Professional Documents

Culture Documents

3 - Bir Ruling No. 013-03

3 - Bir Ruling No. 013-03

Uploaded by

Gino Alejandro SisonCopyright:

Available Formats

You might also like

- Pay Slip BSNLDocument1 pagePay Slip BSNLJohn FernendiceNo ratings yet

- Kotak Mahindra Bank LTD: Full and Final SettlementDocument2 pagesKotak Mahindra Bank LTD: Full and Final SettlementvasssssssSNo ratings yet

- 2018 Suggested Tax Bar AnswerDocument14 pages2018 Suggested Tax Bar AnswerAudrey100% (3)

- Payroll Payslip AUADocument1 pagePayroll Payslip AUAJavier PenagosNo ratings yet

- Tax Code: Partnerships' Are Partnerships Formed by Persons For TheDocument10 pagesTax Code: Partnerships' Are Partnerships Formed by Persons For Thegabriel omliNo ratings yet

- 4 - Itad Bir Ruling No. 005-18Document4 pages4 - Itad Bir Ruling No. 005-18Gino Alejandro SisonNo ratings yet

- Income Tax On IndividualsDocument7 pagesIncome Tax On IndividualsThe man with a Square stacheNo ratings yet

- Bar TaxDocument29 pagesBar TaxMaisie ZabalaNo ratings yet

- Memory-Aid-Taxation San Beda 2001Document24 pagesMemory-Aid-Taxation San Beda 2001jurisNo ratings yet

- Taxation Reviewer-Group 2Document24 pagesTaxation Reviewer-Group 2Angelica ManzanoNo ratings yet

- Taxation One CompleteDocument90 pagesTaxation One CompleteCiena MaeNo ratings yet

- Kinds of Income Tax PayersDocument9 pagesKinds of Income Tax PayersCarra Trisha C. TitoNo ratings yet

- Individual Income TaxDocument9 pagesIndividual Income TaxCharmaine RosalesNo ratings yet

- Income-Tax-for-Ind.-and-Corp. - Wo-A 2Document10 pagesIncome-Tax-for-Ind.-and-Corp. - Wo-A 2shai santiagoNo ratings yet

- 6 11 18 Tax Summary in The Philippines EditedDocument117 pages6 11 18 Tax Summary in The Philippines EditedBianca PalomaNo ratings yet

- Income Tax For Ind. and CorpDocument11 pagesIncome Tax For Ind. and CorpsophiaNo ratings yet

- SEC. 23. General Principles of Income Taxation in The Philippines. - Except WhenDocument11 pagesSEC. 23. General Principles of Income Taxation in The Philippines. - Except WhenMiguel BerguNo ratings yet

- Types of Individual Taxpayers Citizens Revenue Regulations No. 1-79Document8 pagesTypes of Individual Taxpayers Citizens Revenue Regulations No. 1-79James Evan I. ObnamiaNo ratings yet

- Tax 1 Montero Digest Block 2A PDFDocument702 pagesTax 1 Montero Digest Block 2A PDFMich FelloneNo ratings yet

- Tax-Review-Handouts-INDV FWT CGT FBT EST PDFDocument34 pagesTax-Review-Handouts-INDV FWT CGT FBT EST PDFMarinella Oppa100% (1)

- TAX BAR Qs With AnswersDocument10 pagesTAX BAR Qs With AnswersJanila BajuyoNo ratings yet

- University of Perpetual Help System DaltaDocument31 pagesUniversity of Perpetual Help System DaltaDerick Ocampo FulgencioNo ratings yet

- Income Taxation of Individuals: Citizens: Resident Non-Residents CitizensDocument4 pagesIncome Taxation of Individuals: Citizens: Resident Non-Residents CitizensJul A.No ratings yet

- Income Taxation of Individuals: Citizens: Resident Non-Residents CitizensDocument2 pagesIncome Taxation of Individuals: Citizens: Resident Non-Residents CitizenshellomynameisNo ratings yet

- Lecture Notes Individual TaxationDocument16 pagesLecture Notes Individual Taxationבנדר-עלי אימאם טינגאו בתולהNo ratings yet

- Taxation of IndividualsDocument22 pagesTaxation of IndividualsTurksNo ratings yet

- IBAÑEZ Present Income Tax SystemDocument74 pagesIBAÑEZ Present Income Tax SystemJasmine Montero-GaribayNo ratings yet

- CH09B Income and Business TaxationDocument20 pagesCH09B Income and Business TaxationArt MelancholiaNo ratings yet

- PDF Taxation 1 NotesDocument24 pagesPDF Taxation 1 NotesLeuNo ratings yet

- Taxation Atty. Macmod, C.P.A. Individual and Corporate Income TaxpayersDocument12 pagesTaxation Atty. Macmod, C.P.A. Individual and Corporate Income TaxpayersJohn Brian D. SorianoNo ratings yet

- Revenue Regulation Implementing RP-Singapore Tax TreatyDocument15 pagesRevenue Regulation Implementing RP-Singapore Tax Treatybianca.denise.dawisNo ratings yet

