Professional Documents

Culture Documents

Branch and ATM Data March 2010

Branch and ATM Data March 2010

Uploaded by

Kapil Dev KumarOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Branch and ATM Data March 2010

Branch and ATM Data March 2010

Uploaded by

Kapil Dev KumarCopyright:

Available Formats

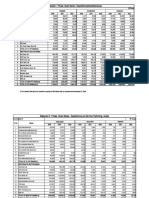

Report on Trend and Progress of Banking in India 2009-10

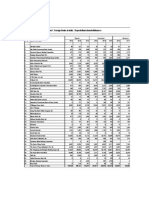

Appendix Table IV.11: Branches and ATMs of Scheduled Commercial Banks (Continued)

(As at end-March 2010)

Sr.

No.

Name of the Bank

Branches

Rural

Semiurban

Urban

ATMs

Metropolitan

Total

On-site

Off-site

Total

Per cent

of

Off-site

to total

Per cent

of

ATMs to

Branches

ATMs

1

10

11

12

Scheduled Commercial Banks

20,773

17,638

16,007

14,742

69,160

32,679

27,474

60,153

45.7

87.0

Public Sector Banks

19,567

14,595

12,920

11,743

58,825

23,797

16,883

40,680

41.5

69.2

Nationalised Banks

47.4

13,652

9,376

9,607

8,961

41,596

12,655

7,047

19,702

35.8

1.

Allahabad Bank

956

403

469

403

2,231

126

85

211

40.3

9.5

2.

Andhra Bank

399

408

429

313

1,549

370

489

859

56.9

55.5

42.6

3.

Bank of Baroda

1,126

724

574

664

3,088

494

821

1,315

62.4

4.

Bank of India

1,236

634

566

588

3,024

500

320

820

39.0

27.1

5.

Bank of Maharashtra

523

266

280

366

1,435

259

86

345

24.9

24.0

6.

Canara Bank

7.

Central Bank of India

758

786

747

754

3,045

1,270

745

2,015

37.0

66.2

1,361

910

690

624

3,585

304

98

402

24.4

11.2

100.0

8.

Corporation Bank

190

236

320

333

1,079

585

494

1,079

45.8

9.

Dena Bank

358

233

231

301

1,123

297

99

396

25.0

35.3

10.

Indian Bank

487

435

435

346

1,703

716

289

1,005

28.8

59.0

11.

Indian Overseas Bank

549

479

514

473

2,015

590

181

771

23.5

38.3

12.

Oriental Bank of Commerce

296

346

478

390

1,510

704

276

980

28.2

64.9

13.

Punjab and Sind Bank

283

127

228

226

864

59

59

6.8

14.

Punjab National Bank

1,947

1,005

968

793

4,713

2,404

1,140

3,544

32.2

75.2

51.0

15.

Syndicate Bank

657

565

583

521

2,326

992

195

1,187

16.4

16.

UCO Bank

779

420

468

438

2,105

330

148

478

31.0

22.7

17.

Union Bank of India

796

743

672

621

2,832

1,548

778

2,326

33.4

82.1

18.

United Bank of India

625

271

339

289

1,524

192

82

274

29.9

18.0

19.

Vijaya Bank

258

244

351

301

1,154

348

87

435

20.0

37.7

20.

IDBI Bank Ltd.

68

141

265

217

691

567

634

1,201

52.8

173.8

5,915

5,219

3,313

2,782

17,229

11,142

9,836

20,978

46.9

121.8

4,678

3,636

2,236

1,887

12,437

7,913

8,381

16,294

51.4

131.0

299

241

157

169

866

571

379

950

39.9

109.7

State Bank Group

21.

22.

State Bank of India

State Bank of Bikaner

and Jaipur

23.

State Bank of Hyderabad

284

355

282

204

1,125

823

243

1,066

22.8

94.8

24.

State Bank of Indore

120

140

89

122

471

308

299

607

49.3

128.9

25.

State Bank of Mysore

211

140

149

187

687

474

134

608

22.0

88.5

26.

