Professional Documents

Culture Documents

04 - Task - Performance - 1 (10) BUSTAX

04 - Task - Performance - 1 (10) BUSTAX

Uploaded by

Aries Christian S PadillaCopyright:

Available Formats

You might also like

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Acctg 101 Ass. #15,17,19&21Document8 pagesAcctg 101 Ass. #15,17,19&21Danilo Diniay Jr67% (6)

- 08 Activity 1.FMDocument3 pages08 Activity 1.FMAries Christian S PadillaNo ratings yet

- Taxation Cup SeriesDocument5 pagesTaxation Cup SeriesGlaiza Atillo Batuto Orgino100% (1)

- Taxation - Gross Income - Quizzer - 2018 - MayDocument5 pagesTaxation - Gross Income - Quizzer - 2018 - MayKenneth Bryan Tegerero TegioNo ratings yet

- Kra Pin PDF EditDocument1 pageKra Pin PDF EditFrancis KorirNo ratings yet

- Pa-Note Nalang Pag May Babaguhin Kayong SagotDocument26 pagesPa-Note Nalang Pag May Babaguhin Kayong SagotErika Mae LegaspiNo ratings yet

- Inv 688817583 200279620 202011200114 PDFDocument1 pageInv 688817583 200279620 202011200114 PDFriyasathsafranNo ratings yet

- Bryan Moises PDFDocument5 pagesBryan Moises PDFMary DenizeNo ratings yet

- 03 - Task - Performance - 1 (15) Business TaxationDocument4 pages03 - Task - Performance - 1 (15) Business TaxationAries Christian S PadillaNo ratings yet

- 01TaskPerformance1 BussinessTaxDocument3 pages01TaskPerformance1 BussinessTaxSnapShop by AJNo ratings yet

- 2022 09 13 Naling IvyjoyDocument4 pages2022 09 13 Naling IvyjoyVjoy LimNo ratings yet

- Aec10 - Business Taxation Solution Tabag CH2Document4 pagesAec10 - Business Taxation Solution Tabag CH2EdeksupligNo ratings yet

- Estate Tax ProblemsDocument22 pagesEstate Tax ProblemsfanchasticommsNo ratings yet

- Answers To Assignment 1 and Problem Exercises Taxation2Document4 pagesAnswers To Assignment 1 and Problem Exercises Taxation2Dexanne BulanNo ratings yet

- Answer To Assignment No. 2Document1 pageAnswer To Assignment No. 2Sophia Angelica Marie MarasiganNo ratings yet

- Calanuga Assignment Final Period Activity - TAX 202ADocument5 pagesCalanuga Assignment Final Period Activity - TAX 202Acjmarie.cadenasNo ratings yet

- Finals Business TaxationDocument5 pagesFinals Business TaxationSherwin DueNo ratings yet

- 01 Task Performance 1 (8) Business TaxationDocument2 pages01 Task Performance 1 (8) Business TaxationAries Christian S PadillaNo ratings yet

- Ackdog 333Document18 pagesAckdog 333Czarina DonatoNo ratings yet

- Taxation 109Document2 pagesTaxation 109Bisag AsaNo ratings yet

- Deal or No Deal Tax 2 Quiz BeeDocument13 pagesDeal or No Deal Tax 2 Quiz BeeRebecca SisonNo ratings yet

- Exercise 7-7. Multiple Choice Problem: Items 1 and 2 Are Based On The Following InformationDocument14 pagesExercise 7-7. Multiple Choice Problem: Items 1 and 2 Are Based On The Following InformationSheie WiseNo ratings yet

- INCOTAX - Multiple Choices - Problems Part 1Document3 pagesINCOTAX - Multiple Choices - Problems Part 1Harvey100% (1)

- TAXATION 2 Chapter 5 Estate Tax Payable PDFDocument5 pagesTAXATION 2 Chapter 5 Estate Tax Payable PDFKim Cristian MaañoNo ratings yet

- Estate Taxation - Discussions...............Document5 pagesEstate Taxation - Discussions...............jangjangNo ratings yet

- DrillDocument4 pagesDrillJEP WalwalNo ratings yet

- Illustrations PDFDocument3 pagesIllustrations PDFCharrey Leigh FormaranNo ratings yet

- Chapter 1 - Succession & Transfer Taxes: Solutions Manual Transfer & Business Taxation, 2018 Edition By: Tabag & GarciaDocument49 pagesChapter 1 - Succession & Transfer Taxes: Solutions Manual Transfer & Business Taxation, 2018 Edition By: Tabag & GarciaLanceNo ratings yet

- Business Taxation Solman Tabag@garcia PDFDocument42 pagesBusiness Taxation Solman Tabag@garcia PDFJoey AbrahamNo ratings yet

