Professional Documents

Culture Documents

33

33

Uploaded by

HappyPurpleOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

33

33

Uploaded by

HappyPurpleCopyright:

Available Formats

33.

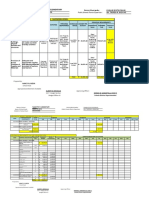

The partnership of DD and BB was formed and commenced operations on

March 1, 20x5, with DD Contributing P30,000 cash and BB investing cash of

P10,000 and equipment with an agreed upon valuation of P20,000. On July 20x5,

BB invested an additional P10,000 in the partnership, DD made a capital

withdrawal of P4,000 on May 2, 20x5 but reinvested the P4,000 on October 1,

20x5. During 20x5, DD withdrew P800 per month and BB, the managing partner,

withdrew P1,000 per month. These drawings were charged to salary expense. A

pre-closing trial balance taken at December 31, 20x5 is as follows: Debit Credit .

Cash ...………………………………… P 9,000 Receivable – net ..…………………… 15,000

Equipment – net ...…………………… 50,000 Other

assets ................................................. 19,000 Liabilities .…………………………….. P

17,000 DD, capital ………………………………… 30,000 BB,

capital ................................................... 40,000 Service revenue .…………………………

50,000 Supplies expense ......................................... 17,000 Utilities expense .

……………………………… 4,000 Salaries to partners...................................... 18,000

Other miscellaneous expenses ………… 5,000 . Total ……………………………………….

P137,000 P137,000 Compute for the share of DD and BB in the partnership net

income assuming monthly salary allowances P800 and P1,000 for DD and BB,

respectively; interest allowance at a 12% annual rate on average capital balances

and remaining profits allocated equally. a. DD, P 10,520; BB, P 13,480 c. DD, P

10,800; BB, P 13,200 b. DD, P 12,000; BB, P 12,000 d. DD, P 10,600; BB. P 13,400

(Adapted) Answer: (d) DD BB Total Salary Allowances P8,000 P10,000 P18,000

Interest on Average Capital 2,800 3,600 6,400 Balance (Equally) (200) (200) (400)

P10,600 P13,400 P24,000 (d) Net Income of P24,000 would be computed as

follows: Service Revenue…………………………………………… P50,000 Less: Expenses:

Supplies……………………………………………… P17,000

Utilities……………………………………………….. 4,000 Other Miscellaneous

expenses………………… 5,000 26,000 Net Income…………………………………………………

P24,000 *DD: P800 x 10 = P8,000 *BB: P1,000 x 10 = P10,000 ***Interest on

Average Capital: DD: P30,000 x 2 = P60,000 P26,000 x 5 = P130,000 P30,000 x 3 =

P90,000 P280,000 10-month average capital: P280,000/10 = P28,000 x 12% x

10/12 = P2,800 Annual average capital: P280,000/12 = P23,333x 12% = P2,800 BB:

P30,000 x 4 = P120,000 P40,000 x 6 = P240,000 P360,000 10-month average

capital: P360,000/10 = P36,000 x 12% x 10/12 = P3,600 Annual average capital:

P36,000/12 = P30,000x 12% = P3,600

You might also like

- Financial and Management Accounting QuizDocument5 pagesFinancial and Management Accounting Quizvignesh100% (1)

- Partnership Formation111Document6 pagesPartnership Formation111Rhoiz75% (8)

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- IR 2 - Mod 6 Bus Combi FinalDocument4 pagesIR 2 - Mod 6 Bus Combi FinalLight Desire0% (1)

- Sure Fire Hedging StrategyDocument3 pagesSure Fire Hedging StrategyAbu Hena Mostofa KamalNo ratings yet

- Resa Afar 2205 Quiz 1Document16 pagesResa Afar 2205 Quiz 1Rafael BautistaNo ratings yet

- Module 6 - Translation of Financial StatementsDocument9 pagesModule 6 - Translation of Financial StatementsasdasdaNo ratings yet

- Partnership 2222Document2 pagesPartnership 2222Rhoiz71% (7)

- Dayag Chapter 3Document45 pagesDayag Chapter 3Clifford Angel Matias90% (10)

- AFAR-01 (Partnership Formation & Operation)Document6 pagesAFAR-01 (Partnership Formation & Operation)Jezzie Santos100% (1)

- Assignment - Writing Business CommunicationDocument8 pagesAssignment - Writing Business CommunicationRohan NandiNo ratings yet

