Professional Documents

Culture Documents

The Fiscal-Budget Flexibility and The Expansion of COVID-19

The Fiscal-Budget Flexibility and The Expansion of COVID-19

Uploaded by

arman jamshidiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Fiscal-Budget Flexibility and The Expansion of COVID-19

The Fiscal-Budget Flexibility and The Expansion of COVID-19

Uploaded by

arman jamshidiCopyright:

Available Formats

The Fiscal-Budget Flexibility and the Expansion of COVID-19

Kebin Deng

School of Economics and Commerce

South China University of Technology

Higher education mega center,Guangzhou,510006, P.R.C.

Email: ecdengkb@scut.edu.cn, Tel: 86-020-39381128

Feng Lin*

School of Economics and Commerce

South China University of Technology

Higher education mega center,Guangzhou, 510006, P.R.C.

Email: fenglin@scut.edu.cn, Tel: 86-020-39381128

Puman Ouyang

Department of Economics

National Chung Cheng University

168, University Rd., Min-Hsiung, Chia-Yi 62102, Taiwan, R.O.C.

Email: pouyang@ccu.edu.tw, Tel: 886-05-2720411

Electronic copy available at: https://ssrn.com/abstract=3570436

The Fiscal-Budget Flexibility and the Expansion of COVID-19

Abstract: This paper documents the daily COVID-19 case-growth rates in the low

fiscal flexibility countries are significantly higher than those in the high-flexibility

countries by 49.1% averagely, given other conditions under the same. Moreover, the

impact of fiscal-budget flexibility only functions when the expansion of COVID-19 is

not out of hand, e.g., is still in a moderate speed.

Key words: Fiscal-Budget Flexibility; Constitutional Budget-Balance Rules;

COVID-19

1. Introduction

A novel coronavirus (COVID-19) disease is spreading rapidly worldwide. Along

with medical measures for fighting the pandemic, many countries provide

unprecedented fiscal stimulus packages to restore the aggregate demand. With

government direct payments and jobless aid, people may not have to rush to work

outside and gather in the special period. Therefore, fiscal expansion may not only ease

the economic pain but also prevent the further spreading of this pandemic.

This paper examines whether the flexibility of fiscal budget would substantially

reduce the expansion speed of COVID-19. Following Heinemann et al. (2016) and

Asatryan et al. (2018), we utilize data on whether a country has constitutional

balanced-budget-rules (BBRs) or non-constitutional BBRs or no BBR at all, to

measure the rigidity of its fiscal budget. We find that the expansion speed of

COVID-19 cases is higher in countries with the lower fiscal-budget flexibility.

Two streams of literature are closely related to our study. First focuses on the

effects of macroeconomic policies on public health care, such as controlling of

tobacco products and alcoholic beverages (Sassi et al., 2013; Myerson et al., 2020).

Second is the literature on COVID-19, addressing the key spreading determinants

such as social distancing, preventing large gatherings and travel quarantine (Adda,

2016; Litvinova et al., 2019; Chinazzi et al. 2020).

Electronic copy available at: https://ssrn.com/abstract=3570436

2. Data, Variables and Empirical Strategy

2.1 Data and Variables

Our sample covers 195 COVID-19 involved economies from January 10, 2020 to

March 27, 20201.

Our key independent variables are the country fiscal-budget flexibility dummies.

Following Asatryan et al. (2018), we utilize the Comparative Constitutions Project

(CCP) dataset and IMF fiscal rules dataset which indicate that there are 20 economies

adopting constitutional BBRs, 51 adopting non-constitutional BBRs and 124 with no

BBR at all. We define the low/medium/high fiscal-budget flexibility countries as

those with constitutional balanced-budget-rules (BBRs)/non-constitutional BBRs

/without any BBRs respectively.

The dependent variable is the growth rate of confirmed COVID-19 cases in country

level. The data on COVID-19 are from the daily report of World Health Organization

(WHO). Specially, China’s data before January 23, 2020 are released by the National

Health Commission of China. We exclude the countries with confirmed period less

than five days. We also delete observations with a zero-growth rate of COVID-9 cases

because the zero record is very likely due to the report omission or the lack of

detection kit in that day or the fact that the disease is completely under control. We

winsorize the dependent variable at the top and bottom 1%. Finally, our sample size is

2696 observations.

We control other variables which may affect the expansion of COVID-19,

including real GDP per capita, population number, gender (male ratio) and aging

(ratio of ages 65 and above), provided by the World Development Indicators database,

and the government size (the government spending divided by GDP) obtained from

IMF’s World Economic Outlook database. We employ the 2018 year-end values of all

the control variables and log them.