State Bank of Patiala

274

239

237

140

890

548

179

727

24.6

81.7

27.

State Bank of Travancore

49

468

163

73

753

505

221

726

30.4

96.4

178

Appendix Tables

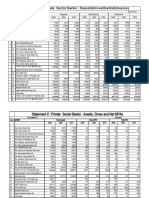

Appendix Table IV.11: Branches and ATMs of Scheduled Commercial Banks (Continued)

(As at end-March 2010)

Sr.

No.

Name of the Bank

Branches

Rural

Semiurban

Urban

ATMs

Metropolitan

Total

On-site

Off-site

Total

Per cent

of

Off-site

to total

Per cent

of

ATMs to

Branches

ATMs

1

2

Private Sector Banks

Old Private Sector Banks

10

11

12

1,201

3,037

3,027

2,762

10,027

8,603

9,844

18,447

53.4

184.0

68.5

861

1,626

1,435

1,030

4,952

2,266

1,124

3,390

33.2

1.

Bank of Rajasthan Ltd.

99

92

142

125

458

101

26

127

20.5

27.7

2.

Catholic Syrian Bank Ltd.

18

193

100

49

360

95

52

147

35.4

40.8

3.

City Union Bank Ltd.

38

63

78

45

224

142

10

152

6.6

67.9

4.

Dhanalakshmi Bank Ltd.

26

92

70

55

243

128

152

280

54.3

115.2

5.

Federal Bank Ltd.

47

340

172

111

670

413

319

732

43.6

109.3

6.

ING Vysya Bank

7.

Jammu and Kashmir Bank Ltd.

8.

Karnataka Bank Ltd.

9.

Karur Vysya Bank Ltd.

83

83

154

154

474

180

177

357

49.6

75.3

220

83

124

64

491

200

92

292

31.5

59.5

88

95

148

138

469

170

47

217

21.7

46.3

34

106

120

75

335

307

69

376

18.4

112.2

10.

Lakshmi Vilas Bank Ltd.

39

95

85

46

265

129

46

175

26.3

66.0

11.

Nainital Bank Ltd.

25

29

25

22

101

24

26

18

19

87

19

19

21.8

100.0

12.

Ratnakar Bank Ltd.

13.

SBI Commercial and

International Bank Ltd.

14.

South Indian Bank Ltd.

69

250

145

92

556

288

85

373

22.8

67.1

15.

Tamilnad Mercantile Bank Ltd.

51

79

54

33

217

92

49

141

34.8

65.0

340

1,411

1,592

1,732

5,075

6,337

8,720

15,057

57.9

296.7

44

252

378

292

966

1,245

3,048

4,293

71.0

444.4

13

13

52

82

76

34

110

30.9

134.1

New Private Sector Banks

16.

Axis Bank Ltd.

17.

Development Credit Bank Ltd.

18.

HDFC Bank Ltd.

19.

ICICI Bank Ltd.

20.

IndusInd Bank Ltd.

10

43

96

64

213

199

298

497

60.0

233.3

21.

Kotak Mahindra Ltd.

16

44

58

132

250

240

252

492

51.2

196.8

22.

Yes Bank Ltd.

20

37

46

48

151

117

94

211

44.5

139.7

95

456

520

644

1,715

2,311

1,924

4,235

45.4

246.9

151

566

481

500

1,698

2,149

3,070

5,219

58.8

307.4

179

Report on Trend and Progress of Banking in India 2009-10

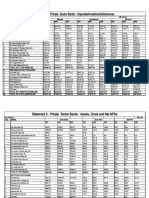

Appendix Table IV.11: Branches and ATMs of Scheduled Commercial Banks (Concluded)

(As at end-March 2010)

Sr.

No.

Name of the Bank

Branches

Rural

Semiurban

Urban

ATMs

Metropolitan

Total

On-site

Off-site

Total

Per cent

of

Off-site

to total

Per cent

of

ATMs to

Branches

ATMs

1

10

11

12

Foreign Banks

60

237

308

279

747

1,026

72.8

333.1

-

1.

