 23-24-1Vishal SinghNo ratings yet

- Kailash 21-22 ComputationDocument2 pagesKailash 21-22 Computationmanoj.sharma110045No ratings yet

- Vasu Comp Ay 21-22Document2 pagesVasu Comp Ay 21-22Manikanta rajaNo ratings yet

- ComputationDocument2 pagesComputationnsispatna1No ratings yet

- August PDFDocument1 pageAugust PDFnivash chinnasamyNo ratings yet

- Pay Slip For The Month of January 2018: Earnings Deductons ReimbursementsDocument1 pagePay Slip For The Month of January 2018: Earnings Deductons ReimbursementsBHAUSAHEB KOKANENo ratings yet

- Sumeet Tiwari Comp 2024-2025Document2 pagesSumeet Tiwari Comp 2024-2025SHUBHAM YADAVNo ratings yet

- Paysliper Template Grid1Document2 pagesPaysliper Template Grid1MS InternationalNo ratings yet

- Kailash 22-23 ComputationDocument2 pagesKailash 22-23 Computationmanoj.sharma110045No ratings yet

- Computation of Shankar Sharma V2Document2 pagesComputation of Shankar Sharma V2akhil kwatraNo ratings yet

- Comp 2324Document2 pagesComp 2324ranjeetdecorater023No ratings yet

- Computation 22-23Document2 pagesComputation 22-23Raj DelhiNo ratings yet

- Arvind Computation 21-22Document2 pagesArvind Computation 21-22BISHAL KCNo ratings yet

- Summary 1689086671Document4 pagesSummary 1689086671Akshay SharmaNo ratings yet

- AY2021-22 ARUN KUMAR-DTTPK8285A-ComputationDocument2 pagesAY2021-22 ARUN KUMAR-DTTPK8285A-ComputationRaghav SharmaNo ratings yet

- Comp 22-23Document1 pageComp 22-23Rohit IrkalNo ratings yet

- AMRINDER2Document1 pageAMRINDER2amancommercialNo ratings yet

- April Payment SleepDocument1 pageApril Payment Sleepizajahamed1No ratings yet

- PL and Balance Sheet Detailed FormatDocument5 pagesPL and Balance Sheet Detailed FormatPradeep G MenonNo ratings yet

- VBRViewer PDFDocument1 pageVBRViewer PDFAmitraja DasNo ratings yet

- Mashood K ITR COMPUTATION AY 2022-23Document3 pagesMashood K ITR COMPUTATION AY 2022-23sidvikventuresNo ratings yet

- Shivansh WarehouseDocument1 pageShivansh WarehouseAccounts DepartmentNo ratings yet

- Pay SlipDocument1 pagePay SlipSonuNo ratings yet

- Aamir 22-23 Income StatementDocument1 pageAamir 22-23 Income StatementMohammed MoizNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Report 20220914150016Document2 pagesReport 20220914150016Suman jhaNo ratings yet

- Memorandum of AssociationDocument6 pagesMemorandum of AssociationSuman jhaNo ratings yet

- (For Individuals and Hufs Having Income From Profits and Gains Business or Profession) (Please See Rule 12 of The Income-Tax Rules, 1962)Document58 pages(For Individuals and Hufs Having Income From Profits and Gains Business or Profession) (Please See Rule 12 of The Income-Tax Rules, 1962)Suman jhaNo ratings yet

- Image (27) - 2Document1 pageImage (27) - 2Suman jhaNo ratings yet

- Udyam Registration Certificate HSC FULLDocument3 pagesUdyam Registration Certificate HSC FULLSuman jhaNo ratings yet

- Haridarshan-Steel-Corporation. GSTDocument3 pagesHaridarshan-Steel-Corporation. GSTSuman jhaNo ratings yet

- Acknowledgement Number 981933260051221Document90 pagesAcknowledgement Number 981933260051221Suman jhaNo ratings yet