- Individual Taxpayers Handouts and ProblemsDocument15 pagesIndividual Taxpayers Handouts and ProblemsLovely De CastroNo ratings yet

- Income TaxationDocument21 pagesIncome TaxationUbalda AbuboNo ratings yet

- Definition Income TaxDocument7 pagesDefinition Income TaxKrishaNo ratings yet

- 2016 Tax Aid Classification of TaxpayersDocument4 pages2016 Tax Aid Classification of TaxpayersDewm DewmNo ratings yet

- Income TaxationDocument21 pagesIncome TaxationElyssa Mariz PevidalNo ratings yet

- Income TaxationDocument21 pagesIncome TaxationJune Baricanosa AlvarezNo ratings yet

- Person - Orporation: Income TaxDocument138 pagesPerson - Orporation: Income TaxMich FelloneNo ratings yet

- Common Questions TaxationDocument5 pagesCommon Questions TaxationChris TineNo ratings yet

- Person - Orporation: Income TaxDocument223 pagesPerson - Orporation: Income TaxMich FelloneNo ratings yet

- FIRS Circular Taxation of Non Residents in Nigeria 2021Document24 pagesFIRS Circular Taxation of Non Residents in Nigeria 2021Abdulhameed BabalolaNo ratings yet

- Present Income Tax SystemDocument57 pagesPresent Income Tax SystemCharm Ferrer100% (1)

- Income Tax For Ind. and Corp. Wo ADocument11 pagesIncome Tax For Ind. and Corp. Wo Ashai santiagoNo ratings yet

- Tax601 Individual Itx Lecture Notes 122Document12 pagesTax601 Individual Itx Lecture Notes 122Justine JaymaNo ratings yet

- Title Ii Tax On Income Chapter I - Definitions SEC. 22. Definitions - When Used in This TitleDocument2 pagesTitle Ii Tax On Income Chapter I - Definitions SEC. 22. Definitions - When Used in This TitleEdward Kenneth KungNo ratings yet

- 396014538-2018-Suggested-Tax-Bar-Answer (7) .PDF: Danilo M.sampaga Full DescriptionDocument7 pages396014538-2018-Suggested-Tax-Bar-Answer (7) .PDF: Danilo M.sampaga Full DescriptionmimimilkteaNo ratings yet

- Income Taxation TableDocument11 pagesIncome Taxation TableRomela Eleria GasesNo ratings yet

- DateDocument11 pagesDateShiela Jane CrismundoNo ratings yet

- Income Tax For Ind - and Corp - 1Document11 pagesIncome Tax For Ind - and Corp - 1bobo kaNo ratings yet

- I. Taxpayers Ii. Situs of TaxationDocument18 pagesI. Taxpayers Ii. Situs of TaxationJennylyn Biltz AlbanoNo ratings yet

- Income On IndividualsDocument6 pagesIncome On IndividualsDarwish masturaNo ratings yet

- BIR Ruling No. 052 10Document2 pagesBIR Ruling No. 052 10MrDigesterNo ratings yet

- Bir Ruling Da 192-08Document2 pagesBir Ruling Da 192-08norliza albutraNo ratings yet

- 20 Air Canada vs. Commissioner of Internal RevenueDocument30 pages20 Air Canada vs. Commissioner of Internal Revenueshlm bNo ratings yet

- G.R. No. 169507. January 11, 2016. Air Canada, Petitioner, vs. Commissioner of INTERNAL REVENUE, RespondentDocument60 pagesG.R. No. 169507. January 11, 2016. Air Canada, Petitioner, vs. Commissioner of INTERNAL REVENUE, RespondentKathleneGabrielAzasHaoNo ratings yet

- Income Taxes: 1. Persons Subject To The Individual Income TaxDocument5 pagesIncome Taxes: 1. Persons Subject To The Individual Income TaxJerome Eziekel Posada PanaliganNo ratings yet

- Individual ItDocument12 pagesIndividual ItlouellasoleilgpNo ratings yet

- 5 Air Canada v. Commissioner of Internal RevenueDocument54 pages5 Air Canada v. Commissioner of Internal RevenueVianice BaroroNo ratings yet

- University of St. Lasalle: Student HandoutsDocument13 pagesUniversity of St. Lasalle: Student HandoutsMae EscanillanNo ratings yet

- Bir 33-00Document3 pagesBir 33-00Lauren KeiNo ratings yet

- Figueroa V PeopleDocument2 pagesFigueroa V PeopleGino Alejandro SisonNo ratings yet

- 2024 Syllabus Political Law and Public International Law For Philippine Bar MVLDocument9 pages2024 Syllabus Political Law and Public International Law For Philippine Bar MVLGino Alejandro SisonNo ratings yet

- Guy and Cheu v. IgnacioDocument3 pagesGuy and Cheu v. IgnacioGino Alejandro SisonNo ratings yet

- SAMAR II vs. SeludoDocument2 pagesSAMAR II vs. SeludoGino Alejandro SisonNo ratings yet

