Professional Documents

Culture Documents

Hair Care in India Analysis

Hair Care in India Analysis

Uploaded by

Vikas MvOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Hair Care in India Analysis

Hair Care in India Analysis

Uploaded by

Vikas MvCopyright:

Available Formats

HAIR CARE IN INDIA - ANALYSIS

Country Report | Jun 2022

KEY DATA FINDINGS Market Sizes

Retail value sales increase by 11% in current terms in 2021 to INR257 billion Sales of Hair Care

Styling agents is the best performing category in 2021, with retail value sales growing Retail Value RSP - INR million - Current - 2007-2026

by 33% in current terms to INR5.6 billion

Hindustan Unilever Ltd is the leading player in 2021, with a retail value share of 16%

257,433 Forecast

400,000

Retail sales are set to rise at a current value CAGR of 7% (2021 constant value CAGR of

2%) over the forecast period to INR368 billion

300,000

2021 DEVELOPMENTS

Early greying of hair and hair fall issues trigger growth of Ayurvedic

200,000

natural oils

Early greying of hair and hair fall have increased significantly compared with previous

generations. The key factors triggering these issues have been changes in diet,

100,000

pollution, increasing stress and the usage of hair care products containing chemicals.

Although the former three are addressable to some extent, there is still limited control

that a person can have on them. However, in terms of purchasing better hair care

products that contain natural ingredients, this is the easiest solution for consumers. 0

Hence, there has been a surge in demand for Ayurvedic hair care products such as oils 2007 2021 2026

and shampoos, and for products that are produced naturally. According to Euromonitor

International’s Voice of the Consumer: Beauty Survey, in 2021, 46% of respondents

mentioned that in terms of desired product features, while considering eco or ethically Sales Performance of Hair Care

friendly products for 2-in-1 shampoo/conditioner, they choose or prefer all natural % Y-O-Y Retail Value RSP Growth 2007-2026

ingredients. Taking note of this, in April 2022 Shahnaz Husain Group expanded its

portfolio of herbal products by launching both hair care and skin care products. Under

this, it launched hair cleansers and hair oils using natural ingredients such as

11.1% Forecast

sandalwood, jasmine, rose, aloe vera and almond. Furthermore, to support and 20%

promote research into and the development of traditional and natural products, the

government of India announced the setting up of the WHO Global Centre for

Traditional Medicine (GCTM) in April 2022 at Jamnagar, Gujarat. At the same time the 15%

government also announced the introduction of Ayush visas for internationals that are

seeking traditional treatments in India. All these factors will boost the availability of

natural hair care products, thus also benefiting demand during the forecast period. 10%

Return of social events allows for recovery of colourants and styling

5%

agents

In 2020, when the pandemic was unleashing its first wave in the country, the

government, as part of its measures to prevent the spread of COVID-19, restricted the 0%

mobility of people, which included restrictions on social events and gatherings. The

same restrictions were applied during the first half of 2021, from March to June, when

the second wave struck. With people isolated at home, they did not feel the need to -5%

2007 2021 2026

colour or style their hair as frequently. However, during the second half of the year the

pandemic situation stabilised, and in the last quarter of the year, when most Indian

festivals are scheduled and the wedding season starts, the situation remained calm,

resulting in the relaxation of mobility restrictions by the government. This allowed

people to step out and socialise, triggering the recovery of colourants and styling

agents during the year. Also, with some workplaces reopening during the second half

of 2021, either entirely or through a hybrid model, this also acted as a catalyst for

recovery. According to Euromonitor International’s Voice of the Consumer: Beauty

Survey, 36% of respondents in India in 2021 answered that they opt for hair colours or

dyes to improve the look or feel of their hair. During the forecast period, with the

pandemic situation stabilising, social events will return in full force, and so will offices

and schools. This will offer a strong opportunity for growth in colourants and styling

agents.

Inflationary pressures result in companies increasing the price of hair

oils

Hair oils has traditionally been a very competitive yet a stagnant product type, which in

the past saw single-digit growth. However, the pandemic, which strongly disrupted

supply chains, created inflationary pressure on players, resulting in price rises of 2.5%

to 7.5% on several hair oil products during 2021. The key reason for the price hike can

be attributed to rising prices of crude oil and crude derivatives, such as Light Liquid

© Euromonitor Interna onal 2022 Page 1 of 3

Paraffin (LLP), which is a key component in the manufacture of hair oils. Also, the rise in

prices of packaging materials such as paperboard also contributed to this decision.