- GST Certificate Piyush PatelDocument3 pagesGST Certificate Piyush PatelSuman jhaNo ratings yet

- (For Individuals and Hufs Having Income From Profits and Gains Business or Profession) (Please See Rule 12 of The Income-Tax Rules, 1962)Document60 pages(For Individuals and Hufs Having Income From Profits and Gains Business or Profession) (Please See Rule 12 of The Income-Tax Rules, 1962)Suman jhaNo ratings yet

- Image (27) - 3Document1 pageImage (27) - 3Suman jhaNo ratings yet

- Last Month Bank StatementDocument2 pagesLast Month Bank StatementSuman jhaNo ratings yet

- Udyam MSME 2021Document2 pagesUdyam MSME 2021Suman jhaNo ratings yet

- Detailstatement - 21 4 2022@18 58 11Document8 pagesDetailstatement - 21 4 2022@18 58 11Suman jhaNo ratings yet

- GST Certificate ElcabDocument3 pagesGST Certificate ElcabSuman jhaNo ratings yet

- DSC Authorisation FormDocument2 pagesDSC Authorisation FormSuman jhaNo ratings yet

- Incon Tax Return (Last Year)Document1 pageIncon Tax Return (Last Year)Suman jhaNo ratings yet

- Image (27) - 5Document1 pageImage (27) - 5Suman jhaNo ratings yet

- Form GST REG-06: (Amended)Document3 pagesForm GST REG-06: (Amended)Suman jhaNo ratings yet

- Acct Statement - FEBRUARYDocument3 pagesAcct Statement - FEBRUARYSuman jhaNo ratings yet

- Itr Ay 2021Document57 pagesItr Ay 2021Suman jhaNo ratings yet

- Elcab PanDocument1 pageElcab PanSuman jhaNo ratings yet

- 6.GSTIN Dhriti EnvirocareDocument3 pages6.GSTIN Dhriti EnvirocareSuman jhaNo ratings yet

- Form GST REG-06: /Mehboobkj-Ian Faridkha N Pa Tha N If Arhana de CoraDocument2 pagesForm GST REG-06: /Mehboobkj-Ian Faridkha N Pa Tha N If Arhana de CoraSuman jhaNo ratings yet

- Divya Designo Tiles 201920 Itr - 1Document79 pagesDivya Designo Tiles 201920 Itr - 1Suman jhaNo ratings yet

- 9.itr 2017-18Document2 pages9.itr 2017-18Suman jhaNo ratings yet

- Divya Designo Tiles 201920 Itr - 1Document64 pagesDivya Designo Tiles 201920 Itr - 1Suman jhaNo ratings yet

- Divya Designo Tiles 201920 ItrDocument61 pagesDivya Designo Tiles 201920 ItrSuman jhaNo ratings yet

- 10.udyam Registration Certificate Udyam Gj-22-0004105Document2 pages10.udyam Registration Certificate Udyam Gj-22-0004105Suman jhaNo ratings yet

- 8.itr 2018-19Document4 pages8.itr 2018-19Suman jhaNo ratings yet

- Crystal Statement - 1Document7 pagesCrystal Statement - 1Suman jhaNo ratings yet

- Bkar3033 Financial Accounting and Reporting Iii: Dr. Halimah at Nasibah Binti AhmadDocument23 pagesBkar3033 Financial Accounting and Reporting Iii: Dr. Halimah at Nasibah Binti AhmadezwanNo ratings yet

- July 25, 2022Document77 pagesJuly 25, 2022Debasish DashNo ratings yet

- Wong Kim Choong Chief Executive Officer UOBM Corporate Day 4 - 5 September 2014Document21 pagesWong Kim Choong Chief Executive Officer UOBM Corporate Day 4 - 5 September 2014Gopalakrishnan SekharanNo ratings yet

- Service Sector in India - A SWOT AnalysisDocument12 pagesService Sector in India - A SWOT AnalysisMohammad Miyan0% (1)

