Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

15 viewsProject III Lrcture MO

Project III Lrcture MO

Uploaded by

akshay7896

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Price Action Strategy Full CourseDocument54 pagesPrice Action Strategy Full CourseAneesh Viswanathan96% (47)

- Fundamental Pip Lord PDFDocument122 pagesFundamental Pip Lord PDFjuanky perez100% (6)

- High Probability Swing Trading Strategies: Day Trading Strategies, #4From EverandHigh Probability Swing Trading Strategies: Day Trading Strategies, #4Rating: 4.5 out of 5 stars4.5/5 (4)

- CONSERVATIVE SNIPER STRATEGY - Revised VersionDocument25 pagesCONSERVATIVE SNIPER STRATEGY - Revised VersionDulika Shinana100% (4)

- Supply, Demand and Deceleration - Day Trading Forex, Metals, Index, Crypto, Etc.From EverandSupply, Demand and Deceleration - Day Trading Forex, Metals, Index, Crypto, Etc.No ratings yet

- Mark Harris Script - Instructions by Mark HarrisDocument11 pagesMark Harris Script - Instructions by Mark Harrisberno eng1234No ratings yet

- JNSAR RulesDocument4 pagesJNSAR Rulesdinesh111180No ratings yet

- What Is Trigger Price or Stop Loss OrderDocument1 pageWhat Is Trigger Price or Stop Loss OrderCarla TateNo ratings yet

- Understanding Signal PlacementDocument7 pagesUnderstanding Signal PlacementEngr MiCh KyNo ratings yet

- How To Trade With A Signal.Document8 pagesHow To Trade With A Signal.Engr MiCh KyNo ratings yet

- Step by Step Guide On How To Trade With A Signal.Document8 pagesStep by Step Guide On How To Trade With A Signal.Duksi BasseyNo ratings yet

- Intraday Trading Strategies 23 2 2018Document13 pagesIntraday Trading Strategies 23 2 2018santanu_1310100% (1)

- Two SMAs and Three Stop Loss Strategy - Sept28Document4 pagesTwo SMAs and Three Stop Loss Strategy - Sept28BiantoroKunartoNo ratings yet

- The System: Extreme TMADocument7 pagesThe System: Extreme TMAkumarin2000No ratings yet

- Intraday Option TradingDocument4 pagesIntraday Option Tradingnarendra bholeNo ratings yet

- Tradewithsam - Money Management PlanDocument5 pagesTradewithsam - Money Management PlanOleg TseraNo ratings yet

- Session Breakout StrategyDocument2 pagesSession Breakout Strategyvamsi kumar0% (1)

- CONSERVATIVE SNIPER STRATEGY - Revised VersionDocument27 pagesCONSERVATIVE SNIPER STRATEGY - Revised VersionMawoussi Afeke100% (1)

- Trading Business Action PlanDocument12 pagesTrading Business Action Plansakthi100% (1)

- A) Stop Loss Sell Order - Mr. X Has Previously Purchased NTPC at Rs.145 in Expectation That The Price WillDocument1 pageA) Stop Loss Sell Order - Mr. X Has Previously Purchased NTPC at Rs.145 in Expectation That The Price Willdhamu_i4uNo ratings yet

- Stop Loss OrdersDocument21 pagesStop Loss OrdersshashiNo ratings yet

- Trading Strategy Forex LSFA BS (Banking System)Document5 pagesTrading Strategy Forex LSFA BS (Banking System)mr12323No ratings yet

- JJM StrategyDocument3 pagesJJM Strategyvkisho5845No ratings yet

- © 2009 - 2013 TradersmartsDocument11 pages© 2009 - 2013 TradersmartsParthNo ratings yet

- Extreme Tma System EnglishDocument5 pagesExtreme Tma System EnglishJackson TraceNo ratings yet

- What Is A Stop Loss OrderDocument1 pageWhat Is A Stop Loss OrderferozamedNo ratings yet

- Reentry Setups BBMADocument7 pagesReentry Setups BBMAThanh Bình Cô NươngNo ratings yet

- 2.bbma MtfaDocument7 pages2.bbma MtfaRENE TOENo ratings yet

- Santosh BabaDocument137 pagesSantosh BabaAkshi KarthikeyanNo ratings yet

- Atr Based StoplossDocument3 pagesAtr Based StoplossAshishNo ratings yet

- SDDocument13 pagesSDvlad_adrian_760% (5)

