Professional Documents

Culture Documents

BT TCDN

BT TCDN

Uploaded by

Võ Hoàng Nhân0 ratings0% found this document useful (0 votes)

22 views6 pagesThe document discusses several scenarios involving investments in stocks and bonds. It provides information on the expected returns and standard deviations of individual stocks and portfolios consisting of different combinations of stocks. It also discusses calculating optimal proportions of risky and risk-free assets for investors with varying risk aversion to construct efficient portfolios.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses several scenarios involving investments in stocks and bonds. It provides information on the expected returns and standard deviations of individual stocks and portfolios consisting of different combinations of stocks. It also discusses calculating optimal proportions of risky and risk-free assets for investors with varying risk aversion to construct efficient portfolios.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

22 views6 pagesBT TCDN

BT TCDN

Uploaded by

Võ Hoàng NhânThe document discusses several scenarios involving investments in stocks and bonds. It provides information on the expected returns and standard deviations of individual stocks and portfolios consisting of different combinations of stocks. It also discusses calculating optimal proportions of risky and risk-free assets for investors with varying risk aversion to construct efficient portfolios.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 6

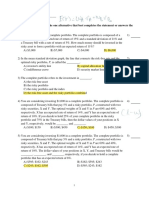

1.

An investor is considering to invest in stock and bond

in the following table:

a. Expected return and standard deviation of the stock and

bond.

b. Expected return and standard deviation of the risky

portfolio P:

+ 60% in stock and 40% bonds.

+ 100% invest in Stocks

+ 100% invest in Bonds

2. Price in 2013 of stock X, Y and Z are $54, $32 and 45

respectively. A financial analyst of ABC Security

Company forecasts the price of stock X,Y and Z after 1

year as following:

Period X Y Z

2014 52 30 40

2015 58 39 45

2016 55 32 47

2017 53 37 44

2018 64 39 49

a. What are expected return and standard deviation of the

three stocks.

b. Should investor combine stock X and Y to form a

portfolio

c. What are expected return and standard deviation of the

risky portfolio P which invests 60% in stock X and 40%

in stock Y.

d. How much should investor invest in risky portfolio P in

order to construct an optimized complete portfolio, given

risk-free rate is 6% and A = 3.

e. What are expected return and standard deviation of

optimized complete portfolio?

f. Which portfolio should be invested if investor is

considering between portfolio 1 (20% in stock X and 80%

in stock Y) and portfolio 2 (50% in stock X and 50% in

stock Z)

3. Current price of stock X and Y are $54 and $32

respectively. A financial analyst of ABC Security

Company forecasts the price of stock X and Y after 1 year

as following:

Economic Price of Price of stock

Probability

conditions stock X Y

Bad 0.2 42 27

OK 0.4 58 35

Good 0.4 65 40

a. What are expected return and standard deviation of the

two stocks.

b. What are expected return and standard deviation of the

risky portfolio P which invests 60% in stock X and 40%

in stock Y.

c. How much should investor invest in risky portfolio P in

order to construct an optimized complete portfolio, given

risk-free rate is 6% and A = 3.

d. What are expected return and standard deviation of

optimized complete portfolio?

4. Stock A, B, C and D have expected return and standard

deviation respectively as follow

Stock Expected Standard

return deviation

A 7% 0%

B 11% 7%

C 19% 14%

D 20% 30%

a) Which stock a risk- neutral investor is most likely to

choose ?

b)Which stock a risk- seeking investor is most likely to

choose, given that his risk aversion has a value of A=

2

c) Calculate the return and standard deviation of the

portfolio which invest 45% in stock B and the

remainding in stock C, given that the correlation of

stock B and C is 0.5

d)Which stock should be invested if the investor is

considering stock C and stock .

5. An investor is considering adding a risk-free asset

with a return of 3% into his risky portfolio. The

expected return and standard deviation of the risky

portfolio is 7% and 15%. His risk aversion value is 2

a) Calculate the optimal proportion invested in risk-free

asset

b) Write an equation for the capital allocation line that

will connect the risk-free asset to the portfolio of

risky assets

c) What is the standard deviation of the new portfolio

that gives a 9% return and is on the capital allocation

line?

