Professional Documents

Culture Documents

Long-Lived Assets Handout

Long-Lived Assets Handout

Uploaded by

Charudatta MundeOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Long-Lived Assets Handout

Long-Lived Assets Handout

Uploaded by

Charudatta MundeCopyright:

Available Formats

LONG-LIVED ASSETS PREPARATION QUESTIONS:

1. For the Carnival Cruise Lines (CCL) property, plant, and equipment (PPE) disclosures:

a. What are their major types of PPE?

b. Looking at the footnote disclosures, do the useful lives they have assigned appear to be

reasonable?

c. How does CCL account for “ship improvement costs” and “repairs and maintenance” costs

related to their ships?

d. How did CCL evaluate their ships for potential impairment following the COVID-19

pandemic?

2. Review the “PPE Analysis for Airlines” Graphic

a. Which airlines are most and least in need to begin replacing their fleet? How might this

affect their cash flows and shareholders?

b. Based on the useful lives assigned to aircraft, which airline would you expect to show

superior profitability? Which airline would you expect to show less favorable profitability?

3. Read the SEC Comment Letter and American Airlines response (excerpted)

a. What served as the basis for the SEC’s concern in the Comment Letter?

b. How did American Airlines attempt to defend the matter that served as the basis for the

SEC’s concern?

ACCT 610: Long-Lived Asset Handout Page 1

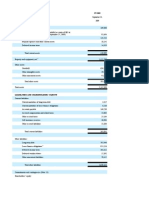

CARNIVAL CORPORATION & PLC

CONSOLIDATED BALANCE SHEETS

(in millions, except par values)

November 30,

2021 2020

ASSETS

Current Assets

Cash and cash equivalents $ 8,939 $ 9,513

Short-term investments 200 —

Trade and other receivables, net 246 273

Inventories 356 335

Prepaid expenses and other 392 443

Total current assets 10,133 10,563

Property and Equipment, Net 38,107 38,073

Operating Lease Right-of-Use Assets 1,333 1,370

Goodwill 579 807

Other Intangibles 1,181 1,186

Other Assets 2,011 1,594

$ 53,344 $ 53,593

LIABILITIES AND SHAREHOLDERS’ EQUITY

Current Liabilities

Short-term borrowings $ 2,790 $ 3,084

Current portion of long-term debt 1,927 1,742

Current portion of operating lease liabilities 142 151

Accounts payable 797 624

Accrued liabilities and other 1,641 1,144

Customer deposits 3,112 1,940

Total current liabilities 10,408 8,686

Long-Term Debt 28,509 22,130

Long-Term Operating Lease Liabilities 1,239 1,273

Other Long-Term Liabilities 1,043 949

Commitments and Contingencies

Shareholders’ Equity

Common stock of Carnival Corporation, $0.01 par value; 1,960 shares

authorized; 1,116 shares at 2021 and 1,060 shares at 2020 issued 11 11

Ordinary shares of Carnival plc, $1.66 par value; 217 shares at 2021

and 2020 issued 361 361

Additional paid-in capital 15,292 13,948

Retained earnings 6,448 16,075

Accumulated other comprehensive income (loss) (“AOCI”) (1,501) (1,436)

Treasury stock, 130 shares at 2021 and 2020 of Carnival Corporation

and 67 shares at 2021 and 60 shares at 2020 of Carnival plc, at cost (8,466) (8,404)

Total shareholders’ equity 12,144 20,555

$ 53,344 $ 53,593

ACCT 610: Long-Lived Asset Handout Page 2

CARNIVAL CORPORATION & PLC

CONSOLIDATED STATEMENTS OF INCOME (LOSS)

(in millions, except per share data)