- Stop Loss Order - ICICI DirectDocument1 pageStop Loss Order - ICICI Directcorreasherwin007No ratings yet

- MCX Commodities Tick Price - Lot Size - GOLD - Silver - Aluminium - Lead - Zinc - Copper - Nickel - Crude Oil - Natural GasDocument3 pagesMCX Commodities Tick Price - Lot Size - GOLD - Silver - Aluminium - Lead - Zinc - Copper - Nickel - Crude Oil - Natural GasmurugangdNo ratings yet

- Bracket and Cover OrderDocument11 pagesBracket and Cover OrderVaithialingam ArunachalamNo ratings yet

- Cycleanalytic v1.2 User GuideDocument6 pagesCycleanalytic v1.2 User GuideTUNLADNo ratings yet

- Trading NeutralDocument3 pagesTrading NeutralsubhojitNo ratings yet

- Price Action ScalperDocument14 pagesPrice Action ScalperMurd DyanNo ratings yet

- TD SystemDocument23 pagesTD Systemmoluguru100% (1)

- Intr Say Tra NG StraesDocument6 pagesIntr Say Tra NG Straesspajk6No ratings yet

- Volatiliy Reversal Rules Check List: Time Frames D1, H4, H1, M30, M15Document3 pagesVolatiliy Reversal Rules Check List: Time Frames D1, H4, H1, M30, M15Victor ChanNo ratings yet

- Sell (Capital Market)Document3 pagesSell (Capital Market)kgsbppNo ratings yet

- Order Flow AnalysisDocument6 pagesOrder Flow AnalysisSumit SinghNo ratings yet

- Earn Daily Profits From Any MarketDocument9 pagesEarn Daily Profits From Any MarketAmit Kumra100% (1)

- Sonic RDocument1 pageSonic Rreza_81No ratings yet

- E-Book GaryDocument19 pagesE-Book GaryRenganathan VenkatavaradhanNo ratings yet

- K K K K K K: Elsh 19-Dec-13 Daily ChartDocument2 pagesK K K K K K: Elsh 19-Dec-13 Daily Chartapi-237717884No ratings yet

- 1 Minute Scalping StrategyDocument6 pages1 Minute Scalping Strategyayub khanNo ratings yet

- The Samni No Den of The MarketDocument6 pagesThe Samni No Den of The MarketAlfonso Logrono100% (1)

- Discussion Topic Is Entry N Exits in Trades and Portfolio HoldingsDocument3 pagesDiscussion Topic Is Entry N Exits in Trades and Portfolio HoldingsDASI SAI TEJANo ratings yet

- Trading With The Trend 12-2-2017Document23 pagesTrading With The Trend 12-2-2017Marc EpsleyNo ratings yet

- Kumo MagicDocument4 pagesKumo MagicErnest CiliaNo ratings yet

- TT TTTDocument19 pagesTT TTTdevanNo ratings yet

- (Liquidity Hunting Targets Strategy) ......... : Logic Behind ThisDocument2 pages(Liquidity Hunting Targets Strategy) ......... : Logic Behind ThisAhmad AkbarNo ratings yet

- Intraday Trading StrategiesDocument6 pagesIntraday Trading Strategiesmdjauhar63% (16)

- Exit Strategies & Stop Loss TechniquesDocument7 pagesExit Strategies & Stop Loss TechniquesBhavya ShahNo ratings yet

- 30 Min StrategyDocument14 pages30 Min StrategyquickutNo ratings yet

- Volatility Trading System Rules PDFDocument6 pagesVolatility Trading System Rules PDFprathapnomulaNo ratings yet

- Sure-Fire Hedging Strategy: SL at 1.9860Document6 pagesSure-Fire Hedging Strategy: SL at 1.9860Komala DewiNo ratings yet

- Forex Trading The Simplest Way To Beat Any Financial Market: Volume 2, #2From EverandForex Trading The Simplest Way To Beat Any Financial Market: Volume 2, #2No ratings yet

- 7.2 InfoDocument1 page7.2 InfoakshayNo ratings yet

- Sample Test CasesDocument4 pagesSample Test CasesakshayNo ratings yet

- 254 StudyDocument5 pages254 StudyakshayNo ratings yet

- Sub QueriesDocument16 pagesSub QueriesakshayNo ratings yet

- Data Types in Java NotesDocument4 pagesData Types in Java NotesakshayNo ratings yet