- List of Arbit Institutions PHDocument1 pageList of Arbit Institutions PHGino Alejandro SisonNo ratings yet

- Salvador v. Patricia - AlcarazDocument2 pagesSalvador v. Patricia - AlcarazGino Alejandro SisonNo ratings yet

- Deposit Notes Credit TransactionsDocument20 pagesDeposit Notes Credit TransactionsGino Alejandro SisonNo ratings yet

- Atwel v. CPAI - CodillaDocument2 pagesAtwel v. CPAI - CodillaGino Alejandro SisonNo ratings yet

- Demand Letter For Fulfilment of Obligation SAMPLEDocument2 pagesDemand Letter For Fulfilment of Obligation SAMPLEGino Alejandro Sison100% (1)

- Promissory NoteDocument1 pagePromissory NoteGino Alejandro SisonNo ratings yet

- 4 - Itad Bir Ruling No. 005-18Document4 pages4 - Itad Bir Ruling No. 005-18Gino Alejandro SisonNo ratings yet

- Deed of Absolute Sale SAMPLEDocument5 pagesDeed of Absolute Sale SAMPLEGino Alejandro SisonNo ratings yet

- Demand Letter For Ejectment SAMPLEDocument1 pageDemand Letter For Ejectment SAMPLEGino Alejandro SisonNo ratings yet

- Hacienda Starke V CuencaDocument2 pagesHacienda Starke V CuencaGino Alejandro SisonNo ratings yet

- 2 - Bir Ruling No. 517-11Document5 pages2 - Bir Ruling No. 517-11Gino Alejandro SisonNo ratings yet

- Radiowealth Finance vs. Sps. Del RosarioDocument2 pagesRadiowealth Finance vs. Sps. Del RosarioGino Alejandro SisonNo ratings yet

- Evangelista vs. Mercator FinanceDocument3 pagesEvangelista vs. Mercator FinanceGino Alejandro SisonNo ratings yet

- Filipinas Pre-Fabricated Building Systems (FilSystems) v. Puente, March 18, 2005Document2 pagesFilipinas Pre-Fabricated Building Systems (FilSystems) v. Puente, March 18, 2005Gino Alejandro SisonNo ratings yet

- Gaza Et Al vs. LimDocument3 pagesGaza Et Al vs. LimGino Alejandro SisonNo ratings yet

- in N Out V SehwaniDocument4 pagesin N Out V SehwaniGino Alejandro SisonNo ratings yet

- St. Mary - S University v. CADocument2 pagesSt. Mary - S University v. CAGino Alejandro SisonNo ratings yet

- 6 - Kimberly Clark Phils V SecDocument2 pages6 - Kimberly Clark Phils V SecGino Alejandro Sison100% (1)

- BENARES V PANCHODocument2 pagesBENARES V PANCHOGino Alejandro SisonNo ratings yet

- Bliss vs. DiazDocument3 pagesBliss vs. DiazGino Alejandro Sison100% (1)

- Legaspi v. COMELECDocument16 pagesLegaspi v. COMELECGino Alejandro SisonNo ratings yet

- 04.) Rowell Industrial Corp v. CADocument2 pages04.) Rowell Industrial Corp v. CAGino Alejandro SisonNo ratings yet

- Labor Law 1 - Digest Group Name - Professor: ABS-CBN Rank-and-File EmployeesDocument2 pagesLabor Law 1 - Digest Group Name - Professor: ABS-CBN Rank-and-File EmployeesGino Alejandro SisonNo ratings yet

- 03) The Manila Peninsula v. AlipioDocument1 page03) The Manila Peninsula v. AlipioGino Alejandro SisonNo ratings yet

- 1) Magis Young Achievers - Learning Center v. ManaloDocument2 pages1) Magis Young Achievers - Learning Center v. ManaloGino Alejandro SisonNo ratings yet

- 2) PIER 8 Arrastre - Stevedoring Services, Inc. v. BoclotDocument2 pages2) PIER 8 Arrastre - Stevedoring Services, Inc. v. BoclotGino Alejandro Sison50% (2)

- PauslipDocument2 pagesPauslipAmanNo ratings yet

- Addis Ababa (Ethiopia) National Officer Category - Annual Salaries and Allowances (In United States Dollars) Effective 1 July 2021Document10 pagesAddis Ababa (Ethiopia) National Officer Category - Annual Salaries and Allowances (In United States Dollars) Effective 1 July 2021Wasihun JimmyNo ratings yet

- Ganaesmurthy Form16Document4 pagesGanaesmurthy Form16sundar1111No ratings yet

- OR OUR Nformation: Information For Non-Profit OrganizationsDocument8 pagesOR OUR Nformation: Information For Non-Profit OrganizationsFuji guruNo ratings yet

- W8-Eci 2021-06-01 Preview DocDocument1 pageW8-Eci 2021-06-01 Preview Docfuture warriorNo ratings yet