Years Ended November 30,

2021 2020 2019

Revenues

Passenger ticket $ 1,000 $ 3,684 $ 14,104

Onboard and other 908 1,910 6,721

1,908 5,595 20,825

Operating Costs and Expenses

Commissions, transportation and other 269 1,139 2,720

Onboard and other 272 605 2,101

Payroll and related 1,309 1,780 2,249

Fuel 680 823 1,562

Food 187 413 1,083

Ship and other impairments 591 1,967 26

Other operating 1,346 1,518 3,167

4,655 8,245 12,909

Selling and administrative 1,885 1,878 2,480

Depreciation and amortization 2,233 2,241 2,160

Goodwill impairments 226 2,096 —

8,997 14,460 17,549

Operating Income (Loss) (7,089) (8,865) 3,276

Nonoperating Income (Expense)

Interest income 12 18 23

Interest expense, net of capitalized interest (1,601) (895) (206)

Gains (losses) on debt extinguishment, net (670) (459) —

Other income (expense), net (173) (52) (32)

(2,433) (1,388) (215)

Income (Loss) Before Income Taxes (9,522) (10,253) 3,060

Income Tax Benefit (Expense), Net 21 17 (71)

Net Income (Loss) $ (9,501) $ (10,236) $ 2,990

Earnings Per Share

Basic $ (8.46) $ (13.20) $ 4.34

Diluted $ (8.46) $ (13.20) $ 4.32

ACCT 610: Long-Lived Asset Handout Page 3

NOTE 2 – Summary of Significant Accounting Policies

Property and Equipment

Property and equipment are stated at cost less accumulated depreciation and any impairment

charges. Depreciation is computed using the straight-line method over our estimates of useful lives and residual

values, as a percentage of original cost, as follows:

Residual

Years Values

Ships 30 15%

Ship improvements 3-30 0%

Buildings and improvements 10-40 0%

Computer hardware and software 2-12 0%

Transportation equipment and other 3-20 0%

Leasehold improvements, including port Shorter of the remaining lease term or 0%

facilities related asset life (3-30)

The cost of ships under construction includes progress payments for the construction of new ships, as well as

design and engineering fees, capitalized interest, construction oversight costs and various owner supplied items.

We account for ship improvement costs, including replacements of certain significant components and parts, by

capitalizing those costs we believe add value to our ships and have a useful life greater than one year and

depreciating those improvements over their estimated remaining useful life. We have a capital program for the

improvement of our ships and for asset replacements in order to enhance the effectiveness and efficiency of our

operations; to comply with, or exceed, all relevant legal and statutory requirements related to health,

environment, safety, security and sustainability; and to gain strategic benefits or provide improved product

innovations to our guests.

We capitalize interest as part of the cost of capital projects during their construction period. The specifically

identified or estimated cost and accumulated depreciation of previously capitalized ship components are written-

off upon retirement, which may result in a loss on disposal that is also included in other operating expenses.

Liquidated damages received from shipyards as a result of late ship delivery are recorded as reductions to the cost

basis of the ship.

The costs of repairs and maintenance, including minor improvement costs and expenses related to dry-docks,

are charged to expense as incurred and included in other operating expenses. Dry-dock expenses primarily

represent maintenance activities that are incurred when a ship is taken out-of-service for scheduled maintenance.

We review our long-lived assets for impairment whenever events or circumstances indicate that the carrying

amounts of these assets may not be recoverable. Upon the occurrence of a triggering event, the assessment of

possible impairment is based on our ability to recover the carrying value of our asset from the asset’s estimated

undiscounted future cash flows. If these estimated undiscounted future cash flows are less than the carrying value

of the asset, an impairment charge is recognized for the excess, if any, of the asset’s carrying value over its

estimated fair value. The lowest level for which we maintain identifiable cash flows that are independent of the

cash flows of other assets and liabilities is at the individual ship level. A significant amount of judgment is required

in estimating the future cash flows and fair values of our cruise ships.