- Taxsynth Page 25Document2 pagesTaxsynth Page 25Anne Marieline BuenaventuraNo ratings yet

- Sample Estate Tax ProblemDocument14 pagesSample Estate Tax ProblemAiza MadumNo ratings yet

- This Study Resource Was: The Professional CPA Review SchoolDocument4 pagesThis Study Resource Was: The Professional CPA Review SchooljtNo ratings yet

- Yeah Yeah Yeah Yeah YeahDocument7 pagesYeah Yeah Yeah Yeah YeahMika MolinaNo ratings yet

- Taxation Suggested SolutionsDocument3 pagesTaxation Suggested SolutionsSteven Mark MananguNo ratings yet

- Taxation With AnswerDocument13 pagesTaxation With AnsweraizaNo ratings yet

- Review MaterialsDocument6 pagesReview MaterialsShiela Marie Sta AnaNo ratings yet

- TaxationDocument10 pagesTaxationSteven Mark MananguNo ratings yet

- Project Taxation (Ouano)Document16 pagesProject Taxation (Ouano)GuiltyCrownNo ratings yet

- M6 - Estate Tax Payable Students'Document17 pagesM6 - Estate Tax Payable Students'micaella pasionNo ratings yet

- CHAPTER 15 - Transfer Business TaxDocument9 pagesCHAPTER 15 - Transfer Business TaxKatKat Olarte67% (3)

- Estate Tax Problems Quizzer 1104Document10 pagesEstate Tax Problems Quizzer 1104Fate Serrano100% (1)

- Corporate LiquidationDocument16 pagesCorporate LiquidationMidas Troy Victor100% (1)

- Illustration Deduction and Taxable EstateDocument8 pagesIllustration Deduction and Taxable EstateLadybellereyann A TeguihanonNo ratings yet

- TaxationDocument6 pagesTaxationAlexa ParkNo ratings yet

- Practice Exercises - Note PayableDocument2 pagesPractice Exercises - Note PayableShane TabunggaoNo ratings yet

- Exercise No. 1-Estate TaxationDocument4 pagesExercise No. 1-Estate TaxationRed Velvet100% (1)

- Tax QuizDocument3 pagesTax QuizLora Mae JuanitoNo ratings yet

- TAXN 2000 SECOND TERM EXAM SY22 23 QuestionnaireDocument15 pagesTAXN 2000 SECOND TERM EXAM SY22 23 QuestionnaireGrace Love Yzyry LuNo ratings yet

- Determination of The Net Taxable Estate Illustration 1: Single Resident or Citizen DecedentDocument14 pagesDetermination of The Net Taxable Estate Illustration 1: Single Resident or Citizen DecedentLea ChermarnNo ratings yet

- 5rd Batch - P2 Final Pre-Boards - Wid ANSWERDocument11 pages5rd Batch - P2 Final Pre-Boards - Wid ANSWERKim Cristian MaañoNo ratings yet

- Transfer and Business Taxes Solutions Manual Tabag Garcia 2015 PDFDocument36 pagesTransfer and Business Taxes Solutions Manual Tabag Garcia 2015 PDFhelaihjsNo ratings yet

- Transfer and Business Taxes Solutions Manual TABAG GARCIA 2015Document36 pagesTransfer and Business Taxes Solutions Manual TABAG GARCIA 2015john patrick acebucheNo ratings yet

- Transfer & Business Taxation, 2015 Edition: Solutions Manual By: Tabag & GarciaDocument41 pagesTransfer & Business Taxation, 2015 Edition: Solutions Manual By: Tabag & Garciajewel dela pazNo ratings yet

- Separate and Consolidated Dayag Part 6Document4 pagesSeparate and Consolidated Dayag Part 6NinaNo ratings yet

- Chapter 15 - Estate Tax Payable: Multiple Choice - TheoryDocument12 pagesChapter 15 - Estate Tax Payable: Multiple Choice - TheorytruthNo ratings yet

- CHAPTER 15 Transfer Business TaxDocument9 pagesCHAPTER 15 Transfer Business TaxJamaica DavidNo ratings yet

- Solman Tax2 Transfer Bus Tax 2018 Edition Chapters 1 To 8Document43 pagesSolman Tax2 Transfer Bus Tax 2018 Edition Chapters 1 To 8sammie helsonNo ratings yet

- Chapter 5 - Estate Tax2013Document12 pagesChapter 5 - Estate Tax2013Anjo Ellis100% (2)

- Real Estate License Exam Calculation Workbook: Volume 2 (2023 Edition)From EverandReal Estate License Exam Calculation Workbook: Volume 2 (2023 Edition)No ratings yet

- 06 TP 2 Financial MarketDocument3 pages06 TP 2 Financial MarketAries Christian S PadillaNo ratings yet

- 01 Task Performance 1 (8) Business TaxationDocument2 pages01 Task Performance 1 (8) Business TaxationAries Christian S PadillaNo ratings yet

