Professional Documents

Culture Documents

Daily Currency Briefing: No Solution For Europe, Dollar Under Pressure

Daily Currency Briefing: No Solution For Europe, Dollar Under Pressure

Uploaded by

timurrsCopyright:

Available Formats

You might also like

- The Dollar Trap: How the U.S. Dollar Tightened Its Grip on Global FinanceFrom EverandThe Dollar Trap: How the U.S. Dollar Tightened Its Grip on Global FinanceRating: 4 out of 5 stars4/5 (1)

- MCQ On Final AccountDocument5 pagesMCQ On Final AccountAnonymous b4qyne75% (12)

- MoaDocument2 pagesMoalynnbethNo ratings yet

- Paginas CryptosDocument4 pagesPaginas CryptosWilson Gil Calderón0% (1)

- Daily Currency Briefing: Quiet Before The Storm?Document4 pagesDaily Currency Briefing: Quiet Before The Storm?timurrsNo ratings yet

- Daily Currency Briefing: US Debt Ceiling: All or NothingDocument4 pagesDaily Currency Briefing: US Debt Ceiling: All or NothingtimurrsNo ratings yet

- Daily Currency Briefing: A Point For TrichetDocument4 pagesDaily Currency Briefing: A Point For TrichettimurrsNo ratings yet

- Daily Currency Briefing: Euro Under FireDocument4 pagesDaily Currency Briefing: Euro Under FiretimurrsNo ratings yet

- Daily Currency Briefing: Event Risk Remains HighDocument4 pagesDaily Currency Briefing: Event Risk Remains HightimurrsNo ratings yet

- Daily Currency Briefing: The Philosopher's Stone?Document4 pagesDaily Currency Briefing: The Philosopher's Stone?timurrsNo ratings yet

- Daily Currency Briefing: Agreement But No Happy EndDocument4 pagesDaily Currency Briefing: Agreement But No Happy EndtimurrsNo ratings yet

- Daily Currency Briefing: Europe's Fingers Crossed ApproachDocument4 pagesDaily Currency Briefing: Europe's Fingers Crossed ApproachtimurrsNo ratings yet

- Daily FX STR Europe 15 July 2011Document7 pagesDaily FX STR Europe 15 July 2011timurrsNo ratings yet

- Daily Currency Briefing: "Substantial Credit Risks"Document4 pagesDaily Currency Briefing: "Substantial Credit Risks"timurrsNo ratings yet

- Daily FX STR Europe 22 June 2011Document9 pagesDaily FX STR Europe 22 June 2011timurrsNo ratings yet

- DCB 230611Document4 pagesDCB 230611timurrsNo ratings yet

- FX Weekly - Jan 22 - Jan 28 2012Document5 pagesFX Weekly - Jan 22 - Jan 28 2012James PutraNo ratings yet

- Daily Currency Briefing: Waiting For Godot?Document4 pagesDaily Currency Briefing: Waiting For Godot?timurrsNo ratings yet

- FX Daily: High Bar To Reverse The Dollar Bear TrendDocument3 pagesFX Daily: High Bar To Reverse The Dollar Bear Trenddbr trackdNo ratings yet

- Daily Currency Briefing: How Would The ECB Treat A Greek Default Rating?Document4 pagesDaily Currency Briefing: How Would The ECB Treat A Greek Default Rating?timurrsNo ratings yet

- Daily FX STR Europe 29 June 2011Document8 pagesDaily FX STR Europe 29 June 2011timurrsNo ratings yet

- Daily FX STR Europe 19 July 2011Document7 pagesDaily FX STR Europe 19 July 2011timurrsNo ratings yet

- Daily FX STR Europe 29 July 2011Document8 pagesDaily FX STR Europe 29 July 2011timurrsNo ratings yet

- Daily Currency Briefing: "Legally Questionable"Document4 pagesDaily Currency Briefing: "Legally Questionable"markuslietzNo ratings yet

- 29 July 2011 FX WEEKLY Dollar Ambiguities Amplified COMPLETEDocument18 pages29 July 2011 FX WEEKLY Dollar Ambiguities Amplified COMPLETEtimurrsNo ratings yet

- Daily FX STR Europe 27 June 2011Document8 pagesDaily FX STR Europe 27 June 2011timurrsNo ratings yet

- 2011-06-17 LLOY Data Analysis - Greek TragedyDocument4 pages2011-06-17 LLOY Data Analysis - Greek TragedykjlaqiNo ratings yet

- Daily Comment RR 21jul11Document3 pagesDaily Comment RR 21jul11timurrsNo ratings yet

- Daily FX STR Europe 30 June 2011Document9 pagesDaily FX STR Europe 30 June 2011timurrsNo ratings yet

- Daily Currency Briefing: JapanisationDocument4 pagesDaily Currency Briefing: JapanisationtimurrsNo ratings yet

- Daily Currency Briefing: The Beginning of The End?Document4 pagesDaily Currency Briefing: The Beginning of The End?timurrsNo ratings yet

- Daily FX STR Europe 23 June 2011Document8 pagesDaily FX STR Europe 23 June 2011timurrsNo ratings yet

- ING Think FX Daily Currencies Gear Up For Another Big Week of Central Bank MeetingsDocument5 pagesING Think FX Daily Currencies Gear Up For Another Big Week of Central Bank MeetingsPositionNo ratings yet

- Daily Currency Briefing: After The Vote Is Before The VoteDocument4 pagesDaily Currency Briefing: After The Vote Is Before The VotetimurrsNo ratings yet

- The Pensford Letter - 1.16.12Document5 pagesThe Pensford Letter - 1.16.12Pensford FinancialNo ratings yet

- Daily FX Strategy: ECB Preview: EUR To Take Fright From QE-lite?Document2 pagesDaily FX Strategy: ECB Preview: EUR To Take Fright From QE-lite?GlobalStrategyNo ratings yet

- 08july2011 - FX Weekly FinalDocument23 pages08july2011 - FX Weekly FinaltimurrsNo ratings yet

- Daily Currency Update: Market SummaryDocument3 pagesDaily Currency Update: Market Summarysilviu_catrinaNo ratings yet

- 24jun2011 - FX Weekly CompleteDocument25 pages24jun2011 - FX Weekly CompletetimurrsNo ratings yet

- FX Daily The Dollar Comeback Hinges On Powell Again 20230207Document5 pagesFX Daily The Dollar Comeback Hinges On Powell Again 20230207Brandon Zevallos PonceNo ratings yet