ACCT 610: Long-Lived Asset Handout Page 4

NOTE 3 – Property and Equipment

November 30,

(in millions) 2021 2020

Ships and ship improvements $ 50,501 $ 49,803

Ships under construction 1,536 1,354

Other property and equipment 3,928 3,992

Total property and equipment 55,965 55,148

Less accumulated depreciation (17,858) (17,075)

$ 38,107 $ 38,073

Average Useful Life = Average PPE (no land)

Depreciation Expense

[(55965-1536) + (55148-1354)]/2

2233

= 24.6

% Used = Accumulated Depreciation

Average PPE (no land)

$17858 / $54000

= 33%

Average Age = Average Useful Life x % Used

24.6 * 33% = 8.1 years

ACCT 610: Long-Lived Asset Handout Page 5

NOTE 11 – Leases

On December 1, 2019, the Company adopted the FASB issued guidance, Leases using the modified retrospective

approach. Substantially all of our leases for which we are the lessee are operating leases of port facilities and

real estate and are included within operating lease right-of-use assets, long-term operating lease liabilities and

current portion of operating lease liabilities in our Consolidated Balance Sheet as of November 30, 2021.

We have port facilities and real estate lease agreements with lease and non-lease components, and in such cases,

we account for the components as a single lease component.

We do not recognize lease assets and lease liabilities for any leases with an original term of less than one year. For

some of our port facilities and real estate lease agreements, we have the option to extend our current lease term

by 1 to 10 years. Generally, we do not include renewal options as a component of our present value calculation as

we are not reasonably certain that we will exercise the options.

As most of our leases do not have a readily determinable implicit rate, we estimate the incremental borrowing rate

(“IBR”) to determine the present value of lease payments. We apply judgment in estimating the IBR including

considering the term of the lease, the currency in which the lease is denominated, and the impact of collateral and

our credit risk on the rate.

We amortize our lease assets on a straight-line basis over the lease term. The components of expense were as

follows:

November 30,

(in millions) 2021 2020

Operating lease expense $ 203 $ 203

Variable lease expense (a) (b) $ (100) $ (61)

(a) Variable lease expense represents costs associated with our multi-year preferential berthing agreements

which vary based on the number of passengers. These costs are recorded within commission,

transportation and other in our Consolidated Statements of Income (Loss). Variable and short-term lease

costs related to operating leases, other than the port facilities, were not material to our consolidated

financial statements.

(b) Several of our preferential berthing agreements have force majeure provisions. We have treated the

concessions granted under such provisions as variable payment adjustments. If our interpretation of the

force majeure provisions is disputed, we could be required to record and make additional guarantee

payments.

The cash outflow for leases was materially consistent with the lease expense recognized during 2021.

We have multiple agreements, with a total undiscounted minimum commitment of approximately $321 million,

that have been executed but the lease term has not commenced as of November 30, 2021. These are substantially

all related to our rights to use certain port facilities. The leases are expected to commence in 2022.

During 2021, we obtained $114 million of right-of-use assets in exchange for new operating lease liabilities.

ACCT 610: Long-Lived Asset Handout Page 6

Weighted average of the remaining lease terms and weighted average discount rates are as follows:

November 30, November 30,

2021 2020

Weighted average remaining lease term - operating leases (in years) 12 13

Weighted average discount rate - operating leases 3.8% 3.4%

As of November 30, 2021, maturities of operating lease liabilities were as follows:

(in millions)

Year

2022 $ 202

2023 186

2024 167

2025 158

2026 145

Thereafter 880

Total lease payments 1,739

Less: Present value discount (358)

Present value of lease liabilities $ 1,381

For time charter arrangements where we are the lessor and for transactions with cruise guests related to the use

of cabins, we do not separate lease and non-lease components. As the non-lease components are the predominant

components in the agreements, we account for these transactions under the Revenue Recognition guidance.

ACCT 610: Long-Lived Asset Handout Page 7

NOTE 10 – Fair Value Measurements, Derivative Instruments and Hedging Activities and Financial Risks

Impairments of Ships

We review our long-lived assets for impairment whenever events or circumstances indicate potential impairment.

As a result of the continued effect of COVID-19 on our business and our updated expectations for certain of our

ships, we determined that these ships had net carrying values that exceeded their respective estimated

undiscounted future cash flows during 2021. We then estimated the fair value of these ships based on their

respective estimated selling values. We then compared these estimated fair values to the net carrying values

and, as a result, we recognized ship impairment charges as summarized in the table below. We believe we have

made reasonable estimates and judgments as part of our assessments. A change in the principal assumptions,

which influences the determination of fair value, may result in a need to perform additional impairment reviews.