2.2 Empirical Strategy

We use the fixed-effects panel design to detect the effect of fiscal-budget flexibility

1

Up to March 27, 2020, there are totally 195 economies involved the attack of COVID-19 disease.

Electronic copy available at: https://ssrn.com/abstract=3570436

on the expansion of COVID-19 as the follows:

Ln COVID growthit = β0 + β1Low flexibilityi + β2Medium flexibilityi

+ β3Low flexibilityi × Low COVIDit + β4Medium flexibilityi × Low COVIDit

+ β5Low COVIDit + δi Χi + λt + μc + ε it

where i and t indicate countries and days respectively. The dependent variable

Ln COVID growth it refers to the log value of each country’s daily growth rate of

confirmed COVID-19 cases. In the independent dummies, Low flexibilityi equals one

if an economy’s current constitution specifies a BBR and zero otherwise. Similarly,

Medium flexibilityi equals one if an economy has a non-constitutional BBR and zero

otherwise. Low COVIDit is the dummy variable defined as one if a country’s daily

growth rate of confirmed cases is below the sample median. The vector Χ i stands

for control variables including real GDP per capita, population, government size,

aging and gender. ε it is a standard error term. We control for the day fixed effects

( λt ). Since certain economies such as Mainland China, USA, and Italy have suffered

severely from the pandemic, we take specific-country fixed effects ( μc ) into account.

3. Results of Regressions

3.1 Summary Descriptions

Table 1 presents the group median test of the confirmed COVID-19 cases. It shows

that in the whole sample, low fiscal-budget flexibility group has the fastest expansion

speed of COVID-19, which is 27.1% on average. The difference between the median

in countries with high fiscal-budget flexibility and that in medium/low fiscal-budget

flexibility is statistically significant. Moreover, the group median differences are only

significant in low-COVID-growth samples. That said, the impact of fiscal-budget

flexibility only functions when the expansion speed of COVID-19 is under a

threshold.

Electronic copy available at: https://ssrn.com/abstract=3570436

Table 1 Group median comparison of the COVID growth

(1) (2) (3)

Low-flexible fiscal-budget Medium-flexible fiscal-budget High-flexible fiscal-budget

(with constitutional BBRs) (with non-constitutional BBRs) (without any BBRs)

Panel A

Whole sample 0.271 0.222 0.222

Between (1) and (2) Between (1) and (3) Between (2) and (3)

Difference

0.049(10.058***) 0.049(15.957***) 0.000(0.036)

Observations 246 925 1525

Panel B

High COVID growth

0.441 0.467 0.500

group

Between (1 ) and (2) Between (1) and (3) Between (2) and (3)

Difference

-0.026(0.313) -0.0591(0.000) -0.033(0.502)

Observations 154 454 743

Panel C

Low COVID growth

0.149 0.115 0.100

group

Between (1) and (2) Between (1) and (3) Between (2) and (3)

Difference

0.339(18.923***) 0.049(35.425***) 0.015(9.692***)

Observations 92 471 782

Notes: COVID growth is calculated as the COVID-19 cases in day t divided by the cases in day t-1, and minus 1.

The Pearson chi2 values are reported in parentheses; the null hypothesis is that both groups have the same median.

The low and high COVID growth groups are partitioned by the median of COVID-growth. ∗∗∗ indicates the 1%

significant level.

3.2 Results of the baseline regression

Table 2 reports the estimation results of equation (1). The coefficients associated

with the low and medium flexibility of fiscal budgets shown in column (2) are

significantly positive, highlighting that in contrast to high fiscal-budget flexibility

countries, low and medium fiscal-budget flexibility would suffer faster expansion of

COVID-19. The coefficient of low-flexibility is 0.491, larger than the coefficient of

the medium-flexibility (0.117). These evidences indicate that the countries adopting

tight fiscal budgets are associated with a prominent acceleration of COVID-19, which

is 49.1% higher than those adopting loose fiscal-budget.

Column (3) shows that the interaction terms of fiscal-budget flexibility and the

low COVID growth dummy are positive and strongly significant at the 1% level.

These findings are consistent with Table 1, addressing that the impact of fiscal-budget

flexibility would function only when the growth rate of COVID-19 is not out of hand.