Sales of Hair Care by Category

Retail Value RSP - INR million - Current - 2021 Growth Performance

Major players such as Dabur have increased the prices of most of their hair oil range,

including power brands such as Amla and Vatika. With the Russian invasion of Ukraine

2-in-1 Products

in early 2022, the easing of raw materials prices, such as crude oil, is unlikely in the near -

term. Therefore, during the forecast period it is projected that the prices of hair oils

Colourants

will continue to be high, which will result in an increase in value sales, even though 49,692.1

volumes are not expected to grow significantly.

Conditioners and Treatments

119,020.2

PROSPECTS AND OPPORTUNITIES Hair Loss Treatments

-

Competition in salon professional hair care to intensify Perms and Relaxants

-

Salon professional hair care experienced slowing growth from the start of the Salon Professional Hair Care

pandemic, as its crucial distribution channel, hair salons, was shut for brief periods in 12,644.9

both 2020 and 2021 due to lockdowns. Even when salons were open, many consumers Shampoos

chose not to use them, due to fear of contracting the virus. Although the losses were 70,436.3

mitigated to some extent due to selling through online platforms, growth in the Styling Agents

category was hampered, although some growth was seen in 2021 as infections eased. In 5,639.4

2022, it is projected that strong momentum will be seen, as the pandemic situation is 0% 20% 35%

projected to remain stable unless a new wave emerges. For this reason, companies are

becoming more aggressive in opening new salons and expanding their presence, which HAIR CARE 257,432.9 CURRENT % CAGR % CAGR

YEAR % 2016-2021 2021-2026

will boost sales of salon professional hair care products. For example, in April 2022, GROWTH

Nykaa is set to partner with Estée Lauder’s Aveda to open The Aveda X Nykaa salon,

which will offer a 100% vegan premium hair experience. The hair care offerings will

include haircuts, colouring and styling. Through this channel, Aveda will also offer clean

beauty products. From 2022, Myntra is also set to partner with L’Oréal Professional Competitive Landscape

Products Division to offer salon-inspired hair care products, covering a range of 60

products, including hair care solutions from L’Oréal Professional Paris, Matrix and

Biolage. The price range of these products is expected to be INR300-800 for hair oils, Company Shares of Hair Care

specialised shampoos, hair masks, deep conditioners, etc. As the pandemic situation % Share (NBO) - Retail Value RSP - 2021

continues to stabilise, it is projected that the performance of salons will only improve,

which will benefit sales of salon professional hair care products. Hindustan Unilever Ltd 16.4%

Marico Ltd 16.3%

Onion juice set to gain traction as an ingredient in hair care products L'Oréal India Pvt Ltd 8.1%

Onions have been used as an ingredient for cooking in Indian kitchens for centuries. Dabur India Ltd 7.2%

However, in addition to cooking, they have also been used to stop hair fall, as well as Procter & Gamble Home Pr... 6.5%

aid hair growth. The reason for this is that when onion juice is applied to the scalp, it

provides extra sulphur, which aids the growth of strong and thick hair, and less hair Emami Ltd 4.0%

loss. The sulphur from onions is also said to aid collagen production, which supports the Godrej Consumer Products... 3.9%

production of healthy skin cells and hair growth. According to Google Trends data, there

has been a strong surge in searches for onion oils in the past three years. This demand Bajaj Consumer Care Ltd 3.3%

from consumers has been recognised by companies, and there are several launches Patanjali Ayurved Ltd 2.5%

that have been seen which focus on addressing hair loss and ensuring growth, with

Hygienic Research Instit... 2.5%

onion juice being the key ingredient. For example, major fmcg companies such as

Marico, Emami and Bajaj Consumer Care have all launched onion-based hair oils, CavinKare Pvt Ltd 1.5%

alongside several direct-to-consumer (D2C) brands, such as Mamaearth and Wow Skin Himalaya Drug Co, The 1.5%

Science. Wow Skin Science also launched a shampoo that contains onion. Leading e-

commerce player Nykaa has not been far behind, as it launched onion-based hair oil Wella India Haircosmetic... 0.8%

under its Nykaa Naturals Hair portfolio in October 2021. During the coming years, it is Dey's Medical Stores Mfg... 0.7%

projected that several other companies will follow suit and introduce onion-based hair

Jyothy Labs Ltd 0.6%

care products.