We performed undiscounted cash flow analyses on certain ships in our fleet throughout 2020 and determined

that certain ships had net carrying values that exceeded their estimated undiscounted future cash flows. The

table below summarizes the impairment charges recognized during 2021 and 2020. We did not recognize ship

impairment charges during 2019. The principal assumption, considered a level 3 input, used in our impairment

analyses consisted of the timing of the sale of ships and estimated proceeds.

The impairment charges summarized in the table below are included in ship and other impairments in our

Consolidated Statements of Income (Loss).

November 30,

(in millions) 2021 2020

NAA Segment $ 273 $ 1,474

EA Segment 318 319

Total ship impairments $ 591 $ 1,794

ACCT 610: Long-Lived Asset Handout Page 8

CRITICAL AUDIT MATTER (FROM PRICEWATERHOUSECOOPERS AUDIT REPORT,

DATED JANUARY 26, 2021):

As described in Notes 2, 3, and 10 to the consolidated financial statements, the Company’s consolidated ship and

ship improvements balance was $49.8 billion as of November 30, 2020. Management reviews their long-lived

assets for impairment whenever events or circumstances indicate potential impairment. As a result of the effect of

COVID-19 on the Company’s expected future operating cash flows and management’s decision to dispose of

certain ships, management determined certain impairment triggers occurred. Accordingly, management

performed undiscounted cash flow analyses on certain ships in the Company’s fleet throughout 2020. Based on

these undiscounted cash flow analyses, management determined that certain ships, specifically those being

disposed, had net carrying values that exceeded their estimated undiscounted future cash flows. Management

determined the fair values of these ships based on their estimated selling value. Management then compared

these estimated fair values to the net carrying values and, as a result, recognized ship impairment charges of $1.5

billion and $0.3 billion within the NAA and EA segments during 2020. The principal assumptions used in

management’s undiscounted cash flow analyses consisted of the timing of the respective ship’s return to service;

changes in market conditions; and port or other restrictions; forecasted ship revenues net of the most significant

variable costs, which are travel agent commissions, costs of air and other transportation, and certain other costs

that are directly associated with onboard and other revenues, including credit and debit card fees; and the timing

of the sale of ships and estimated proceeds.

The principal considerations for our determination that performing procedures relating to certain ship impairment

assessments is a critical audit matter are (i) the significant judgment by management in developing the

undiscounted cash flow analyses for the ships with triggering events; (ii) a high degree of auditor judgment,

subjectivity, and effort in performing procedures and evaluating management’s significant assumptions related to

forecasted ship revenues net of the most significant variable costs, which are travel agent commissions, costs of air

and other transportation, and certain other costs that are directly associated with onboard and other revenues,

including credit and debit card fees and the timing of the sale of ships and estimated proceeds.

ACCT 610: Long-Lived Asset Handout Page 9

AAL (American Airlines), DAL (Delta Airlines), UAL (United Airlines), LUV (Southwest Airlines), ALK (Alaska

Airlines), JBLU (Jet Blue Airlines), SAVE (Spirit Airlines)

ACCT 610: Long-Lived Asset Handout Page 10

EXXON MOBIL

CONSOLIDATED STATEMENT OF INCOME

2020 2019 2018

(millions of dollars)

Revenues and other income

Sales and other operating revenue 178,574 255,583 279,332

Income from equity affiliates 1,732 5,441 7,355

Other income 1,196 3,914 3,525

Total revenues and other income 181,502 264,938 290,212

Costs and other deductions

Crude oil and product purchases 94,007 143,801 156,172

Production and manufacturing expenses 30,431 36,826 36,682

Selling, general and administrative expenses 10,168 11,398 11,480

Depreciation and depletion (includes impairments) 46,009 18,998 18,745

Exploration expenses, including dry holes 1,285 1,269 1,466

Non-service pension and postretirement benefit

expense 1,205 1,235 1,285

Interest expense 1,158 830 766

Other taxes and duties 26,122 30,525 32,663

Total costs and other deductions 210,385 244,882 259,259

Income (Loss) before income taxes (28,883) 20,056 30,953

Income tax expense (benefit) (5,632) 5,282 9,532

Net income (loss) including noncontrolling interests (23,251) 14,774 21,421

Net income (loss) attributable to noncontrolling

interests (811) 434 581

Net income (loss) attributable to ExxonMobil (22,440) 14,340 20,840

FOOTNOTES TO THE FINANCIAL STATEMENTS:

The Corporation has a robust process to monitor for indicators of potential impairment across its asset

groups throughout the year. This process is aligned with the requirements of ASC 360 and ASC 932, and

relies in part on the Corporation’s planning and budgeting cycle. In 2020, the Corporation identified a

number of situations where events or changes in circumstances indicated that the carrying value of

certain long-lived assets may not be recoverable… Under the plan as approved, the Corporation no

longer plans to develop a significant portion of its dry gas portfolio, including a portion of its resources

in the Appalachian, Rocky Mountains, Oklahoma, Texas, Louisiana, and Arkansas regions of the U.S., as

well as resources in Western Canada and Argentina. The decision not to develop these assets resulted in

non-cash, before-tax charges of $24.4 billion in Upstream to reduce the carrying value of those assets

to fair value. Other before-tax impairment charges in 2020 included $0.9 billion in Upstream, $0.5

billion in Downstream, and $0.1 billion in Chemical. Impairment charges are primarily recognized in the

lines “Depreciation and depletion” and “Exploration expenses, including dry holes” on the Consolidated

Statement of Income.

ACCT 610: Long-Lived Asset Handout Page 11

Source: Audit Analytics Database

ACCT 610: Long-Lived Asset Handout Page 12

AMAZON.COM FORM 10-K (filed February 2, 2022)

Use of Estimates

The preparation of financial statements in conformity with GAAP requires estimates and assumptions

that affect the reported amounts of assets and liabilities, revenues and expenses, and related

disclosures of contingent liabilities in the consolidated financial statements and accompanying notes.

Estimates are used for, but not limited to, income taxes, useful lives of equipment, commitments and

contingencies, valuation of acquired intangibles and goodwill, stock-based compensation forfeiture

rates, vendor funding, inventory valuation, collectability of receivables, and valuation and impairment of

investments. Actual results could differ materially from these estimates. For example, in Q4 2021 we

completed a useful life study for our servers and networking equipment and are increasing the useful

lives from four years to five years for servers and from five years to six years for networking

equipment in January 2022, which, based on servers and networking equipment that are included in

“Property and equipment, net” as of December 31, 2021, will have an anticipated impact to our 2022

operating income of $3.1 billion. We had previously increased the useful life of our servers from three

years to four years in January 2020.

ACCT 610: Long-Lived Asset Handout Page 13

You might also like

- Advanced Accounting 7th Edition Jeter Solutions ManualDocument25 pagesAdvanced Accounting 7th Edition Jeter Solutions ManualSamanthaGibsonbqep100% (56)

- Business Valuation - Standard Approaches and ApplicationsDocument17 pagesBusiness Valuation - Standard Approaches and ApplicationsJavier Alejandro Muralles Reyes100% (1)

- E21 16Document2 pagesE21 16Warmthx0% (1)

- Transportation Report Pfm4Document7 pagesTransportation Report Pfm4Lex Jeofrey SadsadNo ratings yet

- Announcement of Annual Results For The Year Ended 30 September 2021 2021120601652Document23 pagesAnnouncement of Annual Results For The Year Ended 30 September 2021 2021120601652l chanNo ratings yet

- Kroger Financial Statement ExcerptsDocument9 pagesKroger Financial Statement ExcerptsAlexa WilcoxNo ratings yet

- 2022 Q4 Earnings Release (Ex-99.1) - Full Release Coca-ColaDocument1 page2022 Q4 Earnings Release (Ex-99.1) - Full Release Coca-ColakusshhalNo ratings yet