- 03 - Task - Performance - 1 (15) Business TaxationDocument4 pages03 - Task - Performance - 1 (15) Business TaxationAries Christian S PadillaNo ratings yet

- Botiong 09activity1 Hm3aDocument2 pagesBotiong 09activity1 Hm3aAries Christian S PadillaNo ratings yet

- 07 - Handout - 1 (5) Business LAwDocument15 pages07 - Handout - 1 (5) Business LAwAries Christian S PadillaNo ratings yet

- Creation of A Corporation: Student - Feedback@sti - EduDocument10 pagesCreation of A Corporation: Student - Feedback@sti - EduAries Christian S PadillaNo ratings yet

- Ortega Nina Alyssa C. 10 Assignment 1Document2 pagesOrtega Nina Alyssa C. 10 Assignment 1Aries Christian S PadillaNo ratings yet

- This Study Resource Was: Ortega, Nina Alyssa C. January 17, 2021 BSA-2ADocument2 pagesThis Study Resource Was: Ortega, Nina Alyssa C. January 17, 2021 BSA-2AAries Christian S PadillaNo ratings yet

- Capalad CzerinaRose 10TaskPerformanceDocument3 pagesCapalad CzerinaRose 10TaskPerformanceAries Christian S PadillaNo ratings yet

- This Study Resource WasDocument2 pagesThis Study Resource WasAries Christian S PadillaNo ratings yet

- Income Tax Department: Computerized Payment Receipt (CPR - It)Document2 pagesIncome Tax Department: Computerized Payment Receipt (CPR - It)Mian EnterprisesNo ratings yet

- TAX-2024 - Version 1.3Document7 pagesTAX-2024 - Version 1.3adityaNo ratings yet

- Engineering Economy: John Rey M. Pacturanan, Ce, MPDocument3 pagesEngineering Economy: John Rey M. Pacturanan, Ce, MPNathanielle AndreaNo ratings yet

- Us 2022 Tax UpdateDocument19 pagesUs 2022 Tax Updateapi-263318846No ratings yet

- GMATDocument4 pagesGMATbrizky ramadhaniNo ratings yet

- Summary of Collections and Remittances - BTDocument18 pagesSummary of Collections and Remittances - BTSt. Veronica Learning CenterNo ratings yet

- Gen Bir Annex B2Document1 pageGen Bir Annex B2ArgielJedTabalBorrasNo ratings yet

- Document Pay SlipDocument3 pagesDocument Pay SlipAfaq AnwarNo ratings yet

- 2019 08 24 15 36 22 554 - 1566641182554 - XXXPR5688X - Itrv PDFDocument1 page2019 08 24 15 36 22 554 - 1566641182554 - XXXPR5688X - Itrv PDFShankar Rao AsipiNo ratings yet

- ch04.ppt - Income Statement and Related InformationDocument68 pagesch04.ppt - Income Statement and Related InformationAmir ContrerasNo ratings yet

- Basic Taxation Law SyllabusDocument7 pagesBasic Taxation Law SyllabusKameesa FateNo ratings yet

- MARGA FAR SolutionDocument5 pagesMARGA FAR SolutionYhancie Mae TorresNo ratings yet

- Partnershipsjoint Venture CoownershipDocument4 pagesPartnershipsjoint Venture CoownershipJane TuazonNo ratings yet

- Income-Tax-Assignment No. 3 SolutionDocument18 pagesIncome-Tax-Assignment No. 3 SolutionAuralin UbaldoNo ratings yet

- Exemption Certificate of Ghandhara Industries 2021Document2 pagesExemption Certificate of Ghandhara Industries 2021Waqar RaoNo ratings yet

- Addedum To The Contract of LeaseDocument3 pagesAddedum To The Contract of LeaseUndo ValenzuelaNo ratings yet

- Monthly VAT ReturnDocument54 pagesMonthly VAT ReturnHAWKINS MASJIDNo ratings yet

- Sesi 7 - Skyview Manor CaseDocument3 pagesSesi 7 - Skyview Manor CasestevenNo ratings yet

- Chapter 14-Income Taxes and Financial Accounting: True/FalseDocument8 pagesChapter 14-Income Taxes and Financial Accounting: True/FalsemilahrztaNo ratings yet

- Chapter 9 - 2021Document15 pagesChapter 9 - 2021Tú NguyễnNo ratings yet

- Basilan Estates Inc. v. CIR and CTADocument2 pagesBasilan Estates Inc. v. CIR and CTATon Ton CananeaNo ratings yet

- DT Icai MCQ 4Document5 pagesDT Icai MCQ 4Anshul JainNo ratings yet

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)nhat duy leNo ratings yet

- Itr 2021-22Document1 pageItr 2021-22DKINGNo ratings yet

- MATHEMATICS PROJECT of Vikas Patil......Document10 pagesMATHEMATICS PROJECT of Vikas Patil......RENUKA S PATILNo ratings yet

