Professional Documents

Culture Documents

Advisory 10 - 2022 DT - 26042022-Payment MIS Report

Advisory 10 - 2022 DT - 26042022-Payment MIS Report

Uploaded by

central exciseCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5835)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Dwnload Full Organizational Behavior Emerging Realities For The Workplace Revolution 4th Edition Mcshane Test Bank PDFDocument36 pagesDwnload Full Organizational Behavior Emerging Realities For The Workplace Revolution 4th Edition Mcshane Test Bank PDFdanielmoreno72d100% (11)

- M:S J.K. International Vs State Govt of NCT of Delhi & Ors. (2001) 3 SCC 462Document5 pagesM:S J.K. International Vs State Govt of NCT of Delhi & Ors. (2001) 3 SCC 462Sundaram OjhaNo ratings yet

- Deed of Family Settlement Between Rival ClaimantsDocument4 pagesDeed of Family Settlement Between Rival ClaimantsMahebub Ghante100% (1)

- Leave Form 2012Document1 pageLeave Form 2012thauwui86No ratings yet

- 2019 REVISED RULES ON EVIDENCE AM No. 19 08 15 SC - Complete HandoutDocument51 pages2019 REVISED RULES ON EVIDENCE AM No. 19 08 15 SC - Complete Handoutgeca.alido.uiNo ratings yet

- Element Six v. Novatek Et. Al.Document26 pagesElement Six v. Novatek Et. Al.PriorSmartNo ratings yet

- Test English: (Topic: Vocabulary) - ENG01Document7 pagesTest English: (Topic: Vocabulary) - ENG01subhashish kumarNo ratings yet

- Flats For RentDocument6 pagesFlats For RentShatadeep BanerjeeNo ratings yet

- First Integrated Insurance vs. HernandoDocument1 pageFirst Integrated Insurance vs. HernandoOscar E ValeroNo ratings yet

- Huawei RTN380H XPIC and SDB Pilot - Test ResultDocument16 pagesHuawei RTN380H XPIC and SDB Pilot - Test Resultreza safivandNo ratings yet

- E Paper Driving LicenseDocument3 pagesE Paper Driving Licensesmsmirpur13No ratings yet

- Speech TranscriptsDocument1 pageSpeech Transcriptsapi-283943860No ratings yet

- EGM FinalDocument16 pagesEGM FinalashvinNo ratings yet

- Business Law ReviewerDocument10 pagesBusiness Law ReviewerJoshua PerezNo ratings yet

- Tropical Smoothie Cafe Franchise DisclosureDocument326 pagesTropical Smoothie Cafe Franchise DisclosureCassia ィNo ratings yet

- Rekap Pbyran Siswa 2020-2021 Per Desember 2020xlsxDocument183 pagesRekap Pbyran Siswa 2020-2021 Per Desember 2020xlsxM OzilNo ratings yet

- 2023 02 Clo Winding Up Court DirectionsDocument8 pages2023 02 Clo Winding Up Court DirectionsSyafietriNo ratings yet

- Pablito V. Sanidad vs. The Commission On Elections: FactsDocument4 pagesPablito V. Sanidad vs. The Commission On Elections: FactsKate Shine MalinaoNo ratings yet

- Angeles, Et Al. vs. Ursula Calasanz, Et Al., G.R. No. L-42283, March 18, 1985Document13 pagesAngeles, Et Al. vs. Ursula Calasanz, Et Al., G.R. No. L-42283, March 18, 1985Lloyd Bryne LunzagaNo ratings yet

- 2 Check Memo 2023-25Document5 pages2 Check Memo 2023-25varma typingNo ratings yet

- Lamis AwbDocument1 pageLamis Awbglanour.comNo ratings yet

- Autodesk - 300 Records Profiling - 2nd Lot For ValidationDocument21 pagesAutodesk - 300 Records Profiling - 2nd Lot For ValidationVainiNo ratings yet

- Akar Tool Proforma Invoice 33Document1 pageAkar Tool Proforma Invoice 33KABIR CHOPRANo ratings yet

- DE LILLE AND ANOTHER V SPEAKER OF THE NATIONAL ASSEMBLY 1998 (3) SA 430 (C)Document25 pagesDE LILLE AND ANOTHER V SPEAKER OF THE NATIONAL ASSEMBLY 1998 (3) SA 430 (C)jennifer tawanaNo ratings yet