- (In Millions, Except Par Values) Assets: The Kroger Co. C B SDocument1 page(In Millions, Except Par Values) Assets: The Kroger Co. C B ShashaamNo ratings yet

- Assets: PAYNET, Inc. Consolidated Balance SheetsDocument3 pagesAssets: PAYNET, Inc. Consolidated Balance Sheetschemicalchouhan9303No ratings yet

- Samorita Hospital (Last 6 Month Financial Report)Document11 pagesSamorita Hospital (Last 6 Month Financial Report)Stalwart sheikhNo ratings yet

- Nicole Irvin - ProjectDocument4 pagesNicole Irvin - Projectapi-581024555No ratings yet

- NuPetCo Slides - DahliaDocument24 pagesNuPetCo Slides - Dahliacik bungaNo ratings yet

- DTCC Annual Financial Statements 2020 and 2019Document51 pagesDTCC Annual Financial Statements 2020 and 2019EvgeniyNo ratings yet

- Consolidated Balance Sheet: December 31, 2022 2021 (In Millions, Except Per Share Data)Document2 pagesConsolidated Balance Sheet: December 31, 2022 2021 (In Millions, Except Per Share Data)Maanvee JaiswalNo ratings yet

- Berger Paints Bangladesh Limited Statement of Financial PositionDocument8 pagesBerger Paints Bangladesh Limited Statement of Financial PositionrrashadattNo ratings yet

- MBA5002 Sample Case Study 2Document13 pagesMBA5002 Sample Case Study 2Mohamed NaieemNo ratings yet

- Appendix PfizerDocument2 pagesAppendix PfizerelatobouloNo ratings yet

- Institute of Rural Management Anand: 1. Non-Current AssetsDocument5 pagesInstitute of Rural Management Anand: 1. Non-Current AssetsDharampreet SinghNo ratings yet

- CHK 4Q 2023 FinancialsDocument10 pagesCHK 4Q 2023 FinancialsRanjan SaxenaNo ratings yet

- Financial Statement Analysis: Jeddah International College Answer PaperDocument4 pagesFinancial Statement Analysis: Jeddah International College Answer PaperBushraYousafNo ratings yet

- Air Canada FinancialsDocument13 pagesAir Canada Financialsgajendra.dpsNo ratings yet

- Consolidated Balance Sheet Metapower International, IncDocument12 pagesConsolidated Balance Sheet Metapower International, IncJha YaNo ratings yet

- Consolidated Interim Financial Information (Unaudited) As of March 31, 2021 and 2020Document45 pagesConsolidated Interim Financial Information (Unaudited) As of March 31, 2021 and 2020Fernando SeminarioNo ratings yet

- Financial Statement Investigation A02-18-2015Document5 pagesFinancial Statement Investigation A02-18-2015碧莹成No ratings yet

- Consolidated Balance Sheet: in Millions, Except Per Share Amounts, at December 31Document1 pageConsolidated Balance Sheet: in Millions, Except Per Share Amounts, at December 31Juan Jeronimo Marin ArevaloNo ratings yet

- The Following Trial Balance Was Extracted From The Books of Craz LTD As at 31 Dec 2014Document5 pagesThe Following Trial Balance Was Extracted From The Books of Craz LTD As at 31 Dec 2014Pham TrangNo ratings yet

- Goodwill HandoutDocument14 pagesGoodwill HandoutCharudatta MundeNo ratings yet

- Five Below 2018 Financial StatementsDocument4 pagesFive Below 2018 Financial StatementsElie GergesNo ratings yet

- Financial Analysis For NIKEDocument12 pagesFinancial Analysis For NIKEAnny Cloveries GabayanNo ratings yet

- Sample 10KDocument29 pagesSample 10KabhishekNo ratings yet

- 2020 FSN q3Document26 pages2020 FSN q3AnujaNo ratings yet

- Business ForecastingDocument6 pagesBusiness ForecastingRahat Mahmud ShoebNo ratings yet

- 2014 AR Excel Financials For AR Web Site FINALDocument6 pages2014 AR Excel Financials For AR Web Site FINALPranjal SharmaNo ratings yet

