Professional Documents

Culture Documents

Jurnal Internasional 2

Jurnal Internasional 2

Uploaded by

Muhammad YudaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jurnal Internasional 2

Jurnal Internasional 2

Uploaded by

Muhammad YudaCopyright:

Available Formats

International Journal of Advanced Science and Management

Vol. 29, No. 05, (2020), pp. 985-994

Financial Performance Evaluation of the commercial banks in

Jordan: Based on the CAMELS Framework.

Dr. Ammar Daher Bashatweh, Prof Emad Yousif Ahmed

Faculty of Business & Finance, The World Islamic Science & Education

University, Jordan - Amman

Abstract

This study aimed at analyzing and evaluating the financial performance of the

Jordanian banks. To achieve the objective of the study, the CAMELS framework was used

to analyze and evaluate the financial performance of banks. The study sample consisted of

13 commercial banks for the period 2014-2018. The study concluded that the overall

Jordanian commercial banks was the degree of classifying them based on CAMELS

framework which was acceptable and that the Jordanian commercial banks have a

convergence in the rating, which is an indication of the convergence of the procedures

and policies adopted in the Jordanian commercial banks.

The study recommended that the banks must reduce their operating expenses and

manage it in a better way and that the management of the Jordanian commercial banks

must reconsider the policies, strategies followed in providing facilities, the level of the

required guarantees as well as the procedures of following debts. The study also

recommended preparing accurate and organized plans for liquidity by the managements

of the banks in order to achieve a consistency between assets and obligations in terms of

maturity, and distributing them to uses transferable to liquid balances. Finally, We

recommend other researchers to conduct studies on the Islamic banks in addition to all

the banks listed on the ASE.

Keywords: Commercial Banks, Financial Performance, Operating Expenses,

Sensitivity to market risk, CAMELS

Contribution: This study is one of the few studies which have analyzed the financial

performance of commercial banking in Jordan with all components of the CAMELS

model. Also it contributes in the existing literature by employing the CAMELS model to

evaluate and compare banking performance. The finding of this study will attract the

attention of managers and stakeholders and academicians.

1. Introduction:

Banks are one of the most important economic sectors in Jordan. The report of the

Central Bank of Jordan of 2018 showed that the volume of the assets of the licensed

banks at the end of the year was 161.9% (CBJ, 2018).

In order to ensure a sound and strong banking sector, it is important to evaluate banks

through a framework or approach that shows the strengths and weaknesses of these banks.

One of the methods used to analyze and evaluate the financial performance was the

CAMELS framework (Roman & Şargu, 2013).

There are many researchers who tried to contribute to providing an assessment for the

financial performance via the CAMELS framework with its six components such as

(Roman & Şargu, 2013) (Rozzani, & Rahman, 2013). Some researchers were limited to

assessing the financial performance through using only five indicators such as

(sangmi&Nazir, 2010) and (Muhmad & Hashim, 2015). In its Financial Stability Report

for 2018, the Central Bank of Jordan was limited to assessing the safety of the financial

performance on four indicators: capital adequacy, asset quality, liquidity and Earnings.

Hence, In accordance to this, the current study fills the gap in the knowledge of camels

ISSN: 2005-4238 IJAST

985

Copyright ⓒ 2020 SERSC

International Journal of Advanced Science and Management

Vol. 29, No. 05, (2020), pp. 985-994

framework financial performance in Jordanian banks by: first analyze all indicators

camels framework and second evaluate financial performance of the Jordanian

commercial banks listed on the ASE using all indicators camels framework and third to

compare the banks and their performance during period study. The present study will be

useful to banks' managers to improve financial performance and stakeholders to evaluate

banks managers, as well as contributing to the literature and future studies so that this

research aims to analyze and evaluate the financial performance of the Jordanian

commercial banks listed on the ASE for the period 2014-2018. To achieve this objective,

the CAMELS framework with its six components was used since this analysis will give a

comprehensive evaluation for the financial performance of the banks, the study sample.

2.CAMELS Framework:

Evaluating the performance of the banks is important for all parties, including

suppliers, investors and others. Generally, the financial structure is the most important

index in evaluating the performance of banks. One of the common financial indicators

used by researchers for measuring the banking performance is the CAMELS framework

(Muhmad & Hashim, 2015). In order to ensure a strong and stable banking sector, banks

must be assessed and evaluated in a way that allows for the removal of gaps where the

CAMELS framework is considered the most used method for this. The framework was

established in 1979 in the United States of America by some banks’ regulators; its uses

were then expanded to include being a tool beneficial for the regulatory agencies. The

acronym for CAMEL is derived from the bank's main operations (capital adequacy, asset

quality, management efficiency, Earning, and liquidity), since 1996. For focusing on the

risks, the letter S was added meaning the sensitivity to the market risks. The six indicators

of the framework are related to the evaluation of the performance of the banks. Some

standards were prepared for the six CAMELS framework indicators ranging from (1), the

best, to (5), the worst. (Rozzani, Rahman, 2013) and (Saker, 2006). It was recommended

by the International Monetary Fund (Roman & Şargu, 2013). This was confirmed by

(Dincer, et al.2011) which studied CAMELS framework; it found that it is a supervisory

rating used to evaluate the financial performance of banks and it was provided in the

United States of America in 1979. The researchers believe that the CAMELS framework

is one of the integrated frameworks measuring the financial performance of banks and it

shows the strength and weakness of the bank in one of the aspects of the framework; as a

result of its importance, it is used by the Central Bank of Jordan. The CAMELS

framework consists of the following six indicators:

1. Capital adequacy: The capital adequacy ratio is the solvency ratio. The minimum of the

rates of the capital adequacy for guaranteeing the banks’ ability to absorb a reasonable

level of the losses before they become insolvent (Arabi, 2013). In Jordan, banks must

maintain the capital adequacy ratio of 12%; the higher such ratio, the higher the bank's

risk to hold risks (CBJ, 2018).