- BS Accountancy Subjects CourseDocument6 pagesBS Accountancy Subjects CourseMhel DemabogteNo ratings yet

- AFAR DAYAG - Anna Joy S. TalanDocument129 pagesAFAR DAYAG - Anna Joy S. TalanAllynna Joy62% (13)

- Cash Flow Statement1Document2 pagesCash Flow Statement1Mila Mercado0% (1)

- Partnership Formation111 PDF FreeDocument6 pagesPartnership Formation111 PDF FreeMAG MAGNo ratings yet

- P2 Quiz On Partnership and CorporationDocument8 pagesP2 Quiz On Partnership and CorporationPrincess Claris Araucto50% (2)

- Prelim Quiz - Business CombinationDocument4 pagesPrelim Quiz - Business CombinationJeane Mae BooNo ratings yet

- Partnership Formation and OperationsDocument60 pagesPartnership Formation and OperationsMiquel Villamarin50% (2)

- FINMAN Cash-Flow-Analysis-Practice-Problem-2Document2 pagesFINMAN Cash-Flow-Analysis-Practice-Problem-2stel mariNo ratings yet

- G 2audit of Other Income Statement Items Prblem 1 15 1Document10 pagesG 2audit of Other Income Statement Items Prblem 1 15 1Werpa PetmaluNo ratings yet

- Cash Flow StatementDocument2 pagesCash Flow StatementMila MercadoNo ratings yet

- Edenic Corporation Balance Sheet 2020Document3 pagesEdenic Corporation Balance Sheet 2020z87p769gbkNo ratings yet

- Accounting For Special TransactionsDocument43 pagesAccounting For Special Transactionsjohnpenielmontales0% (1)

- Accounting For Special TransactionsDocument43 pagesAccounting For Special TransactionsNezer VergaraNo ratings yet

- 25781306Document19 pages25781306GuinevereNo ratings yet

- Part3333Document2 pagesPart3333Vince Raeden AmaranteNo ratings yet

- Part 3333Document2 pagesPart 3333Rhoiz100% (2)

- Midterm Exercises No. 1 Answer KeyDocument12 pagesMidterm Exercises No. 1 Answer Keylinkin soyNo ratings yet

- Afar-1st-Pb-October-2022 - No AnsDocument15 pagesAfar-1st-Pb-October-2022 - No AnsRhea Mae CarantoNo ratings yet

- Quiz 1Document13 pagesQuiz 1randomlungs121223No ratings yet

- Module 2 Foundation ProblemDocument4 pagesModule 2 Foundation ProblemasdasdaNo ratings yet

- Review For Quiz 3 Part 2Document18 pagesReview For Quiz 3 Part 2Mariah ValizadoNo ratings yet

- Sample ProblemsDocument8 pagesSample ProblemsPatrick CuraNo ratings yet

- 핸드아웃Document9 pages핸드아웃hanselNo ratings yet

- Afar 2 Quizzes AcgsbdjxjcudhdhDocument27 pagesAfar 2 Quizzes Acgsbdjxjcudhdhrandomlungs121223No ratings yet

- Statement of Cash Flows - ProblemsDocument2 pagesStatement of Cash Flows - ProblemsMiladanica Barcelona BarracaNo ratings yet

- Module 6 Translation of Financial StatementsDocument7 pagesModule 6 Translation of Financial StatementsThe Brain Dump PHNo ratings yet

- Quiz 1Document8 pagesQuiz 1angelovilladoresNo ratings yet

- Project One 1Document6 pagesProject One 1alemayehu21tNo ratings yet

- AFAR 01 Partnership Formation OperationsDocument6 pagesAFAR 01 Partnership Formation OperationsMichelle GubatonNo ratings yet

- Accounting For Partnership FARDocument31 pagesAccounting For Partnership FARlousevero10No ratings yet

- Compre RevDocument7 pagesCompre RevGellez Hannah MarieNo ratings yet

- Presentation of FS With AnsDocument19 pagesPresentation of FS With AnsMichael BongalontaNo ratings yet

- ABC FinalsDocument10 pagesABC Finalsnena cabañesNo ratings yet

- Answer: PH P 1,240: SolutionDocument18 pagesAnswer: PH P 1,240: SolutionadssdasdsadNo ratings yet

- Auditing ProblemsDocument5 pagesAuditing ProblemsJohn Paulo SamonteNo ratings yet