- Balance SheetDocument1 pageBalance SheetJack DawsonNo ratings yet

- Balance Sheet ExampleDocument2 pagesBalance Sheet ExampleKC XitizNo ratings yet

- Solaria Cuentas enDocument71 pagesSolaria Cuentas enElizabeth Sánchez LeónNo ratings yet

- Statement August 31 2020Document30 pagesStatement August 31 2020NicolasNo ratings yet

- TeslaDocument12 pagesTeslakhushbookohli98No ratings yet

- Case Study: Non-Current AssetsDocument4 pagesCase Study: Non-Current AssetsAsad RehmanNo ratings yet

- Interim Consolidated Condensed Financial Statements For The Six Months 633c1a0975d75Document23 pagesInterim Consolidated Condensed Financial Statements For The Six Months 633c1a0975d75Сергей АнуфриевNo ratings yet

- Acc319 - Take-Home Act - Financial ModelDocument24 pagesAcc319 - Take-Home Act - Financial Modeljpalisoc204No ratings yet

- Taliworks Q4FY19Document28 pagesTaliworks Q4FY19Gan ZhiHanNo ratings yet

- Vitrox q42011Document10 pagesVitrox q42011Dennis AngNo ratings yet

- Asian Paints Ltd. (India) : SourceDocument6 pagesAsian Paints Ltd. (India) : SourceDivyagarapatiNo ratings yet

- Asian PaintsDocument6 pagesAsian PaintsDivyagarapatiNo ratings yet

- BS 2018Document1 pageBS 2018Maanvee JaiswalNo ratings yet

- Course Activity 1: Comparison Of: YearsDocument6 pagesCourse Activity 1: Comparison Of: YearsNae InsaengNo ratings yet

- CLWY Q1 2019 FinancialsDocument3 pagesCLWY Q1 2019 FinancialskdwcapitalNo ratings yet

- FIN 320 Module Three Excel Assignment ExampleDocument10 pagesFIN 320 Module Three Excel Assignment Examplesv03No ratings yet

- Financial Analysis Hewlett Packard Corporation 2007Document24 pagesFinancial Analysis Hewlett Packard Corporation 2007SAMNo ratings yet

- AIS Final ReqDocument10 pagesAIS Final ReqSucreNo ratings yet

- Al Noor 2021Document1 pageAl Noor 2021Afan QayumNo ratings yet

- PTRY AnalysisDocument5 pagesPTRY AnalysisthesaneinvestorNo ratings yet

- TZero 2018 10-KDocument20 pagesTZero 2018 10-KgaryrweissNo ratings yet

- Brianne Kylle Dela Cruz FSA3 111Document29 pagesBrianne Kylle Dela Cruz FSA3 111Kathlene JaoNo ratings yet

- Brianne Kylle Dela Cruz FSA3 10 20 21Document35 pagesBrianne Kylle Dela Cruz FSA3 10 20 21Kathlene JaoNo ratings yet

- Amazon Profitability Analysis - Part IIDocument31 pagesAmazon Profitability Analysis - Part IIShuting QinNo ratings yet

- Practice Problems 2Document10 pagesPractice Problems 2Luigi NocitaNo ratings yet

- Consolidated Balance SheetsDocument3 pagesConsolidated Balance SheetsAninda RestikaNo ratings yet

- 2023 Half Year Balance SheetDocument2 pages2023 Half Year Balance SheetsrishtiladdhaNo ratings yet

- Netflix, Inc. Consolidated Balance Sheets (In Thousands, Except Share and Per Share Data)Document9 pagesNetflix, Inc. Consolidated Balance Sheets (In Thousands, Except Share and Per Share Data)John AngNo ratings yet

- TyuhDocument16 pagesTyuhNikhilNo ratings yet

- Long-Term Debt Handout (UPDATED 8-27-22)Document9 pagesLong-Term Debt Handout (UPDATED 8-27-22)Charudatta MundeNo ratings yet

- Goodwill HandoutDocument14 pagesGoodwill HandoutCharudatta MundeNo ratings yet

- Statement of Cash Flows HandoutDocument17 pagesStatement of Cash Flows HandoutCharudatta MundeNo ratings yet