- EcoWeek 12 06 enDocument13 pagesEcoWeek 12 06 enaki888No ratings yet

- Daily Comment RR 30jun11Document3 pagesDaily Comment RR 30jun11timurrsNo ratings yet

- BBH Dollar Drivers Direction Degree 092410Document3 pagesBBH Dollar Drivers Direction Degree 092410fcamargoeNo ratings yet

- Assignment OF IF: Dollar Vs RupeeDocument7 pagesAssignment OF IF: Dollar Vs RupeeManinder Vadhrah VirkNo ratings yet

- Daily Currency Briefing: Teflon Currency Part IIDocument4 pagesDaily Currency Briefing: Teflon Currency Part IItimurrsNo ratings yet

- Calm Before The Storm: Thursday, 23 May 2013Document11 pagesCalm Before The Storm: Thursday, 23 May 2013Marius MuresanNo ratings yet

- The Pensford Letter - 7.30.12Document4 pagesThe Pensford Letter - 7.30.12Pensford FinancialNo ratings yet

- Danske Daily: Market Movers TodayDocument6 pagesDanske Daily: Market Movers Todaypathanfor786No ratings yet

- Daily Breakfast Spread: EconomicsDocument6 pagesDaily Breakfast Spread: EconomicsShou Yee WongNo ratings yet

- CS - FX Compass Looking For Cracks 20230131Document10 pagesCS - FX Compass Looking For Cracks 20230131G.Trading.FxNo ratings yet

- 5 Factors Weighing On EURDocument3 pages5 Factors Weighing On EURDaniel LeonhaRtNo ratings yet

- The World Overall 03:22 - Week in ReviewDocument4 pagesThe World Overall 03:22 - Week in ReviewAndrei Alexander WogenNo ratings yet

- US Market Wrap: January 4th: Chunky Stock Selling As The Herd Returns Into Catalyst-Rich WeekDocument4 pagesUS Market Wrap: January 4th: Chunky Stock Selling As The Herd Returns Into Catalyst-Rich WeekGilang KopaNo ratings yet

- Weekly Markets UpdateDocument41 pagesWeekly Markets Updateapi-25889552No ratings yet

- The Pensford Letter - 2.9.15Document7 pagesThe Pensford Letter - 2.9.15Pensford FinancialNo ratings yet

- Currency Wars June 2015 FINAL PDFDocument5 pagesCurrency Wars June 2015 FINAL PDFkunalwarwickNo ratings yet

- Shadow Capitalism: Wednesday, November 24, 2010Document4 pagesShadow Capitalism: Wednesday, November 24, 2010Naufal SanaullahNo ratings yet

- JUL 07 DJ Forex FocusDocument3 pagesJUL 07 DJ Forex FocusMiir ViirNo ratings yet

- Foreign Exchange Daily ReportDocument5 pagesForeign Exchange Daily ReportPrashanth Goud DharmapuriNo ratings yet

- The Pensford Letter - 5.11.15Document3 pagesThe Pensford Letter - 5.11.15Pensford FinancialNo ratings yet

- Bar Cap 3Document11 pagesBar Cap 3Aquila99999No ratings yet

- Daily FX STR Europe 24 June 2011Document8 pagesDaily FX STR Europe 24 June 2011timurrsNo ratings yet

- The World Overall 03:29 - Week in ReviewDocument5 pagesThe World Overall 03:29 - Week in ReviewAndrei Alexander WogenNo ratings yet

- Daily Comment RR 29jul11Document3 pagesDaily Comment RR 29jul11timurrsNo ratings yet

- Daily FX STR Europe 29 July 2011Document8 pagesDaily FX STR Europe 29 July 2011timurrsNo ratings yet

- Daily Market Technicals: FX OutlookDocument13 pagesDaily Market Technicals: FX OutlooktimurrsNo ratings yet

- 29 July 2011 FX WEEKLY Dollar Ambiguities Amplified COMPLETEDocument18 pages29 July 2011 FX WEEKLY Dollar Ambiguities Amplified COMPLETEtimurrsNo ratings yet

- Daily Currency Briefing: Agreement But No Happy EndDocument4 pagesDaily Currency Briefing: Agreement But No Happy EndtimurrsNo ratings yet

- Daily Comment RR 27jul11Document3 pagesDaily Comment RR 27jul11timurrsNo ratings yet

- Daily Market Technicals: FX OutlookDocument13 pagesDaily Market Technicals: FX OutlooktimurrsNo ratings yet

- Daily FX STR Europe 27 July 2011Document8 pagesDaily FX STR Europe 27 July 2011timurrsNo ratings yet

- Daily Market Technicals: FX OutlookDocument13 pagesDaily Market Technicals: FX OutlooktimurrsNo ratings yet

- Daily Currency Briefing: Waiting For Godot?Document4 pagesDaily Currency Briefing: Waiting For Godot?timurrsNo ratings yet

- Daily Comment RR 21jul11Document3 pagesDaily Comment RR 21jul11timurrsNo ratings yet

- Daily Comment RR 20jul11Document3 pagesDaily Comment RR 20jul11timurrsNo ratings yet

- Daily Market Technicals: FX OutlookDocument13 pagesDaily Market Technicals: FX OutlooktimurrsNo ratings yet

- Daily Market Technicals: FX OutlookDocument13 pagesDaily Market Technicals: FX OutlooktimurrsNo ratings yet

- Daily Market Technicals: FX OutlookDocument13 pagesDaily Market Technicals: FX OutlooktimurrsNo ratings yet

- Today's Highlights - 07-20-11Document10 pagesToday's Highlights - 07-20-11timurrsNo ratings yet

- Commodity Weekly Technicals: Technical OutlookDocument27 pagesCommodity Weekly Technicals: Technical OutlooktimurrsNo ratings yet

- Daily Currency Briefing: Quiet Before The Storm?Document4 pagesDaily Currency Briefing: Quiet Before The Storm?timurrsNo ratings yet

- Bullion Weekly Technicals 19072011Document20 pagesBullion Weekly Technicals 19072011timurrsNo ratings yet

- Daily FX STR Europe 19 July 2011Document7 pagesDaily FX STR Europe 19 July 2011timurrsNo ratings yet

- Daily Comment RR 18jul11Document3 pagesDaily Comment RR 18jul11timurrsNo ratings yet