AB Bank Ltd.

2.

Abu Dhabi Commercial Bank Ltd.

3.

American Express Banking Corp.

4.

Antwerp Bank Ltd.

5.

Bank Internasional Indonesia

6.

Bank of America NA

7.

Bank of Bahrain and

Kuwait B.S.C.

8.

Bank of Ceylon

9.

Bank of Nova Scotia

10.

Bank of Tokyo-Mitsubishi

UFJ Ltd.

11.

Barclays Bank PLC

10

17

58.8

242.9

12.

BNP Paribas

13.

Calyon Bank

14.

Chinatrust Commercial Bank

15.

Citibank N.A.

12

29

43

56

401

457

87.7

1062.8

16.

CommonWealth Bank of Australia

17.

DBS Bank Ltd.

10

18.

Deutsche Bank AG

13

12

18

30

60.0

230.8

19.

First Rand Bank Ltd.

20.

HSBC Ltd.

10

38

50

73

82

155

52.9

310.0

21.

JPMorgan Chase Bank

22.

JSC VTB Bank Ltd.

23.

Krung Thai Bank Public Co. Ltd.

24.

Mashreqbank psc

25.

Mizuho Corporate Bank Ltd.

26.

Oman International Bank S.A.O.G.

0.0

50.0

27.

Shinhan Bank

28.

Societe Generale

29.

Sonali Bank

30.

Standard Chartered Bank

16

78

94

94

149

243

61.3

258.5

31.

State Bank of Mauritius Ltd.

32.

The Royal Bank of Scotland

10

19

31

36

87

123

70.7

396.8

33.

UBS AG

34.

United Overseas Bank Ltd.

Note : Nil/Negligible.

Source : Master office file (latest updated version) on commercial banks.

180

You might also like

- LEED v4 BD+C Rating System Credit MatrixDocument2 pagesLEED v4 BD+C Rating System Credit Matrixadil271100% (2)

- Company Leased Vehicle PolicyDocument5 pagesCompany Leased Vehicle PolicyGunjan Sharma100% (2)

- ATM & Card Statistics For March 2018 POS AtmsDocument6 pagesATM & Card Statistics For March 2018 POS AtmsMathews KunnekkadanNo ratings yet

- Student Team Learning, Slavin PDFDocument130 pagesStudent Team Learning, Slavin PDFFahmi FathoniNo ratings yet

- Appendix Table Iv.6: Branches and Atms of Scheduled Commercial Banks (Continued)Document3 pagesAppendix Table Iv.6: Branches and Atms of Scheduled Commercial Banks (Continued)swaraj_07No ratings yet

- Top 10 Private Sector Banks by AssetsDocument129 pagesTop 10 Private Sector Banks by AssetsrohitcshettyNo ratings yet

- Private Sec BanksDocument9 pagesPrivate Sec BanksMohsin TamboliNo ratings yet

- Private Sec BanksDocument9 pagesPrivate Sec BankskarunNo ratings yet

- Statement I: Foreign Banks in India: Deposits/Investments/AdvancesDocument25 pagesStatement I: Foreign Banks in India: Deposits/Investments/Advancesmkapoor5686No ratings yet

- PVT Sec BKS 2012 14Document32,767 pagesPVT Sec BKS 2012 14Shital AndhariaNo ratings yet

- Statement I: Foreign Banks in India: Deposits/Investments/AdvancesDocument8 pagesStatement I: Foreign Banks in India: Deposits/Investments/Advancespankajp100No ratings yet

- Public Sec Banks 1Document8 pagesPublic Sec Banks 1ajsharma8No ratings yet

- Banks List IndiaDocument1 pageBanks List Indiadatlarv72No ratings yet

- Final Manila Cities 2005 - 2009.BSPDocument7 pagesFinal Manila Cities 2005 - 2009.BSPJoelene LopezNo ratings yet