6. Stock A and B have expected return and standard

deviation respectively as follow

Stock Expected return Standard

deviation

A 11% 13%

B 23% 18%

Correlation between A and B = 0.45

Risk-free rate = 4%

a) Which portfolio should be invested if investor is

considering between Risky portfolio 1 (30% in stock

A and 70% in stock B) and portfolio 2 (25% in stock

A and 75% in stock B)

b)If Investor add a risk-free asset C with a return of 5%

into the risky portfolio that was choosed in part (a) to

form a complete portfolio. What should the optimal

proportions of risky portfolio and risk-free asset for

an investor whose degree of risk aversion is 3.

c) Calculate the expected return and standard deviation

of the complete portfolio

7. . Price in 2013 of stock X, Y and Z are $54, $32 and 45 respectively. A

financial analyst of ABC Security Company forecasts the price of stock X,Y and Z

after 1 year as following:

Period X Y Z

2014 52 30 40

2015 58 39 45

2016 55 32 47

2017 53 37 44

2018 64 39 49

a. What are expected return and standard deviation of the three stocks.

b. Should investor combine stock X and Y to form a portfolio

c. What are expected return and standard deviation of the risky portfolio P which

invests 60% in stock X and 40% in stock Y.

d. How much should investor invest in risky portfolio P in order to construct an

optimized complete portfolio, given risk-free rate is 6% and A = 3.

e. What are expected return and standard deviation of optimized complete

portfolio?

f. Which portfolio should be invested if investor is considering between portfolio 1

(20% in stock X and 80% in stock Y) and portfolio 2 (50% in stock X and 50% in

stock Z)

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Mock Exam Questions On Risk and Return and BondsDocument10 pagesMock Exam Questions On Risk and Return and BondsArjinder Singh100% (1)

- 4 - Problem - Set FRM - PS PDFDocument3 pages4 - Problem - Set FRM - PS PDFValentin IsNo ratings yet

- F 17 As 1Document3 pagesF 17 As 1Massimo FerranteNo ratings yet

- Arts Council EnglandDocument6 pagesArts Council EnglandShankeyNo ratings yet

- Extra Excise FinalDocument5 pagesExtra Excise FinaluyensakurachanNo ratings yet

- Extra Excise Final NewDocument3 pagesExtra Excise Final NewMinh ThiNo ratings yet

- Extra Excise Final NewestDocument6 pagesExtra Excise Final NewestMinh ThiNo ratings yet

- Utility Theory and Portfolio ManagementDocument3 pagesUtility Theory and Portfolio ManagementMd Roni HasanNo ratings yet

- Extra Final Ex 2023 NewDocument3 pagesExtra Final Ex 2023 NewuyensakurachanNo ratings yet

- HW01Document5 pagesHW01lhbhcjlyhNo ratings yet

- FIN MGT 2 Quiz 1Document3 pagesFIN MGT 2 Quiz 1Alelie dela CruzNo ratings yet

- Assignment 2Document3 pagesAssignment 2Gabriel PodolskyNo ratings yet

- Cfa L 1 Mock Paper - Solution - 2024Document10 pagesCfa L 1 Mock Paper - Solution - 2024guayrestudioNo ratings yet

- Investment Analysis (FIN 670) Fall 2009Document13 pagesInvestment Analysis (FIN 670) Fall 2009BAHADUR singhNo ratings yet

- Chapter 5Document5 pagesChapter 5Khue NgoNo ratings yet

- Chapter 5Document5 pagesChapter 5Tran Phuong ThaoNo ratings yet

- FOI Assignment 2023Document3 pagesFOI Assignment 2023Rohan MauryaNo ratings yet

- Quant ExamDocument13 pagesQuant ExamhootanNo ratings yet

- Quiz 1Document8 pagesQuiz 1HUANG WENCHENNo ratings yet

- Risk and Return (Sample Questions)Document3 pagesRisk and Return (Sample Questions)mintakhtsNo ratings yet

- IUFM - Lecture 5 and Lecture 6 - Homework HandoutsDocument6 pagesIUFM - Lecture 5 and Lecture 6 - Homework Handoutsnhu1582004No ratings yet

- IU - Fm.lecture5 Handouts 2021NCTDocument5 pagesIU - Fm.lecture5 Handouts 2021NCTmai anh NguyễnNo ratings yet

- Business Finance 11Th Edition Peirson Test Bank Full Chapter PDFDocument61 pagesBusiness Finance 11Th Edition Peirson Test Bank Full Chapter PDFmrsamandareynoldsiktzboqwad100% (12)

- Homework 5Document9 pagesHomework 5mas888No ratings yet

- Business Finance 11th Edition Peirson Test BankDocument40 pagesBusiness Finance 11th Edition Peirson Test Bankcodykerrdiaqbnwyrp100% (33)

- Tutorial Questions On Fundamrntal of Investment Analysis 2024Document10 pagesTutorial Questions On Fundamrntal of Investment Analysis 2024Blaise KrisNo ratings yet