- DEEMED INCOMES (Aggregation of Income)Document3 pagesDEEMED INCOMES (Aggregation of Income)Dr. Mustafa KozhikkalNo ratings yet

- TDS Rate Chart For FY 2024-25Document70 pagesTDS Rate Chart For FY 2024-25leelathecaNo ratings yet

- Best Ice Cream Business Plan WTH Financials PDFDocument11 pagesBest Ice Cream Business Plan WTH Financials PDFNishat Nabila80% (15)

04 - Task - Performance - 1 (10) BUSTAX

04 - Task - Performance - 1 (10) BUSTAX

Uploaded by

Aries Christian S PadillaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

04 - Task - Performance - 1 (10) BUSTAX

04 - Task - Performance - 1 (10) BUSTAX

Uploaded by

Aries Christian S PadillaCopyright:

Available Formats

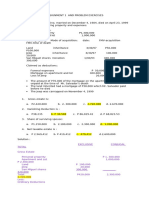

BM1903

Name: Padilla, Aries christian S. Section: BSMA 401

Deductions from Gross Estate (15 items x 2 points: 1 point for each correct answer and 1 point for the

solution)

Encircle the letter of the correct answer and provide a solution to the space provided.

1. The gross estate of the decedent includes a real estate with a market value at the date of death

equivalent to P4,000,000. The heirs of the decedent compiled the following accrued taxes, which were

not yet paid at the date of death:

Before Death After Death

Real property tax P 40,000 P 0

Income tax P 80,000 P 110,000

Estimated estate tax P 0 P 400,000

Which value shall be deductible taxes?

a. P120,000 b. P230,000 c. P510,000 d. P630,000

Solution: 110,000 + 400,0000 = P510,000

2. The following losses of properties occurred during the settlement of the estate of Mrs. Ramos:

Losses of separate properties of Mr. Ramos P 60,000

Losses of common properties P 40,000

Losses of separate properties of Mrs. Ramos P 80,000

Which value shall be deducted as losses from the gross estate?

a. P60,000 b. P80,000 c. P100,000 d. P120,000

Solution: 40,000 / 2 = 20,000

20,000 + 80,000 = P100,000

3. The following properties were lost soon after the death of Mr. Ramos:

Cash from decedent’s professional income P 300,000

Jewelry inherited a year ago by Mrs. Ramos P 500,000

Upon discovery, the event was immediately reported to the BIR. What is the deductible amount of loss

against gross income?

a. P 0 b. P300,000 c. P500,000 d. P800,000

Solution: 300,000 + 500,000 = P800,000

4. Mr. Ramo n donated the following properties in his last will and test ament:

Cash – to Takusa, a social welfare institution P 500,000

Land – to Benguet State University at purchase cost P 1,000,000

Additional information:

a. The donation mortis causa to Takusa was restricted for program expenses. None of it would be used for

administrative purposes.

b. The lot devised to Benguet State University had a fair value of P1,600,000 at the decedent’s death.

Which of the following is the amount of the deductible transfer for public purpose?

a. P500,000 b. P1,000,000 c. P1,500,000 d. P1,600,000

Solution: 500,000 + 1,000,000 = P1,500,000

04 Task Performance 1 *Property of STI

Page 1 of 4

BM1903

5. The following relate to the estate of a decedent:

Gross Estate (P1,000,000 is exclusive) P 3,000,000

Indebtedness and Taxes 150,000

Losses 250,000

Which of the following is the share of the surviving spouses?

a. P800,000 b. P1,000,000 c. P1,200,000 d. P2,600,000

Solution: 2,000,000 – 400,000 = 1,600,000

1,600,000 / 2 (since it is common it’s equally divided)

=P800,000

6. A decedent died, leaving an estate with the following properties and deductions:

Gross Estate (P2,000,000 is exclusive) P 4,000,000

Indebtedness and Taxes 250,000

Losses 150,000

Which of the following is the share of the surviving spouses?

a. P800,000 b. P1,600,000 c. P2,000,000 d. P3,600,000

Solution: 2,000,000 = 400,000 = 1,600,000

1,600,000 / 2 = P800,000

7. The follow ing data pertains to the estate of a decedent:

Separate Common

Gross estate P 2,000,000 P3,000,000

Indebtedness and taxes 200,000 300,000

Losses 50,000 150,000

Transfer for public use 100,000

Which of the following is the share of the surviving spouse?

a. P825,000 b. 1,275,000 c. P2,100,000 d. P2,550,000

Solution: 3,000,000 – 450,000 = 2,550,000

2,550,000 / 2 = P1,275,000

04 Task Performance 1 *Property of STI

Page 2 of 4

BM1903

8. Mr. Ramos died, leaving a family home valued at P1,800,000, which he inherited during the marriage

when it was worth P800,000. What is the deduction for the family home?

a. P800,000 b. P1,000,000 c. P1,800,000 d. P10,00,000

Solution: the fair value of family home is from the amount value the day after Mr. Ramos died.