- Statement I: Public Sector Banks: Deposits/Investments/AdvancesDocument9 pagesStatement I: Public Sector Banks: Deposits/Investments/AdvancesNekta PinchaNo ratings yet

- Data Analysis: Pradhan Mantri Jan-Dhan Yojana (Pmjdy)Document13 pagesData Analysis: Pradhan Mantri Jan-Dhan Yojana (Pmjdy)vivek adkineNo ratings yet

- Statement I: Private Sector Banks: Deposits/Investments/AdvancesDocument8 pagesStatement I: Private Sector Banks: Deposits/Investments/AdvancesanandbhawanaNo ratings yet

- Statement I: Private Sector Banks: Deposits/Investments/AdvancesDocument8 pagesStatement I: Private Sector Banks: Deposits/Investments/AdvancesShajin SanthoshNo ratings yet

- Statement I: Private Sector Banks: Deposits/Investments/AdvancesDocument8 pagesStatement I: Private Sector Banks: Deposits/Investments/AdvancesGyanendra AgrawalNo ratings yet

- Statement I: Private Sector Banks: Deposits/Investments/AdvancesDocument8 pagesStatement I: Private Sector Banks: Deposits/Investments/Advancesprakasht_1No ratings yet

- Private Sec Banks 3806Document9 pagesPrivate Sec Banks 3806Ganesh RamaiyerNo ratings yet

- Demand Forecasting - Economics Exam Date: 08/05/2022 Roll No. Student NameDocument12 pagesDemand Forecasting - Economics Exam Date: 08/05/2022 Roll No. Student NameAakash WaliaNo ratings yet

- Statement I: Foreign Banks in India: Deposits/Investments/AdvancesDocument8 pagesStatement I: Foreign Banks in India: Deposits/Investments/Advancesramkumar6388No ratings yet

- Composition of Assets of SCBsDocument102 pagesComposition of Assets of SCBsmohitash23No ratings yet

- 2009 2010 2011 Bills Purchased and Discounted Name of The Bank S.NoDocument14 pages2009 2010 2011 Bills Purchased and Discounted Name of The Bank S.NomuruganvgNo ratings yet

- Appendix: Table 8.1: Non Performing Assets of Different BanksDocument8 pagesAppendix: Table 8.1: Non Performing Assets of Different Banksshreeya salunkeNo ratings yet

- PAT As % TI Public & Private Sector BanksDocument1 pagePAT As % TI Public & Private Sector BanksPankaj MaryeNo ratings yet

- AppendicesDocument105 pagesAppendicesshani807No ratings yet

- Bank Wise RTGS Inward and Outward - August 2013Document8 pagesBank Wise RTGS Inward and Outward - August 2013Santosh KardakNo ratings yet

- Fund Release During June-2011Document2 pagesFund Release During June-2011rattanbansalNo ratings yet

- Table B6: Movement of Non-Performing Assets (Npas) of Scheduled Commercial Banks - 2012 and 2013Document3 pagesTable B6: Movement of Non-Performing Assets (Npas) of Scheduled Commercial Banks - 2012 and 2013Hitesh MittalNo ratings yet

- Npa PSUDocument1 pageNpa PSUketansanwalNo ratings yet

- Statement I: Public Sector Banks: Deposits/Investments/AdvancesDocument8 pagesStatement I: Public Sector Banks: Deposits/Investments/AdvancesSyed Mahammad AshifNo ratings yet

- Desert Public Sec SinglDocument49 pagesDesert Public Sec SinglPankaj KumarNo ratings yet

- Statement I: Public Sector Banks: Deposits/Investments/AdvancesDocument8 pagesStatement I: Public Sector Banks: Deposits/Investments/AdvancesNirmal SinghNo ratings yet

- Bank FinstatementDocument19 pagesBank FinstatementCool BuddyNo ratings yet

- POs Pre Joining Study Material PDFDocument152 pagesPOs Pre Joining Study Material PDFKushagra Pratap SinghNo ratings yet