- Midterm Exam Part 2 Short ProblemsDocument5 pagesMidterm Exam Part 2 Short Problemsdagohoy kennethNo ratings yet

- Partnership FormationDocument13 pagesPartnership FormationGround ZeroNo ratings yet

- Midterm Exam Part 2 Short Problems RemovalDocument6 pagesMidterm Exam Part 2 Short Problems RemovalJeane Mae BooNo ratings yet

- Solution Chapter 3Document36 pagesSolution Chapter 3Mazikeen DeckerNo ratings yet

- Corporation Liquidation: TO FOLLOW THE SOLUTIONDocument5 pagesCorporation Liquidation: TO FOLLOW THE SOLUTIONJason BautistaNo ratings yet

- Fundamentals of Abm 2.2Document6 pagesFundamentals of Abm 2.2Jasmine ActaNo ratings yet

- PartnershipDocument6 pagesPartnershipMARJORIE BAMBALANNo ratings yet

- AFAR 01 - Partnership FormationDocument2 pagesAFAR 01 - Partnership FormationSamantha Alice LysanderNo ratings yet

- Buscom - Module 3Document10 pagesBuscom - Module 3naddieNo ratings yet

- Part Op ProbsDocument2 pagesPart Op ProbsdmiahalNo ratings yet

- AFAR-01 (Partnership Formation & Operations)Document6 pagesAFAR-01 (Partnership Formation & Operations)Shiela NacasiNo ratings yet

- ReSA B43 AFAR Final PB Exam - Questions, Answers - SolutionsDocument25 pagesReSA B43 AFAR Final PB Exam - Questions, Answers - SolutionsElaine Joyce GarciaNo ratings yet

- Answer Key Audit of SHE LIAB and REDocument8 pagesAnswer Key Audit of SHE LIAB and REReginald ValenciaNo ratings yet

- Part 2 Joint Arrangements Class Consultation PDFDocument6 pagesPart 2 Joint Arrangements Class Consultation PDFidk520055No ratings yet

- Purchasing Power Parities and the Real Size of World EconomiesFrom EverandPurchasing Power Parities and the Real Size of World EconomiesNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Noted For UseDocument3 pagesNoted For UseHappyPurpleNo ratings yet

- Info PPE 2Document2 pagesInfo PPE 2HappyPurpleNo ratings yet

- WarrantsDocument1 pageWarrantsHappyPurpleNo ratings yet

- ConsoDocument2 pagesConsoHappyPurpleNo ratings yet

- Why Study FMDocument1 pageWhy Study FMHappyPurpleNo ratings yet

- Standard Cost NotesDocument1 pageStandard Cost NotesHappyPurpleNo ratings yet

- Liquidity Ratio InfoDocument1 pageLiquidity Ratio InfoHappyPurpleNo ratings yet

- FarrrrDocument1 pageFarrrrHappyPurpleNo ratings yet

- RoutinsDocument1 pageRoutinsHappyPurpleNo ratings yet

- TermsDocument2 pagesTermsHappyPurpleNo ratings yet

- UntitledDocument1 pageUntitledHappyPurpleNo ratings yet

- CapitalDocument1 pageCapitalHappyPurpleNo ratings yet

- UntitledDocument1 pageUntitledHappyPurpleNo ratings yet

- Society EnviDocument1 pageSociety EnviHappyPurpleNo ratings yet

- UntitledDocument1 pageUntitledHappyPurpleNo ratings yet

- RecognitionDocument1 pageRecognitionHappyPurpleNo ratings yet

- UntitledDocument1 pageUntitledHappyPurpleNo ratings yet

- UntitledDocument2 pagesUntitledHappyPurpleNo ratings yet

- UntitledDocument1 pageUntitledHappyPurpleNo ratings yet

- UntitledDocument1 pageUntitledHappyPurpleNo ratings yet

- UntitledDocument2 pagesUntitledHappyPurpleNo ratings yet

- UntitledDocument1 pageUntitledHappyPurpleNo ratings yet

- Asean LiteratureDocument2 pagesAsean LiteratureHappyPurpleNo ratings yet

- CROSSWORDDocument2 pagesCROSSWORDHappyPurpleNo ratings yet

- Why Study HumanitiesDocument3 pagesWhy Study HumanitiesHappyPurpleNo ratings yet

- Taxes 1Document2 pagesTaxes 1HappyPurpleNo ratings yet

- Principle of Humanities and ArtsDocument3 pagesPrinciple of Humanities and ArtsHappyPurpleNo ratings yet