9. During the marriage of Mr. and Mrs. Ramos, they constructed a house using their salaries amounting

to P1,200,000. The lot was inherited by Mrs. Ramos when it was P800,000. Mr. Ramos died when the

house and the lot had fair values of P1,500,000 and P1,200,00, respectively. What is the deduction

for family home?

a. P 0 b. P750,000 c. P1,200,000 d. P1,500,000

Solution: 1,500,000 / 2 = P750,000

(1,500,000 is the amount because it is the fair value of house when Mr. Ramos died)

10. A decedent died, leaving a family home to his children:

Lot – separate property of the decedent P 3,000,000

House – common property P12,000,000

Which of the following is the amount deductible as family home?

a. P3,000,000 b. P9,000,000 c. P10,000,000 d. P15,000,000

Solution: 12,000,000 / 2 = 6,000,000

6,000,000 + 3,000,000 = P9,000,000

11. The estate of the decedent received P80,000 benefit under R.A. 4917. The heirs want to claim the

benefit as part of special deduction. What is the deductible amount of benefits under R.A. 4917?

a. P 0 b. P40,000 c. P80,000 d. None of these

Solution: P80,000 According to R.A 4917 special deduction is still part of benefits that can receive and can

be deductible.

12. A nonresident alien decedent died leaving a substantial estate in the Philippines. He is married with six

dependents. How much standard deduction he can claim?

a. P 0 b. P500,000 c. P5,000,000 d. P10,000,000

Solution: P500,000 because in nonresident alien decedent the standard deduction can only be up to

P500,000

04 Task Performance 1 *Property of STI

Page 3 of 4

BM1903

13. A non-resident alien decedent had the following possible deductions:

Obligations (40% are payables in the Philippines) P 500,000

Losses of properties (60% occurred in the Philippines) P 1,000,000

Transfer of Philippine property for public use P 400,000

The decedent had a P4,000,000 Philippine gross estate and P6,000,000 foreign gross estate. Which of

the following is the total deduction allowable?

a. P1,700,000 b. P1,900,000 c. P4,000,000 d. P6,000,000

Solution: 500,000 + 1,000,000 + 400,000 = P1,900,000

14. On November 1, 2x18, Alex died leaving the following properties:

Mortgage assumed on the

Agricultural land inherited Feb. 2, 2x16 P1,200,000 agricultural land P 500,000

House and lot 2,000,000 Other indebtedness 1,200,000

Cash 2,800,000 Losses 400,000

Car 500,000 Total Ordinary Deductions P2,100,000

Other personal properties 1,000,000

Total Properties P7,500,000

The prior estate paid the estate tax on the agricultural land, which was then valued at P1,000,000.

Compute the vanishing deduction.

a. P140,000 b. P216,000 c. P360,000 d. P500,000

Solution: Initial Value 1,000,000

Less: mortgage assumed 500,000

Initial Basis 500,000

Less: Other deductions

(500,000 / 7,500,000) x 2,100,000 140,000

Final Basis 360,000

Multiplied Percentage 60%

Vanishing Deduction 216,000

15. Mr. Ramos was single when he died, leaving properties he inherited 2 ½ years ago with a current fair

market value of P800,000. The property was inherited when it was worth P1,000,000 and had a

P850,000 unpaid mortgage. Mr. Ramos paid P550,000 until his death. Other properties of Mr. Ramos

had a fair market value of P1,200,000 at the time of his death. The losses, taxes, and transfer for

public purpose is P160,000. How much is the vanishing deduction?

a. P138,000 b. P160,000 c. P230,000 d. P250,000

Solution: Initial Value (lower) 800,000

Less: Mortgage 500,000

Initial Basis 250,000

Less: other deductions

(250,000/2,000,000) x 160,000 20,000

Final Basis 230,000

Multiplied percentage 60%

Vanishing Deduction 138,000

04 Task Performance 1 *Property of STI

Page 4 of 4

BM1903

04 Task Performance 1 *Property of STI

Page 5 of 4

You might also like

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Acctg 101 Ass. #15,17,19&21Document8 pagesAcctg 101 Ass. #15,17,19&21Danilo Diniay Jr67% (6)

- 08 Activity 1.FMDocument3 pages08 Activity 1.FMAries Christian S PadillaNo ratings yet

- Taxation Cup SeriesDocument5 pagesTaxation Cup SeriesGlaiza Atillo Batuto Orgino100% (1)