- REVENUE MEMORANDUM CIRCULAR NO. 27-2011 Issued On July 1, 2011 RevokesDocument1 pageREVENUE MEMORANDUM CIRCULAR NO. 27-2011 Issued On July 1, 2011 RevokesJm CruzNo ratings yet

- Net Cash Flow From Operating Activities 1,222,000Document1 pageNet Cash Flow From Operating Activities 1,222,000Jen DeloyNo ratings yet

- DGWooo004661050000r06053073276621 2Document1 pageDGWooo004661050000r06053073276621 2Janssen PerezNo ratings yet

- Computation of Total Income: Zenit - A KDK Software ProductDocument2 pagesComputation of Total Income: Zenit - A KDK Software ProductAbhishek SaxenaNo ratings yet

- Difference Between OPC and SPDocument2 pagesDifference Between OPC and SPrahulkapur87No ratings yet

- Taco 0088166061500044Document1 pageTaco 0088166061500044Sourav ChakrabortyNo ratings yet

- Bir 16385 16382Document1 pageBir 16385 16382Ryzen LlameNo ratings yet

- Hotel BillDocument6 pagesHotel BillMech2022 PTBENo ratings yet

- AEC 215 Reviewer ComputationsDocument6 pagesAEC 215 Reviewer ComputationsHazel Seguerra BicadaNo ratings yet

- Levis ShirtDocument1 pageLevis ShirtKovalan RNo ratings yet

- SaiBaba Printer (May'22)Document1 pageSaiBaba Printer (May'22)Sriram SNo ratings yet

- Set Off and Carry Forward of LossesDocument3 pagesSet Off and Carry Forward of LossesBilal AwanNo ratings yet

- Financial Model 1Document1 pageFinancial Model 1ahmedmostafaibrahim22No ratings yet

- Diamond ChemicalsDocument3 pagesDiamond ChemicalsJohn RiveraNo ratings yet

- Lorenzo V Posadas (Digest)Document2 pagesLorenzo V Posadas (Digest)StBernard15No ratings yet

- Zamora V CIRDocument2 pagesZamora V CIRSuiNo ratings yet

- Selina Solution Concise Maths Class 10 Chapter 1Document13 pagesSelina Solution Concise Maths Class 10 Chapter 1honeyrani6d16No ratings yet

- PVC 19012012Document4 pagesPVC 19012012Barra PrasetyawanNo ratings yet

- Attachmentu0sview Att&th 17dcdf85a9a7dc52&attid 0 1&disp Attd&safe 1&zw&saddbDocument1 pageAttachmentu0sview Att&th 17dcdf85a9a7dc52&attid 0 1&disp Attd&safe 1&zw&saddbKumar PushpeshNo ratings yet

- National Officer SalaryDocument6 pagesNational Officer SalarytaolawaleNo ratings yet

- Fmda GST RCDocument3 pagesFmda GST RCDipankar BarmanNo ratings yet

- Dinsha C001 200905 2023057263210824609387135Document1 pageDinsha C001 200905 2023057263210824609387135pradeepppatil12No ratings yet

3 - Bir Ruling No. 013-03

3 - Bir Ruling No. 013-03

Uploaded by

Gino Alejandro SisonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

3 - Bir Ruling No. 013-03

3 - Bir Ruling No. 013-03

Uploaded by

Gino Alejandro SisonCopyright:

Available Formats

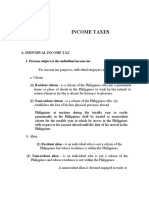

October 13, 2003

BIR RULING NO. 013-03

101 22 (E) 000-00

DCCD Engineering Corporation

SOL Office Condominium Building

112 Amorsolo Street, Legaspi Village

1229 Makati City

Attention: Hermenegildo P. Manzano, Jr.

Corporate Secretary and Treasurer

Gentlemen :

This refers to your letter dated May 21, 2001 requesting for a ruling on

whether or not your regular employees assigned abroad qualify under the

"non-resident citizen" status and are, therefore, exempt from income taxes

and consequently from withholding taxes.

It is represented that DCCD Engineering Corporation (DCCD) is a

domestic corporation registered with the Securities and Exchange

Commission. It is an integrated engineering consulting firm generating

projects from local as well as from foreign sources both from the public and

private sector. It was able to secure a water supply project in Phnom Penh,

Cambodia requiring it to supervise for twenty (20) months the construction

phase thereof. The regular compensation of the employees sent abroad

including their thirteenth-month pay, project bonuses, sick leaves, vacation

leaves and other benefits are paid here in the Philippines.

In reply, please be informed of the following:

Re: First Query

Section 22(E) of the NIRC provides:

"Sec. 22. Definitions. — When used in this Title:

xxx xxx xxx

(E) The term 'nonresident citizen' means:

(1) A citizen of the Philippines who establishes to the

satisfaction of the Commissioner the fact of his

physical presence abroad with a definite intention

to reside therein.

(2) A citizen of the Philippines who leaves the Philippines

during the taxable year to reside abroad, either as

an immigrant or for employment on a permanent

basis.