- MFM Jul 15 2011Document13 pagesMFM Jul 15 2011timurrsNo ratings yet

- Accounts Finalization of PL and Bs StepsDocument5 pagesAccounts Finalization of PL and Bs Stepsvb_krishnaNo ratings yet

- Acct Statement XX7039 12062023Document34 pagesAcct Statement XX7039 12062023Siyaram MeenaNo ratings yet

- Income Tax - FootnotesDocument3 pagesIncome Tax - FootnotesNichelle De RamaNo ratings yet

- Commercial Invoice Pakistan.Document1 pageCommercial Invoice Pakistan.hikamuddin38No ratings yet

- Student Guide Booklet 9 June 2017Document50 pagesStudent Guide Booklet 9 June 2017Ken Chia100% (1)

- FZ5000 Solución Tarea 3 AJ2020Document2 pagesFZ5000 Solución Tarea 3 AJ2020gerardoNo ratings yet

- Complaint Against Kansas Attorney Sean Allen McElwain - April 4th, 2018Document20 pagesComplaint Against Kansas Attorney Sean Allen McElwain - April 4th, 2018Conflict GateNo ratings yet

- ACCT10002 Tutorial 1 Exercises, 2020 SM1Document5 pagesACCT10002 Tutorial 1 Exercises, 2020 SM1JING NIENo ratings yet

- Final RevisionDocument100 pagesFinal RevisionhuongtratranthibnNo ratings yet

- Societe Generale URD 2nd Amendment 04 08 2023Document248 pagesSociete Generale URD 2nd Amendment 04 08 2023cbrnspm-20180717cdcntNo ratings yet

- Calpine CorporationDocument20 pagesCalpine CorporationAbhishek GuptaNo ratings yet

- SaaS Capital Overview 2018 PDFDocument2 pagesSaaS Capital Overview 2018 PDFAnonymous 68LoXZHRHiNo ratings yet

- Privy LeagueDocument3 pagesPrivy Leagueaxelr8xlr8No ratings yet

- Extracts of The Proceedings of The Meeting of The Board of Directors of Enmas Engenius Projects Limited Held On 18 April, 2007Document9 pagesExtracts of The Proceedings of The Meeting of The Board of Directors of Enmas Engenius Projects Limited Held On 18 April, 2007api-3835069No ratings yet

- Module 3 - Partnership DissolutionDocument16 pagesModule 3 - Partnership DissolutionJhanella Faith FagarNo ratings yet

- Option Floor and Caps Collars MFI FINALDocument20 pagesOption Floor and Caps Collars MFI FINALamit_harry100% (2)

- Mathematics OF Investment: Cavite State UniversityDocument14 pagesMathematics OF Investment: Cavite State UniversityAlyssa Bianca AguilarNo ratings yet

- Commerce 115Document40 pagesCommerce 115IAS 2025No ratings yet

- Letter of Agreement - SBI - Loan To Etha Realty PVT LTDDocument11 pagesLetter of Agreement - SBI - Loan To Etha Realty PVT LTDMmamaaNo ratings yet

- Aspen Technology, Inc.: Currency Hedging ReviewDocument18 pagesAspen Technology, Inc.: Currency Hedging ReviewRajat Khandelwal100% (1)

- AdidasDocument6 pagesAdidasLorenz BaguioNo ratings yet

- Chap010-Financial AnalysisDocument40 pagesChap010-Financial Analysishasan jabrNo ratings yet

- Pakistan Q3 Report MagnittDocument26 pagesPakistan Q3 Report MagnittUsaidMandviaNo ratings yet

- The Time Value of MoneyDocument28 pagesThe Time Value of MoneyRajat ShrinetNo ratings yet

- CV of Md. Zahidul IslamDocument2 pagesCV of Md. Zahidul IslamPruzzwal NandiNo ratings yet

- Cost of New Investment-OS 3,250k: Undervalued Equipment P100k X 40% Ownership P40k/5 P8kDocument1 pageCost of New Investment-OS 3,250k: Undervalued Equipment P100k X 40% Ownership P40k/5 P8kQueenie ValleNo ratings yet

- Banking Law B.com - Docx LatestDocument38 pagesBanking Law B.com - Docx LatestViraja GuruNo ratings yet

Daily Currency Briefing: No Solution For Europe, Dollar Under Pressure

Daily Currency Briefing: No Solution For Europe, Dollar Under Pressure

Uploaded by

timurrsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily Currency Briefing: No Solution For Europe, Dollar Under Pressure

Daily Currency Briefing: No Solution For Europe, Dollar Under Pressure

Uploaded by

timurrsCopyright:

Available Formats

Daily Currency Briefing

July 14, 2011

No solution for Europe, dollar under pressure

G10 Currencies

EUR: According to EU Commissioner Olli Rehn the European debt crisis is now systemic, i.e. it has spread to the entire zone. Even if we do not share this view entirely (the yields for French or German bonds for example have not risen), this choice of words illustrates that the pressure on the European politicians has risen notably. Does that mean that the euro might benefit from an imminent solution? We consider that to be unlikely as so far no solution seems in sight. The most prominent part of the debate centres on the issue of Eurobonds (which the Italian Minister of Finance Tremonti mentioned again yesterday) as well as Athens buying back bonds with the help of EFSF funds. Both ideas have major weaknesses. In view of treaties and laws it is simply impossible to introduce a Eurobond, a solution that is also highly contentious. A repurchase of bonds on the other hand is not going to reduce the debt levels as far as many expect. The fact that the summit of the heads of government and state which had been planned for tomorrow has now been postponed to next week, illustrates the fact that the negotiations have not yet progressed far enough for a solution to be reached. At EUR-USD prices above 1.42 the single currency seems to have recovered further this morning (one might almost overlook Fitchs downgrade of Greece). This might however turn out to be the quiet before the storm should Italian yields suddenly rise again. The FX markets will also focus on the auction of long-dated Italian bonds. Yesterdays recovery of EUR-USD is not due to the fact that the difficulties in the Eurozone have become smaller. It is therefore hardly surprising that the EURUSD risk reversals have recovered hardly at all. USD: In the end the recovery in EUR-USD is nothing else but a renewed USD weakness. This was caused by Fed president Ben Bernankes official hearing on the monetary policy situation in front of the US Congress yesterday. Bernanke stressed that the Fed would also consider QE3 (i.e. further stimulation) should the situation of the US economy deteriorate further. Even if he did not announce such a step by any means it became clear that the Fed would extend the high-risk monetary policy strategy. All markets punished the dollar and it eased against all G10 currencies. The unsolved conflict about increasing the debt threshold in the US also contributed to this problem. Bernanke made it clear that capital market yields might rise even if the US government failed to meet its obligations towards its own citizens without defaulting on bonds. Then Moodys entered the debate and lowered the outlook for the US AAA rating to negative. The reason the agency gave was concerns that the debt threshold might not be raised in time. Neither the CDS nor the Treasury market showed a notable reaction to the news. One thing seems to be clear to all parties involved: should Democrats and Republicans be unable to reach an agreement until early August (which we explicitly do not expect) a rating downgrade of the US would be a fait accompli. Moody's has now translated this general view into its rating system. The fact that the FX market did not react to this news should therefore not be interpreted as dollar positive sentiment. Instead we assume that the greenback might come under renewed selling pressure should the retail sales for June due for publication this afternoon disappoint as expected by our economists. From a chart technical point of view EUR-USD is moving in no-mans land at prices around 1.42. While the next major support is only located at 1.3909/00 the next resistance is also some way off at 1.4379 (55 day ma). CHF: The franc has still no competition among the so-called safe havens. The selling-wave in the dollar, which had been initiated by Fed Chairman Ben Bernanke who kept the door open for more quantitative easing, and eventually the warning of Moodys on the AAA-rating of the USA, triggered new all-time lows in USD-CHF at 0.8080. EUR-CHF temporarily fell below the level of 1.15 as there is still no solution regarding the euro zone debt crisis. The following is clear: as