Amway India Enterprises ... 0.5%

Demand for anti-pollution hair care products to rise as pandemic ITC Ltd 0.5%

situation stabilises Quest Retail Pvt Ltd 0.3%

The pandemic situation has been quite stable in the country since the second half of Mandom Corp 0.2%

2021. Although there was some concern about the Omicron variant, the situation has

Others 22.9%

remained calm. This has resulted in offices, colleges and schools reopening, leading to

increased mobility in consumers’ daily lives. In addition, social outings, holidays and

business travel have also started to return. This has resulted in people being exposed

to high levels of traffic on the streets once again, which is intensifying the demand for

anti-pollution hair care products, that claim to keep the hair healthy and prevent hair

fall or the greying of hair. D2C brand Detoxie has already launched an anti-stress, anti-

pollution hair care product range to address this issue. With mobility restrictions

continuing to ease, this situation is not expected to change, which will result in a

continued increase in demand for anti-pollution products.

© Euromonitor Interna onal 2022 Page 2 of 3

Brand Shares of Hair Care

% Share (LBN) - Retail Value RSP - 2021

Parachute Coconut Oil 9.2%

Clinic Plus 5.5%

Dove 5.2%

Head & Shoulders 3.8%

Bajaj 3.3%

Dabur Amla 3.2%

Himani Navratna 2.7%

Pantene 2.7%

Sunsilk 2.5%

Godrej Hair Expert 2.3%

Garnier Color Naturals 2.1%

Super Vasmol 2.1%

Dabur Vatika 2.1%

Parachute Advanced Jasmi... 1.9%

Nihar Shanti Amla 1.7%

L'Oréal Professionnel 1.7%

Kesh Kanti Hair Oil 1.5%

Nihar Naturals Perfumed ... 1.4%

Clear 1.2%

Others 44.0%

5-Year Trend

Increasing share Decreasing share No change

© Euromonitor Interna onal 2022 Page 3 of 3

You might also like

- Personal Care Market - Beauty Growth - Beauty Market Share - RedSeerDocument5 pagesPersonal Care Market - Beauty Growth - Beauty Market Share - RedSeerbileshNo ratings yet

- Hair Care in Pakistan: Euromonitor International July 2020Document9 pagesHair Care in Pakistan: Euromonitor International July 2020foqia nishatNo ratings yet

- Comparative Study of Soaps HLL, P&G, Godrej, Nirma and Johnson & JohnsonDocument92 pagesComparative Study of Soaps HLL, P&G, Godrej, Nirma and Johnson & JohnsonAnish Rana0% (1)

- Color Cosmetics in India PDFDocument11 pagesColor Cosmetics in India PDFPrachi Mohapatra100% (2)

- Cadila Pharmaceuticals LTDDocument6 pagesCadila Pharmaceuticals LTDPau GajjarNo ratings yet

- Skin Care in Singapore DatagraphicsDocument4 pagesSkin Care in Singapore DatagraphicsLong Trần HoàngNo ratings yet

- Brand Management ProjectDocument10 pagesBrand Management ProjectnaveenNo ratings yet

- FMCG - August - 2023Document32 pagesFMCG - August - 2023Barshali DasNo ratings yet

- Marketing Plan (Bournvita)Document36 pagesMarketing Plan (Bournvita)Shailendra GuptaNo ratings yet

- Beyond MarginsDocument107 pagesBeyond MarginsClavita FernandesNo ratings yet

- Iqvia Industry ReportDocument32 pagesIqvia Industry ReportAtharva ThiteNo ratings yet

- FMCGMarket Size Share Analysis Industry OverviewDocument3 pagesFMCGMarket Size Share Analysis Industry OverviewChandraNo ratings yet

- Ujala Co ProjctDocument36 pagesUjala Co ProjctShamseer Ummalil0% (2)

- Marico LTD.: Bachelor of Business Administration. Department of Business Administration SESSION (2021-2022)Document37 pagesMarico LTD.: Bachelor of Business Administration. Department of Business Administration SESSION (2021-2022)varunNo ratings yet

- A Study of Audience Perception About TheDocument2 pagesA Study of Audience Perception About TheRahat HaneefNo ratings yet