- Chap006 Text BankDocument14 pagesChap006 Text BankAshraful AlamNo ratings yet

- Chap 5-Pages-45-46,63-119Document59 pagesChap 5-Pages-45-46,63-119RITZ BROWN100% (1)

- (Download PDF) Business Finance 11th Edition Peirson Test Bank Full ChapterDocument63 pages(Download PDF) Business Finance 11th Edition Peirson Test Bank Full Chapterywksodea100% (14)

- Tutorial 4 - SolutionsDocument7 pagesTutorial 4 - SolutionsstoryNo ratings yet

- PortfolioDocument24 pagesPortfolioAditi SharmaNo ratings yet

- Problem Set 2Document4 pagesProblem Set 2Omar SrourNo ratings yet

- Tutorial 4Document3 pagesTutorial 4sera porotakiNo ratings yet

- Business Finance 11th Edition Peirson Test Bank instant download all chapterDocument53 pagesBusiness Finance 11th Edition Peirson Test Bank instant download all chapterkilkushansra100% (7)

- Ebookfiles 9867Document63 pagesEbookfiles 9867letdcdalandta636No ratings yet

- Chapter 6 QuizzDocument4 pagesChapter 6 QuizzTran Phuong ThaoNo ratings yet

- Act7 2Document4 pagesAct7 2Helen B. EvansNo ratings yet

- Compared To Investing in A Single Security, Diversification Provides Investors A Way ToDocument8 pagesCompared To Investing in A Single Security, Diversification Provides Investors A Way ToDarlyn ValdezNo ratings yet

- Risk Return Sharpe QsDocument2 pagesRisk Return Sharpe QsKshitij TyagiNo ratings yet

- Problem Set 1Document3 pagesProblem Set 1ikramraya0No ratings yet

- Act std4Document3 pagesAct std4Helen B. EvansNo ratings yet

- MCQDocument4 pagesMCQWM WilfordNo ratings yet

- Final Exam Questions Portfolio ManagementDocument9 pagesFinal Exam Questions Portfolio ManagementThảo Như Trần NgọcNo ratings yet

- Sample Exam QuestionsDocument16 pagesSample Exam QuestionsMadina SuleimenovaNo ratings yet

- Risk and Return QUESTIONSDocument4 pagesRisk and Return QUESTIONSJulianNo ratings yet

- Global Finance 15Document4 pagesGlobal Finance 15gracewoods431No ratings yet

- Chapters 12 & 13 Practice Problems: Economy Probability Return On Stock A Return On Stock BDocument4 pagesChapters 12 & 13 Practice Problems: Economy Probability Return On Stock A Return On Stock BAnsleyNo ratings yet

- Bank 1,2,3,4-Portfolios IiDocument11 pagesBank 1,2,3,4-Portfolios IimileNo ratings yet

- DTTC, C7Document8 pagesDTTC, C7NhuNo ratings yet

- Chapter 06 - Efficient DiversificationDocument50 pagesChapter 06 - Efficient DiversificationMarwa HassanNo ratings yet

- FRM Quantitative Analysis Test 1 PDFDocument11 pagesFRM Quantitative Analysis Test 1 PDFConradoCantoIIINo ratings yet

- Homework 2Document5 pagesHomework 2siddev12344321No ratings yet

- Module - 4 Problem On Portfolio Risk & Return-IIDocument4 pagesModule - 4 Problem On Portfolio Risk & Return-IIgaurav supadeNo ratings yet

- FIN352 FALL17Exam2Document6 pagesFIN352 FALL17Exam2Hiếu Nguyễn Minh Hoàng0% (1)

- DTU406 - Mock ExamDocument8 pagesDTU406 - Mock ExamXuân MaiNo ratings yet

- Mock Test QuestionsDocument7 pagesMock Test QuestionsMyraNo ratings yet

- INA W5Formative TSDocument5 pagesINA W5Formative TSNayden GeorgievNo ratings yet

- MBE AssignmentDocument4 pagesMBE AssignmentDeepanshu Arora100% (1)

- CFA 2012 - Exams L1 : How to Pass the CFA Exams After Studying for Two Weeks Without AnxietyFrom EverandCFA 2012 - Exams L1 : How to Pass the CFA Exams After Studying for Two Weeks Without AnxietyRating: 3 out of 5 stars3/5 (2)

- FPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)From EverandFPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)No ratings yet

- Padini Holdings BHDDocument9 pagesPadini Holdings BHDFeliNo ratings yet

- Chapter 1 The Accountancy ProfessionDocument7 pagesChapter 1 The Accountancy ProfessionJoshua Sapphire AmonNo ratings yet

