Professional Documents

Culture Documents

Credit Transactions Matrix

Credit Transactions Matrix

Uploaded by

Ron PaguioOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Credit Transactions Matrix

Credit Transactions Matrix

Uploaded by

Ron PaguioCopyright:

Available Formats

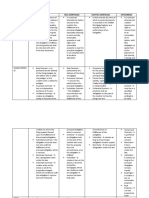

REAL ESTATE MORTGAGE CHATTEL MORTGAGE PLEDGE PERSONAL PROPERTY SECURITY ACT ANTICHRESIS

Act 3135, General Banking Act of 2000, Civil

GOVERNING LAW Act 1508, Civil Code Article 2039-2123 of the Civil Code Republic Act 11057

Code

a contract by virtue of which the

a contract whereby the debtor secures to the debtor delivers to the creditor or to a third A security agreement may provide for the

creditor the fulfillment of a principal a contract by virtue of which a PERSONAL person a PERSONAL PROPERTY/MOVABLE or creation of a security interest in a future

obligation, immediately making document evidencing INCORPOREAL RIGHTS

NATURE IMMOVABLE PROPERTY OR REAL RIGHTS PROPERTY is recorded in the Chattel Mortgage for the purpose of securing the fulfillment of a property, but the security interest in

Register as security for the performance of an PERSONAL PROPERTY is created only when the

OVER IMMOVABLE PROPERTY answerable to obligation. principal obligation with the understanding grantor acquires rights in it or the power to

the principal obligation in case it is not that when the obligation is fulfilled, the thing

complied with at the time stipulated. delivered shall be returned with all its fruits encumber it.

and accessions.

REGISTRATION Registry of Deeds Electronic Chattel Mortgage Registry Public Instrument Personal Property Security Registry

DELIVERY TO CREDITOR NOT REQUIRED NOT REQUIRED REQUIRED YES & NO

Section 49. Right to Dispose of Collateral.—

(a) After default, a secured creditor may sell or

MODE/S OF RECOVERY Judicial or Extra-judicial Foreclosure Judicial or Extra-judicial Foreclosure Public Sale via Notary otherwise dispose of the collateral, publicly or

privately, in its present condition or following

any commercially reasonable preparation or

processing.

POSTING AND PUBLICATION REQUIRED REQUIRED NOT REQUIRED NOTICE OF REGISTRATION IN PPSR

YES - Creditor may maintain action for NO (BASED ON ARTICLE 2115: If the price of YES. Section 52. Application of Proceeds.—

deficiency although the Chattel Mortgage Law the sale is less, neither shall the creditor be

DEFICIENCY / RIGHT TO CLAIM DEFICIENCY YES - Mortgagee is entitled to deficiency is silent on this point, because a chattel entitled to recover the deficiency, (b) The secured creditor shall account to the

mortgage is given only as a security and not as notwithstanding any stipulation to the grantor for any surplus, and, unless otherwise

payment of the debt. contrary.) agreed, the debtor is liable for any deficiency.

YES. Section 52. Application of Proceeds.—

NO (BASED ON ARTICLE 2115: If the price of

the sale is more than said amount, the debtor

RETURN OF SURPLUS MUST BE RETURNED MUST BE RETURNED (b) The secured creditor shall account to the

shall not be entitled to the excess, unless it is grantor for any surplus, and, unless otherwise

otherwise agreed. )

agreed, the debtor is liable for any deficiency.

REDEMPTION YES (Right of Redemption) NONE PROVIDED BY LAW NONE PROVIDED BY LAW YES (Equity of Redemption)

The amount of the winning bid plus 1% legal

FORMULA OF REDEMPTION PRICE interest per month from the date of the NOT APPLICABLE NOT APPLICABLE

auction sale up to the time of redemption

NO (Article 2088)

APPROPRIATION ALLOWED NO (Article 2088) NO (Article 2088) Exception: When the 1st or 2nd Auction sale is YES (Right of Retention)

not successful.