- Nielsen Hair Care IndiaDocument12 pagesNielsen Hair Care Indiarandom122No ratings yet

- Bath and Shower in Chile - Analysis: Country Report - Jul 2020Document3 pagesBath and Shower in Chile - Analysis: Country Report - Jul 2020anonima anonimaNo ratings yet

- Study - Id119509 - Skin Care Users in IndiaDocument30 pagesStudy - Id119509 - Skin Care Users in IndiaAchic CaderNo ratings yet

- Reflective Notes of SMBDDocument9 pagesReflective Notes of SMBDMahak Gupta Student, Jaipuria LucknowNo ratings yet

- Hair Colour Market in IndiaDocument4 pagesHair Colour Market in IndiaAkash Mittal50% (2)

- Marico Over The WallDocument5 pagesMarico Over The WallVartika SethiNo ratings yet

- Skin Care in India - Datagraphics: Country Report - Apr 2021Document4 pagesSkin Care in India - Datagraphics: Country Report - Apr 2021Long Trần HoàngNo ratings yet

- Consumer Appliances in IndiaDocument27 pagesConsumer Appliances in IndiaThe Gupta CircleNo ratings yet

- Dabur 2011Document183 pagesDabur 2011rahulddhNo ratings yet

- DMart Case Emerald 2 Sept 2020Document13 pagesDMart Case Emerald 2 Sept 2020Himani ConnectNo ratings yet

- Sector Capsule: Oral Care in India: Key Data FindingsDocument3 pagesSector Capsule: Oral Care in India: Key Data FindingsShriniket PatilNo ratings yet

- Skin Care Products Market in India 2021Document58 pagesSkin Care Products Market in India 2021adsdNo ratings yet

- Financial Project Report On Asian PaintsDocument48 pagesFinancial Project Report On Asian PaintsKishor KhatikNo ratings yet

- Beauty and Personal Care in India (Full Market Report)Document132 pagesBeauty and Personal Care in India (Full Market Report)Satyam TapariaNo ratings yet

- Sector FMCGDocument45 pagesSector FMCGBijoy SahaNo ratings yet

- Haldiram ReportDocument27 pagesHaldiram ReportG51Mamatha PatlollaNo ratings yet

- Beauty and Personal Care Market in India: Economi C DepartmentDocument6 pagesBeauty and Personal Care Market in India: Economi C DepartmentsurbiNo ratings yet

- Middle East Topicals MarketDocument17 pagesMiddle East Topicals MarketAmolNo ratings yet

- Comparison of Positioning and Branding Strategy Adopted by KVIC With Other Skin Care ProductsDocument15 pagesComparison of Positioning and Branding Strategy Adopted by KVIC With Other Skin Care ProductsNanditaNo ratings yet

- CICO Shampoo Brand Launch PlanDocument56 pagesCICO Shampoo Brand Launch Plannarendra_1983No ratings yet

- Axe Gold Temptation Deodorant: Individual Final Marketing ProjectDocument19 pagesAxe Gold Temptation Deodorant: Individual Final Marketing ProjectBach TangNo ratings yet

- Repositionig The Brand and Capturing Mindshare by Nature's EssenceDocument16 pagesRepositionig The Brand and Capturing Mindshare by Nature's EssenceAbhishek MitraNo ratings yet

- Ganga FailureDocument10 pagesGanga FailureSwasti IBSARNo ratings yet

- Reasons For Failure of Virgin MobilesDocument23 pagesReasons For Failure of Virgin MobilesKaran Khanna100% (1)

- Dabar India LTD CaseDocument2 pagesDabar India LTD CaseAkshat SharmaNo ratings yet

- REVISED PenCo. Business PlanDocument49 pagesREVISED PenCo. Business PlanHendrieck GarceNo ratings yet

- Fundamental Analysis of Nestle India: Capstone ProjectDocument80 pagesFundamental Analysis of Nestle India: Capstone ProjectRushikesh ChandeleNo ratings yet

- Salon Hair Care 2009Document1 pageSalon Hair Care 2009Carrie Baker LumbrezerNo ratings yet

- Baby MarketDocument8 pagesBaby MarketRashmi BahadurNo ratings yet

- Costmer Awareness Project Report at Bajaj AllianzDocument87 pagesCostmer Awareness Project Report at Bajaj AllianzBabasab Patil (Karrisatte)No ratings yet