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

(3) A citizen of the Philippines who works and derives

income from abroad and whose employment

thereat requires him to be physically present

abroad most of the time during the taxable year.

(4) A citizen who has been previously considered as

nonresident citizen and who arrives in the

Philippines at any time during the taxable year to

reside permanently in the Philippines shall likewise

be treated as a nonresident citizen for the taxable

year in which he arrives in the Philippines with

respect to his income derived from sources abroad

until the date of his arrival in the Philippines.

xxx xxx xxx

The regular employees you send to Phnom Penh, Cambodia to

supervise the construction of the water supply project of said country may

qualify as "nonresident citizens" of the Philippines under Section 22 (E) (3) of

the NIRC of 1997, supra., if their employment requires them to be present in

that foreign country most of the time during the taxable year, i.e., they stay

there for at least one hundred eighty-three (183) days or more.

The fact that their salaries are paid here in the Philippines does not

mean that they do not derive income from abroad as the situs of

compensation income is the place where the services are rendered pursuant

to Section 2.78.1 of Revenue Regulations No. 2-98, to wit:

"Sec. 2.78.1 Withholding of Income Tax on Compensation

Income —

xxx xxx xxx

(10) Compensation for services performed outside the

Philippines. —

Remuneration for services performed outside the Philippines by

a resident citizen of the Philippines for a domestic or a resident

foreign corporation or partnership, or for a non-resident corporation

or partnership, or for a non-resident individual not engaged in trade

or business in the Philippines shall be treated as compensation which

is subject to tax.

A non-resident citizen as defined in these regulations is taxable

only on income derived from sources within the Philippines. In

general, the situs of the income whether within or without the

Philippines, is determined by the place where the service is

rendered."

In view of the foregoing, said employees are not subject to income tax.

Section 23(C) of the NIRC of 1997 provides:

"(C) An individual citizen of the Philippines who is working and

deriving income abroad as an overseas contract worker is taxable

only on income from sources within the Philippines . . . ."

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

This ruling is being issued on the basis of the foregoing facts as

represented. However, if upon investigation, it will be disclosed that the

facts are different, then this ruling shall be considered as null and void.

DcAaSI

Very truly yours,

(SGD.) GUILLERMO L. PARAYNO, JR.

Commissioner of Internal Revenue

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

You might also like

- Pay Slip BSNLDocument1 pagePay Slip BSNLJohn FernendiceNo ratings yet

- Kotak Mahindra Bank LTD: Full and Final SettlementDocument2 pagesKotak Mahindra Bank LTD: Full and Final SettlementvasssssssSNo ratings yet

- 2018 Suggested Tax Bar AnswerDocument14 pages2018 Suggested Tax Bar AnswerAudrey100% (3)

- Payroll Payslip AUADocument1 pagePayroll Payslip AUAJavier PenagosNo ratings yet

- Tax Code: Partnerships' Are Partnerships Formed by Persons For TheDocument10 pagesTax Code: Partnerships' Are Partnerships Formed by Persons For Thegabriel omliNo ratings yet

- 4 - Itad Bir Ruling No. 005-18Document4 pages4 - Itad Bir Ruling No. 005-18Gino Alejandro SisonNo ratings yet

- Income Tax On IndividualsDocument7 pagesIncome Tax On IndividualsThe man with a Square stacheNo ratings yet

- Bar TaxDocument29 pagesBar TaxMaisie ZabalaNo ratings yet

- Memory-Aid-Taxation San Beda 2001Document24 pagesMemory-Aid-Taxation San Beda 2001jurisNo ratings yet

- Taxation Reviewer-Group 2Document24 pagesTaxation Reviewer-Group 2Angelica ManzanoNo ratings yet

- Taxation One CompleteDocument90 pagesTaxation One CompleteCiena MaeNo ratings yet

- Kinds of Income Tax PayersDocument9 pagesKinds of Income Tax PayersCarra Trisha C. TitoNo ratings yet

- Individual Income TaxDocument9 pagesIndividual Income TaxCharmaine RosalesNo ratings yet

- Income-Tax-for-Ind.-and-Corp. - Wo-A 2Document10 pagesIncome-Tax-for-Ind.-and-Corp. - Wo-A 2shai santiagoNo ratings yet

- 6 11 18 Tax Summary in The Philippines EditedDocument117 pages6 11 18 Tax Summary in The Philippines EditedBianca PalomaNo ratings yet

- Income Tax For Ind. and CorpDocument11 pagesIncome Tax For Ind. and CorpsophiaNo ratings yet

- SEC. 23. General Principles of Income Taxation in The Philippines. - Except WhenDocument11 pagesSEC. 23. General Principles of Income Taxation in The Philippines. - Except WhenMiguel BerguNo ratings yet

- Types of Individual Taxpayers Citizens Revenue Regulations No. 1-79Document8 pagesTypes of Individual Taxpayers Citizens Revenue Regulations No. 1-79James Evan I. ObnamiaNo ratings yet

- Tax 1 Montero Digest Block 2A PDFDocument702 pagesTax 1 Montero Digest Block 2A PDFMich FelloneNo ratings yet