- Fabre Vs CADocument2 pagesFabre Vs CAEderic ApaoNo ratings yet

- Fusion ReceptionDocument2 pagesFusion ReceptionAfidatul AzwaNo ratings yet

- Southcrypt The Upper Halls 5eDocument26 pagesSouthcrypt The Upper Halls 5eSteve BrodowskiNo ratings yet

- National Land Record Modernization Programme (Mis)Document60 pagesNational Land Record Modernization Programme (Mis)Joint Chief Officer, MB MHADANo ratings yet

- Defective ContractsDocument9 pagesDefective ContractsQueensha GoNo ratings yet

- Harpreet Raikhy: Invoic EDocument1 pageHarpreet Raikhy: Invoic Edalip kumarNo ratings yet

Advisory 10 - 2022 DT - 26042022-Payment MIS Report

Advisory 10 - 2022 DT - 26042022-Payment MIS Report

Uploaded by

central exciseOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Advisory 10 - 2022 DT - 26042022-Payment MIS Report

Advisory 10 - 2022 DT - 26042022-Payment MIS Report

Uploaded by

central exciseCopyright:

Available Formats

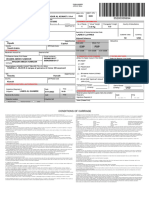

DGSYSIAPPICZUI1/2022-RET OI0-ADG-DGS-ZU-CHENNAI

2

/575610/2022

DIRECTORAT E GENERAL OF SYST EMS & DATA MANAGEMENT

pun1cal vi 3iiagr Jiuuarr fegncu ar a4fear

GST & CENTRAL EXCISE, GST BHAVAN,

sflgre) 3ik a4tr sare gre, flgreh

NO. 26/1, MAHATHMA GANDHI ROAD, NUNGAMBAKKAM, CHENNAI -34

26/1 I&ramijfl te, qi4 ran, ax{-34

Tele: 044-28331101 Fax:044-28331104 Mail: dgschennai@icegate.gov.in

Date: .04.2022

ADVISORY NO: l(}/2022 - PAYMENTS

Sub : Implementation of Payments MIS Report Total Deposit

Summary based on Type of Taxpayer - Reg...

********

The Payments MIS Report- Total Deposit Summary based on Type of Taxpayer

has been deployed in production in ACES-GST application and made available to formation

officers. The officers can log into the GST application and navigate to the Menu pop-up on

the left side of screen under :

Menu -> Reports -> Payments -> Total Deposit Summary based on Type

of Taxpayer:

2. The report can be generated :-

(a) for various formation levels viz. Range/Division/Commissionerate or Zonal

level;

(b) for a particular period (from date and to date to be specified). The period

selected should be within a financial year ( for example from pt April 2021 to 31st March

2022 for say 1 October 2021 to 31° March, 2022). The period should not overlap to other

financial year(s) (for example period cannot be selected as from 1 October 2020 to 3O"

September 2021 as it involves two financial years 2020-21 and 2021-22).

(c) by selecting the type of taxpayers viz. Centre or State or All.

3. The report give the summary details (a) No. of Taxpayers and (b) Tax collected (in

Rs.) (with the break-up of TGST, CGST, SGST/UTGST, Cess and Total) for the period

selected (current period ) and for the corresponding period of the previous year (previous

period). The report also provides the growth percentage of the No. of Taxpayers and the

Total tax collected by comparison of the current period figures with that of the previous

period. The report is generated for different type of taxpayers viz., Normal, Composition,

Casual, OIDAR, TDS, TCS and Others. At the foot of the report the date & time of

generation of report and the Officer who has generated the report are also mentioned.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5835)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Dwnload Full Organizational Behavior Emerging Realities For The Workplace Revolution 4th Edition Mcshane Test Bank PDFDocument36 pagesDwnload Full Organizational Behavior Emerging Realities For The Workplace Revolution 4th Edition Mcshane Test Bank PDFdanielmoreno72d100% (11)

- M:S J.K. International Vs State Govt of NCT of Delhi & Ors. (2001) 3 SCC 462Document5 pagesM:S J.K. International Vs State Govt of NCT of Delhi & Ors. (2001) 3 SCC 462Sundaram OjhaNo ratings yet