- 30 DecDocument7 pages30 DecakshayNo ratings yet

- OOPsDocument7 pagesOOPsakshayNo ratings yet

- Layout AnimationDocument1 pageLayout AnimationakshayNo ratings yet

- E-Commerce TestCasesDocument55 pagesE-Commerce TestCasesakshayNo ratings yet

- Find ExamplesDocument7 pagesFind ExamplesakshayNo ratings yet

- Linux CommandsDocument27 pagesLinux CommandsakshayNo ratings yet

- 18 Dec 2021 - Database (SQL)Document58 pages18 Dec 2021 - Database (SQL)akshayNo ratings yet

- Manpower Reduction PlanDocument3 pagesManpower Reduction PlanakshayNo ratings yet

- EveryDay With GITDocument7 pagesEveryDay With GITakshayNo ratings yet

- 18 Dec 2021 - Manual Part 2Document18 pages18 Dec 2021 - Manual Part 2akshayNo ratings yet

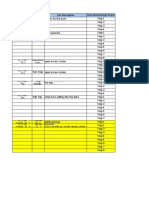

- Project:-Part No.: - Part Name: - Customer/ Supplier:: Insp - Date, Shift & Time: Last Opn.: Next Opn.Document2 pagesProject:-Part No.: - Part Name: - Customer/ Supplier:: Insp - Date, Shift & Time: Last Opn.: Next Opn.akshayNo ratings yet

- All Accounts Balance DetailsDocument1 pageAll Accounts Balance DetailsakshayNo ratings yet

- 18 Dec 2021 - Database (SQL)Document39 pages18 Dec 2021 - Database (SQL)akshayNo ratings yet

- 18 Dec 2021 - Database (SQL)Document6 pages18 Dec 2021 - Database (SQL)akshayNo ratings yet

- Teaching NotesDocument20 pagesTeaching NotesakshayNo ratings yet

- Recent Research in Blast Performance of Tunnel StructuresDocument7 pagesRecent Research in Blast Performance of Tunnel StructuresakshayNo ratings yet

- Principles of Software Testing - Mangesh SirDocument3 pagesPrinciples of Software Testing - Mangesh SirakshayNo ratings yet

- Teaching NotesDocument37 pagesTeaching NotesakshayNo ratings yet

- Teaching NotesDocument23 pagesTeaching NotesakshayNo ratings yet

Project III Lrcture MO

Project III Lrcture MO

Uploaded by

akshay0 ratings0% found this document useful (0 votes)

15 views5 pages7896

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document7896

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

15 views5 pagesProject III Lrcture MO

Project III Lrcture MO

Uploaded by

akshay7896

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 5

Order types –

4 types order place for buy and sell

1. Market order (MKT)

2. Limit order (LM)

3. Stop order (SL)

4. Stoploss with market order (SL-M)

1. Market order (MKT)-

The investors can sell or buy the shares/equity at the immediate current market price or

market rate is known as market order

Buy or sell the equity asap at current market price

Buy or Sell for market order field Quantity

Ex. Market price of TCS = 1@100rs

Buy TCS throw Market order (MKT) Quantity = 10 (Market Price=100rs) If

seller is available Order status = Executed

Buy TCS throw Market order (MKT) Quantity = 10 (Market Price=100rs) If

seller is not available and market is open (9.15am to 3.30pm) Order status = Open

Buy TCS throw Market order (MKT) Quantity = 10 (Market Price=100rs) If

seller is not available and market is closed after 3.30pm Order status = Closed/

cancelled

2. Limit order (LM)-

Limit Order: It means the investor can set the limit at which prize he/she wants to

buy/sell the share, it is designed to buy below current market prize and sell above

current market prize.

Buy or Sell for limit order field Quantity, Limit price / decided price

Ex. Market price of TCS = 1@100rs

Buy TCS throw Limit order (LM) Quantity = 10, Limit Price = 95rs If seller is

available Order status = Executed

Buy TCS throw Limit order (LM) Quantity = 10, Limit Price = 95rs If seller is

not available and market is open (9.15am to 3.30pm) Order status = Open

Buy TCS throw Limit order (LM) Quantity = 10, Limit Price = 95rs If seller is

available but seller prices is not matching (110rs) and market is open (9.15 to 3.30pm)

Order status = Open

Buy TCS throw Limit order (LM) Quantity = 10, Limit Price = 95rs If seller is

not available and market is closed after 3.30pm Order status = Closed/ cancelled

3. Stop loss order (SL)-

Stop Loss Order: It minimizes the risk of money. It is designed if the trader have

captured equity/shares but due to some reasons like vacation , busy schedule he is not

able to watch current market position so he triggered stop loss value when the stock value

reaches below the certain prize against we buy to avoid the loss of the money the Stop

Loss is triggered.