2. Asset quality: The quality of assets is considered an important aspect for evaluating the

performance of banks. The poor quality of assets and the low liquidity are the reasons for

the failure of banks (Jha & Hui 2012). The highest risks facing the banks in general are

the losses resulting from the fluctuating loans. Therefore, banks are always trying to keep

the non-performing loans at a lower level (Ongore&Kusa, 2013).

3. Management quality: the management quality plays a big role in determining the future

of the bank because of the management's overall view on the bank's various operations

(Jha & Hui 2012). The quality of the management (M) is essentially its ability to

determine, measure and control the risks of activities, and to ensure the safe, proper and

effective operation in a way that suits the regulations. The quality of the management is

linked to the bank's success (Ghasempour & Salami, 2016).

ISSN: 2005-4238 IJAST

986

Copyright ⓒ 2020 SERSC

International Journal of Advanced Science and Management

Vol. 29, No. 05, (2020), pp. 985-994

4. Earnings: The ability of the banks to make appropriate earnings helps them to expand

their business, and maintain competitiveness. The earnings are also a key factor in

classifying their continuity (Baidoo, Amankwah & Tobazza, 2014). The earnings indicate

the bank’s ability to absorb the losses, increase capital and support its various operations

(Desta, 2016).

5. Liquidity: Liquidity is one of the factors that determine the level of the performance of

banks. It refers to the bank's ability to meet its obligations and face the unexpected

withdrawals from depositors (Roman & Şargu, 2013). If the management does not

properly exploit liquidity, the bank will face a loss (sangmi&Nazir, 2010).

6. Sensitivity to market risk: There is an indirect relationship between the size of the bank

and its sensitivity to the market risks which is the risk of failure because of the poor

conditions of the market where one increases, the other decreases. As a result, the larger

the size of the assets of the bank compared to the sector, the less sensitive it becomes to

the market risks resulting in avoiding a failure. (Dincer, et al., 2011).

3.Previous Studies

This section of the paper will be a review of the previous research on the topic of the

evaluation of the financial performance:

(Muktuf & Hazim, 2020) The study used a camels model to assess the performance of

banks in Iraq as the study sample consisted Al-Mansour Investment Bank in Iraq for the

period 2014-2018. The results showed that he bank obtained the third classification for its

overall financial performance according to the results of the composite classification of

the CAMELS model during the years of research, in addition to the weak management of

the bank's assets

(Saikrishna & Varghese, 2020) The study used a camel framework to assess the

performance of banks in India as the study sample consisted of one public sector bank, the

State Bank of India, and one private sector bank, HDFC Bank in India for the period

2015-2019. The results showed that Both the banks are maintaining a prescribed level of

CAMEL model. As we compare HDFC bank have more better ratios than SBI. In capital

adequacy, assets quality, management efficiency and earnings quality HDFC bank have

the better ratios. SBI have good ratios only in liquidity. Out of the 17 ratios used in this

CAMEL analysis, HDFC bank, private sector bank is the best in its operations.

(Georgios & Elvis, 2019) The study used a camels framework to assess the

performance of banks in Balkan Countries as the study sample consisted of eight major -

according to their assets - Balkan banks in particular: Greece (Piraeus Bank), Albania

(National Commercial Bank or NCB), FYROM (FYROM Bank for Development

Promotion or MBDP), Bulgaria (UniCredit Bulbank), Romania (Banca Commercial or

BCR), Serbia (Banca Intesa), Croatia (Zagrebacka Banca or ZABA), and Slovenia (Nova

Ljubljanska Banka or NLB group) in Balkan Countries for the period 2009-2016. The

results showed that the Balkan banks were adequately capitalized in general and did not

address capital adequacy issues other than FYROM and Serbia. Banks had a big problem

with asset quality and even liquidity. There was no issue of capital adequacy but it was

raised later due to the financial crisis and during that time, due to the large deposit run, the

difficulty of finding a source of funding, the increase in non-performing loans and the

decrease in interest income. Another problem for banks is the quality of risk management.

The quality of the management of the Balkan banks has great scope for improvement.

There is also a major problem with banks' immediate liquidity, with the exception of

Albania's NCB, which seems to have no problem as its deposits are sufficient for lending.

That is, deposits are more than loans.

(Muhmad & Hashim, 2015) The study used camels framework to evaluate the

performance of the banks in Malaysia where the study sample consisted of the local and

ISSN: 2005-4238 IJAST

987

Copyright ⓒ 2020 SERSC

International Journal of Advanced Science and Management

Vol. 29, No. 05, (2020), pp. 985-994

foreign banks in Malaysia for the period 2008-2012. The results showed that the adequacy

of the capital, the quality of assets, earnings and liquidity affected the performance

compared to the management quality which had not affected the performance.

(Sangmi & Nazir,2010). The study used the CAMELS framework to evaluate the

performance in India where the study sample consisted of two major banks in India. The

study found that the two banks were in a good and sound position in terms of the capital

adequacy, quality of assets, quality of management and liquidity.

(Atikoğulları,2009). The study used CAMELS framework to analyze the performance

of the banking sector in Northern Cyprus. The study sample consisted of 5 banks in the

period following the banking crisis. The study concluded that the adequacy of capital and

liquidity declined while both the earning and the quality of management improved during

the same period.

3.Study Methodology

As study is related to the analyze and evaluate financial performance of banking sector

based on the CAMELS model so following section explained:

3.1Sample:

There are 16 banks in Jordan Listed in Amman Stock Exchange which are divided into

two sets of banks. The first set of banks represents the 13 commercial banks. The second

set of banks represents the 3 Islamic banks. The second set of banks is excluded from this

study. This study covers a five-year period during 2014-2018.

2.3Data Collection

To achieve the aim of the study the descriptive. The study relied on two main sources

for data collection: for the collection of secondary data: study utilized the previous

studies, books periodicals scientific journals, and publications related to the subject of

study. As for primary data, the study utilized the Financial Reporting to collect the data

needed for the study, Annual reports for the 13 listed Jordan banks are downloaded from

the banks’ websites and the Amman stock Exchange(ASE)

3.3Measurement and Ratio Classification for Components of CAMELS

Rating

The elements of the CAMELS framework were measured as shown in Table 1, where

the average of each CAMELS framework element was calculated for 5 years during the

period 2014-2018. The means that were obtained were used for the rating of the banks.