You-Na Park +49 69 136 42155 you-na.park@commerzbank.com Lutz Karpowitz +49 69 136 42152 lutz.karpowitz@commerzbank.com

Lutz Karpowitz +49 69 136 42152 lutz.karpowitz@commerzbank.com

For important disclosure information please refer to the back pages

Daily Currency Briefing

long as uncertainty regarding the debt crisis on both sides of the Atlantic prevails the Swiss franc will remain bid. SNB president Philipp Hildebrand at the weekend ruled out interventions, but the SNB remains very concerned about the strength of the Swiss franc as Vice president Thomas Jordan made again clear yesterday. New all-time lows in USD-CHF and EUR-CHF cannot be ruled out. The next important psychological level in USD-CHF is at 0.80. NZD: Overnight, the NZD temporarily turned the turbo on: Q1 GDP data surprised strongly to the upside with +0.8% qoq (expected was +0.3%), catapulting NZD-USD above 0.85. Moreover, AUD-NZD finally broke the 1.28-handle to the downside after three prior failures, setting a negative signal for the cross. If NZ Q2 CPI data surprises to the upside next week as well, the market is likely to quickly adjust its rate expectations for the RBNZ. We have always stuck to our view that the RBNZ will raise rates again before the end of the year and feel confirmed in our view.

Antje Praefcke +49 69 136 43834 antje.praefcke@commerzbank.com

Emerging Market Currencies

PLN: Consumer price inflation in Poland followed the regional trend and weakened considerably in June. The yoy rate fell from 5.0% in May to 4.2% and so recorded a stronger than expected fall as had been the case in Hungary and the Czech Republic. The best known dove among the MPC members, Elzbieta Chojna-Duch, felt confirmed in her view that further rate hikes would no longer be necessary and would adversely affect economic growth. It can therefore be assumed that Chojna-Duch will also vote against key rate hikes in the coming rate meetings. There is nothing new about that though. The comments of the other MPC members are more important. Anna Zielinska-Glebocka seems to remain part of the hawk camp for now and warned that the fall in inflation might be a one-off. The majority of the MPC members is likely to await the inflation data for July before deciding which side to take. So far further monetary policy tightening is not off the agenda just yet. Against the background of the Eurozone debt crisis the zloty is however unable to benefit from these developments. As soon as risk aversion eases off again notably the zloty will have some ground to regain against the euro though. HUF: The good news delivered by central bank economist Lorant Varga yesterday was that it may be possible to achieve a budget surplus of 2.8% this year. Reaching the governments budget target for 2012 is also within reach. The bad news remains that the Hungarian national finances have been rehabilitated by nationalising the private pension funds. According to the central bank the deficit would amount to a considerable 7% without these measures. Hungarian fiscal policy remains an underlying risk factor for the forint and might put pressure on the currency particularly in times of increased risk aversion. At present EUR-HUF has been able to defend its levels in a more benign market environment, but times for a notable forint recovery are still a long way off. CLP: The Chilean central bank is likely to leave key rates unchanged at 5.25% tonight. This would be the first break after five rate hikes. Since June 2010 the central bank has raised rates by a total of 475bp. As a pause is likely to be priced in it is mainly the central banks statement that will be of interest. Markets expect that the central bank will not take a long break and will hike rates two more times this year. A more dovish statement would therefore constitute a disappointment and would be likely to put pressure on the peso.

Thu Lan Nguyen +49 69 136 82878 thulan.nguyen@commerzbank.com

Carolin Hecht +49 69 136 41505 carolin.hecht@commerzbank.com

You-Na Park +49 69 136 42155 you-na.park@commerzbank.com

14 July 2011

Daily Currency Briefing

Todays Events

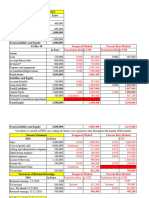

Time 08:00 10:00 Region Indicator HUF EUR Industrial production Consumer prices core rate FX and gold reserves Initial jobless claims Producer price index core rate 13:30 USA Retail sales less vehicles Period Jun Jun Jun Jun Jun Jul Jul Jun Jun Jun Jun Jun Jun mom yoy mom yoy yoy USD bn K mom yoy mom yoy mom mom Actual Our Forecast Survey Last -0,8 +2,6 +0,0 +2,7 +1,5 526,7 418 +0,2 +7,3 +0,2 +2,1 -0,2 +0,3 Direction Cross