- Tax-Review-Handouts-INDV FWT CGT FBT EST PDFDocument34 pagesTax-Review-Handouts-INDV FWT CGT FBT EST PDFMarinella Oppa100% (1)

- TAX BAR Qs With AnswersDocument10 pagesTAX BAR Qs With AnswersJanila BajuyoNo ratings yet

- University of Perpetual Help System DaltaDocument31 pagesUniversity of Perpetual Help System DaltaDerick Ocampo FulgencioNo ratings yet

- Income Taxation of Individuals: Citizens: Resident Non-Residents CitizensDocument4 pagesIncome Taxation of Individuals: Citizens: Resident Non-Residents CitizensJul A.No ratings yet

- Income Taxation of Individuals: Citizens: Resident Non-Residents CitizensDocument2 pagesIncome Taxation of Individuals: Citizens: Resident Non-Residents CitizenshellomynameisNo ratings yet

- Lecture Notes Individual TaxationDocument16 pagesLecture Notes Individual Taxationבנדר-עלי אימאם טינגאו בתולהNo ratings yet

- Taxation of IndividualsDocument22 pagesTaxation of IndividualsTurksNo ratings yet

- IBAÑEZ Present Income Tax SystemDocument74 pagesIBAÑEZ Present Income Tax SystemJasmine Montero-GaribayNo ratings yet

- CH09B Income and Business TaxationDocument20 pagesCH09B Income and Business TaxationArt MelancholiaNo ratings yet

- PDF Taxation 1 NotesDocument24 pagesPDF Taxation 1 NotesLeuNo ratings yet

- Taxation Atty. Macmod, C.P.A. Individual and Corporate Income TaxpayersDocument12 pagesTaxation Atty. Macmod, C.P.A. Individual and Corporate Income TaxpayersJohn Brian D. SorianoNo ratings yet

- Revenue Regulation Implementing RP-Singapore Tax TreatyDocument15 pagesRevenue Regulation Implementing RP-Singapore Tax Treatybianca.denise.dawisNo ratings yet

- Individual Taxpayers Handouts and ProblemsDocument15 pagesIndividual Taxpayers Handouts and ProblemsLovely De CastroNo ratings yet

- Income TaxationDocument21 pagesIncome TaxationUbalda AbuboNo ratings yet

- Definition Income TaxDocument7 pagesDefinition Income TaxKrishaNo ratings yet

- 2016 Tax Aid Classification of TaxpayersDocument4 pages2016 Tax Aid Classification of TaxpayersDewm DewmNo ratings yet

- Income TaxationDocument21 pagesIncome TaxationElyssa Mariz PevidalNo ratings yet

- Income TaxationDocument21 pagesIncome TaxationJune Baricanosa AlvarezNo ratings yet

- Person - Orporation: Income TaxDocument138 pagesPerson - Orporation: Income TaxMich FelloneNo ratings yet

- Common Questions TaxationDocument5 pagesCommon Questions TaxationChris TineNo ratings yet

- Person - Orporation: Income TaxDocument223 pagesPerson - Orporation: Income TaxMich FelloneNo ratings yet

- FIRS Circular Taxation of Non Residents in Nigeria 2021Document24 pagesFIRS Circular Taxation of Non Residents in Nigeria 2021Abdulhameed BabalolaNo ratings yet

- Present Income Tax SystemDocument57 pagesPresent Income Tax SystemCharm Ferrer100% (1)

- Income Tax For Ind. and Corp. Wo ADocument11 pagesIncome Tax For Ind. and Corp. Wo Ashai santiagoNo ratings yet

- Tax601 Individual Itx Lecture Notes 122Document12 pagesTax601 Individual Itx Lecture Notes 122Justine JaymaNo ratings yet

- Title Ii Tax On Income Chapter I - Definitions SEC. 22. Definitions - When Used in This TitleDocument2 pagesTitle Ii Tax On Income Chapter I - Definitions SEC. 22. Definitions - When Used in This TitleEdward Kenneth KungNo ratings yet

- 396014538-2018-Suggested-Tax-Bar-Answer (7) .PDF: Danilo M.sampaga Full DescriptionDocument7 pages396014538-2018-Suggested-Tax-Bar-Answer (7) .PDF: Danilo M.sampaga Full DescriptionmimimilkteaNo ratings yet

- Income Taxation TableDocument11 pagesIncome Taxation TableRomela Eleria GasesNo ratings yet

- DateDocument11 pagesDateShiela Jane CrismundoNo ratings yet

- Income Tax For Ind - and Corp - 1Document11 pagesIncome Tax For Ind - and Corp - 1bobo kaNo ratings yet

- I. Taxpayers Ii. Situs of TaxationDocument18 pagesI. Taxpayers Ii. Situs of TaxationJennylyn Biltz AlbanoNo ratings yet

- Income On IndividualsDocument6 pagesIncome On IndividualsDarwish masturaNo ratings yet