Electronic copy available at: https://ssrn.com/abstract=3570436

Table 2 Fiscal-budget flexibility on the expansion of COVID-19

Dependent Variable:

Ln COVID growth (1) (2) (3)

Low flexibility 0.373*** 0.491*** -0.004

(0.069) (0.068) (0.065)

Medium flexibility -0.038 0.117** -0.023

(0.049) (0.054) (0.049)

Low flexibility × Low COVID 0.582***

(0.088)

Medium flexibility × Low COVID 0.296***

(0.065)

Low COVID -1.807***

(0.047)

Ln real GDP per capita -0.162*** -0.121***

(0.033) (0.022)

Ln population -0.109*** -0.071***

(0.017) (0.011)

Ln gender -5.196*** -1.852***

(0.662) (0.450)

Ln aging -0.584*** -0.214***

(0.079) (0.053)

Ln government size 0.797*** 0.431***

(0.089) (0.062)

Specific-Country effects YES YES YES

Day effects YES YES YES

Observations 2696 2383 2383

R2 0.239 0.359 0.670

Notes: Standard errors are White heteroskedasticity-corrected and reported in parentheses. Significant levels: ∗∗∗

1%, ∗∗ 5%, ∗ 10%. The intercept term is unreported for simplicity.

Moreover, the results indicate that real GDP per capita, population, aging and

gender are negatively associated with the speed of COVID-19, while government size

has a positive significant effect on COVID-19 expansion.

3.3 Robustness tests

The transparency of case information disclosure would mislead our results. High

fiscal-flexibility countries might underreport their COVID-19 cases. To rule out this

concern, we further look into the effects of fiscal flexibility in a more recent sample.

The clue is, even if high fiscal flexibility countries underreport their COVID-19 cases,

the underreporting degree should decrease in response to the passage of time and the

exacerbation of pandemic situation. If the distortion of underreporting is not salient,

Electronic copy available at: https://ssrn.com/abstract=3570436

the results in a more recent sample should be consistent with those in Table 2.

Table 3 Alternative tests: adjusting sample and fixed effects

(1) (2) (3) (4) (5) (6)

Dependent Variable: Sample excluding

Ln COVID growth observations with less Including continent

More recent sample

than 100 confirmed effects

cases

Low flexibility 0.467*** -0.011 0.507*** 0.160** 0.216*** -0.162**

(0.067) (0.065) (0.095) (0.074) (0.064) (0.066)

Medium flexibility 0.144** 0.012 0.239*** 0.079 0.191*** -0.024

(0.056) (0.049) (0.076) (0.057) (0.053) (0.048)

Low flexibility × Low COVID 0.544*** 0.302*** 0.701***

(0.086) (0.109) (0.093)

Medium flexibility × Low COVID 0.233*** 0.176** 0.489***

(0.066) (0.081) (0.071)

Low COVID -1.746*** -1.295*** -1.844***

(0.046) (0.066) (0.051)

Ln real GDP per capita -0.148*** -0.106*** 0.030 0.002 -0.017 -0.056**

(0.033) (0.022) (0.044) (0.028) (0.039) (0.028)

Ln population -0.106*** -0.064*** 0.007 -0.036** -0.134*** -0.121***

(0.017) (0.012) (0.023) (0.016) (0.019) (0.015)

Ln gender -5.471*** -2.037*** -7.539*** -4.219*** -6.242*** -3.176***

(0.682) (0.461) (0.941) (0.622) (0.780) (0.558)

Ln aging -0.588*** -0.213*** -0.876*** -0.494*** -0.672*** -0.295***

(0.081) (0.054) (0.124) (0.078) (0.100) (0.072)

Ln government size 0.701*** 0.355*** 0.857*** 0.479*** -0.209* -0.255***

(0.097) (0.066) (0.114) (0.086) (0.107) (0.082)

Specific-Country effects YES YES YES YES NO NO

Day effects YES YES YES YES YES YES

Continent effects NO NO NO NO YES YES

Observations 2176 2176 1010 1010 2354 2354

R2 0.433 0.730 0.681 0.840 0.353 0.630

Notes: Standard errors are White heteroskedasticity-corrected and reported in parentheses. Significant levels: ∗∗∗

1%, ∗∗ 5%, ∗ 10%. The intercept term is unreported for simplicity.

To mitigate the underreport concern and other endogeneity concerns, we then

undertake following robustness exercises in Table 3. First, we estimate a more recent

sample starting from February 20, 2020 (column (1)and(2)), when the first case was

confirmed in Italy, the first outbreak country out of Asia. Second, we exclude those

observations with less than 100 confirmed cases (column (3)and(4)). Third, we

replace the specific-country fixed effects with the continent fixed effects, defined the

same as Asatryan (2018), and re-estimate the regression (column (5)-(6)).

Electronic copy available at: https://ssrn.com/abstract=3570436

Table 3 shows that the coefficients of Low flexibility and Medium flexibility in

columns (1), (3) and (5) are positive and strongly significant. The interaction terms in

columns (2), (4) and (6) are significantly positive, which are completely consistent

with our baseline results shown in Table 2.

4. Conclusion

This paper shows that fiscal-budget flexibility effectively helps countries slow the

expansion of COVID-19. In addition, the impact of fiscal-budget flexibility only

functions when the expansion of COVID-19 is not out of hand. Our results highlight

the substantial role of the fiscal flexibility on alleviating COVID-19 expansion.