- Private Sector Banks 2020-22Document8 pagesPrivate Sector Banks 2020-22Sidharth Sankar RathNo ratings yet

- Company Name Contact NoDocument50 pagesCompany Name Contact NoAkanksha SinghNo ratings yet

- Deposits Advances Net Income Total Business Profitability RatioDocument3 pagesDeposits Advances Net Income Total Business Profitability RatioSNEHA MARIYAM VARGHESE SIM 16-18No ratings yet

- NIM Public & Private Sector BanksDocument1 pageNIM Public & Private Sector BanksPankaj MaryeNo ratings yet

- TB6 STST1118Document3 pagesTB6 STST1118rajsirwaniNo ratings yet

- Table No. 1.1 - Progress of Commercial Banking at A GlanceDocument1 pageTable No. 1.1 - Progress of Commercial Banking at A GlanceRahulNo ratings yet

- Structure and Functions of Commercial BanksDocument6 pagesStructure and Functions of Commercial BanksShanky RanaNo ratings yet

- Small Medium EnterpriseDocument45 pagesSmall Medium EnterpriseSahil MehtaNo ratings yet

- Table 1: Indian Bank Association Analysis of Banks, 2003 Year Indian Banks Foreign Banks Total BanksDocument17 pagesTable 1: Indian Bank Association Analysis of Banks, 2003 Year Indian Banks Foreign Banks Total BanksWasil AliNo ratings yet

- SR - No: Nationalised Banks 2011Document4 pagesSR - No: Nationalised Banks 2011swap2390No ratings yet

- International Journal of Business and Management Invention (IJBMI)Document37 pagesInternational Journal of Business and Management Invention (IJBMI)inventionjournalsNo ratings yet

- Bankscope Export 15Document1,381 pagesBankscope Export 15yacobo sijabatNo ratings yet

- Year Banks Total Assets 3A.1. Demand Deposits - x000DDocument105 pagesYear Banks Total Assets 3A.1. Demand Deposits - x000Dayush singlaNo ratings yet

- Foreignsecbanks 3806Document8 pagesForeignsecbanks 3806sanjay_1234No ratings yet

- Banks Calling ListDocument6 pagesBanks Calling Listsatendra singhNo ratings yet

- Table B7: Bank-Wise and Bank Group-Wise Gross Non-Performing Assets, Gross Advances, and Gross NPA Ratio of Scheduled Commercial Banks - 2012Document5 pagesTable B7: Bank-Wise and Bank Group-Wise Gross Non-Performing Assets, Gross Advances, and Gross NPA Ratio of Scheduled Commercial Banks - 2012shipra1305No ratings yet

- The Shifting Countenance of Automated Teller Machines - An OverviewDocument6 pagesThe Shifting Countenance of Automated Teller Machines - An OverviewjubairktrNo ratings yet

- Specialized Bank DataDocument11 pagesSpecialized Bank DataTalha A SiddiquiNo ratings yet

- Bank Fees Gen 200412Document1 pageBank Fees Gen 200412dineshvihanNo ratings yet

- Rankings: India's Best Banks: The Winners Cover StoryDocument1 pageRankings: India's Best Banks: The Winners Cover Storynasir_m68No ratings yet

- 8.5. Agriculture Advances As at DECEMBER 2019Document2 pages8.5. Agriculture Advances As at DECEMBER 2019samNo ratings yet

- Bankscope Export 14Document1,381 pagesBankscope Export 14yacobo sijabatNo ratings yet

- Samples DetailsDocument4 pagesSamples Detailsswaroop shettyNo ratings yet

- Export Import Bank of Bangladesh LimitedDocument2 pagesExport Import Bank of Bangladesh LimitedRichard GateNo ratings yet

- ASEAN+3 Bond Market Guide 2017 Lao People's Democratic RepublicFrom EverandASEAN+3 Bond Market Guide 2017 Lao People's Democratic RepublicNo ratings yet