Table (1) Measurement and Ratio Classification for Components of CAMELS Rating

Ratios of Measuring Rank

Acronym Component

CAMELS 1 2 3 4 5

Capital Tier1 + Tier 2 capital /

C ≥12% ≥8% less than 8% less than 6% ≤2%

Adequacy RWA≥12%

Non-Performing Loans /

A Assets Quality <1.25% 1.26%-2.59% 2.60%-3.59% 3.60%-5.50% >5.5%

Total Loans

Operation Expenses /

M Management ≤25% 26% -30.99% 31% - 38.90% 39% - 45.90% ≥46%

gross income

Net Profit after Tax /

E Earnings ≥1% 0.90% - 0.80% 0.70% - 0.35% 0.34% - 0.25% ≥0.24%

Total Assets

Liquid Assets / Total

L Liquidity ≥50% 45% - 49.99% 44.99% - 38% 37.99% - 33% ≥32%

Assets

Sensitivity to Total Securities / Total

S ≤25.490% 25.5% - 30.99% 31% - 37.99% 38% - 42.99% ≥43%

market risk Assets

Sourses: (CBJ,2018),(Dincer et. Al.,2011),( Ghazavi & Bayraktar,2018),(Al Qaisi,2017)

4. Results

ISSN: 2005-4238 IJAST

988

Copyright ⓒ 2020 SERSC

International Journal of Advanced Science and Management

Vol. 29, No. 05, (2020), pp. 985-994

The results of the Average of the total composite evaluation of the CAMELS

framework elements in the Jordanian commercial banks as in the table below:

Table (2) Average of the total composite evaluation of CAMELS framework elements in the

Jordanian commercial banks

Jordan Kuwait Bank

Management Assets Quality Capital Adequacy

Rating Ratio Rating Ratio Rating Ratio

)critical( 5.0 0.58 )critical( 5.0 7.98 )strong( 1.0 13.51

Sensitivity to market risk Liquidity Earnings

Rating Ratio Rating Ratio Rating Ratio

)strong( 1.0 19.31 )critical( 5.0 10.52 )strong( 1.0 1.36

Average of the total composite evaluation of CAMELS framework elements in the Jordan Kuwait

Bank = 3.1 (acceptable)

Jordan Ahli Bank

Management Assets Quality Capital Adequacy

Rating Ratio Rating Ratio Rating Ratio

)critical( 5.0 0.79 )critical( 5.0 9.93 )strong( 1.0 14.55

Sensitivity to market risk Liquidity Earnings

Rating Ratio Rating Ratio Rating Ratio

2.6

)strong( 1.2 23.36 )critical( 5.0 10.31 0.77

)acceptable(

Average of the total composite evaluation of CAMELS framework elements in the Jordan Ahli

Bank = 3.3 (acceptable)

The Housing Bank for Trade and Finance

Management Assets Quality Capital Adequacy

Rating Ratio Rating Ratio Rating Ratio

)critical( 4.8 0.51 )critical( 5.0 6.60 )strong( 1.0 17.07

Sensitivity to market risk Liquidity Earnings

Rating Ratio Rating Ratio Rating Ratio

)good( 1.6 25.95 )critical( 5.0 15.49 )strong( 1.0 3.56

Average of the total composite evaluation of CAMELS framework elements in the Housing Bank

for Trading and Finance = 3.1 (acceptable)

Bank Al Etihad

Management Assets Quality Capital Adequacy

Rating Ratio Rating Ratio Rating Ratio

)critical( 5.0 0.58 )critical( 4.6 6.12 )strong( 1.0 14.38

Sensitivity to market risk Liquidity Earnings

Rating Ratio Rating Ratio Rating Ratio

)strong( 1.4 23.23 )critical( 5.0 8.84 )strong( 1.0 1.11

Average of the total composite evaluation of CAMELS framework elements in the Bank Al Etihad

= 3.0 (acceptable)

)ARAB) Banking Corporation /JORDAN

Management Assets Quality Capital Adequacy

Rating Ratio Rating Ratio Rating Ratio

4.2

)critical( 5.0 0.56 5.38 )strong( 1.0 19.62

)Marginal(

Sensitivity to market risk Liquidity Earnings

Rating Ratio Rating Ratio Rating Ratio

)good( 2.0 27.74 )critical( 5.0 8.41 )strong( 1.2 1.20

Average of the total composite evaluation of CAMELS framework elements in the Banking

)ARAB( Corporation = 3.1 (acceptable)

Invest Bank

Management Assets Quality Capital Adequacy

Rating Ratio Rating Ratio Rating Ratio

)critical( 5.0 0.51 )critical( 5.0 7.54 )strong( 1.0 16.51

ISSN: 2005-4238 IJAST

989

Copyright ⓒ 2020 SERSC

International Journal of Advanced Science and Management

Vol. 29, No. 05, (2020), pp. 985-994

Sensitivity to market risk Liquidity Earnings

Rating Ratio Rating Ratio Rating Ratio

)strong( 1.0 16.03 )critical( 5.0 10.37 )strong( 1.0 1.55

Average of the total composite evaluation of CAMELS framework elements in the Invest Bank =

3.0 (acceptable)

Capital Bank of Jordan

Management Assets Quality Capital Adequacy

Rating Ratio Rating Ratio Rating Ratio

)critical( 5.0 0.64 )critical( 5.0 9.57 )strong( 1.0 16.47

Sensitivity to market risk Liquidity Earnings

Rating Ratio Rating Ratio Rating Ratio

)strong( 1.4 24.95 )critical( 5.0 14.48 )good( 2.0 1.11

Average of the total composite evaluation of CAMELS framework elements in the Capital Bank of

Jordan = 3.2 (acceptable)