References

Adda J. 2016. Economic activity and the spread of viral diseases: Evidence from high

frequency data. The Quarterly Journal of Economics, 131(2): 891-941.

Asatryan Z, Castellon C, Stratmann T. 2018. Balanced budget rules and fiscal

outcomes: Evidence from historical constitutions. Journal of Public Economics,

167: 105-119.

Chinazzi M, Davis J T, Ajelli M, et al. 2020. The effect of travel restrictions on the

spread of the 2019 novel coronavirus (COVID-19) outbreak. Science. DOI:

10.1126/science.aba9757.

Heinemann F, Janeba E, Schröder C, Streif F. 2016. Fiscal rules and compliance

expectations–Evidence for the German debt brake. Journal of Public Economics,

142: 11-23.

Litvinova M, Liu Q H, Kulikov E S, Ajelli M. 2019. Reactive school closure weakens

the network of social interactions and reduces the spread of influenza.

Proceedings of the National Academy of Sciences, 116(27): 13174-13181.

Myerson R, Lu T, Yuan Y, Liu, G. 2020. The impact of government income transfers

on tobacco and alcohol use: Evidence from China. Economics Letters. Available

from: https://doi.org/10.1016/j.econlet.2019.108855.

Sassi F, Belloni A, Capobianco C. 2013.The role of fiscal policies in health promotion.

OECD Health Working Papers No. 66.

Electronic copy available at: https://ssrn.com/abstract=3570436

You might also like

- Jawid (Sum 2) COVID 19 Doesn't Need Lockdown To Destroy Jobs (DiD Model)Document15 pagesJawid (Sum 2) COVID 19 Doesn't Need Lockdown To Destroy Jobs (DiD Model)Jawid Ahmad GulistaniNo ratings yet

- Gist of Economic Survey 2020-21 (MCQS)Document22 pagesGist of Economic Survey 2020-21 (MCQS)Siddharth WorkNo ratings yet

- 003717-0041 Bo-Yu, Wang Economics Extended EssayDocument17 pages003717-0041 Bo-Yu, Wang Economics Extended Essayboyu.wangNo ratings yet

- International Review of Economics and Finance: Shiwei Hu, Yuyao ZhangDocument8 pagesInternational Review of Economics and Finance: Shiwei Hu, Yuyao ZhangJihen KlaiNo ratings yet

- COVID 19 Doesn't Need Lockdowns To Destroy Jobs The Effect of LocalDocument12 pagesCOVID 19 Doesn't Need Lockdowns To Destroy Jobs The Effect of Localfarah lamouchiNo ratings yet

- Covid-19 and Cost of Living in Developing CountrieDocument27 pagesCovid-19 and Cost of Living in Developing Countriedc6nxqmvkxNo ratings yet

- Analysis of The Health Economic and Social Effects of COVID-19 and The Approach To Tiering FINAL - Accessible v2Document48 pagesAnalysis of The Health Economic and Social Effects of COVID-19 and The Approach To Tiering FINAL - Accessible v2bmwscribdNo ratings yet

- Artikel Volatility AlbulescuDocument5 pagesArtikel Volatility AlbulescuEva WinartoNo ratings yet

- PRoblem Set 1Document9 pagesPRoblem Set 1Diogo BaiãoNo ratings yet

- Paper 5Document32 pagesPaper 5UMT JournalsNo ratings yet

- TVET Brief Issue No. 6 - COVID 19s Impact To Economic SectorsDocument14 pagesTVET Brief Issue No. 6 - COVID 19s Impact To Economic SectorsFrancis Joseph Maano ReyesNo ratings yet

- 04 Susak 2020 2Document21 pages04 Susak 2020 2Aivan KielNo ratings yet

- The Impact of Covid-19 Pandemic On The Global Economy: Emphasis On Poverty Alleviation and Economic GrowthDocument13 pagesThe Impact of Covid-19 Pandemic On The Global Economy: Emphasis On Poverty Alleviation and Economic GrowthNisir AyinochNo ratings yet

- Impact of Covid 19 in BangladeshDocument20 pagesImpact of Covid 19 in BangladeshShadowNo ratings yet

- Impacts of Covid-19 Pandemic On Global Economy A M PDFDocument12 pagesImpacts of Covid-19 Pandemic On Global Economy A M PDFJamshaid ahmed DahriNo ratings yet

- Economic Policy Uncertainty in Times of COVID-19 Pandemic Economic Policy Uncertainty in Times of COVID-19 PandemicDocument4 pagesEconomic Policy Uncertainty in Times of COVID-19 Pandemic Economic Policy Uncertainty in Times of COVID-19 PandemicCésar MalagutiNo ratings yet