+2,7 +1,5 415 -0,3 +0,2 -0,3 -0,1

+0,0 +2,7 +1,5 415 -0,2 +7,4 +0,2 +2,2 -0,1 +0,0

13:30 13:30

RUB USA USA

Important Market Data

FX Current Change (%) Last trading day's high Last trading day's low FX Current Change (%) Last trading day's high Last trading day's low FX Current Change (%) Last trading day's high Last trading day's low FX Current Change (%) Last trading day's high Last trading day's low Forwards / Options EUR-USD 3M Money Market Rate (%) Bonds / Bond Futures Yield (%), Price Equity Indices Closing Change Change (%) Oil / Prec.Metals $ per unit EUR-USD 1,4212 +1,45 1,4192 1,3952 EUR-SEK 9,1767 +0,01 9,2434 9,1583 EUR-AUD 1,3244 +0,38 1,3212 1,3106 EUR-RUB 39,7683 +0,35 39,7920 39,5392 Fwd 3M -38,5700 EURIBOR 1,61 10Y Bund 2,75 EuroStoxx50 2715,05 +21,52 +0,80 Oil, Brent 117,77 EUR-JPY 111,77 +0,29 112,07 109,87 EUR-NOK 7,8265 +0,20 7,8479 7,7922 EUR-NZD 1,6873 -1,30 1,7122 1,6890 EUR-RON 4,2808 -0,03 4,2985 4,2739 Fwd 6M -73,2000 $ LIBOR 0,25 10Y T-Note 2,88 DAX 7267,87 +93,73 +1,31 Oil, Nymex 97,78 EUR-GBP 0,8809 +0,19 0,8847 0,8760 EUR-DKK 7,4573 -0,00 7,4604 7,4552 EUR-BRL 2,2392 +1,34 2,2338 2,2020 EUR-CNY 9,1787 +1,31 9,2155 9,0177 Fwd 12M -137,4000 LIBOR 0,20 10Y JGB 1,09 Dow Jones 12491,61 +44,73 +0,36 Gold 1586,00 EUR-CHF 1,1533 -1,24 1,1722 1,1583 EUR-HUF 268,03 -0,39 270,30 267,05 EUR-MXN 16,6358 +0,82 16,6322 16,4456 EUR-SGD 1,7310 +0,87 1,7281 1,7108 Vol 1M 12,96 LIBOR 0,83 EUR-CAD 1,3635 +0,79 1,3607 1,3469 EUR-CZK 24,386 +0,75 24,454 24,157 EUR-TRY 2,3392 +1,12 2,3334 2,3038 EUR-KRW 1504,6705 +0,55 1505,0892 1480,3153 Vol 3M 12,90 $ index 74,90 -1,21 76,09 74,78 EUR-PLN 4,0210 -0,21 4,0584 4,0091 EUR-ZAR 9,6697 +0,38 9,7274 9,5439 EUR-THB 42,7512 +0,58 42,7973 42,3135 Vol 12M 13,18

CHF LIBOR CAD LIBOR 0,18 1,17 10Y T-Note Future 10Y Gilt Bund Future 3,12 128,35 124,84 Nikkei 225 9930,36 -32,78 -0,33 Palladium 782,25 Zinc 2345,5 FTSE 100 5906,43 +37,47 +0,64 Platinum 1765,50 Tin 26605,0 1317,72 +4,08 +0,31 Silver 38,41

S&P 500

Industrial Metals Aluminium Lead Copper Nickel $ per ton 2450,5 2745,0 9658,5 23710,0 Sources: Bloomberg L.P., European Banking Federation, British Bankers Association, Dow Jones, Xetra, S&P, TSE, LSE, LME.

14 July 2011

Daily Currency Briefing

This document has been created and published by the Corporates & Markets division of Commerzbank AG, Frankfurt/Main or Commerzbanks branch offices mentioned in the document. Commerzbank Corporates & Markets is the investment banking division of Commerzbank, integrating research, debt, equities, interest rates and foreign exchange. The author(s) of this report, certify that (a) the views expressed in this report accurately reflect their personal views; and (b) no part of their compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or views expressed by them contained in this document. The analyst(s) named on this report are not registered / qualified as research analysts with FINRA and are not subject to NASD Rule 2711. Disclaimer This document is for information purposes only and does not take account of the specific circumstances of any recipient. The information contained herein does not constitute the provision of investment advice. It is not intended to be and should not be construed as a recommendation, offer or solicitation to acquire, or dispose of, any of the financial instruments mentioned in this document and will not form the basis or a part of any contract or commitment whatsoever. The information in this document is based on data obtained from sources believed by Commerzbank to be reliable and in good faith, but no representations, guarantees or warranties are made by Commerzbank with regard to accuracy, completeness or suitability of the data. The opinions and estimates contained herein reflect the current judgement of the author(s) on the data of this document and are subject to change without notice. The opinions do not necessarily correspond to the opinions of Commerzbank. Commerzbank does not have an obligation to update, modify or amend this document or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate. The past performance of financial instruments is not indicative of future results. No assurance can be given that any opinion described herein would yield favourable investment results. Any forecasts discussed in this document may not be achieved due to multiple risk factors including without limitation market volatility, sector volatility, corporate actions, the unavailability of complete and accurate information and/or the subsequent transpiration that underlying assumptions made by Commerzbank or by other sources relied upon in the document were inapposite. Neither Commerzbank nor any of its respective directors, officers or employees accepts any responsibility or liability whatsoever for any expense, loss or damages arising out of or in any way connected with the use of all or any part of this document. Commerzbank may provide hyperlinks to websites of entities mentioned in this document, however the inclusion of a link does not imply that Commerzbank endorses, recommends or approves any material on the linked page or accessible from it. Commerzbank does not accept responsibility whatsoever for any such material, nor for any consequences of its use. This document is for the use of the addressees only and may not be reproduced, redistributed or passed on to any other person or published, in whole or in part, for any purpose, without the prior, written consent of Commerzbank. The manner of distributing this document may be restricted by law or regulation in certain countries, including the United States. Persons into whose possession this document may come are required to inform themselves about and to observe such restrictions. By accepting this document, a recipient hereof agrees to be bound by the foregoing limitations. Additional notes to readers in the following countries: Germany: Commerzbank AG is registered in the Commercial Register at Amtsgericht Frankfurt under the number HRB 32000. Commerzbank AG is supervised by the German regulator Bundesanstalt fr Finanzdienstleistungsaufsicht (BaFin), Lurgiallee 12, 60439 Frankfurt am Main, Germany. United Kingdom: This document has been issued or approved for issue in the United Kingdom by Commerzbank AG London Branch. Commerzbank AG, London Branch is authorised by Bundesanstalt fr Finanzdienstleistungsaufsicht (BaFin) and subject to limited regulation by the Financial Services Authority. Details on the extent of our regulation by the Financial Services Authority are available from us on request. This document is directed exclusively to eligible counterparties and professional clients. It is not directed to retail clients. No persons other than an eligible counterparty or a professional client should read or rely on any information in this document. Commerzbank AG, London Branch does not deal for or advise or otherwise offer any investment services to retail clients. United States: This document has been approved for distribution in the US under applicable US law by Commerz Markets LLC (Commerz Markets), a wholly owned subsidiary of Commerzbank AG and a US registered broker-dealer. Any securities transaction by US persons must be effected with Commerz Markets. Under applicable US law; information regarding clients of Commerz Markets may be distributed to other companies within the Commerzbank group. This report is intended for distribution in the United States solely to institutional investors and major U.S. institutional investors, as defined in Rule 15a-6 under the Securities Exchange Act of 1934. Commerz Markets is a member of FINRA and SIPC. European Economic Area: Where this document has been produced by a legal entity outside of the EEA, the document has been re-issued by Commerzbank AG, London Branch for distribution into the EEA. Singapore: This document is furnished in Singapore by Commerzbank AG, Singapore branch. It may only be received in Singapore by an institutional investor as defined in section 4A of the Securities and Futures Act, Chapter 289 of Singapore (SFA) pursuant to section 274 of the SFA. Hong Kong: This document is furnished in Hong Kong by Commerzbank AG, Hong Kong Branch, and may only be received in Hong Kong by professional investors within the meaning of Schedule 1 of the Securities and Futures Ordinance (Cap.571) of Hong Kong and any rules made there under. Japan: Commerzbank AG, Tokyo Branch is responsible for the distribution of Research in Japan. Commerzbank AG, Tokyo Branch is regulated by the Japanese Financial Services Agency (FSA). Australia: Commerzbank AG does not hold an Australian financial services licence. This document is being distributed in Australia to wholesale customers pursuant to an Australian financial services licence exemption for Commerzbank AG under Class Order 04/1313. Commerzbank AG is regulated by Bundesanstalt fr Finanzdienstleistungsaufsicht (BaFin) under the laws of Germany which differ from Australian laws. Commerzbank AG 2011. All rights reserved. Version 9.13