- MGB Ignition FeedbackDocument3 pagesMGB Ignition Feedbacktrouble monkeyNo ratings yet

- Traditional Conjoint Workfile XLSTATDocument80 pagesTraditional Conjoint Workfile XLSTATSaurabh SinghNo ratings yet

- David Aguilar ResumeDocument1 pageDavid Aguilar ResumeDavidAguilarNo ratings yet

- Bachelor Thesis - Sedimentation Reduction and Check Dam Design in The Cilalawi River (GJVos) - SendDocument92 pagesBachelor Thesis - Sedimentation Reduction and Check Dam Design in The Cilalawi River (GJVos) - SendLauravista Septy FerlanyNo ratings yet

- Programme Club Inde 201113Document1 pageProgramme Club Inde 201113benteppeNo ratings yet

- Frantz 1998Document13 pagesFrantz 1998Jorge Leopoldo VeraNo ratings yet

- Application of Polymerase Chain Reaction For Detection of Camels' Milk Adulteration by Milk of CowDocument1 pageApplication of Polymerase Chain Reaction For Detection of Camels' Milk Adulteration by Milk of CowMihaelaOlaruNo ratings yet

- Dilip Datta (Auth.) - LaTeX in 24 Hours - A Practical Guide For Scientific Writing-Springer International Publishing (2017)Document309 pagesDilip Datta (Auth.) - LaTeX in 24 Hours - A Practical Guide For Scientific Writing-Springer International Publishing (2017)Leandro de Queiroz100% (3)

- Creating A Raspberry Pi Cluster - A Tutorial For StudentsDocument7 pagesCreating A Raspberry Pi Cluster - A Tutorial For StudentsAlan SagarNo ratings yet

- Service Manual: Controller Sigma Control 2Document33 pagesService Manual: Controller Sigma Control 2Mukhlis YasinNo ratings yet

- Height WorkDocument3 pagesHeight Workssb goddaNo ratings yet

- PhenomenologyDocument27 pagesPhenomenologyMerasol Matias Pedrosa100% (1)

- Settlement Deed A Case Study Study of LaDocument3 pagesSettlement Deed A Case Study Study of Lavaidehipragna pragnaNo ratings yet

- T3530! Operating Manual Eletrolux SecadoraDocument24 pagesT3530! Operating Manual Eletrolux SecadoravilelarodrNo ratings yet

- Review Article The Roles and Responsibilities of Management Accountants in The Era of GlobalizationDocument2 pagesReview Article The Roles and Responsibilities of Management Accountants in The Era of GlobalizationJose Fanny100% (1)

- Validation Guide July2013Document37 pagesValidation Guide July2013Herdiwan NovindraNo ratings yet

- Nar Ont 1 GbpsDocument49 pagesNar Ont 1 GbpsCatalin StoicescuNo ratings yet

- SANITARY PERMIT YampleDocument6 pagesSANITARY PERMIT Yamplekimmy100% (1)

- DIGEST. Complte. Turner V Lorenzo ShippingDocument2 pagesDIGEST. Complte. Turner V Lorenzo ShippingIamIvy Donna PondocNo ratings yet

- Buyer Agent AgreementDocument2 pagesBuyer Agent AgreementIndia PropertiesNo ratings yet

- The Compleat Gentleman PeachamDocument316 pagesThe Compleat Gentleman PeachamCezara Ripa de MilestiNo ratings yet

- Legal FormsDocument29 pagesLegal FormsRiyu Jan Raztech100% (1)

- An Example of Data Analysis: Mathematics Higher Level Internal Assessment ExplorationDocument15 pagesAn Example of Data Analysis: Mathematics Higher Level Internal Assessment ExplorationLorraine SabbaghNo ratings yet

- Faculty of Juridical Sciences SubjectDocument10 pagesFaculty of Juridical Sciences SubjectPhenomenal oneNo ratings yet

- Single-Mode Fibre, E9 - 125 - 250, OS2 - G.652.D PDFDocument1 pageSingle-Mode Fibre, E9 - 125 - 250, OS2 - G.652.D PDFDrago AndrijevicNo ratings yet

- Nigerian Electricity Regulatory Commission: Eligible Customer Regulations 2017 Regulation No. Nerc-R-111Document30 pagesNigerian Electricity Regulatory Commission: Eligible Customer Regulations 2017 Regulation No. Nerc-R-111olisamc_628730283No ratings yet

- Chicco Cortina Stroller Owner's Manual PDFDocument36 pagesChicco Cortina Stroller Owner's Manual PDFRoss Imperial CruzNo ratings yet