Buy or Sell for stop loss order field Quantity, Limit price / decided price, Trigger

price

Ex. Market price of TCS = 1@100rs (End user Account hold TCS 10 share)

Condition for stop loss order, Buy Limit Price > Trigger price

Condition for stop loss order, Sell Limit Price < Trigger price

Sell TCS throw Stop loss order (SL) Quantity = 10, Limit Price = 90rs, Trigger

price= 91rs If buyer is available Order status = Executed

Sell TCS throw Stop loss order (SL) Quantity = 10, Limit Price = 90rs, Trigger

price= 91rs If buyer is not available and market is open (9.15 to 3.30pm) Order

status = Open

Sell TCS throw Stop loss order (SL) Quantity = 10, Limit Price = 90rs, Trigger

price= 91rs If buyer is available but buyer limit prices is not matching (85rs) and

market is open (9.15 to 3.30pm) Order status = Open

Sell TCS throw Stop loss order (SL) Quantity = 10, Limit Price = 90rs, Trigger

price= 91rs If buyer is not available and market is closed after 3.30pm Order

status = Closed/ cancelled

4. Stoploss with market order (SL-M)

Buy or Sell for stop loss with market order field Quantity, Trigger price

Ex. Market price of TCS = 1@100rs (End user Account hold TCS 10 share)

Sell TCS throw Stoploss with market order (SL-M) Quantity = 10, Trigger price=

91rs (Market price) If buyer is available Order status = Executed

Sell TCS throw Stoploss with market order (SL-M) Quantity = 10, Trigger price=

91rs (Market price) If buyer is not available and market is open (9.15 to 3.30pm)

Order status = Open

Sell TCS throw Stoploss with market order (SL-M) Quantity = 10, Trigger price=

91rs (Market price) If buyer is available but buyer prices is not matching (85rs) and

market is open (9.15 to 3.30pm) Order status = Open

Sell TCS throw Stoploss with market order (SL-M) Quantity = 10, Trigger price=

91rs (Market price) If buyer is not available and market is closed after 3.30pm

Order status = Closed/ cancelled

You might also like

- Price Action Strategy Full CourseDocument54 pagesPrice Action Strategy Full CourseAneesh Viswanathan96% (47)

- Fundamental Pip Lord PDFDocument122 pagesFundamental Pip Lord PDFjuanky perez100% (6)

- High Probability Swing Trading Strategies: Day Trading Strategies, #4From EverandHigh Probability Swing Trading Strategies: Day Trading Strategies, #4Rating: 4.5 out of 5 stars4.5/5 (4)

- CONSERVATIVE SNIPER STRATEGY - Revised VersionDocument25 pagesCONSERVATIVE SNIPER STRATEGY - Revised VersionDulika Shinana100% (4)

- Supply, Demand and Deceleration - Day Trading Forex, Metals, Index, Crypto, Etc.From EverandSupply, Demand and Deceleration - Day Trading Forex, Metals, Index, Crypto, Etc.No ratings yet

- Mark Harris Script - Instructions by Mark HarrisDocument11 pagesMark Harris Script - Instructions by Mark Harrisberno eng1234No ratings yet

- JNSAR RulesDocument4 pagesJNSAR Rulesdinesh111180No ratings yet

- What Is Trigger Price or Stop Loss OrderDocument1 pageWhat Is Trigger Price or Stop Loss OrderCarla TateNo ratings yet

- Understanding Signal PlacementDocument7 pagesUnderstanding Signal PlacementEngr MiCh KyNo ratings yet

- How To Trade With A Signal.Document8 pagesHow To Trade With A Signal.Engr MiCh KyNo ratings yet

- Step by Step Guide On How To Trade With A Signal.Document8 pagesStep by Step Guide On How To Trade With A Signal.Duksi BasseyNo ratings yet

- Intraday Trading Strategies 23 2 2018Document13 pagesIntraday Trading Strategies 23 2 2018santanu_1310100% (1)

- Two SMAs and Three Stop Loss Strategy - Sept28Document4 pagesTwo SMAs and Three Stop Loss Strategy - Sept28BiantoroKunartoNo ratings yet