- BIR Ruling No. 052 10Document2 pagesBIR Ruling No. 052 10MrDigesterNo ratings yet

- Bir Ruling Da 192-08Document2 pagesBir Ruling Da 192-08norliza albutraNo ratings yet

- 20 Air Canada vs. Commissioner of Internal RevenueDocument30 pages20 Air Canada vs. Commissioner of Internal Revenueshlm bNo ratings yet

- G.R. No. 169507. January 11, 2016. Air Canada, Petitioner, vs. Commissioner of INTERNAL REVENUE, RespondentDocument60 pagesG.R. No. 169507. January 11, 2016. Air Canada, Petitioner, vs. Commissioner of INTERNAL REVENUE, RespondentKathleneGabrielAzasHaoNo ratings yet

- Income Taxes: 1. Persons Subject To The Individual Income TaxDocument5 pagesIncome Taxes: 1. Persons Subject To The Individual Income TaxJerome Eziekel Posada PanaliganNo ratings yet

- Individual ItDocument12 pagesIndividual ItlouellasoleilgpNo ratings yet

- 5 Air Canada v. Commissioner of Internal RevenueDocument54 pages5 Air Canada v. Commissioner of Internal RevenueVianice BaroroNo ratings yet

- University of St. Lasalle: Student HandoutsDocument13 pagesUniversity of St. Lasalle: Student HandoutsMae EscanillanNo ratings yet

- Bir 33-00Document3 pagesBir 33-00Lauren KeiNo ratings yet

- Figueroa V PeopleDocument2 pagesFigueroa V PeopleGino Alejandro SisonNo ratings yet

- 2024 Syllabus Political Law and Public International Law For Philippine Bar MVLDocument9 pages2024 Syllabus Political Law and Public International Law For Philippine Bar MVLGino Alejandro SisonNo ratings yet

- Guy and Cheu v. IgnacioDocument3 pagesGuy and Cheu v. IgnacioGino Alejandro SisonNo ratings yet

- SAMAR II vs. SeludoDocument2 pagesSAMAR II vs. SeludoGino Alejandro SisonNo ratings yet

- List of Arbit Institutions PHDocument1 pageList of Arbit Institutions PHGino Alejandro SisonNo ratings yet

- Salvador v. Patricia - AlcarazDocument2 pagesSalvador v. Patricia - AlcarazGino Alejandro SisonNo ratings yet

- Deposit Notes Credit TransactionsDocument20 pagesDeposit Notes Credit TransactionsGino Alejandro SisonNo ratings yet

- Atwel v. CPAI - CodillaDocument2 pagesAtwel v. CPAI - CodillaGino Alejandro SisonNo ratings yet

- Demand Letter For Fulfilment of Obligation SAMPLEDocument2 pagesDemand Letter For Fulfilment of Obligation SAMPLEGino Alejandro Sison100% (1)

- Promissory NoteDocument1 pagePromissory NoteGino Alejandro SisonNo ratings yet

- 4 - Itad Bir Ruling No. 005-18Document4 pages4 - Itad Bir Ruling No. 005-18Gino Alejandro SisonNo ratings yet

- Deed of Absolute Sale SAMPLEDocument5 pagesDeed of Absolute Sale SAMPLEGino Alejandro SisonNo ratings yet

- Demand Letter For Ejectment SAMPLEDocument1 pageDemand Letter For Ejectment SAMPLEGino Alejandro SisonNo ratings yet

- Hacienda Starke V CuencaDocument2 pagesHacienda Starke V CuencaGino Alejandro SisonNo ratings yet

- 2 - Bir Ruling No. 517-11Document5 pages2 - Bir Ruling No. 517-11Gino Alejandro SisonNo ratings yet

- Radiowealth Finance vs. Sps. Del RosarioDocument2 pagesRadiowealth Finance vs. Sps. Del RosarioGino Alejandro SisonNo ratings yet

- Evangelista vs. Mercator FinanceDocument3 pagesEvangelista vs. Mercator FinanceGino Alejandro SisonNo ratings yet

- Filipinas Pre-Fabricated Building Systems (FilSystems) v. Puente, March 18, 2005Document2 pagesFilipinas Pre-Fabricated Building Systems (FilSystems) v. Puente, March 18, 2005Gino Alejandro SisonNo ratings yet

- Gaza Et Al vs. LimDocument3 pagesGaza Et Al vs. LimGino Alejandro SisonNo ratings yet

- in N Out V SehwaniDocument4 pagesin N Out V SehwaniGino Alejandro SisonNo ratings yet

- St. Mary - S University v. CADocument2 pagesSt. Mary - S University v. CAGino Alejandro SisonNo ratings yet

- 6 - Kimberly Clark Phils V SecDocument2 pages6 - Kimberly Clark Phils V SecGino Alejandro Sison100% (1)

- BENARES V PANCHODocument2 pagesBENARES V PANCHOGino Alejandro SisonNo ratings yet

- Bliss vs. DiazDocument3 pagesBliss vs. DiazGino Alejandro Sison100% (1)