- Taxation - Gross Income - Quizzer - 2018 - MayDocument5 pagesTaxation - Gross Income - Quizzer - 2018 - MayKenneth Bryan Tegerero TegioNo ratings yet

- Kra Pin PDF EditDocument1 pageKra Pin PDF EditFrancis KorirNo ratings yet

- Pa-Note Nalang Pag May Babaguhin Kayong SagotDocument26 pagesPa-Note Nalang Pag May Babaguhin Kayong SagotErika Mae LegaspiNo ratings yet

- Inv 688817583 200279620 202011200114 PDFDocument1 pageInv 688817583 200279620 202011200114 PDFriyasathsafranNo ratings yet

- Bryan Moises PDFDocument5 pagesBryan Moises PDFMary DenizeNo ratings yet

- 03 - Task - Performance - 1 (15) Business TaxationDocument4 pages03 - Task - Performance - 1 (15) Business TaxationAries Christian S PadillaNo ratings yet

- 01TaskPerformance1 BussinessTaxDocument3 pages01TaskPerformance1 BussinessTaxSnapShop by AJNo ratings yet

- 2022 09 13 Naling IvyjoyDocument4 pages2022 09 13 Naling IvyjoyVjoy LimNo ratings yet

- Aec10 - Business Taxation Solution Tabag CH2Document4 pagesAec10 - Business Taxation Solution Tabag CH2EdeksupligNo ratings yet

- Estate Tax ProblemsDocument22 pagesEstate Tax ProblemsfanchasticommsNo ratings yet

- Answers To Assignment 1 and Problem Exercises Taxation2Document4 pagesAnswers To Assignment 1 and Problem Exercises Taxation2Dexanne BulanNo ratings yet

- Answer To Assignment No. 2Document1 pageAnswer To Assignment No. 2Sophia Angelica Marie MarasiganNo ratings yet

- Calanuga Assignment Final Period Activity - TAX 202ADocument5 pagesCalanuga Assignment Final Period Activity - TAX 202Acjmarie.cadenasNo ratings yet

- Finals Business TaxationDocument5 pagesFinals Business TaxationSherwin DueNo ratings yet

- 01 Task Performance 1 (8) Business TaxationDocument2 pages01 Task Performance 1 (8) Business TaxationAries Christian S PadillaNo ratings yet

- Ackdog 333Document18 pagesAckdog 333Czarina DonatoNo ratings yet

- Taxation 109Document2 pagesTaxation 109Bisag AsaNo ratings yet

- Deal or No Deal Tax 2 Quiz BeeDocument13 pagesDeal or No Deal Tax 2 Quiz BeeRebecca SisonNo ratings yet

- Exercise 7-7. Multiple Choice Problem: Items 1 and 2 Are Based On The Following InformationDocument14 pagesExercise 7-7. Multiple Choice Problem: Items 1 and 2 Are Based On The Following InformationSheie WiseNo ratings yet

- INCOTAX - Multiple Choices - Problems Part 1Document3 pagesINCOTAX - Multiple Choices - Problems Part 1Harvey100% (1)

- TAXATION 2 Chapter 5 Estate Tax Payable PDFDocument5 pagesTAXATION 2 Chapter 5 Estate Tax Payable PDFKim Cristian MaañoNo ratings yet

- Estate Taxation - Discussions...............Document5 pagesEstate Taxation - Discussions...............jangjangNo ratings yet

- DrillDocument4 pagesDrillJEP WalwalNo ratings yet

- Illustrations PDFDocument3 pagesIllustrations PDFCharrey Leigh FormaranNo ratings yet

- Chapter 1 - Succession & Transfer Taxes: Solutions Manual Transfer & Business Taxation, 2018 Edition By: Tabag & GarciaDocument49 pagesChapter 1 - Succession & Transfer Taxes: Solutions Manual Transfer & Business Taxation, 2018 Edition By: Tabag & GarciaLanceNo ratings yet

- Business Taxation Solman Tabag@garcia PDFDocument42 pagesBusiness Taxation Solman Tabag@garcia PDFJoey AbrahamNo ratings yet

- Taxsynth Page 25Document2 pagesTaxsynth Page 25Anne Marieline BuenaventuraNo ratings yet

- Sample Estate Tax ProblemDocument14 pagesSample Estate Tax ProblemAiza MadumNo ratings yet

- This Study Resource Was: The Professional CPA Review SchoolDocument4 pagesThis Study Resource Was: The Professional CPA Review SchooljtNo ratings yet

- Yeah Yeah Yeah Yeah YeahDocument7 pagesYeah Yeah Yeah Yeah YeahMika MolinaNo ratings yet

- Taxation Suggested SolutionsDocument3 pagesTaxation Suggested SolutionsSteven Mark MananguNo ratings yet