- The System: Extreme TMADocument7 pagesThe System: Extreme TMAkumarin2000No ratings yet

- Intraday Option TradingDocument4 pagesIntraday Option Tradingnarendra bholeNo ratings yet

- Tradewithsam - Money Management PlanDocument5 pagesTradewithsam - Money Management PlanOleg TseraNo ratings yet

- Session Breakout StrategyDocument2 pagesSession Breakout Strategyvamsi kumar0% (1)

- CONSERVATIVE SNIPER STRATEGY - Revised VersionDocument27 pagesCONSERVATIVE SNIPER STRATEGY - Revised VersionMawoussi Afeke100% (1)

- Trading Business Action PlanDocument12 pagesTrading Business Action Plansakthi100% (1)

- A) Stop Loss Sell Order - Mr. X Has Previously Purchased NTPC at Rs.145 in Expectation That The Price WillDocument1 pageA) Stop Loss Sell Order - Mr. X Has Previously Purchased NTPC at Rs.145 in Expectation That The Price Willdhamu_i4uNo ratings yet

- Stop Loss OrdersDocument21 pagesStop Loss OrdersshashiNo ratings yet

- Trading Strategy Forex LSFA BS (Banking System)Document5 pagesTrading Strategy Forex LSFA BS (Banking System)mr12323No ratings yet

- JJM StrategyDocument3 pagesJJM Strategyvkisho5845No ratings yet

- © 2009 - 2013 TradersmartsDocument11 pages© 2009 - 2013 TradersmartsParthNo ratings yet

- Extreme Tma System EnglishDocument5 pagesExtreme Tma System EnglishJackson TraceNo ratings yet

- What Is A Stop Loss OrderDocument1 pageWhat Is A Stop Loss OrderferozamedNo ratings yet

- Reentry Setups BBMADocument7 pagesReentry Setups BBMAThanh Bình Cô NươngNo ratings yet

- 2.bbma MtfaDocument7 pages2.bbma MtfaRENE TOENo ratings yet

- Santosh BabaDocument137 pagesSantosh BabaAkshi KarthikeyanNo ratings yet

- Atr Based StoplossDocument3 pagesAtr Based StoplossAshishNo ratings yet

- SDDocument13 pagesSDvlad_adrian_760% (5)

- Stop Loss Order - ICICI DirectDocument1 pageStop Loss Order - ICICI Directcorreasherwin007No ratings yet

- MCX Commodities Tick Price - Lot Size - GOLD - Silver - Aluminium - Lead - Zinc - Copper - Nickel - Crude Oil - Natural GasDocument3 pagesMCX Commodities Tick Price - Lot Size - GOLD - Silver - Aluminium - Lead - Zinc - Copper - Nickel - Crude Oil - Natural GasmurugangdNo ratings yet

- Bracket and Cover OrderDocument11 pagesBracket and Cover OrderVaithialingam ArunachalamNo ratings yet

- Cycleanalytic v1.2 User GuideDocument6 pagesCycleanalytic v1.2 User GuideTUNLADNo ratings yet

- Trading NeutralDocument3 pagesTrading NeutralsubhojitNo ratings yet

- Price Action ScalperDocument14 pagesPrice Action ScalperMurd DyanNo ratings yet

- TD SystemDocument23 pagesTD Systemmoluguru100% (1)

- Intr Say Tra NG StraesDocument6 pagesIntr Say Tra NG Straesspajk6No ratings yet

- Volatiliy Reversal Rules Check List: Time Frames D1, H4, H1, M30, M15Document3 pagesVolatiliy Reversal Rules Check List: Time Frames D1, H4, H1, M30, M15Victor ChanNo ratings yet

- Sell (Capital Market)Document3 pagesSell (Capital Market)kgsbppNo ratings yet

- Order Flow AnalysisDocument6 pagesOrder Flow AnalysisSumit SinghNo ratings yet

- Earn Daily Profits From Any MarketDocument9 pagesEarn Daily Profits From Any MarketAmit Kumra100% (1)

- Sonic RDocument1 pageSonic Rreza_81No ratings yet

- E-Book GaryDocument19 pagesE-Book GaryRenganathan VenkatavaradhanNo ratings yet

- K K K K K K: Elsh 19-Dec-13 Daily ChartDocument2 pagesK K K K K K: Elsh 19-Dec-13 Daily Chartapi-237717884No ratings yet

- 1 Minute Scalping StrategyDocument6 pages1 Minute Scalping Strategyayub khanNo ratings yet