Commerzbank Corporates & Markets Frankfurt London Commerzbank AG Commerzbank AG London Branch PO BOX 52715 DLZ - Gebude 2, Hndlerhaus 30 Gresham Street Mainzer Landstrae 153 London, EC2P 2XY 60327 Frankfurt Tel: + 49 69 13621200 Tel: + 44 207 623 8000

New York Commerz Markets LLC 2 World Financial Center, 31st floor New York, NY 10281 Tel: + 1 212 703 4000

Singapore Branch Commerzbank AG 8, Shenton Way, #42-01 Singapore 068811

Hong Kong Branch Commerzbank AG 29/F, Two IFC 8 Finance Street Central Hong Kong Tel: +852 3988 0988

Tel: +65 63110000

You might also like

- The Dollar Trap: How the U.S. Dollar Tightened Its Grip on Global FinanceFrom EverandThe Dollar Trap: How the U.S. Dollar Tightened Its Grip on Global FinanceRating: 4 out of 5 stars4/5 (1)

- MCQ On Final AccountDocument5 pagesMCQ On Final AccountAnonymous b4qyne75% (12)

- MoaDocument2 pagesMoalynnbethNo ratings yet

- Paginas CryptosDocument4 pagesPaginas CryptosWilson Gil Calderón0% (1)

- Daily Currency Briefing: Quiet Before The Storm?Document4 pagesDaily Currency Briefing: Quiet Before The Storm?timurrsNo ratings yet

- Daily Currency Briefing: US Debt Ceiling: All or NothingDocument4 pagesDaily Currency Briefing: US Debt Ceiling: All or NothingtimurrsNo ratings yet

- Daily Currency Briefing: A Point For TrichetDocument4 pagesDaily Currency Briefing: A Point For TrichettimurrsNo ratings yet

- Daily Currency Briefing: Euro Under FireDocument4 pagesDaily Currency Briefing: Euro Under FiretimurrsNo ratings yet

- Daily Currency Briefing: Event Risk Remains HighDocument4 pagesDaily Currency Briefing: Event Risk Remains HightimurrsNo ratings yet

- Daily Currency Briefing: The Philosopher's Stone?Document4 pagesDaily Currency Briefing: The Philosopher's Stone?timurrsNo ratings yet

- Daily Currency Briefing: Agreement But No Happy EndDocument4 pagesDaily Currency Briefing: Agreement But No Happy EndtimurrsNo ratings yet

- Daily Currency Briefing: Europe's Fingers Crossed ApproachDocument4 pagesDaily Currency Briefing: Europe's Fingers Crossed ApproachtimurrsNo ratings yet

- Daily FX STR Europe 15 July 2011Document7 pagesDaily FX STR Europe 15 July 2011timurrsNo ratings yet

- Daily Currency Briefing: "Substantial Credit Risks"Document4 pagesDaily Currency Briefing: "Substantial Credit Risks"timurrsNo ratings yet

- Daily FX STR Europe 22 June 2011Document9 pagesDaily FX STR Europe 22 June 2011timurrsNo ratings yet

- DCB 230611Document4 pagesDCB 230611timurrsNo ratings yet

- FX Weekly - Jan 22 - Jan 28 2012Document5 pagesFX Weekly - Jan 22 - Jan 28 2012James PutraNo ratings yet

- Daily Currency Briefing: Waiting For Godot?Document4 pagesDaily Currency Briefing: Waiting For Godot?timurrsNo ratings yet

- FX Daily: High Bar To Reverse The Dollar Bear TrendDocument3 pagesFX Daily: High Bar To Reverse The Dollar Bear Trenddbr trackdNo ratings yet

- Daily Currency Briefing: How Would The ECB Treat A Greek Default Rating?Document4 pagesDaily Currency Briefing: How Would The ECB Treat A Greek Default Rating?timurrsNo ratings yet

- Daily FX STR Europe 29 June 2011Document8 pagesDaily FX STR Europe 29 June 2011timurrsNo ratings yet

- Daily FX STR Europe 19 July 2011Document7 pagesDaily FX STR Europe 19 July 2011timurrsNo ratings yet

- Daily FX STR Europe 29 July 2011Document8 pagesDaily FX STR Europe 29 July 2011timurrsNo ratings yet

- Daily Currency Briefing: "Legally Questionable"Document4 pagesDaily Currency Briefing: "Legally Questionable"markuslietzNo ratings yet

- 29 July 2011 FX WEEKLY Dollar Ambiguities Amplified COMPLETEDocument18 pages29 July 2011 FX WEEKLY Dollar Ambiguities Amplified COMPLETEtimurrsNo ratings yet