- A Study of Consumer Behaiour in Decatholon SportsDocument91 pagesA Study of Consumer Behaiour in Decatholon SportsDr Waseem CNo ratings yet

- Final Project DaburDocument78 pagesFinal Project DaburRohit KapoorNo ratings yet

- Vietnam Hair SalonDocument7 pagesVietnam Hair SalonÂn THiênNo ratings yet

- International Dairy Brands in IndiaDocument29 pagesInternational Dairy Brands in IndiaRupam Aryan BorahNo ratings yet

- 1.1 Sunpharma and Pfizer 1 2 3 4Document7 pages1.1 Sunpharma and Pfizer 1 2 3 4AnanthkrishnanNo ratings yet

- FMCG Companies in IndiaDocument7 pagesFMCG Companies in IndiaAnuj KumarNo ratings yet

- Guru ProjectDocument102 pagesGuru ProjectUday BNo ratings yet

- Aadhar Case StudyDocument7 pagesAadhar Case StudySAHIL RAJPALNo ratings yet

- CADBURYDocument14 pagesCADBURYNikita SarangiNo ratings yet

- Consumer Brand Preferences Towards Decorative PaintsDocument7 pagesConsumer Brand Preferences Towards Decorative PaintsIJAR JOURNALNo ratings yet

- Hair Care in Colombia - Analysis: Country Report - Apr 2021Document3 pagesHair Care in Colombia - Analysis: Country Report - Apr 2021MarianaNo ratings yet

- Analysis Hair Care in VietnamDocument3 pagesAnalysis Hair Care in VietnamndvithaoNo ratings yet

- Hair Care in Pakistan AnalysisDocument3 pagesHair Care in Pakistan Analysisasadmanzoor002No ratings yet

- Hair Care in PeruDocument12 pagesHair Care in PerujsantacruzlazaroNo ratings yet

- Skin Care in Peru AnalysisDocument2 pagesSkin Care in Peru AnalysisAndrea NeyraNo ratings yet

- Ten Years of India's Unpital Got Wrong in The CountryDocument1 pageTen Years of India's Unpital Got Wrong in The CountryVikas MvNo ratings yet

- Strait Up Data Lake StarlinkDocument1 pageStrait Up Data Lake StarlinkVikas MvNo ratings yet

- Bank Stocks Are On A Tear, But Rin Numbers Tell A Different StoryDocument1 pageBank Stocks Are On A Tear, But Rin Numbers Tell A Different StoryVikas MvNo ratings yet

- FMCG BrandingDocument11 pagesFMCG BrandingVikas MvNo ratings yet

- Operation Successful, Patient Died' Why India's Nuclear Man Anil Kakodkar Is Worried About Energy SecurityDocument1 pageOperation Successful, Patient Died' Why India's Nuclear Man Anil Kakodkar Is Worried About Energy SecurityVikas MvNo ratings yet

- Why Betting Sites Should Worry As ED Raids Payment Firms Over Chinese Loan AppsDocument1 pageWhy Betting Sites Should Worry As ED Raids Payment Firms Over Chinese Loan AppsVikas MvNo ratings yet

- DIAGRAMA - 2007 - NEW YarisDocument1 pageDIAGRAMA - 2007 - NEW YarisLuis M. Valenzuela Arias50% (2)

- 19 - Bearing Capacity - Eccentric LoadingDocument5 pages19 - Bearing Capacity - Eccentric LoadinghiyeonNo ratings yet

- Scale: 1:5 (1:2) : R TYP 5Document1 pageScale: 1:5 (1:2) : R TYP 5Prateek AnandNo ratings yet

- Lab 7 QUBE-Servo PD Control WorkbookDocument6 pagesLab 7 QUBE-Servo PD Control WorkbookLuis EnriquezNo ratings yet

- Research On Sustainable Development of Textile Industrial Clusters in The Process of GlobalizationDocument5 pagesResearch On Sustainable Development of Textile Industrial Clusters in The Process of GlobalizationSam AbdulNo ratings yet

- 2012 Training Materials PDFDocument32 pages2012 Training Materials PDFWisam Ankah100% (1)

- Subbox 14261298 Fat2810 Ss 8 A DatasheetDocument4 pagesSubbox 14261298 Fat2810 Ss 8 A DatasheetBaye Dame DIOP100% (1)