- Covid 19Document14 pagesCovid 19Fatima FatimaNo ratings yet

- Efl20218 (1) 32 43Document12 pagesEfl20218 (1) 32 43Eimy PinazoNo ratings yet

- The Impact of COVID-19 Outbreak On Poverty:: An Estimation For IndonesiaDocument20 pagesThe Impact of COVID-19 Outbreak On Poverty:: An Estimation For IndonesiaRikyNo ratings yet

- Strict Lockdown Versus Flexible Social Distance Strategy For Covid19 DiseaseDocument6 pagesStrict Lockdown Versus Flexible Social Distance Strategy For Covid19 DiseaseHaleluya LeulsegedNo ratings yet

- W 27264Document19 pagesW 27264Sophie SchrutkaNo ratings yet

- Business Faculty - 1Document4 pagesBusiness Faculty - 1sajjadbappy70No ratings yet

- Impact of COVID-19 On The SDGsDocument30 pagesImpact of COVID-19 On The SDGsAhmad Saepu B UNo ratings yet

- The Impact of Covid-19 On Global EconomyDocument16 pagesThe Impact of Covid-19 On Global Economyasfaq uddinNo ratings yet

- What Might Go Right Upside Risks For 2023 EconomicsDocument10 pagesWhat Might Go Right Upside Risks For 2023 EconomicsThais AlmeidaNo ratings yet

- COVID-19: Briefing Note, March 16, 2020: Our Latest Perspective On The Coronavirus OutbreakDocument8 pagesCOVID-19: Briefing Note, March 16, 2020: Our Latest Perspective On The Coronavirus OutbreakgoogkiteNo ratings yet

- OIT (2020) Covid - 19 - Primera EdiciónDocument15 pagesOIT (2020) Covid - 19 - Primera EdiciónNahuel Aranda EjarqueNo ratings yet

- 1 s2.0 S2214635020302422 MainDocument9 pages1 s2.0 S2214635020302422 MainNeedlaregNo ratings yet

- Resubmission - Math 10A Mini Exploration - Stephen TongDocument8 pagesResubmission - Math 10A Mini Exploration - Stephen TongTang StephenNo ratings yet

- The Impact of COVID-19 Outbreak On Poverty: An Estimation For IndonesiaDocument21 pagesThe Impact of COVID-19 Outbreak On Poverty: An Estimation For IndonesiaIlha VhilaNo ratings yet

- Adb Brief 128 Economic Impact Covid19 Developing AsiaDocument14 pagesAdb Brief 128 Economic Impact Covid19 Developing AsiafacilitutorNo ratings yet

- © 2020 by The Author(s) - Distributed Under A Creative Commons CC BY LicenseDocument37 pages© 2020 by The Author(s) - Distributed Under A Creative Commons CC BY LicenseMd. Rakibul Hasan RabbiNo ratings yet

- Jing - The Impact of Covid-19 Pandemic On The Global Economy Emphasis On Poverty Alleviation and Economic GrowthDocument13 pagesJing - The Impact of Covid-19 Pandemic On The Global Economy Emphasis On Poverty Alleviation and Economic GrowthNova TambunanNo ratings yet

- The Global Economic Impact of The COVID-19 Pandemic: The Second Wave and Policy ImplicationsDocument42 pagesThe Global Economic Impact of The COVID-19 Pandemic: The Second Wave and Policy ImplicationsKaan AktemurNo ratings yet

- Effects of COVID 19 To Labor SectorDocument15 pagesEffects of COVID 19 To Labor SectorAubrey MacalaladNo ratings yet

- Social Sciences & Humanities Open: Steven Brakman, Harry Garretsen, Arjen Van WitteloostuijnDocument6 pagesSocial Sciences & Humanities Open: Steven Brakman, Harry Garretsen, Arjen Van WitteloostuijnJaved AkhtarNo ratings yet

- SSRN Id3598116Document35 pagesSSRN Id3598116M MNo ratings yet

- Spillovercovid 19 Coronavirusglobaleconomypetersonoziliarunthankom FINAL1Document28 pagesSpillovercovid 19 Coronavirusglobaleconomypetersonoziliarunthankom FINAL1Nandini KaushikNo ratings yet

- Sars-Cov-2 Elimination, Not Mitigation, Creates Best Outcomes For Health, The Economy, and Civil LibertiesDocument12 pagesSars-Cov-2 Elimination, Not Mitigation, Creates Best Outcomes For Health, The Economy, and Civil LibertiestuyendNo ratings yet

- The Economic Impact of The COVID-19Document14 pagesThe Economic Impact of The COVID-19Robin Wong0% (1)