- Legaspi v. COMELECDocument16 pagesLegaspi v. COMELECGino Alejandro SisonNo ratings yet

- 04.) Rowell Industrial Corp v. CADocument2 pages04.) Rowell Industrial Corp v. CAGino Alejandro SisonNo ratings yet

- Labor Law 1 - Digest Group Name - Professor: ABS-CBN Rank-and-File EmployeesDocument2 pagesLabor Law 1 - Digest Group Name - Professor: ABS-CBN Rank-and-File EmployeesGino Alejandro SisonNo ratings yet

- 03) The Manila Peninsula v. AlipioDocument1 page03) The Manila Peninsula v. AlipioGino Alejandro SisonNo ratings yet

- 1) Magis Young Achievers - Learning Center v. ManaloDocument2 pages1) Magis Young Achievers - Learning Center v. ManaloGino Alejandro SisonNo ratings yet

- 2) PIER 8 Arrastre - Stevedoring Services, Inc. v. BoclotDocument2 pages2) PIER 8 Arrastre - Stevedoring Services, Inc. v. BoclotGino Alejandro Sison50% (2)

- PauslipDocument2 pagesPauslipAmanNo ratings yet

- Addis Ababa (Ethiopia) National Officer Category - Annual Salaries and Allowances (In United States Dollars) Effective 1 July 2021Document10 pagesAddis Ababa (Ethiopia) National Officer Category - Annual Salaries and Allowances (In United States Dollars) Effective 1 July 2021Wasihun JimmyNo ratings yet

- Ganaesmurthy Form16Document4 pagesGanaesmurthy Form16sundar1111No ratings yet

- OR OUR Nformation: Information For Non-Profit OrganizationsDocument8 pagesOR OUR Nformation: Information For Non-Profit OrganizationsFuji guruNo ratings yet

- W8-Eci 2021-06-01 Preview DocDocument1 pageW8-Eci 2021-06-01 Preview Docfuture warriorNo ratings yet

- REVENUE MEMORANDUM CIRCULAR NO. 27-2011 Issued On July 1, 2011 RevokesDocument1 pageREVENUE MEMORANDUM CIRCULAR NO. 27-2011 Issued On July 1, 2011 RevokesJm CruzNo ratings yet

- Net Cash Flow From Operating Activities 1,222,000Document1 pageNet Cash Flow From Operating Activities 1,222,000Jen DeloyNo ratings yet

- DGWooo004661050000r06053073276621 2Document1 pageDGWooo004661050000r06053073276621 2Janssen PerezNo ratings yet

- Computation of Total Income: Zenit - A KDK Software ProductDocument2 pagesComputation of Total Income: Zenit - A KDK Software ProductAbhishek SaxenaNo ratings yet

- Difference Between OPC and SPDocument2 pagesDifference Between OPC and SPrahulkapur87No ratings yet

- Taco 0088166061500044Document1 pageTaco 0088166061500044Sourav ChakrabortyNo ratings yet

- Bir 16385 16382Document1 pageBir 16385 16382Ryzen LlameNo ratings yet

- Hotel BillDocument6 pagesHotel BillMech2022 PTBENo ratings yet

- AEC 215 Reviewer ComputationsDocument6 pagesAEC 215 Reviewer ComputationsHazel Seguerra BicadaNo ratings yet

- Levis ShirtDocument1 pageLevis ShirtKovalan RNo ratings yet

- SaiBaba Printer (May'22)Document1 pageSaiBaba Printer (May'22)Sriram SNo ratings yet

- Set Off and Carry Forward of LossesDocument3 pagesSet Off and Carry Forward of LossesBilal AwanNo ratings yet

- Financial Model 1Document1 pageFinancial Model 1ahmedmostafaibrahim22No ratings yet

- Diamond ChemicalsDocument3 pagesDiamond ChemicalsJohn RiveraNo ratings yet

- Lorenzo V Posadas (Digest)Document2 pagesLorenzo V Posadas (Digest)StBernard15No ratings yet

- Zamora V CIRDocument2 pagesZamora V CIRSuiNo ratings yet

- Selina Solution Concise Maths Class 10 Chapter 1Document13 pagesSelina Solution Concise Maths Class 10 Chapter 1honeyrani6d16No ratings yet

- PVC 19012012Document4 pagesPVC 19012012Barra PrasetyawanNo ratings yet

- Attachmentu0sview Att&th 17dcdf85a9a7dc52&attid 0 1&disp Attd&safe 1&zw&saddbDocument1 pageAttachmentu0sview Att&th 17dcdf85a9a7dc52&attid 0 1&disp Attd&safe 1&zw&saddbKumar PushpeshNo ratings yet

- National Officer SalaryDocument6 pagesNational Officer SalarytaolawaleNo ratings yet

- Fmda GST RCDocument3 pagesFmda GST RCDipankar BarmanNo ratings yet

- Dinsha C001 200905 2023057263210824609387135Document1 pageDinsha C001 200905 2023057263210824609387135pradeepppatil12No ratings yet