Professional Documents

Culture Documents

Budget Worksheet

Budget Worksheet

Uploaded by

senuli Withanachchi0 ratings0% found this document useful (0 votes)

27 views4 pagesThe document provides a 6-step worksheet to help calculate a yearly budget based on estimated income and expenses for a single person starting a career. It includes estimating gross income, accounting for taxes, and allocating expenses across common categories like housing, transportation, food, utilities, healthcare, entertainment, savings, and more. The goal is to balance total yearly income with estimated expenses. Sample ranges are provided for each expense category to help with estimates.

Original Description:

Original Title

Budget Worksheet (1)

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides a 6-step worksheet to help calculate a yearly budget based on estimated income and expenses for a single person starting a career. It includes estimating gross income, accounting for taxes, and allocating expenses across common categories like housing, transportation, food, utilities, healthcare, entertainment, savings, and more. The goal is to balance total yearly income with estimated expenses. Sample ranges are provided for each expense category to help with estimates.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

27 views4 pagesBudget Worksheet

Budget Worksheet

Uploaded by

senuli WithanachchiThe document provides a 6-step worksheet to help calculate a yearly budget based on estimated income and expenses for a single person starting a career. It includes estimating gross income, accounting for taxes, and allocating expenses across common categories like housing, transportation, food, utilities, healthcare, entertainment, savings, and more. The goal is to balance total yearly income with estimated expenses. Sample ranges are provided for each expense category to help with estimates.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 4

1.04 Why Budget?

- Budget Worksheet

Use this worksheet to complete the assignment. It contains suggested ranges for most

expenses based on common amounts for a single person. Feel free to use them to estimate

your costs, or to use your own experience or research.

Part One–Calculate Your Budget

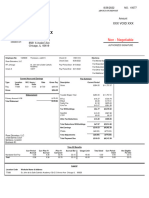

Step 1: Determine Gross Annual Income

Your budget will be based on what your adult salary would be in a starting position of a full-

time career. Think back to the two careers you researched earlier in the module and research

the starting salary for the option that interests you most. Realistically, your annual income

should be under $65,000 for this budgeting exercise.

Career Choice: Real estate agent

Starting Gross Annual Income: 80,000 dollars

Step 2: Calculate Taxable Income

Enter your gross income from step one and subtract the standard deduction to determine your

taxable income.

Starting Gross Income - Standard Deduction = Taxable Income

$80000 - $12,950 = $67,050

Step 3: Calculate Income Taxes

Using the marginal tax rate table, break down your taxable income into each bracket, then

calculate your taxes paid in each bracket. Add them together at the bottom to find your total

taxes paid.

Marginal Tax Rate Table – Show your work

Tax Rate Tax Bracket How much taxable money do Calculate taxes paid

you make in this bracket?

10% $0-$9,700 $9,700 $970

12% $9,701 – $39,475 $29,774 $3,572

22% $39,476 – $84,200 $27,574 $6,066

Total Taxes Paid: $10,608

Step 4: Calculate Your Net Income

Enter your starting gross income from step 1 and subtract the total taxes paid from step 3 to

find your net income.

Starting Gross Income - Total Taxes Paid = Net Income

$80,000 - $10,608 = $69,392

Step 5: Calculate Expenses

Fill out the expenses in the table. You are provided minimums or suggested ranges based on

common amounts for a single person. Choose a realistic amount considering your needs and

wants. You can also do additional research or talk to family members about the best costs to

include. If you choose $0 for an expense, explain why.

Housing (Approximately 30% of your Yearly Cost

gross income)

Mortgage or rent (Research based on your $24,202

area and type of home. Multiply monthly

rent/mortgage by 12 to get the yearly cost.)

Maintenance and repairs ($200 or more) $200

Supplies ($300 or more) $300

Homeowner’s or renter’s insurance $700

(research for your area/housing type)

Furnishings ($500 or more) $600

Property tax (if you own property) -

Subtotal $26,002

Transportation Yearly Cost

Auto loan payment (based on the vehicle you want - $5000

monthly payment x 12)

Bus and taxi/Uber/Lyft fare (varies) -

Auto insurance (research based on age and driving $1632

record what the average is)

Licensing and registration fees ($30–$150) $75

Gasoline (typical use for your chosen vehicle) $1500

Maintenance and repairs ($250-$750) $500

Other -

Subtotal $8,707

Utilities Yearly Cost

House Phone and/or cell phone ($600–$1,200) (You $750

should include the monthly bill and the cost of the

phone.)