- Mandated, Targeted Social Isolation Can Flatten The COVID-19 CurveDocument5 pagesMandated, Targeted Social Isolation Can Flatten The COVID-19 CurveSubhangi NandiNo ratings yet

- 1 s2.0 S0275531922001696 MainDocument12 pages1 s2.0 S0275531922001696 MainMuhammad YusufNo ratings yet

- Effects of Covid-19 Pandemic On Accounting and Financial Reporting in NigeriaDocument12 pagesEffects of Covid-19 Pandemic On Accounting and Financial Reporting in NigeriacpamutuiNo ratings yet

- Spillover of COVID-19: Impact On The Global EconomyDocument27 pagesSpillover of COVID-19: Impact On The Global EconomyowaisNo ratings yet

- Impact of COVID-19 Outbreak On Financial ReportingDocument18 pagesImpact of COVID-19 Outbreak On Financial Reportingsafa haddadNo ratings yet

- B&S - Blockchain Market W C-19 Impact Analysis - Forecast To 2026Document54 pagesB&S - Blockchain Market W C-19 Impact Analysis - Forecast To 2026afinetti3No ratings yet

- The Socio-Economic Determinants of The Coronavirus Disease (COVID-19) PandemicDocument22 pagesThe Socio-Economic Determinants of The Coronavirus Disease (COVID-19) PandemicAbdul WaleedNo ratings yet

- Iese Impact Covid19 PDFDocument30 pagesIese Impact Covid19 PDFDanish KhanNo ratings yet

- Mahler Yonzan Lakner IARIW 2022Document45 pagesMahler Yonzan Lakner IARIW 2022julian casasNo ratings yet

- Rapid Literature Review: Disaster Risk Financing and Public FinanceDocument22 pagesRapid Literature Review: Disaster Risk Financing and Public FinanceStefan TrifunovićNo ratings yet

- 1-s2.0-S031359262030463X-mainDocument10 pages1-s2.0-S031359262030463X-mainKim TanNo ratings yet

- COVID-19 Lockdown Intensity and Stock Market Returns: A Spatial Econometrics ApproachDocument9 pagesCOVID-19 Lockdown Intensity and Stock Market Returns: A Spatial Econometrics ApproachYassinefartakhNo ratings yet

- Economic Survey Set 1Document57 pagesEconomic Survey Set 1himanshu khuswahaNo ratings yet

- Shehzad Qazi TestimonyDocument19 pagesShehzad Qazi TestimonyHang QuynhNo ratings yet

- Journal Pre-Proof: Journal of Safety Science and ResilienceDocument19 pagesJournal Pre-Proof: Journal of Safety Science and ResilienceMohammed Shuaib AhmedNo ratings yet

- Pandemic Preparedness Covid 19 Lessons PDFDocument57 pagesPandemic Preparedness Covid 19 Lessons PDFAngelo BolgarNo ratings yet

- "Singapore's Policy Response To: Danny Quah National University of SingaporeDocument10 pages"Singapore's Policy Response To: Danny Quah National University of SingaporeDiah MhoNo ratings yet

- Consumer Inflation During The COVID-19 PandemicDocument3 pagesConsumer Inflation During The COVID-19 Pandemicsiyabonga dlaminiNo ratings yet

- MPRA Paper 108056Document19 pagesMPRA Paper 108056tamefayo09No ratings yet

- Pandemic Preparedness and Response Strategies: COVID-19 Lessons from the Republic of Korea, Thailand, and Viet NamFrom EverandPandemic Preparedness and Response Strategies: COVID-19 Lessons from the Republic of Korea, Thailand, and Viet NamNo ratings yet

- Technological Forecasting & Social Change: Carlos Santana, Laura AlbaredaDocument15 pagesTechnological Forecasting & Social Change: Carlos Santana, Laura Albaredaarman jamshidiNo ratings yet

- Blockchain For Deep Learning: Review and Open ChallengesDocument25 pagesBlockchain For Deep Learning: Review and Open Challengesarman jamshidiNo ratings yet

- Journal Pre-Proof: Journal of Network and Computer ApplicationsDocument80 pagesJournal Pre-Proof: Journal of Network and Computer Applicationsarman jamshidiNo ratings yet

- Investigation and Application of Differential Privacy in BitcoinDocument21 pagesInvestigation and Application of Differential Privacy in Bitcoinarman jamshidiNo ratings yet

- Computer CommunicationsDocument10 pagesComputer Communicationsarman jamshidiNo ratings yet

- High-Confidence Computing: Yourong Chen, Hao Chen, Yang Zhang, Meng Han, Madhuri Siddula, Zhipeng CaiDocument21 pagesHigh-Confidence Computing: Yourong Chen, Hao Chen, Yang Zhang, Meng Han, Madhuri Siddula, Zhipeng Caiarman jamshidiNo ratings yet