Society General Bank

Management Assets Quality Capital Adequacy

Rating Ratio Rating Ratio Rating Ratio

)critical( 4.6 0.47 )critical( 4.4 5.15 )strong( 1.0 23.02

Sensitivity to market risk Liquidity Earnings

Rating Ratio Rating Ratio Rating Ratio

)strong( 1.4 24.15 )critical( 5.0 17.12 )good( 2.2 0.76

Average of the total composite evaluation of CAMELS framework elements in the Society General

Bank = 3.1 (acceptable)

Cairo Amman Bank

Management Assets Quality Capital Adequacy

Rating Ratio Rating Ratio Rating Ratio

)critical( 5.0 0.61 )critical( 4.0 4.48 )strong( 1.0 15.49

Sensitivity to market risk Liquidity Earnings

Rating Ratio Rating Ratio Rating Ratio

)strong( 1.0 16.67 )critical( 5.0 11.08 )strong( 1.0 1.40

Average of the total composite evaluation of CAMELS framework elements in the Cairo Amman

Bank = 2.8(acceptable)

Bank of Jordan

Management Assets Quality Capital Adequacy

Rating Ratio Rating Ratio Rating Ratio

)critical( 5.0 0.53 )critical( 4.8 6.58 )strong( 1.0 16.36

Sensitivity to market risk Liquidity Earnings

Rating Ratio Rating Ratio Rating Ratio

)strong( 1.0 14.07 )critical( 5.0 11.28 )strong( 1.0 1.80

Average of the total composite evaluation of CAMELS framework elements in the Bank of Jordan

= 3.0 (acceptable)

Jordan Commercial Bank

Management Assets Quality Capital Adequacy

Rating Ratio Rating Ratio Rating Ratio

)critical( 5.0 0.75 )critical( 5.0 8.78 )strong( 1.0 13.56

Sensitivity to market risk Liquidity Earnings

Rating Ratio Rating Ratio Rating Ratio

)good( 1.8 26.77 )critical( 5.0 10.31 )good( 2.4 0.69

Average of the total composite evaluation of CAMELS framework elements in the Jordan

Commercial Bank = 3.4 (acceptable)

Arab Jordan Investment Bank

Management Assets Quality Capital Adequacy

Rating Ratio Rating Ratio Rating Ratio

)critical( 4.8 0.53 )good( 2.2 2.33 )strong( 1.0 15.91

Sensitivity to market risk Liquidity Earnings

Rating Ratio Rating Ratio Rating Ratio

3.0 33.83 )critical( 5.0 5.47 )strong( 1.4 1.14

ISSN: 2005-4238 IJAST

990

Copyright ⓒ 2020 SERSC

International Journal of Advanced Science and Management

Vol. 29, No. 05, (2020), pp. 985-994

)acceptable(

Average of the total composite evaluation of CAMELS framework elements in the Arab Jordan

Investment Bank = 2.9 (acceptable)

Arab Bank

Management Assets Quality Capital Adequacy

Rating Ratio Rating Ratio Rating Ratio

)critical( 5.0 0.65 )critical( 5.0 7.20 )strong( 1.0 13.51

Sensitivity to market risk Liquidity Earnings

Rating Ratio Rating Ratio Rating Ratio

)strong( 1.0 20.47 )critical( 5.0 14.74 )good( 2.0 0.96

Average of the total composite evaluation of CAMELS framework elements in the Arab Bank =

3.2 (acceptable)

Overall Jordanian commercial banks

Management Assets Quality Capital Adequacy

Rating Ratio Rating Ratio Rating Ratio

)critical( 4.9 0.60 )critical( 4.6 6.74 )strong( 1.0 16.49

Sensitivity to market risk Liquidity Earnings

Rating Ratio Rating Ratio Rating Ratio

)Good( 1.5 22.81 )Critical( 5.0 11.42 )Good( 1.5 1.34

Average of the total composite evaluation of CAMELS framework elements in the Jordanian

commercial banks = 3.1 (acceptable)

We note from the previous table (2) represented in the average composite evaluation of

the CAMELS framework elements in the Jordanian commercial banks that:

1. The average capital adequacy ratio in the Jordanian commercial banks has varying

ratios; the rating for all banks was strong where the average highest value was 23.02 at

Societe Generale and the lowest value of 13.510 was for the Arab Bank and the Jordan

Kuwait Bank. . It is concluded that the Jordanian commercial banks are committed to the

decisions of the Central Bank of Jordan as for the capital adequacy ratio of 12%. This

value is higher than the Basel Committee's ratio of 10.50%. The commitment of such

values by the Jordanian commercial banks indicates that they have the ability to face the

capital risk. The higher the ratio for the banks, the more they are able to face the

unexpected losses that enable them to absorb them, the more they are able to survive in

the competitive environment and the more opportunities for expansion in the future.

2. The average of the quality of assets in the Jordanian commercial banks was uneven

and their rating was also different between critical and good. The average ratio of the

quality of assets for the Arab Bank was 7.200, which is the highest ratio among the banks

and they were rated as critical. For the Investment Bank of Jordan, the value was 2.330,

which is rated as good. . It is concluded that the quality of the assets that is measured by

the non-working debt to the total debt indicates that the ratio of the Jordanian commercial

banks is different; this is attributed to the policies, facilities and the level of the guarantees

demanded by the bank from its customers. This also indicates that banks suffer from the

low quality of their assets as it turns out that the average ratio of the quality of the assets

of the banks was critical. This means that the banks suffer from this high rate;

accordingly, their managements must prepare strict policies to limit their rise, capital

drainage and the loss of their customers and thus get out of the competition environment.

3. The average of the quality of the management among the Jordanian banks, the study

sample, was critical, where the average ratios among all banks were greater or equal to

46%. 79% was the ratio of the Jordan Ahli Bank while it was 47% for the Society

General. It was concluded that the quality of the management that is measured by the total

operating expenses to the total earnings increased. This indicates that the Jordanian

commercial banks suffer from the high operating expenses, which are critical. This result

was consistent with the central bank's report of the financial stability of 2018 that banks

suffering from the high operating expenses must work on reducing them and reducing the

ISSN: 2005-4238 IJAST

991

Copyright ⓒ 2020 SERSC

International Journal of Advanced Science and Management

Vol. 29, No. 05, (2020), pp. 985-994

operating expenses. This indicates that the quality of the management among the banks is

variant.