- SALN Form 2017 Downloadable Word and PDF FileDocument2 pagesSALN Form 2017 Downloadable Word and PDF FileGlendel Labata CayabyabNo ratings yet

- English Persuasive EssayDocument1 pageEnglish Persuasive EssayJanel Allison OligarioNo ratings yet

- AVBS1003-2020-Lecture 4-Role of ZoosDocument32 pagesAVBS1003-2020-Lecture 4-Role of ZoosOttilia LaiNo ratings yet

- BULDHANADocument12 pagesBULDHANARiyaz ShaikhNo ratings yet

- Assignment - Subhiksha Case Study: Apoorv Chamoli Jn180024Document3 pagesAssignment - Subhiksha Case Study: Apoorv Chamoli Jn180024sambhav tripathiNo ratings yet

- Saint AlbansDocument11 pagesSaint AlbansKenneth ShermanNo ratings yet

- Koumudi - Sramanakam TeluguDocument152 pagesKoumudi - Sramanakam TeluguRangothri Sreenivasa SubramanyamNo ratings yet

- Nature of Receivables: Student - Feedback@sti - EduDocument12 pagesNature of Receivables: Student - Feedback@sti - EduAbegail AdoraNo ratings yet

- .My Events TOMMS EAM BrochureDocument8 pages.My Events TOMMS EAM BrochureEodrizal MahmoodNo ratings yet

- Chapter 5 L-5.1 The Motor Vehicles Act, 1988 Nature and ScopeDocument10 pagesChapter 5 L-5.1 The Motor Vehicles Act, 1988 Nature and ScopevibhuNo ratings yet

- Putu Gitawijaya Putra Utama 21Document2 pagesPutu Gitawijaya Putra Utama 21Gita WijayaNo ratings yet

- Leah Klein - GDDocument1 pageLeah Klein - GDAbi C. WareNo ratings yet

- Pooja Sharma ResumeDocument2 pagesPooja Sharma ResumePrateek SinhaNo ratings yet

- Outcasts BiographyDocument42 pagesOutcasts Biographysatya7960No ratings yet

- St. Gregory Palama, Freedom and The SelfDocument4 pagesSt. Gregory Palama, Freedom and The SelfSoponaru StefanNo ratings yet

- IA Chap. 19, 20, and 22Document31 pagesIA Chap. 19, 20, and 22Pitel O'shoppeNo ratings yet

- Day 2 Stanza 2 - 605886e13848eDocument23 pagesDay 2 Stanza 2 - 605886e13848emanjeetkaur1556No ratings yet

- Cap - 12 - Betas by Sector DamodaranDocument4 pagesCap - 12 - Betas by Sector DamodaranVanessa José Claudio IsaiasNo ratings yet

- 1 Intro DonationDocument27 pages1 Intro DonationMae NamocNo ratings yet

- NNNNMMMMDocument15 pagesNNNNMMMMSherrylyn Vi Britannia FamadorNo ratings yet

- German RevolutionDocument11 pagesGerman RevolutionMeruthulaNo ratings yet

- Margaret Atwood'S Maddaddam Trilogy: Postmodernism, Apocalypse, and RaptureDocument23 pagesMargaret Atwood'S Maddaddam Trilogy: Postmodernism, Apocalypse, and Rapturetordet13No ratings yet

- Rohleder PresentationDocument135 pagesRohleder Presentationmcwong_98No ratings yet

- Yashenko v. Harrah's NC Casino, 4th Cir. (2006)Document17 pagesYashenko v. Harrah's NC Casino, 4th Cir. (2006)Scribd Government DocsNo ratings yet

- Commercial LessonDocument8 pagesCommercial LessonSnowdenKonan100% (1)

- Rules of Determining Debit & Credit PDFDocument26 pagesRules of Determining Debit & Credit PDFasadurrahman40100% (1)

- As 1988.1-2006 Welding of Ferrous Castings Steel CastingsDocument8 pagesAs 1988.1-2006 Welding of Ferrous Castings Steel CastingsSAI Global - APACNo ratings yet