Cable or satellite and internet ($950–$2,000) $1000

Electric and gas ($1,200–$2,400) $1000

Water and sewer ($800–$1,000) $975

Waste removal ($150–$250) $150

Subtotal $3,875

Food Yearly Cost

Groceries ($2,500 or more) $4000

Dining out ($600 or more) $3000

Subtotal $7000

Personal Care Yearly Cost

Health insurance ($3,000–$8,000) (You still have to $3000

pay for health insurance even if you get it through your

job.)

Other medical costs ($500 or more) $500

Hair and nails ($120–$500) $500

New Clothing/shopping and laundry costs ($500+) $3000

Health club or Gym ($300–$600) $401

Children (If you plan on having a child when starting -

your career at about ages 18-24, add $14,000 for

the year, per child)

Subtotal $8199

Entertainment Yearly Cost

Movies and streaming services ($120–$400) $1000

Vacation ($1,000–$2,000) $2000

Other (Specific hobby, weekends, etc. $500–$1,000) $2000

Subtotal $4000

Gifts and Donations Yearly Cost

Holidays and birthdays ($500+) $500

Charity or religious donations (varies) $2717

Other $100

Subtotal $3317

Pets Yearly Cost

Food ($250+) $300

Medical ($200+) $500

Grooming (varies by animal) $750

Toys $100

Other $500

Subtotal $2150

Savings and Investments (should total at least 10- Yearly Cost

20% of your net income split between the 3)

Retirement account $3000

Investment account $500

Emergency savings $300

Subtotal $3800

Step 6: Balance Your Budget

Fill in the net income from step 4. Next, add up the subtotals from step 5 and fill the amount for

total yearly expenses. Subtract the expenses from the net income. If you have a large surplus of

money left, adjust your budget by adding to different expenses, savings, or investments. If your

difference is a negative amount, adjust your expenses to balance your budget.

Total Net Income (Take it from Step 4 at the top) $67,050

Total Yearly Expenses (add up all your subtotals) $67,050

Difference (“Total Net Income” minus “Total =$0 :D

Yearly Expenses”)

You might also like

- Pay Slip - 473995 - Apr-21Document1 pagePay Slip - 473995 - Apr-21Siva RamakrishnaNo ratings yet

- CA Real Estate Exam Prep - Transfer of PropertyDocument5 pagesCA Real Estate Exam Prep - Transfer of PropertyThu-An Nguyen Thanh100% (1)

- Flower Business in NairobiDocument37 pagesFlower Business in NairobiDj Backspin254No ratings yet

- Monthly Budget Template-2Document8 pagesMonthly Budget Template-2Kirit0% (1)

- Monthly BudgetDocument2 pagesMonthly Budgetddemo17demoNo ratings yet

- PS2Document18 pagesPS2Thanh NguyenNo ratings yet

- 1.09 - Jackson Combass 09.22.2023Document5 pages1.09 - Jackson Combass 09.22.2023jackson combassNo ratings yet

- Manage Your Money Chart: Budget WorksheetDocument4 pagesManage Your Money Chart: Budget WorksheetRyan GreenbergNo ratings yet

- Budget WorksheetDocument4 pagesBudget WorksheetskyNo ratings yet

- Manage Your Money Chart: Budget WorksheetDocument4 pagesManage Your Money Chart: Budget WorksheetAlfia ThahaNo ratings yet

- Budget Worksheet: Career Graphic DesignerDocument5 pagesBudget Worksheet: Career Graphic DesignerArkoNo ratings yet

- Budget WorksheetDocument3 pagesBudget Worksheethayleerudy99No ratings yet

- Consumer Arithmetic (3rd Year)Document19 pagesConsumer Arithmetic (3rd Year)Maleek DrakesNo ratings yet

- Projected Budget Spreadsheet 1Document10 pagesProjected Budget Spreadsheet 1Ismail UsmanNo ratings yet

- Sample BudgetDocument3 pagesSample Budgetwbfuller16641No ratings yet

- Budgetworksheet 2013Document4 pagesBudgetworksheet 2013api-256636603No ratings yet

- Assignment 5 Kelli CoplinDocument3 pagesAssignment 5 Kelli Coplinapi-267765589No ratings yet

- Cash Flow Statement SampleDocument8 pagesCash Flow Statement SampleHeatman RobertNo ratings yet

- Monthly Budget CalculatorDocument3 pagesMonthly Budget CalculatortraskevansNo ratings yet

- Financial Plan For Meet Green: Locally Grown Produce, Chemical-And Preservative-Free GroceriesDocument6 pagesFinancial Plan For Meet Green: Locally Grown Produce, Chemical-And Preservative-Free Groceriesramsha nishatNo ratings yet

- Cash Flow Forecasting TemplateDocument41 pagesCash Flow Forecasting Templatejose miguel baezNo ratings yet