- Invt Chapter 2Document29 pagesInvt Chapter 2Khadar MaxamedNo ratings yet

- Munhumutapa School of Commerce Name Student Number Course Title & Code Lecturer Task DateDocument5 pagesMunhumutapa School of Commerce Name Student Number Course Title & Code Lecturer Task DateNeoline Chipo DzirutsvaNo ratings yet

- 3 - T4 - Business Model & Marketing - enDocument12 pages3 - T4 - Business Model & Marketing - enMera AnaNo ratings yet

- 2018 - Kuldeep Bishnoi - NLU NagpurDocument2 pages2018 - Kuldeep Bishnoi - NLU NagpurLife Hacks Stunt PerfectNo ratings yet

- Cas Persuasive EssayDocument10 pagesCas Persuasive Essayapi-217920829No ratings yet

- Convertible Promissory Note Template 1Document6 pagesConvertible Promissory Note Template 1David Jay Mor100% (5)

- SchemesTap Old - February 2023 Lyst3129Document60 pagesSchemesTap Old - February 2023 Lyst3129Bhanu RaghavNo ratings yet

- Group 6 - BurberryDocument8 pagesGroup 6 - BurberryHasan AshrafNo ratings yet

- Contract-No.-4 FOB Contract For Processed Palm Oil Products in DrumsDocument7 pagesContract-No.-4 FOB Contract For Processed Palm Oil Products in DrumsbillNo ratings yet

- Terms of Reference Levuka Wharf Rehab ProjDocument11 pagesTerms of Reference Levuka Wharf Rehab ProjVinodh KumarNo ratings yet

- 1006 Quality Management PlanDocument35 pages1006 Quality Management PlanSalaNo ratings yet

- SSIS Integration Toolkit For Marketo Help ManualDocument28 pagesSSIS Integration Toolkit For Marketo Help ManualGanesh KamtheNo ratings yet

- Audit of Receivables PSPDocument6 pagesAudit of Receivables PSPMarriel Fate CullanoNo ratings yet

- 2356940-ESTEPHANIA ALVAREZ (Something I Will Always Treasure)Document3 pages2356940-ESTEPHANIA ALVAREZ (Something I Will Always Treasure)Dani OrtizNo ratings yet

- Lipat Vs Pacific BankingDocument10 pagesLipat Vs Pacific BankingYvon BaguioNo ratings yet

- OTC Medicines ListDocument78 pagesOTC Medicines ListBethelhem HabtamuNo ratings yet

- Single-Entry Approach (Sena) : National Conciliation and Mediation BoardDocument7 pagesSingle-Entry Approach (Sena) : National Conciliation and Mediation BoardUNEXPECTEDNo ratings yet

- Shop Leave and License AgreementDocument4 pagesShop Leave and License AgreementDonald Gonsalves60% (10)

- Notification OFK Danger Building Worker PostsDocument11 pagesNotification OFK Danger Building Worker Postssipuns827No ratings yet

- Campus Activewear ProjectDocument17 pagesCampus Activewear Projectscreener0991No ratings yet

- The Procedure of Imports & Exports in Foreign Payment: For BhelDocument72 pagesThe Procedure of Imports & Exports in Foreign Payment: For Bhelsajuthomas1987No ratings yet

- Shanti Business School Operations Management Notes Post Graduate Diploma in Management (PGDM) Module I: Introduction To Operations ManagementDocument18 pagesShanti Business School Operations Management Notes Post Graduate Diploma in Management (PGDM) Module I: Introduction To Operations ManagementYash PatidarNo ratings yet

- 1 HRMP OL Cap Performance p69 Mo Hinh Hooi2020 XemDocument24 pages1 HRMP OL Cap Performance p69 Mo Hinh Hooi2020 XemPhạm NhungNo ratings yet

- Coca Cola Training BookletDocument22 pagesCoca Cola Training BookletrameelNo ratings yet