- Taxation With AnswerDocument13 pagesTaxation With AnsweraizaNo ratings yet

- Review MaterialsDocument6 pagesReview MaterialsShiela Marie Sta AnaNo ratings yet

- TaxationDocument10 pagesTaxationSteven Mark MananguNo ratings yet

- Project Taxation (Ouano)Document16 pagesProject Taxation (Ouano)GuiltyCrownNo ratings yet

- M6 - Estate Tax Payable Students'Document17 pagesM6 - Estate Tax Payable Students'micaella pasionNo ratings yet

- CHAPTER 15 - Transfer Business TaxDocument9 pagesCHAPTER 15 - Transfer Business TaxKatKat Olarte67% (3)

- Estate Tax Problems Quizzer 1104Document10 pagesEstate Tax Problems Quizzer 1104Fate Serrano100% (1)

- Corporate LiquidationDocument16 pagesCorporate LiquidationMidas Troy Victor100% (1)

- Illustration Deduction and Taxable EstateDocument8 pagesIllustration Deduction and Taxable EstateLadybellereyann A TeguihanonNo ratings yet

- TaxationDocument6 pagesTaxationAlexa ParkNo ratings yet

- Practice Exercises - Note PayableDocument2 pagesPractice Exercises - Note PayableShane TabunggaoNo ratings yet

- Exercise No. 1-Estate TaxationDocument4 pagesExercise No. 1-Estate TaxationRed Velvet100% (1)

- Tax QuizDocument3 pagesTax QuizLora Mae JuanitoNo ratings yet

- TAXN 2000 SECOND TERM EXAM SY22 23 QuestionnaireDocument15 pagesTAXN 2000 SECOND TERM EXAM SY22 23 QuestionnaireGrace Love Yzyry LuNo ratings yet

- Determination of The Net Taxable Estate Illustration 1: Single Resident or Citizen DecedentDocument14 pagesDetermination of The Net Taxable Estate Illustration 1: Single Resident or Citizen DecedentLea ChermarnNo ratings yet

- 5rd Batch - P2 Final Pre-Boards - Wid ANSWERDocument11 pages5rd Batch - P2 Final Pre-Boards - Wid ANSWERKim Cristian MaañoNo ratings yet

- Transfer and Business Taxes Solutions Manual Tabag Garcia 2015 PDFDocument36 pagesTransfer and Business Taxes Solutions Manual Tabag Garcia 2015 PDFhelaihjsNo ratings yet

- Transfer and Business Taxes Solutions Manual TABAG GARCIA 2015Document36 pagesTransfer and Business Taxes Solutions Manual TABAG GARCIA 2015john patrick acebucheNo ratings yet

- Transfer & Business Taxation, 2015 Edition: Solutions Manual By: Tabag & GarciaDocument41 pagesTransfer & Business Taxation, 2015 Edition: Solutions Manual By: Tabag & Garciajewel dela pazNo ratings yet

- Separate and Consolidated Dayag Part 6Document4 pagesSeparate and Consolidated Dayag Part 6NinaNo ratings yet

- Chapter 15 - Estate Tax Payable: Multiple Choice - TheoryDocument12 pagesChapter 15 - Estate Tax Payable: Multiple Choice - TheorytruthNo ratings yet

- CHAPTER 15 Transfer Business TaxDocument9 pagesCHAPTER 15 Transfer Business TaxJamaica DavidNo ratings yet

- Solman Tax2 Transfer Bus Tax 2018 Edition Chapters 1 To 8Document43 pagesSolman Tax2 Transfer Bus Tax 2018 Edition Chapters 1 To 8sammie helsonNo ratings yet

- Chapter 5 - Estate Tax2013Document12 pagesChapter 5 - Estate Tax2013Anjo Ellis100% (2)

- Real Estate License Exam Calculation Workbook: Volume 2 (2023 Edition)From EverandReal Estate License Exam Calculation Workbook: Volume 2 (2023 Edition)No ratings yet

- 06 TP 2 Financial MarketDocument3 pages06 TP 2 Financial MarketAries Christian S PadillaNo ratings yet

- 01 Task Performance 1 (8) Business TaxationDocument2 pages01 Task Performance 1 (8) Business TaxationAries Christian S PadillaNo ratings yet

- 03 - Task - Performance - 1 (15) Business TaxationDocument4 pages03 - Task - Performance - 1 (15) Business TaxationAries Christian S PadillaNo ratings yet

- Botiong 09activity1 Hm3aDocument2 pagesBotiong 09activity1 Hm3aAries Christian S PadillaNo ratings yet

- 07 - Handout - 1 (5) Business LAwDocument15 pages07 - Handout - 1 (5) Business LAwAries Christian S PadillaNo ratings yet

- Creation of A Corporation: Student - Feedback@sti - EduDocument10 pagesCreation of A Corporation: Student - Feedback@sti - EduAries Christian S PadillaNo ratings yet