4. The average of the profit ratio of the Jordanian commercial banks ranged between

strong and acceptable. The highest ratio among the banks was for the Housing Bank for

Trade and Finance by 3.56, which is classified as strong, compared to 0.77% which was

for the Jordan Ahli Bank, which is acceptable. It turns out that the profit that is measured

by the ratio of the net profit to the total assets is good due to the fact that the Jordanian

commercial banks enjoy a good level of earnings. This indicates that the Jordanian

commercial banks are able to make earnings and use their resources in the best way to

achieve and maximize their earnings.

5. The average of the liquidity ratio of the Jordanian commercial banks was varied but

the rating was critical in all the Jordanian commercial banks; it was represented by 17.12

at the Society General, which was also critical. The liquidity of the Jordanian commercial

banks, the study sample, suffers from a decline that it was measured by the ratio of the

total liquid assets to the total assets. According to the rating, it was evident that the

Jordanian commercial banks had a critical degree and that there was a variance among the

Jordanian commercial banks in terms of liquidity. This is attributed to the different

methods adopted by banks in using their liquid assets and the way they manage their

control and planning processes.

6. The average of the sensitivity to the market risk among the banks, the study sample,

ranged between strong and acceptable. The Bank of Jordan had a ratio of 14.070, which is

strong and the Housing Bank for Trade and Finance had a ratio of 33.830, which is

acceptable. according to the rating, the sensitivity to the market risk that is measured by

the ratio of the total securities to the total assets was good. This shows that the Jordanian

commercial banks have the ability to control the market risks and face any risk to which

they may be exposed as well as the variety in the volume of the securities invested in

them.

Table 2 showed that the average rating of the Jordanian commercial banks according

to CAMELS rating is acceptable where the capital adequacy of the overall Jordanian

commercial banks was 16.490, which is strong, the quality of the assets was 6.740, which

is critical, the quality of the management was 0.60 which is critical, the earnings were

1.340 which is good, liquidity was 11.420 which is critical and finally the sensitivity to

the market risk was 22.810 which is good.

5. Conclusions

This study aimed at analyzing and evaluating the financial performance of the

Jordanian banks. Data were collected in the period of 2014-2018 from 13 banks listed on

ASE. CAMELS model was used as an evaluate and analyze for the performance of listed

banks. The CAMELS model considered in this study included the capital adequacy, assets

quality, management, earning, liquidity, and sensitive to market risk. The estimated

results by CAMELS model showed that the overall average for the evaluation degree of

rating the CAMELS elements in the Jordanian commercial banks during 2014-2018 was

acceptable. This is because the rating index in each bank was mostly between strong and

critical. The index of the capital adequacy, earnings and sensitivity to the market risks is

mostly strong whereas the index of the quality of the assets, quality of management and

liquidity was mostly critical. It was also concluded that the Jordanian commercial banks

have a convergence in terms of the rating, which means that the policies and procedures

followed by the banks that are the study sample are close.

6. Recommendations:

The study recommends that banks should reduce the operating expenses and manage

them in a better way, the banks’ management should reduce the non-working debt by

ISSN: 2005-4238 IJAST

992

Copyright ⓒ 2020 SERSC

International Journal of Advanced Science and Management

Vol. 29, No. 05, (2020), pp. 985-994

obliging their managements to develop strict policies to reduce their rise and finally the

managements of the Jordanian commercial banks should reconsider the policies and

strategies adopted in providing facilities, the level of the guarantees required, and the

actions taken in following-up the debt. The study recommended preparing accurate and

structured plans for the bank’s liquidity by the management of the Jordanian commercial

banks, which leads to the harmonization between the assets and obligations in terms of

maturity, and distributing such plans on uses that are transferable to liquid balances.

Furthermore, the study recommended researchers to conduct studies on the Islamic banks

and all banks listed on the ASE.

References

[1] Al Qaisi, Fawzan(2017). Analyzing the Factors Affecting the Performance of the

Jordanian Commercial Banks Using the Components of CAMELS Model: An

Applied Study. Jordan Journal of Business Administration, 13(4).

[2] Arabi, Khalafalla Ahmed Mohamed. (2013). Predicting Banks’ Failure: The Case of

Banking Sector in Sudan for the Period(2002-2009). Journal of Business Studies

Quarterly, 4,(3).

[3] Atikoğulları, M. (2009) An Analysis of the Northern Cyprus banking Sector in the

Post - 2001 period Through the CAMEL approach, International Research

Journal of Finance and Economics,32, 212-229.

[4] Baidoo, William Tawiah, Amankwah, Samuel & Tobazza, Stephen (2014). The

Use of CAMELS Model to Evaluate Banks, a Case Study of Seven Banks in Ghana,

International Coference on Applied Sciences and Technology (ICAST).

[5] Central Bank Of Jordan (2018). Financial Stability Report.

http://www.cbj.gov.jo/EchoBusv3.0/SystemAssets/PDFs/EN/JFSR2018E%20-20-

10-2019.pdf.

[6] Desta, T. S. (2016). Financial performance of “The best African banks”: A

comparative analysis through CAMEL rating. Journal of accounting and

management, 6(1), 1-20.

[7] Dincer, H., Gencer, G., Orhan, N., & Sahinbas, K. (2011). A Performance

Evaluation of the Turkish Banking Sector after the Global Crisis via CAMELS

Ratios. Procedia - Social and Behavioral Sciences, 24, 1530–1545.

doi:10.1016/j.sbspro.2011.09.051

[8] Georgios, K., & Elvis, K. (2019). Bank Value using Camels Model Evidence from

Balkans Banking System. International Research Journal of Finance and

Economics, (176).

[9] Ghasempour, Shiva & Salami, Mohamadjavad (2016). Ranking Iranian Private

Banks Based on the CAMELS Model Using the AHP Hybrid Approach and

TOPSIS. International Journal of Academic Research in Accounting, Finance

and Management Science 6 (4),52-62. DOI: 10.6007/IJARAFMS/v6-i4/2294.