- 1Document8 pages1arman jamshidiNo ratings yet

- 13490-EnglishDocument12 pages13490-Englisharman jamshidiNo ratings yet

- Journal Pre-Proof: An Intelligent and Privacy-Enhanced Data Sharing Strategy For Blockchain-Empowered Internet of ThingsDocument10 pagesJournal Pre-Proof: An Intelligent and Privacy-Enhanced Data Sharing Strategy For Blockchain-Empowered Internet of Thingsarman jamshidiNo ratings yet

- Computers and Electrical EngineeringDocument12 pagesComputers and Electrical Engineeringarman jamshidiNo ratings yet

- Journal Pre-Proof: Journal of Network and Computer ApplicationsDocument59 pagesJournal Pre-Proof: Journal of Network and Computer Applicationsarman jamshidiNo ratings yet

- Sensors: Blockchain-Based Smart Home Networks Security Empowered With Fused Machine LearningDocument13 pagesSensors: Blockchain-Based Smart Home Networks Security Empowered With Fused Machine Learningarman jamshidiNo ratings yet

- Security Protocol For Internet of Things (Iot) : Blockchain-Based Implementation and AnalysisDocument6 pagesSecurity Protocol For Internet of Things (Iot) : Blockchain-Based Implementation and Analysisarman jamshidiNo ratings yet

- Journal of Cleaner Production: Tobias H Aggmark, Katarina ElofssonDocument19 pagesJournal of Cleaner Production: Tobias H Aggmark, Katarina Elofssonarman jamshidiNo ratings yet

- Future Generation Computer Systems: Kenji Saito Mitsuru IwamuraDocument12 pagesFuture Generation Computer Systems: Kenji Saito Mitsuru Iwamuraarman jamshidiNo ratings yet

- Journal of Cleaner Production: Shaozeng Dong, Liu Yang, Xuefeng Shao, Yifan Zhong, Yi Li, Ping QiaoDocument12 pagesJournal of Cleaner Production: Shaozeng Dong, Liu Yang, Xuefeng Shao, Yifan Zhong, Yi Li, Ping Qiaoarman jamshidiNo ratings yet

- Heliyon: Lilik Sugiharti, Miguel Angel Esquivias, Bekti SetyoraniDocument14 pagesHeliyon: Lilik Sugiharti, Miguel Angel Esquivias, Bekti Setyoraniarman jamshidiNo ratings yet

- Research in International Business and Finance: Shusheng Ding, Tianxiang Cui, Xiangling Wu, Min DuDocument14 pagesResearch in International Business and Finance: Shusheng Ding, Tianxiang Cui, Xiangling Wu, Min Duarman jamshidiNo ratings yet

- Economics Letters: Benjamin M. Blau, Todd G. Griffith, Ryan J. WhitbyDocument5 pagesEconomics Letters: Benjamin M. Blau, Todd G. Griffith, Ryan J. Whitbyarman jamshidiNo ratings yet

- Computers & Industrial EngineeringDocument14 pagesComputers & Industrial Engineeringarman jamshidiNo ratings yet

- Information Processing and Management: Zeyu Wang, Mingyu Li, Jia Lu, Xin ChengDocument14 pagesInformation Processing and Management: Zeyu Wang, Mingyu Li, Jia Lu, Xin Chengarman jamshidiNo ratings yet

- Accepted Manuscript: 10.1016/j.frl.2018.07.010Document13 pagesAccepted Manuscript: 10.1016/j.frl.2018.07.010arman jamshidiNo ratings yet

- Another Look at The Macroeconomic Information Content of Aggregate Earnings: Evidence From The Labor MarketDocument62 pagesAnother Look at The Macroeconomic Information Content of Aggregate Earnings: Evidence From The Labor Marketarman jamshidiNo ratings yet

- Research Article Effect of Sports Nutrition Supplement On The Increase of Physical Strength Based On Mobile Sensor Network TechnologyDocument12 pagesResearch Article Effect of Sports Nutrition Supplement On The Increase of Physical Strength Based On Mobile Sensor Network Technologyarman jamshidiNo ratings yet

- Journal Pre-Proof: Accounting, Organizations and SocietyDocument53 pagesJournal Pre-Proof: Accounting, Organizations and Societyarman jamshidiNo ratings yet

- Uncertainty and Sectoral Shifts: The Interaction Between Firm-Level and Aggregate-Level Shocks, and Macroeconomic ActivityDocument19 pagesUncertainty and Sectoral Shifts: The Interaction Between Firm-Level and Aggregate-Level Shocks, and Macroeconomic Activityarman jamshidiNo ratings yet