- Ortega Nina Alyssa C. 10 Assignment 1Document2 pagesOrtega Nina Alyssa C. 10 Assignment 1Aries Christian S PadillaNo ratings yet

- This Study Resource Was: Ortega, Nina Alyssa C. January 17, 2021 BSA-2ADocument2 pagesThis Study Resource Was: Ortega, Nina Alyssa C. January 17, 2021 BSA-2AAries Christian S PadillaNo ratings yet

- Capalad CzerinaRose 10TaskPerformanceDocument3 pagesCapalad CzerinaRose 10TaskPerformanceAries Christian S PadillaNo ratings yet

- This Study Resource WasDocument2 pagesThis Study Resource WasAries Christian S PadillaNo ratings yet

- Income Tax Department: Computerized Payment Receipt (CPR - It)Document2 pagesIncome Tax Department: Computerized Payment Receipt (CPR - It)Mian EnterprisesNo ratings yet

- TAX-2024 - Version 1.3Document7 pagesTAX-2024 - Version 1.3adityaNo ratings yet

- Engineering Economy: John Rey M. Pacturanan, Ce, MPDocument3 pagesEngineering Economy: John Rey M. Pacturanan, Ce, MPNathanielle AndreaNo ratings yet

- Us 2022 Tax UpdateDocument19 pagesUs 2022 Tax Updateapi-263318846No ratings yet

- GMATDocument4 pagesGMATbrizky ramadhaniNo ratings yet

- Summary of Collections and Remittances - BTDocument18 pagesSummary of Collections and Remittances - BTSt. Veronica Learning CenterNo ratings yet

- Gen Bir Annex B2Document1 pageGen Bir Annex B2ArgielJedTabalBorrasNo ratings yet

- Document Pay SlipDocument3 pagesDocument Pay SlipAfaq AnwarNo ratings yet

- 2019 08 24 15 36 22 554 - 1566641182554 - XXXPR5688X - Itrv PDFDocument1 page2019 08 24 15 36 22 554 - 1566641182554 - XXXPR5688X - Itrv PDFShankar Rao AsipiNo ratings yet

- ch04.ppt - Income Statement and Related InformationDocument68 pagesch04.ppt - Income Statement and Related InformationAmir ContrerasNo ratings yet

- Basic Taxation Law SyllabusDocument7 pagesBasic Taxation Law SyllabusKameesa FateNo ratings yet

- MARGA FAR SolutionDocument5 pagesMARGA FAR SolutionYhancie Mae TorresNo ratings yet

- Partnershipsjoint Venture CoownershipDocument4 pagesPartnershipsjoint Venture CoownershipJane TuazonNo ratings yet

- Income-Tax-Assignment No. 3 SolutionDocument18 pagesIncome-Tax-Assignment No. 3 SolutionAuralin UbaldoNo ratings yet

- Exemption Certificate of Ghandhara Industries 2021Document2 pagesExemption Certificate of Ghandhara Industries 2021Waqar RaoNo ratings yet

- Addedum To The Contract of LeaseDocument3 pagesAddedum To The Contract of LeaseUndo ValenzuelaNo ratings yet

- Monthly VAT ReturnDocument54 pagesMonthly VAT ReturnHAWKINS MASJIDNo ratings yet

- Sesi 7 - Skyview Manor CaseDocument3 pagesSesi 7 - Skyview Manor CasestevenNo ratings yet

- Chapter 14-Income Taxes and Financial Accounting: True/FalseDocument8 pagesChapter 14-Income Taxes and Financial Accounting: True/FalsemilahrztaNo ratings yet

- Chapter 9 - 2021Document15 pagesChapter 9 - 2021Tú NguyễnNo ratings yet

- Basilan Estates Inc. v. CIR and CTADocument2 pagesBasilan Estates Inc. v. CIR and CTATon Ton CananeaNo ratings yet

- DT Icai MCQ 4Document5 pagesDT Icai MCQ 4Anshul JainNo ratings yet

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)nhat duy leNo ratings yet

- Itr 2021-22Document1 pageItr 2021-22DKINGNo ratings yet

- MATHEMATICS PROJECT of Vikas Patil......Document10 pagesMATHEMATICS PROJECT of Vikas Patil......RENUKA S PATILNo ratings yet

- DEEMED INCOMES (Aggregation of Income)Document3 pagesDEEMED INCOMES (Aggregation of Income)Dr. Mustafa KozhikkalNo ratings yet

- TDS Rate Chart For FY 2024-25Document70 pagesTDS Rate Chart For FY 2024-25leelathecaNo ratings yet

- Best Ice Cream Business Plan WTH Financials PDFDocument11 pagesBest Ice Cream Business Plan WTH Financials PDFNishat Nabila80% (15)