[10] Ghazavi, Masoud & Bayraktar, Sema (2018). Performance Analysis of Banks in

Turkey using CAMELS approach case study: six Turkish Banks during 2005 to

2016. Journal of Business Research Turk, 10(2).847-874.DOI:

10.20491/isarder.2018.458

[11] Jha, S., & Hui, X. (2012). A comparison of financial performance of commercial

banks: A case study of Nepal. African Journal of Business Management, 6(25),

7601.

[12] Muhmad, Siti Nurain & Hashim, Hafiza Aishah (2015). Using the CAMEL

Framework in Assessing Bank Performance in Malaysia. International Journal of

Economics, Management and Accounting, 23,(1). 109-127.

[13] Muktuf, H. S., & Hazim, S. D. (2020). Evaluation of banking performance

according to the CAMELS model An applied study of Al-Mansour Investment

Bank for the period 2014-2018. journal of Economics And Administrative

Sciences, 26(117), 179-199.

ISSN: 2005-4238 IJAST

993

Copyright ⓒ 2020 SERSC

International Journal of Advanced Science and Management

Vol. 29, No. 05, (2020), pp. 985-994

[14] Ongore, V. O., & Kusa, G. B. (2013). Determinants of financial performance of

commercial banks in Kenya. International journal of economics and financial,

3(1), 237-252.

[15] Roman, A., & Şargu, A. C. (2013). Analysing the Financial Soundness of the

Commercial Banks in Romania: An Approach based on the Camels Framework.

Procedia Economics and Finance, 6, 703–712. doi:10.1016/s2212-

5671(13)00192-5.

[16] Saikrishna, M. B., & Varghese, A. (2020). A Camel Model Analysis of Selected

Public (Sbi) And Private (Hdfc) Sector Banks In India. Studies in Indian Place

Names, 40(3), 2145-2152.

[17] Sangmi MD, Nazir T (2010). Analyzing financial performance of commercial

banks in India: Application of CAMEL model. Pak. J. Commer. Soc. Sci., 4 (1):

40-55.

[18] Sarker, A. (2005). CAMELS rating system in the context of Islamic banking: A

proposed ‘S’for Shariah framework. Journal of Islamic Economics and Finance,

1(1), 78-84.

ISSN: 2005-4238 IJAST

994

Copyright ⓒ 2020 SERSC

View publication stats

You might also like

- Development Bank of The PhilippinesDocument41 pagesDevelopment Bank of The PhilippinesRejean Dela CruzNo ratings yet

- Applyingthe CAMELSfor Goldman Sachs Group IncDocument16 pagesApplyingthe CAMELSfor Goldman Sachs Group IncadeoduntanvictorNo ratings yet

- Theories of ProfitDocument9 pagesTheories of ProfitDeus SindaNo ratings yet

- Use of CAMEL Rating Framework: A Comparative Performance Evaluation of Selected Bangladeshi Private Commercial BanksDocument9 pagesUse of CAMEL Rating Framework: A Comparative Performance Evaluation of Selected Bangladeshi Private Commercial BanksShadabNo ratings yet

- CAMELDocument7 pagesCAMELKhanal NilambarNo ratings yet

- Camelmodel ProjectDocument26 pagesCamelmodel ProjectDEVARAJ KGNo ratings yet

- Working Capital Management and Profitability of Commercial Banks in NepalDocument13 pagesWorking Capital Management and Profitability of Commercial Banks in Nepalshresthanikhil078No ratings yet

- Evaluating Performance of Bank Through Camels Model: A Case Study of Select Public and Private Banks in IndiaDocument6 pagesEvaluating Performance of Bank Through Camels Model: A Case Study of Select Public and Private Banks in IndiaAkarsh BhattNo ratings yet

- Ijm 11 10 081-2Document14 pagesIjm 11 10 081-2MINESHNo ratings yet

- Credit Risk, Liquidity Risk and Profitability in Nepalese Commercial BanksDocument9 pagesCredit Risk, Liquidity Risk and Profitability in Nepalese Commercial BanksKarim FarjallahNo ratings yet

- Performance Evaluation of JP Morgan Chase Bank: Sadia ZamanDocument17 pagesPerformance Evaluation of JP Morgan Chase Bank: Sadia ZamanAjith VNo ratings yet

- CAMELS Ratio PDFDocument12 pagesCAMELS Ratio PDFmoonaagNo ratings yet

- CAMELijbt Vol 6 June 2016 4 233-266Document35 pagesCAMELijbt Vol 6 June 2016 4 233-266Sadia R ChowdhuryNo ratings yet

- Camel Analysis of NBFCS in TamilnaduDocument7 pagesCamel Analysis of NBFCS in TamilnaduIAEME PublicationNo ratings yet

- Financial Performance Evaluation of Some Selected Jordanian Commercial BanksDocument14 pagesFinancial Performance Evaluation of Some Selected Jordanian Commercial BanksAtiaTahiraNo ratings yet

- "Using As A Tool For Evaluate Banking Performance": Shawkat Abdul Amir Shamir Dr. Qassim Mohammed Al-BaajDocument13 pages"Using As A Tool For Evaluate Banking Performance": Shawkat Abdul Amir Shamir Dr. Qassim Mohammed Al-BaajSaint CutesyNo ratings yet

- A Comparison of Financial Performance in The Banking SectorDocument12 pagesA Comparison of Financial Performance in The Banking SectorandoraphNo ratings yet

- Asset Valuation An Its Effect On Financial Statement of Nigeria Deposit Money BankDocument30 pagesAsset Valuation An Its Effect On Financial Statement of Nigeria Deposit Money BankAFOLABI AZEEZ OLUWASEGUN100% (1)

- 10.2478 - JCBTP 2022 0025Document18 pages10.2478 - JCBTP 2022 0025ZinebNo ratings yet

- Camels Model AnalysisDocument11 pagesCamels Model AnalysisAlbert SmithNo ratings yet