- Motor Circuit Analysis For Energy, Reliability and Production Cost ImprovementsDocument4 pagesMotor Circuit Analysis For Energy, Reliability and Production Cost ImprovementsAmin Mustangin As-SalafyNo ratings yet

- Quantitative Interpretation of The Response of Surface Plasmon Resonance Sensors To Adsorbed FilmsDocument13 pagesQuantitative Interpretation of The Response of Surface Plasmon Resonance Sensors To Adsorbed FilmsKaren Régules MedelNo ratings yet

- Transformer MaintenanceDocument22 pagesTransformer MaintenanceAugustine Owo UkpongNo ratings yet

- Cambium PTP 670 Series 02-00 User GuideDocument553 pagesCambium PTP 670 Series 02-00 User GuidelefebvreNo ratings yet

- Assignment 3: Task #1 Has (10 Parts) That Corresponds To CLO # 2 For A Total of 30 PointsDocument2 pagesAssignment 3: Task #1 Has (10 Parts) That Corresponds To CLO # 2 For A Total of 30 PointsWaqas AliNo ratings yet

- High Protein Foods List PDFDocument3 pagesHigh Protein Foods List PDFAnonymous P1FbQoqsHJ100% (1)

- The Talmud of Jerusalem - Schwab Moise 1839-1918 TRDocument201 pagesThe Talmud of Jerusalem - Schwab Moise 1839-1918 TRJanice O'BrianNo ratings yet

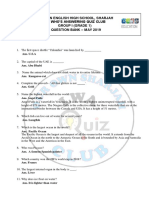

- Our Own English High School, Sharjah Look Who'S Answering Quiz Club Group I (Grade 1) Question Bank - MAY 2019Document3 pagesOur Own English High School, Sharjah Look Who'S Answering Quiz Club Group I (Grade 1) Question Bank - MAY 2019Abimanyu ShenilNo ratings yet

- 510-15 CodigoDocument6 pages510-15 CodigoUriel MFNo ratings yet

- Test Report CMI, 200 Amp 35kV Class "Tuf-Ex-Well II" Bushing WellDocument8 pagesTest Report CMI, 200 Amp 35kV Class "Tuf-Ex-Well II" Bushing WellCristobal BohorquezNo ratings yet

- Product Requirements Specification Process in ProdDocument12 pagesProduct Requirements Specification Process in ProdemmyNo ratings yet

- Apple Serial Number Info - Decode Your Mac's Serial Number!Document1 pageApple Serial Number Info - Decode Your Mac's Serial Number!edp8 malsbyNo ratings yet

- Introduction To Food Hygiene: Screen DescriptionDocument27 pagesIntroduction To Food Hygiene: Screen Descriptionmartin faithNo ratings yet

- Methods?: Condoms Internal Condoms Sexually Transmissible Infections (Stis)Document25 pagesMethods?: Condoms Internal Condoms Sexually Transmissible Infections (Stis)Alecia R. CastilloNo ratings yet

- MotiliumDocument5 pagesMotiliumAkram KhanNo ratings yet

- Outsmart Your Anxious Brain - Worksheet Diagnosis Guide ExercisesDocument6 pagesOutsmart Your Anxious Brain - Worksheet Diagnosis Guide Exercisesdoppler_100% (1)

- Sherlock Holmes Script - Dialogue TranscriptDocument83 pagesSherlock Holmes Script - Dialogue TranscriptLocustaNo ratings yet

- Kezelesi Utmutato Q3 RF 2010 AngolDocument12 pagesKezelesi Utmutato Q3 RF 2010 AngolClaudiu AdamNo ratings yet

- Euthenics 2 ReviewerDocument8 pagesEuthenics 2 ReviewerSun Tea SeguinNo ratings yet

- Travel Tourism in Bangladesh: A Study On Regent Tours & TravelDocument72 pagesTravel Tourism in Bangladesh: A Study On Regent Tours & TravelNahidNo ratings yet

- BLOBITECTUREDocument23 pagesBLOBITECTURESonal TarkasbandNo ratings yet

- Wee1964 N001Document9 pagesWee1964 N001Oliver RubioNo ratings yet

- Optoma DS325 DLP ProjectorDocument6 pagesOptoma DS325 DLP ProjectorWebAntics.com Online Shopping StoreNo ratings yet