- The Samni No Den of The MarketDocument6 pagesThe Samni No Den of The MarketAlfonso Logrono100% (1)

- Discussion Topic Is Entry N Exits in Trades and Portfolio HoldingsDocument3 pagesDiscussion Topic Is Entry N Exits in Trades and Portfolio HoldingsDASI SAI TEJANo ratings yet

- Trading With The Trend 12-2-2017Document23 pagesTrading With The Trend 12-2-2017Marc EpsleyNo ratings yet

- Kumo MagicDocument4 pagesKumo MagicErnest CiliaNo ratings yet

- TT TTTDocument19 pagesTT TTTdevanNo ratings yet

- (Liquidity Hunting Targets Strategy) ......... : Logic Behind ThisDocument2 pages(Liquidity Hunting Targets Strategy) ......... : Logic Behind ThisAhmad AkbarNo ratings yet

- Intraday Trading StrategiesDocument6 pagesIntraday Trading Strategiesmdjauhar63% (16)

- Exit Strategies & Stop Loss TechniquesDocument7 pagesExit Strategies & Stop Loss TechniquesBhavya ShahNo ratings yet

- 30 Min StrategyDocument14 pages30 Min StrategyquickutNo ratings yet

- Volatility Trading System Rules PDFDocument6 pagesVolatility Trading System Rules PDFprathapnomulaNo ratings yet

- Sure-Fire Hedging Strategy: SL at 1.9860Document6 pagesSure-Fire Hedging Strategy: SL at 1.9860Komala DewiNo ratings yet

- Forex Trading The Simplest Way To Beat Any Financial Market: Volume 2, #2From EverandForex Trading The Simplest Way To Beat Any Financial Market: Volume 2, #2No ratings yet

- 7.2 InfoDocument1 page7.2 InfoakshayNo ratings yet

- Sample Test CasesDocument4 pagesSample Test CasesakshayNo ratings yet

- 254 StudyDocument5 pages254 StudyakshayNo ratings yet

- Sub QueriesDocument16 pagesSub QueriesakshayNo ratings yet

- Data Types in Java NotesDocument4 pagesData Types in Java NotesakshayNo ratings yet

- 30 DecDocument7 pages30 DecakshayNo ratings yet

- OOPsDocument7 pagesOOPsakshayNo ratings yet

- Layout AnimationDocument1 pageLayout AnimationakshayNo ratings yet

- E-Commerce TestCasesDocument55 pagesE-Commerce TestCasesakshayNo ratings yet

- Find ExamplesDocument7 pagesFind ExamplesakshayNo ratings yet

- Linux CommandsDocument27 pagesLinux CommandsakshayNo ratings yet

- 18 Dec 2021 - Database (SQL)Document58 pages18 Dec 2021 - Database (SQL)akshayNo ratings yet

- Manpower Reduction PlanDocument3 pagesManpower Reduction PlanakshayNo ratings yet

- EveryDay With GITDocument7 pagesEveryDay With GITakshayNo ratings yet

- 18 Dec 2021 - Manual Part 2Document18 pages18 Dec 2021 - Manual Part 2akshayNo ratings yet

- Project:-Part No.: - Part Name: - Customer/ Supplier:: Insp - Date, Shift & Time: Last Opn.: Next Opn.Document2 pagesProject:-Part No.: - Part Name: - Customer/ Supplier:: Insp - Date, Shift & Time: Last Opn.: Next Opn.akshayNo ratings yet

- All Accounts Balance DetailsDocument1 pageAll Accounts Balance DetailsakshayNo ratings yet

- 18 Dec 2021 - Database (SQL)Document39 pages18 Dec 2021 - Database (SQL)akshayNo ratings yet

- 18 Dec 2021 - Database (SQL)Document6 pages18 Dec 2021 - Database (SQL)akshayNo ratings yet

- Teaching NotesDocument20 pagesTeaching NotesakshayNo ratings yet

- Recent Research in Blast Performance of Tunnel StructuresDocument7 pagesRecent Research in Blast Performance of Tunnel StructuresakshayNo ratings yet

- Principles of Software Testing - Mangesh SirDocument3 pagesPrinciples of Software Testing - Mangesh SirakshayNo ratings yet

- Teaching NotesDocument37 pagesTeaching NotesakshayNo ratings yet

- Teaching NotesDocument23 pagesTeaching NotesakshayNo ratings yet