- Green Supply Chain Management in The Platform Economy: A Bibliometric AnalysisDocument17 pagesGreen Supply Chain Management in The Platform Economy: A Bibliometric Analysisarman jamshidiNo ratings yet

- 8Document10 pages8arman jamshidiNo ratings yet

- F1609 TarjomeFa EnglishDocument17 pagesF1609 TarjomeFa Englisharman jamshidiNo ratings yet

- Human Resources DevelopmentDocument16 pagesHuman Resources DevelopmentZahwa DhiyanaNo ratings yet

- MCQ QuestionsDocument5 pagesMCQ Questionskushal singhNo ratings yet

- Porter'S Five Forces: Modern SCM201Document19 pagesPorter'S Five Forces: Modern SCM201Le Hong Phuc (K17 HCM)No ratings yet

- Mutual Fund ScriptDocument12 pagesMutual Fund ScriptSudheesh Murali NambiarNo ratings yet

- Defining Marketing For The 21st CenturyDocument46 pagesDefining Marketing For The 21st CenturytawandaNo ratings yet

- The Role of Corporate Boards IN THE 1990s: February 29, 1992 Beaver Creek, ColoradoDocument21 pagesThe Role of Corporate Boards IN THE 1990s: February 29, 1992 Beaver Creek, ColoradoMuhammad RandyNo ratings yet

- The Position of Distribution LogisticsDocument5 pagesThe Position of Distribution LogisticsAlfira RestyNo ratings yet

- Final Examination Ge3 The Contemporary WorldDocument4 pagesFinal Examination Ge3 The Contemporary WorldRamon III ObligadoNo ratings yet

- The Social Economy: Professor Erik Olin WrightDocument14 pagesThe Social Economy: Professor Erik Olin WrightMike daryll NakigoNo ratings yet

- Coop Perspective and SupportDocument11 pagesCoop Perspective and SupportPlantacion de SikwateNo ratings yet

- British Gas Case StudyDocument15 pagesBritish Gas Case StudySubhalakshmi GanapathyNo ratings yet

- Fin Man HeavenDocument6 pagesFin Man HeavenJoshelFlorentinoNo ratings yet

- Blockchain and FinTech - Lecture 1 Courses 2022Document75 pagesBlockchain and FinTech - Lecture 1 Courses 2022puhao yeNo ratings yet

- World Development Report 2016 PDFDocument359 pagesWorld Development Report 2016 PDFZoune ArifNo ratings yet

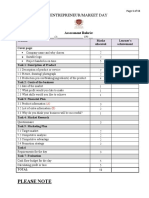

- Entrepreneurs DayDocument11 pagesEntrepreneurs DaySuperaraw3 MasterNo ratings yet

- CVF Technologies - DescriptionDocument2 pagesCVF Technologies - DescriptionGareth WealeNo ratings yet

- Considerations For Entrepreneurs Entering The Recreational Marijuana IndustryDocument15 pagesConsiderations For Entrepreneurs Entering The Recreational Marijuana IndustryRay RodriguezNo ratings yet

- ICON College of Technology and Management Faculty of Business and Management StudiesDocument26 pagesICON College of Technology and Management Faculty of Business and Management Studiesasifabdullah khanNo ratings yet

- Crocs Case StudyDocument18 pagesCrocs Case StudyAndrea BonfantiNo ratings yet

- Quiz 1 FMDocument3 pagesQuiz 1 FMwaqar HaiderNo ratings yet

- Macrs TableDocument3 pagesMacrs Tableeimg20041333No ratings yet

- Kavade Industries Company ProfileDocument6 pagesKavade Industries Company ProfileShruti LataneNo ratings yet

- Legal Compliances in CSRDocument30 pagesLegal Compliances in CSRspandan100% (1)

- Risk Assessment For Capital Construction ProjectsDocument27 pagesRisk Assessment For Capital Construction ProjectsM.TauqeerNo ratings yet

- Solid Waste Management Laws in PakistanDocument9 pagesSolid Waste Management Laws in PakistanhaloangleNo ratings yet

- AP Microeconomics Midterm Study GuideDocument1 pageAP Microeconomics Midterm Study Guidecuwekaza0% (1)

- Ap04-Ev04 Taller de Comprension de LecturaDocument3 pagesAp04-Ev04 Taller de Comprension de LecturaNELCY YULIETH CONTRERAS SANCHEZ100% (4)

- TATA STEEL's Acquisition of CORUSDocument9 pagesTATA STEEL's Acquisition of CORUSPallabi DowarahNo ratings yet

- Approaches To Policy AnalysisDocument2 pagesApproaches To Policy AnalysisAmar nath DholayNo ratings yet

- Transit: Problems and ProspectsDocument9 pagesTransit: Problems and ProspectsSumon Kumar DasNo ratings yet