Professional Documents

Culture Documents

Orca Company

Orca Company

Uploaded by

lk0 ratings0% found this document useful (0 votes)

9 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

9 views1 pageOrca Company

Orca Company

Uploaded by

lkCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 1

CHAPTER 8

ACCOUNTING CHANGES

Accounting policy and accounting estimate

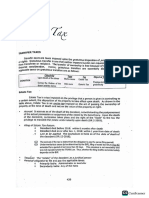

Pproblera8-1 (AICPA Adapted)

During 2021, Orca Company decided to

inventory valuation to the weighted averag

tax rate is 30%,

from the FIFO

change

he income

e method. T

FIFO Weighted average

7,100,000 7,100,000

7,900,000 8,200,000.

umulative effect of the

January | inventory

December 31 inventory

What amount should be reported as the c

accounting change for 2021?

a. 420,000 increase

b. 420,000 increase

c. 600,000 increase

d. 600,000 decrease

Solution 8-1 Answer a . :

FIFO inventory = January 1 7,100,000

Weighted average inventory ~ January 1 7,700,000

Cumulative effect 600,000

Cumulative effect after tax (70% x. 600,000) 420,000

The change from FIFO to weighted average isachangein accounting

policy. The cumulative effect of the change accounting policy is an

adjustment of retained earnings. 7

Inventory 600,000

Retained earnings 420,000

180,000

Income tax payable

101

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Part 9Document76 pagesPart 9lkNo ratings yet

- Part 4Document114 pagesPart 4lkNo ratings yet

- Part 7Document48 pagesPart 7lkNo ratings yet

- Part 8Document12 pagesPart 8lkNo ratings yet

- Part 3Document18 pagesPart 3lkNo ratings yet

- Part 2Document100 pagesPart 2lkNo ratings yet

- Ronalyn CompanyDocument2 pagesRonalyn CompanylkNo ratings yet

- Part 0Document6 pagesPart 0lkNo ratings yet

- Roma CompanyDocument1 pageRoma CompanylkNo ratings yet

- Digestive System Study GuideDocument1 pageDigestive System Study GuidelkNo ratings yet

- Raven CompanyDocument1 pageRaven CompanylkNo ratings yet

- Folk CompanyDocument1 pageFolk CompanylkNo ratings yet

- Kenya CompanyDocument2 pagesKenya CompanylkNo ratings yet

- Natasha CompanyDocument1 pageNatasha CompanylkNo ratings yet

- Mint CompanyDocument2 pagesMint CompanylkNo ratings yet

- Samar CompanyDocument1 pageSamar CompanylkNo ratings yet

- Racelle CompanyDocument2 pagesRacelle CompanylkNo ratings yet

- Jazz CompanyDocument1 pageJazz CompanylkNo ratings yet

- Norway CompanyDocument1 pageNorway CompanylkNo ratings yet

- Lee CompanyDocument1 pageLee CompanylkNo ratings yet

- Gibson CompanyDocument1 pageGibson CompanylkNo ratings yet

- Flame CompanyDocument1 pageFlame CompanylkNo ratings yet

- Hiligaynon CompanyDocument1 pageHiligaynon CompanylkNo ratings yet

- Flax CompanyDocument1 pageFlax CompanylkNo ratings yet

- Goddard CompanyDocument1 pageGoddard CompanylkNo ratings yet

- Ginger CompanyDocument1 pageGinger CompanylkNo ratings yet

- Dublin CompanyDocument1 pageDublin CompanylkNo ratings yet

- Gold CompanyDocument2 pagesGold CompanylkNo ratings yet

- Caroline CompanyDocument1 pageCaroline CompanylkNo ratings yet

- Dean CompanyDocument1 pageDean CompanylkNo ratings yet