- Bank NiftyDocument14 pagesBank NiftySwarupKumarNo ratings yet

- 09 - Chapter 3 PDFDocument40 pages09 - Chapter 3 PDFVishal MalikNo ratings yet

- Impact of Liquidity On Profitability of Nepalese Commercial BanksDocument8 pagesImpact of Liquidity On Profitability of Nepalese Commercial BanksWelcome BgNo ratings yet

- 4 Importnt - DETERMINANTSOFBANKPROFITABILITY1.JordanDocument12 pages4 Importnt - DETERMINANTSOFBANKPROFITABILITY1.JordanFarooq KhanNo ratings yet

- An Analysis of Indian Public Sector Banks Using Camel ApproachDocument9 pagesAn Analysis of Indian Public Sector Banks Using Camel ApproachAratiPatelNo ratings yet

- Performance Analysis of Islamic Banks ADocument11 pagesPerformance Analysis of Islamic Banks AGREEN FIELD AGRO HI- TECH SERVICES SANGAMNER.No ratings yet

- Research Proposal - Dissertation - 2018-23Document21 pagesResearch Proposal - Dissertation - 2018-23Abhijeet MondalNo ratings yet

- Performance Analysis Using Camel Model-A Study of Select Private BanksDocument10 pagesPerformance Analysis Using Camel Model-A Study of Select Private BanksLIKHITHA RNo ratings yet

- 123 PDFDocument13 pages123 PDFMuhammadNo ratings yet

- December 2013 5Document13 pagesDecember 2013 5bedilu77No ratings yet

- Evaluationof Financial Performanceof Private Commercial Banksin Bangladesh JBSQDocument14 pagesEvaluationof Financial Performanceof Private Commercial Banksin Bangladesh JBSQAuishee BaruaNo ratings yet

- Performance Evaluation of Banking Sector in Pakistan: An Application of BankometerDocument6 pagesPerformance Evaluation of Banking Sector in Pakistan: An Application of BankometertafakharhasnainNo ratings yet

- CAMEL Model in Banking SectorDocument6 pagesCAMEL Model in Banking SectorAshenafi GirmaNo ratings yet

- Md. Anwarul Kabir & Suman Dey PDFDocument10 pagesMd. Anwarul Kabir & Suman Dey PDFVivekKumarNo ratings yet

- Project Work On Banking & InsuranceDocument13 pagesProject Work On Banking & InsuranceKR MinistryNo ratings yet

- MPRA Paper 112482Document24 pagesMPRA Paper 112482Hafiz Muhammad SaleemNo ratings yet

- Performance Analysis Through CAMEL Ratin PDFDocument10 pagesPerformance Analysis Through CAMEL Ratin PDFkshemaNo ratings yet

- Applying The CAMEL Model To Assess Performance ofDocument11 pagesApplying The CAMEL Model To Assess Performance ofMai Anh NguyễnNo ratings yet

- The Effects of Mergers and Acquisitions On The Performance of Commercial Banks in IndiaDocument17 pagesThe Effects of Mergers and Acquisitions On The Performance of Commercial Banks in Indiagoutam goutamNo ratings yet

- Islamic Banks Performance: An Assessment Using Sharia, Sharia Conformity and Profitability and CAMELSDocument16 pagesIslamic Banks Performance: An Assessment Using Sharia, Sharia Conformity and Profitability and CAMELSAssyifa NurtiasihNo ratings yet

- Abdc Paper Anubha 2022Document21 pagesAbdc Paper Anubha 2022ANUBHA SRIVASTAVA BUSINESS AND MANAGEMENT (BGR)No ratings yet

- An Analysis of Financial Performance of Public Sector Banks in India Using Camel Rating SystemDocument15 pagesAn Analysis of Financial Performance of Public Sector Banks in India Using Camel Rating SystemTHILAGALAKSHMI M DNo ratings yet

- A Comparative Study On Financial Performance of Public Sector Banks in India: An Analysis On Camel ModelDocument17 pagesA Comparative Study On Financial Performance of Public Sector Banks in India: An Analysis On Camel ModelkishoremeghaniNo ratings yet

- 2021 BPMJ Zhao - The Role of Technical Efficiency, Market Competition and RiskDocument17 pages2021 BPMJ Zhao - The Role of Technical Efficiency, Market Competition and RiskWahyutri IndonesiaNo ratings yet

- Publication 1 Seid MDocument9 pagesPublication 1 Seid Mseid100% (1)

- 08 v31 2 July2018Document13 pages08 v31 2 July2018Farhan SarwarNo ratings yet

- Analysis of Factors Influencing Bank ProfitabilityDocument35 pagesAnalysis of Factors Influencing Bank ProfitabilityA M DraganNo ratings yet

- Open Access Under: Keywords: Banks, Financial Soundness, Performances, CAMELS Framework, RomaniaDocument4 pagesOpen Access Under: Keywords: Banks, Financial Soundness, Performances, CAMELS Framework, RomaniaMihaela TanasievNo ratings yet

- 13518-Article Text-46378-1-10-20150929 PDFDocument8 pages13518-Article Text-46378-1-10-20150929 PDFMadhu ChyNo ratings yet

- A Study On Liquidity Management of Commercial Banks in Nepal (With Refrence To Samina Bank LTD, Nabil Bank LTD and Kumari Bank LTD)Document5 pagesA Study On Liquidity Management of Commercial Banks in Nepal (With Refrence To Samina Bank LTD, Nabil Bank LTD and Kumari Bank LTD)Gangapurna Multipurpose Cooperative Ltd.No ratings yet

- A Selective Study: Camels Analysis of Indian Private Sector BanksDocument7 pagesA Selective Study: Camels Analysis of Indian Private Sector BanksRabinNo ratings yet

- 2020 IJEM Saw - Price Efficiency of Islamic and Conventional BanksDocument10 pages2020 IJEM Saw - Price Efficiency of Islamic and Conventional BanksWahyutri IndonesiaNo ratings yet