- Daily FX STR Europe 27 June 2011Document8 pagesDaily FX STR Europe 27 June 2011timurrsNo ratings yet

- 2011-06-17 LLOY Data Analysis - Greek TragedyDocument4 pages2011-06-17 LLOY Data Analysis - Greek TragedykjlaqiNo ratings yet

- Daily Comment RR 21jul11Document3 pagesDaily Comment RR 21jul11timurrsNo ratings yet

- Daily FX STR Europe 30 June 2011Document9 pagesDaily FX STR Europe 30 June 2011timurrsNo ratings yet

- Daily Currency Briefing: JapanisationDocument4 pagesDaily Currency Briefing: JapanisationtimurrsNo ratings yet

- Daily Currency Briefing: The Beginning of The End?Document4 pagesDaily Currency Briefing: The Beginning of The End?timurrsNo ratings yet

- Daily FX STR Europe 23 June 2011Document8 pagesDaily FX STR Europe 23 June 2011timurrsNo ratings yet

- ING Think FX Daily Currencies Gear Up For Another Big Week of Central Bank MeetingsDocument5 pagesING Think FX Daily Currencies Gear Up For Another Big Week of Central Bank MeetingsPositionNo ratings yet

- Daily Currency Briefing: After The Vote Is Before The VoteDocument4 pagesDaily Currency Briefing: After The Vote Is Before The VotetimurrsNo ratings yet

- The Pensford Letter - 1.16.12Document5 pagesThe Pensford Letter - 1.16.12Pensford FinancialNo ratings yet

- Daily FX Strategy: ECB Preview: EUR To Take Fright From QE-lite?Document2 pagesDaily FX Strategy: ECB Preview: EUR To Take Fright From QE-lite?GlobalStrategyNo ratings yet

- 08july2011 - FX Weekly FinalDocument23 pages08july2011 - FX Weekly FinaltimurrsNo ratings yet

- Daily Currency Update: Market SummaryDocument3 pagesDaily Currency Update: Market Summarysilviu_catrinaNo ratings yet

- 24jun2011 - FX Weekly CompleteDocument25 pages24jun2011 - FX Weekly CompletetimurrsNo ratings yet

- FX Daily The Dollar Comeback Hinges On Powell Again 20230207Document5 pagesFX Daily The Dollar Comeback Hinges On Powell Again 20230207Brandon Zevallos PonceNo ratings yet

- EcoWeek 12 06 enDocument13 pagesEcoWeek 12 06 enaki888No ratings yet

- Daily Comment RR 30jun11Document3 pagesDaily Comment RR 30jun11timurrsNo ratings yet

- BBH Dollar Drivers Direction Degree 092410Document3 pagesBBH Dollar Drivers Direction Degree 092410fcamargoeNo ratings yet

- Assignment OF IF: Dollar Vs RupeeDocument7 pagesAssignment OF IF: Dollar Vs RupeeManinder Vadhrah VirkNo ratings yet

- Daily Currency Briefing: Teflon Currency Part IIDocument4 pagesDaily Currency Briefing: Teflon Currency Part IItimurrsNo ratings yet

- Calm Before The Storm: Thursday, 23 May 2013Document11 pagesCalm Before The Storm: Thursday, 23 May 2013Marius MuresanNo ratings yet

- The Pensford Letter - 7.30.12Document4 pagesThe Pensford Letter - 7.30.12Pensford FinancialNo ratings yet

- Danske Daily: Market Movers TodayDocument6 pagesDanske Daily: Market Movers Todaypathanfor786No ratings yet

- Daily Breakfast Spread: EconomicsDocument6 pagesDaily Breakfast Spread: EconomicsShou Yee WongNo ratings yet

- CS - FX Compass Looking For Cracks 20230131Document10 pagesCS - FX Compass Looking For Cracks 20230131G.Trading.FxNo ratings yet

- 5 Factors Weighing On EURDocument3 pages5 Factors Weighing On EURDaniel LeonhaRtNo ratings yet

- The World Overall 03:22 - Week in ReviewDocument4 pagesThe World Overall 03:22 - Week in ReviewAndrei Alexander WogenNo ratings yet

- US Market Wrap: January 4th: Chunky Stock Selling As The Herd Returns Into Catalyst-Rich WeekDocument4 pagesUS Market Wrap: January 4th: Chunky Stock Selling As The Herd Returns Into Catalyst-Rich WeekGilang KopaNo ratings yet

- Weekly Markets UpdateDocument41 pagesWeekly Markets Updateapi-25889552No ratings yet

- The Pensford Letter - 2.9.15Document7 pagesThe Pensford Letter - 2.9.15Pensford FinancialNo ratings yet

- Currency Wars June 2015 FINAL PDFDocument5 pagesCurrency Wars June 2015 FINAL PDFkunalwarwickNo ratings yet

- Shadow Capitalism: Wednesday, November 24, 2010Document4 pagesShadow Capitalism: Wednesday, November 24, 2010Naufal SanaullahNo ratings yet

- JUL 07 DJ Forex FocusDocument3 pagesJUL 07 DJ Forex FocusMiir ViirNo ratings yet

- Foreign Exchange Daily ReportDocument5 pagesForeign Exchange Daily ReportPrashanth Goud DharmapuriNo ratings yet

- The Pensford Letter - 5.11.15Document3 pagesThe Pensford Letter - 5.11.15Pensford FinancialNo ratings yet

- Bar Cap 3Document11 pagesBar Cap 3Aquila99999No ratings yet

- Daily FX STR Europe 24 June 2011Document8 pagesDaily FX STR Europe 24 June 2011timurrsNo ratings yet

- The World Overall 03:29 - Week in ReviewDocument5 pagesThe World Overall 03:29 - Week in ReviewAndrei Alexander WogenNo ratings yet

- Daily Comment RR 29jul11Document3 pagesDaily Comment RR 29jul11timurrsNo ratings yet

- Daily FX STR Europe 29 July 2011Document8 pagesDaily FX STR Europe 29 July 2011timurrsNo ratings yet

- Daily Market Technicals: FX OutlookDocument13 pagesDaily Market Technicals: FX OutlooktimurrsNo ratings yet

- 29 July 2011 FX WEEKLY Dollar Ambiguities Amplified COMPLETEDocument18 pages29 July 2011 FX WEEKLY Dollar Ambiguities Amplified COMPLETEtimurrsNo ratings yet