- Expenses Per Month Type of Expense (Fixed or Variable) : Budget Performance TaskDocument3 pagesExpenses Per Month Type of Expense (Fixed or Variable) : Budget Performance TaskKrystal ZhangNo ratings yet

- Monthly Family BudgetDocument3 pagesMonthly Family BudgetMohamed ElhousniNo ratings yet

- OfficeSuite BudgetOverviewDocument3 pagesOfficeSuite BudgetOverviewJulianoorNo ratings yet

- OfficeSuite BudgetOverviewDocument4 pagesOfficeSuite BudgetOverviewManuel Eduardo Ipenza NegriNo ratings yet

- Cash Flow Forecasting TemplateDocument41 pagesCash Flow Forecasting TemplateAdil Javed CHNo ratings yet

- Family BudgetDocument7 pagesFamily BudgetDy Ju Arug ALNo ratings yet

- Managing Money Curriculum: Components of Your Own Budget and Financial PlanDocument33 pagesManaging Money Curriculum: Components of Your Own Budget and Financial PlanJulius PalmaNo ratings yet

- Monthly Budget WorksheetDocument2 pagesMonthly Budget Worksheetapi-534083600No ratings yet

- Math SignDocument5 pagesMath SignaliyaNo ratings yet

- FIRE EstimatorDocument10 pagesFIRE EstimatorJared PerezNo ratings yet

- 6 Budget WorksheetDocument3 pages6 Budget Worksheetmerxedes xoNo ratings yet

- Business BudgetDocument5 pagesBusiness BudgetCarolNo ratings yet

- OfficeSuite BudgetOverviewDocument6 pagesOfficeSuite BudgetOverviewShreyas RamachandranNo ratings yet

- Ubc Student Financial Planning Worksheet: Term 1 Budget (September To December)Document2 pagesUbc Student Financial Planning Worksheet: Term 1 Budget (September To December)api-410564314No ratings yet

- Farm BudgetDocument2 pagesFarm BudgetKristilyn CartaNo ratings yet

- Documento 3Document2 pagesDocumento 3aimarylorenzoizquierdoNo ratings yet

- 03-M2 Personal Finance SpreadsheetDocument20 pages03-M2 Personal Finance SpreadsheetAtlass StoreNo ratings yet

- Thomas Frank's Budget Modeler Template!Document9 pagesThomas Frank's Budget Modeler Template!Norman LefortNo ratings yet

- Lesson 1 DebtDocument21 pagesLesson 1 DebtAlf ChingNo ratings yet

- Budget OverviewDocument2 pagesBudget Overviewkhalil.kadasiNo ratings yet

- Assignment 2: Part 1: Preparing Financial Statements (50 Marks Total)Document4 pagesAssignment 2: Part 1: Preparing Financial Statements (50 Marks Total)Julia KristelNo ratings yet

- Ruben Lopes Insurace Case StudyDocument3 pagesRuben Lopes Insurace Case Studygabbarsinghh00123No ratings yet

- Chapter 5 Tax 2014 Some SolutionsDocument5 pagesChapter 5 Tax 2014 Some Solutionstherock25No ratings yet

- 02.04 Why BudgetDocument17 pages02.04 Why BudgetmeaNo ratings yet

- M1 U3 A1 ANMC Objetivosfinancieros.Document14 pagesM1 U3 A1 ANMC Objetivosfinancieros.Armando RamirezNo ratings yet

- Cicero 6Document5 pagesCicero 6Bryan CiceroNo ratings yet

- POA MCQ SolutionsDocument141 pagesPOA MCQ SolutionssyrasgamingttNo ratings yet

- GLBL Budget Template v1 1Document14 pagesGLBL Budget Template v1 1Ankur Jain0% (1)

- Lesson 14-Budget Planning WorksheetDocument6 pagesLesson 14-Budget Planning Worksheetapi-253889154No ratings yet

- Profit and Loss Statement SampleDocument6 pagesProfit and Loss Statement SampleHeatman RobertNo ratings yet

- Individual Taxation 2013 Pratt 7th Edition Test BankDocument19 pagesIndividual Taxation 2013 Pratt 7th Edition Test Bankbrianbradyogztekbndm100% (47)

- Mashmglons Print PostDocument9 pagesMashmglons Print Postankush diwanNo ratings yet

- 1st-31st April (Office)Document2 pages1st-31st April (Office)Tushar ChandaniNo ratings yet

- Managerial Accounting Assignment-1: Submitted by Harpreet Singh 2010PGP020Document10 pagesManagerial Accounting Assignment-1: Submitted by Harpreet Singh 2010PGP020happiest1No ratings yet