- Profitabilityof Saudi Commercial Banks AComparative Evaluationbetween Domesticand Foreign Banksusing CAMELDocument9 pagesProfitabilityof Saudi Commercial Banks AComparative Evaluationbetween Domesticand Foreign Banksusing CAMELNahid Md. AlamNo ratings yet

- A Study of Performance Evaluation OF Top 6 Indian BanksDocument12 pagesA Study of Performance Evaluation OF Top 6 Indian BanksKeval PatelNo ratings yet

- Determinants of Bank Profitability: A Study On The Banking Sector of BangladeshDocument15 pagesDeterminants of Bank Profitability: A Study On The Banking Sector of BangladeshJunaeadHossainOlyNo ratings yet

- 25 10 1108 - Ajar 08 2020 0071Document13 pages25 10 1108 - Ajar 08 2020 0071Hafiz Muhammad SaleemNo ratings yet

- Analyzing Dubai Islamic Bank's Performance Using The CAMEL ApproachDocument8 pagesAnalyzing Dubai Islamic Bank's Performance Using The CAMEL Approachventures.acolyteNo ratings yet

- SSRN Id3525666Document17 pagesSSRN Id3525666v1v1subrotoNo ratings yet

- ZobiDocument10 pagesZobiPham NamNo ratings yet

- ASEAN Corporate Governance Scorecard Country Reports and Assessments 2019From EverandASEAN Corporate Governance Scorecard Country Reports and Assessments 2019No ratings yet

- Mutual Funds in India: Structure, Performance and UndercurrentsFrom EverandMutual Funds in India: Structure, Performance and UndercurrentsNo ratings yet

- BS English Delhi 17-11-2023Document19 pagesBS English Delhi 17-11-2023Anurag SinghNo ratings yet

- For Employer PresentationDocument35 pagesFor Employer PresentationAlmario Javate SagunNo ratings yet

- Cfas Report Pas 1 & 7Document57 pagesCfas Report Pas 1 & 7sean lawrenceNo ratings yet

- Raj Singh Fazilka 24.06.2023Document7 pagesRaj Singh Fazilka 24.06.2023rohit. remooNo ratings yet

- Toll Road Financial ModelDocument10 pagesToll Road Financial ModelStrategy PlugNo ratings yet

- Cpar AfarDocument21 pagesCpar AfarFrancheska NadurataNo ratings yet

- Dear Kim!Document3 pagesDear Kim!carter michealNo ratings yet

- ACC 102 Chapter 10 Review QuestionsDocument3 pagesACC 102 Chapter 10 Review QuestionsKaitlyn MakiNo ratings yet

- Cash Conversion Cycle - Group1Document23 pagesCash Conversion Cycle - Group1Parvesh AghiNo ratings yet

- Product Disclosure Sheet: Customer'SDocument2 pagesProduct Disclosure Sheet: Customer'SojoNo ratings yet

- SUBEXLTD 20062022131358 QuickResultsDocument23 pagesSUBEXLTD 20062022131358 QuickResultsSocial OnlyNo ratings yet

- Agrani First PartDocument5 pagesAgrani First Partmd. Piar AhamedNo ratings yet

- Ebook Corporate Finance 9Th Edition Ross Test Bank Full Chapter PDFDocument67 pagesEbook Corporate Finance 9Th Edition Ross Test Bank Full Chapter PDFquachhaitpit100% (11)

- LM INTERM ACTG 2 1of8 2SAYE2024 2ADocument17 pagesLM INTERM ACTG 2 1of8 2SAYE2024 2AKristine CamposNo ratings yet

- Financial Reporting and Accounting StandardsDocument24 pagesFinancial Reporting and Accounting StandardsAnnissa Nuur CahyaniNo ratings yet

- A747 308 81 41 37195 - Rev 1Document1 pageA747 308 81 41 37195 - Rev 1Shaik AbdullaNo ratings yet

- Global Financial Crisis OverviDocument12 pagesGlobal Financial Crisis Overvispinor01238No ratings yet

- Financial PositionDocument2 pagesFinancial PositionKatherine BorjaNo ratings yet

- Pal Corporation Acquired A 90 Percent Interest in Sor CorporatioDocument1 pagePal Corporation Acquired A 90 Percent Interest in Sor CorporatioCharlotteNo ratings yet

- The Budgeting of Account ReceivableDocument5 pagesThe Budgeting of Account ReceivableAnanda RiskiNo ratings yet

- Financial Reporting May 22 Mock Test Ques PPRDocument7 pagesFinancial Reporting May 22 Mock Test Ques PPRVrinda GuptaNo ratings yet

- Unit 1 Theory - Business ValuationDocument7 pagesUnit 1 Theory - Business ValuationPrathmesh AmbulkarNo ratings yet

- Budget Driving Institute Prob 2&3Document94 pagesBudget Driving Institute Prob 2&3Ma Sophia Mikaela EreceNo ratings yet

- Cascade Regional Holdings Limited Annual Report Financial Statements 31 December 2019 PDFDocument51 pagesCascade Regional Holdings Limited Annual Report Financial Statements 31 December 2019 PDFVishal RathiNo ratings yet

- Fin 427 HW 3Document2 pagesFin 427 HW 3B M Rakib HassanNo ratings yet

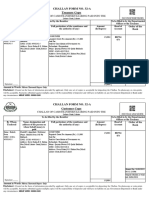

- Challan Form No. 32-A Treasury Copy: Challan of Cash/Transfer/Clearing Paid Into TheDocument1 pageChallan Form No. 32-A Treasury Copy: Challan of Cash/Transfer/Clearing Paid Into TheZahoorNabiNo ratings yet

- Credit Card I PdsDocument11 pagesCredit Card I PdsIskandar ZulqarnainNo ratings yet

- Lesson 6 Accounting For Merchandising Business Part 2 ExercisesDocument9 pagesLesson 6 Accounting For Merchandising Business Part 2 ExercisesTalented Kim SunooNo ratings yet

- RTB ASSIGNMENT On Vechile LoanDocument21 pagesRTB ASSIGNMENT On Vechile Loan19DM001 Ashis0% (1)