- Deed of Family Settlement Between Rival ClaimantsDocument4 pagesDeed of Family Settlement Between Rival ClaimantsMahebub Ghante100% (1)

- Leave Form 2012Document1 pageLeave Form 2012thauwui86No ratings yet

- 2019 REVISED RULES ON EVIDENCE AM No. 19 08 15 SC - Complete HandoutDocument51 pages2019 REVISED RULES ON EVIDENCE AM No. 19 08 15 SC - Complete Handoutgeca.alido.uiNo ratings yet

- Element Six v. Novatek Et. Al.Document26 pagesElement Six v. Novatek Et. Al.PriorSmartNo ratings yet

- Test English: (Topic: Vocabulary) - ENG01Document7 pagesTest English: (Topic: Vocabulary) - ENG01subhashish kumarNo ratings yet

- Flats For RentDocument6 pagesFlats For RentShatadeep BanerjeeNo ratings yet

- First Integrated Insurance vs. HernandoDocument1 pageFirst Integrated Insurance vs. HernandoOscar E ValeroNo ratings yet

- Huawei RTN380H XPIC and SDB Pilot - Test ResultDocument16 pagesHuawei RTN380H XPIC and SDB Pilot - Test Resultreza safivandNo ratings yet

- E Paper Driving LicenseDocument3 pagesE Paper Driving Licensesmsmirpur13No ratings yet

- Speech TranscriptsDocument1 pageSpeech Transcriptsapi-283943860No ratings yet

- EGM FinalDocument16 pagesEGM FinalashvinNo ratings yet

- Business Law ReviewerDocument10 pagesBusiness Law ReviewerJoshua PerezNo ratings yet

- Tropical Smoothie Cafe Franchise DisclosureDocument326 pagesTropical Smoothie Cafe Franchise DisclosureCassia ィNo ratings yet

- Rekap Pbyran Siswa 2020-2021 Per Desember 2020xlsxDocument183 pagesRekap Pbyran Siswa 2020-2021 Per Desember 2020xlsxM OzilNo ratings yet

- 2023 02 Clo Winding Up Court DirectionsDocument8 pages2023 02 Clo Winding Up Court DirectionsSyafietriNo ratings yet

- Pablito V. Sanidad vs. The Commission On Elections: FactsDocument4 pagesPablito V. Sanidad vs. The Commission On Elections: FactsKate Shine MalinaoNo ratings yet

- Angeles, Et Al. vs. Ursula Calasanz, Et Al., G.R. No. L-42283, March 18, 1985Document13 pagesAngeles, Et Al. vs. Ursula Calasanz, Et Al., G.R. No. L-42283, March 18, 1985Lloyd Bryne LunzagaNo ratings yet

- 2 Check Memo 2023-25Document5 pages2 Check Memo 2023-25varma typingNo ratings yet

- Lamis AwbDocument1 pageLamis Awbglanour.comNo ratings yet

- Autodesk - 300 Records Profiling - 2nd Lot For ValidationDocument21 pagesAutodesk - 300 Records Profiling - 2nd Lot For ValidationVainiNo ratings yet

- Akar Tool Proforma Invoice 33Document1 pageAkar Tool Proforma Invoice 33KABIR CHOPRANo ratings yet

- DE LILLE AND ANOTHER V SPEAKER OF THE NATIONAL ASSEMBLY 1998 (3) SA 430 (C)Document25 pagesDE LILLE AND ANOTHER V SPEAKER OF THE NATIONAL ASSEMBLY 1998 (3) SA 430 (C)jennifer tawanaNo ratings yet

- Fabre Vs CADocument2 pagesFabre Vs CAEderic ApaoNo ratings yet

- Fusion ReceptionDocument2 pagesFusion ReceptionAfidatul AzwaNo ratings yet

- Southcrypt The Upper Halls 5eDocument26 pagesSouthcrypt The Upper Halls 5eSteve BrodowskiNo ratings yet

- National Land Record Modernization Programme (Mis)Document60 pagesNational Land Record Modernization Programme (Mis)Joint Chief Officer, MB MHADANo ratings yet

- Defective ContractsDocument9 pagesDefective ContractsQueensha GoNo ratings yet

- Harpreet Raikhy: Invoic EDocument1 pageHarpreet Raikhy: Invoic Edalip kumarNo ratings yet