- Monthly BudgetDocument8 pagesMonthly BudgetYuana SopianNo ratings yet

- HW CH3Document2 pagesHW CH3Hà HoàngNo ratings yet

- Academic Version: PheonixDocument16 pagesAcademic Version: Pheonixkrukruch1602No ratings yet

- Financial Literacy-Student GuideDocument6 pagesFinancial Literacy-Student Guidetrent123456789No ratings yet

- Always Questions Concerning Donations?: BSB4uDDocument4 pagesAlways Questions Concerning Donations?: BSB4uDSandi PniauskasNo ratings yet

- Ap8 Ev4 InglesDocument5 pagesAp8 Ev4 InglesPaula ForeroNo ratings yet

- LacprofitandlossstatementDocument3 pagesLacprofitandlossstatementBaris MironNo ratings yet

- 529credit SS1Document1 page529credit SS1loristurdevantNo ratings yet

- MujiDocument5 pagesMujiHương PhanNo ratings yet

- TATA Family TreeDocument1 pageTATA Family Treemehulchauhan_9950% (2)

- Proposal Form Credit Insurance: Your CompanyDocument2 pagesProposal Form Credit Insurance: Your Companyrahul sNo ratings yet

- Research Proposal FinalDocument14 pagesResearch Proposal FinalPiumal HerathNo ratings yet

- The Foreign Exchange MarketDocument33 pagesThe Foreign Exchange MarketShantanu ChoudhuryNo ratings yet

- Final Group Assignment 2 - Three Key Strategic Management TheoriesDocument9 pagesFinal Group Assignment 2 - Three Key Strategic Management TheorieskathrynNo ratings yet

- Algeria ProjectDocument24 pagesAlgeria ProjectAli SarwarNo ratings yet

- Order FN9316204764: Mode of Payment: NONCODDocument1 pageOrder FN9316204764: Mode of Payment: NONCODKritvee ModiNo ratings yet

- 5a - FreddyDocument29 pages5a - Freddyaliona.simon.ousviatsevNo ratings yet

- Report 1Document2 pagesReport 1Raashid Qyidar Aqiel ElNo ratings yet

- Closed Loop Supply ChainDocument21 pagesClosed Loop Supply ChainNurrul JannathulNo ratings yet

- ENSM - Comparative and Superlative - Pie Charts - Part 2Document30 pagesENSM - Comparative and Superlative - Pie Charts - Part 2med27919No ratings yet

- Primary & Excess Property Accounts: DistributionDocument2 pagesPrimary & Excess Property Accounts: DistributionMatt EbrahimiNo ratings yet

- FinTech Playbook - Buy Now Pay Later - HSIE-202201081155123688696.cleanedDocument43 pagesFinTech Playbook - Buy Now Pay Later - HSIE-202201081155123688696.cleanedhojunxiongNo ratings yet

- ProBanker Registration InstructionsDocument3 pagesProBanker Registration InstructionscarinaNo ratings yet

- Literature ReviewDocument8 pagesLiterature ReviewKEDARANATHA PADHY100% (1)

- Module 4 - Market IntegrationDocument24 pagesModule 4 - Market IntegrationJeprox MartinezNo ratings yet

- Biogas Plant Invoice BillDocument1 pageBiogas Plant Invoice BillmtecnaacNo ratings yet

- ReconDocument1 pageReconaarley swiftNo ratings yet

- Naeem Ullah: Registration #: 91116Document4 pagesNaeem Ullah: Registration #: 91116Naeem MalikNo ratings yet

- Single Index ModelDocument7 pagesSingle Index ModelNeelam MadarapuNo ratings yet

- Laporan Tahunan 2019 PerusahaanDocument393 pagesLaporan Tahunan 2019 PerusahaanAnton SuryantoNo ratings yet

- Agreement For Purchase and Sale of BusinessDocument6 pagesAgreement For Purchase and Sale of BusinessPastor Deaundrea Williams-Green100% (1)

- Facts:: Anpc (Vs BirDocument2 pagesFacts:: Anpc (Vs BirDNAANo ratings yet

- The Largest Fundraisers in Focus: A Guide To The Evolution of The Market and Investing in The Asset ClassDocument36 pagesThe Largest Fundraisers in Focus: A Guide To The Evolution of The Market and Investing in The Asset ClassPierreNo ratings yet

- Business Model Canvas Key Partners Key Activities Value Propositions Customer Relationships Customer SegmentsDocument2 pagesBusiness Model Canvas Key Partners Key Activities Value Propositions Customer Relationships Customer SegmentsLuqman SyahbudinNo ratings yet