- Daily Currency Briefing: Agreement But No Happy EndDocument4 pagesDaily Currency Briefing: Agreement But No Happy EndtimurrsNo ratings yet

- Daily Comment RR 27jul11Document3 pagesDaily Comment RR 27jul11timurrsNo ratings yet

- Daily Market Technicals: FX OutlookDocument13 pagesDaily Market Technicals: FX OutlooktimurrsNo ratings yet

- Daily FX STR Europe 27 July 2011Document8 pagesDaily FX STR Europe 27 July 2011timurrsNo ratings yet

- Daily Market Technicals: FX OutlookDocument13 pagesDaily Market Technicals: FX OutlooktimurrsNo ratings yet

- Daily Currency Briefing: Waiting For Godot?Document4 pagesDaily Currency Briefing: Waiting For Godot?timurrsNo ratings yet

- Daily Comment RR 21jul11Document3 pagesDaily Comment RR 21jul11timurrsNo ratings yet

- Daily Comment RR 20jul11Document3 pagesDaily Comment RR 20jul11timurrsNo ratings yet

- Daily Market Technicals: FX OutlookDocument13 pagesDaily Market Technicals: FX OutlooktimurrsNo ratings yet

- Daily Market Technicals: FX OutlookDocument13 pagesDaily Market Technicals: FX OutlooktimurrsNo ratings yet

- Daily Market Technicals: FX OutlookDocument13 pagesDaily Market Technicals: FX OutlooktimurrsNo ratings yet

- Today's Highlights - 07-20-11Document10 pagesToday's Highlights - 07-20-11timurrsNo ratings yet

- Commodity Weekly Technicals: Technical OutlookDocument27 pagesCommodity Weekly Technicals: Technical OutlooktimurrsNo ratings yet

- Daily Currency Briefing: Quiet Before The Storm?Document4 pagesDaily Currency Briefing: Quiet Before The Storm?timurrsNo ratings yet

- Bullion Weekly Technicals 19072011Document20 pagesBullion Weekly Technicals 19072011timurrsNo ratings yet

- Daily FX STR Europe 19 July 2011Document7 pagesDaily FX STR Europe 19 July 2011timurrsNo ratings yet

- Daily Comment RR 18jul11Document3 pagesDaily Comment RR 18jul11timurrsNo ratings yet

- MFM Jul 15 2011Document13 pagesMFM Jul 15 2011timurrsNo ratings yet

- Accounts Finalization of PL and Bs StepsDocument5 pagesAccounts Finalization of PL and Bs Stepsvb_krishnaNo ratings yet

- Acct Statement XX7039 12062023Document34 pagesAcct Statement XX7039 12062023Siyaram MeenaNo ratings yet

- Income Tax - FootnotesDocument3 pagesIncome Tax - FootnotesNichelle De RamaNo ratings yet

- Commercial Invoice Pakistan.Document1 pageCommercial Invoice Pakistan.hikamuddin38No ratings yet

- Student Guide Booklet 9 June 2017Document50 pagesStudent Guide Booklet 9 June 2017Ken Chia100% (1)

- FZ5000 Solución Tarea 3 AJ2020Document2 pagesFZ5000 Solución Tarea 3 AJ2020gerardoNo ratings yet

- Complaint Against Kansas Attorney Sean Allen McElwain - April 4th, 2018Document20 pagesComplaint Against Kansas Attorney Sean Allen McElwain - April 4th, 2018Conflict GateNo ratings yet

- ACCT10002 Tutorial 1 Exercises, 2020 SM1Document5 pagesACCT10002 Tutorial 1 Exercises, 2020 SM1JING NIENo ratings yet

- Final RevisionDocument100 pagesFinal RevisionhuongtratranthibnNo ratings yet

- Societe Generale URD 2nd Amendment 04 08 2023Document248 pagesSociete Generale URD 2nd Amendment 04 08 2023cbrnspm-20180717cdcntNo ratings yet

- Calpine CorporationDocument20 pagesCalpine CorporationAbhishek GuptaNo ratings yet

- SaaS Capital Overview 2018 PDFDocument2 pagesSaaS Capital Overview 2018 PDFAnonymous 68LoXZHRHiNo ratings yet

- Privy LeagueDocument3 pagesPrivy Leagueaxelr8xlr8No ratings yet

- Extracts of The Proceedings of The Meeting of The Board of Directors of Enmas Engenius Projects Limited Held On 18 April, 2007Document9 pagesExtracts of The Proceedings of The Meeting of The Board of Directors of Enmas Engenius Projects Limited Held On 18 April, 2007api-3835069No ratings yet

- Module 3 - Partnership DissolutionDocument16 pagesModule 3 - Partnership DissolutionJhanella Faith FagarNo ratings yet

- Option Floor and Caps Collars MFI FINALDocument20 pagesOption Floor and Caps Collars MFI FINALamit_harry100% (2)

- Mathematics OF Investment: Cavite State UniversityDocument14 pagesMathematics OF Investment: Cavite State UniversityAlyssa Bianca AguilarNo ratings yet

- Commerce 115Document40 pagesCommerce 115IAS 2025No ratings yet

- Letter of Agreement - SBI - Loan To Etha Realty PVT LTDDocument11 pagesLetter of Agreement - SBI - Loan To Etha Realty PVT LTDMmamaaNo ratings yet

- Aspen Technology, Inc.: Currency Hedging ReviewDocument18 pagesAspen Technology, Inc.: Currency Hedging ReviewRajat Khandelwal100% (1)

- AdidasDocument6 pagesAdidasLorenz BaguioNo ratings yet

- Chap010-Financial AnalysisDocument40 pagesChap010-Financial Analysishasan jabrNo ratings yet

- Pakistan Q3 Report MagnittDocument26 pagesPakistan Q3 Report MagnittUsaidMandviaNo ratings yet

- The Time Value of MoneyDocument28 pagesThe Time Value of MoneyRajat ShrinetNo ratings yet

- CV of Md. Zahidul IslamDocument2 pagesCV of Md. Zahidul IslamPruzzwal NandiNo ratings yet

- Cost of New Investment-OS 3,250k: Undervalued Equipment P100k X 40% Ownership P40k/5 P8kDocument1 pageCost of New Investment-OS 3,250k: Undervalued Equipment P100k X 40% Ownership P40k/5 P8kQueenie ValleNo ratings yet

- Banking Law B.com - Docx LatestDocument38 pagesBanking Law B.com - Docx LatestViraja GuruNo ratings yet