DIVISIBLE NO (Article 2089-2090) NO (Article 2089-2090) NO (Article 2089-2090) NO (Article 2089-2090)

You might also like

- Understanding RA 11057 and Its Effect With NCC and Prior LawsDocument2 pagesUnderstanding RA 11057 and Its Effect With NCC and Prior LawsKym Algarme100% (2)

- PPSA V Civil CodeDocument3 pagesPPSA V Civil CodeElaizza ConcepcionNo ratings yet

- Revised PPSA V. Chattel Mortgage, Pledge, Preference of CreditDocument8 pagesRevised PPSA V. Chattel Mortgage, Pledge, Preference of CreditJj Jumalon67% (3)

- Art 2085-2141 Reviewer Self MadeDocument15 pagesArt 2085-2141 Reviewer Self MadeJyasmine Aura V. AgustinNo ratings yet

- Personal Property Security Act V. Chattel Mortgage Chattel Mortgage (NCC ACT 1508) PPSA (R.A. 11057)Document8 pagesPersonal Property Security Act V. Chattel Mortgage Chattel Mortgage (NCC ACT 1508) PPSA (R.A. 11057)Jj JumalonNo ratings yet

- REPUBLIC ACT (R.A.) NO. 11057: Otherwise Known As The "Personal Property Security Act"Document10 pagesREPUBLIC ACT (R.A.) NO. 11057: Otherwise Known As The "Personal Property Security Act"Al MarvinNo ratings yet

- Notes On PledgeDocument4 pagesNotes On Pledgefe rose sindinganNo ratings yet

- Comparison PPSA NCC CMLDocument6 pagesComparison PPSA NCC CMLNur Omar100% (1)

- Table of Comparison FinalsDocument5 pagesTable of Comparison FinalsThelma PelaezNo ratings yet

- Redemption: Exists Only in Real Estate Mortgage Enclosure. The Period ToDocument27 pagesRedemption: Exists Only in Real Estate Mortgage Enclosure. The Period ToReign Christel EstefanioNo ratings yet

- Table of Comparison FinalsDocument5 pagesTable of Comparison Finalscarl stabliNo ratings yet

- This Study Resource Was: Credit TransactionsDocument9 pagesThis Study Resource Was: Credit TransactionsChristian FloraldeNo ratings yet

- CredTrans Pledge ReviewerDocument8 pagesCredTrans Pledge ReviewerLayaNo ratings yet

- MortgageDocument19 pagesMortgageLisa PorjeoNo ratings yet

- MortgageDocument19 pagesMortgagesolomontemplestoneNo ratings yet

- Obligations and Contracts: San Beda College of LawDocument36 pagesObligations and Contracts: San Beda College of LawGlory Nicol OrapaNo ratings yet

- RA 11057 vs. Repealed LawsDocument2 pagesRA 11057 vs. Repealed LawsSage Rainelle LingatongNo ratings yet

- Guaranty-Suretyship MatrixDocument17 pagesGuaranty-Suretyship MatrixKirstie Marie SaldoNo ratings yet

- Oblicon - Art 1163 To 1179Document37 pagesOblicon - Art 1163 To 1179jammyNo ratings yet

- MOD 3 - COMM - FinalsDocument13 pagesMOD 3 - COMM - Finalslunameru93No ratings yet

- Guaranty, REMDocument3 pagesGuaranty, REMAndrea Ivy DyNo ratings yet

- PledgeDocument4 pagesPledgefe rose sindinganNo ratings yet

- Mortgage Possession of Property MortgagedDocument5 pagesMortgage Possession of Property MortgagedNikki D. ChavezNo ratings yet

- Real Mortgage Note: de LeonDocument6 pagesReal Mortgage Note: de LeonGela Bea BarriosNo ratings yet

- Marx Notes - Civil Law Review 2 (Seña) (Jaky Pagarigan's Conflicted Copy 2014-12-29) - 141-147Document7 pagesMarx Notes - Civil Law Review 2 (Seña) (Jaky Pagarigan's Conflicted Copy 2014-12-29) - 141-147Elle WoodsNo ratings yet

- Pledge Real Estate Mortgage Chattel Mortgage: ObjectDocument3 pagesPledge Real Estate Mortgage Chattel Mortgage: Objectpatrick ademNo ratings yet

- Personal Property Security ActDocument4 pagesPersonal Property Security ActREENA ALEKSSANDRA ACOPNo ratings yet

- Collateral SecuritiesDocument2 pagesCollateral SecuritiesJoey SulteNo ratings yet

- Pledge Provisions Common To Pledge and Mortgage (Common Provisions), Articles 2085-2092Document14 pagesPledge Provisions Common To Pledge and Mortgage (Common Provisions), Articles 2085-2092Gideon Salino Gasulas BunielNo ratings yet

- Credit Transactions TablesDocument2 pagesCredit Transactions TablesAster Beane AranetaNo ratings yet