- Financial 2Document1 pageFinancial 2HappyPurpleNo ratings yet

- Internal Control Over ReceivablesDocument3 pagesInternal Control Over ReceivablesHappyPurpleNo ratings yet

- Ppe BuildingDocument7 pagesPpe BuildingHappyPurpleNo ratings yet

- CinePro CaseDocument4 pagesCinePro Casemoshe1.bendayanNo ratings yet

- CH 12 - SolutionDocument50 pagesCH 12 - SolutionMuhammad RehmanNo ratings yet

- Project On Partnership Accounting PDFDocument17 pagesProject On Partnership Accounting PDFManish ChouhanNo ratings yet

- Words From The Wise Charles Ellis On Confronting Investing ChallengesDocument23 pagesWords From The Wise Charles Ellis On Confronting Investing ChallengesFrederico DimarzioNo ratings yet

- 0 0 0 0 0 0 SGST (0006)Document2 pages0 0 0 0 0 0 SGST (0006)sufyan006No ratings yet

- Financial Risk Faced by Bank Al FalahDocument3 pagesFinancial Risk Faced by Bank Al FalahAlina NadeemNo ratings yet

- Basics of AccountingDocument11 pagesBasics of AccountinganbarasinghNo ratings yet

- Cairo For Investment & Real Estate Development (CIRA) : Initiation of Coverage A Promising Decade AheadDocument14 pagesCairo For Investment & Real Estate Development (CIRA) : Initiation of Coverage A Promising Decade AheadSobolNo ratings yet

- MSDocument36 pagesMSJason WangNo ratings yet

- Auditing Problems With AnswersDocument12 pagesAuditing Problems With AnswersFlorie May HizoNo ratings yet

- Fund Accounting: True/False (Chapter 2)Document25 pagesFund Accounting: True/False (Chapter 2)lantapanNo ratings yet

- Internship Report On Deposit and Investment Management of Al Arafah Islami Bank LimitedDocument211 pagesInternship Report On Deposit and Investment Management of Al Arafah Islami Bank LimitedWahidHossainNo ratings yet

- DA RatesDocument2 pagesDA Ratesदाढ़ीवाला दाढ़ीवालाNo ratings yet

- 2021 Continuing Fund - Tagoytoy ESDocument5 pages2021 Continuing Fund - Tagoytoy ESMark Laurence NunezNo ratings yet

- FICO Vox Pop Report - Fine Tuning Our Financial FuturesDocument16 pagesFICO Vox Pop Report - Fine Tuning Our Financial FuturesChidera UnigweNo ratings yet

- Chuong 10Document44 pagesChuong 10mummimNo ratings yet

- Solutions To Chapter 8 Net Present Value and Other Investment CriteriaDocument21 pagesSolutions To Chapter 8 Net Present Value and Other Investment CriteriaChaituNo ratings yet

- Q.1. Write Short Notes On The Following (A) Business Entity Concept (B) Subsidiary Books (C) Errors of Principles (D) Promissory Notes (E) ProvisionsDocument4 pagesQ.1. Write Short Notes On The Following (A) Business Entity Concept (B) Subsidiary Books (C) Errors of Principles (D) Promissory Notes (E) ProvisionsLekha DhagatNo ratings yet

- Presentation On Advance Options StrategiesDocument14 pagesPresentation On Advance Options StrategiesChandan PahelwaniNo ratings yet

- IAC PPE and Intangible Students FinalDocument4 pagesIAC PPE and Intangible Students FinalJoyce Cagayat100% (1)

- Offer Letter For ShareholderDocument3 pagesOffer Letter For ShareholderPrachi RajputNo ratings yet

- Scribd Assignment 5Document3 pagesScribd Assignment 5Antoine GaraNo ratings yet

- Resume of Shivani ThakurDocument2 pagesResume of Shivani ThakurAman AgarwalNo ratings yet

- Income Taxation T or F ReviewerDocument13 pagesIncome Taxation T or F ReviewerZalaR0cksNo ratings yet

- JetBlue Airways IPO ValuationDocument16 pagesJetBlue Airways IPO ValuationDerek Levesque100% (2)

- Hull: Chapter 10: Options, Futures, and Other Derivatives, 7thDocument15 pagesHull: Chapter 10: Options, Futures, and Other Derivatives, 7thIshaan PatelNo ratings yet