- Final Project PEP, KODocument3 pagesFinal Project PEP, KOCharudatta MundeNo ratings yet

- Pamantasan NG Cabuyao: Katapatan Subd., Banay Banay, Cabuyao, LagunaDocument4 pagesPamantasan NG Cabuyao: Katapatan Subd., Banay Banay, Cabuyao, LagunaDan RyanNo ratings yet

- Account MOCK Test - 1Document6 pagesAccount MOCK Test - 1CA ASPIRANTNo ratings yet

- Consolidation of Wholly Owned Subsidiaries Acquired at More Than Book ValueDocument90 pagesConsolidation of Wholly Owned Subsidiaries Acquired at More Than Book ValueSelena SevvinNo ratings yet

- ACT112 Final Exam Set 1 QuestionnaireDocument10 pagesACT112 Final Exam Set 1 QuestionnaireBashayer M. Sultan100% (1)

- What Are The Main Types of Depreciation Methods?: Depreciation Expense Book ValueDocument4 pagesWhat Are The Main Types of Depreciation Methods?: Depreciation Expense Book ValueSNo ratings yet

- 5.09 Analysis of Income TaxesDocument10 pages5.09 Analysis of Income TaxesClaptrapjackNo ratings yet

- Kuis AK 2Document4 pagesKuis AK 2Jhon F SinagaNo ratings yet

- Seminar 3 2017Document85 pagesSeminar 3 2017Stephanie XieNo ratings yet

- SAP Standard Reports Asset AccountingDocument51 pagesSAP Standard Reports Asset AccountingDavidNo ratings yet

- Liquidation ValueDocument3 pagesLiquidation ValueBercasio KelvinNo ratings yet

- 10000000301Document92 pages10000000301Chapter 11 DocketsNo ratings yet

- Departmental Examination: Multiple ChoiceDocument16 pagesDepartmental Examination: Multiple Choicecherry blossomNo ratings yet

- Acctg 11 PDFDocument77 pagesAcctg 11 PDFKilimanjaroNo ratings yet

- Multiple ChoiceDocument9 pagesMultiple ChoiceCj SernaNo ratings yet

- Hhtfa8e ch03 SMDocument119 pagesHhtfa8e ch03 SMharryNo ratings yet

- 2021 CH 7 AnswersDocument8 pages2021 CH 7 AnswersMiquel VillamarinNo ratings yet

- 06 - Raising Equity CapitalDocument46 pages06 - Raising Equity CapitalAnurag PattekarNo ratings yet

- Modern Advanced Accounting in Canada Canadian 7th Edition Hilton Test Bank PDFDocument6 pagesModern Advanced Accounting in Canada Canadian 7th Edition Hilton Test Bank PDFSpencerMoorenbds100% (45)

- Final Requirement FIN 004 Group 3Document80 pagesFinal Requirement FIN 004 Group 3Can't think of any namesNo ratings yet

- Practical Financial Management 6th Edition Lasher Solutions ManualDocument26 pagesPractical Financial Management 6th Edition Lasher Solutions Manualbarrydixonydazewpbxn100% (8)

- SEIU 2021 Financial DisclosuresDocument294 pagesSEIU 2021 Financial DisclosuresLaborUnionNews.comNo ratings yet

- ch6Document6 pagesch6YuitaNo ratings yet

- AfarDocument14 pagesAfarPaulo MiguelNo ratings yet

- Sums On Cash Flow StatementDocument5 pagesSums On Cash Flow StatementAstha ParmanandkaNo ratings yet

- Merger Acquisition CADocument24 pagesMerger Acquisition CAYogesh NeupaneNo ratings yet

- The Following List of Accounts For Company Y Ltd. Is Available at The End of 200XDocument2 pagesThe Following List of Accounts For Company Y Ltd. Is Available at The End of 200Xai0412No ratings yet

- Important Question - IBBI - PMDocument43 pagesImportant Question - IBBI - PMSanjay PatelNo ratings yet