- Rule 65 Certiorari 65 Prohibition 65 Mandamus 66 Quo Warranto 67 Expropriation 68 Foreclosure of Real Estate Mortgage 69 PartitionsDocument8 pagesRule 65 Certiorari 65 Prohibition 65 Mandamus 66 Quo Warranto 67 Expropriation 68 Foreclosure of Real Estate Mortgage 69 PartitionsVanessa SagmitNo ratings yet

- PledgeDocument26 pagesPledgeAli BastiNo ratings yet

- Obligations and Contracts: San Beda College of LawDocument33 pagesObligations and Contracts: San Beda College of LawKezia EscarioNo ratings yet

- 04 Pledge Mortgage and AntichresisDocument24 pages04 Pledge Mortgage and AntichresisJan33% (3)

- Credit Reviewer HandoutsDocument7 pagesCredit Reviewer HandoutsChrizllerNo ratings yet

- Pledge Real Mortgage Chattel Mortgage AntichresisDocument12 pagesPledge Real Mortgage Chattel Mortgage AntichresisKATHERINEMARIE DIMAUNAHANNo ratings yet

- 08 - Law-on-Business-Transactions-Credit-TransactionsDocument121 pages08 - Law-on-Business-Transactions-Credit-TransactionsBea GarciaNo ratings yet

- CredTrans 2 FinalDocument7 pagesCredTrans 2 FinaltheamorerosaNo ratings yet

- Notes On Obligations and Contracts (Notes)Document32 pagesNotes On Obligations and Contracts (Notes)Merry DaguimolNo ratings yet

- Comparative Tables CreditDocument2 pagesComparative Tables CreditArvi RiveraNo ratings yet

- Truth in Lending ActDocument3 pagesTruth in Lending ActAlyssa PuentespinaNo ratings yet

- When The Debtor Attempts To AbscondDocument2 pagesWhen The Debtor Attempts To AbscondLeona SanchezNo ratings yet

- Comparison..pledge, Mortgage, AntichresisDocument2 pagesComparison..pledge, Mortgage, AntichresisElfin Kenneth Puentespina0% (1)

- Summary of ContractsDocument1 pageSummary of ContractsDang GVNo ratings yet

- Assignment: Bs Accounting & FinanceDocument3 pagesAssignment: Bs Accounting & FinanceBurairNo ratings yet

- Assignment: Bs Accounting & FinanceDocument3 pagesAssignment: Bs Accounting & FinanceBurairNo ratings yet

- OBLICON NotesDocument7 pagesOBLICON Notesa.cabilbil03742No ratings yet

- Obligation To Pay InterestDocument20 pagesObligation To Pay InterestPaulyn BathanNo ratings yet

- Cred Trans - PpsaDocument10 pagesCred Trans - PpsaJane Galicia100% (3)

- Law Mid 2Document10 pagesLaw Mid 2Gwyneth RobledoNo ratings yet

- Memory Aid - OBLICON Memory Aid - OBLICONDocument29 pagesMemory Aid - OBLICON Memory Aid - OBLICONEliNo ratings yet

- Lecture Notes 2-FRIADocument5 pagesLecture Notes 2-FRIAAndre G. LagamiaNo ratings yet

- Asset Privatization Trust vs. T.J. EnterprisesDocument13 pagesAsset Privatization Trust vs. T.J. EnterprisesdelbertcruzNo ratings yet

- 3 - Civil Law - Green NotesDocument52 pages3 - Civil Law - Green NotesCelina GonzalesNo ratings yet

- Form and InterpretationDocument10 pagesForm and Interpretationaileen reyesNo ratings yet

- Bar Civil Nptes 2022Document10 pagesBar Civil Nptes 2022Tin TinNo ratings yet

- Stipulations That Are Usurious Are Void and The Borrower Can Recover From Such Devious SchemeDocument4 pagesStipulations That Are Usurious Are Void and The Borrower Can Recover From Such Devious SchemeDonna IsubolNo ratings yet

- Quizzes and Codal - MidtermsDocument2 pagesQuizzes and Codal - MidtermsVernon ArquinesNo ratings yet

- GUILLERMO-Tabular Comparison of PPSA As Against Pledge, Chatel Mortgage and Preference of CreditsDocument2 pagesGUILLERMO-Tabular Comparison of PPSA As Against Pledge, Chatel Mortgage and Preference of CreditsPATRICIA MAE GUILLERMONo ratings yet

- Convention on International Interests in Mobile Equipment - Cape Town TreatyFrom EverandConvention on International Interests in Mobile Equipment - Cape Town TreatyNo ratings yet